Entering the European market for soap

The European market is an interesting market for exporters of soap. Basic mass-produced soap dominates the lower ends of the market. As a result, the mid-high segment is your best option. To compete, you need to add value to your products. Entering the European market means you must comply with the European Union’s mandatory legal (and other) requirements, as well as any additional or niche requirements from your buyers.

Contents of this page

1. What requirements must soap comply with to be allowed on the European market?

What are mandatory requirements?

The following requirements apply to soap on the European market. For a more detailed overview, see our study on buyer requirements for Home Decorations and Home Textiles (HDHT). Cosmetics Regulation

Soap has to comply with the EU’s Cosmetics Regulation (EC 1223/2009). This regulation ensures the safety of cosmetic products on the European market by regulating the use of chemicals in these products. It bans the use of animal testing for cosmetic purposes. It is also forbidden to claim that your soap has characteristics or functions it does not have.

The ISO 22716:2007 provides guidelines on good manufacturing practices for cosmetic products. It focuses on production, control, storage and shipment in relation to the quality of the product.

Soap must also be correctly labelled, in indelible, easy to read and visible lettering.

The label must include information such as:

- Manufacturer or responsible person;

- Country of origin;

- Weight or volume;

- Date of minimum durability;

- Function;

- Ingredients; and

- Warnings.

For unpackaged soap bars, this information can also be mentioned on an enclosed or attached leaflet, label, tape, tag or card.

Tips:

- Read more about the Cosmetics Regulation.

- Check which ingredients are prohibited (Annex II), restricted (Annex III) or allowed (Annex IV for colorants and Annex V for preservatives).

- For more information on product claims, see the technical document on cosmetic claims.

Does it look like food?

Some soap bars look so much like food, that consumers could mistake them for real food products. Because children could be tempted to eat them, these food-imitating products pose a choking hazard. The European Union’s Council Directive 89/357/EEC on dangerous products resembling foodstuffs bans these items from the European market. Keep this in mind when designing your soap. Make sure that they do not resemble food too much with characteristics such as:

- Shape;

- Colour;

- Scent; or

- Size.

Unsafe products are rejected at the European border or withdrawn from the market. The EU uses the Safety Gate system to list and share information about such products.

Tip:

- Search the Safety Gate alerts for soaps that pose a choking hazard. This gives you an idea of the designs to avoid.

Packaging legislation

The Packaging Directive (94/62/EC) aims to prevent or reduce the impact of packaging and packaging waste on the environment. Buyers may therefore ask you to minimise the use of packaging and/or to use sustainable (recycled) materials. The EU’s new Circular Economy Action Plan identifies packaging as a sector that uses the most resources, with high potential for circularity. By 2030 all packaging on the European market should be reusable or recyclable in an economically-viable way. To help achieve this, the Packaging Directive is under review.

Europe also has requirements for wood packaging materials (WPM) used for transport, such as packing cases and pallets. The goal is to prevent organisms that are harmful to plants or plant products from entering and spreading within the EU.

Tips:

- For more information, see the EU’s packaging and packaging waste legislation and wood packaging material factsheet.

- Stay up to date on the review of the Packaging Directive.

What additional requirements do buyers often have?

Sustainability

Social and environmental sustainability are becoming more and more common requirements on the European market. Think of sustainable raw materials and production processes, as well as the impact your company has on the environment, the wellbeing of your workers and the community. You can use these topics in the “story” behind your product and company. Buyers appreciate good storytelling to create an emotional connection with their customers.

Consumers value sustainability

The increasing importance of sustainability is reflected in a recent Maison&Objet Barometer, where 62% of HDHT retailers have noticed growing interest in ethical products. They indicate that 92% of their customers think natural materials are important, 77% value socially responsible production methods and 71% care about recyclable/recycled materials.

A growing number of European buyers would like you to comply with the following schemes:

- Business Social Compliance Initiative (BSCI): An initiative of European retailers to improve social conditions in sourcing countries. They expect their suppliers to comply with the BSCI Code of Conduct.

- Ethical Trading Initiative (ETI): An alliance of companies, trade unions and voluntary organisations. ETI aims to improve the working conditions in global supply chains via their ETI Base Code of labour practice.

- Sedex: A membership organisation striving to improve working conditions in global sourcing chains. The Sedex Advance platform lets you share your sustainable performance, based on a self-assessment.

You can study sustainable options by reading about standards such as ISO 14001 and SA 8000. However, only niche market buyers demand compliance with these standards.

Greenwashing – be honest about your sustainability

Half of green claims lack evidence, according to a recent screening of websites by the European Commission and national consumer authorities. Via this so-called ‘greenwashing', companies pretend to be doing more for the environment than they really are. In 42% of cases the claims were believed to be exaggerated, false or deceptive and could potentially qualify as unfair commercial practices under EU rules. Unsurprisingly, many consumers (and importers) do not trust generic sustainability claims. In a 2021 study, just 20% of Western European respondents had a great deal/a lot of trust in claims about sustainable business practices.

Clearly, being honest yet effective is key. For help with communicating your sustainable performance, you can use the guidelines sustainability claims by the Netherlands Authority for Consumers and Markets. The British Competition and Markets Authority’s guidance for businesses on making environmental claims also lists six principles to follow.

Tips:

- Optimise your sustainability performance. Study the issues included in initiatives such as BSCI and ETI to learn what to focus on.

- If you can show your sustainability performance, this may give you a competitive advantage. You can use self-assessments like the BSCI Producer Self-Assessment and Sedex’ Self-Assessment Questionnaire, or a code of conduct such as the ETI Base Code of labour practice.

- For more information, see our special study on sustainability in HDHT.

- See the ITC Standards Map for more information on BSCI, ETI, Sedex and SA8000.

- For more information on European developments in the field of human rights and sustainability, see the proposal for a Directive on corporate sustainability due diligence. This Directive requires larger companies to identify and – where necessary – prevent, end or reduce negative impacts of their activities on human rights and the environment.

The information on the outer packaging should correspond to the packing list sent to the importer.

External packaging labels should include:

- Producer name;

- Consignee name;

- Quantity;

- Size;

- Volume; and

- Caution signs.

Your buyer will specify what information they need on the product labels or on the item itself, such as logos or 'made in' information. This is part of the order specifications. In Europe it is common to use EAN or barcodes on the product label.

Packaging specifications

Importer specifications

You should pack soap according to the importer’s instructions. They have their own specific requirements for the use of packaging materials, filling boxes, palletisation and stowing containers. Always ask for the importer’s order specifications. These are part of the purchase order.

Damage prevention

Proper packaging minimises the risk of damage by shocks, temperature or humidity. How an item is packaged for export depends on how easily it can be damaged. Packaging should make sure the items inside a cardboard box cannot damage each other. It should also prevent damage to the boxes when they are stacked inside the container. Packaging therefore usually consists of outer and inner cardboard boxes. The inner boxes are filled with protective materials like bubble wrap or paper.

Dimensions and weight

Packaging must be easy to handle in terms of size and weight. Standards are often related to labour regulations at the point of destination and must be specified by the buyer.

Cost reduction

Boxes are usually palletised for air or sea transport and you have to maximise pallet space. Packaging must provide maximum protection, but you must also avoid using excess materials or shipping ‘air’. Waste removal is a cost for buyers.

Material

Importers are increasingly banning wooden crating and packaging. Economical and sustainable packaging materials are more popular. Using biodegradable packing materials can be a market opportunity. For some buyers, it can even be a demand.

Consumer packaging

Soap sold as a gift or luxury product carries information about the ingredients, production process and additional features that support its premium marketing, such as the brand identity. Small labels or forms of packaging express the exclusivity of the product. However, packaging is reduced to show the soap bars’ natural qualities and minimise waste. Retailers may use refillable consumer packaging for liquid soaps, and therefore order in bulk or temporary packaging.

You are not always responsible for attractive consumer packaging. The importer usually designs it to reflect the brand identity. Gift packs or complete spa packs can be offered as a further selling point. You may be asked to supply the packaging for this, again depending on the importer’s preferences and your options.

Tips:

- Always ask for the importer’s order specifications, with their packaging and labelling requirements.

- See Packaging Europe for more information on the latest packaging developments, including regular news articles about biodegradable packaging.

Payment terms

Payment terms are usually agreed upon with the buyer in the order contract. They vary from buyer to buyer and are related to the volume and value of the order, the type of distribution partner, whether or not an agent is involved, and what delivery terms apply.

Delivery terms, known as Incoterms, depend on the type of distribution partner and their preferences regarding physical distribution. Importers generally prefer FOB (Free On Board) or FCA (Free Carrier) arrangements.

Tips:

- See our tips on how to organise your export for more information on payment and delivery terms.

- Study the different types of Incoterms, including what your and your buyer’s rights and obligations are.

- For a more elaborate overview of the various terms and conditions, how to work with them, and the benefits of having your own, see our study on terms & conditions.

What are the requirements for niche markets?

Natural and/or organic cosmetics

COSMOS and NATRUE are two of the most common international standards for natural and/or organic cosmetics, like soap. They cover all aspects of the sourcing, manufacturing, marketing and control of these products. See an example of COSMOS-certified handmade organic soap bars by The MUNIO

Tips:

- If you use natural and/or organic ingredients, research whether certification would offer opportunities.

- For more information, see how to apply for COSMOS certification and the steps for certification/approval by NATRUE.

Fair trade

According to the World Economic Forum, 86% of people want significant change to make the world fairer and more sustainable after COVID-19. The concept of fair trade supports fair pricing and improved social conditions for producers and their communities. Especially if the production of your items is labour intensive, fair-trade certification can give you a competitive advantage. This certification often includes aspects of environmental sustainability as well.

Common fair-trade certifications are issued by the World Fair Trade Organisation (WFTO) and Fair For Life. For most fair-trade oriented buyers in Europe however, simply complying with WFTO’s fair trade principles is enough.

Tips:

- Ask buyers what they are looking for. Especially in the fair-trade sector, you can use the story behind your product for marketing purposes.

- Determine which certification programme would be the best fit for you and apply for it if you can.

- If certification is not feasible, work according to fair-trade principles without being officially guaranteed or certified. Carefully document your company processes so you can support your story.

- Check the ITC Standards Map database for more information on Fair for Life.

FSC certification

FSC (Forest Stewardship Council) certification is the most common label for sustainable wooden products, including paper. The FSC chain of custody certification guarantees that a product’s source material comes from responsibly managed forests. These products are especially popular in Western European markets. See an example of COSMOS-certified handmade natural soap bars with FSC-certified packaging by Apeiron.

Programme for the Endorsement of Forest Certification (PEFC) is another option. Like with FSC, the PEFC chain of custody certification verifies that the certified forest-based material contained in a product comes from sustainably managed forests.

Tips:

- For more information, see the five steps towards FSC certification and/or how to become PEFC Certified.

- If you use recycled paper for the packaging of your soap, you can apply for the FSC Recycled label.

2. Through what channels can you get soap on the European market?

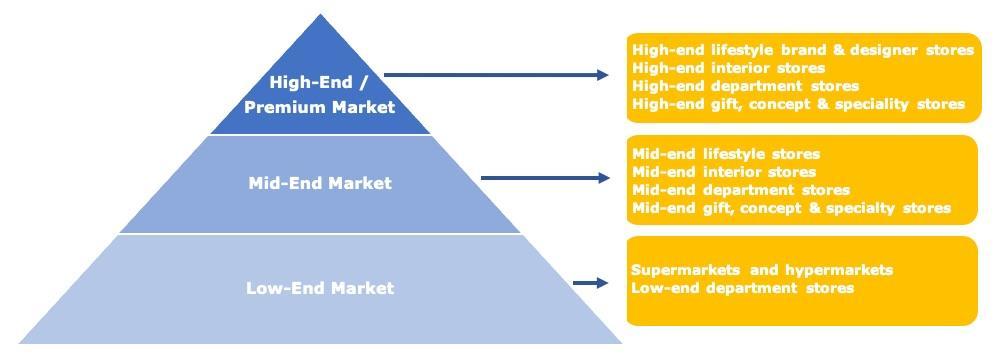

The soap market is segmented into low-, mid- and high-end (premium) market segments. Soap is put on the market through the traditional channels: importers/wholesalers that supply to retailers, as well as retailers that buy directly from suppliers.

How is the end market segmented?

Figure 1: Soap market segmentation in Europe

Source: Globally Cool, GO! GoodOpportunity & Remco Kemper

Low-end market

The well-developed low-end market mainly consists of basic mass-produced soap positioning on functionality. As such, this segment is not easy to enter for you. Typical retailers include hypermarkets such as Carrefour. These soaps often come in sets and at a low price. The higher mid-end market offers more opportunities for you, as a small or medium-sized enterprise (SME) from a developing country.

Mid-end market

This segment follows trends. Soap with added value is especially popular.

You can add value to your soaps with:

- Natural (and other) ingredients and scents that are specific to your context;

- Sustainable values of the product or production process;

- Craftsmanship – creating interesting designs or shapes; and

- Gift packaging.

The handmade soap segments start from mid-high, which is the most promising segment for you. Specialty stores like Lush and Rituals are examples of players in the mid-end market.

High-end/premium market

In the high-end market, branding also plays a role. At the top end are chunky bars of soap with special ingredients or slick, branded dispensers. Luxury department stores such as Harrods play an important role in this segment.

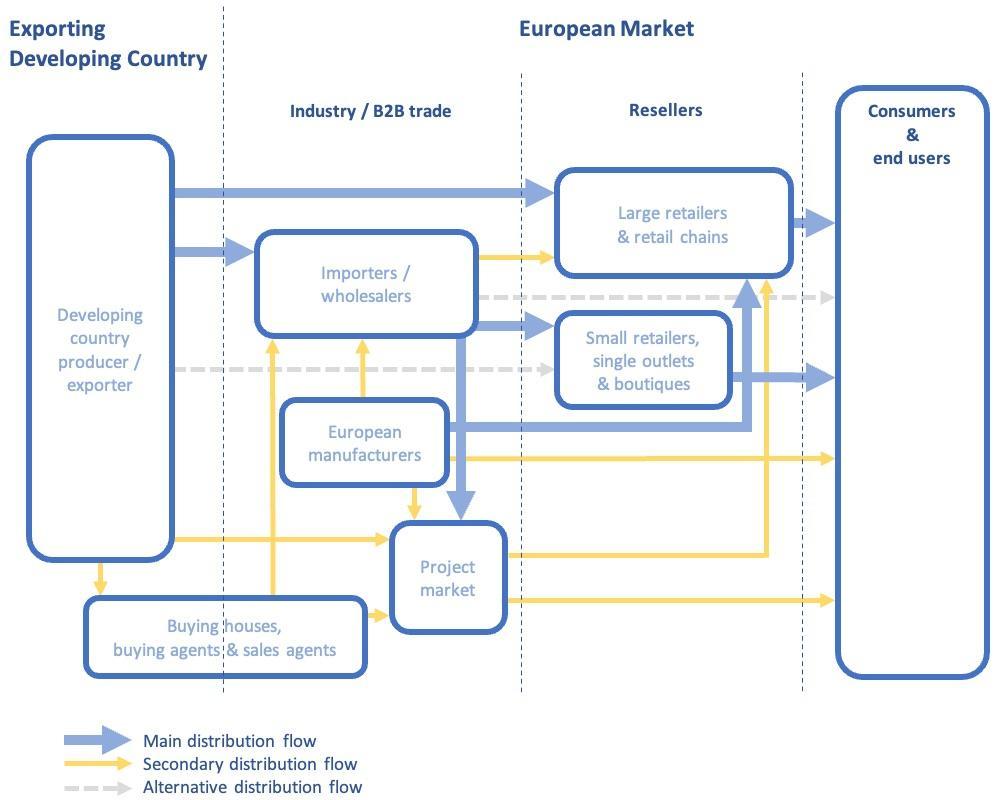

Through what channels does soap end up on the end-market?

The channels through which soap is put on the market follow the traditional patterns: import takes place via importers/wholesalers that supply to retailers. Larger retail chains often bypass the importers/wholesalers and import themselves, while more and more smaller retailers have also started buying directly from the supplier. In some cases, buying agents play a role.

Figure 2: Trade channels for soap in Europe

Source: Globally Cool, GO! GoodOpportunity & Remco Kemper

Importers/wholesalers

Importers/wholesalers sell products to retailers in their own country or region, or re-export across Europe. Some European markets are therefore supplied by wholesalers/importers from other European countries (intra-European trade). Supplying to buyers in the project market (such as hotels and spas) can be considered as a secondary distribution flow for them.

These importers/wholesalers handle the import procedures. They take ownership of the goods when they buy from you (as opposed to agents), taking on the risk of the onward sale of the products. Developing a long-term relationship can lead to a high level of cooperation on appropriate designs for the market, new trends, use of materials, types of finishing and quality requirements.

Importing retailers

Retailers come in many sizes: large and part of a chain, or small and independent. Especially larger retail chains often import directly from their suppliers in developing countries. Many even have their own buying offices in developing countries. Others, mainly the smaller independent stores, order in Europe from wholesalers.

There is a tendency towards consolidation in European retail. Large retail brands are becoming more widespread and more ‘lifestyle-centred’, offering home decoration and textiles as well as cosmetics.

Buying agents, buying houses and sales agents

You can encounter several types of intermediaries when doing business with European buyers. In your own country there may be buying houses, and in Europe there are both buying agents and sales agents.

- European buying agents represent European buyers in sourcing countries. They act as intermediaries, meaning they do not import products themselves. Sometimes they have a more limited role, such as checking the quality of the products. They can work individually or as part of a purchasing company.

- Buying houses are comparable to buying agents, but they are based in your country and usually offer more services, ranging from raw material sourcing to design and sampling services.

- European sales agents can help you find European buyers. However, you should be careful before entering into agreements with commercial agents, because European legislation protects their position.

Agents and buying houses mostly work on commission. They may approach you directly, or your buyer may indicate that they prefer to use an intermediary. However, you should always try to work directly with your buyer. This saves on commission and allows you to communicate with your buyer directly.

E-commerce

E-commerce is growing, especially since the COVID-19 pandemic. Your best way to benefit from this, is by supplying to a European wholesaler or retailer with a strong online presence. For most producers, this is not a separate channel. Catering to buyers that sell online is no different from your regular business. Retailers often combine online and offline channels, but the way of supplying to them is the same. Companies that only sell online also need to take stock before they can sell.

Direct business-to-consumer (B2C) sales

Selling directly to European consumers via your own website can be complicated and costly. You are responsible for factors like aftersales obligations and payment systems for consumer use. For most exporters from developing countries this is not feasible. In addition, according to Dutch consumer association Consumentenbond Dutch consumers buy less from non-EU web shops since new EU VAT rules were rolled out in July 2021. This makes direct online sales even less attractive.

Tips:

- To find potential buyers of your soaps, search the list of exhibitors or visit the main trade fairs in Europe: (Ambiente (February) and Tendence (August) in Frankfurt, Maison&Objet (January and September) in Paris, and VIVANESS (February) in Nürnberg.

- Search the list of members of Cosmetics Associations to find potential buyers, such as: Cosmetics Europe.

- See our tips for finding buyers on the European HDHT market.

- For more information about trading directly with smaller retailers and e-commerce, see our study about alternative distribution channels.

What is the most interesting channel for you?

Importers/wholesalers are the main channel between exporters in developing countries and European retailers. They are interesting if you want to develop a long-term relationship. These importers usually know the European market well, so they can provide you with valuable information and guidance on market preferences.

However, as the market is becoming more and more competitive, large retailers are increasingly importing themselves instead of through importers/wholesalers. The obvious advantages are cutting out the margins of the wholesaler and reducing delivery time to the market. In the lower-end market segments, self-importing retailers might want to drive a much harder bargain with you. However, price is a bit less sensitive in the mid-high segment, which offers you the most opportunities.

Smaller, independent European retailers continue to buy mainly from domestic importers/wholesalers. As in other sectors, independent HDHT retailers struggle to compete with retail chains. They need to differentiate on value-added service, specialised offers and authenticity. These buyers typically prefer small order quantities per item, small total order volumes and delivery to their doorstep, with a limited likelihood of repeat orders. You need to calculate if this is cost-effective for you.

The trend of direct sourcing is expected to continue and may create more opportunities for you. The pool of buyers grows if more retailers become importers, which could improve your bargaining position. Importing retailers order for their own shops and can therefore place orders much more quickly than some importers/wholesalers, who may need to show samples to their retailers before ordering.

Tips:

- Consider targeting retailers directly to improve your bargaining position and potentially close deals faster.

- Relate your offer and terms to the targeted retailer (large/small). Ask your existing buyers how they operate if you are unsure. The better informed you are, the better you will be able to set prices.

- Build a relationship based on mutual benefits by offering services such as fast delivery and after-sales support.

- If you are interested in selling to small independent retailers, make sure to have a policy for them when you participate in international trade fairs. You must have appropriate terms of trading, such as low minimum order quantities or pre-stocking.

3. What competition do you face on the European soap market?

Most European soap imports are intra-European trade. Germany, Poland and the Netherlands supply nearly half of Europe’s soap imports. This includes re-exports of European brands that outsource production to developing countries. Your best opportunities are in the mid-high market.

Germany is Europe’s main soap supplier with 22% of the imports, followed by Poland (11%). The Netherlands (8.1%), Italy (5.6%), Turkey (5.6%) and Spain (5.2%) are next on the list. Most of Europe’s soap import is intra-European trade. Some of that is re-export of European brands that outsource production to developing countries.

Re-exporters or producers

Be aware that European countries have different roles in the HDHT market. Some are mainly importers and others are mainly manufacturers. Western European countries are mainly importers (and re-exporters). Most Western European importers do not just sell their products in their own country, but they distribute them across the continent.

European production mainly takes place in Eastern Europe, mostly because of relatively low transport and labour costs. This can make these countries a good alternative for European buyers to source low- to mid-end products. Western and Southern Europe also produce some high-end products from well-known premium brands with a long history.

Mass-produced soap is segmented in the lower ends of the market and produced in the most cost-effective country. You do not compete with these countries, as your best chances are in the mid-high market.

Which countries are you competing with?

Source: UN Comtrade

Poland strengthens its position as a lower-cost European supplier

Polish soap exports to other European countries grew from €171 million in 2017 to €231 million in 2021, at an average annual rate of 7.8%. Nearly half of this is exported to Germany, where Poland is the leading soap supplier. Western European brands are increasingly outsourcing their production to Eastern European countries like Poland, especially at the lower end of the market.

As an Eastern-European country, Poland benefits from its closeness to the Western-European market. This allows suppliers to offer short delivery times. At the same time, labour is relatively affordable compared to Western Europe. Suppliers have a good understanding of the European consumer and have well-established and efficient production lines. In addition, products that are ‘Made in Europe’ are increasingly popular.

Poland’s industrialised soaps target the lower and the lower-middle ends of the market. In the lower segments, Polish producers are private label suppliers to Western European soap or lifestyle brands. For you, the handmade segment of the mid-high market offers much more opportunities. This approach also avoids straight competition with the Polish range. You can target the mid-high segment with specific ingredients and scents, social and environmental values, design and packaging, as well as customised service to importers.

Turkish supplies peaked sharply in 2020

Turkey’s soap supplies to Europe increased sharply by 68% in 2020, before dropping again by -28% in 2021. They grew from €92 million in 2017 to €117 million in 2021, at an overall average annual rate of 6.0%. Turkey’s main European soap markets are the United Kingdom (€26 million), the Netherlands (€21 million) and Germany (€17 million).

Like Poland, Turkey also has the advantage of being located close to the European market. The country also offers a low-cost workforce, and relatively easy and affordable transport. This makes production locations in Turkey attractive based on cost and lead times.

Turkey has a dual role in the market. Turkish producers are direct competitors to Poland with an industrially made product for the lower ends of the market. Turkey also has a handmade tradition in soap making. The country is famous for its Turkish hammam tradition, often using olive oil-based soap. By adding brand value to this, they can compete in the mid-high market. This is also your target market. You should differentiate with specific ingredients and scents, sustainable values, design, packaging, and customised service to importers.

France has strong associations to soap

French soap exports to other European countries grew from €82 million in 2017 to €104 million in 2021, at an average annual rate of 5.9%. This resulted in an import market share of 5.0%. The country supplies its soap to all main European markets.

French soaps dominate the wellness and branded upper ends of the middle market and the luxury market. With its famous soaps like Savon de Marseille and luxury brands such as Diptyque and Sisley Paris, France is closely tied to the product category of soap. International producers may even give their products French names to benefit from the excellent soap reputation of France. At the same time, France also has a tradition in industrialised soap making for the mass market (lower and lower-middle market), although much of that has been outsourced to Asia.

France is hard to beat as it is competing in almost all segments of the soap market. However, your opportunities are in that part of the mid-high handmade segment where small, customised orders are welcome. Especially when you can add special ingredients and scents, and sustainable values. Larger players often prefer larger runs.

China provides low-cost mass production

China is the world’s leading soap exporter. Its leading export market is the United States of America. China plays a relatively small role on the European soap market, with a 3-4% import market share. Its exports grew from €67 million in 2017 to €93 million in 2021, at an average rate of 8.5% per year. Nearly half of this is exported to the United Kingdom, where China is the leading soap supplier. Chinese producers mainly supply the lower ends of the market with low-priced products, as product development and creativity are not their core strengths.

China is a competitive supplier because of its low-cost workforce, availability of raw materials and efficient shipping to Europe (compared to other Asian countries). However, the country’s rising labour costs in the last ten years have affected its price competitiveness. In the coming years, disruptions following China’s trade war with the United States and the COVID-19 pandemic may negatively impact the country’s trade performance. This could benefit companies from other developing countries who can make an industrialised product for the mass market.

Malaysia lets some of its market share slip

Malaysia’s soap supplies to Europe dropped from €30 million in 2017 to €24 million in 2021, at an overall average annual rate of -5.3%. As a result, its direct import market share fell from in 1.8% 2017 to 1.2% in 2021. About half of these exports were destined for France, the country’s leading European soap market.

Malaysia produces industrialised soap and is a large-scale producer of palm oil. Europe is a relatively small market for Malaysian soap. Malaysia is the world’s 4th largest soap exporter, but less than 10% of its exports are destined for Europe. Since Turkish Evyap moved its soap bar production facility to Malaysia to save costs, Turkey has become the country’s main export destination. Malaysia is an option especially for importers who want to do smaller runs and are looking for an alternative to China. By targeting the handmade section of the mid-high market, you avoid direct competition with Malaysia.

Indonesia recovers its market share

After a dip in 2019, Indonesia’s soap supplies to Europe recovered strongly. They grew from €19 million in 2017 to €24 million in 2021, at an average annual rate of 5.8%. A 37% increase in 2021 resulted in a direct import market share of 1.2%. This makes Europe a relatively small market for Indonesia, which is the world’s 2nd largest soap exporter.

Indonesia is a private label manufacturer of soaps for importers in the lower and middle ends of the market. The country also has a flourishing crafts industry that offers handmade soap for the mid-high end, but it’s relatively small. Wages in Indonesia are relatively high for an Asian country, but energy costs are still relatively affordable due to government subsidies on fossil fuel. The logistical structure and business climate in Indonesia are good, making the country accessible for European importers. You can compete with Indonesia’s handmade soap via your ingredients and scents, sustainability, design and packaging, as well as personalised service to importers.

Which companies are you competing with?

Maroma, India

WFTO Fair Trade Guaranteed producer Maroma offers a full range of home fragrances and body care products, including soaps. Although they are a private label supplier, they do have one product brand: Encens d’Auroville. This is a clever wink to the associations of ‘Frenchness’ that this product group carries.

Maroma’s experience and coherent collection make them a reputable, specialist supplier to the industry. They are a modern business, catering to the needs of the modern consumer with their promise of “care for the environment and concern for social development”. Most of their employees are women, who mainly use recyclable and preferably locally sourced natural materials for their products and packaging. The company’s principles of being Earth Friendly, Vegan, Natural, Toxin Free and Cruelty Free reflect their sustainable values.

Figure 4: Maroma – soap production process

Source: Maroma @ YouTube

Botanika Marrakech by Ircos Maroc, Morocco

Botanika Marrakech is a natural cosmetics brand by Ircos Maroc, a Moroccan manufacturer of body care and home fragrance products. They offer a full collection in cosmetic, body and home care products, including home fragrances. The formulas of their eight product lines include essential oils and organic plant extracts, with a focus on argan oil and leaf extract. Argan is a well-known Moroccan ingredient for cosmetics.

For its soap bars, Botanika Marrakech combines argan oil with shea butter in various scents from Moroccan soil. Their liquid hand soaps contain argan extract and chamomile extract, to “purify the hands and delicately perfume them while respecting the natural balance of your skin”. The company’s jars of creamy soap paste are linked to the well-known local tradition of hammams, popular among European consumers.

Silk Road Bazaar, United States of America

American wholesaler Silk Road Bazaar carries hand-made felted soaps from Kyrgyzstan. They use traditional crafting techniques, natural fibres and eco-friendly resources to make products with a fun, modern touch. Their goal is to build sustainable livelihoods for craftspeople in marginalised regions. The fact that these soaps come from a country or region unknown to many, triggers consumers’ curiosity.

The soaps are handmade by female artisans and wrapped in felt. The felt gives the soaps an interesting look and makes them act as a so-called loofa – a sponge and soap at the same time. This is very much in tune with the wellness side of soaps. The ingredients on offer are lavender, jasmine and rose.

Which products are you competing with?

Competition for soap mostly comes from within the category, from different ingredients and designs with different benefits. The COVID-19 pandemic has made consumers more aware of personal hygiene. Not only in their home, but also on the road. This has boosted interest in liquid soap without water and disinfection gels. However, these strictly functional products do not directly compete with the soaps in the HDHT category that have high emotional and gift value.

Tips:

- Compare your products and company to the competition. You can use ITC Trade Map to find exporters per country and compare on market segment, price, quality and target countries.

- Focus on design, craftsmanship, quality and the story behind your products to stand out from your competitors.

4. What are the prices for soap on the European market?

Prices for soap vary across market segments, ranging from low- to high-end. After adding logistics costs, wholesaler and retail margins, and Value Added Tax (VAT), European consumer prices amount to about 4-6.5 times your selling price.

Table 1 gives an overview of the prices of soap in the low-, mid- and high-end market segments.

Table 1: Indicative consumer prices of soap

| Low-end | Mid-end | High-end | |

| Soap | Up to €1.50 | €1.50 to €10 | €10 and over |

Consumer prices depend on the value perception of your product in a particular segment. This is influenced by your marketing mix.

Figure 5: Marketing mix – the four Ps

Source: Globally Cool, GO! GoodOpportunity & Remco Kemper

The European consumer price of your soap is about 4-6.5 times your selling price (Free on Board - FOB) price. Besides energy, labour and transport costs, FOB prices depend heavily on the availability and cost of raw materials. Occasional cost increases are not directly passed on to the consumer, so they put pressure on exporters’, importers’ and retailers’ margins. Current pandemic-related disruptions have resulted in longer-term cost increases. Because of this continuing pressure, some European retailers have now decided to increase their consumer prices.

Consumer prices generally consist of:

- Your FOB price;

- Shipping, import, handling costs;

- Wholesaler margins;

- Retail margins; and

- VAT – varies per country, about 20% on average

Figure 6: Price breakdown indication for soap in the supply chain

Source: Globally Cool, GO! GoodOpportunity & Remco Kemper

For example, in Table 2 the FOB price is set at €10. Depending on the market segment your product is designed for, the consumer price ranges from €41 in the low-end market to €65.50 in the high-end market.

Table 2: Example of the price breakdown per market segment

| Low margin | Middle margin | High margin | ||

| FOB price | €10.00 | €10.00 | €10.00 | Your FOB price |

| Transport, handling charges, transport insurance, banking services (20/15/15%) | +2.00 €12.00 | +1.50 €11.50 | +1.50 €11.50 | Landed price for the wholesale importer |

| Wholesalers' margins (50/75/90%) | +6.00 €18.00 | +8.60 €20.10 | +10.40 €21.90 | Selling price from the wholesale importer to the retailer |

| Retailers' margins (90/110/150%) | +16.20 €34.20 | +22.20 €42.30 | +32.70 €54.60 | Selling price excluding VAT from the retailer to the end consumer |

| Selling price incl. VAT (20%) | +6.80 €41.00 | +8.50 €50.80 | +10.90 €65.50 | Selling price including VAT from the retailer to the end consumer |

The FOB price of €10 includes your own margins as a producer. These margins depend on your efficiency and price setting. Generally, margins in the lower segment, that deals with high volumes for low prices, are smaller than those in the middle and higher segments.

Some examples of soap prices across Europe are:

- Basic soap bar set of two, Action (the Netherlands), €1.49;

- Handmade organic soap bar, Ohëpo (France), €8.90;

- Handmade vegan olive oil soap bar, Lush (United Kingdom), €12.50.

Tips:

- Study consumer prices in your target segment to determine your price and adjust your cost accordingly. The quality and price of your soap must match what is expected in your chosen target segment.

- Calculate your prices regularly and carefully, especially if prices of your raw materials fluctuate. When raw material prices pressure your margin for a longer period, consider increasing your price or finding an alternative.

- Understand your segment. Offer a correct marketing mix to meet consumer expectations. Adapt your business model to your position in the market.

This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with GO! GoodOpportunity.

Please review our market information disclaimer.

Search

Enter search terms to find market research