The European market potential for sesame seeds

Sesame seeds are a common food product in many European countries. Greece consumes the most sesame per capita, using it in traditional products like tahini and halva. Germany is another major importer, offering opportunities in the bakery industry and for organic sesame for health-oriented consumers. It is a difficult and expensive crop to grow in Europe. The demand creates an ideal opportunity for sustainable and smallholder farmers in tropical and semi-tropical countries.

Contents of this page

1. Product description

Sesame (Sesamum indicum) is one of the most ancient crops cultivated for its edible seeds. The crop is mainly grown in tropical and sub-tropical regions in Asia, Africa and Latin America. There is also small-scale production in the far south of Europe. Sesame plants produce pods with tiny, flat seeds, about 3–4 mm long by 2 mm wide and 1 mm thick (see Figure 1).

Sesame seeds have different appearances, tastes and content. The colour of the seeds varies from creamy white and yellow shades to dark brown and black. Light coloured seeds are often hulled, but they also occur naturally and are the most expensive because of how they look. Mixed seeds with high oil content are suitable for crushing. Black sesame seeds are an excellent source of magnesium and calcium and work very well in non-dairy milk powders and other premium applications.

This study looks at whole sesame seeds for direct consumption and food processing. For more information on the demand for sesame oil, see the study on exporting sesame oil to Europe. The Harmonised System (HS) trade code for sesame seeds is 120740 (see Table 1).

Figure 1: Sesame plant with seed pods

Sources: Franz Eugen Köhler, Köhler's Medizinal-Pflanzen and Anna Frodesiak, Public domain, via Wikimedia Commons, 2007 and 2013

Figure 2: Young sesame plant at the flowering stage

Source: ICI Business (2024)

Table 1: Harmonised System (HS) trade code for sesame seeds

| 1207 40 | Sesame seeds |

| 1207 40 10 | Sesame seeds for sowing |

| 1207 40 90 | Sesame seeds (excluding for sowing) |

2. What makes Europe an interesting market for sesame?

Europe has gradually developed a taste for sesame, influenced by new and traditional foods. Europe is not able to produce large volumes itself. As a result, this consumption growth will need to be met almost exclusively by non-European suppliers.

Europe is a long-term growth market

In the long term, importers expect European demand for sesame to continue to grow. The increasing popularity of Asian, Mediterranean and Middle Eastern cuisines, as well as new applications of sesame, push the demand in Europe.

There is steady demand for sesame for use in baked goods, cereals and snacks. The consumption of other sesame-based foodstuffs has also spread rapidly in Europe in recent years. Sesame paste (tahini) and hummus, sweets (halva) and spices with sesame (za’atar) are available in most supermarkets now, even though they were only sold in ethnic food stores several years ago. Asian cuisine, such as sushi, is also a big user of sesame.

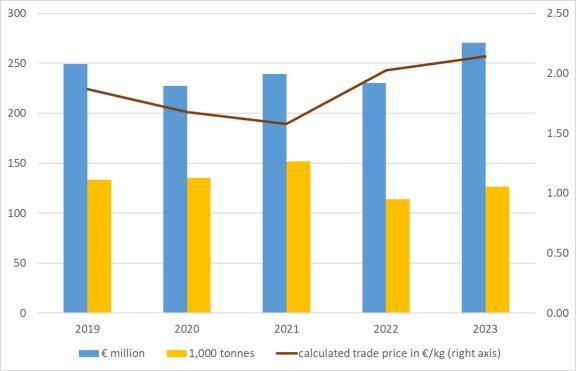

The European demand increased up until 2021, when it saw a dip. Import volumes still exceeded 150,000 tonnes in 2021. Recent years have shown a decline in volume, reaching 126,000 tonnes in 2023 (see Figure 3). Along with growing demand, global production has increased, but European importers sometimes struggle to find the quality and volume they need. This has resulted in higher prices but lower volumes.

Figure 3: European import of sesame seeds from non-European origins

Source: Eurostat and ITC Trademap, July 2024, calculations by ICI Business, *latest data on trade volumes may not be fully accurate.

Figure 4: Example of tahini sold in a Dutch supermarket

Source: ICI Business (2024)

Dependence on non-European supply

Europe highly depends on a foreign supply of sesame seeds. The European production is very small compared to demand and concentrated in the far south of Europe. The latest available data shows, together, that Greece and Italy produced 940 tonnes in 2017. This is less than 1% of market demand. Prices for European sesame are also higher.

As a result, the European market relies on larger producers, such as India and Nigeria. There are opportunities for a lot of supply countries. Since supply fluctuates, importers tend to prefer steady and reliable sources. This is also a reason to integrate the supply chain through partnerships or to use foreign-owned seed cleaning facilities in production countries.

Good prices for quality and organic seeds

Food safety requirements and costs for certification and product testing can be a burden when exporting to European buyers. Despite the strict rules, there is a good market for companies that can comply with the EU’s quality and food safety standards. This also translates to higher prices. According to trade data, the export prices from Nigeria and India to China were around €1,600 per tonne, while their export to Germany and the Netherlands averaged around €2,100 per tonne.

As a supplier, you can create value by improving your standards. For example, there is a growing demand for organic certified sesame seeds. The European trade control and expert system (TRACES) shows that organic sesame has a market share of between 10 and 20%. The organic sesame imports in the European Union (EU) increased from 15,000 to 22,000 tonnes between 2019 and 2022. Demand has not always been met due to a lack of supply, which explains the dip in 2022 in Figure 5. Organic data for 2023 has not been published yet.

Sesame is an easy-growing crop. However, to maintain organic standards, all rotational crops need to be produced in the same organic way. In practice, this is not easy for farmers, but it helps them secure a niche market that not everybody can reach.

Sources: Eurostat and Trade Control and Expert System (TRACES)

Tips:

- Read our study about entering the European market for sesame seeds to learn more about the competition and what you need to do to comply with market demand.

- Follow different news sources to keep up-to-date with market developments. Use news sources like the Commodity Board and read updates from large buyers on outlets like Dipasa.

3. Which European countries offer the most opportunities for sesame?

Germany and Greece are the main consumer markets for sesame in Europe. The Netherlands is the third largest importer, playing an important role as a re-exporter of sesame throughout Europe. Poland and Italy offer opportunities, and France has the potential for organic and fair trade.

Source: ITC Trade Map

Greece is the largest traditional consumer of sesame

Greek consumption habits are part of the eastern Mediterranean and Middle Eastern tradition, where sesame is a very popular ingredient. This is why Greece has the highest sesame consumption in Europe.

Widespread consumption of products like tahini (sesame paste), halva (sesame sweets), pasteli (sesame bars) and koulouri (round bread with sesame) are the main reason for the country’s high sesame imports. One of the companies responsible for sesame processing is Haitoglou Family Foods. It produces tahini, sesame butter, halva, fruit-nut bars with sesame, sesame oil and other products. Several of these foods have found their way to other European countries as well.

Greece is a typical end-market; 95% of the imported sesame are processed or consumed locally. Stable demand and imports of almost 36,000 tonnes in 2023 make Greece a main target market for exporters. Demand should remain strong in the future, but the market’s maturity does not allow for exceptional growth.

India, Ethiopia and Sudan are Greece’s main suppliers. Like many other importers in Europe, Greek importers are diversifying their origin countries by sourcing from Nigeria, Pakistan, Mozambique, Turkey and others. This is necessary to keep a stable supply of sesame. Since most sesame is used for processing, visual quality is less important. This is why Greece has a lower value than Germany and a lower price range.

Figure 8: Halva is a popular sesame product in Greece

Source: Pixabay (2021)

Germany consumes large volumes in diverse segments

The German sesame market is diverse. The country has a large bakery sector, growing demand for healthy oilseeds and, at the same time, a significant diaspora whose eating habits contribute to strong consumption. This makes Germany one of the biggest sesame seed markets in Europe.

The bakery sector uses sesame seeds in products like bread and bread buns. In 2023, the bakery and confectionary sector represented 9.5% and 7.9% of the value of the German food and drink industry respectively, according to the Federation of German Food and Drink Industries (BVE). German companies that sell ingredients to the bakery and confectionary sectors are an important target group for sesame exporters. These include Küchler (part of the Acomo group), Tampico Trading and Schlüter & Maack.

Germany’s diverse population also has a strong influence, particularly the portion of the population of Middle Eastern origin. For example, tahini, halva and simit (the Turkish version of Koulouri) are popular in the Turkish community. According to IamExpat Media, Germans are almost as fond of Turkish snacks as they are of their own traditional dishes. Companies like SesaMe Land have turned halva into a trendy vegan snack.

German sesame imports have continuously increased. The current market is worth nearly €80 million. This value equals almost 34,000 tonnes. Most sesame is imported from Nigeria, followed by Uganda, India and Guatemala.

The demand for sesame may grow further thanks to the different segments and increasing interest in healthy foods. Suppliers that offer organic sesame have an advantage in entering Germany’s growing niche market for organic food. Germany is the largest market for organic food. At between 6,000 and 9,000 tonnes of organic sesame, Germany imports far more than most other European markets.

Figure 9: Example of Turkish simit or Greek koulouri

Source: Pixabay (2019)

The Netherlands offer a main entrance into Europe.

The Netherlands is one of the main import countries for sesame imports. Import values are high because the country handles a large part of the European trade. It is unlikely that this role will change anytime soon. As an exporter, the Netherlands has extensive logistical services. For companies looking for a foothold in the European market, the country can be interesting to find partners for seed cleaning and warehousing.

Being a trade hub, the Netherlands can help to manage supply and demand. In 2023, traders imported close to 19,000 tonnes of sesame with a value of €42 million. Two thirds of the total import were destined for other European markets, in particular Germany, France and Belgium. The origin countries are diverse, depending on available qualities and volumes.

The Netherlands does not have a specific country that supplies its traders. The country received the largest volume from Pakistan, which solved some of the sourcing and supply issues from India. Uganda was the main source of organic sesame seeds in 2022 and 2021.

Sesame seeds that remain in the country find their way to retail packs and ingredients for the food industry. Hummus and tahini have become popular products with Dutch consumers. Tahini brands like Al’Fez and Sebahat are available on the main retail shelves. Popular hummus brands include Garden Gourmet (Tivall/Nestlé), Maza and the organic brand Florentin. It bears mentioning that for traditional consumers, most hummus brands do not compare with the original recipe.

Source: ITC Trade Map (*Germany has a similar market share to Egypt and Nigeria but is included in the other supply countries)

Poland uses sesame in confectionary

Poland is the third of the top three largest sesame consumption countries in Europe. Import values have reached €33 million. No less than 11,000 tonnes were consumed and processed domestically.

Sesame consumption originates from when Persian nomadic tribes brought sesame to what is now Poland. As a result, sesame is commonly used in the confectionery industry. This explains the strong and consistent import levels.

One popular sesame snack is ‘Sezamki’, which consists of layers of seeds with honey or glucose syrup, much like the pasteli in Greece. However, you can also find Polish versions of halva and tahini. Unitop is a leading producer of these sesame snacks. Sesame use as a healthy ingredient may also grow, as a result of vegetarian and vegan diets, for example. Poland has a relatively high percentage (8.4%) of consumers who identify as vegetarians. Go VEGE is one of the favourite vegetarian brands for hummus.

With several popular sesame products and a good supply of sesame already, there are opportunities to increase sesame supply to Poland for processing activities. In 2023, Turkey, Pakistan and (to a lesser degree) Nigeria were the principal suppliers.

The long-standing tradition of sesame use makes it a reliable market. The growing interest in new vegetarian products forecasts growing demand.

Figure 11: A popular hummus brand in Poland

Source: Photo by pierwszy per Open Food Facts

France offers specific opportunities

Sesame consumption in France has declined over the past few years (2021–2023). The total imported value dropped almost 20% to €20.7 million. Its market is not as robust as the leading European markets. Still, the French market requires a significant volume and provides several unique opportunities.

The decline in French imports has mainly been caused by a drop in volumes from India. In 2023, France imported more sesame from the Netherlands than directly from India. Nigeria became the third largest supplier. There are also good opportunities for French speaking countries that produce sesame, such as Mali and Burkina Faso.

France is one of the main destinations for organic sesame (see Figure 7), and there are several companies that are involved in responsible and Fairtrade sourcing.

Sesame is an ingredient in bakery and snack products, such as breadsticks, crackers and biscuits. It is also used in ethnic products, such as hummus. France is one of the main European markets of sesame oil, importing both seeds for pressing and oil.

Companies involved in sesame oil include Huilerie Moog (Bio Planète), Huilerie Emile Noël and OLVEA. Haudecoeur specialises in the import and distribution of oriental foods, including halva, tahini and sesame spices. Markal packs organic sesame for wholesale and retail sales. The social solidarity company Etiquable sources its organic sesame directly from the cooperative COOPAKE in Burkina Faso.

To stand a good chance in the bakery and vegetable oil segments, sesame needs to be available and attractively priced. This will partly dictate sesame’s prospects in the coming years.

Italy offers growth potential

Italian sesame consumption is gradually increasing. Imports fluctuate but, over the long term, the market has shown continuous growth. The import value almost reached €20 million. If the current market continues at the same pace, the sesame market could grow by another €2–3 million in the next three years.

Italy made a place for new suppliers after India proved unable to supply suitable quality and volume. Since 2019, Brazil has supplied sesame to Italy and become its largest supplier, with a value of €4.1 million in 2023. Other countries also increased their supply, including Turkey, Paraguay and Pakistan (each supplying between €1.3 and €2.3 million). Germany and the Netherlands are important re-exporters to Italy. Italy also has a minor production of their own by artisan producers, such as Gambuzza, although recent data is lacking.

Being a Mediterranean country, Italy is influenced by Greece, northern Africa and the Middle East, where sesame is a popular ingredient. You can find products with sesame particularly in Sicily in the south of Italy, such as sesame honey nougat ‘cobaita’ and sesame biscuits ‘Biscotti Regina’, shown in Figure 12.

Figure 12: Example of Italian ‘Biscotti Regina’

Source: Photo by kiliweb per Open Food Facts (2023)

Tips:

- Start your market orientation with larger consumer countries, Germany, Greece and the Netherlands, from which a lot of sesame is distributed. Here, you will find the major players and the highest concentration of buyers. Several large sesame buyers will also be present at major food trade fairs, such as Anuga and SIAL. Use client references to attract other buyers in Europe.

- Distinguish your company by creating a background story or earning organic certification. There are buyers in Germany and France, for example, who are interested and specialised in this type of added value.

- Look at the assortment of products that contain sesame in leading supermarkets. This is a good way to learn more about food brands and manufacturers that need sesame for their products. Most supermarket chains in Europe show their assortment online.

4. Which trends offer opportunities or pose threats in the European sesame market?

The growing popularity of ethnic foods, the trend towards healthier food choices and the growing market share of organic products are developments that present opportunities. The changing food safety and sustainability landscape could change the focus to new suppliers and supply countries.

International cuisine and ethnic consumption drive growth

Culturally, Europe is very diverse. Cultural interaction drives the demand for sesame seeds. Middle Eastern and the Asian diaspora have a significant influence on general consumption habits in Europe.

Sesame is a key ingredient in products like tahini, hummus, halva, sushi and several snacks and confectionery products. Sesame and sesame oil are also common as garnishes and taste-makers in Asian dishes, such as in gomashio, a mix of ground sesame and salt. European consumers embraced many of these products and cuisines.

Traditional consumers who have introduced their cuisines to Europe have created a basic demand for sesame. The market potential lies in the adoption of non-traditional consumers. Sometimes, specific foods become very popular. This happened in the past decade with sushi and the growth of sushi restaurants. Sesame is a common ingredient in this popular food. Franchise chains, such as Sushi Daily, and smart shop-in-shop concepts, such as Eat Happy in Germany, capitalised on the sushi trend and indirectly increased the demand for sesame.

Sesame in hummus and other healthy foods

A growing number of consumers are becoming concerned about their diets, and Europe is no exception. These consumers want healthier food and ingredients. Research by FoodDrinkEurope shows that 74% of European consumers believe that healthy food is the most important aspect of a sustainable diet. Two-thirds claim to follow a healthy and sustainable diet most of the time (56%) or always (10%).

Sesame is a versatile ingredient and taps into several health trends, such as natural, clean label, vegan and healthy nutrition. Sesame is a good source of fibre and plant-protein. It is rich in magnesium, calcium and vitamin B and E. One substance found in it, Sesaminol, a natural organic compound found in sesame seeds and sesame oil, is linked to anti-inflammatory and anti-oxidant properties.

The growing focus on plant proteins could further boost products that contain sesame, such as tahini and hummus, two popular products with vegans. Hummus consumption has increased significantly. Different pieces of research have predicted further annual growth of between 8.14% and 9.20% (CAGR) until 2030/2032. Original hummus is around 15% tahini. However, there are many commercial versions of hummus on the market that contain different percentages of sesame. Other products include organic sesame bars, low-carb sesame crackers and gluten-free crispbread with sesame.

Sesame for the health food segment must be naturally cleaned or processed. As a supplier, you will also have an advantage if you can supply organically certified sesame. You can also use this information in your marketing. For example, the Indian company HL Agro praises itself for its advanced and hygienic cleaning, and it uses blogs to promote sesame’s health benefits.

Figure 13: Wasa Gluten-free sesame and sea salt crispbread in Sweden

Source: Photo by inf per Open Food Facts

Attention to sustainable crops is good for sesame farmers

Climate change is important in Europe. Consumers have also become more aware of the social impact of the products they consume. As a result, the trend for responsible and ethical sourcing has become much more important.

Sesame has the potential to address sustainability challenges mainly because of its climate resilience. It grows well in arid conditions and with minimal input. Second, sesame can have a positive impact on small farmers. Companies like AjigoFarms in Nigeria recognise that this “small seed can make a big difference” and help farmers to adopt sustainable cultivation methods.

Sesame is a typical crop to be cultivated by smallholders. It is also easier to manually weed and bring farmers closer to organic practices on small plots. This gives them access to a growing market that not everyone can reach. As a farmer, you can also experiment with intercropping to increase diversity and yield, for example, with groundnuts or a leguminous crop. Another niche opportunity is formalising your social contribution, such as through Fairtrade certification. The Nicaraguan Del Campo Cooperative was the first Fairtrade certified sesame supplier. They partnered with Ético, a company based in the United Kingdom that is 100% owned by cooperatives and charities. Together, they offer fully traceable, certified organic and Fairtrade sesame. Another organisation, Oxfam Fair Trade, markets sesame paste and sesame bars from a cooperative named Sakaran SDA.

The Sakaran SDA cooperative

Sakaran SDA was founded around the turn of the 21st century with the aim of uniting and supporting farmers in and around the village of Sakaran. As early as 2005, the founders chose to grow according to organic standards. Five years later, Fairtrade certification was awarded. This helped the association to grow from 80 to 185 members.

Source: Oxfam Fair Trade (Belgium)

Turning residue issues into an opportunity

Sesame is a high-risk crop for traders. Over the past few years, the European Union has increased the border controls for sesame seeds. Some of the main issues include mould, salmonella and fumigation residues. Food safety is one of the top factors that influences consumers’ purchases (42%).

Food safety is a weakness in the sesame supply chain and has caught European buyers’ attention. Food safety issues are not related to a single country. However, for India, the unauthorised use of ethylene oxide has significantly reduced trade with Europe. The use of ethylene oxide for disinfecting foodstuffs is not permitted in the European Union. The maximum residue limit for sesame seeds is 0.05 milligrams per kilogram. Some batches in the past have exceeded the maximum limit by more than 1,000 times. These events may reduce European consumer confidence in sesame.

Turning this weakness in the sesame supply chain into a strength will set your business apart from other competitors. Many of the problems can be avoided by employing good agricultural practices (GAP), suitable cleaning with microbiological sterilisation and testing before shipment.

Good agricultural practices include minimising agrochemical use, drying carefully during post-harvest drying and avoiding chickens in the field. There have been some positive attempts to promote smart and sustainable agriculture. Sesame for Life in Zimbabwe tries to avoid commercial fertilisers and presents itself as a national centre of excellence for sesame farming.

Tips:

- Get a better understanding of what trends affect the demand for sesame and other grains, pulses and oilseeds by reading the CBI study Which trends offer opportunities or pose threats on the European grains, pulses and oilseeds market?.

- Find ways to build confidence with buyers by showing that you understand the food safety risks of sesame. Learn more about the rules regarding chemical residues and organic agriculture in Entering the European market for sesame seeds.

ICI Business carried out this study on behalf of the CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research