Entering the European market for natural food colours

The European market combines several characteristics that make it a promising market for natural food colours. Europe has a large food and beverage industry that uses natural food colours. Because European consumers are more concerned about the origin of products, artificial additives are increasingly being replaced with natural alternatives.

To enter the European market for natural food colours, you must comply with European Union food safety regulations as well as meet niche market requirements. Integrating sustainability into your company’s core strategy and communicating about steps you are taking are key to your success in the European market. Although some natural food colours are available to end consumers, most applications are in the food and beverage industry.

Contents of this page

1. What requirements must natural colours comply with to be allowed on the European market?

To enter the European natural food colours market, you must comply with EU regulations as well as market requirements. If you want to enter niche markets, additional requirements will apply.

What are mandatory requirements?

Under European legislation, a distinction is made between colours used as food additives and colouring foods:

- Colouring foods, also known as colouring foodstuffs, are food ingredients used by the food industry primarily to deliver colour to food and beverage products. They are obtained from foods such as fruits, vegetables, flowers, spices, algae and/or other edible source materials. The difference with food colour additives is that there is no selective extraction.

- Colours, as defined in Regulation (EC) No 1333/2008 on food additives, are “substances which add or restore colour in a food, and include natural constituents of foods and natural sources which are normally not consumed as foods as such and not normally used as characteristic ingredients of food. Preparations obtained from foods and other edible natural source materials obtained by physical and/or chemical extraction resulting in a selective extraction of the pigments relative to the nutritive or aromatic constituents are colours within the meaning of this Regulation”.

As an example, the pigment Anthocyanins E163 is a purple natural colour additive extracted from elderberry, whereas elderberry juice concentrate, which does not undergo selective pigment extraction and can be consumed as such, is an example of a colouring food.

Tip:

- If you are unsure about your product’s classification, ask your buyer and see the Code of Practice for the Classification, Manufacturing, Use and Labelling of Colouring Foods (EU), Annex C: Decision Tree - How to distinguish a Colouring Food and a Colour Additive, developed by the Natural Food Colours Association (NATCOL).

The table below gives an overview of key legislation for the European natural food colours market:

Table 1: Key European legislation for natural food colours

| Regulation | Colours | Colouring foods |

| General food law | Regulation (EC) No 178/2002 | |

| Food additives that can be used in colours/colouring foods | Annex III to Regulation 1333/2008 | Annex II to Regulation 1333/2008 |

| Novel food | NA | Regulation (EU) 2015/2283 |

| Transparency regulation | Regulation (EU) 2019/1381 | |

| Enzyme used in production | Regulation (EU) No 231/2012 | Regulation (EC) No 1332/2008 |

| Extraction solvents | Regulation (EU) No 231/2012 | Directive 2009/32/EC |

| Aluminium lakes | Authorised for some colours – Annex II to Regulation (EC) No 1333/2008 | Not authorised |

| Impurities/contaminants | Regulation (EC) No 1881/2006 | |

| Pesticides on feed and food | Regulation (EC) No 396/2005 | |

| Labelling | Regulation (EU) No 1169/2011 | |

| Biodiversity | Regulation (EC) 338/97 Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) Regulation EU 511/2014 Nagoya Protocol on Access and Benefit-sharing (ABS) | |

| Classification, labelling and packaging (CLP) | Regulation 1272/2008 |

Source: Market research based on NATCOL information and EU regulation

Tips:

- For more information and updates about natural food colours legislation, visit the NATCOL website and see their Code of Practice for colouring foods.

- For an overview of general requirements, read the CBI buyer requirements study for the natural food additives sector.

Food safety

Food safety is a top priority in the European Union. The General Food Law, which applies to all food products and food ingredients, ensures that all food is safe to consume. Having a Hazard Analysis and Critical Control Points (HACCP) system and certification are minimum requirements to manage food safety.

If a product fails to meet food safety requirements under EU law, a notification can be made in the European Union’s Rapid Alert System for Food and Feed (RASFF). Information exchanged there can result in products being recalled from the market, putting a burden on you and your buyers.

Tips:

- Read more about the HACCP principles and start implementing them in your operations by following the Codex Alimentarius application guidelines in Chapter Two of the General Principles of Food Hygiene.

- Visit the interactive RASSF portal and search for recent and past notifications for natural food colour products. You can search by keyword, date, product, country of origin, notification type and risk degree.

List of permitted colours

Regulation (EC) No 1333/2008 contains detailed rules on food additives and defines the term ‘colour’. Annex II lists food additives, including colours, that are approved for use in foods and the conditions of use. Annex III lists food additives approved for use in food additives and the conditions of use.

Every food additive that is approved in the European Union is assigned an E-number. Having an E-number means that an additive has passed safety tests and is authorised for use. The approval process for food additives, both natural and synthetic, has a number of steps that include a prior assessment by the Scientific Committee on Food (SCF) and/or the European Food Safety Authority (EFSA).

Figure 1 presents some of the main natural colours authorised in the European Union.

Figure 1: Selected natural food colours authorised by the EU

Source: NATCOL, 2022

Tip:

- To easily look up authorised colours and their uses, see the European Union’s Additives Database, based on the EU list of food additives in Annex II to Regulation (EC) No 1333/2008.

Novel food

Raw materials used in the production of colouring foods must be recognised as food within the EU or authorised as novel foods. Novel foods are defined as foods that were not widely consumed by humans in the European Union before 15 May 1997 (Regulation (EU) 2015/2283). As there are separate regulatory frameworks and authorisation bodies for food additives, the authorisation of novel foods mainly affects colouring foods.

Tip:

- If you are unsure whether the source material of your colouring food is recognised as food within the EU, check the Novel Food Catalogue, based on the EU list of novel foods.

Use of enzymes and extraction solvents

Regulation (EU) No 231/2012 specifies enzymes and extraction solvents that may be used for colours.

The use of extraction solvents for colouring foods is regulated by Directive 2009/32/EC. Annex I contains a list of authorised extraction solvents for use in food and the conditions of use. As an example, sulphur dioxide extraction is not authorised. Regulation (EC) 1332/2008 specifies enzymes that may be used in food production, including colouring foods. Since there is currently no EU list of authorised food enzymes, national rules for the use of enzymes continue to apply.

Tips:

- See the EU legislation cited above to check if the extraction solvents and enzymes you use in production are authorised in the EU.

- Check if the enzymes you use to produce your colouring foods are included in the Commission’s Register of food enzymes to be considered for inclusion in the EU list.

Impurities and contaminants

The Annex to Regulation (EU) No 231/2012 defines purity criteria that individual food colours must comply with. As an example, Table 2 shows the purity criteria for curcumin (E 100).

Table 2: Purity criteria for curcumin E 100

| Solvent residues | Ethylacetate | Not more than 50 mg/kg, singly or in combination |

| Acetone | ||

| n-butanol | ||

| Methanol | ||

| Ethanol | ||

| Hexane | ||

| Propan-2-ol | ||

| Dichloromethane | not more than 10 mg/kg | |

| Arsenic | Not more than 3 mg/kg | |

| Lead | Not more than 10 mg/kg | |

| Mercury | Not more than 1 mg/kg | |

| Cadmium | Not more than 1 mg/kg |

Source: Annex to Regulation (EU) No 231/2012

In view of the strict purity criteria and to avoid solvent residues, the industry is shifting towards using solvent-free substances. Many buyers prefer to buy extracts obtained through steam distillation. However, this is difficult or impossible for some ingredients.

The Annex to Regulation (EC) No 1881/2006 defines maximum levels of specific contaminants allowed in foodstuffs. These levels differ depending on the food. Although the legislation defines specific levels for groups of foodstuffs, any contaminated product can be rejected by buyers or banned by the sanitary control authorities. Among the contaminants regulated are nitrate, mycotoxins and metals such as lead, cadmium and mercury.

Tips:

- Check the specific purity criteria for your natural food colour in the Annex to Regulation (EU) No 231/2012.

- Find out if the ingredients you use are suitable for steam distillation, which is preferred by buyers.

- Check the maximum contaminant levels in the Annex to Regulation (EC) No 1881/2006. Keep in mind that some buyers may have stricter levels, depending on the final application of the foodstuff.

Pesticides residues

Maximum residue levels (MRLs) for pesticides on food are regulated by Regulation (EC) No 396/2005. The limits on raw materials also apply proportionally to derivative products, such as extracts.

The raw materials used for the production of food additives must comply with the MRL rules set out in Annex I to Regulation (EC) No 396/2005. Since some extraction processes increase the potency of even low pesticide residues in raw materials, make sure to use high-quality raw materials to produce your extracts.

Exporters from developing countries should pay special attention to the use of ethylene oxide against microbiological contamination. Regulation (EU) No 231/2012 prohibits the use of ethylene oxide for sterilisation purposes in food additives. Despite this, there are RASFF notifications of ethylene oxide in curcumin and other food additives from developing countries. As the costs of having to take products off the market is very high, some buyers double test products from high-risk countries in their own laboratories. India and China are rated as high-risk countries due to recent notifications of ethylene oxide residues.

Tip:

- Check the MRL database to identify the MRLs that apply to your product.

Labelling

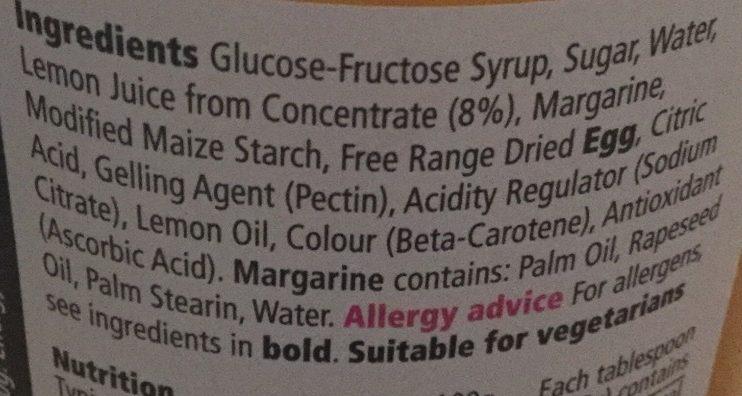

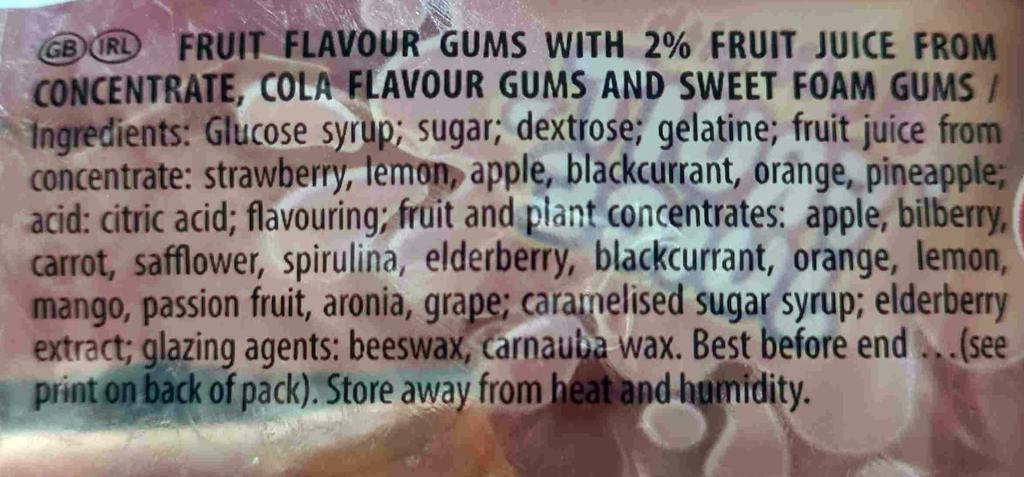

Chapter IV of Regulation (EC) No 1333/2008 specifies labelling requirements for food additives and Regulation (EU) No 1169/2011 specifies requirements for the provision of food information, including on food additives, to consumers. Under the latter regulation, food additives must be labelled with their category name (in this case ‘colours’), followed by their specific name or, if appropriate, E-number. Since colouring foods are actual foods, not additives, they are listed as food in the final product’s ingredient list. Figure 2 and Figure 3 show examples of labels with food additives (colours) and colouring foods, respectively.

Some consumers are distrustful of E-numbers, even when assigned to natural additives. Besides helping to drive a trend towards clean labels, this has led to further development of colouring foodstuffs in the industry.

Figure 2: Label of a product containing the natural colour E160ai (beta-carotene)

Source: Photo by kiliweb, with additional modifications by moon-rabbit, for Open Food Facts

Figure 3: Label of a product coloured with fruit and plant concentrates (colouring foods)

Source: Photo by alia for Open Food Facts

Tip:

- See examples of colouring food solutions such as Oterra’s Fruitmax®, Sensient’s Cardea and Naturex’s VegeBrite®, which were designed to meet manufacturer and consumer clean label requirements.

Classification, labelling and packaging (CLP)

The Globally Harmonised System of Classification and Labelling of Chemicals (GHS) is a system developed to standardise and harmonise global management of chemicals. In Europe, it is implemented in Regulation 1272/2008 on the classification, labelling and packaging (CLP) of substances and mixtures. The CLP regulation applies to food additives, including colours.

In addition to this regulation, buyers have their own packaging requirements that you should discuss with them directly. In general, packaging has to protect the product and prevent cross-contamination of raw materials. Many buyers also require packaging materials to be approved for food (food-grade).

Solid extracts are normally transported in bulk and packed in paper bags of 25 kg, which are loaded on pallets and then in containers. However, less common extracts may be packed in 1-5 kg bags. Although paper is becoming more common as a packaging material, some buyers prefer polypropylene bags to best maintain product quality.

Liquid extracts, such as cochineal, turmeric and annatto extracts, are usually packed and transported in 50 kg high-density polyethylene (HDPE) drums, stainless steel or aluminium barrels or intermediate bulk containers (IBC) with an inner coating to prevent product oxidation. For carotenoids and curcumin, which are reactive to oxygen and light, the quality of the packaging also affects the colour.

Tip:

- If you produce both organically certified and conventional ingredients, keep them separate to prevent contamination of the organic products.

What additional requirements do buyers often have?

Certifications

Besides HACCP certification, most buyers require quality management standards or certifications such as those of the International Organization for Standardization (ISO 22000, 9001), Food Safety Systems Certification (FSSC 22000), British Retail Consortium Global Standards (BRCGS), International Featured Standards (IFS) or another certification recognised by the Global Food Safety Initiative (GFSI). Small to medium-sized buyers normally only ask for HACCP certification and see the others as a bonus. For larger companies, however, these other certifications are a minimum requirement.

Even if your product is processed, many buyers also ask for certification of good agricultural and sustainable farming practices for the raw material used in production. The most common certifications are Global G.A.P. and the Farmer Sustainability Assessment (FSA). For example, Exberry expects all suppliers to achieve sustainable agricultural practices by 2030 through Global G.A.P. (or equivalent scheme) and/or FSA (at least bronze) certification.

Note that certifications are the starting point and most buyers also visit their suppliers on-site to conduct an audit before starting a business relationship.

Tips:

- If you are not yet certified, consider making a 3-4 year plan with steps needed to get certification. Buyers expect this from suppliers that are not yet certified.

- Check GFSI-recognised certifications and their How to get certified factsheet.

Documentation

European buyers will ask you to provide documentation to assess your product’s compliance with European regulations and whether you meet the purchasing specifications agreed for the final industry user. The Specific documentation requested therefore depends on the end customer’s needs and market segment to which you are selling your natural colour. A few documents are always required:

Other documents that may also be requested are:

- Allergens declaration

- Radioactive-free certification

- Heavy metals declaration

- Non-GMO certificate

- Gluten-free certification

Depending on your buyer’s requirements, you may be asked to submit other up-to-date certifications for quality management systems, food safety and organic, fair-trade, kosher or halal production, among others.

Some buyers are willing to let you do the testing, while others prefer to do it themselves. This is also because European laboratories are equipped to test more substances than those in developing countries. Some buyers advise suppliers on how to take samples and send them abroad. To be safe, ask your buyer what they prefer. If you do your own testing, send the laboratory data along so your buyer can verify it.

Some buyers use questionnaires to evaluate new suppliers. These questionnaires ask about production specifications, CITES documentation, toxicological information, raw material origins and production details (use of pesticides, fertilisers, farm and crop size, water use, etc.), effectiveness data, packaging materials and processing activities, among other things.

Tip:

- If a potential buyer asks you to complete a supplier questionnaire, take your time, answer honestly and provide back-up documentation. This will give you a competitive advantage, as buyers are known to complain about potential suppliers’ lack of transparency when providing information.

Sustainability

Sustainability is bringing about a major shift in the food ingredients industry as European consumers increasingly demand products that are socially and environmentally responsible. Sensient Food Colors Europe for example pioneered palm oil-free colours in response to consumer concerns about the deforestation impact of oil palm plantations.

The Farm to Fork Strategy, which is part of the European Green Deal, aims to create fair, healthy and environmentally friendly food systems. To learn about this strategy and how the European Green Deal can impact your business, read this CBI study.

A transparent supply chain is key to deal with sustainability concerns. Leading natural food colours manufacturers are providing this transparency by publishing annual sustainability reports and communicating their efforts, initiatives and targets for corporate social responsibility. Another common practice in the industry is the use of supplier codes of conduct. Most such codes are based on the UN Global Compact principles or Ethical Trading Initiative Base Code and focus on issues such as human rights and fair working conditions and wages. Buyers expect their suppliers to follow these codes of conduct and often require confirmation in writing as part of business contracts.

Companies with global supply chains use the Supplier Ethical Data Exchange (Sedex) principles to assess and audit their suppliers. SMETA is the Sedex's social auditing methodology and is recognised worldwide. Becoming a Sedex certified member can give you a big competitive advantage if you wish to supply these large companies. Although SMETA is still a voluntary standard, a survey among buyers found it is likely to become a basic industry requirement in the coming years.

Tips:

- Make sure you can manage and trace your entire supply chain. Buyers are increasingly recommending the use of smartphone traceability apps, examples of which are Galapp in Latin America and Dimuto worldwide.

- Read your potential European buyers’ supplier codes of conduct and sustainability reports. Examples include Döhler’s code of conduct for suppliers and the Sensient Group Sustainability Report.

- Read more about the SMETA audit and use their guidance documents to familiarise yourself with the audit methodology.

What are the requirements for niche markets?

Organic, Halal and Kosher certification are the main certifications for niche markets.

In the European Union, products are allowed to carry the organic production logo if they are organically certified and if at least 95% of the agriculturally sourced ingredients are organic. In January 2022, a new organic regulation became applicable. As under the old regulation, only food additives listed as authorised additives are allowed. The only authorised colour additive is annatto, and its use is only authorised in four types of cheese. For this reason, there is growing demand for organic colouring foods to impart colour to organic foodstuffs.

The new organic regulation presents an opportunity for developing country suppliers, because it offers more flexibility on product origin. Under the old regulation, products that said ‘EU Agriculture’ on the label could contain up to 2% non-EU ingredients. Under the new regulation, this has been increased to 5%.

Tips:

- To see which colouring foods are offered in organic quality, check the websites of European colouring food manufacturers such as Exberry, which recently launched two colouring foods based on organic safflower and spirulina.

- Consider converting to organic production to boost your chances in the European market. Safflower and paprika are examples of pigment sources with high organic demand.

- Read DDW, The Color House’s article about kosher alternatives to carmine. Red beet and anthocyanins are among the natural alternatives.

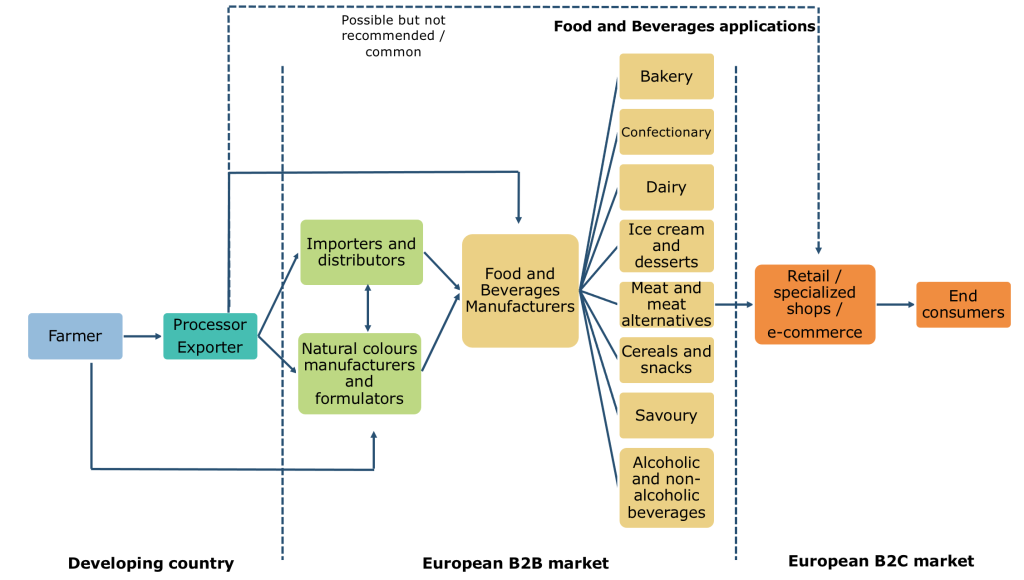

2. Through what channels can you get natural colours on the European market?

How is the end market segmented?

The European end market for natural food colours can be segmented by application in the food and beverage industry. Figure 4 shows the end-market segments.

Figure 4: End-market segments for natural food colours

Template design by Slidesgo

Natural colours have several applications in the food and beverage industry. In food products, they are mainly used in confectionary, dairy, ice creams and desserts, bakery, cereals and snacks, meat and meat alternatives, and savoury foods. In beverages, they can be used in both alcoholic and non-alcoholic beverages.

The use of natural colours is expected to keep growing, because while visual appeal is a key purchasing factor in food and beverage sales, consumers want natural ingredients they recognise. For example, in 2020, 98% of coloured sweet baked goods launched in Europe were coloured with natural colours and/or colouring foods and the majority of confectionary launches contained non-artificial colouring. Spirulina-based colouring agents were used in 21% of coloured sugar and gum confectionary launches, and this trend has been increasing in recent years.

Tip:

- Follow food and beverage sector trends to see which natural colours have more applications in the market. Also visit portals such as Food Navigator and Food Ingredients First and the websites of global food colours manufacturers such as Sensient Food Colors.

Through what channels do natural food colours reach the end market?

The main channels to the European market are importers and distributors, natural food colours manufacturers and formulators, and food and beverage manufacturers. Figure 5 shows the export value chain for natural food colours.

Figure 5: Export value chain for natural food colours

Importers and distributors

Specialised importers and distributors of natural raw materials and natural colours for the food and beverage industry are a main channel to the European market. They sell to natural food colours manufacturers and formulators for further processing or to food and beverage manufacturers.

The role of importers and distributors is important as not all food manufacturers have the expertise and their own import department to source natural colours directly from developing countries. Moreover, importers have the experience to ensure product quality and expertise about food and beverage manufacturers’ needs. Distributors often also offer consulting services and custom solutions to manufacturers, and have in-house laboratories to test different product applications for customers. Roeper and TER Ingredients are among the main players in this channel.

Natural food colours manufacturers

Growing demand for natural and clean-label products is driving countless innovations in the sector, and European manufacturers of natural food colours are at the forefront of these developments. Europe is home to the largest natural food colours manufacturers in the world. In recent years, there have been several mergers and acquisitions (M&A), with global companies buying small local players to increase their dominance not only in Europe, but worldwide. Some examples are Givaudan’s acquisitions of DDW, The Color House and Naturex, Oterra’s acquisitions of SECNA Natural Ingredients Group S.L. and Diana Food’s natural food colouring business and the consolidation of the Nactarome SPA Group.

Despite these mergers and acquisitions, industry sources say there is still room for medium-sized manufacturers in the market as demand for natural food colours is still growing.

Natural colours manufacturers sell to food and beverage manufacturers directly or through distributors. Companies such as Dutch natural food colours manufacturer BETTEC B.V. have also developed brands to sell their colouring foodstuffs directly to consumers. Though you can target retailers and consumers directly, it is not common and may be very challenging to do. It requires more marketing efforts, a deep understanding of labelling requirements for the consumer market and a distribution centre or partner in Europe.

Some manufacturers, such as DDW, The Colour House, buy raw materials from developing countries to process in their own facilities, giving them control over the whole value chain, while others buy extracted pigments or partially processed raw materials and add value with further processing at their premises.

Food and beverage manufacturers

Natural food colours make up only a small share of the ingredients in a final product. This can make it expensive for food and beverage manufacturers to source directly from the origin. However, those that want to be in control of their whole supply chain and that have the means are starting to import directly. This is a promising channel for exporters with high quality standards, repeatability and ready-to-use products.

Tips:

- In the changing business landscape, it is a good idea to diversify your customer base and talk openly with potential and existing customers about their possible involvement in mergers and acquisitions. Ask specifically about the impact on you as a supplier.

- Instead of targeting end consumers directly, rely on the experience and know-how of European importers.

What is the most interesting channel for you?

The three channels mentioned earlier offer interesting opportunities for suppliers from developing countries. To choose the right channel, consider your competitive position and potential challenges you face.

Importers/distributors

Germany is one of the most important markets for this channel, with many distributors based in Hamburg. Spain is also a relevant country for natural colours importers and distributors, due to the size of the Spanish food sector and Barcelona’s growing position as a natural colours hub. Interesting European distributors and importers of natural food colours are Roeper, A2 Trading, Brenntag Food and Nutrition, TER Ingredients, Disproquima, EPSA and Falken Trade. Most of these distributors have strong positions in the natural colours segment (additives with an E-number). Consider choosing this channel if you are a producer and exporter of natural colours.

Natural food colours manufacturers

If you are a supplier of raw materials with a high concentration of colour, this is an interesting channel for you. However, due to increasing processing costs in Europe, more companies are thinking about buying pre-processed products, such as extracts. This makes the long-term stability of this channel unclear, and supplying products with more added value may be more promising.

If you produce extracted pigments, this channel is also interesting for you. Pigments still require a quality check upon arrival. In some cases, pigments are used to make blends or custom solutions for food and beverage manufacturers.

Global players in this channel include DSM (the Netherlands), Oterra (formerly Chr Hansen Natural Colours Division, Denmark), Döhler and Exberry (Germany), Sensient Foods Colors (US-based, with a presence in Germany) and Symrise and Givaudan (Switzerland), along with Givaudan group companies such as Naturex and DDW, The Color House. Other interesting medium-sized manufacturers that also distribute to the food and beverage industry include Proquimac (Spain), Bart (Poland), Kanegrade (United Kingdom), Holland Ingredients (the Netherlands) and Ringe Kuhlmann (Germany).

Food and beverage manufacturers

If you offer ready-to-use natural colours and colouring foodstuffs, selling directly to food and beverage manufacturers is certainly an interesting channel for you. The main market for this is Spain, and the main segments are confectionary, dairy, beverages (alcoholic and non-alcoholic) and meat.

Price is one of the main reasons manufacturers choose to buy directly from the source instead of through distributors. However, you should be able to offer excellent after-sale service and the flexibility to develop specific formulations for your customers. This is why many developing country suppliers have opened commercial offices in Spain, enabling them to expand their market share, be closer to customers and build trust.

Some examples of interesting companies to target this segment are Vidal Candies, Fini Golosinas and El Pozo.

Tips:

- To find buyers, see the exhibitor lists of Fi Europe as well as FoodIngredientsFirst’s list of natural colours suppliers. Also read the CBI’s tips to find buyers in the natural food additives sector.

- If you want to target food and beverage manufacturers, see the exhibitor lists of the leading food European trade fairs, Anuga and SIAL, and of sector-specific trade fairs such as ISM, which is the leading sweets and snacks show. Focus on targeting large companies with enough scale to import directly.

- Participate in events organised by business support organisations (BSOs) in your country. Buyers use these events to find reliable new suppliers.

3. What competition do you face on the European natural colours market?

Although the majority of European imports of natural colours are from intra-EU suppliers, exports from non-EU suppliers grew steadily between 2017 and 2021, both in value (2.2%) and volume (1.9%).

Source: Eurostat, 2022

Keep in mind that if you decide to sell directly to food and beverage manufacturers in Europe, you will also be competing with intra-EU suppliers – that is, the European natural colours distributors and manufacturers discussed in the previous section. These manufacturers and distributors not only export their own products to other EU countries, but also re-export products sourced from developing countries.

Which countries are you competing with?

As shown in Figure 7, the main non-EU suppliers of natural colours to the European market are China, India, the United States, Turkey, Mexico and Peru. Imports from the United States are dominated by intra-company trade among global players, whereas Turkey and Mexico mainly supply the non-food and beverage industries.

This analysis focuses on China, India and Peru, which are the leading non-European developing country suppliers relevant to your market entry.

China: the main non-EU exporter

China is the main non-EU exporter of natural colours to the European Union, accounting for 13% of total EU imports. The country produces and formulates natural colours in large volumes at low prices. China is one of the main origins of curcumin, but also imports other products such as safflower and sweet potato.

The main challenges that importers sourcing from China face are the use of pesticides and logistics issues. China has had several lockdowns since the start of COVID-19, affecting both the export landscape and global supply chains. Where pesticides are concerned, although most Chinese companies conduct pesticide residue analyses, many buyers test Chinese products again at their own premises due to the high risk of contamination.

India: leader in the curcumin market

India is the largest manufacturer, consumer and exporter of curcumin, accounting for more than 80% of global production. India is the second-largest non-EU exporter (after China) of natural colours to the European Union, accounting for 4% of total EU imports. Within the natural colours industry, India also exports annatto and safflower to the European Union. Like China, the country has strong global companies that produce and formulate colours. Its main weaknesses are the same as for China: logistics challenges, high risk of pesticide residues and rising transportation costs.

Peru: well-established source of bixin and norbixin from annatto

Peru is a top exporter of natural colours to Europe and the rest of the world. EU imports of plant-based natural colours from Peru decreased at an annual average rate of 13% in both value and volume between 2017 and 2021. However, Peru is seen as a well-established source country by European buyers, with good government support for exporters and good-quality products, especially annatto. The country is very experienced in the sector and home to world-class companies with excellent capacity and laboratories. The main pigments exported from Peru are carotenoids from annatto, lutein from marigold, curcumin from turmeric and anthocyanins from purple corn. Peru is also one of the main exporters of carmine from cochineal insects. However, exports of carmine are expected to decrease due to the rise of veganism and preference for plant-based products.

The world market for annatto is dominated by production from Cote D’Ivoire and Peru[EM1] . Peru produces from its own raw material, harvested one a year during the European autumn. Cote D’Ivoire has up to three annatto harvests per year, which is unusual and gives the country a competitive advantage. However, logistics problems in Africa such as a shortage of sea shipping containers have led to higher prices and shortages of annatto in the past two years. Local transport strikes in Peru in recent years (for example in 2021 and early 2022) have created challenges for agricultural goods exports from Peru, also affecting the natural colours value chain. This situation and some Peruvian exporters’ response times, as reported by buyers, have negatively impacted imports from this region.

Which companies are you competing with?

The following companies are good examples of suppliers to the European natural food colours market and the competition you will face.

Imbarex, Peru

Imbarex is a leading exporter of natural colours from Peru, with 20 years’ experience, and an excellent example of a mid-sizes global, vertically integrated company in a developing country. If you wish to supply the European natural colours market, Imbarex is a good reference point.

The company has its own crops and production plants in Peru. They also have commercial offices and distribution warehouses sites in Spain, the United States, Brazil and Mexico, from which they distribute their main products to regional customers, including other distributors, and to natural colours and food and beverage manufacturers.

Imbarex meets the entry requirements for the European Union, with certifications including HACCP and BRC to show food safety compliance, Global G.A.P for sustainable agricultural practices for their raw materials, and Halal and Kosher to serve expanding niche markets. They use a variety of methods to extract their products (aqueous, CO2, solvent and resin extraction).

The company has a professional online presence, with an informative website in six languages and pages on social media such as LinkedIn, making them easily findable for potential buyers in Europe.

Arjuna Natural, India

Arjuna Natural is an Indian manufacturer of standardised botanical extracts for the dietary supplement and food and beverage industries. Notably, Arjuna Natural allocates at least 10% of its profits to collaborative research and development at international universities in Australia, the United States and Japan. This has allowed the company to innovate new products for customers while also committing to sustainability. As an example, Arjuna Natural was the first company in the world to produce turmeric extract using solar energy.

Arjuna has a professional English website with strong marketing and several calls-to-action to help it connect with potential customers. The company communicates its applications, success stories and certifications in an appealing way. Arjuna has also received several acknowledgments from government agencies and works with national stakeholders such as chambers of commerce. These affiliations and recognition help create trust among potential customers.

ROHA, India

ROHA is an Indian multinational that started in 1972 as a manufacturer of synthetic colours. Since then, the company has continued adapting to customer and manufacturing requirements, and is now recognised as an industry innovator. ROHA offers natural colours and colouring foods for the food and beverage industry and has customers and locations around the world. The company website clearly communicates its corporate social responsibility strategy and quality standards for natural colours and colouring foods.

ROHA is a major industry player to be aware of. With its extensive global presence, it can be both a potential buyer of your products in countries where it has manufacturing facilities, but also a giant competitor.

Which products are you competing with?

Natural colours and colouring foods compete with synthetic colours, but natural food colours dominate the European market. The annual growth rate of the natural colours market is estimated at more than 7%. Moreover, with the plant-based trend expected to continue, the natural colours market will remain very significant. There are also factors working against the expansion of this market, including volatility in the prices of raw materials and the instability of natural colours at different pH levels, temperatures and light intensities.

Exporters of natural colours authorised for use as additives in the EU also compete with colouring foods. As mentioned earlier, consumers distrust E-numbers, even natural colours, and colouring foods offer a clean-label alternative to natural colours. While clean-label products are becoming mainstream, they also have drawbacks. For example, spirulina extract, which imparts blue shades that are rare in nature, does not work in all applications. Further research and testing is therefore needed to enable the use of natural colours and colouring foods in products that now still use synthetic colours.

4. What are the prices for natural colours on the European market?

Price structures for natural colour products strongly depend on the market entry channel and type of colourant. Figure 8 shows a sample cost breakdown for two colourants from different pigment sources: carmine and annatto. As stated, cost breakdowns can differ greatly: while raw materials account for 80-85% of the total cost of carmine, they account for 50-60% of the cost of annatto. To calculate the price of your product, make a breakdown of your own costs and closely monitor the costs influencing your final price.

The main factors influencing your export price are quality, availability and demand, exclusivity and novelty, availability of raw materials, and certifications. Also, the more value you add at origin, the higher the price will be. The mark-up at each step depends on the work involved for each actor.

Figure 9 shows European import prices for natural food colours. As the HS code used here includes natural colours of different plant origins, these prices serve as a guide only. As stated, import prices from Peru are much higher than import prices from China and India. One of the main reasons is difference in volumes, as India and China supply high volumes at lower prices.

Tips:

- Keep track of the prices of food colours and colouring foods by regularly checking B2B platforms such as Colourfood professional, 1-2taste and Alibaba.

- Regularly calculate and carefully review your prices, especially if fluctuations in raw material prices could start affecting you in the long run.

This study was carried out on behalf of CBI by Dana Chahin in collaboration with Global Trade Promotion partners.

Please review our market information disclaimer.

Search

Enter search terms to find market research