The European market potential for shea butter for food

The European market has strong potential for shea butter in food products. Europe has a large confectionery and bakery industry, with increasing demand for plant-based oils and fats. This is reflected in the growing European imports of these ingredients. The most promising markets for shea butter are Denmark, Germany, France, the Netherlands, the United Kingdom, and Belgium. Trends that further drive demand are that more people are choosing plant-based diets and that there is a growing demand for alternatives to cocoa butter. Additionally, companies are moving away from using palm oil, and ethical, sustainable sourcing is becoming more important.

Contents of this page

1. Product description

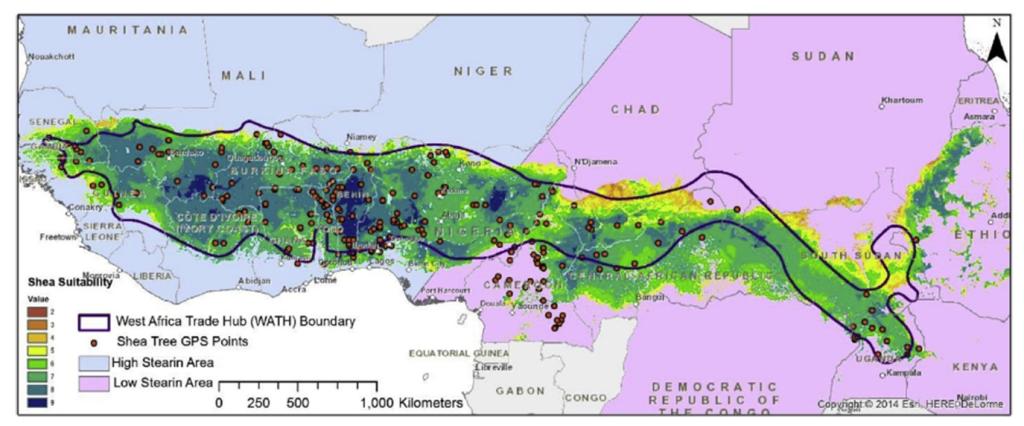

Shea butter, also known as Karité butter, is a natural fat that is the primary product of shea nuts. It is widely used in various food and cosmetics applications. Shea nuts are produced by shea trees that almost exclusively grow in sub-Saharan Africa's ‘shea belt’, which ranges from Senegal in the west to Uganda in the east. Main producers are mostly located in West Africa; Ghana, Togo, Benin, Western Nigeria, Burkina Faso, Mali, and Côte d'Ivoire. Shea is also found in Central and East African countries like Chad, Central African Republic, South Sudan, Cameroon, Uganda, Ethiopia, Congo, and Eastern Nigeria. However, these regions are currently less developed for export.

In recent years, European consumers have become familiar with shea primarily through its depiction on cosmetic labels. However, only 10% of the total volume of exported shea is used in cosmetics, while the food industry uses the remaining 90%.

Shea comes in two main varieties: Shea Nilotica and Shea Paradoxa. Shea Nilotica, found in East Africa, is soft and creamy with a light texture, making it popular in cosmetics. It has a mild scent and is easy to spread on the skin. On the other hand, Shea Paradoxa, from West Africa, is harder and has a strong nutty aroma. This is the variety that is more commonly used by the food industry.

Figure 1: A map of the shea belt

Source: ProFound, 2023

Figure 2: Detailed map of the shea belt

Source: Peter N. Lovett, 2015

Shea butter has been traditionally used as a staple ingredient in cooking and a cosmetic product for skin moisturising throughout Africa. More recently, shea butter has become a significant export product worldwide in food and cosmetics. While the supply of shea has been able to meet the rising demand, this might change in the foreseeable future. The modernisation of agriculture has led farmers to cut down trees to allow for modern machinery in their fields, as there is more money to be made from crops than from shea nuts. Lands are also increasingly farmed all year round, affecting the regeneration and productivity of the shea trees. At the same time, efforts to add to the existing trees by planting new shea trees have been limited.

Shea butter food application uses

Shea butter is used in multiple food products, using butter or fractionations like shea stearin. Shea stearin is a premium fat fraction that separates shea butter into different components, including shea olein and latex. It is known for its high melting point, typically between 35°C and 45°C, which makes it especially useful in heat-stable food applications, particularly in the confectionery industry. Shea stearin has a rich fatty acid profile and is an important ingredient in various food products. It is particularly effective as an ingredient in creating Cocoa Butter Equivalents (CBE).

Shea-based CBEs are blended with cocoa butter to make chocolate products in the chocolate industry. Due to its chemical and physical properties, shea butter is a very good cocoa-butter equivalent or improver with the right organoleptic characteristics. In Europe, products that make use of CBEs are allowed to be marketed as chocolate when their non-cocoa butter fats amount to less than 5%.

In addition to being used in the form of a CBE, shea butter has other applications in confectionery products. Its stable fat properties contribute to the texture and mouthfeel of candies, sweets, ice cream and other treats, which helps with a desirable consistency and longer shelf life.

In the bakery sector, shea butter is an effective substitute for dairy butter and palm oil. It can replace these fats in pastries, cookies, and cake recipes, providing a similar texture, crumb, and flakiness. For example, shea butter is used as a vegan alternative in products such as croissants.

Shea butter is also used as an ingredient in the production of butter-like spreads, offering a plant-based alternative to traditional dairy-based butter. Shea butter properties, such as its creamy texture and mild flavour, make it suitable for spreads used on bread and crackers, and contribute to maintaining product stability at room temperature.

Although less common in Europe than in Africa, shea butter is occasionally used as a cooking oil. Its high smoke point and stability make it suitable for high-temperature cooking, offering a viable alternative fat source for various culinary applications.

Trade data

International trade data on different products is categorised using HS codes (Harmonised System Codes). Unfortunately, shea butter and shea kernels do not have a dedicated HS code. Instead, shea trade is registered under grouped HS codes.

Trade in shea nuts or kernels is registered under HS 120799, which captures all trade of “other oil seeds and oleaginous fruits.” This term refers to a wide variety of oil-bearing seeds and fruits not specifically covered under other HS codes for more common products.

Trade in shea butter is registered under HS 151590, which captures all trade of “other fixed vegetable fats and oils and their fractions”, including shea butter, jojoba oil, moringa oil, and marula oil.

Table 1: HS Codes for shea butter

| HS Code | Description |

| HS 120799 | Other Oil Seeds and Oleaginous Fruits, Whether Broken or Not, Not Elsewhere Specified or Included It covers oil seeds and oleaginous fruits that are not classified under specific categories, including shea kernels. |

| HS 151590 | Other fixed vegetable fats and oils and their fractions, whether refined or not, but not chemically modified. It covers oils that do not fall under specific categories, including shea butter and shea butter fractions. |

Source: ITC Trade Map, 2024

While these HS classifications not only involve the trade of shea, it is assumed that the trade registered under these codes is indicative of the trade in shea. This assumption is made because HS 120799 and HS 151590 exclude the other most used fats, oils, and oil seeds in the European market. As a result, it is assumed that most of the registered trade under these HS codes is shea-related.

At the national level, this study focuses on trade data between Ghana, Burkina Faso, and EU countries under HS code 151590 to provide more reliable indications of the shea butter trade. Given that Ghana and Burkina Faso are the world’s leading suppliers of shea butter, it is logical to assume that most of the imports under HS code 151590 from these countries to Europe are, in fact, shea butter.

It is also important to note that since shea butter is used for both food and cosmetics, the trade data under this code does not differentiate between these applications.

This study primarily uses Access2Markets data for HS codes 120799 and 151590 to estimate the imports of shea into Europe. The data spans the last five years (2019-2023) and, although not highly specific, provides a workable indication of European trade import volumes and values for shea.

2. What makes Europe an interesting market for shea butter?

Europe has been increasingly importing natural oils and fats due to its extensive food processing and manufacturing industry. This industry has a strong demand for natural fats, including shea butter. The significant size of the European confectionery and bakery markets makes the European market even more attractive, as these sectors increasingly use plant-based butters like shea butter. Additionally, the innovative nature of the European market presents further opportunities for suppliers, as more food products containing shea butter are being developed and introduced to meet consumer needs.

Rising European imports of plant-based oils and fats and oil seeds

The European imports of plant-based oils and fats have increased over the last five years. Trade data by Access2Markets shows that European imports amounted to 470 thousand tonnes and €1,200 million in 2023. Between 2019 and 2023, European imports grew by 1.7% in volume and 12% in value per year on average. While this growth is lower than the average global growth of trade in shea, an expanding market does offer exporters opportunities.

The trade data shows that imports of plant-based oils (HS 151590), including shea butter, grew in value at a strong rate of 13% on average per year from 2019 to 2023. Similar value growth is seen for the imports of oil seeds and fruits (HS 120799), including shea kernels, at 9.1% annually between 2019 and 2023.

While the quantity of these oils grew slowly (2.2% for plant-based oils, including shea butter, and 0.3% for oil seeds and fruits), the increase in value shows that the average price paid for these oils has increased. This is partly explained by a significant shift in the processing of shea kernels into shea stearin within West Africa over the past two decades.

Several large non-African companies have invested in setting up processing plants, such as Bunge, sometimes through joint ventures with a local partner. On a smaller scale, some African-owned processing plants, such as Ghana Nuts, have been built. Together, these crushing and fractionation plants now process shea kernels and convert shea butter into, among other fractions, stearin, before exporting it. Shea stearin is priced significantly higher than shea butter.

Source: Access2Markets, 2024

Source: Access2Markets, 2024

Europe’s large confectionery and bakery industry drives demand for shea butter

The European confectionery and bakery industries are key players in shea butter demand. Shea butter is a cost-effective and functional ingredient in alternatives to cocoa butter and other vegetable fats in chocolates, pastries, and baked goods.

The European confectionery market accounts for over 30% of the world market and is estimated to reach a size of €62 billion in 2024. Further growth is expected in the coming years, leading to a market size of €81 billion by 2030.

The demand for shea will benefit from the projected growth as many products in these manufacturing industries use shea as an ingredient. Specifically, the chocolate industry has a high demand for shea butter, which is utilised as a key ingredient in cocoa butter equivalents (CBE).

The European chocolate industry produced an estimated 3.6 million tonnes of final chocolate products in 2020, not including industrial chocolate. Germany is the leading producer of chocolate as a consumer product, followed by Italy and Belgium. Many global cocoa and chocolate companies are based in Europe. Barry Callebaut is the world's largest manufacturer of chocolate and cocoa products. In 2021-2022, Barry Callebaut had 66 factories worldwide and a product sales volume of 2.3 million tonnes. Other large players in the industrial chocolate market are Cargill, Cémoi, Fuji Oil, Natra and Puratos.

Europe is a leading market for innovative food products

The European food market is highly innovative, with manufacturers constantly introducing new products and formulations to meet changing consumer demands and comply with evolving legislation. Organisations and research institutions like FoodDrinkEurope drive this innovation by collaborating with European governments to improve sustainability and health standards through research. This dynamic environment creates a prime opportunity for shea, as the industry seeks unique, high-quality ingredients. As European companies grow increasingly interested in shea's benefits, it is being incorporated into a broader range of new products. Examples include puff pastries like croissants, savoury biscuits, vegan stock cubes, plant-based butters and spreads, and fondant icing.

Tips:

- Compare both the food and cosmetic markets for shea to see which fits your product best. Take a look at CBI’s Shea butter for cosmetics product study to read more about this segment.

- Visit websites like Food and Drink Europe, Food Navigator, and Food Ingredients First regularly to keep up with the European food and beverage market.

- Read more about the European chocolate market in CBI’s cocoa studies to understand trends and buyer requirements. Shea butter is often used as a cocoa butter substitute, so insights into sustainability, ethical sourcing, and consumer preferences can help exporters align their products with market demand.

3. Which European countries offer the most opportunities for shea butter?

The European countries that offer the best opportunities for shea butter for food stand out for their substantial demand and imports of vegetable oils and fats, large processing and manufacturing industries, and interesting consumer market characteristics. The most interesting markets include Germany, France, the United Kingdom, the Netherlands, Belgium, and Denmark. Other interesting European markets include Italy and Spain. Italy stands out due to its robust chocolate manufacturing industry, which demands high-quality plant-based fats, including shea.

Source: Access2Markets, 2024

Germany

Germany has the largest population in Europe with 85 million people, and is one of the largest food industries, making it the largest consumption market in Europe. Moreover, Germany is a major re-exporter of processed food ingredients and foods.

In 2023, Germany imported 75,059 tonnes of vegetable fats and oils registered under HS 151590 worth €217 million. This accounted for 22% of total European imports in volume. Compared to 2019, the volume of imports grew by 7.0% while the value grew by 24% per year on average, more than any of the other European countries.

In 2023, Germany imported 342 tonnes of vegetable oils and fats from Ghana, 435 kilos from Burkina Faso, and 44 tonnes from Côte d’Ivoire.

Of particular interest to exporters of shea is Germany’s confectionery industry, which is one of the biggest confectionery manufacturer and export industries in Europe, and home to the largest chocolate manufacturer in the world. The German confectionery market is expected to grow by another 3.3% per year between 2024 and 2029, making it an attractive market for exporters planning to supply the confectionery market.

Players in Germany’s shea imports include Heess Oils, a business-to-business wholesaler that specialises in importing and distributing oils and fats. Other interesting players are retailers like BioPlanete and LandKrone, which sell shea products on the consumer market.

Denmark

Denmark is an important market for shea because it is the largest European importer of shea kernels, which is done by the company AAK. AAK is one of the largest European players in plant-based oils. Unlike European countries that mostly import shea butter, Denmark imports mostly shea kernels because AAK has invested in a processing facility in Denmark. Here, they turn shea kernels into different shea fats and oils, which are then sold and used throughout Europe by, for example, the confectionery industry.

No specific trade data on the exact imports of Danish shea kernels is available.

The Danish market is also interesting because of its focus on sustainability, as shown by AAK’s efforts to buy shea responsibly. Through its Kolo Nofaso programme, AAK has created a supply chain in Western Africa that provides high-quality shea kernels and gives a stable income to over 230,000 women collecting them. This programme supports sustainable development in African communities and fits in well with Denmark’s commitment to ethical business practices, making it an attractive market for organic and fair trade shea exporters.

Netherlands

The Netherlands is a major trade hub for food ingredients in Europe through the port of Rotterdam. This is one reason the country accounts for a large share of the European imports of vegetable oils and fats, including shea. While the size of the population and respective domestic consumption are relatively small, importing companies in the Netherlands play a significant role in the processing and re-exporting of shea products to the rest of Europe.

In 2023, the Netherlands imported 28,461 tonnes of vegetable fats and oils registered under HS 151590 worth €82 million. This accounted for 8.0% of total European imports in volume. Compared to 2019, the volume of imports declined by 14% while the value declined by 4.2% per year on average. This is because the Bunge fractionation plant in Ghana has recently become fully operational, and the company is now mainly importing shea stearin.

In 2023, the Netherlands imported 19,998 tonnes of vegetable oils and fats from Ghana, 3,602 tonnes from Burkina Faso and 519 tonnes from Côte d’Ivoire.

The country is home to several big companies involved in trading shea. Bunge is Europe’s second-largest shea processor. It extracts and fractionates shea butter in Africa but manufactures its products in the Netherlands. Bunge is active in manufacturing and innovating with shea-based CBEs. Additionally, Bunge invests in local development through The Women Shea Business Cooperative project, which aims to support over 2,500 shea-collecting women and their communities in Northern Ghana.

Moreover, the Dutch market is interesting for shea exporters because of its focus on innovation and sustainability. In response to palm oil's negative image in regards to the cutting down of forests, palm oil-free products, like Flower Farm, offer spreads in which shea butter is used. Also, the Netherlands is a frontrunner in creating meat replacements, and shea butter is increasingly used to mimic the texture and feel of animal fats.

Figure 6: Meat replacement product with shea by De Vegetarische Slager

Source: De Vegetarische Slager, 2024

Figure 7: Shea-based butter replacement spread by Flower Farm

Source: The Flower Farm, 2024

Belgium

Belgium is an interesting market for shea butter, both as a major trade hub with the port of Antwerp and as the third-largest chocolate manufacturer in Europe. Belgium is known for its chocolate around the world and produces 584 thousand tonnes of chocolate and cocoa-based products annually. Chocolate production and exports play a significant role in its economy.

The country’s strong chocolate industry makes it an attractive market for shea butter. Belgian chocolate manufacturers require a large volume of different cocoa and chocolate-related ingredients, including shea butter. This industry is a significant driver of Belgium’s large imports of shea, primarily in the form of stearin. Notably, Fuji Oils Europe, one of the world’s leading shea processors, operates out of Belgium.

In 2023, Belgium imported 33,753 tonnes of vegetable fats and oils registered under HS 151590 worth €77 million. This accounted for 9.0% of total European imports in volume. Compared to 2019, the volume of imports has increased by 8.0%, while the value increased by 19% per year on average.

In 2023, Belgium imported 5,836 tonnes of vegetable oils and fats from Ghana, 111 tonnes from Burkina Faso and 146 tonnes from Côte d’Ivoire.

France

With 65 million people, France comes second in Europe in population size. Like Germany, France has a large confectionery industry, with a market worth €14.4 billion. The confectionery market is expected to further expand by 3.2% on average annually between 2024 and 2029.

In 2023, France imported 25,504 tonnes of vegetable fats and oils registered under HS 151590 worth €73 million. This accounted for 7.0% of total European imports in volume. Compared to 2019, the volume of imports increased by 2.9% while the value increased by 18% per year on average.

In 2023, France imported 694 tonnes of vegetable oils and fats from Ghana, 5,383 tonnes from Burkina Faso and 151 tonnes from Côte d’Ivoire.

One of the important players in the import of shea butter in France is Olvea, which specialises in vegetable oils for the B2B market. Olvea has a processing plant in Burkina Faso and is working on programmes to support socio-economic development in West Africa.

The company primarily markets its organic and fairtrade shea butter to the cosmetics industry, but its sustainable practices, like fair trade and local processing in Burkina Faso, are also relevant to the food sector. As France is a key market for organic products, these values align well with consumer demand for ethically-sourced ingredients. Although focused on cosmetics, there is potential for Olvea's shea butter in food applications, especially in the growing organic market.

United Kingdom (UK)

The UK is a significant market for shea, with a population of 67 million people and a good trading infrastructure. The UK is also known for its leading role in food innovation on the European continent. Thanks to companies like Olam Food Ingredients, the UK is also home to major producers of CBEs.

In 2023, the United Kingdom imported 11,608 tonnes of vegetable fats and oils registered under HS 151590 worth €44 million. This accounted for 3.0% of total European imports in volume. Compared to 2019, the volume of imports increased by 30% while the value increased by 21% per year on average.

The UK market is particularly interesting because manufacturers frequently launch new products, especially in growing areas like meat replacements and spreads. The UK food market is highly innovative, constantly exploring new trends and ingredients. Known for its cutting-edge approach to food development, the UK frequently introduces unique and high-quality products. A strong focus on health, sustainability, and premium products drives this innovation. British consumers are open to trying novel ingredients.

Tips:

- Be aware of and understand legal differences between the EU and the UK. Refer to the UK government’s import, export and customs web page. Since Brexit, the UK has had its own trade regulations, which can differ slightly from those of the European Union.

- Conduct in-depth market research. Beyond basic data, exporters should dive deeper into understanding market specifics. This will contribute to more effective negotiations with potential European buyers. Read more about market research in CBI’s Tips for Finding Buyers for Natural Food Additives.

- Explore other markets like Norway, Luxemburg, and Poland if you are selling lower volumes for niche markets. These markets can offer untapped opportunities.

4. Which trends offer opportunities or pose threats in the European shea butter market?

Several trends drive up the demand for shea in the European market. Among these are rising and unpredictable cocoa prices, a growing demand for plant-based foods, growing health consciousness among European consumers, and sustainability, which has become essential.

Growing demand for plant-based foods in Europe

In Europe, more people are choosing vegetarian, vegan, or flexitarian diets, increasing the demand for plant-based products. Approximately 75 million European consumers buy vegan or vegetarian foods, and this number is growing. The sales value of plant-based foods in Europe increased by 21% between 2020 and 2022, amounting to a total value of €5.8 billion.

Plant-based meat replacement is one of the fast-growing product segments. The market for plant-based meat alternatives is expected to reach €10.9 billion by 2025. Shea butter is becoming an important ingredient in these meat-replacement products because it can mimic the texture and feel of animal fats.

The same trend is driving the demand for replacements for dairy products, such as butter. Shea is increasingly used by manufacturers in plant-based spreads. Unlike other plant-based oils, like palm oil, shea butter is considered a healthier and more sustainable option by consumers, making it popular with manufacturers. Shea butter’s good properties and the negative view of palm oil due to its environmental impact, make shea an appealing fat alternative in the plant-based food industry. This, combined with the ongoing investments and innovations in plant-based foods, is creating opportunities for shea butter exporters.

The five most innovative countries with respect to product launches for plant-based foods are the UK, Portugal, the Netherlands, Germany and Austria.

Figure 8: Lurpak plant-based spread with Shea

Source: Arla Foods, 2024

What drives demand for Cocoa Butter Equivalents (CBEs) in chocolate

The European demand for shea butter as an ingredient for CBEs has grown significantly. Shea butter has become a popular choice for chocolate manufacturers, providing a cost-effective alternative to cocoa butter while maintaining similar properties. This is particularly important as cocoa butter prices are currently very high and are rising, putting pressure on production costs in the confectionery industry. As a result, many European food companies are turning to shea butter to keep their products price-competitive without compromising on quality.

Shea butter alternatives are about 40% cheaper, helping to keep chocolate products affordable. As cocoa prices continue to rise, European companies are creating new product lines that offer a chocolate experience but at a lower cost.

Sustainable shea is increasingly popular

Although a small niche market, there is a growing demand in Europe for handmade, organic, and Fairtrade-certified shea butter. European consumers increasingly seek natural, ethically sourced, and environmentally-friendly products. Handmade shea butter, made using traditional methods, is finding interest from consumers who want authentic and artisanal products.

Organic and Fairtrade certifications make shea butter more appealing by assuring consumers that the product is free from harmful chemicals and supports fair wages and working conditions for farmers. This creates a valuable niche market where handmade, organic, and Fairtrade shea butter exporters can succeed. By meeting these consumer demands, exporters can potentially charge higher prices and build strong customer loyalty in the European market.

This growing interest in organic and fairtrade shea butter is particularly driven by smaller traders who buy directly from women in villages. A great example is the Savannah Fruits Company from Ghana, which has become one of the largest exporters of handmade shea butter in the West African region. The company has successfully leveraged its operations to meet the increasing demand in the European market, focusing on ethical sourcing and high-quality products that appeal to European buyers.

European consumers demand clean-label products

European consumers are increasingly choosing clean-label products, which are seen as healthier and more natural. Clean-label products typically contain simple, recognisable ingredients and avoid artificial additives and preservatives. There is also a consumer trend to avoid industrially-grown food ingredients, such as volume-intensive produce from monoculture farming. Shea butter fits in well with this trend because it is a natural ingredient with minimal processing and is not farmed on monoculture plantations.

Manufacturers use shea butter in various products, like plant-based spreads, because it meets the clean label criteria while offering good functionality and taste. As the demand for clean-label products continues to grow, shea butter’s use in these products is expected to expand as well.

Deforestation is one of the main challenges and environmental issues

Shea butter supply has struggled to keep up with rising demand, worsened by environmental problems like deforestation and the use of shea trees for firewood. The 2024 shea crop is expected to be one of the worst in recent years. A two-month heat wave in Ghana in 2024 gave a good indication of climate change's effects on shea. As a consequence, it is expected to impact supply and will likely increase prices for shea in the coming years if not adequately addressed.

These challenges highlight the need for sustainable farming, harvesting and supply practices. These can include shea tree protection and planting new trees. Investments and innovation are needed to secure a stable supply, which is important to European importers.

Reforestation projects and Shea

One example of an organisation that tries to strengthen the shea sector is Eco Restore, through reforestation work. NGO-funded projects like the Ghana Shea Landscape Emission Reductions Project can further strengthen the sector.

Other projects aimed at strengthening the sustainability of the shea trade include:

Tips:

- Read more about sector trends in CBI’s study Opportunities for natural food additives in plant-based foods.

- Evaluate and improve your sourcing and processing operations for sustainability. Search for and participate in projects that aim to strengthen the shea sector and make it more sustainable.

- Develop a compelling marketing narrative for your product. Consider questions such as: What makes your product or company unique; what sets it apart from your competitors? Does it have an exotic origin or a special story? Can you highlight its traditional uses in food? How does your business contribute to the well-being of local communities?

ProFound – Advisers In Development carried out this study in partnership with Peter Lovett on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research