The European market potential for natural food colours

The European market for natural food colours is driven by innovation, health, safety and sustainability. Due to an increasing consumer demand for natural colour alternatives to artificial additives, the industry is constantly searching for raw materials and extracts that can meet performance, stability and safety requirements. At the same time, the industry is increasingly demanding compliance with sustainability standards and practices. This is a reaction to the growing consumer attention to the provenance of food and beverages. Exporters that are able to combine these characteristics have a greater chance to access the European market successfully.

European countries that are interesting for exporters of natural food colours include Germany, the Netherlands, Spain, Italy, France, the United Kingdom and Denmark. These countries combine aspects like a sizeable food and beverage industry, an important role in the trade and/or formulation of natural food colours, and relevant imports of natural colours.

Contents of this page

1. Product description

In general, natural colours are an ingredient to enhance, strengthen or add colour to food, beverages and cosmetics, with the latter not being included in this study. Natural colours add or restore colour in food. In some cases, this is essential for the taste, as people “eat with the eye”.

Food colours are food additives that are added to foods to

- make up for colour losses due to light, air, moisture and temperature variations;

- enhance naturally occurring colours;

- add colour to food that would otherwise be colourless or coloured differently.

Food colours are contained in many foods, including snack foods, margarine, cheese, jams and jellies, desserts, drinks etc. Any kind of food colour has to be authorised for use in the European Union, as it must undergo a safety assessment. Once authorised, these substances are included in the EU list of permitted food additives laid down in Regulation EC 1333/2008, which also specifies their conditions of use. At present, 39 colours are authorised as colour additives for use in food. The existing legislation is consolidated into four simplified regulations covering all so-called food improvement agents (i.e. food additives, food enzymes and flavourings).

There is an essential distinction between food extracts as colours – food additives – and the term ‘foods with colouring properties’, mainly called ‘colouring food’.

A food additive is any substance not normally consumed as a food in itself and not normally used as a characteristic ingredient of food. Food additives are intentionally added to food for a technological purpose during manufacture, processing, preparation, treatment, packaging, transport or storage.

Food with a secondary colouring effect, i.e. food normally consumed as such or used as characteristic ingredients of food, should not be considered as food additives and can therefore be called colouring food. Food normally consumed as such in the EU – made from edible fruits, vegetables or other edible plants, juices, concentrates and others with colouring properties – would be regarded as an ingredient and would be labelled as such, even when added principally for colouring purposes. This is because it is manufactured using physical processes that result in concentrates in which the pigments have not been extracted selectively.

If the pigments in the original product are extracted selectively (relative to nutritive or aromatic constituents of the food), the extract is no longer considered as retaining the essential characteristics of the food and will be classed as a food colour. If, however, the extraction is not selective and the extract retains the same ratio of constituents as the starting product, it will be classed as colouring food.

Both colouring food and food colours (food additives) should be used in accordance with the rules of the EU General Food Law and other national rules that apply. When used as colouring food, the food also needs to comply with food legislation. Colouring food does not need to be designated as a food colour additive, i.e. by the name of its category “colour” and an E number.

Read the guidance note for more details, including on legislation.

The international HS code for natural food colours is HS 32030010 – colouring matter of vegetable origin. NB: other colouring matter of animal origin or cochineal (HS 320500050) may apply, but this is not the focus of this study. You may also refer to the CBI natural food additives study on oleoresins like paprika and turmeric.

Figure 1: Examples of natural food colours: turmeric, annatto seeds and safflower

Some of the most popular natural colours in the food sector are the following:

Annatto seeds

Annatto is a colourant – ranging from yellowish to deep, dark orange – derived from the seeds of the achiote tree (Bixa orellana). The seeds are used as a spice in traditional cooking in tropical regions, such as Peru, Brazil, Bolivia, Ecuador, Jamaica, East Africa and the Philippines. The reddish orange colour of the annatto mainly comes from the resinous outer covering of the seeds of the plant. The yellow to orange colour is produced by the chemical compounds bixin and norbixin, which are classified as carotenoids. The lipophilic colour is called bixin, which can then be saponified into water-soluble norbixin. This dual solubility property of annatto is rare for carotenoids. The seeds contain 4.5–5.5% pigment, which consists of 70–80% bixin. Unlike beta-carotene, another well-known carotenoid, annatto-based pigments are not vitamin A precursors. The more norbixin in an annatto colour, the more yellow it is; a higher level of bixin gives it a more orange shade.

Beetroot

Red derived from beetroot (Beta vulgaris) (E 162) is a natural colour containing a number of pigments, all belonging to the class known as betalains. The betalains and can be divided into two classes, the red betacyanins and yellow betaxanthins; both are very water soluble. The betalains have a limited distribution in the plant world and it would appear that betalains and anthocyanins are mutually exclusive. Plants producing betalains do not contain anthocyanins.

Concentrated beetroot juice is mainly used as food ingredient. The juice can also be spray-dried to a powder, though a carrier as maltodextrin has to be added, since the high sucrose content preludes direct drying of the juice. The application is confined to products that receive limited heat processing, have low water activity or a short shelf- life, due to the susceptibility of betanin.[1][MV1] It is the natural colour equivalent of raspberries or cherries.

Butterfly pea

Butterfly pea (Clitoria ternatea) has gained relevance over the last years on the European market. Grown in West Africa, but also in Asian countries such as Sri Lanka, the dried flowers are traditionally used as tea. The colouring properties of butterfly pea are also applied through grinded powder and extraction. Butterfly pea contains anthocyanins as well as p-coumaric acid and ferulic acid. Apart from anthocyanins, Clitoria ternatea petals contain several flavonoid compounds such as p-coumaric acid and ferulic acid.

For butterfly pea, read the novel food regulation on the latest developments and consult with the potential European partner.

Hibiscus

Hibiscus sabdariffa produces red calyces that are used in various food and beverage products. The extracted colour is also a good alternative for use in the cosmetic and pharmaceutical industries. Hibiscus is mainly known as an ingredient for the preparation of tea and other beverages, as the flavour of hibiscus is appealing to all age groups. The red pigments contained in red flowers of the Hibiscus species are anthocyanins and are widely used as colouring agents. The main anthocyanins found in Hibiscus sabdariffa are cyanidin-3-sambubioside and delphinidin-3-sambubioside. New developments such as freeze-dried powder extracts (stabilised with maltodextrin) offer a stable colourant for the industry.

Red cabbage

The demand for natural food colouring is growing because consumers are concerned about synthetic dyes and the impact on their health. Natural food dyes often come from vegetables and fruits, but a true blue is more difficult to obtain compared to other colours. It mainly comes from red or purple dyes. Researchers have recently obtained natural cyan blue from red cabbage. Red cabbage contains anthocyanins, which are water-soluble pigments. Blue anthocyanins exist in small amounts inside red cabbage, so it does not make commercial sense to attempt to extract them for the food industry. However, researchers used enzymes to convert other anthocyanins in red cabbage to the blue colour. This allowed them to extract large quantities of the blue colouring.

Saffron and safflower

Saffron has accompanied all civilizations, whether for its culinary role, for its quality as a dye or for its ancestral virtues rooted in folk medicine. Today, saffron is regarded as the most expensive spice, the “golden spice. The stigmas of Crocus sativus have a rich colour as well as an exquisite flavour and are rich in riboflavin, a yellow pigment, and vitamins. In addition, saffron contains crocin, the major source of yellow-red pigment. Α-crocin is a carotenoid pigment that is primarily responsible for saffron’s golden yellow-orange colour. The bitter glycoside picrocrocin is responsible for saffron’s flavour. Safranal is responsible for the aroma of saffron.

Similar in colour, but vastly different in price and taste, is safflower (Carthamus tinctorius). Safflower has been a valuable plant throughout the centuries, in particular as an oil seed, medicinal plant and source of carthamin, a dye. The safflower flower is the source of both the dye and the plant’s medicinal properties. Safflower contains carthamin, which produces a water-insoluble red dye, and carthamidin, which produces a water-soluble yellow dye.

Turmeric

The rhizome of turmeric has been used as a medicine, spice (one of the principal ingredients in curry powder) and colouring agent for thousands of years. Turmeric contains a chemical called curcumin, which gives a range of colour from yellow to a deep orange. Turmeric contains about 5% of volatile oil, resin and yellow colouring substances known as curcuminoids. Chemically, turmeric contains about 50–60% curcumin, which is responsible for the yellow colour of the natural colourant. Curcumin is a pure colourant and contains little of the flavour components. These are obtained from the oleoresin by crystallisation and have a purity level of 95% (under EU rules, this should not be less than 90%).

Turmeric powder is insoluble in water and imparts colour by dispersion or dissolution only. In processed foods, turmeric is mainly used as an oleoresin, as it contains the flavour and colour compounds in the same relative proportion as present in the spice. It has several advantages over ground spice and contains approximately 37–55% curcumin (see also the CBI study on oleoresins).

Tips:

- Always keep an eye on the latest developments and legal requirements regarding natural colours. Pay special attention to the novel food regulation, E numbers and general regular updates.

- Take a close look at the guidance note on the classification of food extracts with colouring properties, based on Regulation (EC) No 1333/2008, as well as the European Commission’s info on food improvement agents.

- Stay informed about state-of-the-art natural colour processing, as research and development departments work intensely on challenges such as instability, reactivity with other food components and other factors. Subscribe to international newsletters and magazines about food processing technologies and keep yourself informed about the developments of main players such as Döhler.

- Check with potential European partners what applications and product categories your natural food colour could provide solutions for.

- Review quality standards by industry associations, such as the Natural Food Colours Association (NATCOL).

2. What makes Europe an interesting market for natural colours?

Europe has a large food and beverage industry that demands natural food colours for various applications. European consumers are paying more attention to the ingredients in their food and beverage products, so there is a growing demand for healthier food and beverage products that contain natural ingredients. This presents an opportunity for suppliers of natural food colours in developing countries. Demand for natural food colours also stems from an increasing substitution of artificial colours due to stricter EU legislation. Constant product safety assessments and bans by European authorities lead to the adoption of lower-risk and natural alternatives by the industry.

A large food and beverage industry drives demand for natural colours in Europe

The European food and beverage market is one of the largest in the world. According to Food and Drink Europe, the industry has a turnover of nearly EUR 1.1 trillion. The size of the European market as well as its long-term growth prospects are attractive to suppliers of natural food colours from emerging markets and developing countries.

Some of the main players in the EU’s food and beverage industry are among the largest end users of natural food colours. For example, the dairy industry accounts for around 15% of the industry’s total turnover, while the bakery industry accounts for another 11%. Dairy and confectionery are the leading product categories for food colours, followed by desserts, ice cream, juices, bakery products, chocolates, snacks, ready meals, soft drinks, sauces and seasonings.

As a result, European demand for natural food colours continues to grow. The European market for food colours is projected to increase at an annual rate of 3.8% between 2020 and 2025. Europe is considered a global frontrunner in the use of natural food colours, followed closely by the USA.

Natural food colouring in the food and beverage industry is gaining popularity, with an increasing number of natural food colours being produced commercially. The main market drivers in Europe are related to a growing demand for clean-label foods and health awareness.

Also, several European companies that produce items like convenience foods have started using natural food colour ingredients in food manufacturing to provide added value and differentiate their products from those of their competitors. This factor also plays an important role in driving sales of natural food colours in Europe. For example, around 95% of new coloured meat alternative solutions contain natural food colours. The confectionery sector is also seen as interesting for natural colour applications in Europe.

The European market uptake of natural colours drives up imports

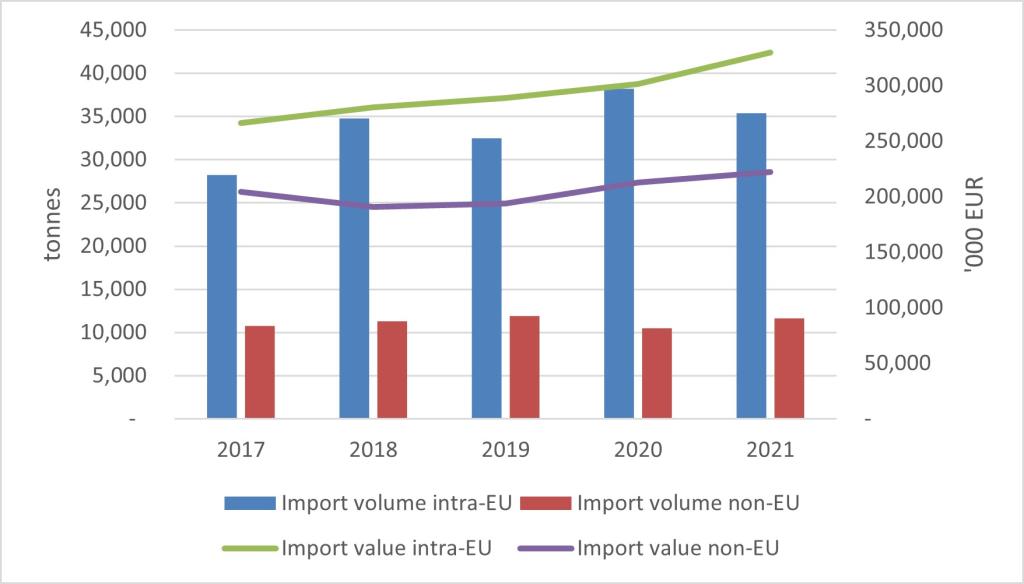

The increased use of natural colours in several food categories in Europe is driving up imports of various plant-based alternatives. European imports of products under HS code 32030010, which covers colouring matter of vegetable origin, have increased consistently over recent years.

In 2021, EU imports amounted to EUR 552 million or 47,000 tonnes, having increased at an annual average rate of 4.1% in value and 4.8% in volume since 2017. Around 75% of imports are sourced from intra-EU suppliers, but supplies from non-EU sources showed a steady annual growth of 2.2% in value and 1.9% in volume in the same period.

Figure 2: EU imports of colouring matter of vegetable origin (HS 32030010), intra-EU and non-EU suppliers, 2017–2021, values in EUR 1,000, volumes in tonnes.

Source: Eurostat, 2022

The EU’s regulatory framework favours natural colours

Consumer demand for sustainable and plant-based options has been a key driver for the natural food colours industry. According to the online platform FoodManufacture, the EU’s regulatory framework is also a major driver. All food colours and other additives in the EU must be authorised and listed with conditions of use in the EU’s positive list based on:

- a safety assessment;

- the technological need;

- ensuring that use of the additive will not mislead consumers.

Food colours undergo continuous EU safety evaluations over the years, conducted by scientific experts. Based on these evaluations, the European Food Safety Authority (EFSA) may decide to ban the use of specific colours by the European food industry. This is increasingly happening to non-natural colours, which is leading to the increasing use of fruit, vegetable and other plant alternatives by the industry.

For example, titanium dioxide (E 171) was recently deemed unsafe for use in food by EU authorities. It was mainly used in bakery products, sweets, chewing gum, soups, broths, sauces and spreads to give a white opaque effect. In a series of evaluations, this non-natural colour presented a concern related to genotoxicity, which may cause cancer. Following the ban, the European market was left with a significant gap in the white colour category. This led to a wave of reformulations by European manufacturers, using fruit, plant and vegetable alternatives. Plant-based alternatives include those developed by companies like Exberry (GNT Group), which uses rice starch in its Shade White – HP Powder formulation. ADM presented a plant-based solution called PearlEdge, made from corn starch, and several other companies like Givaudan and Döhler have come forward with natural-based solutions.

Due to stricter regulation, safer, natural alternatives are being adopted across the board for all colours and food categories in Europe. This has opened up opportunities for exporters of natural food colours, especially those with a consistent colour intensity, stability upon exposure to light and heat, consistent supply, no reactivity with other food components and no secondary flavours and odours. Note that natural food colours are also subjected to re-evaluations by European authorities, as in the case of annatto. This makes it essential for suppliers to prove the safety of specific natural alternatives as well.

Tips:

- In order to target the correct industry, investigate the specific application areas for the natural food colours that you export. You can use the European Commission’s food additives database to search by E number, name or synonym, but you can also check the catalogues of different industry players such as Sensient, Exberry (GNT Group) and Oterra to identify the application areas for each natural colour.

- Visit the website of the Natural Food Colours Association (NATCOL) to stay up to date with regulatory changes, the addition of new members and other relevant news items that might impact your business.

- Provide complete product documentation to your potential European buyers, highlighting the performance, stability, consistency and safety of the natural colours. If you are dealing with a new product, make sure to have a dossier to back up your claims. Refer to CBI’s workbook on how to prepare a dossier for food additives for more information on this subject.

- Stay up to date with the European food and beverage market, specifically with developments in the natural food colours category, by regularly visiting relevant websites such as Food and Drink Europe, Food Navigator and Food Ingredients First.

3. Which European countries offer most opportunities for natural colours?

European countries that are interesting for exporters of natural food colours include Germany, the Netherlands, Spain, Italy, France, the United Kingdom and Denmark. These countries combine aspects such as a sizeable food and beverage industry with a particular focus on end users that demand natural food colours, an important role in the trade and/or formulation of natural food colours and relevant imports of vegetable-origin food colours, with special attention to suppliers from non-EU countries.

Table 1: Imports by selected European markets of natural colours (HS 32030010) in 2021

| European market | Imports in 2021, in EUR 1,000 | % value change (2017–2021) | Imports in 2021, in tonnes | % volume change (2017–2021) | Main non-EU suppliers |

| Germany | 85,136 | 2.0% | 4,802 | -0.2% | China (20%), India (6.2%), Australia (4.9%), Turkey (4.2%), United States (3%) |

| The Netherlands | 81,321 | 10.5% | 8,243 | 10.9% | United States (16%), China (11%), Israel (7.7%), India (3.6%) |

| Spain | 80,777 | 1.4% | 4,609 | 1.8% | China (47%), United States (13%), India (11%), Turkey (0.6%), Peru (0.5%) |

| Italy | 69,077 | 10% | 9,416 | 7% | China (6.6%), India (6.4%), United States (3.8%), Israel (1.3%), Peru (0.8%), Mexico (0.2%) |

| France | 65,307 | 1.8% | 5,000 | 3.1% | United States (19.1%), China (5.7%), India (5.6%), Mexico (1.7%) |

| United Kingdom | 46,783 | -0.9% | 3,621 | -13.3% | China (15.9%), India (5.4%), United States (2.2%), Peru (1.2%), Hong Kong (1.2%), Kenya (1.0%) |

| Denmark | 39,614 | -3.1% | 2,931 | -4.8% | Peru (18%), China (15%), United States (9%), India (4.1%), Ecuador (2.3%) |

Source: Access2Markets/Eurostat and ITC Trade Map 2022

Germany

Germany is Europe’s largest importer of plant-based natural colours. It caters to several end-using industries, which also makes it the largest European food and beverage manufacturer.

German imports of natural colours increased steadily between 2017 and 2021 with an overall growth in value of 2.0% in this period, while the volume decreased slightly by 0.2%. Around 46% of Germany’s imports in 2021 were sourced from non-EU countries. One-fifth of total imports in 2021 were sourced from China and India (6.2%), followed by Australia (4.9%) and Turkey (4.2%). Imports were sourced from South Africa, Peru and Indonesia to a much lesser extent (about 1.0%).

According to Food and Drink Europe, Germany had the second-largest food and beverage market in Europe in terms of turnover in 2019. Also, the food and beverage industry is the fourth-largest industrial sector in Germany. Meat, dairy and bakery products are key in Germany. As the main areas for the use of natural colours, they are pushing the market forward. The expected compound annual growth rate (CAGR) between 2020 and 2025 is 3.4%.

Moreover, the organic food market in Germany is the largest in Europe. Growing food safety concerns and the pressure to adopt a clean label have created an innovative environment in the Germany food and beverage sector, aimed at developing natural colours that meet this consumer demand.

Major German companies active in natural colours are the multinational ingredient formulator Symrise, which has a 70-year tradition in the industry with its SymColor® range, and Döhler, which sources ingredients worldwide in a vertically integrated manner. Brenntag is another German multinational active in natural colours, among several other natural ingredients. Another interesting Germany-based company is ADM, which offers formulations of a wide range of colours, including yellow, red, green and blue.

Other German companies like TER Ingredients and BIOSS offer the full service of product and colour development, as the use of natural colours in food and beverages requires innovative technologies and expertise. Roeper and All Organic Treasures (specialised in organic ingredients) are interesting German-based trading companies active in natural colours.

The Netherlands

In the Netherlands, the main industry that uses natural food colours is the cheese industry, followed by the meat and beverage industries. With a 10% increase in volume and value between 2017 and 2021, the Netherlands is a fast-growing importer of natural colours. Over 40% of Dutch imports were sourced in non-EU countries in 2021. These mainly originated from the United States (16%), China (11%), Israel (7.7%) and India (3.6%).

The Netherlands is a significant entry point of ingredients into Europe. This is partly due to re-exports to other European countries as well as a strong ingredient processing industry. It is expected that the Dutch industry will continue to grow in the coming years.

With examples such as Exberry (part of GNT), a major food colour formulator, the Netherlands aggregates much know-how on food colours. Ingredient formulator DSM (now part of the Firmenich group) and the trading companies Holland Ingredients and Caldic are also examples of internationally-active companies working with natural food colours.

Spain

Spain is the third-largest importer of products under HS code 32030010. Imports of this group grew slightly but steadily between 2017 to 2021 by 1.4% in volume and 1.8% in value, amounting to 4,609 tonnes and about EUR 80 million. Spain has one of the largest shares of imports originating from non-EU countries, at over 70% of total imports. Among non-EU suppliers, Spain sources natural food colours from China (47%), the United States (13%), India (11%), Turkey (0.6%) and Peru (0.5%).

Spain’s food and beverage market is the fourth-largest in the European Union. The organic food and beverage market is also growing steadily each year, as is the food colourant market with a CAFR forecast of 3.6% until 2025.

Spain has one of the most active food colour industries in Europe. Among the main Spanish companies specialised in food colours are Sancan, which provides solutions for several product categories from meat to a vegan and vegetarian range, and Coralim, which also offers tailor-made solutions in natural colours and ingredients like flavourings and anti-oxidants. PROCONA (part of the SEIMEX Group) is one of the main natural colour formulators in Spain, founded more than 20 years ago and specialising in a wide range of colours. Other interesting Spanish companies are Secna, Sancolor, Colorante Campanar and Flavorix Aromáticos, in addition to ingredients trader Bidah Chaumel.

Italy

Italy has a smaller market for natural food colours, but is still interesting to exporters in developing countries. The country registered a growth in import volume ten times larger than Spain’s between 2017 and 2021. This goes back to increasing consumer alignment of natural foods with superior quality. Consumers accept and recognise colours derived from well-known and locally-available plant sources such as beetroot, paprika and others. Italy also has one of the largest markets for organic products in Europe, which is growing at a steady pace.

Main non-EU suppliers to the Italian market are China (6.6%) and India (6.4%), followed by the United States and Israel, Peru and Mexico. Interestingly, a much higher percentage of Italy’s natural colour imports are sourced from EU countries Spain, France and Germany.

Some of the main importers and formulators of natural colours in Italy are Aromata Group and D-Ingredients, in addition to international companies with branches in Italy like Brenntag and Sensient.

France

France is one of the leading European importers of ingredients for the food and beverage industry. France has a strong, leading food and beverage market and its organic market is the second-largest in Europe. The demand for organic products has been increasing over the last decade, and continuous growth is expected. This is also true for the food colour market, which has one of the highest potentials in Europe.

French imports of natural colours increased annually by 1.8% in value and 3.1% in volume between 2017 and 2021. About half of French imports were supplied by non-EU countries. Just as the other European importing countries, France mainly sources from the United States, China, India and Mexico. France also sources a high share of natural colours from the UK. Within the EU, France’s main supplier of natural colours is the Netherlands.

France is home to Naturex (now part of the Switzerland-based multinational Givaudan), one of the main natural extract companies worldwide engaged in sourcing, producing and selling natural ingredients for the food, health and beauty sectors.

The United Kingdom

Outside the EU, the United Kingdom (UK) has one of the largest consumer markets in Europe. According to the UK Food and Drink Federation (FDF), the country’s food and beverage sector generated about EUR 120 billion in turnover in 2020.

The UK market for organic food and beverages is also growing. Rising consumer awareness and growing demand for natural and healthier food and beverage products are major drivers.

Imports of natural colours increased steadily until 2020. The 2020–2021 Brexit period led to a drastic decline in imports, amounting to a decrease of 13.3% in volume between 2017 and 2021. In 2021, 16% of British imports were sourced from China and 5.4% from India. Other smaller suppliers of natural colours were the USA (2.2%), Peru and Hong Kong (1.2% each).

The main importers in the UK are Dura Color, Plant-Ex and ScotBio. The latter company developed ScotBio Blue, a natural blue colourant extracted from spirulina suitable for use in food and beverages, but also as a nutraceutical ingredient or in cosmetics. The UK has a Food Additives & Ingredients Association (FAIA) that can be an interesting starting point to search for potential buyers.

Denmark

The Danish natural food colour industry is home to the world’s largest natural colour company, Oterra – previously known as Chr. Hansen. The company has expanded significantly in recent years through a series of acquisitions. Food Ingredients Solutions, Diana Foods and SECNA are among the companies that are now part of the Oterra group. These acquisitions give Oterra access to several markets and segments; for example, Diana Foods is specialised in beetroot red and organic colours. Other relevant importers of natural colours in Denmark are Dairy Food Denmark and Chromologics.

Denmark is among Europe’s main importers of natural colours from non-EU countries (more than half of total imports), though although imports decreased in both value (-3.1%) and volume (-4.8%) between 2017 and 2021. Main suppliers are Peru (18% of total Danish imports), China (15%), the USA (9.0%), India (4.1%), Ecuador and Kenya (2.8% each).

In 2020, Denmark had the largest organic market share in the EU (13%), with Danes spending the most on organic food per capita. Consumers focused on health, well-being and nutrition – attributes associated with organic and naturally produced food. This entails a high interest in natural food additives, including colours, and a focus on healthy and natural colours as substitutes for synthetic ingredients.

Tips:

- Check the list of members of the Natural Food Colours Association to identify the main European and international companies active in this sector.

- Conduct additional market research to obtain a greater insight into the differences between the countries mentioned above. Use free statistical databases such as ITC Trade Map or Access2Markets.

- Read further CBI studies on the European natural food additives market – particularly the study covering the European market for oleoresins, which are also used as a natural food colour.

- Visit trade fairs and/or check their exhibitor lists to identify interesting buyers in individual European countries. Examples include Food Ingredients and Health Ingredients Europe, Vitafoods, Anuga and SIAL for food products and ingredients, and Biofach specifically for organic products and ingredients.

- Make sure to read the CBI module on finding buyers for food additives to identify potential commercial partners in different European countries.

4. Which trends offer opportunities on the European natural colours market?

The European market for natural food colours is driven by innovation, health, safety and sustainability. Due to an increasing consumer demand for natural colour alternatives to artificial additives, the industry is constantly searching for raw materials and extracts that can meet performance, stability and safety requirements. At the same time, the industry is increasingly demanding compliance with sustainability standards and practices. This is a reaction to the growing consumer attention to the provenance of food and beverages. Exporters that are able to combine these characteristics have a great chances to access the European market successfully.

Increased innovation in natural food colours to meet consumer demand in Europe

The trend for food and beverages with a clean label is driving the growth of natural colours in the European industry. European consumers demand natural products containing natural ingredients that have undergone little processing. Long and complicated names and lists on products labels are becoming less and less attractive to them. This is because concerns over the safety and allergenic characteristics of added ingredients have been growing steadily in recent years, especially with regard to synthetically produced ingredients.

The demand for natural food colours continues to challenge the industry and push for more innovations that could replace synthetics. For example, Nestlé switched the colour source of Butterfinger’s yellow centre in 2017 from Yellow 5 and Red 40 to annatto, derived from the seeds of the achiote tree. In another example, Sensient offers a wide range of natural orange colours from vegetable origin, including annatto, paprika and carrot, that are suitable for several applications across various end-using industries.

Innovation in natural food colours to mitigate the challenges faced by the food industry is key to meeting this consumer demand. The search for natural colours that combine performance, safety and supply reliability is coupled with the need for tailored solutions. The industry has been experimenting across several colours. For example, GNT offers spirulina-based colour powders for food and beverage formulators that need high-intensity blues form a natural source. Colours like yellow turmeric, red elderberry and cranberry extracts are also increasingly used.

Novel ingredients like butterfly pea (Clitoria ternatea) and genipapo/jaguá (Genipa americana) are among several that are not yet approved by EU authorities for use as a food colour. In spite of the regulatory hurdle in the EU, these might provide future opportunities. It is therefore important for exporters of innovative natural food colours to keep an open dialogue with buyers in the European market, including formulators and end-using industries across different segments.

Tip:

- Make sure to provide clear and complete product specifications to potential European buyers. Also pay special attention on how you present your product and company to potential European buyers and include product specifications, certificates, packaging and unique selling points (USPs). Buyers can use this information when approaching food and beverage companies. Take a look at an example from the Peruvian company Imbarex. Besides its various food safety certificates, the company highlights the farmlands where its crops are produced. Imbarex also presents complete product information on its website; for example, look at its product specifications for annatto.

European plant-based diets are a growing market for plant-based colours

Plant-based products continue to drive the demand for natural food colours on the European market. With the increase in the number of flexitarian and vegan consumers in Europe, the demand for natural food colours from vegetable origin has also grown significantly. Products like plant-based yoghurts, dairy-alternative drinks and vegan cheeses are driving up demand for colours that offer a sensory experience without compromising on taste.

Also, foods containing red colours are often avoided by vegan consumers or those that follow Halal or Kosher diets. This is because red food colours are normally derived from carmine, which is extracted from insect shells. This opens up opportunities to suppliers of plant-based alternatives. Natural red colours based on anthocyanins and beetroot are the most common replacements for carmine.

Plant-based diets also require more complex solutions to make products like meat substitutes more visually appealing. For example, Naturex (part of Givaudan) launched a product line made from beetroot and other natural extracts called VegebriteTM Veggie Reds, aimed at achieving an authentic meat-like colour in meat substitutes.

Tip:

- Keep an eye on international events like trade fairs specialised in vegan and flexitarian diets to identify existing opportunities and potential applications for your natural food colours. Examples include the Free From Functional Food Expo in Amsterdam or Veggie World in Hamburg.

Growing European demand for ethical and traceable value chains

European consumers are looking for more transparent labelling of the food and beverage products they consume. Part of this trend is related to ingredients such as food colours; consumers want ingredients to be instantly recognisable and understandable and to know exactly where they come from. This has a direct influence on consumer demand for more ethical and traceable ingredients with evidence-based stories. Market Insights ranked storytelling as the No. 1 trend among its top 10 trends in 2020.

As a result, ingredient transparency has become an important buyer demand in Europe and on other international markets. US-based DDW The Color House’s chlorophyll green, for example, is fully traceable to the site where it is grown in the UK. The demand has also prompted the industry to adopt codes of conduct that safeguard harmonious interpretation and practices related to this subject. The NATCOL Code of Conduct, adopted by industry leaders like GNT, defines principles regarding the classification, sourcing, manufacturing, quality and safety of natural food colours.

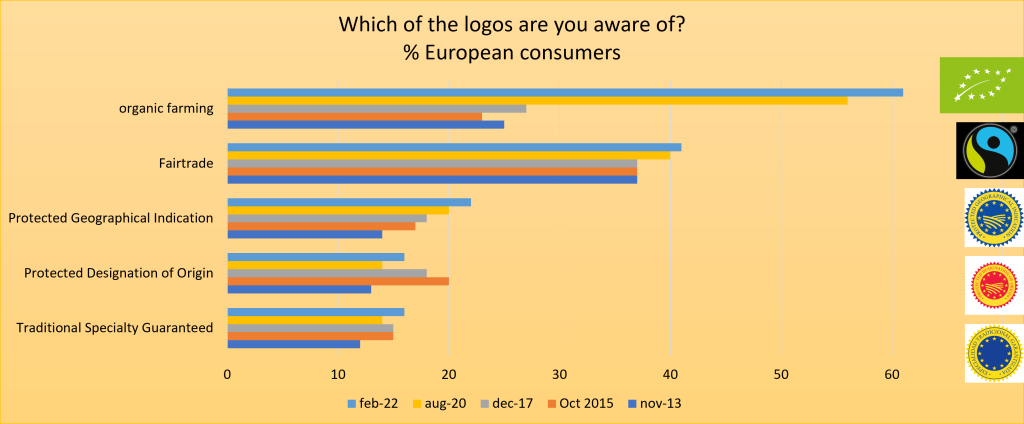

This development has also influenced the uptake of sustainability certification by the natural food colours industry. According to European industry sources, organic certification is growing steadily, but not for all natural colours. Some interesting organic-certified colours are safflower (example: GNT), turmeric and paprika. Organic certification has become a minimum requirement for some natural food colours and other extracts. This is due to concerns over food safety, in particular with regard to pesticide residues and other cross-contamination sources in the ingredient supply chain. In addition, the various extraction processes have the potential to activate impurities found in the botanical ingredient. To the consumer, organic certification communicates the idea of healthier and safer ingredients.

Figure 3: Awareness of the ‘organic farming’ logo is increasing fast

Source: Special Eurobarometer 520, Summary

The demand for organic certification also goes hand-in-hand with specific buyer requirements as to the level of other food safety certifications (ISO22000 and GFSI-compliant certifications), corporate social responsibility (CSR) and voluntary sustainability standards (VSS), including the standard defined by the Sedex Members Ethical Trade Audit (SMETA).

Due to the high priority that sustainability has on the international agenda, European companies are also looking into projects related to social and environmental impact that they can develop at source. For example, take a look at the sustainability page of German company Döhler.

Compliance with international standards and certification can be added to an exporter’s marketing story. Not only food safety, but also the social component is interesting to European consumers potential buyers. Offering buyers and consumers an insight into how ingredients are produced and sourced contributes to building trust. One of the main advantages of storytelling is its ability to a convey a brand's sustainability efforts.

In this social context, Fair Trade certification is currently less relevant for natural food colours, but it can still be used to support an ethical claim.

Tips:

- Importers in Europe increasingly apply food safety standards. HACCP is mandatory and ISO22000 is becoming a minimum requirement. GFSI-accredited certifications such as FSSC22000 and BRC are preferred.

- Work out a marketing story for your natural food colour. Think of questions like: What sets your product or your company apart from competitors? For example, does it have an exotic origin? Can you link it to a traditional use in food? What benefits do you provide to local communities? Determine which story is the most attractive for your target market segment.

- Be prepared to support statements that you make with documentation. Consumers in Europe are increasingly interested in the social component of your product and your company. Be ready to prove your policies on corporate social responsibility (CSR).

- Be open to visits from buyers to your facility. If you are transparent and create a trustworthy partnership, importers will be more open to buying the value-added natural colour from your country instead of purchasing only the plant material.

This study was carried out on behalf of CBI by Teresa Hüttenhofer and Gustavo Ferro.

Please review our market information disclaimer.

Search

Enter search terms to find market research