Market channels and segments in home decoration and home textiles

The European home decoration and home textile (HDHT) market is segmented into low, mid and high-end (premium) market segments. Products are traditionally put on the market via importers/wholesalers that supply to retailers and larger retail chains that buy directly from suppliers. Nowadays, smaller retailers have also started to bypass the importers/wholesalers and import themselves. E-commerce is also becoming increasingly prominent in HDHT.

Contents of this page

1. Through what channels can you get your home decoration and home textiles on the market?

The distribution chain in the European HDHT market has long remained stable, with wholesale importers and self-importing retailer chains (as opposed to individual, smaller retailers) as the main channels between exporters and end consumers. However, within this basic structure, alternative distribution strategies to shorten the chain and save time/costs are gaining in importance. The main changes involve wholesalers approaching consumers directly, single retailers approaching manufacturers/exporters directly and the influence of e-commerce.

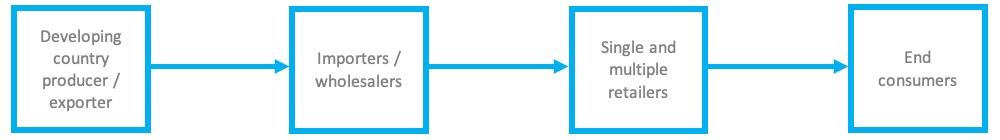

As a manufacturer/exporter from a developing country, you need to select the most effective channels to reach the European market. All available channels and their linkages are called the ‘distribution chain’. In a simplified form, the chain looks like this:

Figure 1: The HDHT distribution chain

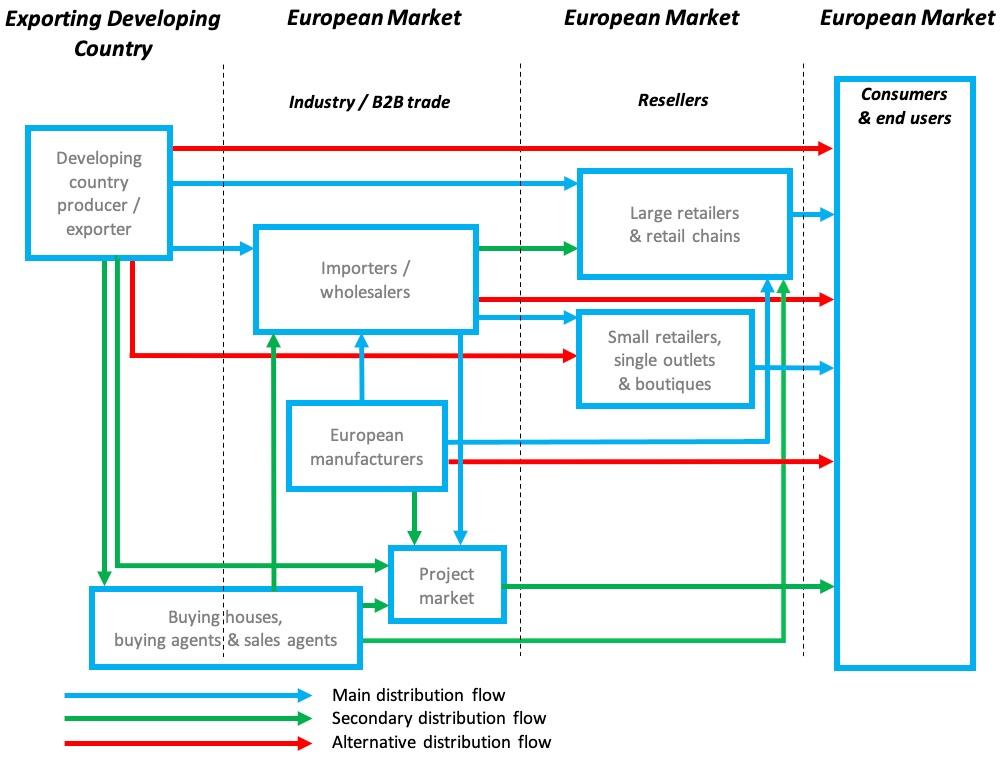

However, in reality, the distribution chain is more complex, with more available channels and the option to adopt a variety of distribution strategies.

Key questions affecting your distribution strategy are:

- Are you producing large volumes or smaller quantities?

- What are the logistical options in your area or country?

Based on this, you can, for instance, target wholesaler importers (higher volumes on FOB terms) or single retailers (low volumes on DDP terms).

Figure 2: Trade channels for HDHT in Europe

Importers/wholesalers

Importers/wholesalers sell products to retailers in their own country or region or re-export to the broader European continent. Some European markets are therefore supplied by wholesalers/importers from other European countries (internal European trade). Supply to buyers in the project market (such as hotels and spas) can be considered a secondary distribution flow for European importing wholesalers.

These importers/wholesalers take care of the import procedures. They take ownership of the goods when they buy from an exporter (as opposed to agents), taking on the risk of the onward sale of the products. Developing a long-term relationship can lead to a high level of cooperation on appropriate designs for the market, new trends, use of materials, type of finishing and quality requirements. They usually have good knowledge of the European market and can provide you with valuable information and guidance on European market preferences.

Retailers

Retailers are the resellers of the imported product to the final consumer, and they come in many sizes: large and part of a chain or small and independent. Especially larger retail chains often import directly from their suppliers in developing countries. Many even have their own buying offices in developing countries, such as Ikea. Others, mainly the smaller independent stores, order in Europe from wholesalers.

There is a tendency for consolidation in European retail. Large retail brands are becoming more widespread in Europe and more ‘lifestyle-centred’, offering home decoration and textiles as well as fashion accessories and furniture.

Project (or contract) market

This mostly covers the market of interior designers, decorators and architects who cater to corporate markets such as public buildings (the project market) and the hospitality market (such as hotels, spas and restaurants), as well as to people’s private homes. Interior decorators need a broad overview of different materials and techniques as inspiration for the process of designing for this market. They will go to specialised or non-specialised wholesalers to find such product and material collections, or they work for these companies on a fixed or project basis.

This part of the market is only interesting if you are able to provide a high level of design and service, often on a one-off basis. Prices and quantities can be favourable, depending on the type of project. For instance, decorating large hotels demands large quantities of bedlinen, furniture and lighting.

Many interior designers will require customised solutions, so the development phase may take time, without a guaranteed order. As a producer, you need to take this into consideration when agreeing the terms of such a collaboration.

Buying agents, buying houses and sales agents

You can encounter several types of intermediaries in your dealings with European buyers. In your own country, there may be buying houses, and in Europe, there are both buying and sales agents.

European buying agents represent European buyers in sourcing countries. They act as intermediaries, meaning they do not import products themselves. Sometimes, agents have a more limited role, such as checking the quality of the products in your warehouse on behalf of a specific importer or checking the codes of conduct that you have agreed on with your buyer. Buying agents can work individually or as part of purchasing companies.

Buying houses are comparable to buying agents, but they are based in your country and usually have a broader spectrum of services. This can range from raw material sourcing to design and sampling services.

European sales agents can represent you in helping to find buyers in the European market. However, you should be careful before entering into exclusive or other agreements with them, as European legislation is quite protective when it comes to the position of commercial agents.

Agents and buying houses mostly operate based on commissions. They may approach you directly, or your buyer or potential buyer could indicate that they prefer working through an intermediary. However, if possible, working directly with a buyer is preferable. This saves on commission fees and allows you to communicate directly with the buyer.

E-commerce

Stimulated by the increasing sophistication of technology, the 24/7 economy, the millennial and Gen Z consumer generations that are always online and the COVID-19 pandemic, e-commerce is on the rise and becoming an integral part of our shopping, also in HDHT.

The industry has been embracing online platforms for business-to-business (B2B) trade, allowing retailers to log in to their wholesaler websites for specific price offers and for ordering, as well as for promotional material. This way, the website supports the wholesalers and their retail customers in logistics and marketing communication. A consequence for exporters is that, increasingly, they will need to pack and label the goods for direct distribution to the retailer, without unpacking and repacking by the wholesaler first.

On a business-to-consumer (B2C) level, HDHT e-commerce has been increasing, particularly since the pandemic. Although it can help you reach a broader range of customers, the rise in e-commerce has fairly little effect on the way you should conduct your business as an exporter. Because European HDHT retailers often sell their products both in physical stores and online, the way you supply to them remains the same. Even online-only retailers need to take stock before they can sell to consumers. This means that supplying to online retail is not a separate market channel in itself.

You should be aware that European online-only B2C HDHT concepts are, by and large, not used to importing directly, with the exception of a few large ones. Buyers prefer sourcing close to home (nationally or from Western European brands), keeping stock risks low and with the wholesaler. There are exceptions, but you would generally have to source a European wholesaler first if you want your products to be distributed to online shoppers.

Another way to tap into the trend of online B2C sales is by opening your own web shop. However, this is not easy.

Selling directly to European consumers via your own website would mean:

- Supplying small batches and/or individually packaged items;

- Being prepared to pre-stock and offer more just-in-time supply concepts;

- Arranging effective consumer payment systems;

- Competing with experienced and well-known European and producer-country wholesalers/retailers;

- Dealing with aftersales on a business-to-consumer (B2C) level, including returns and replacements[CM1] .

In addition, the new European Market Surveillance Regulation comes into force in July 2021. From then on, non-European manufacturers of products such as toys or energy-related products must have an ‘economic operator’ in Europe, often the importer. Because all this is rather complicated and can be costly, direct online sales to European consumers are not feasible for most exporters from developing countries.

Tips:

- For more information on how to come into contact with potential buyers, see our tips for finding buyers on the European HDHT market.

- Study the various Incoterms you and your buyer can agree on. These international commercial terms are standardised, universally accepted terms, to help facilitate the flow of global trade. They are part of your Terms of Trading and deal with matters between sellers and buyers involving obligations, risks and costs in the physical transfer of goods.

The following section identifies the options in distribution and discusses recent developments in the distribution chain.

Single retailers importing directly from manufacturers/exporters

Wholesale importers traditionally are the main interface between exporters/producers in developing countries and European retailers. An early change, but now quite common, was that larger retailers (mostly chains) started to import directly, instead of through European wholesale importers. This way, such retail multiples were able to cut out the margins of the wholesaler and reduce delivery time to the end market. It also enabled them to develop customised product ranges in close collaboration with the producers in developing countries.

Smaller, independent European retailers still mainly purchase from domestic wholesalers/importers. As in other sectors in the European market (such as food and clothing), independent HDHT retailers are struggling to compete with the aforementioned retail chains and need to differentiate on value-added service, as well as on specialised offers and authenticity. In this need to differentiate their offer from the large retailers, some smaller retailers have resorted to buying directly from producers/exporters in developing countries.

When approaching smaller retailers, you need to understand that these buyers typically prefer small total order volumes. This means low order volumes and small quantities per item. Orders will often be less or much less than half a container. This is related to the fact that such small retailers need to keep their investments in stock limited and want to have a flexible collection. They also typically need delivery to their doorstep. The likelihood of repeat orders is limited, as this buyer group wants to keep their options open and be flexible in their ordering.

If you produce smaller quantities, you may yet find this distribution channel attractive, as there are plenty of smaller retailers, and they are increasingly open to importing themselves. Moreover, by skipping the wholesaler, margins may be slightly higher for both the exporter and the importer. Also, because smaller retailers are ordering for themselves, they can place orders much quicker than importers/wholesalers, who first need to test their market before they can place orders.

This trend of direct sourcing by small retailers is expected to continue in the future and may create more opportunities for you. The pool of buyers may increase if more small retailers start buying outside Europe, resulting in a more viable business model for you as an exporter.

Tips:

- Relate your offer and terms to your targeted buyer. Ask your existing buyers how they operate if you are unsure. The better informed you are about this, the better you are able to set prices. You then need to calculate whether such a business model is cost effective and logistically feasible.

- When you participate in international trade fairs, especially within Europe, make sure that you have a policy for small, independent retailers coming to your booth. If you choose to sell to them, you must have appropriate terms of trading such as low minimum order quantities, delivery to the doorstep of the retailer or pre-stocking.

- For more information about trading directly with smaller retailers, see our special study about alternative distribution channels.

Wholesalers selling directly to end consumers

Some wholesalers also sell directly to end consumers. There have always been wholesalers that opened their own brick-and-mortar shop(s) to increase sales and promote their brand. The advantage for the producer could be that this leads to more sales of a particular product, and as such to bigger orders.

With the increasing sophistication of technology (with respect to both logistics and online sales), wholesalers that did not sell directly to end consumers before now also experiment with online B2C sales. The COVID-19 pandemic has been an accelerator in this process.

Tips:

- To help your wholesale buyer in both its B2B and B2C online sales, make sure you have relevant photo and other material for online marketing and promotion.

- Be aware of your wholesaler’s needs and be flexible in design. Wholesalers selling directly to end consumers may want to avoid channel conflicts with their retail network by developing specific ranges for the end consumers, including specific consumer packaging and labelling.

Retailers and wholesalers sourcing ‘Made in Europe’ concepts

European retailers and wholesalers are increasingly buying closer to home, from manufacturing sources on the continent. These sources include:

- The few remaining traditional manufacturing bases in Europe (such as Portugal for ceramics);

- Eastern Europe, where some remaining heavy and light industries can be tapped into or have been revived.

Eastern Europe offers both some traditional craftsmanship (such as in wood or metal) and an increasing tendency to mechanise production and achieve economies of scale. Increasingly, we see joint investment initiatives between a local manufacturer and a Western European importer. Most importantly, labour costs are still lower than in Western Europe. Sustainability also plays a role, as locally sourced home goods have a smaller impact on the environment.

This trend poses a threat to you, as production in Europe shortens lead times and allows for smaller/partial shipments and lower stock levels in retail. Communication may also be easier than with overseas partners. However, overall costs may not always match imports from developing countries, and not every product category is available in Europe.

Tips:

- Be different: make sure you offer authentic materials and techniques that are not available in Europe.

- Be indispensable: the more effective your business relationship with the European buyer, the less inclined it will be to look for alternative sources in Europe or elsewhere.

2. Which market segments should you target?

The European HDHT market is segmented into low, mid and high-end (premium) market segments. Each segment fulfils specific consumer needs.

What is segmentation?

Consumers can have different reasons to buy an item. Taking vases as an example, a consumer may be looking for a simple container that can hold water and display a bunch of flowers. This is a purely functional need, and the consumer will be looking for a fairly simple, inexpensive ‘basic’. On the other hand, a consumer may be looking for a vase that will get a prominent place in the living room and is meant to add to the atmosphere of the room. This consumer may want to spend a bit more and choose a special design, perhaps by a particular designer or brand.

Each of these vases represents a different market segment, as they are based on fundamentally different consumer needs. Within every product category in HDHT, we can identify different segments.

Key questions to ask in understanding the needs that create market segments include:

- Is the consumer looking for a more hidden, functional item or for an item that gets special attention?

- How much effort is the consumer willing to make to buy the item?

- How much is the consumer willing to spend on the item?

- How badly does the consumer want the item? Related to this: is the item a gift to himself or herself or a person close to the consumer, or is it a more casual buy?

The answers to these questions determine the value of the items in the eyes of the consumer. In each product category, there are segments with low, medium or high-value purchases.

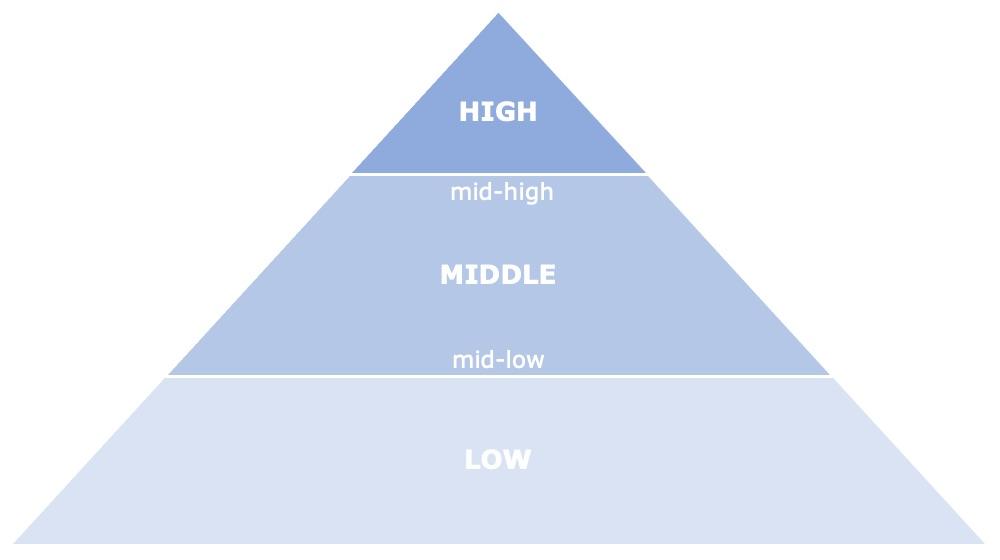

Figure 3: HDHT market segmentation in Europe

By comparing the value of different items within 1 category, you can place them in the same or different segments. The ‘pyramid’ has become an accepted (if simplified) way to characterise high, middle and lower ends of markets.

Generally, the following applies:

- The top end is usually narrow and fairly flat, containing a limited number of premium products and brands.

- The mid-market is wide and spacious, which is why it is usually subdivided into a mid-mid, mid-low and mid-high segment.

- The bottom of the pyramid has a broad base and tapers towards the mid-market.

To describe each segment, we use the ‘4 Ps’ of marketing: product, price, place and promotion. Together, they form the marketing mix. To target a particular segment, you have to create a marketing mix that meets the needs of the consumers in that segment. This is called positioning

The mix for each segment is generally:

High

- Product: exclusive (or limited edition), innovative, top design, a statement piece in the home;

- Price: premium, the consumer is price insensitive;

- Place: offline and online brand stores, design stores, higher-end department stores;

- Promotion: brand communication, personalised communication.

Middle

- Product: mass (but some design added), functional as well as decorative, trendy, for aspirational consumers;

- Price: good value for money, consumers shop around for alternatives;

- Place: offline and online lifestyle home stores, private label and retail brands, gift shops, malls;

- Promotion: focus on trendiness and lifestyle, affordability, via Home magazines.

Low

- Product: everyday basics, functional but not always durable (limited originality);

- Price: available to all, discounted, a price-sensitive consumer, impulse buying;

- Place: offline and online, always around the corner, supermarkets and hypermarkets and other one-stop shopping places, discounter outlets;

- Promotion: door-to-door leaflets, direct mail; focus on more for less.[CM1]

Continuing with the example of vases, the market for these products is extremely segmented. Broadly speaking, the lower-end market contains mass-produced, machine-made containers, such as Ikea’s glass Beräkna vase (€9.99); the mid-market offers items with some design value, such as Nordal’s moulded and glazed stoneware Nago vase (€41.49); and the top end offers, for example, handmade, quirky art pieces such as Lladro’s modern design classic Conversation (€3020).

A clear concept increases your chance of success

There is a growing number of segments and sub-segments based on clear and focused buying motives, both in the mid-high and the high-end market. This responds to the need of the trade to differentiate from others and to the growing need of consumers to buy products that say something about them and give them a good feeling. The clearer the concept, the more the consumer will find their identity reflected in it, resulting in greater loyalty and less price sensitivity.

Differentiation can be based on a number of product characteristics, including:

- Handmade (supreme craftsmanship);

- Design (innovative or experimental use of material or techniques);

- Functionality (superior ergonomics or professional quality);

- Origin (cultural traditions in a contemporary styling);

- Values (such as sustainable, fair trade, ethical offers)[CM2] .

On the 1 hand, European consumers seem to look for ‘value-for-money’ products (bargains) and opt for convenience goods from the lower-end markets. These are generally supplied by established lower-end suppliers from China, Vietnam and, to an extent, India and Indonesia, which benefit from economies of scale (volume orders at low prices/margins), high productivity (mechanisation and/or low labour cost) and sophisticated logistical concepts. You should only target the lower-end market if you are able to compete with these specialised suppliers.

Alternatively, consumers appear to save up for products with ‘added value’, as offered by the higher-end segments. This is leaving the mid-market under pressure, although there will always be possibilities there too. If you are clear about your own identity, you can find segments with matching identities and establish profitable, longer-term relationships in any segment.

Tips:

- Study the competition in your product category to understand how consumers perceive ‘low’, ‘mid’ or ‘high’ value. The most effective way to do so is by studying online or offline trade fairs, sales platforms and selected retailers.

- Create a coherent marketing mix. If you have high prices (due to high costs) but no special materials, techniques or design ideas, then your mix is out of balance, and you will lack impact in your segment. On the other hand, if you do have a special product property (such as a special, much-appreciated fibre) and lower prices, you could bring the pricing up to the appropriate level and improve your profit margins.

- After bringing your mix in line with the segment you are targeting, find ways to differentiate. After all, what is already in the market does not need to be offered again. Find out where you are special.

Segmentation and sustainability

There is no separate segment related to sustainability. In every category and segment in HDHT, you can find product offers based on social and/or environmental friendliness. Rather than forming separate segments or sub-segments, sustainable or ethical concepts are ways to differentiate within your segment. In other words, sustainability is an added value, a way to gain preference over your competitors. However, there is a connection between segments and sustainable values.

In the lower-end market, a big concern regarding sustainability is that it may increase prices in a segment where margins are thin. Here, cleaner production therefore needs to go hand-in-hand with greater effectiveness (lower cost, higher output). This is happening, especially in areas concerning energy use, transport and packing.

At the same time, mass production is increasingly associated with unfair labour practices and pollution. This is why greater transparency in communication, product and process certification, and adherence to international labour standards are common measures to achieve greater sustainability.

In the mid-market, competitive pressure is high, and younger consumers increasingly ‘vote with their wallet’ – opting for products/brands that are socially and environmentally progressive. Here, attitudes in the trade are less defensive and reactive than at the lower end. Sustainability is increasingly seen as a positive way to combine influencing consumer behaviour, contributing to a better world and increasing profitability. Especially in the mid-high market, more and more wholesale and retail brands are popping up that are integrated concepts based on sustainability.

Stimulated by the increasingly dominant millennial and Gen Z consumer generations and protest movements related to issues such as #MeToo, BLM and the climate emergency, consumers are increasingly asking brands what they stand for. This makes the industry more activist and in search of causes and an identity that matches the expectations of these new consumers.

The high-end market, especially at the uppermost luxury end, used to be slow in adopting sustainable values. However, this is changing due to the influence from the fashion industry, where ‘doing good’ in the form of products that have been made with respect for people and the planet makes rich consumers appear broad-minded, adding status beyond just being wealthy.

Consumers are increasingly considering sustainability as the responsibility of the distribution chain. As such, sustainable offers in themselves do not justify a price premium, unless accompanied by superior design, functionality or authentic stories. In every segment, prices have a bandwidth. Within that price band, your prices may be slightly lower or higher according to the value in your product or your value set – that now includes any sustainable values.

All in all, sustainability is happening right across the segments and the categories in HDHT and has become a valid way to differentiate. As such, it will not stop broadening and diversifying.

Tips:

- Improve your sustainability performance. Determine how you can develop better social and environmental practices in any aspect of your value chain: in the selection and use of raw materials, in the production process, in transport and distribution, in helping consumers use your items longer and, at the end of the cycle, in ensuring that the materials are recyclable or biodegradable.

- If your importer is interested, consider certification options such as fair trade. The fair-trade market is traditionally strong in offering salad servers and bowls, which are often made by hand and from natural materials. For more information, see our study about buyer requirements.

- Clearly communicate your sustainable values through your marketing materials. If your products have a unique origin and/or story, communicate the details in terms of special techniques, materials, producers, processes or meanings. This may add value to your concept and that of your importer.

- For more information, see our special study on sustainability in HDHT.

This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with GO! GoodOpportunity and Remco Kemper.

Please review our market information disclaimer.

Search

Enter search terms to find market research