Entering the European market for plant pots

Although the European market for plant pots offers opportunities, competition is strong. Given that mass-producing countries dominate the lower ends of the market, the middle to high-end segments are your best option. To supply these segments, you should focus on materials, decoration and artisanry. Sustainability can also add value to your plant pots. You must comply with mandatory legal requirements, as well as any additional requirements your buyers may have.

Contents of this page

1. What requirements must plant pots comply with to be allowed on the European market?

The following requirements apply to plant pots on the European market. For a more detailed overview, see our study on buyer requirements for home decorations and home textile (HDHT).

What are mandatory requirements?

When exporting to Europe, you must comply with the following legal requirements:

- General Product Safety Directive/General Product Safety Regulation;

- Restricted chemicals: REACH;

- Packaging legislation; and

- Intellectual property rights.

General Product Safety Directive/General Product Safety Regulation

All non-food products marketed in the European Union (EU) must be safe to use according to the General Product Safety Directive (GPSD, 2001/95/EC). The GPSD will be replaced by the General Product Safety Regulation (GPSR, EU 2023/988), which requires products on the EU market to be safe, regardless of whether they are sold online or in traditional shops. The GPSR came into force in June 2023, and it will apply from December 2024 onwards.

Unsafe products are rejected at the European border or withdrawn from the market. The EU uses the Safety Gate system to list and share information about such products.

Tips:

- Read more about the General Product Safety Directive and the new General Product Safety Regulation.

- Make sure to comply with the new General Product Safety Regulation by December 2024.

- Use your common sense to ensure that normal use of your product does not cause any danger.

- Search the Safety Gate alerts for plant pots and other objects made of your specific materials for an idea of issues that may arise.

Restricted chemicals: REACH

Your products should not contain certain chemicals. A list of such restricted chemicals is provided in the REACHregulation (EC 1907/2006).

Restricted chemicals in the production of plant pots include:

- Lead in the paints and ceramic glazing

- Arsenic and creosotes as wood preservatives

Tips:

- Make sure you are in compliance with the restrictions for the use of chemicals, as specified in REACH.

- Become familiar with the full list of restricted substances in products marketed in Europe through the Access2Markets platform.

- Consult various sources for information and tips from the European Chemical Agency (ECHA), including REACH Annex XVII (a list of all restricted chemicals), information for non-EU companies and questions & answers.

Packaging legislation

You should minimise the use of packaging and, ideally, use sustainable (recycled) materials. The EU’s Packaging Directive (94/62/EC) aims to prevent or reduce the impact of packaging and packaging waste on the environment, and the Circular Economy Action Plan identifies packaging as a sector that uses the most resources, with a high potential for circularity. By 2030, all packaging on the EU market should be reusable or recyclable in an economically viable way. To help achieve this, a new Packaging and Packaging Waste Regulation (PPWR) is being developed.

Europe also has requirements for wood packaging material and dunnage (WPM) used for transport, including packing cases and pallets. The goal is to prevent organisms that are harmful to plants or plant products from entering and spreading within the EU.

Tips:

- For more information, see the EU’s packaging and packaging waste legislation and factsheet on wood packaging material.

- Stay up to date on the proposal for a new regulation.

Intellectual property rights

When developing products for the European market, you must take care not to copy any existing designs. Intellectual property (IP) is protected in Europe, and products that violate IP rights are banned from the market. The European Commission has adopted a new IP action plan, which provides European companies with access to fast, effective and affordable protection tools.

Tips:

- For more information, see the European Union Intellectual Property Office (EUIPO) and the World Intellectual Property Office (WIPO).

- Keep track of developments in Europe through the state-of-play of the implementation of the key actions mentioned in the IP action plan.

What additional requirements do buyers often have?

Buyers often have additional requirements in terms of sustainability, crystalline silica, labelling and packaging, and payment and delivery terms.

Be sustainable (or more sustainable)

Social and environmental sustainability are becoming increasingly common requirements in the European HDHT market. Environmental sustainability focuses on your company’s impact on the environment. Aspects include the sustainability of your raw materials and production processes. For example, you could minimise your negative impact by using renewable and sustainably produced natural materials and dyes.

Social sustainability focuses on your company’s impact on the well-being of your workers and the community. Issues like fair wages and safe working conditions are key topics. You can highlight your sustainable activities and policies in the ‘story’ behind your product and company. Buyers appreciate good storytelling, which helps their customers develop an emotional connection with your products.

Consumers value sustainability

The increasing importance of sustainability is reflected in a recent Maison & Objet Barometer, in which 62% of responding HDHT retailers reported noticing a growing interest in ethical products amongst their customers. The survey further indicates that 92% of their customers consider natural materials important or very important, with 77% valuing socially responsible production methods and 71% caring about recyclable/recycled materials.

A growing number of European buyers would like for their suppliers to comply with the following schemes:

- Business Social Compliance Initiative (BSCI): An initiative of European retailers to improve social conditions in sourcing countries. They expect their suppliers to comply with the BSCI Code of Conduct.

- Ethical Trading Initiative (ETI): An alliance of companies, trade unions and voluntary organisations. The ETI aims to improve the working conditions in global supply chains through its ETI Base Code of labour practice.

- Sedex: A membership organisation striving to improve working conditions in global sourcing chains. The Sedex platform allows you to share your sustainable performance, based on a self-assessment.

Various standards (for example, ISO 14001 and SA 8000) provide information on options for sustainability. Note, however, that only niche-market buyers demand compliance with such standards.

Avoid greenwashing: Be honest about your sustainability

Being honest about your sustainability is very important. Buyers and consumers must be able to trust you. In many cases, however, companies pretend to be doing more for the environment than they really are. This is known as ‘greenwashing’. In a recent European screening of websites, national consumer protection authorities had reason to believe that many green claims were exaggerated, false or deceptive. This explains why Europeans do not have much faith in sustainability claims.

Sources that can help you communicate your sustainable performance honestly and effectively include:

- Guidelines regarding sustainability claims by the Netherlands Authority for Consumers and Markets

- Guidance for businesses on making environmental claims by the British Competition and Markets Authority

Tips:

- Optimise your sustainability performance. Study the issues included in various initiatives (for example, BSCI and ETI) to learn what you should focus on.

- If you are able to demonstrate your sustainability performance, this could give you a competitive advantage. To do this, you could use self-assessments (for example, through the Sedex platform) or codes of conduct (for example, the ETI Base Code of labour practice).

- For more information, see our special study on sustainability in HDHT.

- See the ITC Standards Map for more information on BSCI, ETI, Sedex and SA8000.

- For more information on European developments in the field of human rights and sustainability, see the proposal for a Directive on corporate sustainability due diligence. This Directive requires larger companies to identify and, where necessary, to prevent, eliminate or reduce the negative impacts of their activities on human rights and the environment.

Handle crystalline silica with care

If you work with ceramics, you should be aware that European buyers care about worker safety and may demand proper handling of crystalline silica during production. Respirable crystalline silica (RCS) can cause lung cancer through inhalation. In the ceramics industry, crystalline silica is used primarily in the form of quartz and cristobalite.

Tip:

- See the European Network on Silica for access to various materials, including a Good Practice Guide.

Label products and packaging correctly

Buyers will specify the information they need on product labels or items (for example, logos or ‘made in…’ information). This will be part of the order specifications. In Europe, EAN or barcodes are commonly used on product labels.

The information on the outer packaging should match the packing list sent to the importer. Outer packaging labels for plant pots should include the following:

- Producer name;

- Consignee name;

- Quantity;

- Size;

- Volume; and

- Caution symbols.

Package your products properly for transport

Importer specifications

You should pack your plant pots according to the importer’s instructions. Importers have their own specific requirements for packaging materials, filling boxes, palletisation and stowing containers. Always ask for the importer’s order specifications. They should be part of the purchase order.

Damage prevention

Proper packaging minimises the risk of damage caused by shocks. The way in which an item should be packaged for export depends on how easily it can be damaged. Packaging should ensure that the items inside a cardboard box cannot damage each other. It should also prevent damage to the boxes when they are stacked inside the container. In most cases, therefore, packaging consists of inner and outer cardboard boxes. The inner boxes are filled with protective materials or clever partitioning with corrugated cardboard.

If you produce wooden pots, you should properly dry the wood after production to prevent mould or cracks. Condensation inside the container during transport can also cause mould. This is due to humid air that becomes colder at night and warmer during the day. Good air ventilation inside the container can prevent this. You should therefore inspect containers for air holes before shipment. You could also include products that reduce humidity amongst the cargo.

Dimensions and weight

Packaging must be easy to handle in terms of size and weight. Standards are often related to labour regulations at the point of destination, and they must be specified by the buyer.

Cost reduction

Boxes are usually palletised for air or sea transport, and you should maximise the use of pallet space. Nesting or stacking can reduce costs. Consider this when designing your products.

Although packaging should provide maximum protection, you should avoid using excess materials or shipping ‘air’. Waste removal is a cost for buyers. You can reduce the amount and diversity of packing materials by:

- Using folded cardboard to create partitions inside boxes;

- Using standard sizes to match inner and outer boxes;

- Considering packing and logistical requirements when designing your products;

- Asking your buyers for alternatives.

Material

Importers are increasingly banning wooden crating and packaging. Economical and sustainable packaging materials are more popular. The use of biodegradable packing materials can be a market opportunity, and some buyers may even demand it.

Consumer packaging

Some importers may ask for consumer packaging for their plant pots. This usually applies to gift (or other) packaging for smaller plant pots, as consumer packaging for larger models is too costly. Consumer packaging is often made of printed cardboard. If you have access to suppliers of this type of packaging in your country, this could make you more attractive as a supplier. Always emphasise that any consumer packaging is available only at a surcharge.

Tips:

- Always ask for the importer’s order specifications, packaging and labelling requirements.

- See Packaging Europe for more information on the latest packaging developments, including regular news articles about biodegradable packaging.

Agree on payment and delivery terms with your buyer

Payment terms are usually agreed on with the buyer in the order contract. These terms vary from buyer to buyer, and they are related to the volume and value of the order, the type of distribution partner, the involvement of an agent and the applicable delivery terms.

Delivery terms (known as Incoterms) depend on the type of distribution partners and their preferences regarding physical distribution. In general, HDHT importersprefer Free on Board (FOB) or Free Carrier (FCA) arrangements.

Tips:

- See our tips for organising your exports for more information on payment and delivery terms.

- Study the various types of Incoterms, including what the rights and obligations of you and your buyers are.

- See our study on terms and conditions for a more elaborate overview, as well as information on how to work with them and the benefits of having your own.

What are the requirements for niche markets?

Fair trade practices and sustainability certification are the most common niche-market requirements.

Fair trade

Fair trade includes fair pricing and improved social conditions for producers and their communities. Fair-trade certification can give you a competitive advantage, especially if the production of your items is labour-intensive. This certification often includes aspects of environmental sustainability as well.

Common fair-trade certifications are issued by the World Fair Trade Organization (WFTO) and Fair for Life. For most European buyers who are oriented towards fair trade, however, it is usually sufficient to comply with the WFTO’s 10 principles of fair trade.

Tips:

- Ask buyers what they are looking for. Especially in the fair-trade sector, you can use the story behind your product for marketing purposes.

- Determine which certification programme would be the most suitable for you, and apply for it if you can.

- If certification is not feasible, work according to the WFTO principles without being officially guaranteed or certified. Carefully document your company processes in order to support your story.

- Consult the ITC Standards Map database for more information on Fair for Life.

Sustainable wood certification

If you sell wooden plant pots, certification from the Forest Stewardship Council (FSC) is the most common label for use with sustainable products. The FSC chain of custody certification guarantees that a product’s source material comes from responsibly managed forests. Products with FSC certification are especially popular in Western European markets. Non-timber forest products (for example, rattan and bamboo) can also be certified.

The Programme for the Endorsement of Forest Certification (PEFC) is another option. As is the case with FSC, the PEFC chain of custody certification verifies that the forest-based material in a product comes from sustainably managed forests.

Tips:

- For more information on the application process, see 5 steps towards FSC certification and/or how to become PEFC Certified.

- If you use recycled wood or paper, apply for the FSC Recycled label.

- Read more about FSC and PEFC in the ITC Standards Map.

2. Through what channels can you bring plant pots to the European market?

The best way to bring your plant pots to the market is through importers/wholesalers who supply to retailers or through retailers who buy directly from you. The most important segments for you are the middle and high-end (premium) market segments.

How is the end market segmented?

The European market for plant pots is subdivided into low, middle and high-end (premium) segments.

Figure 1: Segmentation of the European market for plant pots

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

Low-end market

At the lower end of the market, prices are low and designs are simple. Plant pots for this market are generally functional basics. Examples of retailers in this segment are general interior stores (for example, JYSK) and hypermarkets (for example, Carrefour). This segment is dominated by low-cost, mass-produced items from China and other countries that are hard to compete with. Instead, the middle and high-end segments offer you the most opportunities.

Mid-end market

Plant pots for the mid-end market are more decorative and reasonably priced. This segment follows trends, mainly through design (for example, shape, decoration) and colour. Sustainable values and the story behind your products appeal to consumers in this segment. The higher end of this segment (the middle-high market) also appreciates artisanry in terms of material use and surface techniques. Important players in this market include garden centres (for example, Intratuin) and interior stores (for example, Habitat).

Figure 2: Mica Decorations – Handmade ceramic plant pots

Source: Mica Decorations @ YouTube

High-end/premium market

Plant pots for the high-end/premium market are generally ‘statement’ pieces that draw attention. They feature premium materials, design and artisanry. Brands play an important role in this segment (for example, at Harrods or other luxury department stores).

Through what channels do plant pots arrive on the end market?

The channels through which plant pots are brought to the market follow the traditional patterns for HDHT items, with imports taking place through importers/wholesalers supplying to retailers. Larger retail chains often bypass the importers/wholesalers and import themselves, and smaller retailers have also started buying directly from their suppliers. In some cases, buying agents are involved.

Figure 3: Trade channels for plant pots in Europe

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

Importers/wholesalers

Importers/wholesalers sell products to retailers in their own countries or regions, or they re-export across Europe. Some European markets are therefore supplied by wholesalers/importers from other European countries (internal European trade). Supplying to buyers in the project market (for example, hotels and spas) is also important for some European importing wholesalers.

Import procedures are handled by importers/wholesalers, who take ownership of the goods when they buy from you (as opposed to agents), thereby assuming the risks associated with the further sale of the products. Developing a long-term relationship can lead to a high level of cooperation on appropriate designs for the market, as well as on new trends, use of materials, type of finishing, and quality requirements.

Importing retailers

Retailers come in many sizes: large and part of a chain, or small and independent. Larger retail chains are especially likely to import directly from suppliers in developing countries. Many even have their own buying offices in developing countries.

There is a tendency towards consolidation in European retail, with large retail brands becoming more widespread and more ‘lifestyle-centred’, offering home decoration and textiles, as well as fashion accessories and furniture. This means that they often work with their own mood or storyboards, asking you to create designs according to their own style for a particular period of time. If your collection clearly shows what you are capable of doing in terms of materials, finish and techniques, they will easily see whether they can work with you.

Buying agents, buying houses and sales agents

You are likely to encounter several types of intermediaries when doing business with European buyers:

- European buying agents represent European buyers in sourcing countries. They act as intermediaries, meaning that they do not import products themselves. In some cases, their role is more limited (for example, verifying the quality of products). They can work either individually or as part of a purchasing company.

- Buying houses are comparable to buying agents, but are based in your country and, in most cases, they offer more services. These services can range from the sourcing of raw materials to support in design and sampling.

- European sales agents can help you find European buyers. You should be cautious before entering into agreements with commercial agents, however, as their position is protected by European legislation.

Most agents and buying houses work on commission. They may approach you directly, or buyers may prefer to use intermediaries You should nevertheless always try to work directly with your buyers. This will save on commission costs and allow you to communicate directly with your buyers.

E-commerce

E-commerce has been growing in recent years. It became particularly popular during the pandemic, which drove consumers to buy their HDHT products online. Your best opportunity for benefiting from this trend is by supplying to European wholesalers or retailers with a strong online presence. This is thus not an additional channel for producers to target, but it could be an additional channel for your buyers. Although retailers often combine online and offline channels, the manner of supplying is the same for both types of sales. Companies that sell only online must also take stock before they can sell.

Direct business-to-consumer (B2C) sales

Selling directly to European consumers through your own website can be complicated and costly. You are responsible for many factors, including aftersales obligations and payment systems for consumer use. For most exporters from developing countries, this is not feasible. In addition, according to the Dutch consumer association Consumentenbond, Dutch consumers tend to buy less from non-EU webshops, due to the introduction of new EU VAT rules in July 2021. This makes direct online sales even less attractive.

Tips:

- To find potential buyers, search the list of exhibitors or attend the main trade fairs in Europe (either online or in person): Ambiente (February) in Frankfurt and Maison & Objet (January and September) in Paris.

- See our tips for finding buyers in the European HDHT market.

- For more information about trading directly with smaller retailers and e-commerce, see our study on alternative distribution channels.

What are the most interesting channels for you?

The most interesting trade channels for you are importers/wholesalers and importing retailers. Importers/wholesalers are the main channel between exporters in developing countries and European retailers. They are interesting if you would like to develop a long-term relationship. Because these importers usually know the European market well, they can provide you with valuable information and guidance on market preferences. They generally prefer Free on Board (FOB) or Free Carrier (FCA) Incoterms.

Figure 4: Incoterms

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

Large retailers are increasingly importing for themselves instead of through importers/wholesalers. The obvious advantages include eliminating the margins of the wholesaler and reducing delivery time to the market. In the lower-end market segments, self-importing retailers seek to keep prices as low as possible. Because prices are somewhat less sensitive in the middle-high segment, however, it is likely to offer the most opportunities.

Smaller, independent retailers continue to buy mainly from domestic importers/wholesalers. As is the case in other sectors, however, independent HDHT retailers struggle to compete with retail chains. They have to differentiate on value-added service, specialised offers and authenticity. One interesting way for them to do so is by buying directly from producers in developing countries. They typically prefer to order small quantities of each item, along with small total order volumes and delivery to their doorstep using Delivered Duty Paid (DDP) or Delivery At Place (DAP). Repeat orders are less likely.

The trend of direct sourcing is expected to continue and may create more opportunities for you. The pool of buyers will grow as more retailers become importers, and this could improve your bargaining position. Importing retailers order for their own shops and can therefore place orders much more quickly than some importers/wholesalers, who may need to show samples to their retailers before ordering. You should calculate whether trading directly with smaller retailers would be cost-effective for you.

Tips:

- Consider targeting retailers directly to improve your bargaining position and potentially close deals faster. If you are interested in selling to small independent retailers, be sure to have a policy for them when you participate in international or European trade fairs. You must have appropriate terms of trading (for example, low minimum order quantities or pre-stocking).

- Relate your offer and terms to the targeted retailer (large/small). If you are uncertain, ask your existing buyers how they operate. The better informed you are, the better you will be able to set prices.

- Build relationships based on mutual benefits by offering fast delivery, after-sales support or similar services.

3. What competition do you face on the European market for plant pots?

China is Europe’s leading supplier of product groups that include plant pots. Many of these supplies consist of mass-produced items for the lower-end segments. Instead of competing with these manufacturers, your best opportunities are in the higher mid-end market, where you can add value.

Because no specific trade data are available for plant pots, the following statistics cover various related HS-codes for decorative objects and basketry in general.

China is by far the main supplier of the product groups that include plant pots to the European market, accounting for 57% of all imports. Vietnam is in second place, at a distance, with 6.9%, followed by Germany (6.4%), the Netherlands (4.5%), India (3.8%) and Indonesia (2.6%).

Re-exporters or producers

European countries have different roles in the HDHT market. Some are mainly importers, and others are mainly manufacturers. Western European countries are mainly importers. Most Western European importers are re-exporters. They do not just sell their products in their own countries, but distribute them across the continent.

European production takes place primarily in Eastern Europe, largely because of the relatively low cost of transport and labour. This can make these countries a good alternative for European buyers to source low to mid-end products. Western and Southern Europe also produce some high-end products from well-known premium brands with a long history.

Which countries are you competing with?

Given that your best opportunities are in the middle to high-end market, your main competition will be from countries such as India, Indonesia and Poland. The lower-end segments are dominated by China.

Source: UN Comtrade

China dominates the market (particularly the lower end)

China is by far the leading supplier of the product groups that include plant pots to Europe. Its supplies grew from €1.6 billion in 2018 to €2.0 billion in 2022. The country primarily supplies the lower-end market with low-priced plant pots. This is reflected in the fact it supplies more than two-thirds of Europe’s total imports of plastic products in this group, representing about a third of China’s supplies. About one quarter of China’s supplies are ceramics. The country has become the ceramic ‘factory of the world’, handling the production of many European brands.

China is a competitive supplier of plant pots because of its large-scale and highly mechanised production systems, low-cost workforce, availability of raw materials, and efficient shipping to Europe compared to other Asian countries. In the past 10 years, however, its price competitiveness has been affected by rising labour costs. In the coming years, China’s trade war with the United States and other disruptions may affect its exports. Moreover, European importers are seeking to become less dependent on China as a single supplier. This could benefit companies from other developing countries, like you.

Smaller importers are increasingly looking for second sources in Asia (for example, Vietnam, India, Indonesia or Bangladesh). This also applies to importers whose designs require some handwork. To avoid having to compete with Chinese suppliers on cost, you should avoid mass-produced plant pots. Instead, focus on innovative design, sustainability, natural materials and the story behind your products in order to enter the middle to high-end market, where your best opportunities will be.

Vietnam is another low-cost producer

Like suppliers from China, Vietnamese manufacturers are very productive and can produce at low cost. Their exports of the product groups that include plant pots to Europe grew from €153 million in 2018 to €271 million in 2022, at an average annual rate (CAGR) of 15%. With this, the country’s import-market share increased from 5.6% to 6.9%. Most of these items are baskets made of natural materials.

Vietnamese suppliers generally have a good idea of what is commercially successful and trendy. Their effective combination of handmade and mechanised production enables them to cater to a wide range of lower and mid-end markets. They have therefore been an effective second-sourcing alternative to suppliers from China for several years now.

India maintains its market share

With skilled labour and transport at competitive costs, India could be in a good position to take a larger share of the market. After a dip in 2020, Indian supplies of the product groups that include plant pots to Europe reached €149 million in 2022. This translates to a CAGR of 11% between 2018 and 2022, resulting in a relatively stable import-market share of close to 4%. These supplies consist primarily of metal items.

India has a rich craft culture, with an abundance of producers and easy access to natural materials. This allows them to target higher market segments than those dominated by mass-produced products from China. In addition, India is increasingly offering an effective combination of handmade and more mechanised production techniques. As it becomes more difficult for buyers to order short runs from China, India is becoming a popular alternative. This is especially the case because European lifestyle buyers have already been sourcing broad HDHT collections from India and are increasingly able to do one-stop shopping.

Indonesia focuses on rattan and wooden objects

Indonesia’s exports of the product groups that include plant pots to Europe grew from €67 million in 2018 to €104 million in 2022, at a CAGR of 12%. These products consist primarily of rattan baskets and wooden objects, which probably include a large amount of teak wood (new or reclaimed). Indonesia is famous for its rattan products, as it produces 80% of the world’s rattan. It is therefore not surprising that the country is Europe’s leading supplier of rattan basketry. Indonesian producers have access to a variety of other natural materials as well, ranging from palm leaves to water hyacinth and several types of grass.

Wages in Indonesia are relatively high for the region. Suppliers must therefore target the middle to high-end markets to be able to compete. They often offer a range of handmade (or other) home-decoration products made of a particular material. This allows lifestyle buyers to do some convenient one-stop shopping in Indonesia and fill containers with a complete range of accessories, storage and furniture. The logistical structure and business climate in Indonesia are good, making the country easily accessible to European importers.

Poland keeps its position as a regional supplier

Europe’s sixth largest supplier of the product groups that include plant pots to Europe is Poland. As an Eastern European country, Poland benefits from its geographic proximity to the Western European market, which allows suppliers to offer short delivery times. At the same time, labour is relatively affordable compared to Western Europe. Suppliers have a good understanding of European consumers and have efficient, well-established production lines. In addition, products that have been ‘Made in Europe’ are increasingly popular.

Poland steadily increased its exports of the product groups that include plant pots to Europe, until they peaked in 2021. They thus grew from €55 million in 2018 to €70 million in 2022. This translates to a CAGR of 6.3%, as Poland’s share of the European import market dropped to 1.8%.

More than one quarter of Polish supplies of the product groups that include plant pots to Europe are made of plastic. With this, Polish manufacturers of plant pots compete primarily in the more price-sensitive lower and lower-middle ends of the market.

Bangladesh nearly triples its supplies to Europe

Another supplier that is quickly increasing its exports of the product groups that include plant pots to Europe is Bangladesh, Europe’s 12th leading supplier. Its main selling points are its reasonable prices, large skilled workforce and abundance of renewable natural materials. Importers generally perceive the country as accessible and customer-oriented.

The country’s supplies nearly tripled from €12 million in 2018 to €35 million in 2022, at an impressive average annual growth rate of 31%. Virtually all of these supplies were baskets, made largely of natural materials, including jute, hogla (sea grass), kaisa grass and mela grass. Recycled materials are also possible. These materials are also used to produce ‘planters’: plant pots with a plastic lining to allow for watering.

The country is especially a leader in jute, accounting for about three quarters of all global jute exports. Bangladesh produces the highest quality jute and is home to the world’s best jute-processing industry. This allows producers to create home products that are beautifully soft, yet strong.

Which companies are you competing with?

The following companies are examples of the competition you might face in the European market for plant pots.

Doan Potters – Vietnam

A typical example of a Vietnamese supplier in this category is Doan Potters. This company makes handcrafted pots, vases and accessories for both home and garden. It offers glazed and semi-glazed earthenware planters, decorated in various styles. The factory is BSCI-compliant, meeting a common requirement among HDHT buyers. Doan Potters is committed to socially responsible practices and encourages its material suppliers to adopt similar practices, based on an International Social Accountability Standard.

KELAPOT – Indonesia

Based in Bali, KELAPOT has a different approach to plant pots, focussing exclusively on the environmental qualities of its products. Made from local coconut waste, which is collected at the shores of the island, the plant pots are 100% biodegradable and are very suitable for growing plants. The look and shape of the pots are based upon those of the classic terracotta plant pots, making them very recognisable. For hanging these pots, the company also supplies special macramé ropes made by local Balinese artisans.

Figure 6: KELAPOT – Handmade ceramic plant pots

Source: KELAPOT @ YouTube

Indigenus – South Africa

South Africa’s luxury brand Indigenus produces unique high-quality planters with internationally renowned designers and artists. The company strives to reduce its carbon footprint by carefully selecting raw materials and processes. Indigenus planters are handmade from durable local materials that are sustainably sourced: FSC-certified Iroko (African teak) and glass-reinforced concrete (GRC). The wood is hand-cut and turned, and the relatively lightweight outer face coat of the GRC is applied and finished by hand to bring out an earthy and long-lasting finish.

Indigenus believes in buying fewer, better things, and it works to constantly improve quality and move away from fleeting trends or fast fashion. The company strives to make durable indoor and outdoor planters that are not just for a few seasons. The company is ‘committed to constant refinement and a willingness to be courageous, curious and experimental with natural materials and new designs’. The design of its sculptural planters expresses a ‘close connection to the earth’.

Which products are you competing with?

Most competition for plant pots comes from within the category itself, and it can be fierce. Buyers and consumers can choose from a variety of materials and designs, based on personal preferences. Price is often a determining factor. Special techniques and designs, sustainable values and good storytelling can make your plant pots stand out.

Tips:

- Compare your products and company to the competition. The ITC Trade Map can help you find exporters from specific countries, and compare them in terms of market segment, price, quality and target countries.

- To avoid having to compete on cost, you should avoid mass-produced plant pots. Instead, your best opportunities are in the mid-end market.

- Focus on design, artisanry, sustainability, natural materials, quality and the story behind your products to distinguish your company from competitors. Be sure to offer a high level of service to build strong, lasting relationships.

4. What are the prices for plant pots on the European market?

Prices for plant pots vary across market segments, ranging from low-end to high-end. After adding logistics costs, wholesaler and retail margins and value added tax (VAT), European consumer prices amount to about 4–6.5 times your selling price.

An overview of the prices of plant pots in the low, middle and high-end market segments is provided in Table 1. These figures are intended purely as an indication, and prices vary depending on technique, size, material, design, brand and other forms of added value, including a strong sustainable concept.

Table 1: Indicative consumer prices for plant pots in Europe

| Low-end | Mid-end | High-end/premium | |

| Plant pots | €1.50–€45 | €15–€245 | €250 and higher |

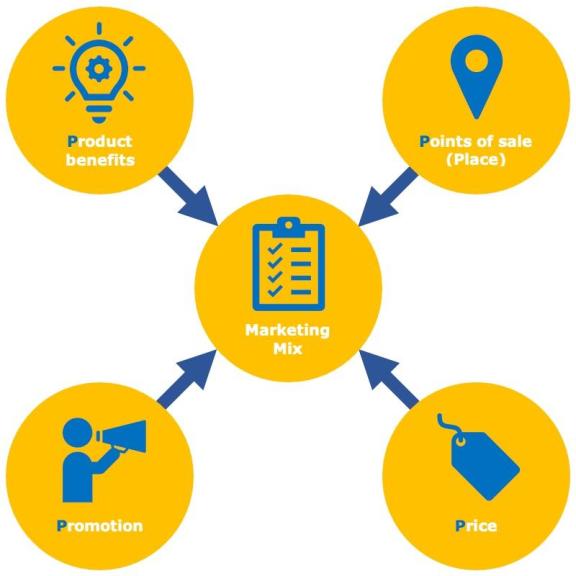

Consumer prices depend on the perceived value of your product within a particular segment. This is influenced by your marketing mix.

Figure 7: Marketing mix – The 4 P’s

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

The European consumer price for your product is about 4–6.5 times your FOB price. In addition to the costs of energy, labour and transport, FOB prices depend heavily on the availability and cost of raw materials. Because occasional cost increases are not passed directly on to the consumer, they exert pressure on the margins of exporters, importers and retailers. Recent disruptions have nevertheless resulted in longer-term cost increases. This continuing pressure has led many retailers to raise their consumer prices. As shipping rates begin to drop again, consumer prices may follow.

Consumer prices generally consist of the following:

- Your FOB price;

- Shipping, import, handling costs;

- Wholesaler margins;

- Retail margins;

- VAT – varies by country, about 20% on average.

Figure 8: Price breakdown indication for plant pots in the supply chain

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

For example, in Table 2, the FOB price is set at €10. Depending on the market segment for which your product is designed, the consumer price ranges from €41 in the low-end market to €65.50 in the high-end market.

Table 2: Example of the price breakdown by market segment

| Low margin | Middle margin | High margin | ||

| FOB price | €10.00 | €10.00 | €10.00 | Your FOB price |

| Transport, handling charges, transport insurance, banking services (20/15/15%) | +2.00 €12.00 | +1.50 €11.50 | +1.50 €11.50 | Landed price for wholesale importer |

| Wholesaler margins (50/75/90%) | +6.00 €18.00 | +8.60 €20.10 | +10.40 €21.90 | Selling price from wholesale importer to retailer |

| Retailer margins (90/110/150%) | +16.20 €34.20 | +22.20 €42.30 | +32.70 €54.60 | Selling price (excluding VAT) from retailer to end consumer |

| Selling price, incl. VAT (20%) | +6.80 €41.00 | +8.50 €50.80 | +10.90 €65.50 | Selling price (including VAT) from retailer to end consumer |

The FOB price of €10 includes your own margins as a producer. These margins depend on your efficiency and price-setting. In the lower segment, which is characterised by high volumes at low prices, margins are generally smaller than those in the middle and higher segments.

The following are several examples of plant-pot prices across Europe:

- Ceramic plant pot, Plantje.nl, €8.95

- Rattan garden pot with recycled plastic liner, The Garden Shop, €69

- Brass holder in iron stand, Nkuku, €135–€180

Tips:

- Study consumer prices in your target segment (for example, in web shops) to determine your price and adjust your costs accordingly. The quality and price of your pots should correspond to expectations in your chosen target segment.

- Calculate your prices regularly and carefully, especially if the prices of your raw materials fluctuate. If raw-material prices are pressuring your margin for longer periods, consider increasing your price or finding an alternative.

- Understand your segment. Offer a proper marketing mix to meet consumer expectations. Adapt your business model to your position in the market.

Globally Cool B.V. carried out this study in collaboration with GO! GoodOpportunity on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research