Entering the European market for bed textiles

The European market for bed textiles offers opportunities, but competition is strong. As volume-producing countries dominate the lower ends of the market, the middle-high segment is your best option. You can add value through special techniques, artisanry, and the type and quality of raw materials. Entering the European market means you must comply with mandatory (legal) requirements, as well as any additional or niche requirements your buyers may have.

Contents of this page

1. What requirements must bed textiles meet to be allowed on the European market?

The following requirements apply to bed textiles on the European market. For a more detailed overview, see our study on buyer requirements for home decorations and home textiles (HDHT).

What are mandatory requirements?

When exporting to Europe, you must comply with various legal requirements.

General Product Safety Regulation

The new General Product Safety Regulation (GPSR, EU 2023/988) requires that non-food products marketed in the European Union (EU) are safe to use. This applies to all non-food products sold online and offline. Non-EU products can only be sold if an ‘economic operator’ based in the EU is responsible for their safety. For business-to-consumer (B2C) trade, you must contract an authorised representative or fulfilment service provider.

To prove that your products are safe, you must do a risk analysis and write the required technical documentation. Unsafe products are rejected at the European border or withdrawn from the market. The EU uses the Safety Gate system to list and share information about such products.

Tips:

- Read more about the GPSR, including the questions and answers (Q&A).

- Use common sense to ensure that normal use of your product does not cause any danger.

- Search Safety Gate alerts for bed textiles for examples of possible issues, such as prohibited chemicals or long cords that could lead to strangulation.

Restricted chemicals: REACH

The REACH regulation (EC 1907/2006) lists restricted chemicals in products that are marketed in Europe.

Restricted chemicals in the production of textiles include:

- Azo dyes that release prohibited aromatic amines;

- Certain flame retardants, such as TRIS, TEPA and PBBs.

Tips:

- Comply with the restrictions as laid down in REACH.

- Do not use azo dyes that release forbidden aromatic amines. Also check that your suppliers adhere to this and ask them for certified azo-free dyes.

- Follow developments in the field of flame retardants, for instance through pinfa.

- Explore information and tips from the European Chemical Agency (ECHA), like its list of all restricted chemicals (REACH Annex XVII), information for non-EU companies and questions & answers.

Intellectual property rights

When you develop products, you must not copy an existing design. Intellectual property (IP) is protected in Europe, and products that violate IP rights are banned from the market.

Tip:

- For more information, see the websites of the European Union Intellectual Property Office (EUIPO) and the World Intellectual Property Office (WIPO).

European Green Deal

The European Green Deal is a set of policies that support social and environmental sustainability. Its Circular Economy Action Plan includes initiatives that cover the entire product life cycle. As a result of the European Green Deal, legislation is being updated and new laws are being developed. Some of these laws will apply to you directly, and some indirectly via your buyers.

Textile Regulation

The Textile Regulation (EU 1007/2011) states that products containing ≥80% textile fibres must be labelled or marked. The label must state the full fibre composition and, if applicable, the presence of non-textile parts of animal origin. It must be durable, easily legible, visible and accessible. The label should be printed in all the official national languages of the European countries where the product is sold.

There is no EU-wide legislation on symbols for washing instructions and other care aspects. To give consumers clear information, you should follow the ISO 3758:2023 standard for graphic symbols in care labelling.

The European Commission plans to revise the Textile Regulation to introduce specifications for physical and digital labelling of textiles, including sustainability and circularity requirements based on the new Ecodesign for Sustainable Products Regulation.

Tips:

- Read more about the Textile Regulation. Also see the FAQ.

- Find out more about textile labelling rules from Access2Markets.

- Stay updated on the revision of the Textile Regulation.

Ecodesign for Sustainable Products Regulation

The new Ecodesign for Sustainable Products Regulation (ESPR – EU 2024/1781) entered into force in 2024. It aims to ensure that products:

- Are designed to last longer;

- Are easier to reuse, repair and recycle;

- Incorporate recycled raw materials wherever possible.

The regulation also introduces Digital Product Passports with information about products’ environmental sustainability, like their durability and use of recycled materials. The Commission adopted the first working plan in April 2025, which includes textiles. The first measures could be adopted in 2027 and be applicable 18 months later.

Tips:

- Read more about the ESPR. Also see the FAQ, Q&A and factsheet.

- Stay updated on the implementation of the ESPR.

Corporate Sustainability Due Diligence Directive and Forced Labour Regulation

The Corporate Sustainability Due Diligence Directive (CSDDD – EU 2024/1760) requires larger companies to do everything they can to reduce negative impacts of their activities on human rights and the environment. The CSDDD applies to both the company’s own operations and their direct business partners. This means that the new rules may apply to you indirectly via your buyers. The European Commission plans to publish guidelines to help companies conduct due diligence.

In February 2025, the European Commission proposed an Omnibus package to simplify sustainability due diligence requirements. As part of this package, the European Parliament has agreed to postpone the CSDDD’s introduction. The CSDDD will now come into force following a staggered approach: it will apply to the first group of companies from 26 July 2028 until full application on 26 July 2030.

In addition, the Forced Labour Regulation (FLR – EU 2024/3015) bans products made with forced labour. The FLR will apply from 14 December 2027.

Packaging legislation

The Packaging and Packaging Waste Directive (PPWD – 94/62/EC) aims to prevent or reduce the impact of packaging and packaging waste on the environment. Buyers may therefore ask you to minimise the use of packaging materials and/or to use sustainable (recycled) materials.

By 2030, all packaging on the European market should be reusable or recyclable economically. To help achieve this, the new Packaging and Packaging Waste Regulation (PPWR – 2025/40) entered into force in February 2025. This regulation will apply from 12 August 2026, replacing the PPWD.

The Plant Health Law (EU 2016/2031) also sets requirements for wood packaging materials used for transport, such as packing cases and pallets. The goal is to prevent organisms that are harmful to plants or plant products from entering and spreading within the EU.

Tip:

- Read more about EU rules on packaging and packaging waste and the requirements for wood packaging materials.

Pending: Green Claims Directive

The European Commission has proposed a Green Claims Directive to:

- Make green claims reliable, comparable and verifiable;

- Protect consumers from greenwashing (pretending you are ‘greener’ than you are);

- Contribute to a circular and green economy;

- Help create a level playing field when it comes to the environmental performance of a product.

The proposal is currently awaiting approval. If the Directive is approved, any green claim you make about your product will have to meet certain requirements. These requirements will apply to how you prove and verify your environmental claims, and to how you communicate about them. The same goes for any claim your buyer makes. Until then, 2 current directives already ban misleading and false environmental green claims: the Unfair Commercial Practices Directive (2005/29/EC) and the new Directive to empower consumers for the green transition (EU 2024/825), which enters into force on 27 September 2026.

Tips:

- For details, see the Q&A and factsheet.

- Stay updated on the proposed rollout of the Green Claims Directive.

- For tips on how to communicate about your sustainable performance honestly and effectively, see the Netherlands’ guidelines regarding sustainability claims and the British guidance for businesses on making environmental claims.

What additional requirements do buyers often have?

Buyers often have additional requirements related to sustainability, labelling and packaging, and payment and delivery terms.

Sustainability

Social and environmental sustainability are becoming more and more important in the European market. Environmental sustainability is about your company’s impact on the environment, for example through the raw materials you use or your production processes. Social sustainability focuses on your company’s impact on the wellbeing of your workers and the community. Key topics include fair wages and safe working conditions.

In addition to laws and regulations, a growing number of European buyers would like you to comply with:

- Business Social Compliance Initiative (BSCI): an initiative of European retailers to improve social conditions in sourcing countries. They expect their suppliers to follow the BSCI Code of Conduct;

- Ethical Trading Initiative (ETI): an alliance of companies, trade unions and voluntary organisations. ETI aims to improve working conditions in global supply chains via their ETI Base Code of Labour Practice;

- Sedex: a membership organisation striving to improve working conditions in global sourcing chains. The platform lets you share your sustainable performance, based on a self-assessment. You can also be SMETA-audited.

You can learn more about sustainable options from standards such as ISO 14001 and SA8000. There are certificates for these standards, but most buyers do not require them.

Tips:

- Optimise your sustainability performance. Study the issues included in initiatives such as BSCI and ETI to learn what to focus on.

- If you can show your sustainability performance, this may give you a competitive advantage. For example, ITC’s Green Performance Toolkit helps small textile businesses assess and track their environmental performance and identify areas of improvement. You can also use a code of conduct like the ETI Base Code.

- For more information, see our study on sustainability in HDHT, our tips on going green and becoming socially responsible, and our webinars on sustainability in the European HDHT market and sustainable innovations for your HDHT business.

- To learn more about BSCI, ETI, Sedex and SA8000, see the ITC Standards Map. You can also conduct a free online self-assessment.

- Highlight your sustainable activities and policies in the ‘stories’ behind your products and company. Buyers like good storytelling that creates an emotional connection.

Labelling

The information on the product’s outer packaging should correspond to the packing list sent to the importer.

External packaging labels should include:

- Name of producer;

- Name of consignee;

- Quantity;

- Size;

- Volume;

- Warning labels.

The most important information on the product labels of bed textiles is composition, size, origin and care labelling. Your buyer will further specify what information they need on product labels or the item itself, such as logos or ‘made in…’ information. This is part of the order specifications. In Europe, EAN or barcodes are commonly used on the product label. For more information, please refer to the Textile Regulation.

Packaging specifications

Importer specifications

You should pack bed textiles according to the importer’s instructions. They have their own specific requirements for packaging materials, filling boxes, palletisation and stowing containers. Always ask for the importer’s order specifications, which are part of the purchase order. Packaging usually consists of plastic wrapping to protect the fabric from water, solar radiation and staining.

Preventing damage

Proper packaging minimises the risk of damage through dirt, temperature or humidity. Packaging should protect the items inside a box and make sure they stay clean. It should also prevent damage to the boxes when they are stacked inside the container. Packaging usually consists of an outer cardboard box lined with protective material, like plastic wrapping. The actual products are usually packed in polybags, either individually or in small numbers, depending on product size.

Dimensions and weight

Packaging must be easy to handle in terms of size and weight. Standards are often related to labour regulations at the point of destination and must be specified by the buyer.

Reducing costs

Boxes are usually palletised for transport, and you have to maximise the use of pallet space. Packaging has to provide maximum protection, but you must also avoid using excess materials or shipping ‘air’. Waste removal is a cost to buyers.

Material

Importers are increasingly banning wooden crating and packaging. Economical and sustainable packaging materials are more popular. Using biodegradable packaging materials can be a market opportunity. Some buyers may even demand it.

Consumer packaging

Bedspreads and duvet covers are usually displayed in stores without any packaging. In general, consumer packaging can be simple in design, like paper or plastic wrapping. However, in the high-end and middle-high segments, bed textiles often come in well-designed (gift) packaging, like a luxurious box with paper wrapping around the product. Consumer packaging also offers space to explain more about the product’s qualities.

Tips:

- Always ask for the importer’s order specifications, including their packaging and labelling requirements.

- See Packaging Europe for more information on the latest packaging developments.

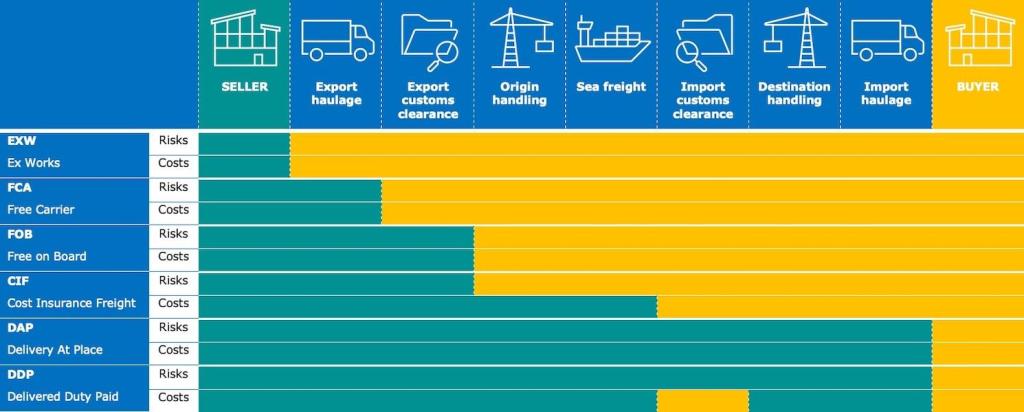

Payment and delivery terms

Payment terms are confirmed in the order contract. They vary from buyer to buyer and are related to the volume and value of the order, the type of distribution partner, whether or not an agent is involved, and what delivery terms apply.

Delivery terms, known as Incoterms, depend on the type of distribution partner. HDHT importers generally prefer Free On Board (FOB) or Free Carrier (FCA) arrangements.

Tips:

- See our tips on how to organise your exports for more information.

- Study the different Incoterms, including your and your buyer’s rights and obligations.

- See our study on terms & conditions for a more elaborate overview, how to work with them, and the benefits of having your own.

What are the requirements for niche markets?

Fair-trade practices and sustainability certification are the most common niche market requirements.

Fair trade

The concept of fair trade supports fair pricing and improved social conditions for producers and their communities. Fair-trade certification can give you a competitive advantage, especially if the production of your bed textiles is labour-intensive. It often includes aspects of environmental sustainability as well.

Common fair-trade labels are the World Fair Trade Organization (WFTO) Guarantee System and Fair for Life-certification. For most fair trade-oriented buyers in Europe, simply complying with WFTO’s 10 Principles of Fair Trade is enough.

Figure 1: West Elm – Fair-trade flax linen bed textiles

Source: West Elm @ YouTube

Tips:

- Ask buyers what they are looking for. Especially in the fair-trade sector, you can use the story behind your product for marketing purposes.

- If certification is not feasible, work according to WFTO’s principles without being officially guaranteed or certified. Carefully document your company processes so you can support your story.

- Read more about Fair for Life in the ITC Standards Map.

Sustainable textiles

Buyers are increasingly interested in certification to ‘prove‘ their sustainability, especially organic certification.

Popular textile certifications include:

- Global Organic Textile Standard (GOTS) – a textile-processing standard for organic fibres that ensures environmental and social responsibility throughout the production chain.

- OEKO-TEX Standard 100 – certification that guarantees textile articles are free of harmful substances.

OEKO-TEX Made in Green combines Standard 100 and STeP. Other options include the Nordic Swan Ecolabel (in Nordic countries) and the EU Ecolabel.

Figure 2: Care By Me – GOTS-certified organic cotton bed textiles

Source: Care By Me @ YouTube

Tips:

- Explore the possibility of sourcing organic materials. Textile products containing ≥70% organic fibres can be GOTS-certified. The easiest option is to use certified yarn or fabric.

- Read more about GOTS, OEKO-TEX Standard 100, Made in Green and the EU Ecolabel in the ITC Standards Map.

Recycled materials

The Global Recycle Standard (GRS) is a standard for products containing recycled material, with criteria for environmentally friendly production and good working conditions. Products containing ≥20% recycled material can be GRS-certified, but only if the entire production process is certified. Additional social, environmental, and chemical requirements must also be met. For consumer-facing labelling, the product must contain ≥50% recycled content. If you use GRS-certified material, you can highlight in your communication that this material is certified.

Similarly, the Recycled Claim Standard (RCS) is intended for products containing ≥5% recycled material. The RCS does not address social or environmental aspects of processing and manufacturing.

Tips:

- Check for GRS/RCS-certified versions of the materials you use, as an alternative or addition.

- Carefully check the specifications of the available certified materials. Sometimes composition changes due to the recycling process.

- When using GRS/RCS-certified materials, communicate this correctly.

- Read more about GRS and RCS in the ITC Standards Map.

2. Through which channels can you get bed textiles on the European market?

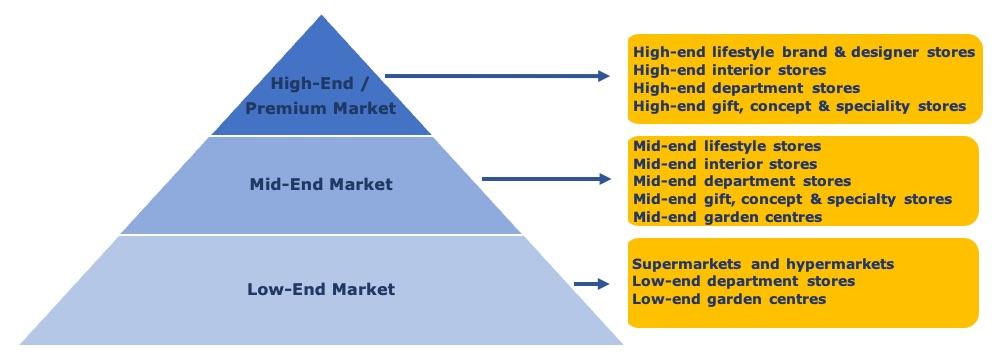

Bed textiles enter the market through importers/wholesalers that supply to retailers, as well as retailers that buy directly from suppliers. There are three market segments: low-end, mid-end and high-end (premium).

How is the end-market segmented?

Figure 3: Bed textile market segmentation in Europe

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

Low-end market

In the low-end segment, simple and inexpensive bed textiles are common. Products are generally machine-made using man-made fibres such as polyester, or blends such as microfibre. Sometimes man-made fibres are blended with cotton, but hardly any bed textiles in this segment are made of 100% natural fibres. Typical retailers include low-end department stores like Zeeman.

Cheap mass production from Pakistan generally dominates this market and is almost impossible to compete with. As a small or medium-sized enterprise (SME) from a developing country, you will be most competitive in the mid-high segment.

Mid-end market

In the middle segment, bed textiles are more fashionable, following trends mainly through design and colour. Prices are still reasonable. An example of a player in this market is Habitat.

At the higher end of the mid-market segment, artisanry, sustainable values and branding play a bigger role. This mid-high segment offers you the most opportunities. To appeal to these consumers, you can add value to your bed textiles through handmade artisanry and decoration (such as embroidery), timeless designs and sustainable/organic materials.

High-end/premium market

In the high-end segment, designer quality is common and private labels are the standard. The emphasis is on excellent quality of both the raw materials and finish. The finish is often done by hand, using traditional techniques. Luxury department stores such as Harrods play an important role here.

Figure 4: Christy – OEKO-TEX Made in Green-certified duvet cover set with floral print

Source: Christy @ YouTube

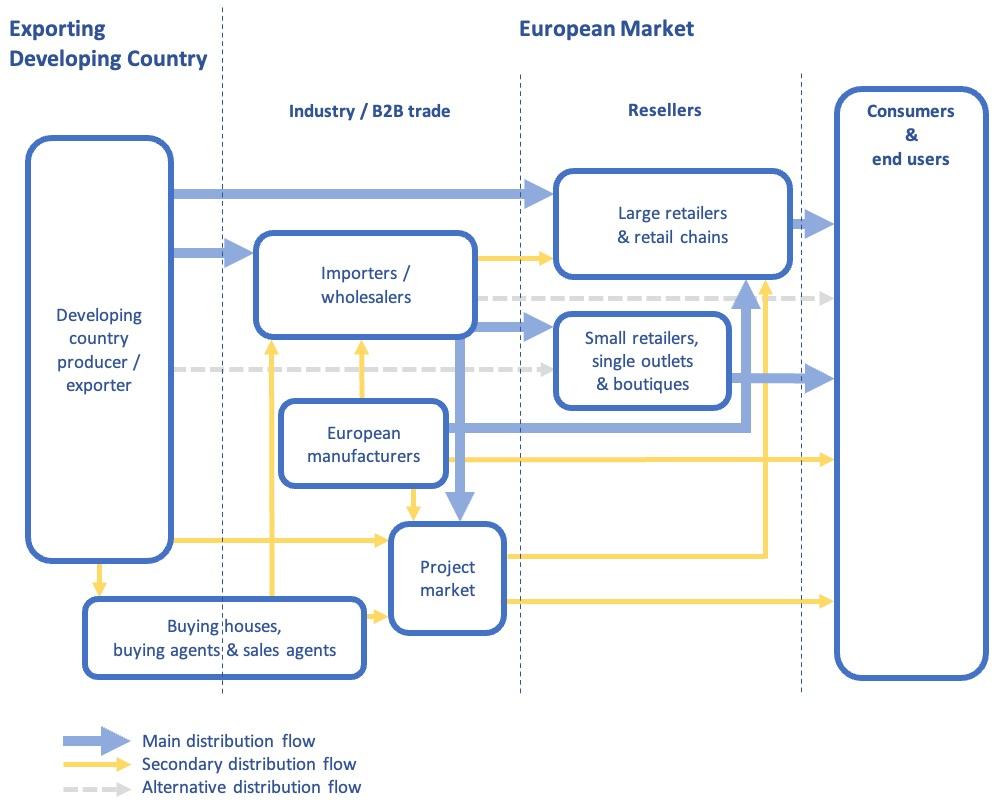

Through which channels do bed textiles end up on the end-market?

Market access channels for bed textiles mainly follow traditional patterns. Importers/wholesalers supply to retailers. Larger retail chains often bypass these intermediaries and handle their own imports, but more and more smaller retailers have also started buying directly from suppliers. In some cases, buying agents play a role.

Figure 5: Trade channels for bed textiles in Europe

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

Importers/wholesalers

Importers/wholesalers sell products to retailers in their own country or region, or re-export across Europe. Supplying buyers in the project market (such as hotels and spas) is another distribution flow for them.

These importers/wholesalers handle the import procedures. They take ownership of goods when they buy from you (unlike agents), taking on the risk of the onward sale of the products. Developing a long-term relationship can lead to a high level of cooperation on appropriate designs for the market, new trends, use of materials, types of finishing and quality requirements.

Importing retailers

Retailers come in many sizes: they can be large and part of a chain or small and independent. Especially larger retail chains often import directly from suppliers in developing countries. Many even have their own buying offices in developing countries. Others, mainly smaller independent stores, order in Europe from wholesalers.

There is a tendency towards consolidation in European retail. Large retail brands are becoming more widespread and more ‘lifestyle-centred’, offering home decoration and home textiles as well as fashion accessories and furniture.

Buying agents, buying houses and sales agents

You may encounter several types of intermediaries in your dealings with European buyers:

- European buying agents: represent European buyers in sourcing countries, but do not import products themselves. Sometimes they have a more limited role, such as checking product quality. They can work individually or as part of a purchasing company;

- Buying houses: comparable to buying agents, but they are based in your country and usually offer more services. These can range from raw material sourcing to design and sampling services;

- European sales agents: can help you find European buyers. However, you should be careful about entering into agreements with commercial agents, because European legislation protects their position.

Agents and buying houses mostly work on commission. They may approach you, or your buyer may request an intermediary. However, you should always try to work directly with your buyer. This saves on commission and allows you to communicate directly.

E-commerce

E-commerce has grown in recent years. The easiest way to benefit from this trend is by supplying a European wholesaler or retailer with a strong online presence. This is usually not a separate channel. Retailers often combine online and offline channels, which have the same supply processes. Companies that only sell online also need to take stock before they can sell.

Direct business-to-consumer (B2C) sales

Selling directly to European consumers can be complicated and costly. You need an ‘economic operator’ in the EU, and you are responsible for factors like aftersales obligations. For most exporters from developing countries, this is not feasible.

Tips:

- To find buyers, search exhibitor lists or visit the main HDHT trade fairs in Europe: Ambiente, Heimtextil and Maison&Objet.

- See our tips for finding buyers in the European HDHT market.

- For more information about trading directly with smaller retailers and e-commerce, see our study about alternative distribution channels.

What is the most interesting channel for you?

Importers/wholesalers are the main channel between exporters in developing countries and European retailers. They are interesting if you want to develop a long-term relationship. These importers usually know the European market well, so they can provide valuable information and guidance on market preferences. They generally prefer FOB or FCA Incoterms.

Figure 6: Incoterms

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

Large retailers are increasingly handling their own imports to cut out the margins of importers/wholesalers, reduce time to market, and have more control over product design and finish.

Smaller, independent retailers need to set themselves apart from retail chains through value-added service, specialised offers and authenticity. Buying directly from producers in developing countries is an interesting way for them to do this. They typically prefer small order quantities per item, small total order volumes, and delivery to their doorstep via Delivered Duty Paid (DDP) or Delivery At Place (DAP). Repeat orders are less likely. You need to calculate whether this is cost-effective for you.

The trend of direct sourcing is expected to continue. This may create more opportunities for you, as a growing pool of buyers could improve your bargaining position. Because importing retailers order for their own shops, they can place orders much quicker than importers/wholesalers who may need to show samples to their retailers before ordering.

Tips:

- Consider targeting retailers directly to improve your bargaining position and potentially close deals faster.

- Relate your offer and terms to the targeted retailer (large/small). Ask your existing buyers how they operate if you are unsure.

- Build a relationship based on mutual benefits by offering services like fast delivery and after-sales support.

- If you are interested in selling to small independent retailers, make sure to have a policy for them if you participate in trade fairs. You must have appropriate terms of trading, such as low minimum order quantities.

3. What competition do you face on the European bed textile market?

Europe’s leading suppliers of bed textiles are Pakistan and China. A large part of this supply consists of mass-produced items for the lower-end segments. Instead of competing with these manufacturers, your best opportunities are in the mid- to high-end market, where you can add value.

Pakistan increasingly dominates Europe’s bed textile imports, with a growing direct import market share of 38% in 2024. China follows with 10%. Next are Germany (9.2%), Türkiye (6.9%), the Netherlands (3.7%) and Portugal (3.4%).

Re-exporters or producers

European countries have different roles in the HDHT market. Some are mainly importers and others are mainly manufacturers. Western European countries are mainly importers. Most Western European importers are re-exporters. They do not just sell products in their own country, but also distribute them across the continent.

European production mainly takes place in Eastern Europe, mostly because of relatively low transport and labour costs. This can make these countries a good alternative for European buyers to source low- to mid-end products. Western and Southern Europe also produce some high-end products from well-known premium brands with a long history.

Which countries are you competing with?

Source: UN Comtrade & Eurostat Comext, 2025

Pakistan increases its market share

Pakistan is Europe’s leading bed textile supplier by far. The country’s bed textile exports to Europe grew from €1.3 billion in 2020 to €1.9 billion in 2024, at an average annual rate (CAGR) of 9.4%. Its direct import market share grew from 31% to 38% over the same period. This makes Pakistan an increasingly dominant player. In markets like the United Kingdom (UK) and the Netherlands, it supplied about 60% of bed textile imports in 2024.

Pakistan has access to a large and cheap workforce. It is among the world’s leading cotton producers and has a large spinning capacity to produce textile products. Pakistani producers also have the wider power looms required for efficiently manufacturing larger-width items. This makes Pakistan a high-volume, low-pricing sourcing hub, and gives the country a clear competitive edge in the production of cotton bed textiles. You should appeal to the mid-high segment instead, and differentiate by focusing on quality, design and sustainability.

China supplies the lower-end market with synthetic items

China’s bed textile supplies to Europe grew from €426 million in 2020 to €519 million in 2024, at a CAGR of 5.0%. This translated to a relatively stable direct import market share of about 10%. These supplies mainly consist of low-priced, mass-produced synthetic items for the lower ends of the market.

China’s strengths are its low-cost workforce, availability of raw materials and efficient shipping to Europe. However, rising labour costs have affected the country’s price competitiveness. In the coming years, China’s trade war with the United States and other disruptions may further affect exports. This could benefit suppliers from other developing countries, like you. To avoid having to compete with Chinese suppliers on costs, you should differentiate and stay away from mass-produced synthetic items.

Unfair competition from non-compliant e-commerce platforms

Although cheap Chinese e-commerce platforms have become increasingly popular, they are subject to product quality issues and ethical concerns. In November 2024, the European Commission urged Temu to respect EU consumer protection laws following various infringing practices. The Commission has opened formal proceedings against Temu to assess whether it has breached the Digital Services Act in areas linked to, for example, the sale of illegal products. Similarly, the Commission has sent several requests for information to SHEIN. In May/June 2025, the European consumer authorities established that SHEIN violated consumer protection law and filed a complaint.

To achieve a safer, more sustainable and fairer market, the European Commission has published its E-commerce Communication. This toolbox for safe and sustainable e-commerce offers coordinated customs controls and product safety checks. It also proposes to remove the €150 duty exemption, and to introduce a simplified customs duty calculation for the most common low-value goods bought from outside the EU.

Türkiye’s bed textile exports to Europe are in decline

Türkiye’s bed textile supplies to Europe peaked in 2022, after which they dropped considerably. Overall, they declined from €408 million in 2020 to €343 million in 2024, at a CAGR of -4.2%. This led Türkiye’s direct import market share to drop from 9.6% to 6.9%. In addition to cotton items, a lot of Türkiye’s supplies were knitted or crocheted.

Türkiye offers a low-cost workforce and a convenient location close to the European market, allowing for relatively easy and affordable transport. This can make Turkish manufacturers an attractive option for European importers, primarily based on cost and lead times.

India is a key player in cotton

Overall, India’s bed textile exports to Europe grew from €172 million in 2020 to €199 million in 2024, at a CAGR of 3.7%. The country’s direct share of the European import market remained relatively stable at about 4.0%.

India offers skilled labour and transport at relatively low costs. As the country is one of the biggest cotton producers in the world, Indian manufacturers have direct access to high-quality cotton at relatively low prices.

Which companies are you competing with?

The following companies are examples of the type of competition you face in the European market for bed textiles.

Sarita Handa - India

India’s Sarita Handa targets the lower part of the high-end segment, selling both ‘off-the-shelf’ products and bespoke textiles. It capitalises on the quality of its materials and finish, as well as on its design content, which derives a lot of its strength from the use of special techniques. The company’s bed textiles come in a variety of materials, including cotton, linen and silk. Sarita Handa strives to “preserve heirloom design languages, reimagined for contemporary homes.” Techniques include jacquard weaving, quilting and embroidery. Many of the artists and artisans are women.

Tribal Textiles - Zambia

Tribal Textiles is a women-led handcrafted home goods brand based in a remote part of Zambia. The company focuses on social and environmental sustainability. They are ethically certified through the Nest Ethical Handcraft programme. The company is audited every year to verify compliance with Nest’s standards for informal workshops and home-based artisan settings. These include topics like health and safety, fair wages and environmental care.

The company uses cotton that is grown, spun and woven in neighbouring Zimbabwe. They aim to switch to organic cotton, but have not yet been able to find a farm in southern Africa that can provide large enough quantities. Tribal Textiles’ highly skilled artists use a traditional African batik method to hand-draw African-inspired patterns. The non-toxic and environmentally friendly batik paste consists of water and flour. Their bedroom collection includes hand-painted duvet covers, pillowcases and bedspreads, as well as accent cushion covers.

Barine - Türkiye

The Turkish lifestyle brand Barine offers home linens, beach towels, textiles for babies and children, and clothing. They specialise in simple, elegant designs with “sophisticated touches”. Barine’s bed textiles (duvet covers, bedspreads and pillowcases) are mainly made of cotton and linen/cotton-blends in neutral colours – often OEKO-TEX-certified. They showcase techniques such as waffle, muslin and jacquard weaves, as well as subtle embroidery and decorative tassels. The more expressive designs are reserved for a range of cushion covers and throws.

Barine has “a conscious design approach”. In the coming years, they aim to ensure that 80% of their products come from sustainable sources. They consciously create timeless designs for long-lasting use, to prevent “fast consumption”. The company is SMETA-audited, verifying its commitment to environmentally and socially responsible business practices.

Which products are you competing with?

Because bed textiles comprise many different products that combine both practical and decorative purposes, most competition comes from products within the same group. Some consumers may opt for a cheaper duvet cover and use a more expensive bedspread to add a decorative element to the bedroom. Others, who like a simpler and more sophisticated look, could go for a duvet cover made from a high-quality material and with a high-end finish.

For decorative purposes, there is competition from throws. On the practical side (bed textiles to keep warm), there is competition from blankets.

Tips:

- Compare your products and company to the competition. You can use the ITC Trade Map to find exporters per country.

- Focus on design, artisanry, quality, your sustainable values and the story behind your products to stand out from your competitors.

- See our study on blankets and throws for more information on these competing products.

4. What are the prices for bed textiles on the European market?

Prices for bed textiles vary across market segments. After adding logistics costs, wholesaler and retail margins, and Value Added Tax (VAT), European consumer prices amount to about 4-6.5 times your selling price.

Table 1 gives examples of prices across market segments. Be aware that these are just an indication, since prices vary depending on technique, size, material, design, brand and other forms of value addition, including a strong sustainable concept.

Table 1: Indicative average consumer prices of bedspreads and duvet covers in Europe

| Low-end | Mid-low | Mid-high | High-end/premium | |

|---|---|---|---|---|

| Bedspreads | €10-20 | €20-40 | €40-80 | €80 or more |

| Duvet covers | €10-30 | €30-50 | €50-80 | €80 or more |

| Pillowcases | €10-15 | €15-30 | €30-45 | €45 or more |

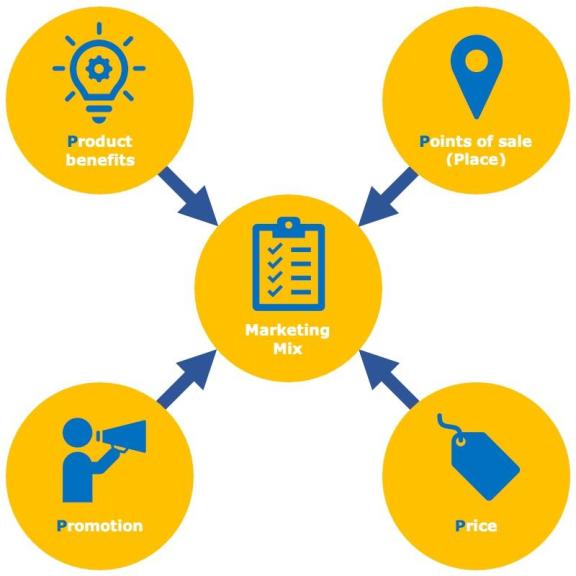

Consumer prices depend on the value perception of your product in a particular segment. This is influenced by your marketing mix.

Figure 8: Marketing mix – the 4 Ps

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

The European consumer price of your bed textiles is around 4-6.5 times your FOB price. Besides energy, labour and transport costs, FOB prices depend heavily on the availability and cost of raw materials. Occasional cost increases are not directly passed on to the consumer, so they put pressure on margins in the supply chain. However, recent disruptions have resulted in longer-term cost increases. This continuing pressure made many European retailers raise consumer prices. If costs drop again, consumer prices may follow.

Consumer prices generally consist of:

- Your FOB price;

- Shipping, import, handling costs;

- Wholesaler margins;

- Retail margins;

- VAT – varies per country, about 20% on average.

Figure 9: Price breakdown indication for cushion covers in the supply chain

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

For example, in Table 2, the FOB price is set at €10. Depending on the market segment your product is designed for, the consumer price ranges from €41 in the low-end market to €65.50 in the high-end market.

Table 2: Example of the price breakdown per market segment

| Low margin | Middle margin | High margin | ||

|---|---|---|---|---|

| FOB price | €10.00 | €10.00 | €10.00 | Your FOB price |

| Transport, handling charges, transport insurance, banking services (20/15/15%) | +2.00 €12.00 | +1.50 €11.50 | +1.50 €11.50 | Landed price for the wholesale importer |

| Wholesalers’ margins (50/75/90%) | +6.00 €18.00 | +8.60 €20.10 | +10.40 €21.90 | Selling price from the wholesale importer to the retailer |

| Retailers’ margins (90/110/150%) | +16.20 €34.20 | +22.20 €42.30 | +32.70 €54.60 | Selling price excluding VAT from the retailer to the end consumer |

| Selling price incl. VAT (20%) | +6.80 €41.00 | +8.50 €50.80 | +10.90 €65.50 | Selling price including VAT from the retailer to the end consumer |

The FOB price of €10 includes your margins. These depend on your efficiency and price setting. Margins in the lower segment are generally smaller than those in the middle/higher segments.

Examples of consumer prices:

- Undyed and unbleached cotton bedspread (≥50% recycled), IKEA, €19;

- Hand-block-printed kantha-style bedspread, French Bedroom, ±€256;

- GOTS- and OEKO-TEX-certified handmade duvet cover set, 200x200 cm, Matt Sleeps, €199;

- Fair-trade GOTS-certified hand-block-printed duvet cover set, Their Story, ±€80-150.

Tips:

- Study consumer prices in your target segment to determine your price and adjust your cost accordingly. Your quality and price must match your chosen target segment.

- Calculate your prices regularly and carefully, especially if the prices of raw materials fluctuate. When raw material prices put pressure on your margin for a longer period, consider increasing your price or finding an alternative.

- Understand your segment and offer a correct marketing mix to meet consumer expectations.

Globally Cool carried out this study in partnership with GO! Good Opportunity and Remco Kemper on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research