Entering the European market for natural syrups

To export natural syrups to the European Union, producers must comply with strict EU safety, quality, and sustainability standards. Buyers require proof that the product meets these requirements, and any safety concerns can lead to the product being removed from the market. Natural syrups enter the market mainly through importers and distributors. Competition is fierce, between natural syrups, as well as from other natural sweeteners and artificial syrups. To stand out, you must understand the specifics of the product you sell, its composition, functionality and nutritional profile, and find your unique selling points.

Contents of this page

- What requirements and certifications must natural syrups meet to be allowed to enter the European market?

- Through which channels can you get natural syrups onto the European market?

- What competition do you face in the European natural syrups market?

- What are the prices of natural syrups in the European market?

1. What requirements and certifications must natural syrups meet to be allowed to enter the European market?

You can only export natural syrups to European Union (EU) members if you comply with strict EU requirements. For a complete overview of these standards, refer to our study on buyer requirements for natural food additives or consult the specific requirements for your product in Access2Markets by the European Commission.

Buyer requirements can be divided into:

- Mandatory requirements: legal requirements you must meet to enter the market;

- Additional requirements: those you need to comply with to stay relevant in the market;

- Niche requirements: apply to specific niche markets.

What are the mandatory requirements?

Natural food additives must be safe for human consumption when entering the European market. That is why legal requirements mainly deal with food safety, food hygiene, and traceability. The hygiene of foodstuffs regulation requires you to have a Hazard Analysis and Critical Control Point (HACCP) system in place, if you are a food processor of natural syrups.

The EU has set specific requirements that require you to avoid specific sources of contamination, namely:

- Pesticides: consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide.

- Contaminants in food and microbiological contamination of food. Regulation (EU) 2023/915 sets maximum levels for certain contaminants in food, including mycotoxins, metals and processing contaminants. Regulation (EC) No 2073/2005 lays down food safety criteria for microbiological contaminants, such as Salmonella.

- The use of extraction solvents for foodstuffs and food ingredients is regulated by Directive 2009/32/EC. Annex I contains a list of the authorised extraction solvents for use in food and the conditions of use. The permitted extraction solvents are propane, butane, ethyl acetate, ethanol, carbon dioxide, acetone and nitrous oxide. This means, for example, that sulphur dioxide extraction is not authorised. Remember that extraction processes can amplify even minimal pesticide residues present in your product. It is, therefore, important to carefully monitor your laboratory tests to ensure you meet the MRLs.

What additional requirements and certifications do buyers often have?

Buyers demand proof of your product’s safety and proof that your product meets the quality and sustainability requirements before they buy from you. If European companies or authorities find out that the safety of your product cannot be guaranteed, they will take the product off the market.

Documentation

European buyers of natural syrups expect exporters to provide clear and organised product and company documentation. This helps them verify that you meet their quality standards and requirements. The main documentation buyers will expect from you are:

- Technical Data Sheet or Specification (check this example from Ricels, Pakistan)

- Certificates of analysis – CoA (see this example from Leroma, Germany – please note: link automatically downloads pdf file)

- Certificate of origin (see this example)

Depending on your buyer’s requirements, you may also be required to submit other certifications and documents, such as non-GMO or gluten-free certifications, or an allergens declaration.

Food safety management

In addition to the required HACCP standard, European buyers increasingly want suppliers to follow more complete food safety standards or use food safety management systems. ISO 9001:2015 is an industry (management) standard that sets out the expectations for a quality management system. Examples of food safety management systems include ISO 22000, FSSC22000, IFS, and BRCGS.

Quality requirements

Adulteration (the intentional addition of undeclared substances to a product) is a serious issue. There have been cases of adulteration with natural syrups, for instance with agave syrups. Adulteration causes the product to become unusable for the buyer. It loses the necessary properties to fulfil its intended function, and purification is usually either impossible or too costly.

Strict controls are in place in Europe to detect potential adulterants. For instance, in the case of agave syrup, the Mexican Standard regulates many parameters, such as water content, sugar content, pH-value and microbiological criteria. In addition to these parameters, international laboratories such as QSI Bremen (Germany) have tests to provide the verification of authenticity of agave syrup.

If adulteration is detected, you as a supplier will not be paid for your products and you will lose business from your buyer. European buyers regularly test products they buy, usually on a batch basis, to ensure that products meet the quality requirements and are not adulterated or contaminated.

You need to supply quality consistently to keep your client satisfied. To minimise variations in quality, you could develop Standard Operating Procedures (SOPs), which include instructions on how to conduct specific activities in production.

Sustainable practices

European buyers are increasingly pressured by EU legislation to ensure their supply chains are transparent and traceable. Therefore, when selecting product suppliers, they demand a transparent supply chain. Buyers want guarantees that the product they buy matches the product specifications and can be traced back to the source.

Buyers expect their suppliers to provide them with all the necessary information. It is common practice that buyers require their suppliers to follow and sign their supplier codes of conduct. Such codes are based on, for instance, the Ethical Trading Initiative Base Code. It focuses on issues such as human rights and fair working conditions. See this supplier declaration of Norevo’s code of conduct for an example.

For exporters, this means it is important to have information on production and labour practices, as well as environmental issues. Implementing an environmental management system, such as ISO 14001, will help you improve environmental performance through a more efficient use of resources and reduction of waste.

Supplier Ethical Data Exchange (SEDEX) is another standard that is used commonly by European buyers. SEDEX principles are used to assess audit suppliers. Becoming a SEDEX-certified member can be an advantage, especially if you wish to supply larger companies.

Packaging requirements

Packaging must be safe for consumer health and for the environment. Specific packaging requirements may differ per buyer and per product. Typically, bulk liquids imported into Europe and intended for industrial use are packed in steel or plastic drums of 200 litres, or in IBC containers. In the case of drums, buyers strongly prefer steel drums over plastic drums because of handling and quality. Due to the weight of syrup, plastic drums may collapse when stacked. In practice, this also means that storage of plastic drums requires more space. Moreover, importers’ equipment is not always suitable for plastic, which may break as it is less durable. Plastic is also more permeable, which means that syrup is more easily contaminated by, for example, materials/liquids on the floor.

There are some additional general requirements you will have to take into account. These include:

- Always ask your buyer for their specific packaging requirements.

- Clean and dry the drums before filling them to prevent contamination.

- Store drums or containers in a dry, cool place to prevent quality deterioration.

- If you offer organic-certified ingredients, physically separate them from products that are not certified.

Figure 1: IBC container and steel drum

Source: AB’s Honey, 2023

Labelling requirements

Labelling your products for export is mandatory and mainly serves traceability and safety purposes during transport and storage. Use the English language for labelling unless your buyer has indicated otherwise. Labels of products must include the following:

- Product name

- Batch code

- Place of origin

- Name and address of exporter

- Date of manufacture

- ‘Best before’ date

- Net weight

- Recommended storage conditions

If you supply organic ingredients, your label needs to include the name/code of the inspection body and certification number.

When supplying syrups in final consumer packaging, be careful not to make health claims relating to the low glycaemic index, as European legislation does not allow this.

What are the requirements for niche markets?

Having specific product certification for your syrups can add value to your product and can open up specific market segments for you. The most common certifications for natural syrups are:

- Organic: Organic certification acts as a quality control system and can help improve your quality image and traceability performance. Regulation (EC) 2018/848 sets down rules on organic production and labelling in Europe. Refer to this list of recognised control bodies and control authorities issued by the EU to ensure that you always work with an officially-recognised accredited certifier.

- Fairtrade: Although less common, some buyers offer Fairtrade-certified syrups. For instance, Tuchel & Sohn offer Fairtrade-certified coconut blossom syrups. To sell Fairtrade-certified syrups, you must comply with the standards set by Fairtrade International. The accredited certifier for Fairtrade is FLOCERT. You are only allowed to put the Fairtrade logo on your product after accreditation.

- Kosher and halal: Although actual demand for kosher and halal products is limited, demand for certification of compliance with these religious standards is on the rise. Kosher and/or halal certification allows food manufacturers to use the ingredients in kosher and halal products. European buyers aim to prevent exclusion from these markets. Many European buyers therefore now require kosher and/or halal certification.

Figure 2: Examples of certification standards for sustainable production

Source: various certification standards, 2024

Tips:

- Establish a traceability system and keep samples from each of your suppliers to trace the origin of a product in the event of non-conformity.

- Keep your facilities clean by setting up strict operating procedures, such as cleaning schedules for your processing equipment.

- Search the European Union’s Rapid Alert System for Food and Feed (RASFF) database to see examples of withdrawals from the market and the reasons for these withdrawals.

- Only agree to European buyers’ specific requirements if you can actually meet them, as failure to do so may end your business relationship.

- Read about payment and delivery requirements in the CBI Tips for organising your natural food additives export to Europe.

2. Through which channels can you get natural syrups onto the European market?

Natural syrups are primarily used as ingredients in a wide range of applications within the food and beverage industry. However, there is also a market for natural syrups as retail products for home consumption. The most common route to entering the European market for natural syrups is through importers and distributors.

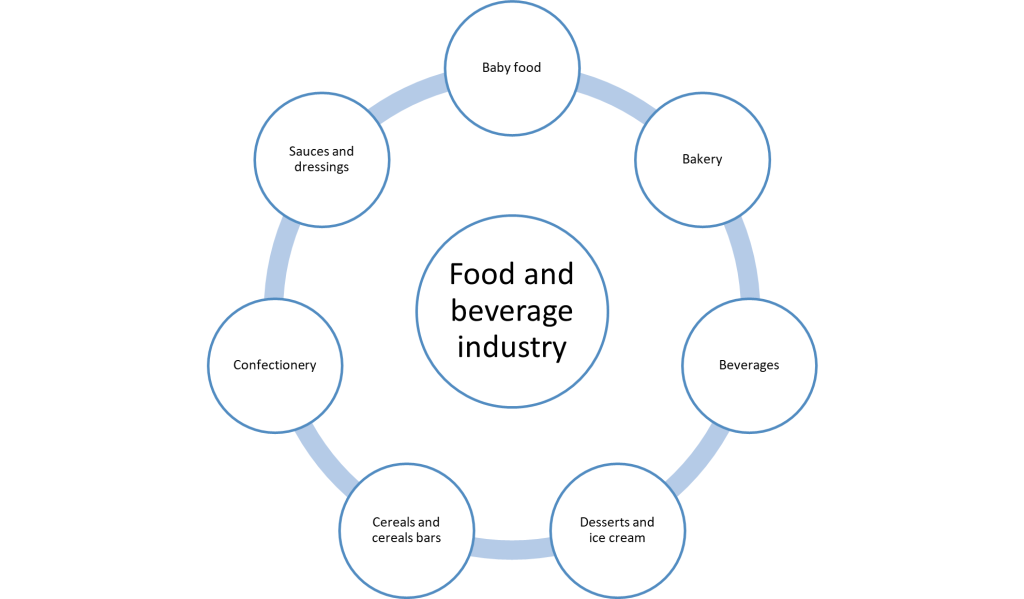

How is the end-market segmented?

The European market for natural syrups can be divided into several industries, including consumption for home use, or as an ingredient in food and beverage and health products. While natural syrups have diverse applications, this study focuses primarily on their use in the food and beverage industry. Within this sector, the market can be further segmented based on specific applications. The figure below illustrates the key end-market segments for natural syrups in the food and beverage industry.

Figure 3: End-market segments for natural syrups in the food and beverage industry

Source: ProFound, 2024

Natural syrups are widely used by food and beverage manufacturers as a versatile sweetener. Their applications are very wide, from baby food to baked goods, confectionery, sauces, and dressings, and they are also popular as table-top sweeteners for direct consumption by the consumer.

Beyond sweetness, these syrups offer important functional benefits such as enhancing colour, adding viscosity, serving as coating or binding agents, and more. Continuous innovation by food processors is driving the development of natural sweetening solutions, with growing health consciousness and the demand for vegan-friendly options as key drivers behind the increasing use of natural syrups in the industry.

The EU food and drink industry registered a turnover of €1,112 billion in 2020. The meat sector is the EU’s largest sub-sector with a 20% share, followed by dairy products (16%), drinks (13%), baked goods (11%), and other various food products (16%). The largest food and drink industries are found in France (€228 billion turnover in 2021), Germany (€186 billion), Italy (€155 billion) and Spain (€145 billion).

Tip:

- Follow food and beverage sector trends to see which natural syrups have more applications in the market. You can visit the websites of European sector associations to learn about specific sub-sectors of the industry. For instance, refer to EUROGLACES – European Ice Cream Association, FEDIMA - Federation of EU Manufacturers and Suppliers of Ingredients to the Bakery, Confectionery and Patisserie Industries or ENSA – European Plant-based Food Association.

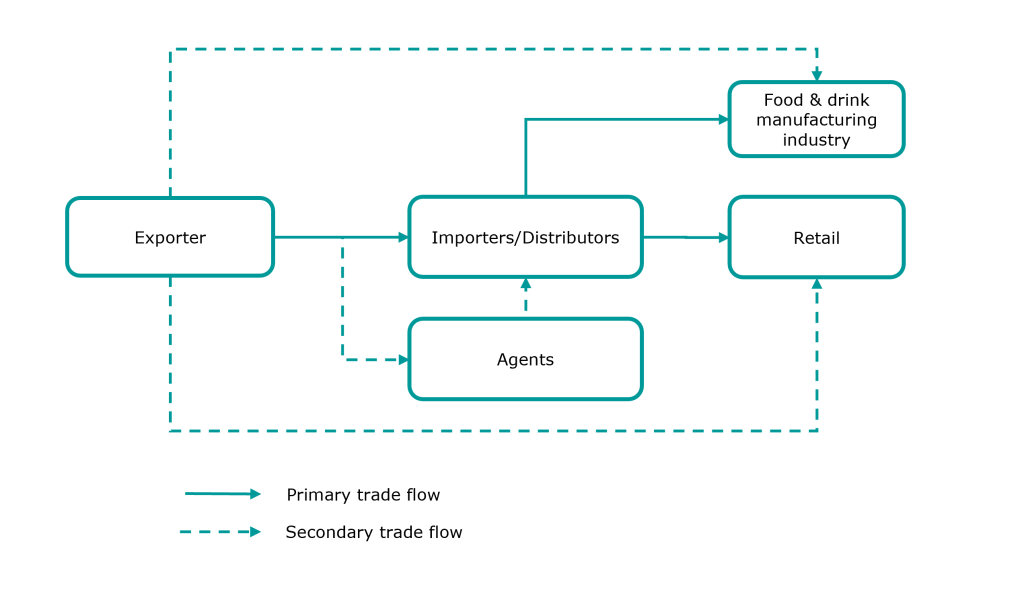

Through which channels does a product end up on the end-market?

The main channels to the European market are importers and distributors. The figure below shows the most common market entry channels for natural syrups.

Figure 4: Simplified market entry channel visualisation for natural syrups

Source: ProFound, 2024

Importers/Distributors

European importers and distributorsare your most important entry point. They buy syrups directly from exporters or through agents. Their clients include processors and food and drink product manufacturers as well as retailers. The role of importers and distributors is important as not all food manufacturers have the expertise and their own import departments to buy ingredients directly from the source.

Importers typically focus on establishing and maintaining strong relationships with suppliers to ensure a consistent and reliable supply of raw materials. They often deal in a wide range of natural ingredients and their import volumes can range from kilos to thousands of tonnes. Their expertise lies in the global sourcing of ingredients, ensuring quality documentary and regulatory compliance.

Examples of European companies that buy natural syrups are Tuchel & Sohn (Germany), Meurens Natural (Belgium) and Tradin Organic (Netherlands).

Agents

An agent's role is to facilitate trade between exporters and European importers. They typically do not hold stock or have their own storage facilities. Agents are often well-connected to European distributors and importers, and may operate both in and outside of Europe. You can for instance look for commercial agents on the website of the Federation of German Commercial Agents and Distributors.

Food and drink manufacturing industry

Natural syrups constitute only a small fraction of the ingredients in a final product, making it costly for food and beverage manufacturers to buy them directly from the origin. However, companies aiming for greater control over their supply chain (and if they have the resources to do so) are beginning to import directly. This might present a promising opportunity for exporters who can offer high-quality, consistent, and ready-to-use syrups.

Examples of European and national federations in the food and drink manufacturing industry include FoodDrinkEurope (European level), the Federation of German Food and Drink Industries (BVE), the Belgian Federation of the Food Industry (Fevia), the French National Association of Food Industries (ANIA), and the Polish Federation of Food Producers Employers’ Union (PFPZ).

Retail

Retailers typically buy their syrups from importers and distributors, who also take care of the packaging of the final consumer products. Sometimes retailers outsource their private label product manufacturing to origin countries. For instance, Royal Palm (United Arab Emirates) has manufacturing facilities and packaging solutions that meet retail requirements, allowing them to engage in partnerships with global retailers.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and certifications. For more tips on finding the right buyer for you, see our study on finding buyers in Europe.

- Visit the website of Food Ingredients Europe to find ingredient importers and distributors. You can view the exhibitor list at any time to look for potential buyers.

- Visit trade fairs in order to connect with European buyers. You can use this opportunity to get contact details and network with buyers sourcing natural syrups. Examples of interesting fairs include Anuga, Food Ingredients Europe, Biofach, and Plant Based World Expo.

What is the most interesting channel for you?

Importers/distributors are your most interesting channel. Using importers can help you avoid issues related to logistics and other trade-related risks. It is interesting for you to look into entering into long-term partnerships with them. Do note that European importers and distributors may demand additional services from their suppliers, such as audits and certifications. Importers typically provide storage and logistics facilities, making the distribution of your products easier. They use their resources to market your syrups to their customers in the market.

Tips:

- Rely on the experience and know-how of European importers, instead of targeting end consumers directly (except if you get approached directly by a retailer for a private-label product, for instance during an international trade fair).

- Make sure that you can meet the demands of buyers before you target them. Can you meet their demands regarding quantity, delivery schedules, documentation, financial reporting and auditing, price and quality?

3. What competition do you face in the European natural syrups market?

In the European natural syrups market, you face strong competition from various countries and various products. Producing countries like Mexico (agave syrup), Indonesia (coconut syrup), Tunisia (date syrup), and Pakistan (rice syrup) are important suppliers of natural syrups to the European market. In terms of products, competition may come from other natural syrups, but also from other natural sweeteners, sugar alternatives, and artificial syrups.

Which countries are you competing with?

The natural syrups category includes a wide variety of products, each with key producing countries. Mexico leads in agave syrup, while Indonesia excels in coconut syrup production. Tunisia is coming up as a significant supplier of date syrup, and Pakistan continues to expand its export share in rice syrup. These countries are already or are shaping up to become potential competitors in their respective syrup markets.

Mexico

Mexico is the largest producer of agave syrup. This syrup comes from the agave plant, a succulent that is native to dry regions in Mexico. Agave varieties used for syrup production are limited to Blue Agave and Salmiana. The government of Mexico and agave manufacturers have set specifications for agave syrup that do not allow any food additives, ingredients, or sugars from other sources that are not agave plants to be used in the manufacturing of agave nectar. It also sets standards for the quality, labelling and conformity of agave syrup.

Although most syrup is produced using the agave varieties Salmiana and Tequilana, legislation does not impose any restrictions on the specific varieties of agave that can be used for syrup production. Because of this and the scarcity of agave, adulteration and fake labels are a concern. The substitution with cheaper sugar syrups makes it particularly vulnerable to fraud. As a response, national and international laboratories have developed methods of analysis to differentiate and authenticate agave syrup. An example is the authentication analysis of agave products of Eurofins.

Total European imports from Mexico for HS code 1702.60, which includes agave syrup, reached 23,193 tonnes in 2023, valued at €54.1 million. The largest European importers of this product from Mexico in 2023 were Germany (11,251 tonnes), Belgium (2,962 tonnes), the Netherlands (2,794 tonnes), France (2,449 tonnes), Spain (1,375 tonnes), and the United Kingdom (UK) (1,049 tonnes).

Indonesia

Indonesia is the world’s largest coconut producer and has a well-established coconut-processing industry. The Indonesian government actively supports coconut production by implementing policies such as replanting areas with high-yield coconut varieties, expanding cultivation regions, and fostering partnerships between growers and processors. Additionally, they provide essential support like post-harvest equipment and low-interest credit.

However, the industry faces several challenges, including limited land availability, lack of transparency, and an inadequate infrastructure. In addition, coconut trees have a productive lifespan of 30 to 40 years, after which their yield significantly decreases. As a result, many multi-generational coconut farmers in Indonesia face declining harvests and rising production costs as their trees age, leading to lower profitability over time.

There are several initiatives in Indonesia to make the coconut sector more sustainable, which is of interest to European buyers. For instance, PUR has set up a regenerative agroforestry programme in Indonesia to help spread knowledge of sustainable practices and long-term prosperity throughout the region. The project has introduced various tree species alongside coconut, offering a range of benefits to smallholder coconut farmers.

Total European imports from Indonesia for HS code 1702.90, which includes coconut blossom syrup, reached 5,246 tonnes in 2023, valued at €10.6 million. The largest European importers of this product from Indonesia in 2023 were the Netherlands (2,496 tonnes), Germany (919 tonnes), the UK (506 tonnes), Greece (223 tonnes), Bulgaria (208 tonnes), and Poland (125 tonnes).

Tunisia

Tunisia ranks as the world’s fifth-largest producer of dates. The annual production of dates is about 365 thousand tonnes of which 120 thousand tonnes are exported. Tunisia holds the fifth position, following Iraq, the United Arab Emirates, Saudi Arabia, and Iran. Despite its 10% share of global exports, Tunisia holds a 38% share of exports to the European market. Notably, nearly 20% of Tunisian date exports are certified organic. The primary date variety grown in Tunisia is Deglet Nour, renowned for its superior sensory and nutritional qualities compared to other varieties.

Regarding the processing of date syrup, Tunisian date processing facilities mainly focus on washing, sorting, and packaging dates for both domestic consumption and export. However, a significant portion of dates is excluded from export due to lower quality. These lower-grade dates are increasingly used to produce value-added products such as date syrup. Several initiatives in Tunisia have been supporting the development of date-derived products, such as the Project for Market Access of Typical Agrofood Products (PAMPAT). PAMPAT aims to promote and support the development of traditional, origin-based agrifood products in Tunisia, and, among other things, focuses on dates and date derivatives.

Pakistan

Rice is an important export product for Pakistan. GMOs are not allowed in the country’s food supply. This ensures that only non-GMO rice syrups are exported. While the country accounted for only 3% of the global rice syrup market in 2018, it now holds a significant position as a supplier of rice syrups. Pakistan has a rapidly growing food processing industry, supported by a fast-growing economy and a mix of multinational and local food manufacturers. This offers a strong platform for partnerships with international companies.

One factor behind Pakistan's rise as a global supplier of rice syrups is its attractiveness and its ability to establish strategic partnerships. In 2018, Matco Foods partnered with Ciranda (USA), a global supplier of certified organic, non-GMO ingredients. This was followed in 2019 by a joint venture between Matco Foods and Dutch specialty ingredients distributor Barentz International. This joint venture provides a ‘one-stop-solution’ service for standard and specialty food ingredients.

Total European imports from Pakistan for HS code 1702.30, which includes rice syrup, reached 4,766 tonnes in 2023, valued at €4.6 million. The largest European importers of this product from Pakistan in 2023 were Germany (1,979 tonnes), France (1,645 tonnes), Italy (434 tonnes), the UK (234 tonnes), and Spain (196 tonnes).

Other major exporting countries with robust processing industries for rice syrups are China and India.

Tips:

- Position yourself against competing countries by highlighting your country’s strengths to European buyers. These strengths may include your country’s close geographical proximity to Europe or trade agreements in place, among other things.

- Find out if your country has programmes to help exporters improve the harvest, cultivation, processing and exporting of natural syrups. You can do this by contacting local chambers of commerce or government ministries of trade.

- Help manufacturers and importers build their story by documenting and visualising your product and company’s unique value proposition. You can base this on your country’s image, specific production processes, how you support communities or the traditional uses of your product. This will also add to your own marketing effort. Final manufacturers can use this information to market the end product in Europe.

Which companies are you competing with?

The following companies are examples of suppliers to the European natural syrup market and the competition you will face.

Nature Bio Foods (India)

Nature Bio Foods is a global organic food ingredients company with a strong focus on sustainability. They adapt traditional farming values and are among the world’s largest producers of organic basmati rice and other varieties of specialty rice. The company works with over 74 thousand farming families, adopts fair and ethical practices, and follows organic standards. The company follows rigorous procurement and auditing procedures, to ensure high quality benchmarks. Also, the rice is harvested in accordance with the principles of regenerative organic farming and follows the guidelines of the Sustainable Rice Platform. The company is organic, Naturland, Fairtrade, Demeter and regenerative organic-certified.

Nature Bio Foods is India’s leading exporter of organic food ingredients. The company invested in research and innovation to create its own organic rice syrup. Its rice syrup processing facilities hold various food safety management certifications, including FSSC 22000, BRCGS and IFS Food Standards. It has a local presence in Europe (the Netherlands) and the US, allowing it to have short lead times and reliable delivery services.

Royal Palm Dates Group (United Arab Emirates)

Royal Palm Dates Group works with both conventional and organic dates, as well as a variety of date-based ingredients such as syrup. Their annual production capacity is 78 thousand tonnes, and they offer a diverse range of packaging solutions to cater to industrial and retail requirements. They ensure high standards of food safety, and are BRCGS, Global Gap, FSSC 22000, ISO 22000, IFS Food, SEDEX, halal, kosher, and organic-certified. The company exports their products to 63 countries.

They adopt traceability systems to control the coordination of the whole supply chain, from production to distribution. The company has a built-in cold storage facility equipped with refrigeration and food storage technology, that allows the products to breathe and stay fresh for longer periods of time. They have extensive storage capacity, and have factories located in United Arab Emirates, Saudi Arabia, Tunisia, Algeria, and Iraq.

Natural West (Mexico)

Natural West belongs to the Iidea Company, which is a manufacturer of organic agave products. Natural West is the leading distributor of agave products. It has a production plant in Mexico, co-packing facilities in Germany, sales offices in the Netherlands, the US, Hong Kong, and Mexico, and warehouses in Spain, Germany and the Netherlands. This allows for fast lead times and full control of the chain. They ensure high quality and food safety standards and their facilities are BRCGS, IFS, FSSC22000, Fairtrade, and organic-certified. They are committed to reducing their carbon footprint by using green technologies and recycled materials.

CV. Bonafide Anugerah Sentosa (Indonesia)

CV. Bonafide Anugerah Sentosa is an exporter of multiple coconut products. It supplies EU organic-certified coconut syrup to the European market. The organic certification highlights the high quality of its products. The company also provides detailed technical information and documentation, showcasing its capacity to meet large export demands in Europe. With its own Corporate Social Responsibility (CSR) and Social Activity policy, Bonafide Anugerah Sentosa has established strong credibility and trust within the European market.

Tips:

- Consider converting to organic production to boost your chances in the European market.

- Build long-term and sustainable trade relationships with your buyers. Trust is necessary from both sides: the supplier and the buyer. Respond quickly and always follow up. A good website with information on your company, products and certifications can support this.

- Highlight your sustainability strategy. For instance, have a look at the website of Grupo Solave (Mexico) to learn from the type of information they display.

- Align quality improvements to your product with buyers’ requirements/specifications and their willingness to pay for them. Quality improvements can be costly, and you need to ensure that the potential exists for getting at least an adequate return on investment.

- Consider getting food safety certification for your company. This demonstrates the high quality and safety of your processing facilities. An example is the British Retail Consortium Food Safety certification. However, consult with your (potential) buyers to determine if this is necessary or not, to prevent having to deal with unnecessary costs.

Which products are you competing with?

There is a lot of competition for natural syrups. In addition to competing with other natural syrups, you will also be competing with other natural sweeteners, sugar alternatives, and artificial syrups. Examples of competing products include:

- Competition from other natural syrups: There are many natural sweeteners available, including syrups made from agave, maple, date, Yucon, tapioca, coconut, oat, rice, corn malt, and many more. Also, there is competition from honey. This diversity of options offers food manufacturers and consumers choices. Manufacturers base their formulations on specific product qualifications, such as sweetening power, glycaemic index, taste profile, consistency, fructose-glucose levels, calories, and mouthfeel. To stand out, companies must understand the type of product they sell, their functionality, nutritional profile and flavour, and focus on unique selling points and effective marketing.

- Competition from artificial syrups: In addition to the natural options, there is a wide range of artificial syrups that are often used by the European food and beverage industry. Examples include maltitol syrup, sorbitol syrup, glucose syrup, high-fructose corn syrup, and invert sugar syrup. Food and beverage manufacturers often opt for artificial syrups because they are more cost-effective than pure sugar. However, the trend for more natural and healthier products is a threat to the use of these products.

- Competition from other sweeteners: There is a wide variety of sugars available in the market, from regular white sugar to raw cane sugar to natural sweeteners such as monk fruit. Stevia is also a competing product. Both monk fruit and stevia contain no calories, have no effect on blood sugar levels, and are 200-300 times sweeter than sugar in the same concentration. Potential weaknesses of monk fruit are that it is relatively difficult to grow, expensive to export, and there is limited availability. One of stevia's main weaknesses is that it lacks essential nutrients. It also has a bitter aftertaste, though this is less noticeable when used in small quantities, such as in food and drink production.

Figure 5: Examples of different natural syrups, from left to right: date syrup, rice syrup, coconut blossom syrup

Sources: Royal Palm Dates Group, NaVitalo, Ingredients Network, 2024

Tips:

- Familiarise yourself with products competing with your product that are available in the European market. Learn about their strengths and weaknesses. For instance, do so by reading the CBI Study on stevia, honey or coconut sugar.

- Do market research into potential substitute products. Find out, for example, how your different ingredients compare in terms of nutritional profile, price, supply security/sustainability and the feasibility and costs of substitution. Make sure that you have these results prepared when you talk to potential buyers.

4. What are the prices of natural syrups in the European market?

The price of syrups depends on various aspects, including:

- The product quality and type: Syrups that comply with high-quality standards are likely to attain a higher market value when the appropriate market and buyer segment is targeted.

- Cost price: Raw material prices and processing costs.

- Availability: Popular syrups with limited availability can be sold for a higher price.

- Certification: Certified syrups could be sold for a higher price if you can find buyers who are willing to pay for the certificate.

- Buyer relations: The relationship between you and your (potential) client and your negotiation skills.

Examples of wholesale prices and final retail prices of syrups on the European market are:

Table 1: Examples of wholesale prices and final retail prices of agave syrup and rice syrup

| Wholesale price | Final retail price | |

| Agave syrup | Light agave syrup, organic-certified: €6.76 per kilo – sold per 25 kilogram | Private label REWE organic-certified: €7.56 per kilo – sold in 250 ml package |

| Rice syrup | Organic-certified, wholesale private label: €5.58 per kilo – sold per 25 kilogram | €7.97 per kilo – sold in 350 ml package |

Source: ProFound, 2024

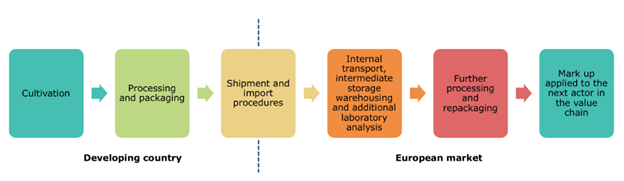

Product suppliers should consider various factors that impact the final price of natural syrups sold to consumers and food and beverage manufacturers. Each stage of the value chain adds costs, some of which are shared among parties or the responsibility of the buyer within the European market. Understanding this cost structure is crucial for setting a competitive price. The mark-up applied at the final stage of the value chain depends on the buyer's role. For example, if the buyer is an agent selling to an importer and then to a processor, the mark-up will differ from a situation where the buyer is a processor selling directly to manufacturers.

Figure 6: Steps in the price breakdown of natural syrups sold to food and beverage manufacturers

Source: CBI, 2022

Tips:

- Calculate your production costs using a detailed cost breakdown. Remember to include additional costs such as customs, loading/unloading, marketing, samples for analysis, and internal transport. Add your profit margin to the cost breakdown result to achieve the selling price.

- When pricing your product, consider the maximum price that the market is willing to pay for your product, plus the existing demand, your cost analysis and break-even analysis. Ensure that the price reflects the quality levels and delivery conditions.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research