10 tips for finding buyers on the European home decoration and home textile market

Finding European buyers for your home decoration and home textile (HDHT) products is not easy. Your success depends on factors like your product quality, the number of suppliers already in the market, and your competition. Having a clear idea of what you can offer buyers and what kind of partner you need is key. To help you on your way, these tips give you an overview of the steps to take in your search.

Contents of this page

1. Define your offer

Before you can start looking for buyers, you have to define your offer. A clearly defined offer tells potential buyers exactly what you can do for them, and why they should choose you.

Your offer should include:

- A detailed description of your product(s) and product quality;

- The quantity you can provide;

- Your price category; and

- Any certificates you may have, such as organic or fair trade.

Then, you need to determine your Unique Selling Point (USP) that highlights what makes your product different from the competition.

To define your USP, think of aspects such as:

- Do you use special (local) techniques and materials?

- Is your product innovative?

- Do you simply provide excellent quality and/or attractive prices?

- Do you offer specific services, such as design and sample development?

- Do you have a special focus on social and environmental sustainability?

Defining your offer and USP helps you identify the type of buyers you should look for. This will save you time when you are making a list of potential buyers. For instance, if your products are organic and handmade you can skip buyers that focus on low-cost mainstream products.

Tips:

- Be thorough when describing your product and USP. The more precise you are about what you offer, the better you can target the right buyers. Often it is the combination of USPs that makes buyers consider you as a supplier.

- See our study on doing business with European Buyers for more information on USPs.

2. Determine your segment

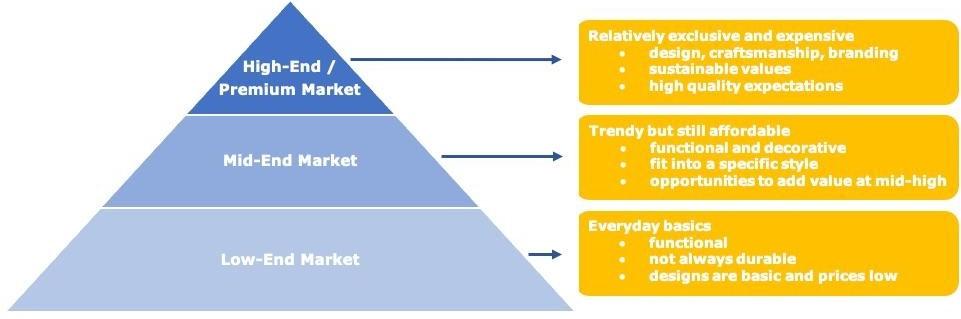

After defining your offer, you must determine what segment it belongs in. In HDHT, targeting the appropriate segment is more important than targeting a specific country. Because most Western-European importers sell their products throughout Europe, the country of entry is less relevant. Every European country has segments ranging from low- to high-end, although their size varies per country and product. If you supply to importers in your target segment, they can sell to customers in that segment across Europe.

To determine which segment fits your offer, you should look at aspects like:

- Pricing;

- Quality and finish;

- Style and design content; and

- Volumes.

Figure 1: HDHT market segments

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

The mid-mid to mid-high market generally has the most potential for you, an SME exporting from outside Europe. It allows you to avoid competition from the low-cost/high-volume manufacturers that dominate the low-end market. Instead, you can try to create a niche market for your products in this segment. It offers good opportunities for you to add value based on special materials and/or techniques that tell a story about the origin of your product. Sustainable concepts also play an important role in the mid- to high-end segments.

Tips:

- See our special study about market segments for more information.

- For more product-specific insights, see our studies about promising export products.

3. Target suitable buyers

When you have established your offer and the appropriate segment, you can use this to determine what buyers to target.

To define your preferred buyer type, consider questions such as:

- Does your product offer, match or complement theirs?

- Do their values – such as sustainability or craftsmanship – match your USP?

- Which segment do they focus on?

- What is their role in the distribution chain: do they import directly, or do they use agents

Figure 2: Trade channels HDHT in Europe

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

The 3 most suitable types of buyers in the European HDHT market can be defined as follows:

- Importers/wholesalers are generally your main channel and often re-export products across Europe. They take care of import procedures and can give you valuable information about market preferences.

- Importing retailers (large retailers or chains) often import directly from their suppliers in developing countries. This cuts out the margins of the wholesaler, reduces delivery time to the market and gives the retailer more control over the end product.

- Small retailers traditionally buy from importers/wholesalers, but they increasingly source directly from producers. This helps them differentiate on value-added service, specialised offers and authenticity.

You should always try to work directly with your buyer, instead of via agents or buying houses. This saves on commission and allows you to communicate with your buyer directly. Importers/wholesalers and importing retailers usually buy medium to large volumes. Small retailers prefer small quantities, delivered to their doorstep. Because importing retailers order for their own shops, they can place orders much quicker than some importers/wholesalers.

A typical example of an importer/wholesaler is POLSPOTTEN from the Netherlands. They develop their own product ranges in collaboration with many producers, mainly from Asia. Zara Home is a good example of an importing retailer. This Spanish chain of shops has more than 300 stores in Europe, and over 150 stores in the rest of the world. An example of a smaller importing retail chain is the French company Caravane. They have 11 shops in France and the United Kingdom, and 2 more in Denmark and the United States of America.

An importer can also be both a wholesaler and a retailer. Rivièra Maison from the Netherlands has its own shops and sells its products to other retailers as well.

E-commerce

The share of e-commerce in HDHT sales has grown in recent years. Your best way to benefit from this is by supplying to a European wholesaler or retailer with a strong online presence. Selling directly to European consumers is practically impossible for exporters like you, but European retailers often combine online and offline channels. For most exporters, this is not a separate channel. Because both online and offline retailers need to take stock before they can sell, the way of supplying to them is the same.

Tips:

- Define your offer and determine the appropriate segment before you start searching for buyers.

- Consider targeting retailers directly to improve your bargaining position and potentially close deals faster.

- If you are interested in selling directly to small independent retailers, you need to calculate if this is cost-effective for you. If so, make sure to have a policy for them when you participate in international (European) trade fairs. You must have appropriate terms of trading, such as low minimum order quantities or pre-stocking.

- Find an importing wholesaler or retailer with a strong online presence, instead of trying to directly sell online to European consumers.

- See our special studies about market channels and alternative distribution channels for more information. For more product-specific insights, see our studies about promising export products.

4. Present your company online

You need to invest in your online presence, so potential buyers can find you online. Because your company website is often the first point of contact, it must make a good impression. Your website must be professional, well-designed and up to date. It should clearly present your USP, and reflect your offer, target segment and preferred buyer type. This helps buyers determine whether you are a good match for them.

Sarita Handa from India is an example of a firm with a solid online presence. They combine their website with social media channels, aimed at B2C channels (Facebook and Instagram) and B2B clients (LinkedIn).

When your website is live, you need to attract visitors. You can use Search Engine Optimisation (SEO) to make sure you are visible in search engine results. If you struggle to stand out, you can also use paid services such as Google Ads or professional SEO help to boost your ranking.

Social media can also help you promote your company. You can use it to share content and engage with (potential) buyers, consumers and other stakeholders. The most suitable platforms include:

- Instagram – photos and videos

- YouTube – videos

- LinkedIn – professional networking

- Facebook – short- and long-form content

- X, formerly known as Twitter – short-form content

Visual platforms like Instagram and YouTube are particularly suitable for showcasing your products and the story of your company/artisans. On LinkedIn, you can use your professional (company) profile to highlight your expertise and connect to buyers or potential buyers.

Lighting manufacturer Ong Cen Kuang from Indonesia is a good example of how to use Instagram to showcase your products, projects and manufacturing process. The quality of the photography is high and there is a lot of variation, which is especially relevant for an image-oriented channel like Instagram. On Facebook the company has a similar approach, but there you can use more text.

Tips:

- Be aware that for good results, you need to invest time and money in your online presence.

- Regularly update your website, for example with new product releases or certifications. You can also share your updates on social media to increase your visibility and connect with your network.

- Use storytelling to highlight the unique background of your products and company. For example, feature the artisans who make your products and the special techniques or materials they use.

- Create high-quality photos and videos to showcase your products and illustrate your stories. This is especially relevant in a visual industry like HDHT. See for example Conzoom Solutions’ guide to product photography to learn more.

- For tips to improve your search engine ranking, see Google’s Search Engine Optimisation Starter Guide.

5. Visit trade fairs

After following the previous steps, you can start your search. The well-known HDHT trade fairs are a great place to meet potential buyers. Many European importers use these fairs as their main showroom for introducing new collections to customers. Exhibiting can be expensive, so you should attend as a visitor first. This allows you to get a feel for the event and spend time talking with buyers and exhibitors without the stress of running your own stand. You can also determine which hall would be most suitable for you if/when you do exhibit.

The main HDHT trade fairs in Europe include:

- Ambiente (Frankfurt) – world’s leading consumer goods trade fair for dining, living, giving and working, showcasing key themes such as sustainability.

- Maison & Objet (Paris) – key European trade fair for decoration, design and lifestyle at the higher ends of the market, less relevant for volume business.

- Heimtextil (Frankfurt) – Europe’s leading trade fair for home and contract textiles.

- Domotex (Hannover) – focuses on the latest international trends and lifestyle for floor coverings.

- IMM Cologne – trade visitor-only interior design fair.

- Christmas World (Frankfurt) – leading international trade fair for seasonal and festive decorations sector, held together with Ambiente.

- INNATEX (Hofheim-Wallau) – international trade fair for sustainable (home) textiles, focused on both social and ecological factors.

- Spring Fair (Birmingham) – wholesale home, gift and fashion show for the retail industry in the United Kingdom.

- spoga+gafa (Cologne) –world’s largest garden and lifestyle fair.

- Salone del Mobile.Milano (Milan) – international event for the furnishing and design sector.

Figure 3: Ambiente 2023 - recap

Source: Ambiente @ YouTube

Relevant trade fairs outside Europe include:

- INDEX (Dubai) – trade event for the interior design and fit-out industry in the Middle East.

- Intertextile Shanghai Home Textiles – Asia’s leading home textile event.

- Home InStyle (formerly the Hong Kong Houseware Fair) – one of Asia’s biggest trade fairs for lifestyle houseware products.

- Decorex Africa (Cape Town and Johannesburg) – South African design and decor exhibition.

- Sarcda (Johannesburg) – trade fair for toys, gifts and decorations.

- IHGF Delhi Fair – Indian trade fair for home, lifestyle, fashion, textiles and furniture products.

Before visiting a trade fair, you need to prepare. Study the exhibitor list and try to make appointments with suitable potential buyers. This will save time and make communication easier. If you are exhibiting, you should try to build a new collection around this event, invite new and existing buyers, and set clear marketing goals. As business will develop after the event, you will also have to take time to follow up effectively. Contact your leads within 1 week, summarising your conversation, addressing the next steps and providing any information they may have requested.

Tips:

- Look for potential buyers in the online exhibitor databases of important trade fairs, such as Ambiente and Maison & Objet.

- To decide if you should visit a fair, research whether it suits your product and attracts the buyers you are looking for.

- Before you visit a trade fair, confirm appointments with potential buyers to make sure they have time for you. First-time visitors often forget this.

- Prepare questions for your potential buyers and think about what information they may need from you.

- Carefully follow up with your leads after the fair.

6. Showcase your products on digital platforms

Another way to attract new buyers is to use online business-to-business (B2B) marketplaces. A good example is MOM, the digital platform of Maison & Objet. For an annual fee, MOM offers you a dedicated ‘mini site’. You can use digital showrooms to showcase products, upload a company video, and highlight collections, projects and news. Interested buyers can contact you directly, so you can do business outside of the platform. MOM has just added the option to shop directly on the marketplace, but this feature is currently only available for European brands.

Figure 4: MOM, the Maison & Objet Paris digital platform

Source: Maison & Objet @ YouTube

Another option is nmedia.hub (formerly Nextrade), an international B2B store solution for the home and living industry. This platform is linked to Messe Frankfurt, the organisation behind trade fairs such as Ambiente and Heimtextil. Unlike MOM, nmedia.hub allows buyers to order your products directly via your shop on the platform. For this service, it charges a provision per realised order in addition to the annual fee.

Marketplaces such as Orderchamp and Ankorstore not only process orders via their platforms, but also handle the payments. They are currently only available to suppliers from Europe, but you should be aware of their existence. Faire is a similar marketplace, specifically for small independent retailers and brands. Fairling connects retailers and independent brands, particularly those that are sustainable and eco-friendly. Like with MOM, buyers and sellers can do business outside of the Fairling platform.

The AliBaba B2B marketplace is especially suitable for sellers of larger volumes. It can be challenging to stand out from the competition on this platform. Successful sellers often have a dedicated ‘AliBaba team’ to attract buyers.

Tips:

- Study your options at online B2B marketplaces such as MOM and nmedia.hub.

- When selecting a marketplace, make sure that it caters to your preferred buyer type. If you produce large volumes, you should not use a marketplace that targets small retailers. Platforms such as MOM and nmedia.hub mainly focus on retailers (including sole traders) and the project market, so they are not suitable for container business.

- Provide high-quality product details, images and videos to showcase your products on digital marketplaces.

7. Visit the websites of sector associations

Sector associations play an important role in the representation and promotion of the HDHT sector. Most associations focus on a specific sub-sector. Their websites can provide you with important information on topics such as requirements and developments. Associations often publish research reports and the latest news, and some organise events. They also have an extensive network, which can make them a good source to find buyers.

Start by visiting the websites of associations that cover your product on an international level. European associations often consist of several national associations and large manufacturers. These national associations often list their individual members on their websites. You can use these member lists to search for suitable buyers.

HDHT sector associations include:

- European Floral and Lifestyle Suppliers Association (EFSA) – seeks to boost the global competitiveness of the European floral, gardening and lifestyle industry.

- International Housewares Association (IHA) – strives to maximise the success of the home and housewares industry.

Relevant product-specific associations include:

- European Candle Manufacturers Association (ECMA) – represents the entire European candle industry, focusing on issues such as safety and sustainability.

- European Ceramic Industry Association (Cerame-Unie) – represents the European ceramic industry in sub-sectors such as table- and ornamental ware, and flowerpots.

- European Federation of Furniture Retailers (FENA) – represents the interests of about 100,000 companies in furniture retail and interior design.

- European Furniture Industries Confederation (EFIC) – represents more than 70% of the total European furniture industry turnover, with a focus on issues such as the environment and international trade.

- European Furniture Manufacturers Federation (UEA) – supports European furniture manufacturing and the exchange of information within the sector.

- European Timber Trade Federation (ETTF) – represents national federations for importers, merchants and distributors of timber products.

- International Textile Manufacturers Federation (ITMF) – provides an international platform for the global textile industry, striving to connect, inform and represent its members.

- Lighting Europe – represents over 1000 companies, striving for fair competition and efficient lighting that benefits both people and the environment.

Tips:

- Visit the websites of sector associations to stay up to date on the developments in your market. You can also contact them to find out what else they can do for you.

- Search for potential buyers in the member lists of relevant associations. Study the companies’ websites to decide if they are a good fit.

8. Be selective when using databases

You can use company databases to search for potential buyers, but you should be selective with them. National chambers of commerce are generally a reliable source of information, such as the Netherlands Chamber of Commerce (KvK).

Free online B2B business directories may also be helpful, such as:

- Kompass: A global database of companies that lets you search by sector and filter by selecting, for example, importers

- Europages: A directory of European companies that allows you to select sectors and filter distributors or wholesalers

- Wer liefert was: A leading online marketplace in Germany, Austria and Switzerland where you can search for suppliers and products

Individuals or institutions (including trade fairs) may also offer databases with buyer addresses for sale. This may seem interesting, but you should not buy such standard databases. While they may contain up to thousands of addresses, many of them are often irrelevant or outdated. In addition, companies usually do not appreciate unsolicited and standardised mass-emails from sellers. This type of ‘spam’ could actually turn potential buyers off.

Tips:

- Carefully select relevant companies for your list of potential buyers. Do not buy and copy-paste standard databases.

- When you come across an interesting company in a database, study their website to see if they are a good fit.

- When you contact potential buyers, tailor your message to their company to make sure your offer is relevant. This also shows buyers you are serious and interested in them specifically.

9. Use matchmaking services

If you need help finding buyers, matchmakers such as CDH can be an option. They can select relevant potential buyers for you and prevent an overload of irrelevant addresses. Matchmakers usually work for a fee or on a commission basis. They can provide you with distributor contacts or contact distributors on your behalf. However, these services are usually only relevant for bigger volumes – otherwise the costs of the services are too high compared to the order value.

You can search for matchmakers online or ask local non-governmental organisations (NGOs) or sector experts. Most of the leading European HDHT trade fairs also include matchmaking facilities, such as Maison et Objet’s targeted business meetings.

Tips:

- If you plan to visit a trade fair, see if they offer matchmaking services.

- If you use matchmaking services, provide the matchmaker with precise information on your offer, target segments, positioning and production capacity. Unclear or incomplete information often leads to mismatches.

- Make a clear deal with matchmakers, specifying mutual responsibilities and deliverables. Pay attention to the legal/contractual side of the deal and get legal or sectoral advice if you need it.

- Consider a trial period for your matchmaker. Matchmaking usually starts on a one-off basis, but if you are pleased with the results you can engage in a longer-term relationship.

10. Look for organisations that can support you

Governmental organisations and NGOs that support international business activities can often help you with your export.

To get started with your export activities, you can contact organisations such as embassies, chambers of commerce and export promotion agencies.

In addition, Business Support Organisations (BSOs) may fund export-related activities such as market research, matchmaking and trade fair visits.

Important international BSOs that may be able to support you include:

- Centre for the Promotion of Imports from developing countries (CBI) – supports small and medium-sized enterprises (SMEs) from developing countries in exporting to the European market with export coaching projects and market intelligence.

- Swiss Import Promotion Programme (SIPPO) – supports BSOs in their export-related promotion and services to exporting companies in the areas of market intelligence, matchmaking and networking.

- Import Promotion Desk (IPD) – promotes the import of certain products, including sustainable wood products, from SMEs in partner countries.

- International Trade Centre (ITC) – trade development agency of the World Trade Organisation and the United Nations supporting the competitiveness of micro, small and medium-sized businesses (MSMEs) in developing countries.

- Enterprise Europe Network (EUN) – European Commission initiative that helps companies to innovate and grow internationally through international partnerships, advice and innovation.

Tips:

- Check our current and upcoming export promotion projects and programmes in the HDHT sector.

- Visit BSO websites to see if they have suitable export-related projects. You can also contact them to find out what they can do for you.

More tips for exporting to Europe

- When you are ready to approach potential buyers, our tips for doing business with European buyers help you with European business culture, making quotations and defining your unique selling point.

- Our tips for organising your HDHT exports to Europe offer you insights into issues such as payment terms, export insurance, customs, international transport and packaging.

Globally Cool B.V. in collaboration with GO! GoodOpportunity and Remco Kemper carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research