Entering the European market for travel accessories made from textiles

The European market for travel accessories from textiles offers opportunities, but the competition is strong. China continues to be a fierce competitor, while Vietnam and India are serious upcoming competitors. Competition within the European Union is also increasing. To enter the European market, your products need to comply with mandatory requirements introduced by the European Union. Compliance with additional buyer requirements in the area of product quality and sustainability will improve your chances of succeeding on the European market.

Contents of this page

- What requirements must travel accessories made from textiles comply with to be allowed on the European market?

- Through what channels can you get travel accessories made from textiles on the European market?

- What competition do you face on the European market for travel accessories made from textiles?

- What are the prices for travel accessories made from textiles?

1. What requirements must travel accessories made from textiles comply with to be allowed on the European market?

What are the mandatory requirements?

General Product Safety

The General Product Safety Directive (GPSD) states that all products marketed in the European Union must be safe to use. Even if no specific legal requirements have been established for your product and its uses, the General Product Safety Directive still applies. If there are specific requirements applicable to travel accessories made from textiles, the General Product Safety Directive applies in addition to these, covering all other safety aspects that may not have been explicitly described in the product’s specific legal requirements.

Unsafe products are rejected at the European border or withdrawn from the market. The European Union has introduced a rapid alert system (RAPEX) to list such products.

Tips:

- Read more about the General Product Safety Directive in the EU Trade Helpdesk to understand the general safety requirements in the European market.

- Use your common sense to ensure that normal use of your product does not cause any danger.

- Check the RAPEX database for an idea of what issues may arise.

Restricted chemical substances

The European Union has restricted a great number of chemicals in products that are marketed in Europe. These are listed in the REACH regulation. For the manufacturing of textile travel accessories, the following groups of chemicals are restricted: azo dyes, flame retardants, nonylphenol and heavy metals like mercury, nickel and chromium. However, this will change as per December 2020 as a result of amendment (EU) 2018/1513. The list of restricted chemicals will be expanded significantly to include 33 additional chemicals used in the textile sector which are classified as carcinogenic, mutagenic or toxic for reproduction (CMR).

The adoption of these CMR chemicals is now set out in entry 72 of Annex XVII to REACH by Regulation (EU) 2018/1513 and includes substances such as formaldehyde, heavy metals and benzenes that may be present due to contaminants left over from the production process or because they have been intentionally added to give specific properties to textiles (such as shrink-proofing or fabric crease-resistance). In general, the maximum concentration limit is set at 1 mg/kg, but exceptions apply. Check entry 72 as listed above for the exact details on each restricted chemical. European companies will need to comply with the new restriction by December 2020. Companies will also impose these restrictions on their suppliers.

Azo dyes

If you dye your products, make sure you do not use any of the azo dyes that release any of the 22 prohibited aromatic amines. The European Union’s legislation lists the aromatic amines, not the azo dyes that release them. The vast majority of azo dyes are therefore legally acceptable.

Flame retardants

The flame retardants that can be used are restricted. Tris (2.3 dibromopropyl) phosphate (TRIS), Tris (aziridinyl) phosphineoxide (TEPA) and Polybromobiphenyles (PBB) have been prohibited in products intended to come into contact with the skin, including bags.

Tips:

- In case of dyeing: Make sure your products do not contain any of the azo dyes that release the prohibted aromatic amines. This includes checking your suppliers.

- Follow the new developments in the field of flam -retardants, as new alternatives are being developed. You can do so for instance through the European Flame Retardants Association (EFRA). The addition of other flame retardants and proofing agents is only permitted for products that are intended for use in commercial buildings where they are subject to and fulfil the appropriate fire protection regulations.

- Familiarise yourself with the full list of restricted substances in products marketed in the European Union by checking out restricted chemicals in textile products in the EU Trade Helpdesk.

Specific rules for labelling of textiles

Textiles should be labelled or marked to indicate fibre composition whenever they are made available on the market. Such labelling should be durable, easily legible, visible and accessible. The main purpose of the European Union’s Textile Regulation is to ensure that consumers are given an accurate indication of the fibre composition when purchasing textile products.

There is no European Union-wide legislation on the use of symbols for washing instructions and other care aspect of textile articles. However, consumers consider care information to be the second-most important detail on a product’s label (after size). You are therefore advised to follow ISO standards on this matter.

Tips:

- Know your own product and study the labelling rules of the European Union to find out how it should be labelled in Europe. For example, if you use a cotton name, trademark or other term that implies the presence of a type of cotton, the generic fibre name ‘cotton’ must be used. Find out more about textile labelling rules in the EU Export Trade helpdesk.

- You are advised to follow ISO 3758: 2012 on the care labelling code using symbols for textiles.

What additional requirements do buyers often have?

Social performance

Sustainability is one of the ways in which companies can differentiate themselves. There are numerous options for offering sustainable products, ranging from recycling to certification and use of labels. The processes of textile manufacturing are energy-intensive and require significant water use and disposal of waste. Two retail initiatives have gained ground, particularly in West European countries:

The Business Social Compliance Initiative (BSCI) was developed by European retailers to improve social conditions in sourcing countries. Suppliers of BSCI participants are expected to comply with the BSCI Code of Conduct. To prove compliance, your production process can be audited at the request of the importer. Once a company has been audited, it will be included in a database that can be used by all BSCI participants.

The Ethical Trading Initiative (ETI) is an alliance of companies, trade unions and voluntary organisations working in partnership to improve the working lives of people across the globe who make or grow consumer goods.

Payment terms

The payment term is usually agreed upon with the buyer in the order contract. Payment terms vary from buyer to buyer and are related to the volume and value of the order, the type of distribution partner, whether or not an agent is acting as an intermediary, and what delivery terms apply. In general, the payment term will be 30 or 60 days after receipt of the goods or the date of the invoice.

Occasionally a deposit or advance payment can be agreed upon. This happens, for example, in Fair Trade business relations. Certain sourcing countries have regulations stipulating 100% prepayment before delivery. This can hamper business, as buyers usually shy away from such costs or will negotiate a harder price deal. A special form of financial security is offered by Letters of Credit. The so-called L/C is often used in first transactions, but it is an expensive system and therefore not preferred by European buyers.

The payment terms are the outcome of your negotiations about the risks involved in export trade, particularly the following:

- financial risk (who funds what part of the production and transport process?)

- transportation risk (if damage or loss occurs, who pays?)

- the transfer of ownership (when do the goods change hands?)

A balanced outcome is in the interest of both the seller and the buyer and is the result of a process of negotiation.

If the payment term is not covered in the contract, you can refer to European Directive 2011/7/EU. This Directive was established to protect SMEs against late payment. Although in principle this Directive does not apply to companies outside the European Union, you can use these terms as covered in the Directive as a guideline:

- If no payment term is agreed to in the contract (or General Terms & Conditions), then 30 calendar days after receipt of the invoice.

- If the date of receipt of the invoice is not determined, then 30 calendar days after receipt of the goods and/or services.

- If the invoice is received before the goods and/or services, then 30 calendar days after receipt of the goods and/or services.

- If a verification or acceptance procedure is agreed to with regard to conformity, then 30 calendar days after the date this procedure is completed.

- A verification or acceptance procedure may not take longer than 30 calendar days.

- Payment terms in Europe that are set in a contract may not be longer than 60 calendar days unless otherwise expressly agreed.

Tips:

- Carefully study the payment terms offered by your (potential) buyer, especially the number of days for delayed payment.

- Always include the payment term in your negotiations about the price, as an advance payment can justify a lower price. On the other hand, a long credit period can justify a higher price.

- Study Directive 2011/7/EU regarding payment terms and late payment regulations in case payment terms are not covered in the contract.

Delivery terms

Delivery terms depend on the type of distribution partner and respective preferences as to physical distribution. Importers will prefer FOB (Free On Board) or FCA (Free Carrier) arrangements. FOB is restricted to goods transported by sea or inland waterway. It means that the seller pays for transportation of the goods to the port of shipment, plus loading costs. The buyer pays the cost of marine freight transport, insurance, unloading and transportation from the arrival port to the final destination.

FCA can be used for any transportation mode. It means that the seller fulfils his obligation to deliver when he has handed over the goods, cleared for export, into the charge of the carrier designated by the buyer at the specified place or point.

Retail multiples can ask for CIF (Cost Insurance Freight). That means they will ask you to include the shipping and insurance charges in your quotation. Small retailers may go a step further and ask you to arrange for the goods to be delivered to their doorstep. The delivery terms for DDP (Delivered Duty Paid) may then be negotiated. For importers who consolidate orders in your country, Ex Works (EXW) terms are often best.

Details about the rights and obligations of the buyer and the seller under the respective terms can be found in the Incoterms 2020.

Tip:

- Study the rights and obligations of buyers and sellers for the different Incoterms and include these in your negotiations.

What are the requirements for niche markets

While sustainability is gaining ground, the actual use of certification is still not widespread in this sector. Nevertheless, there are several eco-labels used for textiles, including travel accessories. As this is a means of showing sustainability, there is an increasing interest from buyers. The Global Organic Textile Standard (GOTS) is a textile-processing standard for organic fibres, OEKO-TEX stands for no use of hazardous chemicals and the European Union’s Ecolabel also looks at environmentally friendly options. The voluntary Nordic Swan eco-label is used for textile products in Sweden, Norway, Finland, Denmark and Iceland.

Tips:

- Check the possibility of sourcing organic cotton. Textile products that contain a minimum of 70% organic fibres can become GOTS certified. The easiest way is to use certified organic cotton yarn if you are weaving the fabric yourself, or certified organic cotton fabric if you perform CMT (Cutting, Making, Trimming) only.

- Consider the Oeko-Tex® Standard 100 for your product. This certification provides textile and clothing companies with more transparent supplier relationships and facilitates the flow of information regarding potentially problematic substances.

- Consider the Ecolabel for your product. This label is awarded only to products with the lowest environmental impact in a product range.

- Consider the Swan eco-label when targeting the Nordic countries.

For a complete overview of certifications for textiles, please consult the ITC Standards Map

2. Through what channels can you get travel accessories made from textiles on the European market?

How is the end-market segmented?

The European market for travel accessories made from textiles offers opportunities for you as a supplier from a developing country. This is especially true in the mid- to high-end segment, where consumers are looking for good quality at a higher but still affordable price. However, the nature of trade in this product group remains volatile. Continuing globalisation is forcing players to reposition themselves within the trade channel. Relatively new options include direct trade, co-supplying and working with smaller specialised retailers.

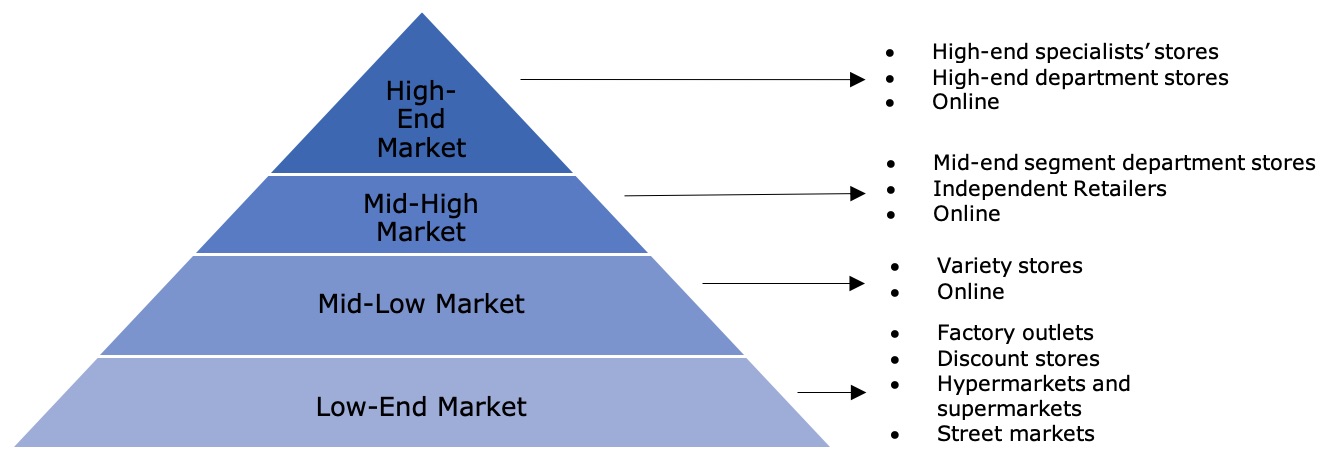

Figure 1: Travel accessories made from textiles segmentation in Europe

High-end segment – luxury

This segment is characterised by luxury products of high quality, often carrying an exclusive brand name. Most of these products are sold by specialists and department stores at high prices. European manufacturers mostly target this segment. They invest a lot in product development, including the design and use of materials. High-end products are relatively timeless.

It is difficult to enter this segment directly because of the fierce competition from European manufacturers and their established brand names. One option is to cooperate with a European manufacturer that outsources part of its production to a low-cost country.

Mid- to high-end segment – value for money

The middle-high segment markets fashionable products of good quality at a higher but still affordable price. Products are trendsetting and often carry a brand name. They are mostly sold at department stores and independent retailers. This segment currently provides excellent opportunities for you.

Low- to mid-end segment – value for money

For consumers in this segment, price is the determining factor for their purchase. They are looking for good, standard quality at the lowest possible price. There is a limited range of colours and designs available, as products are more standardised. Manufacturers of these products are trend followers; they copy existing designs and adapt them slightly. These products are mostly sold at variety stores.

Low-end segment – basic but fashionable, or just cheap

Products in this segment are of basic quality and sold at a low price. Consumers in this segment often look for bargains, mostly at factory outlets and discount stores or hypermarkets, supermarkets and street markets. Low-end products are standard and unfashionable and do not carry a brand name. When targeting this segment, it is difficult to compete with large Asian manufacturers who can efficiently produce these standardised products at competitive prices.

Tip:

- Find potential buyers of your textile travel accessories by searching the list of exhibitors of specialised trade fairs, such as Ambiente in Frankfurt (Germany), INDX Accessories & Travel Goods in Solihull (the United Kingdom), Maison & Objet in Paris (France) and TourNatur in Düsseldorf (Germany).

Through what channels do travel accessories made from textiles reach the consumer?

The channels through which travel accessories from textiles are put on the market follow the traditional patterns: import takes place via importers/wholesalers that supply to retailers. Larger retail chains often bypass the importers/wholesalers and import themselves. European manufactures are under pressure due to rising production costs and might be looking for low-cost sources in other countries. Online platforms have also become increasingly prominent. In some cases, agents play a role. Below is an overview of the main actors in the market for travel accessories made from textiles.

European manufacturers

Rising production costs are challenging European manufacturers, forcing them to assume the role of importer. Manufacturers are looking for low-cost sources that produce textile travel accessories on a made-to-order basis. They often buy products in semi-finished form so as to finish the product in Europe according to their own design, quality and colour specifications.

You can try to work with some of these importing manufacturers as an outsourced supplier. Your role will be minor, because you will not be selling your own products to European retailers. However, you may regard this approach as a first step towards developing a relationship with a European manufacturer.

European manufacturers are increasingly outsourcing production to manufacturers in developing countries and selling directly through their own retail outlets. This may result in more value addition by exporters such as you.

Agents

Agents are independent companies that negotiate on behalf of their clients and act as intermediaries between buyer and seller. They do not take ownership of the products or keep stock.

Buying agents are usually located in the supplying country and typically act on behalf of buyers. They fulfil an inspection role and act as communication intermediaries. Their commission fee must be added to the price.

Selling agents are located within the European market. They have good knowledge of the European market. If you have exclusive products, you could work with a selling agent. They charge commissions of 3–10%. However, the influence of agents is disappearing from the trade structure due to increased consolidation within the value chain.

You must carefully consider the disadvantages of working with agents. Under European legislation, agents (as opposed to importers/wholesalers) are very well protected. Once you engage with agents, it is very hard to bypass them and deal directly with your clients.

Importers and wholesalers

Importers and wholesalers sell products to retailers all over the world. They take ownership of the goods when they buy from an exporter (as opposed to agents), taking on the risk of the onward sale of the products. Developing a long-term relationship can lead to a high level of cooperation on appropriate designs for the market, new trends, use of fabrics, type of finishing and quality requirements.

Importers and wholesalers are interesting if you want to develop a long-term relationship. They usually have good knowledge of the European market and can supply you with valuable information and guidance on European market preferences. Please note that they often insist on a similar infrastructure on your side. Traditionally, importer and wholesaler margins range between 50% and 90%.

Importing retailers

Importing retailers are often larger retail organisations, travel chain stores with large numbers of outlets, and department stores with sufficient knowledge to buy directly and a strong online presence. They are very demanding in terms of product standardisation, lead times and deliveries.

Importing retailers are increasingly integrating their suppliers into their value chain and selling internationally. They achieve this integration either by outsourcing production to selected manufacturers who produce according to their specifications, or by importing through buying groups. Importing retailers place orders directly with manufacturers and provide their specifications to produce their own private labels. Otherwise, they may buy ‘off-the-shelf’ items.

When trading directly with retailers, take into account the following:

- Selling price – When using traditional distribution channels, the Free on Board (FOB) price is around 20% of the consumer end-price;

- Product development – Wholesalers/importers often have a design department, implying that you will produce a tailor-made product for them. When targeting a retailer, you must develop and design your own product range, and show that you can produce a certain product range. Larger importing retailers/chains in particular can develop their own products with you to coordinate your product with their range and distinguish themselves from the competition;

- You must meet the specifications provided by the importing retailer within the agreed lead time.

Non-importing retailers

Non-importing retailers are independent retailers and smaller retail chains that buy from you indirectly through wholesalers, agents or domestic manufacturers. Many high-quality and exclusive travel accessories are sold by travel and department stores which also sell their products online. These stores still represent a significant proportion of the distribution network in most European countries and could be the best channel for selling your product to a targeted consumer group.

However, some of the non-importing retailers have slowly become interested in buying directly from smaller producers as well, in order to distinguish their collection from the larger retail chains and create their own unique niche.

Tips:

- When considering working with an agent, be aware that they are well protected in Europe and cannot easily be bypassed. You can read more on this in Directive 86/653/EEC.

- Focus on importing wholesalers when you want to establish long-term relationships with partners in the market.

- For more information on the pros and cons of supplying directly to smaller retailers, read our trends special on alternative distribution channels.

Figure 2: Trade channels for travel accessories made from textiles in Europe

What is the most interesting channel for you?

Dominance of chain store retailers is stimulating direct trade

Larger chain store retailers are increasingly controlling the entire chain for home textiles and textile travel accessories, from production (in developing countries) to sale in European retail outlets. Large travel accessories retailers such as Decathlon are quickly gaining market share in Europe by offering good-quality travel accessories at reasonable prices. For these large retailers, controlling the chain leads to profit from larger margins and cost-efficiencies at the expense of the position of wholesalers and importers.

These large retailers are expected to consolidate their position on the mature Western European markets and move gradually towards Southern and Eastern European markets, especially in large urban areas. This increasingly dominant position will increase the buying power of such large chain store retailers and apparel retailers, which will result in a tougher bargaining position for you since there will be fewer potential buyers.

Tips:

- If your scale of operation (high volume, standardisation of products) is able to satisfy the demands of large retailers, you could move up the value chain and trade directly with them.

- Promote the benefits of your country or region to European buyers of home textiles by showing the logistics benefits of trading with your company, such as good infrastructure or proximity to the European market.

- Work on commitment, mutual trust, cooperation and exclusivity. Get to know your buyers by understanding their situation more fully and staying in touch with them.

Present yourself as a co-supplier

Due to consolidation in the trade structure, importers and wholesalers are facing stronger competition. This situation affects their buying policies and sourcing strategies. There is a growing need for cooperation within the value chain to compete with chain store retailers. As importers’ and wholesalers’ influence in the trade structure diminishes, they have to become stronger in information technology, planning and logistics so as to build their supply chain.

Changes in the nature of trade have forced buyers to be more aware of risk management. An interesting development in developing countries is the emergence of co-suppliers. By cooperating on production, co-suppliers allow principal suppliers to deliver larger quantities with a shorter lead time. This process allows buyers to better cope with future insecurities and to diversify their supply sources.

Tips:

- When approaching specialist importers/wholesalers, be aware that they demand high-quality raw materials, perfect technical execution and finishing, and efficient logistics. Showcase your craftsmanship in your products.

- Present yourself as a co-supplier to large buyers or to other exporters from developing countries who produce similar travel accessories made from textiles.

Specialisation brings new opportunities for exporters

To compete with the chain store retailers, smaller retailers on the European market for textile travel accessories are increasingly specialising. They distinguish themselves by selling more personalised products with a story. As a result of further specialisation by retailers, importers/wholesalers are also specialising. They will focus on a specific product group or cater to specific consumer target groups.

Tip:

- To supply to the higher-end segments, consider tailoring your product line in order to cater to specialised importers and wholesalers.

E-commerce offers good opportunities

European consumers are increasingly buying online, supported by the widespread use of smartphones and tablets. They enjoy the convenience of online shopping and the sense of community through social media.

At present, online retailers are not used to importing directly from exporters from developing countries such as yours. They prefer sourcing closer to home, keeping stock risks low and maintaining direct contact with the wholesaler.

Tips:

- Consider a ‘Business-to-Consumer’ strategy to sell your goods online nationally, regionally or even globally.

- Be aware that e-commerce requires a totally different and tailor-made business model, involving specific arrangements for working capital, investment, logistics, communication, stocking, range development and marketing.

3. What competition do you face on the European market for travel accessories made from textiles?

As seen in Figure 3, China is by far the main supplier of textile travel accessories to Europe, followed at a considerable distance by Vietnam. While imports from China show a slightly downward trend since 2015, imports from Vietnam are on the rise. Other smaller suppliers are India, Poland, the Czech Republic and Indonesia.

Which countries are you competing with?

China dominates the market

China is the main supplier of travel accessories made from textiles to the European market. In 2018, China supplied these goods to Europe at a value of more than €1.9 billion. This is over 44% of total European imports. Due to the popularity of lighter-weight travel accessories, buyers note that shipping is less of an issue in their sourcing decisions. Labour has become the most significant portion of the total cost of production. China’s low-cost workforce, nearby raw materials, lower cost and more frequent shipping to Europe compared to other Asian countries make it the most attractive supplier.

China is an excellent producer of fabrics made from man-made fibres such as nylon and polyester. As a result, Chinese producers have a big advantage when it comes to the availability and price of these raw materials. This is one of the reasons why China is Europe’s main supplier of textile travel accessories, since fabrics made from man-made fibres are lightweight, strong, durable and relatively inexpensive.

Although China is dominating the market, imports showed a declining trend between 2015 and 2018. This is due to the supply from other upcoming markets such a Vietnam and India, which are strong and growing players in the market for textile products. The disruptions following the trade war the United States may further negatively impact the trade performance of China and benefit companies from the other supplying nations.

Product development and creativity are not the core strengths of Chinese manufacturers. To compete with Chinese suppliers, you should differentiate and stay away from mass-produced travel accessories. Focus more on products with high emotional value, sustainability and the story behind the product.

Vietnamese supplies show strong growth

Vietnam is the second-largest supplier of travel accessories made from textiles, with an 8.1% share of European imports. The Vietnamese supply has grown strongly in the last few years, from €271 million in 2014 to €437 million in 2018. Major producers are continuing to explore expansion and production opportunities.

Vietnam is known for a number of very well-organised factories that can make good-quality products for competitive prices. Like China, Vietnam is relatively weak in product development and creativity. Most Vietnamese manufacturers make products entirely based on the information provided by the buyer. This information normally includes the design drawings, bill of materials, logo, artwork files and label files. Only a few manufacturers offer design services. You can compete by focusing on product development and creating your own designs.

India shows a modest upward trend in supplies

The Indian supply of travel accessories made from textiles showed a moderate increase between 2014 and 2018. In 2018 this supply reached a total value of €96 million, accounting for 1.8% of the total supply to Europe. Although the total value is not significant compared to China and Vietnam, there is a clear upward trend in the Indian supply to Europe.

India has skilled labour available at an equal or lower cost compared to China. India is also one of the biggest cotton producers in the world, which gives manufacturers direct access to high-quality cotton for relatively low prices.

Currently, India also has fewer tariff sanctions compared to China. Transportation costs are competitive as well. In addition, the Indian government’s efforts in the last four years to reach out to the leading nations in the world have resulted in strong bilateral trade relationships with these countries.

Poland: a low-cost producer close to the market

Poland is smaller player when it comes to the supply of textile travel accessories to Europe. The country accounts for only 1.6% of total European imports. Between 2014 and 2017, Polish exports showed a stable increase, but in 2018 the export value dropped to €87 million.

Overall, Polish exports have increased in the last five years, making it the 24th-largest exporter in the world. Top export destinations are Germany and the United Kingdom. The country’s strength is its geographical proximity to the European market, giving suppliers the opportunity to offer short delivery times. Polish suppliers also have a good understanding of the European consumer and have well-established, efficient production lines. To compete with Poland’s relatively cheap production, you should focus on design, branding and material use. Moreover, ensure that you offer a high level of service to build strong relationships.

Czech supplies are stagnating

The Czech Republic shows the same trend as Poland and Indonesia. These countries face strong competition from suppliers from China and Vietnam. In 2018, the Czech Republic’s total exports of textile travel accessories to Europe reached €55 million. However, compared to 2017 (€73 million), the total export value decreased by almost €18 million, which equals a decline of 24%.

Like Poland, the Czech Republic’s strength is its geographical location. Because they are surrounded by European countries, Czech companies can offer short delivery times. However, no significant increase in exports is expected for 2020, as the Czech Republic is likely to be impacted by external threats such as Brexit.

Indonesian supplies are fluctuating

Indonesian exports of travel accessories made from textiles peaked in 2017 at €59 million, but decreased to €45 million in 2018. The country is responsible for 0.8% of the total European imports of textile travel accessories. In the last five years, growth fluctuated between €37 million in 2014 and €45 million in 2018. Like China and Vietnam, Indonesia’s low-cost workforce and access to raw materials are the country’s main strengths.

Tip:

- Compare your products and company to the strong competition from China and Vietnam. You can use the ITC Trademap or business directories like Kompass to find exporters per country and compare based on market segment, price, quality and target countries.

Which companies are you competing with?

Companies from China

China is by far Europe’s main supplier of travel accessories made from textiles. Companies from this country will be your main competitors and can offer the products at a relatively low price. It is therefore important to differentiate and focus on design, branding and material use.

There are many manufacturers of textile travel accessories in China. Examples are:

- Newcomer manufactures backpacks and laptop bags for brands such as Samsonite and Calvin Klein.

- Twin Oaks Bags produces textile backpacks and laptop bags for companies such as Target and Lidl.

- Dapai produces backpacks, duffel bags and laptop bags.

Companies from Vietnam

In the last few years, Vietnam has shown strong and stable growth in supplying travel accessories to Europe. Vietnamese companies generally have well-organised factories that can make good-quality products for competitive prices. Examples of Vietnamese companies are:

Companies from India

Compared to 2014, India almost doubled its export value in 2018. This stable growth is expected to continue in the coming years. Indian companies have skilled workers, often at low costs. With direct access to high-quality raw materials, Indian companies are increasingly becoming important players in the market for travel accessories made from textiles. Examples of exporting companies are:

Companies from Poland, the Czech Republic and Indonesia

Milo is a Polish company specialised in backpacks for climbing. The company exports to other European countries. An example from the Czech Republic is Hannah, a company that exports backpacks, duffel bags and other textile travel accessories to other European countries. Tas Centre Cemerlang is an example of a company from Indonesia. This company offers a wide range of (travel) bags, including backpacks made from textiles. Like Indian companies, Indonesian companies have low-cost skilled workers and direct access to raw materials.

Tip:

- Compare your products and company to the strong competition from China and Vietnam. You can use the ITC Trademap and business directories like Kompass to find exporters per country and compare based on market segment, price, quality and target countries.

Which products are you competing with?

Consumers are increasingly committed to travelling responsibly and minimising their environmental impact. Eco-friendly travel accessories are an ongoing trend, representing substitute products for mainstream travel accessories made from textiles. Examples of these products are:

Travel accessories made from eco-dyed fabric

These products made from eco-dyed fabric are manufactured using an innovative eco-dying process, which means less usage of water and energy and fewer chemicals. Another alternative is to use natural dyes.

Travel accessories made from recycled and upcycled plastic

These products are marketed as fancy and responsible products, fitting in with the sustainability trend of recycling and upcycling. Companies are using recycled bottles or other plastic materials to manufacture their products, while working hard to minimise the effect they have on the environment.

Another substitute product that you will compete with is travel accessories made from leather. The discussion about using leather in the fashion and outdoor industry is ongoing, especially with the rising vegan trend in Europe. However, leather is and will remain a popular material for travel accessories and other items.

4. What are the prices for travel accessories made from textiles?

There is a very wide price range within the European market for travel accessories made from textiles. Duffel bag retail prices can vary from €35 to more than €170. Laptop sleeve retail prices can vary from €10 to more than €95. The prices vary based on the size and composition of the product, as well as the brand or designer.

Your products will be sold to European consumers for a price that is significantly higher than your selling price. The consumer price is approximately 4-6.5 times the FOB price in the country of origin.

Table 1: Indicative consumer prices

| Low-end | Low- to mid-end | Mid- to high-end | High-end | |

| Duffel bags | €30-€58 | €70-€90 | €110-€150 | €170 or more |

| Laptop sleeves | €10-€30 | €39-€50 | €55-€89 | €95 or more |

Tip:

- Developing country producers are advised to focus on the mid- to high-end segment if they can offer added value, or on the low- to mid-end segment if they offer mechanised production.

Rising raw material prices puts pressure on margins

Besides energy, labour and transport costs, FOB prices depend heavily on the availability and prices of raw materials. Cotton-based products, for example, are very sensitive to fluctuations in the raw material’s price. Incidental price hikes cannot directly be passed on to the consumer, but instead exert pressure on exporters’, importers’ and retailers’ margins.

The indicative price mark-ups starting from FOB prices are:

- Logistics costs: +15-20%

- Wholesale: +50-90%

- Retailer: +90-150%

- Retail price (VAT)*: +20%

*VAT percentages in Europe range from 18% in Malta to 27% in Sweden. On average, these percentages are around 20%.

A few examples of prices of textile travel accessories across Europe are the following:

- Decathlon (the Netherlands) duffle bag, 40 litres, €29.90

- Globetrotter (Germany) travel backpack, 25 litres, €179.95

- Viking (United Kingdom) laptop bag, €14.50

- Travel bags (the Netherlands) duffle bag, 26 litres, €645.00

- Elvan Kaya (Turkey) travel bag, 45 litres, €325

- Mismo (Denmark) travel bag, 32 litres, €600

Tips:

- Research your specific target market, segment and competition to determine your price competitiveness.

- Competition is fierce, so calculate your cost price and margin carefully, especially when you know that the prices of your raw materials are regularly fluctuating. When the prices of your raw materials put pressure on your margin for an extended period, consider increasing your price or finding a suitable alternative.

This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with Remco Kemper (MDD).

Please review our market information disclaimer.

Search

Enter search terms to find market research