Entering the European market for speciality grains with added value

There is a demand in Europe for healthy food products, but the market for speciality grains with added value is still a niche. Every speciality grain is produced in different countries and even in Europe, which makes competition high. Focus on delivering good volumes, ideally with organic certification, to be competitive.

Contents of this page

- What requirements and certifications must speciality grains with added value comply with to be allowed on the European market?

- Through what channels can you get speciality grains with added value on the European market?

- What competition do you face on the European speciality grains with added value market?

- What are the prices for speciality grains with added value?

1. What requirements and certifications must speciality grains with added value comply with to be allowed on the European market?

To enter the European market, you must meet various mandatory legal requirements. Additionally, potential buyers may have extra requirements and request certifications. Sustainability requirements are also growing in importance for these products.

What are mandatory requirements?

The mandatory requirements for speciality grains with added value in Europe prioritise ensuring consumer health and safety. You must meet the requirements on:

- General foodstuffs hygiene rules

- Food contaminants, pesticide residues and microbiological criteria

- Traceability

- Genetically Modified (GM) food and feed

- Product composition

- Labelling and nutritional claims

General foodstuffs hygiene rules

The European Union (EU) regulation on General foodstuffs hygiene rules establishes that companies must meet the relevant hygiene requirements during all production stages. It also states that companies placing food on the market should have permanent procedures based on the Hazard Analysis and Critical Control Point principles, HACCP. It is not mandatory to have a certification proving this. However, the company must have the necessary documentation to demonstrate compliance with this requirement.

This regulation also provides provisions and requirements for maintaining hygiene in the various production stages, which also apply to companies outside the EU placing products on the EU market.

Food Contaminants in speciality grains with added value

Food contaminants are substances that have not been intentionally added to food. They can end up in flour, flakes, and other products as a result of the various stages of production, packaging, transport or storage, or environmental contamination. Contaminants can pose a health risk to consumers. According to the EU regulation about contaminants in food (pdf), a food containing a contaminant to an amount unacceptable for public health (at a toxicological level) shall not be placed on the EU market and will be rejected. Contaminant levels must be kept as low as possible.

For some specific substances, the EU has set maximum levels for contaminants in foodstuffs. There are several contaminants with specific maximum limits for cereals and milling products.

Table 1: Maximum levels for certain contaminants in food applicable to speciality grains with added value, (μg/kg)

| Contaminant | Cereals and products derived from cereals (at least 80% cereal content) | Bakery wares, cereal snacks and breakfast cereals | Foods for babies, infants or children |

| Aflatoxins B1 | 2 | ||

| Total Aflatoxins (Sum of B1, B2, G1 and G2) | 4 | 0.10 | |

| Ochratoxin A | 3* | 2 | 0.50 |

| Patulin | 10 | ||

| Deoxynivalenol | 750* | 500 | 200 |

| Zearalenone | 75* | 50 | 20 |

| Ergot alkaloids | 20 | ||

| Atropine | 1 | ||

| Scopolamine | 1 | ||

| Lead | 0.020 | ||

| Cadmium | 0.10** | 0.040 | |

| Arsenic | 0.020 | ||

| Benzo(a)pyrene | 1 | ||

| Sum of PAHs: benzo(a)pyrene, benz(a)anthracene, benzo(b) fluoranthene and chrysene | 1 | ||

| Perchlorate | 0.01 | 0.02 |

Source: Commission Regulation (EU) 2023/915 of 25 April 2023 on maximum levels for certain contaminants in food/ Globally Cool

*applies to products for the final consumer, **for cadmium, quinoa has a limit of 0,15 μg/kg.

Non-compliance with European food legislation is reported via the Rapid Alert System for Food and Feed (RASFF). Most notifications registered in RASFF regarding speciality grains with added value report the presence of aflatoxins (like Ochratoxin A) and tropane alkaloids (like atropine and scopolamine). Specifically, teff and millet products presented these issues. In 2020, there was also a report of amaranth wafers contaminated with activated caron.

Pesticide residues

The EU regulation on Maximum Residue Levels of pesticides (pdf) sets maximum residue levels (MRLs) for pesticides in food products, including speciality grains with added value. Products containing more pesticide residues than allowed will be rejected or withdrawn from the market. The EU has a database where you can look for your own product and find out the residue limits of each active ingredient allowed as a pesticide.

The notifications registered in RASFF regarding speciality grains with added value report the presence of ethylene oxide in amaranth and quinoa products, propiconazole in teff products, and chlorpyrifos and chlorate in quinoa.

Microbiological criteria

Your products should be free of dangerous micro-organisms like Listeria monocytogenes and Salmonella. Implementing an HACCP system in your company will help you achieve this, together with regular testing of your product.

Traceability

Traceability refers to the ability to trace food or substances used for consumption at all stages of production, processing and distribution. According to the EU general food law, food businesses must be able to identify the immediate supplier of a product and the immediate subsequent recipient (one step back, one step forward principle).

Food operators in the EU must also have systems and procedures in place to make this information available to the Competent Authorities upon request. For exporters, like you, this implies that you must provide sufficient information to your buyers to enable them to comply with the regulation.

Genetically Modified (GM) food and feed

EU law on genetically modified food and feed mandates that food or feed containing GMO cannot be marketed, used, or processed without proper authorisation and adherence to labelling rules. A unified EU authorisation process applies to GMO-based products. For GMOs used in food/feed without EU cultivation, an authorisation for such use is needed. If there is prior EU cultivation, an authorisation for cultivation and food/feed use is required.

Applicants must submit experimental data, a risk assessment, and follow specific procedures. The process involves sending the application to a Member State authority, after which EFSA assesses the risk. The Commission proposes authorisation based on EFSA's opinion, subject to committee approval. Approved products are listed in the Community Register of GM food and feed.

Product composition

There are specific legislations for additives (pdf), such as colouring agents and thickeners, and for flavourings (pdf) that list the substances that may be used, for which products, and at which maximum levels. These legislations also define which of these additives must be declared on the label and under which code. This is especially important for snacks and other preparations.

Labelling requirements

Each export package should declare:

- Name of product, for example “Sorghum flour”

- Net weight in metric system

- Shelf life of the product or best before date, and recommended storage conditions

- Lot identification number

- Country of origin and name and address of the manufacturer, packer, distributor or importer

Other key information about the product should be included in the Product Specification Sheet. This document contains the specific characteristics of your product, which your buyer will ask for to assess your product. Check this example for organic quinoa flakes processed in Peru (pdf).

In the case of consumer packaging, product labelling must comply with the EU Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and minimum font size for mandatory information, among other topics.

If your product is organic, your label must include the name/code of the inspection body and certification number. Also, if you are going to mark your product as gluten-free, keep in mind that the statement ‘gluten-free’ may only be made where the food as sold to the final consumer contains no more than 20 mg/kg of gluten.

Nutritional claims

Speciality grains with added value are marketed as healthy products. Nevertheless, you cannot claim health benefits that are not approved by the EU. Any nutritional or health claim should only be made in accordance with the requirements of the Health and Nutrition Claims Regulation.

Tips:

- Select your product or the pesticide you use in the EU pesticide database for a list of relevant MRLs.

- Search the RASFF database for examples of withdrawals from the European market.

- Check what legislation applies to your product in the interactive tool Access2Markets by entering the HS code of your product, origin, and destination country.

- Comply with the Codex Alimentarius General Principles of Food Hygiene (pdf) and Code of Hygienic Practice for Low Moisture Food to avoid food contamination in your company.

What additional requirements and certifications do buyers often have?

European buyers often have additional requirements. Companies often have specific quality requirements for the products, as well as packaging preferences. To fulfil their own legal obligations in the EU, they might also ask you to demonstrate a certain level of food safety and sustainability with a certification or a third-party audit of a standard.

Quality requirements for speciality grains with added value

There are currently no standards for speciality grains with added value, except for pearl millet and sorghum flour.

Table 2: Quality standards for pearl millet flour and sorghum flour

| Criteria | Pearl Millet Flour | Sorghum Flour |

| General | The product shall be safe and suitable for human consumption, free from abnormal flavours, odours, and living insects and free from filth (impurities of animal origin, including dead insects) in amounts which may represent a hazard to human health. | |

| Moisture content | 13.0% m/m max. | 15.0% m/m max. |

| Tannin content | - | 0.3% max |

| Ash | RANGE: 0.8 to 1.0% on a dry matter basis | MIN: 0.9% on a dry matter basis MAX: 1.5% on a dry matter basis |

| Protein | (N. x 5.7) MIN: 8.0% on a dry matter basis | (N. x 6.25) MIN: 8.5% on a dry matter basis |

| Crude fat | MAX: 5.0% on a dry matter basis | MIN: 2.2% on a dry matter basis MAX: 4.7% on a dry matter basis |

| Crude fibre | MAX: 1.5 m/m on dry matter | MAX: 1.8% on a dry matter basis |

| Colour | RANGE: 18 to 30 Kent-Jones units | RANGE: 18 to 30 units |

| Particle size | Fine flour MIN: 100% shall pass through a 0.5 mm sieve Medium flour MIN: 100% shall pass through a 1 mm sieve | MIN: 100% of flour shall pass through a sieve; the dimensions of the mesh being a diameter of 0.5 mm for “fine” flour and a diameter of 1 mm for “medium” flour |

Source: Codex Alimentarius for Pearl Millet flour (pdf) and Sorghum flour (pdf)/Globally Cool

Packaging requirements

For shipping, speciality grains with added value should be packed in bags of no more than 25kg. Organic products are often shipped in paper bags, while conventional products can also be shipped in polypropylene bags. Whatever the material is, the packaging should be food-grade.

The packaging size depends on the product. The weight of the package might vary depending on the product. Since puffed grains are very voluminous, they are packed in smaller bags. Here are some common practices:

- For flour and raw flakes, 25kg paper bags

- For roasted flakes and quinoa flakes, 7-10 kg

- For puffs, multilayer paper bags of around 8 kg

Keep in mind that your buyer might have a different preference in terms of packaging.

The net weight of retail packaging of speciality grains with added value is usually lower than that of similar products made from wheat or maize, and it varies depending on the product:

- Flours: 250 – 350 gr plastic or paper bag

- Puffs: 125 gr plastic bag

- Flakes: 250 gr plastic or paper bag

- Pre-cooked grains: 200 gr box

Food safety certification

Food safety is essential for the European market. Food safety management systems are a great tool to guarantee continuous food safety, and that is why they have become a standard in Europe. For this reason in particular, importers prefer to work with producers and exporters who have a Global Food Safety Initiative (GFSI) recognised food safety system certificate.

Within Europe, these are the most popular certification programmes:

- Food Safety System Certification (FSSC 22000) is a widely recognised certification programme and gives access to almost all countries in the world.

- International Featured Standards (IFS) is a scheme that is common in Germany and a few other European countries, such as France.

- British Retail Consortium Global Standards (BRCGS) can be relevant if European buyers ask for it. This scheme is especially relevant if your product ends up in British retail outlets, although not all of the British retailers use BRCGS anymore.

Such a third-party certified programme is an asset to your company and appreciated by new buyers. Nevertheless, serious buyers might also visit and/or audit the production facilities of new suppliers. Typically, the larger the buyer is, the more advanced and stricter their quality requirements are.

Sustainability compliance

Social and environmental compliance is increasingly demanded by European buyers. This often means that the supplier must undersign the buyer’s code of conduct and provide information to demonstrate social and environmental practices. Your buyers might also ask you for a third-party auditing scheme such as Amfori BSCI.

Codes of Conduct (CoC) vary from company to company, but they are often similar in structure and the issues they cover, as they are usually based on the Ethical Trading Initiative’s ETI Base Code.

Currently, the EU is discussing a Corporate Sustainability Due Diligence Directive (CSDDD). The idea behind this directive is to make companies accountable for the environmental and human issues happening in their supply chain. It requires companies to assess their own activities and the processes of their subsidiaries and suppliers in their value chains.

So far, the CSDDD will apply to European businesses with over 250 employees and a global annual income of €40 million or more. Non-European firms may also come under its scope if they generate a global income of more than €150 million, with at least €40 million originating from within the European Union.

Even if the directive doesn't directly impact smaller exporters, it might affect their buyers, in other words importers or retailers. Exporters looking to sell their products to European companies will need to demonstrate that they do not present sustainability risks to their buyers. Buyers will need proof of this, which might be a series of questionnaires but might also include a sustainability certification. Every company can decide how to implement their own due diligence. It is expected that third-party audited standards will play an important role.

Tariffs

The EU has relatively high tariffs for speciality grains with added value. This might reduce the competitiveness of your product. The tariff applied depends on the specific product and the country of origin. For example, if your country has a free trade agreement with the EU, as is the case with Peru, the product might enter the EU without paying any tariffs.

The EU also has several preferential schemes that might reduce the tariff applied to your products when entering the EU. The “Everything but Arms” (EBA) scheme, for example, removes tariffs from all goods coming from Least Developed Countries, except for arms. Also, the Generalised Scheme of Preferences (GSP) and the Generalised Scheme of Preferences Plus (GSP+) reduce the tariffs on many goods entering the EU from certain developing countries.

In the table below, you will find the import tariffs applied to the analysed speciality grains with added value by country of origin. Peruvian products pay zero tariffs thanks to the free trade agreement between the EU and Peru. India is a beneficiary of the GSP and Bolivia of GSP+, so some of their products are eligible for reduced tariffs. Ethiopia and Guinea benefit from the EBA scheme, so their products enter the EU with zero tariff.

Table 3: Tariffs for speciality grains with added value from selected origins

| HS code | Description | General Tariff | India | Peru | Bolivia | Ethiopia | Guinea |

| 1102.90.90 | Cereal flours (excl. wheat, meslin, rice, rye and maize, barley, oat flour) | €98.00 / 1000 kg | €98.00 / 1000 kg | 0 | €98.00 / 1000 kg | 0 | 0 |

| 1104.19.99 | Cereal grains rolled or flaked, other than oats, barley, wheat, rice, and maize | €173.00 / 1000 kg | €173.00 / 1000 kg | 0 | €173.00 / 1000 kg | 0 | 0 |

| 1904.10.90 | Food preparations obtained by the swelling or roasting of cereals or cereal products e.g., corn flakes | 5.10% + €33.60 / 100 kg | 1.60% + €33.60 / 100 kg | 0 | 0% + €33.60 / 100 kg | 0 | 0 |

| 1904.20.99 | Food preparations obtained from unroasted cereal flakes or from mixtures of unroasted cereal flakes and roasted cereal flakes or swelled cereals, other than muesli, not obtained from rice or maize | 5.10% + €33.60 / 100 kg | 1.60% + €33.60 / 100 kg | 0 | 0% + €33.60 / 100 kg | 0 | |

| 1904.90.80 | Food preparations cereal or cereal products (excluding maize), in grain form, pre-cooked or otherwise prepared, other than rice and bulgur | 8.30% + €25.70 / 100 kg | 4.80% + €25.70 / 100 kg | 0 | 0% + €25.70 / 100 kg | 0 | 0 |

Source: Access2Markets/Globally Cool

Tips:

- Ask your buyer for their specific product requirements regarding quality and packaging. They might be able to provide you with their own Product Data Sheets with all the specifications.

- Find out more about sustainability requirements and the CSDDD in our 6 Tips to become more socially responsible in the grains, pulses and oilseeds sector study.

- Check the tariff of your product according to your country of origin in Access2Markets. This might help you determine if you are competitive in terms of price.

What are the requirements for niche markets?

Currently, speciality grains with added value are mostly present in niche markets. The main two niche markets for these products are organic and gluten-free. While Fair Trade might offer chances, the products are still not present in the market.

Organic certification

Organic certification plays a big role in speciality grains with added value. If you want to sell your products as organic in Europe, they must be grown and processed using organic production methods that comply with organic legislation. Both the farming and the processing must be audited in order to obtain certification.

Gluten-free

In order to sell to processors specialised in gluten-free products, you need to guarantee the purity of your product and avoid contamination. The easiest way to achieve this is by not processing any products containing gluten, which might cause contamination. Keep in mind that for the EU, a gluten-free product should contain no more than 20 mg/kg of gluten. Companies that specialise in gluten-free food may be stricter than the European regulation.

Figure 1: Organic bread mix with teff of the Gluten-free specialist Schnitzer

Source: Photo by Arnaud Leene per Open Food Facts

Your buyer might also ask you for a third-party certification for gluten-free. BRCGS, for example, offers a gluten-free certification that will help you do business with specialised gluten-free buyers.

Fairtrade

When it comes to speciality grains with added value, Fairtrade International certification is only available for quinoa. For the other products, you can apply to Fair For Life to demonstrate that they are sourced and produced ethically. This programme focuses on ensuring fair working conditions, fair wages, and respect for human rights throughout the supply chain. It also includes environmental sustainability and community development.

Having a Fair-Trade certification might help you sell more easily to specialised Fair-Trade buyers in Europe, who are more prone to buy products with added value from origin.

Tips:

- Certify organic! This is the most sought-after certification for speciality grains with added value.

- Check the guidelines for imports of organic products into the EU (pdf) to understand the requirements for European traders.

- Check ITC Standards Map for a full overview of relevant certification schemes and their requirements.

2. Through what channels can you get speciality grains with added value on the European market?

There are several uses for the different speciality grains with added value. They can be sold directly to the consumer as flour, flakes or puffs to make various preparations. These products can also be used as an ingredient for the food industry, especially in the gluten-free segment. The HORECA (Hotel, restaurant and catering) sector also uses these products, including bakeries, healthy and ethnic restaurants.

How is the end-market segmented?

Figure 2: End market segments for speciality grains with added value in Europe

Source: Globally Cool

Food processing industry

The food-processing industry is a key segment for speciality grains with added value in Europe. The largest users within the food-processing segment include repackers, who repack flours, flakes and puffed grains in smaller packages for the retail market. The German company Ziegler Organic, for example, sells organic quinoa with added value (flour, puffs, flakes, etc) in different presentations and packaging, including 500gr consumer units with private label, 2.5 kg/5.0 kg units for catering, and 25kg and even 750kg big bags for industry.

Manufacturers specialised in healthy foods sometimes repack the product like packers do, to sell the puffs, flakes and flour under their brand. They also use the speciality grains with added value as an ingredient to manufacture other products. The German company Davert, specialised in organic, dried foods, uses quinoa flakes as an ingredient in their quinoa burger mix, and also sells quinoa flakes and amaranth puffs.

Manufacturers of gluten-free products are key partners for flour suppliers since they use these as an ingredient. They might also repack the speciality grains with added value, such as puffs, flakes and flour, to sell them under their own brand name. The British company amisa, for example, sells quinoa flour, flakes and puffs, and also uses quinoa, amaranth, teff and millet flour as ingredients in other products, like their pancake mix, porridge or their crispbread.

Multinationals such as General Mills, Kellogg’s and Heinz Kraft sell gluten-free products in Europe and play an important role, as they are present in the main retail chains. Other key European gluten-free companies are: Dr. Schär, Damhert, Glutafin and Amy´s Kitchen.

Cereal manufacturers can also be interesting, as they often have several cereal variations that might include puffs and flakes of speciality grains. For example, the French manufacturer of organic breakfast cereals Favrichon currently has one muesli reference in their portfolio with quinoa.

In this segment, packers and gluten-specialists offer the most opportunities for exporters of speciality grains with added value.

Retail

Physical retail is still dominant in food sales in Europe. Big supermarket chains are key actors, as consumers usually make their food purchases in this type of outlet. Today, you can find quinoa and amaranth products in the supermarket, as these are already popular enough to be relevant for these retailers. This will not be the first stop for newer products like teff or fonio, as they might not sell as much at the beginning.

The main retail chains in Europe are: Schwarz Group (Lidl and Kaufland, Germany), Aldi (Germany), REWE Group (Germany), Edeka (Germany), Tesco (UK), Carrefour (France), E-Leclerc (France), Les Mousquetaires (France), Sainsbury's (UK), and Auchan (France).

For speciality grains with added value and products containing them, specialised retail might offer more opportunities. On the one hand, drugstores are increasingly widening their range of food products, focusing on healthy brands. The German drugstore chain Müller, for example, has several products with amaranth, quinoa and millet with added value, ranging from pre-cooked meals to puffed grains.

Many drugstores sell food products from brands specialising in organic or healthy products, and often carry their own private label, which might include puffs, for example. The private label is probably produced by a packer or a manufacturer that has its own brand and also offers private label. The drugstore chains do not import directly but work with suppliers in Europe.

Drugstore chains are strongly represented in Germany with DM, Rossman and Müller the biggest ones. Both DM and Rossman have sale points in several other countries, especially in Eastern Europe. Other chains are Drogisten Associatie (DA) in the Netherlands.

Figure 3: Healthy food section in a small outlet of the German drugstore chain DM

Source: Globally Cool

Independent stores, including organic and stores specialising in health products are also interesting outlets for speciality grains with added value. They need to differentiate themselves from bigger chains, and offering different or new products is a way of achieving this. As they are independent and small, you need a local partner to supply these companies.

Online retailers might have a small share in relation to physical retailers, but they play an interesting role in the retail of speciality foods, including speciality grains with added value. There are several vendors on Amazon offering speciality grains with added value, some of which were produced and packed in their country of origin.

Some online retailers that specialise in health products have a much wider product range than physical stores and have the chance to include several speciality products that fall into the health category. The Spanish company AMCORE BALANCE, S.L (Naturitas) currently offers value-added products from teff, quinoa, amaranth, millet and sorghum, from different brands. This company ships to 19 countries in Europe.

Online retailers will not import directly. You might need a partner to sell to them. In fact, some of them might not even carry any stock at all, but will pass the order to the importer so that they can ship it to the end-consumer (dropshipping). Other online retailers might carry the stock of the items that sell the most, while others might keep some of your stock in inventory.

Ethnic stores are interesting for suppliers of speciality grains with added value, as they cater to people interested in buying ethnic foods. These consumers might already know the traditional uses of your product and might be interested in buying it. The shops are independent and usually import directly. You can supply them through a distributor specialised in ethnic shops.

Food service

The foodservice channel (hotels, restaurants and catering) is usually supplied by specialised importers, wholesalers or Cash & Carry’s. The foodservice segment often requires larger packaging sizes of flour or puffs, such as 2,5 kg or 5,0 kg bags.

These companies are sometimes the same as the brands that supply the retail segment.

World cuisines and healthy food are the major drivers in the foodservice channel in Europe that affect speciality grains with added value. African restaurants might be interested in purchasing teff and fonio products, while organic or speciality bakeries might be interested in the flours.

Nevertheless, it is fair to say that this channel is not the most crucial in Europe for the sales of speciality grains with added value.

Through what channels do speciality grains with added value end up on the end-market?

Importers represent the most important channel for specialty grains with added value in Europe. The importers can be specialised in ethnic products or in healthy products. When the product is popular enough to be sold in bigger volumes, sometimes processors and packers might import directly.

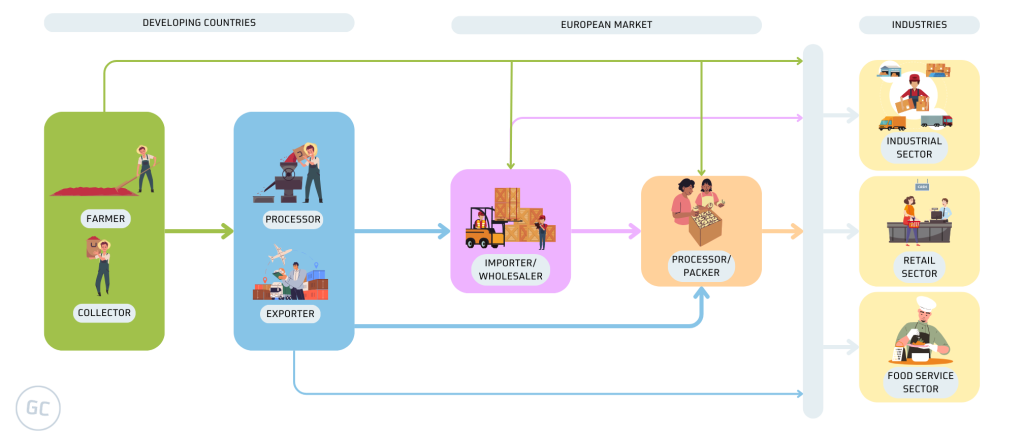

Figure 4: Trade channels for speciality grains with added value in Europe

Source: Globally Cool

Importers / Wholesalers

Importers and wholesalers are usually specialised in ingredients for the food sector. Some importers might deal with a broader range of products including other dried products such as milling goods, grains, seeds and nuts.

These importers purchase directly from the producers outside the EU to supply various customers, ranging from processors and packers to manufacturers of finished food products.

In some cases, the importers might offer private label services to retailers. They might offer this service with their own infrastructure, or they might team up with a packer.

A significant trend involves the increasing demands that retailers place on their suppliers, including importers and food producers. These expectations set the tone for how the supply chain operates, starting from the top and going down to the producer. This pressure often leads to lower prices and more value, like making primary production more sustainable.

To be able to deliver goods under those conditions, importers are forced to find long-term suppliers in developing countries that can guarantee continuous supply and social and environmental sustainability. This is only possible through long-term cooperation. This is an opportunity for exporters that are willing to invest in productivity and sustainability.

Examples of bulk importers of speciality grains with added value are Nutriboost (the Netherlands), Naturkost Übelhör (Germany) or Haudecoer (France).

On the other hand, there are specialised importers selling ethnic foods. These are very interesting, especially for grains that are not as popular, such as teff and fonio, in comparison to quinoa. Very often these specialised importers import goods directly from origin or want to leave the added value in the country as part of their company values. Companies like Racines in France, specialised in ethnic food from Africa and Oceania, have processing plants in Senegal, Benin and Madagascar and import several flours directly.

Processor/ Packer

Processors and packers sometimes import the raw materials directly to further process or pack them if the quantities justify the operation. In the case of speciality grains with added value, some processors and packers might opt to buy the quantities needed from an importer instead of importing directly.

These processors offer private label services to retailers or other brands. Since private label goods perform very well in Europe, this is indeed an interesting market for speciality grains with added value. Nevertheless, direct contact with processors might only make sense for quinoa or amaranth products, as these are more popular at the moment.

Erbacher Food Intelligence is a German packer specialising in extruded products and grains and cereals with texture. Markal is a processor and packer of organic products in France, which also has several speciality grains with added value.

What is the most interesting channel for you?

Importers and wholesalers are key partners for the export of speciality grains with added value because they can handle the volumes needed. Importing at least a full container is fundamental to reduce the logistic costs to a minimum. Other actors in the value chain might not be willing to do so, because the volumes they use are too low.

You can combine flours and flakes in the container, but not all producers have both or not all buyers will necessarily order the two products.

In addition, the shelf life of flour or flakes is lower than the shelf life of grains. The storage of grains with added value is more difficult. Flour, for example, can absorb moisture and spoil or become hard. It is therefore not necessary to import a full container. You must also sell it timely to avoid any quality issues.

To what extent the importers might import the grains with or without the added value might also depend on the product. Pops, for example, are currently being produced in Europe because their transportation cost would be too high if shipped directly from origin.

Flour and flakes are feasible to transport by ship, and in fact, some importing companies are already doing this. Nevertheless, feasibility depends highly on the food safety and quality management of the exporting companies in the countries of origin. The facilities at the places of origin need to guarantee that the product is produced and stored properly so that it arrives in good condition. Potential problems are that the product absorbs moisture or becomes mouldy or rancid due to poor storage conditions.

Another consideration beyond safety is guaranteeing that the goods are gluten-free. If the importer is targeting the gluten-free segment, it must guarantee that the flour or flakes are not contaminated with any traces of gluten. If the company in the country of origin is milling other cereals in the same facility, the product will most probably be contaminated during production or storage.

The price is also a consideration. The processing of the grains to flakes and flour for direct export can be more price effective for the importer than importing the grains and processing the grains in Europe. This saves the potentially higher cost of electricity and labour in Europe plus the transportation of the grains to the processing company. To achieve this cost effectiveness, the companies in the countries of origin must have facilities and processes that allow them to produce effectively.

In conclusion, it is certainly viable to export flour and flakes to sell to importers, as long as your company is able to guarantee that the goods are processed, stored and shipped in a way that is safe, that maintains the quality and fulfils the requirements of the buyer, such as being gluten-free.

Tips:

- Put a safety and quality management system in place to be able to supply a quality product.

- Benefit from the network of specialised European importers instead of approaching manufacturers directly.

- Look for companies selling gluten-free products per country on the site of the Association of European Coeliac Societies (AOECS)

- To find packers and producers of private label goods, visit the trade show PLMA.

- Attend trade fairs to assess the market’s interest in your product, gather market insights, and identify potential buyers. The key trade shows for you are ANUGA, SIAL, SANA, Health Ingredients Europe, Food Ingredients Europe, Biofach (the main trade show for organic products) and Vitafoods.

3. What competition do you face on the European speciality grains with added value market?

The leading suppliers of added-value grains form a diverse group with the main exporter being Thailand with 16.0 thousand tonnes in 2022, followed by the United States of America (5.86 thousand tonnes), Türkiye (5.37 thousand tonnes), India (5.08 thousand tonnes), Ukraine (3.71 thousand tonnes) and Serbia (2.96 thousand tonnes).

Source: UN Comtrade (2022)

Which countries are you competing with?

Since the HS codes for speciality grains with added value might include products from other grains different from those researched, the main competitors according to the statistics are not necessarily direct competitors. Thailand, for example, is a key supplier of rice products with added value, including puffed rice, rice flour and even pre-cooked rice, all in organic and conventional quality.

Key suppliers for the analysed grains with added value are:

- Quinoa products: Bolivia and Ecuador

- Amaranth products: Peru, Bolivia, India, EU

- Teff products: EU, Ethiopia, India and South Africa

- Sorghum products: India

- Millet products: India, EU

- Fonio products: West Africa

Leading suppliers export mainly products from non-speciality grains

The imports of speciality grains with added value from Thailand to Europe have been rising since 2018 with a CAGR of 17.25%, reaching over 16 thousand tonnes in 2022. Thailand is a big producer of rice products, which are an important product because it is gluten-free and low-cost.

Thai companies are currently able to supply good quantities of puffed rice, rice flour and even pre-cooked rice, all in organic and conventional quality.

Speciality grains with added value have a very different price point than rice products. Usually, manufacturers tend to use more rice and maize products and less speciality grains to maintain a low price of the finished good.

The case of the United States is similar. The imports of specialty grains with added value coming from the United States have been growing at 4.27% per year between 2018 and 2022, reaching 5.6 thousand tonnes. Nevertheless, the products being imported are mainly corn flakes.

The imports coming from Türkiye are mostly pre-cooked rice, while Ukraine and Serbia supply mainly corn flakes.

India supplies several products of sorghum, amaranth and millet

India is the third-largest supplier of European imports of specialty grains with added value. These imports peaked in 2021 at over 6 thousand tonnes and declined in 2022 to five thousand tonnes. From India, Europe mainly imports flours from speciality grains, which include flours from millet, teff, sorghum and amaranth.

India currently enters the European market with ethnic products such as sorghum and millet flour used for traditional preparations. On top of this, Indian suppliers are also tapping into the trend of healthy ingredients, especially with organic amaranth.

Good volumes and organic certification are key advantages of Indian suppliers over other countries.

Peru is a key supplier of quinoa and amaranth

Peru is very well known as a supplier of quinoa products in Europe. Peruvian companies also supply amaranth products, but in smaller quantities, simply because there is more demand for quinoa products.

Peru is well known in the European market for its “superfoods” which include several food products that belong to this category of “healthy ingredients” such as turmeric, chia seeds or maca. Quinoa and amaranth are key components of “Peruvian superfoods” and are well recognised in the market.

Peruvian companies have organic certified production and can supply to the “healthy ingredients” segment.

Bolivia is the quinoa pioneer

Bolivia was the pioneer exporter of quinoa to Europe and this has extended to quinoa and amaranth products with added value. As the Bolivians introduced quinoa to Europe, they are still sought-after as a supplier of quinoa products. This has also translated to amaranth.

The quinoa and amaranth industry in Bolivia is composed of a large indigenous population involved in the cultivation of the grains. In some cases, the producers are associated in cooperatives and might even be fair trade-certified. This is very compelling to European buyers that might be looking for a socially responsible supply chain.

On top of that, a lot of the quinoa and amaranth cultivated in Bolivia is certified organic, which matches the requirements of several buyers in the segment of “healthy ingredients”.

Ethiopia is the main producer of teff

Ethiopia is the main producer of teff worldwide but this is not necessarily reflected in European imports. There are some Ethiopian teff products on the market, but European teff is slowly gaining market share, especially because European companies offer certified organic teff.

The government of Ethiopia had a ban in place for non-processed teff to avoid the price rises that happened in Bolivia and Peru with quinoa. This partially explains why teff products are not widespread in Europe. The ban has been lifted and companies can export teff with an export licence. Teff is generally being sold as dried grain to be prepared at home. The product is still mainly in the African cuisine niche.

Teff is a staple food for Ethiopians, so the main demand for the product is internal. For this reason, the production of teff products corresponds mainly with the local demand, which might be less demanding in terms of food safety management as compared to Europe. Nevertheless, some companies are exporting teff products, such as flour.

West Africa is the origin of fonio

Fonio is produced in West Africa, mainly in Guinea, Nigeria and Mali. The fonio products on the European market come from multiple West African origins, such as Guinea, Mali, Senegal and Benin.

As Guinea produces around 76% of the fonio worldwide, this country has the potential to increase exports of the product.

Nevertheless, as the product is still very unknown on the market, the volumes needed are still small and the opportunities are limited to companies that have a good food safety system in place and ideally are certified organic, so that they can tap into the “healthy ingredient” niche.

EU has local production of all speciality grains except fonio

Currently, there is local European production of all the speciality grains discussed in the study except fonio. There are several millet products in Europe that come from local agricultural production and are preferred by consumers, who trust and support European agriculture.

There are also several companies in Europe selling teff flour and flakes from European teff, as well as from sorghum flour. Some European milling companies are processing the grains and selling the flour, puffs or flakes to the industry or retail. European production is still quite low in comparison with the production of teff in Africa or sorghum in India. Nevertheless, since the market for these products is so small, European production is a strong competitor.

Tips:

- Participate in organic farming because the expanding organic market in Europe can provide additional opportunities for new suppliers.

- Conduct a comprehensive feasibility study before you engage in the cultivation and processing of speciality grains. Include the costs of placing a food safety standard in place and obtaining certification in your calculations.

Which companies are you competing with?

The main competitors change depending on the product. While India is a key exporter of sorghum, millet and amaranth products, Peru and Bolivia are the leaders in quinoa and amaranth. Ethiopia is the main teff supplier to Europe while several West African countries sell small volumes of fonio.

Companies from India

Companies in India exporting millet, sorghum and amaranth products are very often trading companies selling a wide variety of other products. Om Shree International, for example, is a trading company selling a wide variety of Indian foods, including millet and sorghum flour among many other products.

This company is ISO22000 certified and currently sells to multiple countries in Europe including the United Kingdom, Belgium, Denmark, Germany, the Netherlands, Norway, Spain and Sweden.

The company Sakaria Trade Corporation is specialised in the trade of oats and oat products but also sells puffed amaranth, millet flakes and quinoa flour as well as other grains and flours. This company is ISO9000 certified and is currently exporting to Spain, Germany, France and the United Kingdom.

Very often trading companies might not be certified with a food safety management system, as they might not even come into contact with the goods. As long as the processor is certified, the buyer might agree to it.

The company Organic Tattva is different from the other two, as it is a processor and exporter of a wide variety of organic products including millet flour. This company is not only certified organic but also BRCGS certified.

Competition among the many companies is considerable, which gives buyers an advantage when it comes to price negotiations. Also, European companies are more interested in direct trade with processors instead of having traders and brokers in between.

Companies from Peru

Exporters of quinoa and amaranth products in Peru are often medium-sized companies specialised in “Andean grains” and other food products. On the other hand, some international companies have sourcing operations in those markets for organic quinoa and amaranth products, among others.

The company Solid Food Global, for example, specialises in quinoa products, including puffs and flour. This company is vertically integrated from production to sales in Europe, where they have their headquarters.

The German importer Naturkost Übelhör also has a subsidiary in Peru, from where they source quinoa and amaranth products. The subsidiary produces a whole range of quinoa products with added value. Products leaving the Peruvian manufacturing facility are exported to France, Germany, the Netherlands and Spain, among others.

The company Consorcio del Valle on the other hand, is a 100% Peruvian company processing and selling a wide variety of foods, including quinoa and amaranth products. This company is Global Gap and HACCP-certified. Even though there is no standard HACCP certification, some auditing companies offer these audits, which are the minimum standard for processing foods.

Companies from Bolivia

Quinoa is one of the most important export products of Bolivia and the companies selling their products usually specialise in quinoa and amaranth, and products made from these grains.

The company Irupana Andean Organic Food S.A. is a processing company producing various types of food products based mainly on quinoa and amaranth in organic and conventional quality.

The company SumaJuira processes and sells organic quinoa and quinoa products, including flour, flakes and puffs. This company is ISO22000 certified and has been audited under the SMETA methodology to guarantee social responsibility.

Companies from Ethiopia

The company Lovegrass was established in 2016 with the purpose of exporting teff products. Currently, the company sells several types of teff mainly on the British market, where they have a sales and distribution operation.

The company G-link sells injera, a typical Ethiopian pancake used in traditional dishes and made of teff. This company also exports coffee beans and sesame seeds.

Companies from West Africa

There are several companies from various countries in West Africa exporting fonio products. La Petite Damba from Guinea, for example, sells pre-cooked fonio through Saveurs du Pays, an importer in France specialised in African products. This company aims to sell Guinean products locally and internationally. Besides fonio, La Petite Demba exports palm oil, dried mango and powdered chilli.

Figure 6: Company video from La Petite Damba

Source: La Petite Damba YouTube Channel

The company Ets POULHO from Benin currently supplies the French retailer Vegg’Eat, specialised in plant-based foods with several fonio products.

La Vivrière is a Senegalese company producing fonio, millet and other products. This company currently sells several products, including millet flour and pre-cooked fonio to the Dutch company Unidex Holland, an importer and distributor specialised in ethnic foods. The product is packaged for the end consumer with the original branding of the company, targeting consumers with Senegalese roots.

Tip:

- Differentiate yourself from other suppliers with transparency and a short and traceable supply chain. European buyers prefer to do business with processors rather than intermediaries.

Which products are you competing with?

All these products can more or less replace each other. Other gluten-free grains in the market are maize, rice and oats which have a much lower price and are very well known in the market. Nevertheless, since these speciality grains are believed to be more nutritious, they have a competitive advantage.

This competitive advantage is relevant for a niche focused on healthy nutritious foods and not for the mainstream market. It is not expected that speciality grains will reach the volumes of rice and maize, due to their price.

In the case of flours for the gluten-free bakery, maize and rice have an advantage over new flours because the industry already knows how to use these gluten-free alternatives. New gluten-free flours are difficult to use and need a lot of trial and error to get a suitable mixture for bakery products. If a product gains popularity, brands might be interested in including it as an ingredient, but the percentage might be kept low to save money and to keep the product development process simple.

Tips:

- Build a marketing story for your products. Show how they are different from competing products based on their nutritional values.

- Research applications for the gluten-free niche. Some companies might want to include the product but don’t know how it reacts in bread mixes. If you can provide some options, this might facilitate the sale.

4. What are the prices for speciality grains with added value?

Prices for individual grains have their own specifics and are not related to each other. More similar are the premiums that are paid for organic products, which are usually between 10 and 20%.

The most relevant is the value generated by the extra processing of the grains. If the price breakdown of added value grains is analysed (see Figure 7), you can see that the step of processing, packaging, and branding represents a share of 17% of the final consumer price. This share can be more (up to 30% of the consumer price) or less (as low as 10% of the consumer price), however it is this step of adding value that can also take place in the origin country.

Source: Globally Cool (September 2023)

The margin is determined by the type of added value processing. Relatively simple processing such as milling to flour has a lower margin than processing into pops.

Examples of speciality grains with added value prices available across Europe are:

The Netherlands

- Organic 100% Wholegrain quinoa puffed in 125 gr plastic bag from the Dutch brand Volkoren for €1.99 (€15.92 per Kg) available at the supermarket chain Albert Heijn.

- Teff flakes in a 300 gr carton box from the Dutch brand Zonnatura for €3.42 (€11.40 euros per kilo) available at the supermarket chain Hoogvliet.

- Teff flakes in a 400 gr plastic bag from the Dutch brand Holland & Barrett for €5.29 available at Holland & Barrett stores.

- Sorghum flour in a plastic bag from the Indian brand Heera for (€4.30 per kilo) available at the Indian grocery store Ekriana.

- Rice waffle amaranth organic in a 100 gr plastic roll from the Dutch brand BioToday for €1.09 (€10.90 per kilo) available at the supermarket chain PLUS.

Germany

- Organic quinoa in a 400 gr plastic bag from the German brand Schneekoppe for €1.99 (€4.98 per kilo) available at the supermarket chain Aldi

- Organic millet grains in a 500 gr plastic bag, from the German brand Rapunzel Naturkost for €3.49 (€6.98 per kilo) available at the supermarket chain Kaufland.

- Amaranth flakes in 1 kilo paper bag from the German brand Piowald for €14.95, available at the supermarket chain Kaufland.

- Teff flour in a 400 gr paper bag from the German brand Bio-Planet for €5.99, available at the supermarket chain Kaufland.

France

- Quinoa grains in a 450 gr carton box from the French brand Reflets De France for €3.35 (€7.44 per kilo) available at the supermarket chain Carrefour.

- Organic millet flour in a 500 gr paper bag from the French brand NATURALINE for €2.95 (€5.90 per kilo) available at the supermarket chain Carrefour.

- Choco Amaranth Muesli in a 375 gr from Rapunzel for €5.95, available at the supermarket chain Carrefour.

United Kingdom

- Organic Quinoa Pops in a 120 gr carton bag from the British brand BioFair for £4.99 available at G.Baldwin & Co online platform.

- Organic fonio grain in a 350 gr paper bag from the British brand Biona Organic for £4.69 available at Biona Organic online store.

- Organic teff flakes in a 750 gr paper bag from the Ethiopian-British brand Topia for £8.50 available Topia online store.

- Gluten free millet flour in a 500 gr paper bag from the British brand Yourhealthstore for £5.99 (£8.29 per kilo) available at Yourhealthstore.co.uk online platform.

- Gluten Free Sweet White Sorghum Flour in a 500 gr plastic bag from the British brand Miller’s Choice for £3.29 available at Just natural online store.

Belgium

- Sorghum millet in a 1 kg plastic bag from the Indian brand Aachi for €4.51 available at global food hub online store.

- Organic Millet Flour, Gluten Free in a 652 gr paper bag, from the American brand Arrowhead Mills for €20 available at U-buy online platform.

- Amaranth Flour Organic in a 454 gr plastic bag, from the American brand Herbazest, for €23, available at U-buy online platform.

Spain

- Dry white quinoa in a 400 gr carton bag from the French brand Auchan for €1.98, available at the supermarket chain Alcampo.

- Organic sorghum flour in a 4 kg paper bag from Salutef for €35.95 available at the online store mentta.

- Whole bio teff flakes in a 250 gr plastic bag from the Spanish brand El Granero Integral, for € 5.19 available on the online Para pharmacy Bio-Farma

- Amaranth flakes in a 500 gr plastic bag, from the Spanish brand El Oro de los Andes for €6.0 available on the online Para pharmacy Bio-Farma

Tip:

- Consider the prices of competing products before making an investment. If there is a sudden increase in demand for a product, this might cause a short-term rise in the prices until there are enough suppliers. If you are planning an investment, consider the current price of quinoa or amaranth in your target markets, which are now more stable. This might give you a better estimation for your business plan.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research