8 tips on how to organise your home decoration and home textile exports to Europe

When you have found a buyer for your home decoration and home textiles (HDHT), you need to prepare for your first shipment to them. European buyers are generally professional, well-informed customers who will often offer a contract with a set of strict conditions, including payment terms and the type of insurance and packaging. You need to agree on these conditions with your buyer before signing the contract. The tips listed below discuss your options to help you become an efficient, trustworthy and successful exporter.

Contents of this page

1. Draw up a detailed order, agreement or contract

When a buyer places an order with you, that is an agreement or contract. Whenever you enter into any kind of agreement, it is important that both parties know and agree to the terms of that contract. Buyers may see drawing up an extra contract in addition to the order as an extra step or even a hurdle. However, in case of a series of orders or recurring orders within a set time frame, it makes sense to draw up an agreement or contract that further specifies what you have agreed to with your buyer.

The most important details to include in your order, agreement or contract are:

- Names and addresses of both parties;

- Product specification;

- Quantity — both in numbers and words;

- Total value — including the currency;

- Payment terms;

- Delivery terms;

- Taxes, duties and charges — who is responsible for what;

- Delivery procedure — places of dispatch and delivery, and a definition of the period of delivery;

- Packaging, labelling and marking requirements;

- Insurance — who insures what, the type of risk covered, and the extent of coverage;

- Documentary requirements — including the documents needed for customs clearance;

- General terms and conditions;

- Legal signature of both parties;

- Any special arrangements, provisions, requirements, rules, specifications; and standards you have agreed upon.

To be prepared if things do not work out as planned, you should also include clauses for:

- Force majeure — when parties are relieved of their liability for a delay or failure to perform due to an extraordinary event or circumstance beyond their control;

- Governing law — which law applies (that of your country or your buyer’s country);

- Place of jurisdiction — the competent court in case of a dispute between the parties;

- Arbitration – an alternative to legal proceedings before a general jurisdiction court.

Tips:

- Ask a lawyer who is experienced in international trade to help with your first contracts.

- For more information and examples, see the model contracts and clauses of the International Chamber of Commerce (ICC) and the model contract for small firms of the International Trade Centre (ITC).

2. Include a product specification sheet

For clarity’s sake, you can include a product specification sheet with your order confirmation that lists everything your buyer needs to know about your product. Think of it as a factsheet that helps everyone understand exactly what your product is all about – what it looks like, how it works, what it’s made of, and more. Using product specification sheets makes sure everyone’s clear on the product details and ensures consistency.

Key components include:

- Product identification: name and code;

- Technical specifications: including size, weight, materials and composition, colour, technical drawings;

- Performance characteristics: performance parameters, capabilities, functional features;

- Compliance information: for example, industry/quality standards, safety regulations, certifications;

- Packaging and shipping requirements: for example, labelling, storage, handling, sustainability, waste management, damage prevention;

- Information about the intended use and applications of the product;

- Warranty terms, maintenance instructions and care guidelines; and

- Additional notes or disclaimers.

Tips:

- Create a standard format/template for your product specification sheets so they are consistent across your collection.

- Consider using product information management (PIM) software to manage your product data and create consistent specification sheets.

- If your buyer asks you to use their template, consider using it for your other buyers too if the template is practical.

3. Negotiate the payment terms

Payment terms are part of the terms and conditions you have to negotiate with your buyer. These terms and conditions will be stated in a contract and signed by both parties. They generally include specifications regarding delivery/lead times, labelling and packaging, minimum order quantities, as well as payment terms. The contract formalises all these details and offers both parties protection if things go wrong.

Payment terms vary from buyer to buyer. They are related to the volume and value of the order, the type of distribution partner, whether or not an agent is involved, and what delivery terms apply.

The most commonly used payment terms in HDHT are:

Cash in advance (CIA)

When you agree on CIA, the buyer pays before receiving your shipment. This limits the risks for you, as the seller. In Europe, it is not uncommon to ask for payment or partial payment in advance. For example, an advance payment of 50% is typical in the fair-trade sector, but mainstream buyers usually do not pay more than 30% in advance.

Cash against documents (CAD)

This method, also known as documentary collection (D/C), guarantees physical control of the goods until you get paid. Under CAD, you submit key export documents (such as the invoice and shipping papers) to your bank. After your bank has received the payment, your buyer can access the documents. If your buyer does not pay, you can return or store the products, although this obviously increases your costs. Combining 50% CIA with 50% CAD is a relatively safe method for both you and your buyer.

Figure 1: International Trade Administration – Documentary collection

Source: International Trade Administration @ YouTube

Letter of credit (LC)

An LC is another fairly safe method of payment. This letter guarantees that your buyer’s bank will cover the payment if your buyer is unable to. You are paid based on documentation that proves you have met the requirements agreed upon in the LC, such as shipping papers. There are various types of LCs. Most importantly, your LC should be irrevocable. This means that the issuing bank cannot make any changes without your approval. A downside to doing business via LCs is that bank fees can make them relatively expensive.

Figure 2: International Trade Administration – Letter of credit

Source: International Trade Administration @ YouTube

Cash on delivery (COD) and open account (OA)

COD and OA terms are the riskiest options for you. As the name implies, under COD your buyer pays when your shipment is delivered. In an OA arrangement, payment is made within a set time — usually 30, 60 or 90 days from the date of invoice — which is also known as deferred payment. You should generally avoid these types of agreements.

A long-term relationship between buyers and sellers is based on trust. For your first shipments to a new buyer, you should insist on CIA or LC arrangements. If an LC is considered too expensive, you can suggest sharing the fees. As your relationship with your buyer develops and you have both proven to be trustworthy, you can move towards CAD terms.

Tips:

- See our study on terms & conditions for information on how to make your own and for further details on payment terms.

- Always include the payment terms in your price negotiations, and carefully study any proposal from your potential buyer. While you can offer a lower price in return for advance payment, a long credit period can justify a higher price. Always include in the terms that your buyer must pay all bank charges in their country.

- Agree with your buyer on how you will receive their payment. Direct bank transfers are common in international trade. Give your buyer all the bank details needed for a transfer into your account. Establish the currency you will be paid in and make sure your bank account accepts international currency transfers, if necessary. If you may be charged a currency conversion fee, you can include this in the price you quote to your buyer.

- Ask advice from your bank or Chamber of Commerce to help you better understand the various payment terms. You can also buy several guides and practical documents on trade finance from the ICC, or follow their online courses.

- If you are considering using an LC, check with your bank for the actual costs and procedures. Select a bank that is recognised in Europe and has daily experience in dealing with LCs. Ideally, your bank and the bank of your buyer should be part of the same subsidiary network.

4. Agree on delivery terms

HDHT products from developing countries are usually shipped to Europe by sea. While sea freight may be slow, it is particularly suitable for large volumes of finished goods. Especially when the goods are relatively heavy or large, such as pieces of furniture. Truck or rail transport are faster options if your country is connected to Europe by land. These modes of transport can also be used to move your products within Europe beyond the port of arrival. Airfreight, while fast, is expensive and therefore usually reserved for high-value items.

Each shipment involves 7 steps:

- Export haulage — moving the goods from your location to the freight forwarder

- Export customs clearance — having the goods cleared for export by the local customs authority

- Origin handling — inspecting the goods, loading them into a container and then onto an export vessel

- Sea freight — transporting the goods to Europe via a shipping line

- Import customs clearance — having the goods cleared for import by the European customs authority

- Destination handling — unloading the container and preparing the goods for collection

- Import haulage — moving the goods from the freight forwarder to the buyer’s location

With each step come costs that must be settled by either the exporter or the buyer. To avoid cost surprises and unnecessary delays, your contract must specify the rights and responsibilities of the exporter (you) and the buyer. These delivery terms, or Incoterms, determine who pays for each of the steps. They specify who is responsible for paying and managing shipment, insurance, documentation, customs clearance, and other logistical activities. The preferred Incoterm depends on the type of buyer you work with.

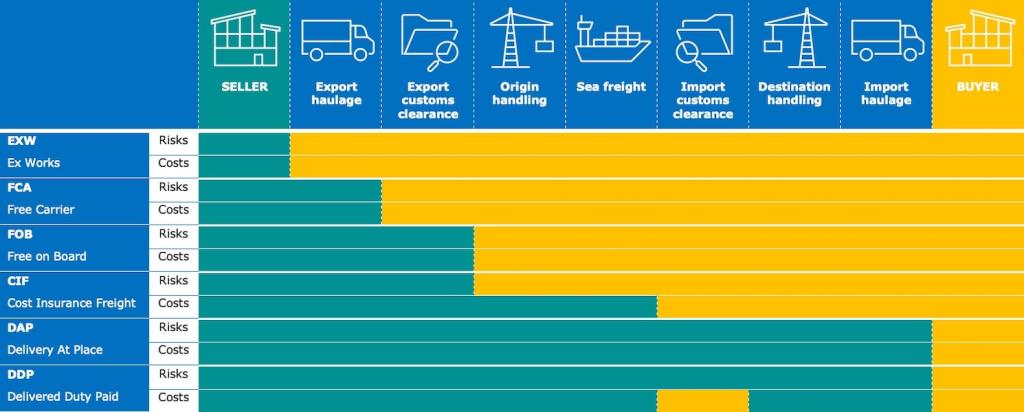

Figure 3: Incoterms

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

Importers generally prefer Free on Board (FOB) or Free Carrier (FCA). Under FOB, you pay for transporting the goods to the port, plus loading costs. After that, the buyer is responsible. With FCA, you have to clear the goods for export and hand them over to the carrier. Retail multiples may prefer cost insurance freight (CIF), where you include the shipping and insurance charges in your quotation. Small retailers may ask for the goods to be delivered to their doorstep via Delivered Duty Paid (DDP) or Delivery At Place (DAP). Importers who consolidate orders often prefer Ex Works (EXW).

You can use the free online Incoterms® Digital Guide to select the most suitable Incoterm® for your contracts.

Figure 4: ICC Germany – The Incoterms® 2020 Digital Guide

Source: ICC Germany @ YouTube

Tips:

- Study the rights and obligations of buyers and sellers for the different Incoterms and make them part of your negotiation. The delivery terms are part of the service and solutions you offer. Check out ICC’s free Incoterms introduction, Digital Guide and wallchart.

- Carefully select your freight forwarder. Send your request for proposal to several operators and be as specific as possible. When you have selected a forwarder, sign a detailed contract including aspects such as responsibilities, how damaged goods will be dealt with, price changes and compensation.

- See Transporteca’s how-to guide on the shipping process for a more detailed discussion of the 7 steps.

- For information on the safe transport of your products, you can check out the Container Handbook and the Cargo Handbook. The European Union (EU) also offers best practice guidelines on cargo securing for road transport.

- Use Freightos’ free freight rate calculator to estimate your freight costs and determine your freight rates. Also stay up to date on the latest news about shipping and freight cost increases, shipping issues, and shipping container shortages via their blog.

5. Use safe, efficient and sustainable packaging

Your buyer will usually instruct you how to pack the goods. They have their own specific requirements for the use of packaging materials, filling boxes, palletisation, and stowing containers. These are included in the order specifications.

Safety

Proper packaging minimises the risk of damage from shocks. It should ensure that the items inside a box cannot damage each other and prevent damage to the boxes when they are stacked inside the container. Packaging therefore usually consists of inner and outer cardboard boxes, filled with protective materials or cardboard partitioning. Another concern is moisture, as condensation inside the container can cause mould. Proper ventilation and dehumidifiers inside the container can prevent this.

To reduce risks, you should:

- Pack your products in strong containers, adequately sealed and filled;

- Provide proper bracing in the container and distribute the weight evenly ;

- Use moisture-resistant material for your packaging and filler;

- Use straps, seals and shrink wrapping to prevent theft, and not write contents or brand names on packages; and

- Observe any product-specific hazardous materials packing requirements.

Efficiency

Boxes are usually palletised for transport. You have to maximise the use of pallet space and minimise transport costs, for example by flat-packing, nesting and efficient stacking. Packaging should be easy to handle in terms of size and weight. Standards are often related to labour regulations at the point of destination and must be specified by the buyer. Most European traders use Euro-pallets of 120x80 cm. The maximum recommended height of a cargo unit is about 200 cm. You should discuss the options with your shipping agent – especially high cube containers are much higher.

As waste removal is a cost, you should avoid using excess materials or shipping ‘air’.

You can reduce the amount and diversity of packing materials by:

- Partitioning inside the cartons, using folded cardboard;

- Matching inner and outer boxes by using standard sizes;

- Considering packing and logistical requirements when designing your products;

- Asking your buyer for alternatives.

Sustainability

Importers are increasingly banning wooden crating and packaging. Economical and sustainable packaging materials are more popular. Using biodegradable packing materials can be a marketing opportunity. Some buyers may even demand it.

Europe’s Packaging Directive (94/62/EC) aims to prevent or reduce the impact of packaging and packaging waste on the environment. This includes preventing the production of packaging waste, as well as promoting reuse, recycling and other forms of recovery. Buyers may therefore ask you to minimise the use of packaging and/or to use sustainable (recycled) materials. Europe also has requirements for wood packaging material and dunnage (WPM) used for transport, such as packing cases and pallets. The goal is to prevent organisms that are harmful to plants or plant products from entering and spreading within the EU.

The EU's new Circular Economy Action Plan identifies packaging as one of the most resource-intensive sectors, with a high potential for circularity. By 2030 all packaging on the European market should be reusable or recyclable in an economically viable way. To help achieve this, a new Packaging and Packaging Waste Regulation (PPWR) is in the works.

Labelling

Outer packaging labels should include:

- Producer name;

- Consignee name;

- Quantity;

- Size;

- Volume; and

- Caution signs.

Your buyer will specify what information they need on the product labels or on the item itself, such as logos or ‘made in’ information. This is part of the order specifications. In Europe, EAN or barcodes are commonly used on the product label. Labelling should be in English unless your buyer indicates otherwise.

Packing list

Upon completion of packing and labelling, you must prepare a packing list. This is an essential document, needed for customs procedures. It will be used by carriers, cargo handlers, warehouses and customers. The packing list gives the total number of packages and the total gross weight and volume.

It should also contain the following details for each package:

- Marks;

- Numbers;

- Gross and net weight in kg;

- Dimensions in cm;

- Volumes; and

- Content description.

The information on the outer packaging of your products should match the packing list.

Tips:

- Make sure that your packaging protects your products, while minimising costs and the effects on the environment. Use biodegradable packaging where you can. Smart packaging and optimising pallet and container space can save a lot of money. For some (larger) products, you should already consider this in the design phase of the product.

- Always ask for the importer’s order specifications, packaging and labelling requirements.

- Stay up to date on the EU’s proposal for a PPWR, and visit Packaging Europe for more information on the latest packaging developments.

- Check software such as ShipHawk, packVol and TOPS Pro. These programmes allow you to calculate and design packaging, as well as plan the best arrangement of the goods inside containers and trucks.

- See our studies about promising export products for more product-specific packaging requirements.

6. Insure your export

Because doing international business involves considerable risks, insurance is important for you, as an exporter. You should insure the payment and goods, especially if the contract involves larger volumes and values.

Export credit insurance

Export credit insurance protects you by covering payment if your international buyer is unable to pay, for example due to insolvency. An insurance company or export credit agency evaluates your potential buyer to determine their creditworthiness and set a credit limit for them. This makes it easier for you to agree to deferred payment if a European buyer asks for it. As such, credit insurance not only ensures that you are paid, it can also increase your competitiveness.

Transport insurance

In addition to insuring payment, you can also insure your products. International transport or cargo insurance can protect your products throughout their entire journey to your buyer. It typically covers risks such as theft and damage due to heavy weather or problems with a vessel.

Your Incoterms define whether the exporter (you) or the importer (your buyer) is responsible for insuring the goods. They define each party’s rights and obligations regarding insurance and transportation. If you are responsible, you need an insurer that can handle international claims. Your policy should cover the goods from the time they leave your premises until your buyer has taken possession of them. Hiring a professional carrier does not automatically mean their insurance covers your goods. If it does, coverage is usually limited.

Product liability insurance

As a manufacturer, you need to make sure your products are safe. If a product proves faulty and causes harm, international product liability insurance can cover your legal fees, compensation costs and other claims. This type of insurance is particularly important for small and medium-sized enterprises (SMEs), as the costs associated with defective products can be so high that you risk bankruptcy. Although you are not legally obliged to have product liability insurance, your European buyers may well demand that you do.

Product liability insurance does not cover intentional damage, contractual liabilities (where you have contractually agreed to assume another party’s liability) or criminal prosecution. To make sure you are covered, you need to make every effort to ensure product safety and comply with any laws that apply to your product.

Even if you export to only one European country, your products may be re-exported across Europe (or even worldwide). Because of this, you need an insurance company that offers global coverage and is familiar with international claims.

Tips:

- Before obtaining any kind of insurance, carefully study its coverage.

- Find a reliable insurance provider that is part of a larger international network, for example via the Berne Union – the International Union of Credit and Investment Insurers.

- Check Chamber of Commerce business registrations or business directories like Kompass, to see if data such as the annual turnover and basic balance sheets of your potential buyers are available for free.

- Be clear with your buyer about who is responsible for transport insurance according to your Incoterms. If you are, you can look for a reliable insurer via the International Union of Marine Insurers and its member associations.

7. Comply with EU customs policy

Importers, agents or customs brokers are responsible for taking your goods through European customs. You, as the exporter, are not directly involved in this process at the point of entry into the EU. However, it is extremely important to be in touch with the transporter and importer, and to provide them with all necessary documents and further support.

European import procedures roughly have 3 steps:

- Entry summary declaration (ENS): the transporter usually electronically submits an ENS at least 24 hours before loading begins.

- Inspection and control: customs authorities check the documentation and the goods declared in the ENS and the customs declaration.

- Decision on customs procedure: the goods are either released for free circulation or placed under a special procedure, unless they are rejected because they do not comply with European legislation.

Documents needed for customs clearance are:

- commercial invoice: a record of the transaction between you and the importer, with basic information such as your name and address, a description of the goods, and the total value

- transport documents: a set of documents including the Bill of Lading (for sea freight), air waybill, road waybill or rail waybill

- packing list (P/L): a commercial document with information on the imported items and the packaging details of each shipment, such as weight, dimensions and contents of the packages

- customs value declaration: a document stating the value of the goods, including all the costs incurred, which must be presented if the value of the imported goods exceeds €20,000

- proof of origin: a document certifying that the goods originate from a particular country or territory, as lower customs duties may apply based on the rules of origin

- freight insurance: an invoice, required only when the premium paid to insure the merchandise is not included in the commercial invoice

- customs import declaration: a single administrative document (SAD) with information such as the identifying data of the goods and the parties involvedTips

- Read the guidance document on Customs Formalities on Entry and Import to become familiar with the Union Customs Code. For more information on customs clearance documents and procedures, see Access2Markets.

- Use ITC’s Market Access Map to analyse competitive advantage based on applied tariffs for your country and other countries. Learn how this works from the Market Access Map Tutorials.

- Follow the 3 steps to paying lower customs duties based on proof of origin.

- Learn about freight forwarders from Freightos’ guide to choosing a freight forwarder.

Consult your freight forwarder or customs agent about export documents and customs procedures. You can find forwarders and agents via the International Forwarding Association. You can also look for national associations via the European Association for Forwarding, Transport, Logistics and Customs Services, or your national association via the International Federation of Freight Forwarders Associations.

Tips:

- Read the guidance document on Customs Formalities on Entry and Import to become familiar with the Union Customs Code. For more information on customs clearance documents and procedures, see Access2Markets.

- Use ITC’s Market Access Map to analyse competitive advantage based on applied tariffs for your country and other countries. Learn how this works from the Market Access Map Tutorials.

- Follow the 3 steps to paying lower customs duties based on proof of origin.

- Learn about freight forwarders from Freightos’ guide to choosing a freight forwarder.

- Consult your freight forwarder or customs agent about export documents and customs procedures. You can find forwarders and agents via the International Forwarding Association. You can also look for national associations via the European Association for Forwarding, Transport, Logistics and Customs Services, or your national association via the International Federation of Freight Forwarders Associations.

8. Look for organisations that can support you

Government bodies and private sector organisations in your European target markets may be able to help you organise your export.

Organisations that could support you include:

- HDHT associations, such as the European Floral & Lifestyle Suppliers Association (EFSA), could offer sector-specific assistance;

- the German Federal Ministry for Economic Affairs and Energy promotes foreign trade and investment and offers information that may be of help;

- the Institute of Export and International Tradeprovides information and advice for international trade;

- the EU’s import and export page and Access2Markets provide extensive information on import regulations and taxes;

- ITC provides publications and its SME Trade Academy / Global Textile Academy with online courses on international trade topics;

- the ICC has worldwide offices and offers arbitration, export learning tools and information about Incoterms;

- your own Chamber of Commerce and Industry can give you advice and information on topics such as certificates of origin, transport, trade agreements and legal issues.

Business support organisations (BSOs) in your own country may also be able to give advice or offer training. ITC’s global BSO directory lists more than 600 registered BSOs in nearly 160 countries.

More tips for exporting to Europe

- If you are looking for new buyers, our tips on how to find buyers in the European HDHT market outline the steps you can take.

- When you are ready to approach potential buyers, our tips on how to do business with European buyers help you with European business culture, making quotations and defining your unique selling point.

Globally Cool carried out this study in partnership with Remco Kemper on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research