The German market potential for honey

Germany is one of the largest and wealthiest countries in Europe. With the largest European honey consumption and highest import volumes, Germany is one of the most important honey markets in the world. It is also a leading market for organic and fair-trade food products, including honey. As consumers increasingly seek natural, sustainably-sourced products, the German market offers strong potential for honey suppliers.

Contents of this page

1. Country description

Germany is a prominent country located in Central Europe, known for its influential role in regional and global affairs as a founding member of the European Union (EU), the United Nations, NATO, and other international organisations. With a population of 84.6 million people as of December 2023, Germany has the largest population out of all the member states in the European Union and is one of the most densely-inhabited countries in Europe.

Most of the country’s residents are German (approximately 85%) but the share of foreigners has been increasing; from 12% in 2019 to 15% in 2023. In 2023, the total population grew by only 0.29%. This increase was mainly the result of the continuous increase in net immigration due to the forced migration resulting from Russia’s attack on Ukraine in 2022, and the war that has been ongoing ever since. This made up for the -0.25% drop in the number of German citizens.

Figure 1: Location of Germany within Europe

Source: ProFound, 2024

Germany’s official language is German, but many citizens also speak English and other European languages. With the largest economy in Europe and the fourth largest in the world by real GDP, Germany’s economic strength is driven by innovation, a skilled labour force, and investment in research and development. Key industries include automotive, mechanical engineering, chemical, and food and beverage. In 2023, Germany’s GDP reached €4,121 billion at current prices, accounting for nearly a quarter (24%) of the EU’s total GDP. However, in real terms, the German economy has stagnated, growing by a mere 0.35% annually since 2018, and even shrinking by -0.3% between 2022 and 2023. This is mainly due to high inflation and interest rates, which have created a difficult business environment in Europe. Germany is the most affected country due to the cost-of-living crisis, the lack of labour supply, and the effects of the Russia-Ukraine war. The country's economic outlook for the coming year is for minimal growth.

Source: World Bank Data, 2024

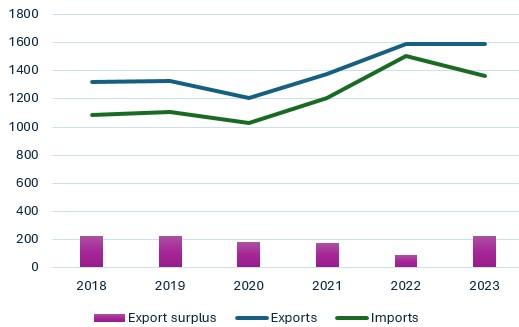

Germany is known for its strong export activities, which are a major part of its economy. In 2023, Germany exported for a total value of €1,590 billion and imported a total value of €1,366 billion, leading to an export surplus of €224 billion. While both exports and imports have mostly grown steadily in the last five years, Germany’s export surplus has shown a slight decline, recording an average rate of -0.39% per year between 2018 and 2023.

This is mainly because German imports rose sharply in 2021 and 2022, outpacing export growth. In 2022, imports increased by 26%, while exports only grew by 16%. This was due to significant increases in imports of various goods, especially fertilisers (113%), mineral fuels and oils (96%), organic chemicals (86%), nickel (54%), coffee, tea, mate, and spices (46%), and animal or vegetable fats, oils, and waxes (44%). However, in 2023, imports fell sharply by -9.3%, while exports remained largely unchanged.

Figure 3: Developments in German foreign trade

Source: Destatis, 2024

Some of the leading trade partners for Germany include the United States, China, the Netherlands, France, Poland, and Italy. Major trade hubs in Germany include the Port of Hamburg, which is one of the busiest ports in Europe, as well as Frankfurt, which is a global hub for finance and trade fairs. These cities are instrumental in facilitating trade not only across Europe but also globally, using Germany's strategic location as a bridge between eastern and western economic zones.

2. What makes Germany an interesting market for honey?

Germany is by far the European market with the greatest opportunities and potential for honey from non-EU countries. Not only is it the largest market in terms of retail sales, but it also dominates European honey imports, both in value and volume. Germany stands out due to its large population and high demand, but also because it has very large organic and fair-trade food markets.

Germany is the leading European consumer market for honey

Germany is the third largest honey market globally, and the largest market for retail sales of honey in Europe, both in volume and value. In 2022, the German honey market was valued at €641 million (USD 708 million). The German honey market has grown significantly over the last years. Only between 2020 and 2022, did the German honey market grow at an average annual rate of 5.0%, from 581 million (USD 642 million) in 2020. The size of the German market is supported by the fact that Germany has the largest population of any country in Europe.

Germany is also the largest consumer of honey in Europe, with an apparent consumption of 88,596 tonnes in 2022. Germans consumed around 78.6 thousand tonnes of honey in 2022, based on preliminary figures. This was an increase compared to the previous year of 68.8 thousand tonnes. Germany accounts for 22% of the total EU honey apparent consumption. Honey is becoming increasingly popular among those looking for alternatives to sugar in their daily food consumption.

Source: Statista, 2024

Per capita consumption has fluctuated somewhat in recent years, though generally it remained within the one kilo mark. Germany has the highest sales but ranks 9th globally for per capita consumption with €7.70 (USD 8.50) per person in 2022. German per capita consumption amounted to 0.81 kg per person in 2022 and 0.95 kg per person in 2023. Considering both per capita spending and market growth in the previous years, Germany stands out as a very attractive market, surpassing larger markets such as the United Kingdom, the USA, China, and Japan.

Industrial honey is estimated to make up a large share of total German honey consumption, with the food industry as the main consumer. Honey is integral to German cuisine and is a common ingredient in baked products, confectionary, candy, breakfast cereals, beverages, milk products, and many preserved products. Many products sold in Germany, such as gingerbread and honey cakes, also use honey as a main ingredient. Plus honey is widely used in cosmetics and as an ingredient in pharmaceutical production.

German consumers mainly use honey as a sweetener in meals and drinks, and as a bread spread. After marmalade and jam, honey is the second most popular bread spread in Germany, often enjoyed at breakfast or as a favourite snack. Supermarkets, hypermarkets, and discounters are the key channels for sweet bread spreads in Western Europe. In 2021, honey represented around 28% of the sweet spreads category by value in Western Europe. As Germany leads the honey market, mostly using honey as a bread spread, this data can be translated into similar behaviour for Germany.

The most popular honey in Germany is Acacia honey, which has a mild taste and stays liquid for a long time. Other popular types are buckwheat honey, clover honey, dandelion honey, forest honey, heath flower honey, pine tree honey, and lavender honey. The variety of available honeys is relatively large. Both liquid and creamed honeys are popular. Rather than bolstering it, the maturity of the German honey market hampers its further growth. Consequently, honey consumption is expected to remain stable in the next five years.

Germany is the largest producer of honey in Europe

Germany is the largest producer of honey in Europe, outpacing France, Romania, and Spain. In 2022, Germany produced 34,100 tonnes of honey, accounting for 12% of the total European production. German honey production recovered in 2022, after a very low production of less than 20 thousand tonnes in 2021. This year was a difficult one for German beekeepers, as there were no harvests in several regions of the country. More than 50 percent of the beekeepers who responded had no yield at all in 2021. In 2018, this was six percent of beekeepers.

In 2022, with a total of 149,105 beekeepers and 996,000 bee hives, Germany had the largest number of beekeepers in Europe, most of which are members of the German Beekeeper’s Association (DBIB). This number has steadily increased since 2016, recording a 16% growth between 2019 and 2022.

As in many other EU countries, beekeeping in Germany is mainly a hobby. In fact, the average amount of hives per beekeeper in Germany is only seven, well below the EU average of 29. Moreover, as of December 2023, less than 1% of beekeepers practice beekeeping commercially. However, the country’s strength relies first on the production of honeys which are typically of high quality, and second, on the fact that the German beekeepers with their bees are among the most productive in the world. In fact, each hive is estimated to produce an average of 20 to 30 kg of honey per year.

Despite being the largest producer in Europe, German honey production represents less than 40% of domestic consumption. The German industry therefore needs more honey and is heavily dependent on imports.

Germany is the largest European importer of honey from developing countries

Germany is the main EU importer of honey and plays a leading role in the European honey trade. Moreover, developing countries account for a considerable share in these imports, which provides opportunities for developing country exporters.

In 2023, Germany imported 64,425 tonnes (€211 million) of honey, representing 18% of total European imports. German import volumes have registered a steady fall of -5.9% on average per year since 2019. The value of German honey imports grew almost steadily at an average annual rate of 8% between 2019 and 2022, but then declined by -27% in 2023. The overall fall in import volumes is linked on the one hand to the increase in honey prices in 2021 and 2022, in the context of the slowdown in the European economywhere both consumers and businesses saw their purchasing power affected, and on the other hand, to the German government’s and the industry’s improved efforts to combat food fraud through greater scrutiny.

Source: ITC Trade Map, 2024

Germany also stands out as the largest European importer from emerging economies, with 45,058 tonnes (€116 million) in 2023. German honey imports from emerging economies have declined on average by -7.3% per year, in line with the decline in total imports. Still, the share of non-EU countries supplying Germany has remained relatively stable, with around 70% of total imports since 2019. The main non-EU countries supplying honey to Germany are Ukraine (13,084 tonnes), Argentina (9,091 tonnes), Mexico (7,784 tonnes), and China (3,134 tonnes). German imports from non-EU suppliers are fairly divided between different supplying countries which indicates this market is not highly concentrated or dominated by one country. More importantly, and in contrast to other leading EU importers, Germany does not import a large share of honey from China, indicating more opportunities for other exporters.

Germany is the largest European market for organic food products

Germany is the world’s second largest market in terms of organic retail sales, worth more than €15 billion in 2022. It is also the largest European market for organic food products. In 2022, organic retail sales made up 6.3% of all retail sales in Germany, giving this country the sixth highest share worldwide. Regarding per capita consumption, Germany ranks among the top six European countries with the largest consumption of organic products. In 2022, it was estimated that each German spent €181 on organic products that year, far exceeding the average per capita expenditure in the European market (€85).

Between 2018 and 2022, organic retail sales in Germany grew significantly at an average annual rate of 8.8%. German consumer demand for organic products has resulted in the establishment of many organic food processors and importers in the country. In fact, Germany has the largest number of organic importers in Europe and the second largest number of organic processors, with 1,944 and 21,981, respectively. This number accounts for 25% of total European organic food processors.

Organic certification is particularly common for honey. German buyers place high value on organic honey, whether sourced from EU or non-EU countries. The demand for organic honey has increased significantly, largely driven by growing environmental concerns and a shift toward healthier lifestyles among consumers. Also, as German consumers are constantly warned about the risks of honey contamination, some of them choose organically-certified as a sign of stricter quality control and a guarantee that the honey is not contaminated, and that beekeeping is controlled. It is important to note that organic honey must carry the proper organic certification or label to be marketed as such, ensuring its authenticity and compliance with strict organic standards.

Tips:

- Read more about the general dynamics and developments of Europe’s honey market in our study on European market demand.

- Visit the website of the Research Institute of Organic Agriculture (FiBL) to learn more about organic markets in Europe.

- Visit the European Commission’s honey website for detailed information on the honey market in the European Union. This website provides data on production, trade and prices, as well as an explanation of quality and labelling standards and other relevant developments.

3. Which trends offer opportunities or pose threats on the German honey market?

Several trends are changing the German honey market and creating opportunities for suppliers from developing countries. The growing focus on healthier lifestyles, for example, with consumers reducing their sugar consumption, is driving demand for honey. At the same time, Fairtrade honey is becoming more popular. These create interesting opportunities for suppliers from developing countries looking to enter the market.

Healthy lifestyle among German consumers drives demand for honey

In recent years, German consumers have become increasingly conscious about their health and wellbeing. In 2023, 24.6 million Germans expressed a high interest in healthy eating and maintaining a healthy lifestyle, corresponding to 30% of the total population. This shift is driving changes in food choices, as more consumers seek products that align with their health goals.

Source: Statista, 2024

One of the main ways this trend is affecting the market is through the increasing demand for alternatives to refined sugar. Sugar has come under public, political, and media scrutiny, overtaking fat and salt as the primary consumer concern. Because of these growing concerns about the negative effects of sugar, like its role in obesity and diabetes, consumers are searching for healthier sweeteners.

As people are making the connection between health and naturalness, consumers are increasingly choosing natural substitutes to sugar. Honey is seen as a more natural and healthier option compared to sugar and artificial sweeteners. As a result, many manufacturers are replacing sugar with honey in their products, especially in the mid- and high-end markets, where consumers care more about health than price. This creates a big opportunity for honey producers, as more products have started using honey as a natural, sugar-free option.

At the same time, many health-conscious consumers are looking for foods that are known to have specific health benefits. This is where ‘medicinal’ honey becomes important. The most successful example in the medicinal honey segment is the case of manuka honey from New Zealand. Manuka honey is a dark honey with a very rich flavour, produced by bees foraging on the manuka tree (Leptospermum scoparium). Manuka honey has become popular in the German market, which is crowded with manuka honey products. Many German consumers use Manuka to help with coughs, sore throats, and digestive health, not just as a sweetener. In fact, over 40% of surveyed German consumers said they use Manuka honey mainly for health reasons. This reflects a wider trend where people are seeking natural products that offer real health benefits, further increasing the demand for honey.

Figure 7: Example of manuka honey sold in Germany

Source: Breitsamer Honig, 2024

These two factors—wanting healthier sweeteners and looking for foods with health benefits—are driving the growing demand for honey in Germany. Honey is in a good position to benefit from both trends. The success of Manuka honey shows that other types of honey can also succeed in the health-focused market, especially if these benefits are scientifically proven. At the same time, the growing interest in health and natural products is also helping to boost demand for organic and fair-trade honey. Germany is the largest market in Europe for organic honey (see above), and there is more demand for organic honey to be used in the preparation of different types of food.

Demand for fair trade honey creates opportunities for suppliers in developing countries

Germany is becoming an attractive market for fair trade products, and this trend is creating opportunities for honey suppliers in developing countries. However, fair trade remains a very small segment, and thus opportunities are limited.

German consumers are increasingly concerned about how their food is produced, which is driving demand for Fairtrade honey. In 2023, Fairtrade product sales in Germany grew by 8.5%, reaching €2.6 billion. For the first time, per capita spending on Fairtrade products went over €30, showing that German consumers still support Fairtrade, even during difficult economic times.

Honey is one of the Fairtrade products that has grown over the past decade. In 2023, 883 tonnes of Fairtrade-certified honey was sold in Germany, generating €10.1 million in revenue. Around 7.1% of this Fairtrade honey was also organic. The slight economic recovery in early 2024 and the expected decrease in inflation support positive forecasts for Fairtrade honey in the coming years. However, it is important to note that Fairtrade honey is a very small part of the total German honey market. While there is interest in Fairtrade honey, the amount sold is much smaller compared to other types of honey.

Fairtrade-certified products ensure that producers receive a fair price, which is crucial in regions where they often face poor conditions. The economic benefits of Fairtrade have a great impact on developing countries, where the additional income from the sale of Fairtrade products can significantly improve the quality of life in producing communities. This ethical appeal resonates with German consumers, creating opportunities for suppliers in developing countries to meet the needs of their customers.

A successful example of a Fairtrade-certified supplier in the German honey market is the Pueblo Apícola Cooperative in Uruguay. Founded in 2006, the cooperative joined Fairtrade in 2010, when it also started offering organic honey. Fairtrade certification has allowed them to secure better prices, invest in modern equipment, and adopt sustainable production practices.

Tips:

- See our study on trends for honey to learn more about current trends on the European market.

- Check out Fairtrade International’s standards to learn more about the social, environmental, and economic rules that producers and organisations must follow to get certified.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research