The European market potential for speciality grains with added value

Due to the growing interest in healthy foods, speciality grains with added value are growing in relevance in the European market. While quinoa, millet and amaranth are already popular, other grains like teff, fonio and sorghum are just starting to grow. You can find opportunities to sell speciality grains with added value in Western Europe, where the interest in healthy and sustainable food products is very strong.

Contents of this page

1. Product description

Added-value grains in this document refers to grains that are exported after undergoing processing. In this case, we are looking at speciality grains, with a focus on:

- quinoa

- amaranth

- teff

- fonio

- millet

- sorghum

These speciality grains have become popular due to their nutritional profile, including a high protein content, some antioxidants, and the absence of gluten. They are usually exported dried, to be further processed. Some are repacked and sold for consumers, who can cook and consume them directly instead of rice, bulgur or couscous. This is the initial form in which European consumers started consuming speciality grains.

On the other hand, these grains are also processed further by the industry. This document focuses on the opportunities for speciality grains that are processed in the country of origin to be exported as flour, flakes, extruded snacks, “puffed or popped grains”, pre-cooked meals or mixed grains. It uses the following HS codes to indicate trade in these grains:

Table 1: HS Codes of speciality grains with added value

|

HS code |

Description |

|

110290 |

Cereal flours (excl. wheat, meslin, rice, rye and maize) |

|

110419 |

Cereal grains rolled or flaked, other than oats and barley |

|

190410 |

Food preparations obtained by the swelling or roasting of cereals or cereal products e.g., corn flakes |

|

190420 |

Food preparations obtained from unroasted cereal flakes or from mixtures of unroasted cereal flakes and roasted cereal flakes or swelled cereals |

|

190490 |

Food preparations cereal or cereal products (excluding maize), in grain form, pre-cooked or otherwise prepared |

As you can see in the table above, the HS codes exclude other grains like wheat or corn but are not specific for the group of products we are researching. Therefore, the trade statistics will point at markets importing “alternative” or less popular grain products that include our products of interest but are not limited to them.

Use of the product

As consumers are increasingly looking for gluten-free and nutrient-dense foods, speciality grains are used to replace wheat in processed foods. Some of these products are baked goods and baking mixtures, as well as breakfast cereals. Other applications include vegan and vegetarian preparations and food mixes.

Speciality grains with added value have different uses depending on the product.

Table 2: Common uses of speciality grains with added value

|

Product |

Use |

|

Flour |

|

|

Flakes |

|

|

“Puffs” |

|

|

Extruded grains |

|

|

Pre-cooked |

|

|

Mixtures |

|

Source: Globally Cool BV

The use of these speciality grains with added value also depends on the grain. Some, like quinoa or amaranth, are present in many forms. Others are still starting to develop. The table below provides the most common added-value products found in the European market per grain.

Table 3: Most common added-value products per grain sold in Europe

|

Product |

Description |

Main uses |

|

Quinoa |

Quinoa has become very popular in Europe due to its exceptional nutritional profile. This ancient grain is prized for its high protein content, making it a popular choice for health-conscious consumers, vegans and vegetarians. Since it is also gluten-free, it presents an alternative for people looking for gluten-free foods. |

|

|

Amaranth |

Amaranth has also become very popular in Europe as a healthy, gluten-free grain, although to a lesser extent than quinoa. |

|

|

Teff |

Teff is less known and is present in the market mainly as whole grain to be cooked at home. Nevertheless, flour and flakes are somewhat present, as well as other foods containing flour. |

|

|

Millet |

Millet is traditionally consumed in Europe as porridge, especially in Central and Eastern Europe. Nevertheless, its popularity has increased in the past ten years with the growing interest of consumers in nutritious, gluten-free foods. |

|

|

Sorghum |

Sorghum for human consumption in Europe is mainly used for the production of gluten-free products. In retail, it can also be found as a dried grain for cooking at home and as a stand-alone flour, but it is less popular than the other grains of the group. |

|

|

Fonio |

Fonio is the least-known grain of the group but is slowly gaining recognition in the European market as a healthy, gluten-free alternative to other grains. Is present in the market mainly as dried grain. |

|

Source: Globally Cool

2. What makes Europe an interesting market for speciality added-value grains?

The European added-value grains market is stabilising. While intra-European trade continues to dominate the market, imports from developing countries are developing very rapidly. This shows the growing relevance of direct trade in value-added grains from developing countries.

Source: UN Comtrade

The European added-value grains market is fairly stable, with imports growing at a modest average annual rate (CAGR) of around 1.8% between 2018 and 2022.

In 2022, European imports of added-value grains totalled 2.1 million tonnes (US$3,924 million), of which 50 thousand tonnes (€114 million) originated from developing countries. As a result, imports from developing countries only represent 2.4% of the total trade volume, indicating potential for growth for these emerging nations. Imports coming from other geographies accounted for less than 1% of total imports (12 thousand tonnes, €53 million).

The high share (97%) of intra-European trade in this category is not surprising, as the dried grain is usually imported to Europe for further processing and packaging. Nevertheless, the imports from developing countries have been growing with a strong CAGR of 11%, compared to a CAGR of only 1.6% for intra-European imports.

The decreasing intra-European imports and increasing imports from developing countries indicate that the speciality grains coming from developing countries are rising in interest, but also that adding value to grains is increasingly happening in the countries of origin.

Source: UN Comtrade

Swelled or roasted cereals (like puffs) were the most imported product of the category in the last five years, although imports decreased after 2020. The second product is flakes, which peaked in 2019, and dropped in the following two years, to recover in 2022.

Source: UN Comtrade

In the case of European imports coming directly from developing countries, flour was the main imported product. It showed steady growth in the last five years, going from 11 thousand tonnes in 2018 to 17 thousand tonnes in 2022. Imports of pre-cooked cereals also went from 8 thousand tonnes in 2018 to 16 thousand tonnes in 2022.

Which added-value products from speciality grains have more opportunities in the European market depends on several factors:

- Shipping: The shipping costs of the product depend on the weight and volume relation. Grains, pre-cooked grains, flour, and even flakes are dense enough for the shipping costs to stay relatively low per kilo. Puffed cereals have a lot of volume, so it is more cost-efficient to import the grains and process them in Europe than to import the puffed grains. In addition, processed grains are more delicate than dry grains, and their organoleptic characteristics can suffer during transport.

- Competitiveness: Processing in developing countries is often thought to be cheaper than processing in Europe due to lower labour costs. Nevertheless, food processing in Europe is very efficient and often more cost-effective than in developing countries. Only companies in developing countries with up-to-date facilities and efficient processes might be able to compete.

- Packaging: Companies in developing countries often lack adequate packaging to offer products such as packed snacks for the end consumer. Importing the packaging increases the final cost of the product, losing competitiveness versus snacks produced and packed in Europe.

Tip:

- Make your processes efficient and make use of good machinery to guarantee competitiveness.

3. Which European countries offer the most opportunities for speciality grains with added value?

In 2022, the Netherlands was the main importer with a share of 15.6%, followed by Germany with a share of 10.8%. Together, both countries account for over a quarter of the European import market. The next main importers were France (9.8%), the United Kingdom (8.9%), Belgium (7.1%), and Spain (6.8%). These top six countries account for around 60% of European imports of speciality grains with added value.

Source: UN Comtrade

The Netherlands

In 2022, the Netherlands imported 329 thousand tonnes of added-value grains with a CAGR of -2.4% between 2018 and 2022. This is a slight decrease over the last five years.

Belgium was the Netherlands’ leading supplier with 152.5 thousand tonnes and an import share of 46.4%. Germany was the second-largest with 136.1 thousand tonnes (41.4% of total imports), followed by the United Kingdom (8.2 thousand tonnes and a share of 2.5%). In fact, intra-European imports account for 99% of the Dutch imports of these products.

The Netherlands plays a key role in the supply chain of food products in Europe, as it acts as a trade hub for the wholesale of goods. The Dutch company Royal Natural Foods, for example, imports and re-sells conventional and organic grains, pulses, and oilseeds, including speciality grains, with and without added value to customers in Europe and overseas.

The imports of speciality grains with added value from developing countries have been increasing, with a CAGR of 18% between 2018 and 2022. From the imports coming from developing countries, flour accounted for more than 50% (1,303 tonnes) of the total, followed by pre-cooked cereals (484 tonnes) and swollen or roasted cereals (396 tonnes) with a share of 19% and 16% respectively.

Among developing countries, Thailand was the main supplier. Its imports went from 750 tonnes in 2018 to 1,041 tonnes in 2022 (a CAGR of 9%), with a peak of 1,487 tonnes in 2021. The Republic of Korea followed with 873 tonnes and a CAGR of 104%, India with 334 tonnes and a CAGR of 123%, and Senegal with 123 tonnes and a CAGR of 4%.

The organic niche is key for speciality grains with added value. The Netherlands is not a key consumer of organic products compared to other markets in Europe, but consumers interested in these products are inclined to buy organic. Besides, since its importers and traders supply other countries, organic certification plays a key role. For example, the Dutch company DO IT ORGANIC imports and re-sells organic ingredients, including speciality grains with and without added value, to customers in Europe.

Germany

Germany is both a big consumer of speciality grains with added value and a key exporter of these products. In 2022, German imports reached 226 thousand tonnes. They declined with a CAGR of -3.9% between 2018 and 2022.

94% of German imports come from other European countries. The Netherlands was Germany’s largest supplier, amounting to 38 thousand tonnes and a share of 16.9% of German imports in 2022. Belgium was the second-largest supplier with 28 thousand tonnes (12.5% of total imports), followed by Poland (26 thousand tonnes and a share of 11.6%). The intra-European imports showed a CAGR of -4.9% in the last five years, which drove the overall import decline of the category.

Around 6% of German imports come from developing countries. These showed a CAGR of 24.7% in the last five years. The main suppliers from developing countries are Thailand and Turkey. For instance, imports from Thailand increased from 1 thousand tonnes in 2018 to 4.12 thousand tonnes in 2022 – a 544.9% increase. Pre-cooked cereals accounted for 63% (7.8 thousand tonnes) of German imports coming from developing countries, followed by swollen or roasted cereals (18%, 2.2 thousand tonnes) and flours (16%, 2 thousand tonnes).

When it comes to exports, Germany is the main exporter of speciality grains with added value in Europe. In 2022, Germany’s exports of this product group were over 60% higher than its imports. The reason for this is that Germany has a very strong food processing industry in this range of products, which includes snacks, breakfast cereals, and gluten-free products. For example, Davert exports various organic products including pre-cooked grains, breakfast cereals and others, as well as raw materials and ingredients like bulk grains with added value.

In general, flakes, puffs, and extruded products have potential in the German market as healthy and gluten-free alternatives to snacks, bakery products and cereals. More on this trend in the upcoming chapter about trends. The flours have opportunities to grow as Germany has very strong companies in the gluten-free segment, such as Schär, 3Pauly and Alnavit.

Germany is the largest market in Europe for organic-certified food products. In fact, speciality grains with added value are usually sold in Germany under the organic label. Although there are no statistics available about the market share of organic speciality grains in Germany, the products present in physical retail are virtually always organic.

Figure 5: Organic quinoa and amaranth puffs in German drugstore chain DM, private label

Source: Globally Cool

Germany is also the second-biggest market in the world for Fair Trade products. Nevertheless, Fair Trade-certified speciality grains with added value are virtually non-existent in the market. The reason for this might be that these grains are mainly processed in Europe, and the processing partners are not Fair Trade-certified. In addition, Fair Trade International, the most recognised Fair Trade Standard in Europe for food products, only covers quinoa among the speciality grains discussed in this study.

Currently, you can find Fair Trade and organic dried grains such as quinoa, but not processed Fair Trade quinoa. The company Clasen Bio, for example, repacks dried organic and Fair Trade quinoa and organic quinoa puffs for the retail market. In conclusion, Fair Trade does not play a big role in the German market of speciality grains with added value, although in theory, the market welcomes these kinds of products.

France

In 2022, France imported 207 thousand tonnes of added-value grains, with a CAGR of 3.5% between 2018 and 2022. This makes France the largest importer of added-value grains with a positive yearly growth rate. France’s growth was driven by imports from other European countries (a CAGR of 3.9%). Belgium was France’s leading supplier with 52.7 thousand tonnes and a 25.5% share of imports. Germany was the second-largest with 52.6 thousand tonnes (25.4%), followed by Spain (30.5 thousand tonnes, 14.8%).

The imports from developing countries accounted for 3% in 2022. Unlike the Netherlands and Germany, France’s imports from developing countries showed a yearly decrease of 3% in the last five years. The leading supplier from developing countries was Thailand, with imports increasing from 3.06 thousand tonnes in 2018 to 3.63 thousand tonnes in 2022.

If we break down French imports per product classification from developing countries, we see that the imports have consistently decreased among all categories. Except for food preparations from roasted cereals (HS code 190410), where imports increased from 280 tonnes in 2018 to 535 tonnes in 2022, with a CAGR of 17.5%. Flour accounted for 73% (3.9 thousand tonnes) of French imports coming from developing countries, followed by pre-cooked cereals in grain form (15%, 784 tonnes) and swollen or roasted cereals (10%, 235 thousand tonnes).

France is a key market for speciality grains such as teff or fonio, as it has been one of the first countries in Europe to import and sell these products. On the one hand, the population with African roots in France drives demand for these products in the ethnic market. On the other hand, there is still room for growth in the development of the gluten-free market, which is not as developed as in other markets such as Germany, the United Kingdom, and Scandinavia.

France is the second-largest market in Europe for organic-certified food products. Organic certification is key in the segment of healthy foods, including speciality grains with added value. A great range of these products in the market currently are organic-certified. For example, the French company Mouline de Moine offers organic-certified quinoa flakes and flour, sorghum flour, millet flour and teff flour. Also, Markal sells teff flour (grown and produced in France) and quinoa puffs.

The United Kingdom

In 2022, British imports of added-value grains amounted to 188 thousand tonnes, with a CAGR of -1.2% between 2018 and 2022. Germany was the United Kingdom’s largest supplier with 38 thousand tonnes and an import share of 20.2%. Ireland was the second-largest with 34.5 thousand tonnes (18.4%), followed by France (20.4 thousand tonnes, 7.4%). When it comes to suppliers from developing countries, India takes the lead in the British market, increasing from 2.5 thousand tonnes in 2018 to 2.9 thousand tonnes in 2022.

When we break down British imports per product classification, imports have decreased among most categories over the last five years – except for rolled or flaked cereal grains (HS code 110419) and food preparations from unroasted cereal flakes (HS code 190420). However, food preparations from roasted cereals make up Britain’s largest imports with 89 thousand tonnes imported in both 2018 and 2022 without any growth over the last five years.

British imports from developing countries are growing across all categories apart from food preparations from unroasted cereal flakes. Cereal flours (HS code 110290) remain the most imported product class with 1.7 thousand tonnes imported from developing countries in 2018, compared to 2.5 thousand tonnes in 2022 with a CAGR of 9.6%.

The United Kingdom has a big market for Indian foods due to an important population with Indian roots. Therefore, there are several brands distributing traditional Indian products which include millet and sorghum flours. Jaipur Millers and TRS Foods are both British brands of Indian foods that sell these flours.

The United Kingdom is the fifth-largest market in Europe for organic-certified products. For speciality grains with added value, this certification is key – especially for the health and wellness category. For the flour used to make gluten-free products, there is a market for both organic and conventional.

The United Kingdom is the biggest market in Europe for Fair Trade-certified products. Nevertheless, there are very few speciality grains with added value that are fair trade-certified, even in this market. BIOFAIR, for example, sells various organic-certified quinoa products from Bolivia and Ecuador, ranging from flour and flakes to snacks. The company claims to sell only organic and Fair Trade products, but the products do not include a Fair Trade logo matching the most known certification schemes such as Fair Trade International or Fair For Life.

The British market offers opportunities for Fair Trade grains with added value for the retail market. Nevertheless, for industrial purposes, such as making bread mixtures, this certification does not play a role.

Belgium

In 2022, Belgium imported 150 thousand tonnes of added-value grains, with a CAGR of 2.0% between 2018 and 2022. France was Belgium’s leading supplier with 37.7 thousand tonnes and a 25.1% import share. The Netherlands was the second-largest with 37.6 thousand tonnes (25% of total imports), followed by Germany (23 thousand tonnes, 15.3%). The imports from developing countries accounted for 1% of the total in 2022.

Belgium’s largest import category is cereal flour (HS code 110290), with imports growing from 44 thousand tonnes in 2018 to 63 thousand tonnes in 2022 with a CAGR of 9.5%. This shows that opportunities can be found in Belgium’s flour market.

From developing countries, Belgium mainly imported flour – accounting for 86% of the whole category (1,174 tonnes) and with a CAGR of 4% in the last five years. Belgian imports of puffed grains from developing countries are still small, with over 50 tonnes (4% share), but they have been increasing at a strong CAGR of 28% since 2018. Unlike Europe’s top three importers, Belgium’s largest supplier of added-value grains from developing countries is Cambodia, with 650 tonnes in 2022 (CAGR 6%).

From the researched speciality grains, quinoa is the only one that is relatively widespread in Belgium. For example, prepacked bread producer and exporter Patroba (Brand name Biaform) has bread with spelt, quinoa and millet. The Belgian supermarket chain Delhaize also sells organic quinoa puffs as a gluten-free breakfast cereal alternative under their private label. The other grains are still not very well-known in the market.

Currently, you can find teff flour, quinoa flour, and millet flour among other alternatives of gluten-free flour to be used for baking at home. Nevertheless, their presence in industrial bakery products is still very limited. One reason for this is the fact that being gluten-free has a major impact on their use in the preparation of bread. Appropriate processing technology is needed to use them pure or mixed as ingredients in baking. Nevertheless, the increasing interest of Belgian consumers in these so-called ancient grains presents an opportunity.

Spain

In 2022, Spanish imports of added-value grains totalled 143.5 thousand tonnes with a CAGR of 0.3%. France was Spain’s leading supplier with 39.9 thousand tonnes and a 46.4% import share. Portugal was the second-largest with 36.2 thousand tonnes (41.4% of total imports), followed by Germany (23.4 thousand tonnes, 2.5%).

When we break down Spanish imports per product classification, Spain is Europe’s leading importer of cereal flours (HS code 110290), with imports growing from 52 thousand tonnes in 2018 to 89 thousand tonnes in 2022 at a CAGR of 14.5%.

The same applies to suppliers from developing countries. Cereal flour imports from developing countries have increased from 362 tonnes in 2018 to 3,222 tonnes in 2022, with a CAGR of 72.7% – accounting for 88% of the whole category. Brazil is Spain’s largest supplier among developing countries, increasing from 70 tonnes in 2018 to 2.1 thousand tonnes in 2022 – a 2,909% increase.

Spain is also becoming a producer of some specialty grains, including quinoa and teff. The Spanish company Salutef, for example, sells various teff products that are “made in Spain”. Nevertheless, some of the products do indicate that they are not produced in the EU, as is the case with their amaranth flour. Companies such as Salutef might want to add complementary healthy products to their range of imported goods. This can be an opportunity for producers of speciality grains with added value.

As in the other markets, plant-based and gluten-free nutrition drives the consumption of speciality grains with added value. The Spanish company El Granero sells flours, flakes and snacks from quinoa, teff, amaranth and some convenience foods with millet flour. These products are certified organic and sold as “functional”, gluten-free foods. Similarly, the Spanish company Biodarma produces organic biscuits with quinoa flour.

Like the Netherlands, Spain is not a key market for organic products. Nevertheless, the niche for healthy food, including speciality grains, does value the organic certification.

You can find opportunities in Spain by targeting the food production sector, which is adapting to the increasing interest of consumers in new healthy ingredients. Nevertheless, the volumes might still be low, as these grains are usually one of several ingredients in a finished product.

Tip:

- Focus on the Netherlands, Germany, France and the United Kingdom for bulk markets. These are countries with experienced importers that have an international focus.

4. Which trends offer opportunities or pose threats on the European speciality grains with added value market?

The patterns described below can be observed throughout Europe. Their influence on the food market is stronger in Northern Europe. As a result, the Netherlands, Germany, the United Kingdom, France, and Belgium experienced the greatest effects from these trends. In Spain, the influence of these trends is moderate.

Environmental concerns are shaping consumption in Europe

In Europe, the environment is becoming a major influence on how people choose and consume food. People are increasingly aware of the environmental impact of their food choices and are opting for more sustainable and eco-friendly options. Plant-based diets are driving the consumption of speciality grains with added value, as they are a good source of protein.

This shift is prompting changes in the way food is produced, distributed, and sold. From farm to table, there is a growing emphasis on reducing waste, supporting local and organic agriculture, and making choices that have a lower carbon footprint. As a result, environmental concerns are playing a significant role in shaping the food consumption habits of Europeans.

Vegan, vegetarian and plant-based diets

Vegan, vegetarian, and plant-based diets are becoming more popular across Europe. People are increasingly opting for these dietary choices due to health, environmental, and ethical reasons. In many European countries, restaurants, supermarkets, and food manufacturers are offering a wider variety of plant-based products to cater to this growing demand.

Quinoa and amaranth are sources of complete protein, which is difficult to find in plant-based products. This has made these products grow in popularity among vegetarian and vegan consumers. The German company Rila, for example, sells organic protein patty mixes containing quinoa. Although other speciality grains such as millet, teff, fonio, and sorghum might not be complete proteins, they have more protein content than other grains such as wheat or maize. This also makes them a good option for vegans and vegetarians.

Figure 6: Organic meat replacement for vegans with quinoa, bulgur and tomato sold in France

Source: Photo by sqoia per Open Food Facts

Health and sustainability go hand in hand with organic certification

Speciality grains such as amaranth, fonio, teff and sorghum, which are still becoming popular in the market, are niche products associated with healthy and vegan nutrition. Products that are marketed for these categories are often certified organic. Especially in Germany, a big majority of puffed speciality grains, flours and snacks sold directly to the end consumer are certified organic. In the German drugstore chain DM, a key sales channel for healthy speciality foods in Germany, all millet, quinoa, and amaranth products are certified organic.

In the other key countries, the prevalence of organic certification in grains with added value is a bit lower than in Germany, but still relevant in the niche of speciality and healthy products. Quinoa is the most popular of the speciality grains and has become a more mainstream product. Therefore, it can be found in both the organic and conventional aisles in European markets. Before it became popular, it was almost always present as an organic product.

The social aspect of sustainability is also very important for speciality grains with added value. Companies are currently under pressure to ensure the sustainability of their supply chains, especially if they import goods from developing countries. Having a sustainability standard in place will be a requirement for your buyers.

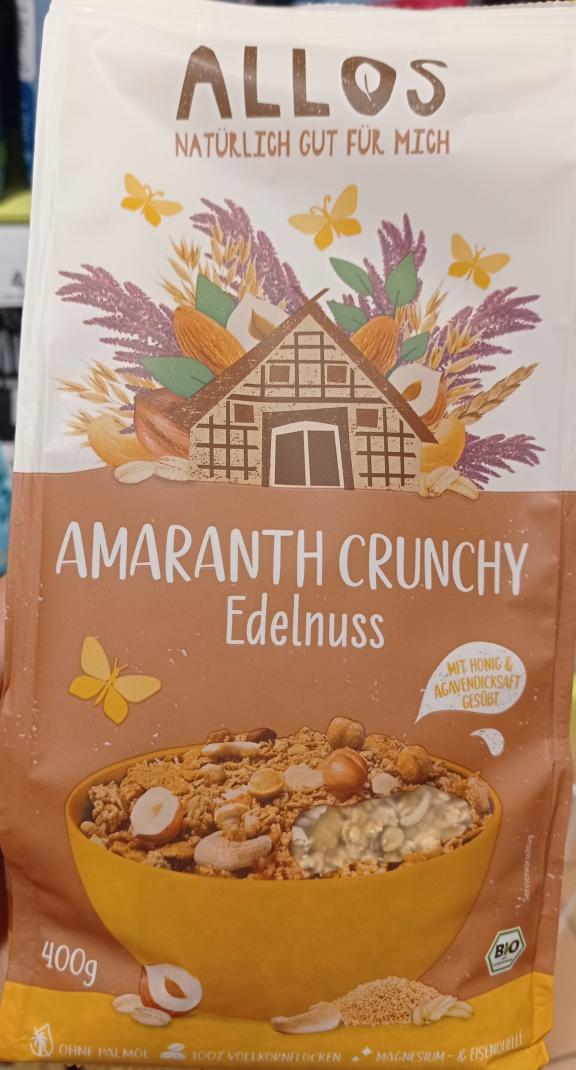

Figure 7: Organic muesli with amaranth, whole flakes and nuts and sweetened with honey and agave syrup

Source: Photo by openfoodfacts-contributors per Open Food Facts

Shift in the health and nutrition patterns among European consumers

Consumers in Europe are becoming increasingly aware of the importance of a healthy diet for their overall health. There is a lot of talk in traditional and social media about healthy foods, which has opened the market for new products offering health advantages. Speciality grains with added value can profit from this trend, as they are marketed in Europe as healthy alternatives to other cereals or grains such as wheat or corn.

Popularity of gluten-free diets

More gluten-free food alternatives have emerged in the European market. On the one hand, celiac disease and gluten intolerance have become more visible in society. On the other hand, some people are trying to avoid or reduce gluten in their diets, simply hoping to obtain health benefits.

Speciality grains such as quinoa, amaranth, teff, fonio, sorghum, and millet are gluten-free and can be used to produce gluten-free products. Popular gluten-free products include replacements for typical foods from wheat, such as baked goods, pasta, breakfast cereals, snacks, and baking mixtures.

To produce gluten-free bakery products and baking mixes, companies usually experiment with different types of flours to get the right consistency and flavour, which is difficult to achieve with one single gluten-free flour. For example, the Italian-based world leader in gluten-free products, Schär, uses flour from all the speciality grains researched for their bakery and convenience products, except fonio.

When it comes to gluten-free specialised products, there are both organic and conventional products in the market. For companies that lack organic certification, this niche can therefore be very interesting. For this reason, companies looking to sell flours or other forms of speciality grains with added value must be able to guarantee that the product is gluten-free and is not contaminated during storage or processing. The European Union has a standard in place that defines gluten-free products. Read our Market Entry Report for Speciality Grains with Added Value for more information.

Health and nutrition meet convenience

The awareness of the link between diet and overall well-being, and the desire for diverse culinary experiences are driving Europeans to explore alternative food options. Speciality grains have attracted attention because of their nutritional profiles, including high protein content, essential vitamins and dietary fibre.

On the other hand, convenience food is very popular among European consumers, who have little time to cook. Therefore, the market for healthy convenience products is growing, and speciality grains with added value are profiting from it.

For example, the British rice specialist Tilda offers a pre-cooked wholegrain rice and quinoa mix as a nutritious alternative that is ready in 2 minutes. The product is also advertised as a good source of fibre and suitable for vegans and vegetarians. Lovegrass Agro Processing PLC, with production in Ethiopia and distribution offices in London, advertises its extruded teff snacks as a healthy option due to their content of prebiotic fibre, iron, magnesium and complex carbs.

There are several snacks in the European market with puffed quinoa and amaranth, some puffed in origin countries and others in Europe. The German company El Origen sells organic-certified quinoa and amaranth snacks that are produced in Ecuador and imported in their final form. Part of the unique value proposition of the company is sustainability, from both a social and an environmental perspective. They want to import a finished product and add value in the origin country.

The Bolivian cooperative Anapqui currently sells Fair Trade and certified organic quinoa flour and flakes to the German company El Puente Gmbh. This company’s focus lies on fair trade, so they are willing to import finished goods, as long as they have the right quality and sell well in the German, Austrian and Swiss markets.

Nevertheless, this is not always the case for the mainstream in Europe. Companies might be willing to import semi-processed or even finished goods if this provides a price advantage and if the product arrives in perfect condition. Otherwise, they will stick to their current European suppliers.

Tips:

- Switch to organic agriculture. Niche food products related to health trends are often certified organic. Also, companies with a focus on sustainability might be more inclined to purchase products where value is added in the country of origin. At the same time, these companies might require a certified organic product.

- Advertise your product by referencing several trends. For example, an extruded quinoa snack is nutritious, gluten-free, and contributes to the plant-based protein intake of vegans and vegetarians.

- Promote the sustainable aspects of your company and product. Have proof of your claims like a Code of Conduct, a standard or certification, and your corporate social responsibility (CSR) practices. Our requirements for grains, pulses, and oilseeds study provides you with more information on certification and standards.

- Find out more about social sustainability good practices in our Tips to become a socially responsible exporter of grains, pulses and oilseeds study.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research