Entering the German market for honey

Exporting honey to Germany means following strict rules, especially regarding food safety, sustainability and traceability. The focus on sustainability creates opportunities for honey suppliers who have third-party sustainability certifications. Germany gets honey from many different countries, which gives new businesses opportunities but also creates more competition. To successfully enter this competitive market, you should work with importers.

Contents of this page

1. What requirements and certifications must honey meet to be allowed on the German market?

You can only export honey to Germany if you comply with strict European Union (EU) regulations. The most important requirements are given below, specified for the German market where relevant.

What are mandatory requirements?

To export honey to Germany, you must comply with a number of mandatory requirements such as the EU General Food Law and the EU Honey Directive. In addition, because of Germany's high quality standards and expectations, it is crucial to understand national regulations such as the German Food and Feed Law and the German Honey Guidelines, without which your entry into the German market may be very difficult. Refer to our study on buyer requirements for honey for a full overview and more details.

General Food Law

Regulation (EC) No 178/2002 sets out the general principles for food safety and requirements on traceability, hygiene and control. Honey importers are legally required to ensure that the honey they are trading complies with EU marketing standards and that they correctly identify its nature, composition, place and country of origin. Therefore, buyers will request that you meet certain traceability and food safety requirements. They will most likely expect you to provide records demonstrating the origin of all of your produce. When food is unsafe, it will be withdrawn or recalled, and the competent national authorities will be notified.

Hygiene of foodstuffs

Regulation (EC) 852/2004 lays down general rules on the hygiene of foodstuffs. This regulation requires compliance with microbiological criteria, temperature control, sampling and analysis, implementation of procedures based on the Hazard Analysis and Critical Control Point (HACCP) principles, cooperation with competent authorities, and other general hygiene provisions described in the annexes.

Traceability requirements for food of animal origin

Honey must comply with the traceability requirements set out in Regulation (EU) No 931/2011. This regulation requires that honey importers are able to identify each supplier of every honey batch they import. For you as an exporter, this means you are expected to label every batch and keep samples for 2-3 years.

German Food Commodities and Feed Act

The German Food, Commodities and Feed Act (LFGB) is the primary legal framework that governs the safety, quality and handling of food, feed, consumer goods and cosmetics in Germany. Its primary aim is to ensure consumer protection and the integrity of food products, making it a crucial regulation for honey exporters seeking to enter the German market.

The LFGB Act applies throughout the entire food value chain. It mandates that food products, including honey, are free from contaminants and meet existing purity standards. Honey exporters must comply with these requirements to ensure that their products are not rejected upon entry into the German market. Additionally, the Act has strict labelling requirements. Honey must be accurately labelled with essential information, such as the origin, ingredients and processing methods, to avoid misleading consumers.

For honey exporters, maintaining full traceability is vital. The Act requires detailed documentation throughout the production, processing and supply chain stages, all of which must be available for inspection by authorities, particularly the Federal Office for Agriculture and Food (BLE), which oversees imports.

In addition to traceability, the Act requires that honey imports are accompanied by a conformity certificate or an agricultural certificate of origin. These certificates, often issued by recognised inspection services or the BLE, verify that the honey meets German and EU standards. Without these documents, honey may face delays or rejection at customs. The Act also covers hygiene and veterinary requirements, ensuring that honey production and transport adhere to strict sanitary standards.

Finally, for customs procedures, honey exporters must complete the Single Administrative Document (SAD) when exporting to Germany from non-EU countries. This document serves as the basis for customs declarations and ensures that the imported honey complies with EU food safety regulations.

List of third countries authorised to place honey on the EU market

Honey and other apiculture products intended for human consumption are only allowed to enter Germany if they come from the third countries listed in Annex-I of Legislation (EU) 2021/405. In compliance with Regulation (EC) No 853/2004, honey must also come from approved processing establishments in the authorised countries to be allowed for import. According to Regulation (EU) 2023/2652, honey from establishments not listed after 29 November 2024 will be refused entry into the EU.

Health certificates

A health certificate must accompany each lot/shipment of honey and apiculture products. The model certificate is included in Regulation (EU) 2020/2235, along with some explanatory notes and associated requirements. Health certificates must be completed, signed and stamped by the official veterinarian or certifying officer authorised by the competent authority of the exporting country.

Maximum residue levels of pharmacologically active substances, veterinary medicinal products and pesticides in foodstuffs of animal origin

All honey imported into the EU and placed on the EU market must comply with maximum residue limits (MRLs). Regulation (EC) 470/2009, together with the annexes of Regulation (EC) 2377/90, establishes MRLs for the use of authorised veterinary drugs, such as antibiotics, applied to honeybees.

Regulation (EC) 396/2005 sets out the limits for pesticides in/on food of plant or animal origin. The current pesticide MRLs for food products can be found in the European Commission’s Pesticides Database on its website.

The German Regulation on Maximum Residue Levels of Pesticides in or on Food aligns with the MRLs set at EU level. This regulation sets the same permissible limits for pesticide residues in food products, including honey, that are marketed in Germany. Both domestically produced and imported honey must comply with these limits.

EU Honey Directive

The EU Honey Directive (Directive (EC) 110/2001) sets out the required composition criteria for honey (for human consumption) and the associated labelling requirements. It is used as a guide for EU countries to develop their own national honey standards. The Directive was recently amended with Directive (EU) 2024/1438, introducing mandatory country labelling on honey blends. All the countries of origin must be indicated in a main visual field, rather than just stating whether the honey comes from the EU or not. The new measures will apply throughout the EU by 2026.

At a national level, the German Honey Ordinance, introduced in 2004, is largely aligned with the EU Honey Directive. It defines the specifications for honey produced or sold in Germany. The ordinance mirrors the EU’s composition and labelling standards, including the prohibitions on additives.

Tips:

- Consult EC Acces2Markets for more information on current regulations, including guidance on tariffs, taxes and import requirements.

- Search the EU's Rapid Alert System for Food and Feed (RASFF) database for examples of honey recalls and the reasons for them. Learn from these cases and avoid similar problems.

- Read the German honey regulations carefully. Make sure you comply with the specific requirements, as non-compliance may result in importers refusing honey.

- Check out the website of the German Beekeepers' Association (Deutscher Imkerbund). It has a list of all the legal requirements for beekeeping in Germany. Please note that not all of these regulations apply to non-European exporters, some are only for German producers.

What additional requirements and certifications do buyers often have?

Additional requirements common in Germany include providing complete documentation, meeting strict quality and labelling standards, and adhering to packaging standards. Given the established sustainability mindset in the German market, suppliers must also demonstrate responsible production practices and transparency, in line with the expectations of German buyers and the European Green Deal.

Documentation requirements

Buyers in Germany expect clear and complete documentation from their suppliers. Transparency and detailed information are essential for building trust and ensuring smooth business transactions. German buyers typically require documentation that covers the various aspects of the product and the company. This includes:

- Product specifications (quality specifications, pricing information, packaging)

- Production capacity (turnover, number of employees)

- Processing capabilities (certificates, quality management systems)

- Company structure (history, mission, vision and activities)

Additional documentation, such as health certificates, should be provided for customs.

Quality requirements

As a minimum, suppliers must meet the quality requirements described in the German Honey Ordinance. However, some buyers have stricter requirements and there are standards that go beyond the legal minimum. Understanding these additional requirements and meeting them where possible can be a good idea for exporters wishing to enter this market.

The German guidelines for honey, outlined in the German Food Code, provide detailed information on the production, presentation, classification and labelling of honey in Germany, in line with the German Honey Ordinance. While these standards are not legally binding, they are widely recognised as a benchmark for ensuring high-quality and authentic honey within the German market. Exporters who wish to sell honey in Germany must ensure that their products meet these guidelines.

The guidelines cover a range of quality characteristics, including the physicochemical and organoleptic properties of honey, and classify honey based on its botanical and regional origins. They also define acceptable production methods to preserve honey’s natural qualities. These standards ensure that honey is free from foreign substances and that its natural composition remains intact.

One of the key aspects of the German guidelines is their focus on maintaining premium quality. They establish stricter criteria for high-quality honeys, such as lower hydroxymethylfurfural (HMF) levels, higher enzyme activity and controlled moisture content.

In addition to the German guidelines for honey, the German Beekeepers' Association has established an industry standard that further raises the bar for honey quality. While this standard is voluntary, it is highly regarded within the German market and can provide a significant advantage for exporters who meet the standard’s criteria. The DIB standard includes stricter thresholds for quality indicators such as moisture content, enzyme activity and HMF levels. Exporters who comply with the DIB standard demonstrate their commitment to premium-quality honey, which can help them gain a competitive edge with German buyers.

Table 1: Comparison of some of the quality requirements of the German Beekeepers' Association and the German Honey Ordinance

| German Honey Ordinance | DIB Industry Standard | |

| Moisture content | Max. 20% in general Max. 23% for clover honey Max. 23% for heather honey | Max. 18% in general Max. 18% for clover honey Max. 21.4% for heather honey |

| Hydroxymethylfurfural | Max. 40 mg/kg | Max. 15 mg/kg |

Source: Deutscher Imkerbund, 2024

Importers will usually send honey samples to accredited independent laboratories (e.g. Intertek Food Services, Quality Services International, FoodQS and Eurofins Food Integrity Control Services) for analysis before authorising the shipment. German buyers generally do not accept quality analyses provided by honey suppliers themselves, making independent testing an essential part of the export process.

Labelling requirements

German buyers have strict expectations when it comes to labelling honey, and these must be met to ensure successful market entry. At a minimum, honey labels must comply with the requirements set in the EU Honey Directive and the German Honey Ordinance. The label should clearly indicate the product as “honey” and specify the type of honey, such as blossom honey or forest honey. Other key labelling requirements include the net quantity, the best-before date, special conditions for storage or use, the batch number, and the name or business address of the producer/exporter. The contents of the labels must be in German.

The origin of the honey is also crucial. Indicating your honey’s geographical origin gives the consumer confidence in the product. Recent amendments to EU regulations now require that all countries of origin for blended honey are listed on the label, with the percentage share of each origin. This new rule enhances transparency for consumers and will apply in full by 2026. Additionally, it is essential to note whether the honey has undergone any processing, such as pasteurisation and filtering. The labelling must also not mislead consumers, and terms like “natural”, “pure” or “organic” should only be used if the product genuinely meets those criteria and if there is supporting certification.

Packaging requirements

Packaging for honey intended for the German market must be designed to maintain the product’s quality and meet consumer preferences. Packaging should be airtight and moisture-proof to prevent both changes to the honey’s consistency and contamination. Buyers prefer food-grade stainless steel drums for packaging. This preference is driven by their durability, quality and ability to offer better protection against contamination compared to plastic drums.

The interior of the drums should be clean and lined with either beeswax or plastic bags, such as polyethylene, depending on the buyer's preference. This reduces the risk of contamination and helps preserve the honey's quality during transportation. It is crucial that suppliers avoid using used drums, as they pose a significant risk of contamination, which can compromise the honey's quality and safety.

Although these are the standard packaging specifications, the most important factor for European buyers is that suppliers strictly adhere to the agreed-upon terms and conditions.

Sustainability requirements

Due to the European Green Deal (EGD), requirements for social and environmental sustainability in the honey industry are increasing in number and urgency. For suppliers, this means taking proactive steps to prepare for these changes. You will most likely have to collect and provide more information on the products you export to Europe and you may potentially be audited on this information. You can start by improving transparency, adopting sustainable practices, and putting in place traceability systems or complying with a voluntary sustainability standard. Some suppliers are already using SEDEX to ensure ethical supply chain practices. By using this platform, suppliers can share their CSR credentials with potential buyers, demonstrating their commitment to sustainability and ethical practices.

You can consider adopting Corporate Social Responsibility (CSR) policies, including environmental and social aspects. Environmental management systems can be based on the international standard ISO14000. Similarly, the international standard ISO45001 for occupational health and safety can provide a solid basis for improving social conditions, although certification is optional.

German Supply Chain Act

The German Supply Chain Act came into force on 1 January 2023. This Act was introduced to ensure that companies operating in Germany comply with human rights and environmental standards throughout their global supply chains. This law requires German buyers to apply stricter requirements and increase monitoring of their suppliers, ensuring compliance with these standards. Similar to other regulations, this act requires that suppliers provide detailed information about their business practices to ensure transparency. Honey exporters will need to be transparent in their operations, so that German buyers can check for risks and confirm compliance with human rights and environmental standards. This could mean providing details about working conditions on farms, following local labour laws, and using environmentally friendly practices.

Tips:

- Prepare a commercial Product Data Sheet with photos, origin information and bibliographical references if available.

- Ensure that the delivery of the honey matches the specifications of the original sample submitted to avoid disappointment or even rejection by the buyer.

- Ask your buyer for detailed packaging instructions as their preferences may differ from your standard packaging.

What are the requirements for niche markets?

Niche honey markets in Germany include organic, Naturland and Fairtrade-certified honey.

Figure 1: Logo of the most common honey certifications in Germany

Source: Fairtrade Deutschland, European Commission, Naturland, 2024

Organic

Organic honey is the most prominent, with Germany being the largest market for organic products. Compliance with the EU Organic Regulation (Regulation (EU) 2018/848) is crucial. Because of these requirements, organic honey is more strictly tested for chemical residues than conventional honey. Buyers of organic honey apply a zero-tolerance policy to pesticide residues and other chemical contaminants.

Note that the use of the terms ‘organic’ and ‘ecological’ is only allowed if your honey is certified. Before you can market your honey as organic, an accredited certifier must audit your growing and/or processing facilities. You can expect a yearly inspection and audit, which aims to ensure that you comply with the rules on organic production.

Naturland

Naturland is a leading organic certification body in Germany. Naturland also offers a fair trade certification, combining in essence organic farming, social responsibility and fair trade. Naturland certification is well-recognised by consumers. While not as large as the market for EU-organic certified honey, Naturland-certified products hold a significant position in the organic segment. Naturland-certified honey must meet strict requirements that are often stricter than the EU organic regulations. Specific requirements are described in the Naturland Standard on Organic Beekeeping.

Fairtrade

Fairtrade remains extremely niche and only small volumes are traded. To sell Fairtrade-certified honey, you must comply with the standards set by Fairtrade International. The accredited certifier for Fairtrade is FLOCERT. Only after accreditation will you be allowed to put the Fairtrade logo on your product. Refer to this full guidance to learn more on how to become a Fairtrade producer.

Tips:

- Contact a certifier in your country to obtain information about the costs and processes of organic certification.

- Look for Naturland Fair-certified honey companies in Germany but also in other European countries on the organisation’s partner list.

- Check this document on the comparison of Naturland standards with the EU Organic Regulation.

- Refer to the standards webpage of Fairtrade International to find all the requirements you need to meet to get honey Fairtrade certified.

- Read our study on tips for organising your export to learn more about safe packaging and labelling requirements.

2. Through which channels can you get honey on the German market?

Honey is used for household consumption and as an ingredient by the food industry. Regardless of its end use, the most interesting channel for honey exporters is through importers who also act as packagers.

How is the end market segmented?

The German market follows the same end-market segmentation as the larger European market. The European honey market is segmented into honey for household consumption (table honey) and honey for industrial use. An estimated 70-85% of all honey is for household consumption.

Table honey is often used by households and consumers in food preparation, as a spread or as a natural sweetener. Depending on consumer preferences, honey for home consumption can be conventional multi-floral honey, certified honey or more niche honey (i.e. mono-floral honey). In this respect, the table honey segment covers a wide price range and has a higher demand, as it caters to the preferences of different consumer groups.

The food industry mainly uses low-priced, conventional honey. This industrial honey is primarily used in the bakery, confectionery and cereal industries. It is particularly useful in baked goods. In this segment, quality is typically lower, there is often no product differentiation, and only competition based on price. Industrial honey often makes up the low end of the honey market.

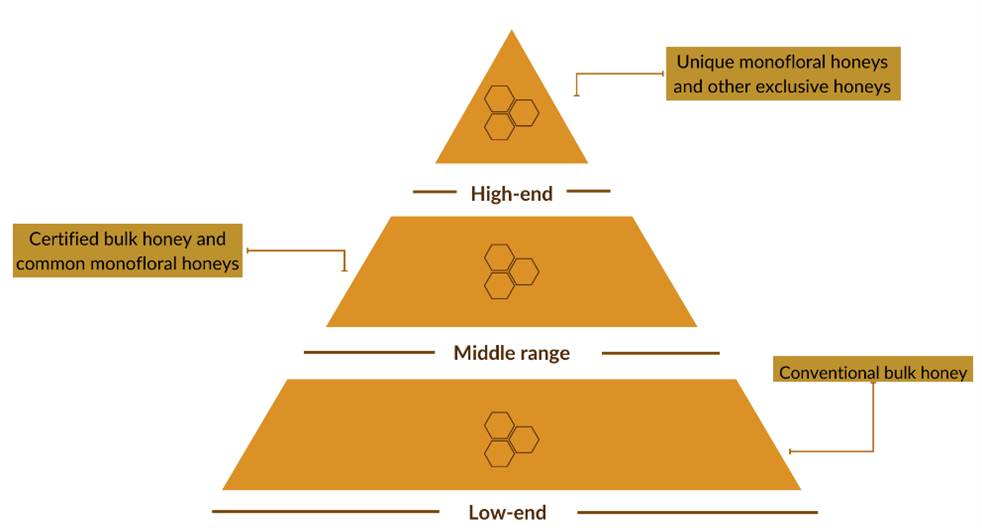

In addition, the German honey market can be segmented into low-end, middle-range and high-end categories, reflecting differences in quality, production methods and certifications.

Figure 2: German honey market segments on scale from low-end to high-end

Source: ProFound, 2024

Low-end segment

This is the largest segment, mainly consisting of bakers’ honey and conventional bulk honey. Honey in this segment is undifferentiated, multi-floral and mostly blended to standardise quality. It typically lacks transparency and certifications. Bulk honey meets minimal legal requirements, is usually shipped in 20-tonne container loads of 200 litres drums, and is sold at low prices. Bulk honey is sold to large importers, packers and retail chains.

Middle range

The medium-sized segment mainly consists of poly-floral honey for table use, some common and cheap mono-floral honeys such as acacia honey, and also certified bulk honey. Certified bulk honey is the same honey as described above but certified based on certain standards, like organic or Fairtrade.

Organic products, including honey, are no longer exclusive to specialised shops; they can now be found in a wide variety of retail chains across Germany. The range of organic products in retail is increasing. Retailers have their own organic private label table honeys, while more and more products also contain organic honey as an ingredient.

High-end

This is the smallest segment of the market and consists mainly of specific flavoured honeys, often mono-floral and single origin. A wide range of mono-floral honeys is increasingly being sold in Germany. These honeys are praised for their high quality, distinctive aroma and refined, unique taste.

In recent years, consumers in Germany have shown a growing preference for mono-floral honeys, driving an increase in demand. Mono-floral honeys tend to be priced higher than multi-floral honeys, but pricing varies significantly depending on floral origin. For instance, while common varieties are positioned in the mid-range segment, more exclusive types like manuka honey occupy the high-end segment.

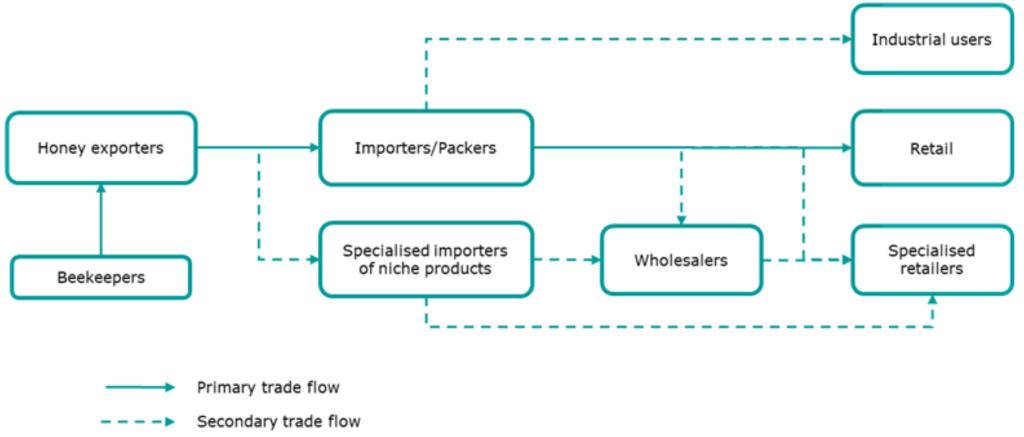

Through which channels does honey end up on the end market?

Most of the honey imported into Germany is supplied in bulk, where it is processed and repackaged by German businesses. This is often necessary to blend poly-floral honey into products that are more appealing to German consumers.

Figure 3: Most common market channels for honey in Europe

Source: ProFound, 2024

Importers

Importers often act as both importers and packagers. Large importers focus on conventional honey and typically supply large retailers, such as supermarkets. Smaller importers supply health food stores, organic shops and specialty retailers. Industrial honey is mainly sourced by importers/wholesalers, who ensure a stable supply chain by sourcing honey from multiple origins. They blend honey from various sources to maintain consistency when there are supply disruptions. Key players in the German honey market include companies like D. Schumacher, Honig-WERNET and Tuchel & Sohn.

Wholesalers

Wholesalers in Germany play an essential role in the food and beverage industry. While the sector is composed of many small and medium-sized operators, the market is dominated by a few large central buyers and importers. Many regional wholesalers have grouped into larger entities like Intergast and Service Bund to meet the growing demand for product variety and competitive prices. Key wholesalers in Germany include Allos and Wilhelm Reuss.

It should be noted that the line between retail and wholesale is blurring. Major players like Edeka Group, Rewe Group and METRO have both retail and wholesale operations under one roof and manage their own logistics. Some major retailers like Lidl and Aldi have almost no need for traditional wholesale operations.

Retailers

Retailers dominate the German food market, with the top three grocery retailers—Edeka, Schwarz Group and Rewe Group—controlling nearly half of the market. Most German food retailers prefer to work with importers and wholesalers to handle the import, customs clearance and distribution of honey.

Industrial users

Industrial users of honey, such as food manufacturers, cosmetics companies and pharmaceutical firms, often source honey through importers. Honey is a key ingredient in a variety of products, ranging from food items to health and beauty products. Importers play a vital role in ensuring a consistent supply of honey for these sectors. A German example of an industrial user of honey is DE-VAU-GE Gesundkostwerk.

Table 2: Primary sectors using honey in industrial applications

| Industry | Reasons for usage | Uses |

| Food and beverages | Natural sweetening properties, taste enhancement and commercial attractiveness as a healthier alternative to refined sugar. | To produce baked goods, confectionery, alcoholic beverages, cereals and speciality foods. |

| Cosmetics and personal care | Moisturising, antibacterial and antioxidant properties. | Skincare and haircare products. |

| Pharmaceuticals and nutraceuticals | Antibacterial and healing properties. | Cough syrups, wound care products and ointments. |

Source: ProFound, 2024

What is the most interesting channel for you?

The most interesting channel for honey exporters is importers who also act as packagers. These companies serve a broad range of clients, including the food processing industry, to which they supply honey in bulk, as well as grocery retailers and wholesalers. These importers often develop private-label products or offer already branded honey, making them essential for reaching both large retailers and smaller, specialised outlets.

Given that only a limited number of German retailers import directly from suppliers, working with importers who can provide wide-reaching distribution across various sectors is crucial for market success. These partners handle not only the logistics but also the marketing and packaging, ensuring that your product meets the expectations of the German market.

Tips:

- Check the list of members of the German Honey Association to find potential buyers in Germany and their contact information. You can also find market-related information and guidance on trade regulations and requirements.

- Visit or exhibit in major food trade shows like ANUGA and BioFach. These events provide valuable opportunities to network directly with German buyers, helping you to establish relationships and better understand market demands.

3. What competition do you face on the German honey market?

The main competitors on the European honey market are Mexico, Brazil, Argentina and China. These are all well-established suppliers with strong production and export capabilities. Product competition mainly includes cheaper alternatives like sugar, maple syrup or agave syrup.

Which countries are you competing with?

The main competitors are Mexico, Brazil, Argentina and China. These countries have historically established themselves as major suppliers of honey to Europe and are currently the main suppliers of honey to Germany. These countries have significant production and export experience. Some of them also have significant organic production.

Source: ITC Trade Map

Ukraine

Ukraine has long been the largest supplier of honey to Germany. This position has remained stable in the last few years despite the ongoing war. In 2023, Ukraine supplied 13,084 tonnes of honey to Germany, accounting for 20% of total imports. Over the last five years, Ukrainian honey exports to Germany have seen only a slight decline of 1.6%, down from 13,953 tonnes in 2019, showcasing the resilience of the Ukrainian honey industry even in challenging circumstances.

In 2022, the average EU import price for Ukrainian honey increased to €2.63 per kilogram, up from €1.68 in 2019. This price remains competitive, just slightly below the EU average for non-EU suppliers (excluding New Zealand), which stood at €2.65 per kilogram. Ukraine’s ability to offer affordable honey, combined with its proximity to the EU, helps it maintain a strong presence in the German market.

Ukraine’s honey sector benefits from large production volumes and relatively low production costs, making it a reliable supplier for European markets. However, the ongoing war has posed significant challenges to the country’s economy and infrastructure. With its strong historical ties to the German market, Ukraine continues to play a critical role in meeting the country’s demand for honey.

Argentina

Argentina remains a key competitor in the global honey market due to its position as the third-largest exporter and fifth-largest producer of honey worldwide. Its ability to supply high-quality honey, combined with advanced beekeeping technology and favourable climatic conditions, makes Argentina a large player.

However, the sector is facing some challenges such as the abuse of pesticides, the lack of financial support and the spread of diseases. In addition, the expansion of the area cultivated with soybeans in Argentina is associated with a 60% drop in yield of honey per hive.

In 2023, Argentina was the second-largest supplier of honey to Germany, accounting for 14% of total imports with 9,091 tonnes of honey delivered. In the last five years, there has been a decline of -5.3%, down from 11,296 tonnes in 2019.

Argentina was the first country in South America to achieve developing country parity to export to the EU, allowing Argentinian honey producers to sell to the EU with direct recognition from the destination country as a major competitive advantage.

Argentina also stands out for its production and marketing of Fairtrade honey. In 2022, Argentina ranked as the second-largest supplier of Fairtrade honey in Latin America and the Caribbean with 363 tonnes of honey sold – 5.2% less than in 2021. This also places Argentina among the top Fairtrade honey-supplying countries in the world, commanding a 12.6% share of the global Fairtrade-certified honey sales volume in 2022.

In 2022, the average EU import price for Argentinian honey was €3.31 per kilogram, a significant increase from €2.28 in 2019.

Mexico

Mexico is a significant player in the honey market, ranking as the seventh-largest honey producer worldwide. Germany is the main destination for Mexican honey entering Europe. Today, Mexico is the third-largest supplier of honey to the German market, with an import volume of 7,784 tonnes in 2023. Imports from Mexico represent 12% of the total honey imports to Germany. Despite remaining among the main suppliers of honey to Europe and Germany, demand for honey from Mexico was low over the last two years and packagers claimed to be overstocked. Between 2019 and 2023, Mexican honey supplies to Germany dropped by almost -16%.

Mexico is one of the world's leading exporters of organic honey. Mexico has 2,322 bee producers certified under the Organic Products Law (5% of the total number of beekeepers in the country). In addition, Mexico has 448,185 organic hives, making it the country with the third-largest number of organic hives in the world in 2022. This is a significant increase of 70% compared to the number of organic beehives in 2021. The annual production of organic honey is estimated at four thousand tonnes and is mainly marketed for the European Union, Japan and the United States.

In 2022, the average EU import price for Mexican honey was €3.67 per kg, up from €2.56 in 2019.

China

China is the largest exporter of honey in the world and to Europe. It has a competitive advantage in terms of the volume produced and the ability to sell at extremely low prices. This is a large country with many beekeepers and a great diversity of botanical sources capable of producing high-quality honeys such as clover, linden, milkweed, alfalfa and acacia. In 2022, China produced 461,900 tonnes, ranking as the world’s largest producer of honey. This immense production capacity enables China to supply honey at prices as low as €1.58 per kg – a price point no other country can easily match.

Although China is authorised to sell honey in Europe, the EU is more cautious about buying honey from China and a growing number of European importers, including German ones, avoid Chinese honey because of its bad reputation. China is well-known as an epicentre for food fraud and fake honey is often linked to Chinese honey.

Unlike other major European importers, Germany is not heavily dependent on China. Only 4.9% of total honey imports come from China. In 2023, China exported 3,134 tonnes to Germany. Chinese honey supplies to Germany dropped by -8.3% in the last 5 years, mainly due to quality problems with Chinese honey (mainly related to residues).

Which companies are you competing with?

Examples of successful export companies include Argenmieles (Argentina), Bioflora (Mexico) and Ukrainian Bee (Ukraine). What all these companies have in common is that they work closely with local beekeepers and implement rigorous quality controls from the harvesting to the packaging of honey in accordance with international standards.

All of these companies are committed to sustainability, adopting organic production practices and obtaining certifications such as organic or Fairtrade. In addition, they are certified for Good Manufacturing Practices and/or have food safety management system certification such as ISO 22000.

Which products are you competing with?

In the industrial sector, honey competes with many processed sweeteners and natural alternatives used to make food, cosmetics and pharmaceuticals. Industrial users can often replace honey with sweeteners such as sugar, corn syrup/glucose syrup, molasses or agave syrup. These offer the same volume and similar sweetness and are often cheaper.

In the table honey market, consumers often choose between honey and other natural sweeteners for home use. Competitors include sugar, maple syrup and, more recently, fruit-based sweeteners (e.g. monk fruit sweetener and date syrup). In this segment, honey competes based on its health benefits, taste and versatility.

Figure 5: Examples of syrups and sweeteners competing with honey

Source: ProFound with images sourced from KoRo, Rapunzel, Hoyer, Transparency Foods and Unsplash, 2024

Tips:

- Build a strong online presence through a professional website and social media platforms to increase your company’s visibility and connect with potential buyers.

- Refer to our study on Finding Buyers to learn how to define your range and understand its value proposition. This can make it easier to target potential buyers and stand out among competitors.

4. What are the prices of honey on the German market?

On average, German import prices for honey reached €3.28 per kilogram in 2023. This is higher than the EU average import prices for honey of €2.26 during the same year. Wholesale prices for honey reached €5.28 per kilogram in Germany. This also surpasses the EU average of €4.21 per kilogram. The higher wholesale price reflects the added value of processing and packaging, and the logistical costs associated with importing and distributing honey.

Retail prices in Germany are generally 2.5 to 3 times higher than import prices. This markup covers costs associated with logistics, packaging, labelling and distribution. Retail prices for honey can vary significantly depending on the variety of the honey, its origin and the presence of certifications, among other factors. Organic honey tends to have an additional 15% premium above market prices, reflecting the higher production standards and certification costs.

Figure 6: Price breakdown of honey

Source: ProFound, 2024

Honey passes through several intermediaries before reaching the consumer, each adding a margin to cover their costs. The price structure and the value added at each stage can be broken down as follows:

- Transport and Customs: 10%

- Importer Commission: 5%

- Packager (blending, filtering and packing): 10%

- Wholesaler: 5-10%

- Retailer: 30-50% on average, depending on the retail channel

Tips:

- Visit the websites of the supermarkets to monitor consumer prices. REWE has an online shopping platform. You may be required to enter a zip code. Just type in any zip code to be able to see the products.

- Consider getting involved in certification schemes as this might allow you to charge a premium for your honey. However, make sure you have the resources if you decide to opt for certification. You will need a buyer interested in certification to make this premium price effective.

- Check the European Commission's overview of the honey market, where you can find average EU import prices for honey, as well as import prices per supplier country. This information can help you anticipate price changes and make decisions.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research