Entering the European market for essential oils

As a non-EU company that wants to sell essential oils for use in cosmetics, you need a good understanding of the European regulations that relate to your products. The closer you match those requirements, the easier it is to find customers who want to buy from you.

As well as the existing technical requirements, new regulations are going to be introduced soon. These cover sustainability, human rights, the climate and the environment. In addition, many European companies have their own requirements for their suppliers. Also, your products may suit certain niche segments with their own rules.

Contents of this page

- What requirements must essential oil for cosmetics comply with to be allowed on the European market?

- Through what channels can you get essential oils on the European market?

- What competition do you face on the European essential oil market?

- What are the prices for essential oils on the European market?

1. What requirements must essential oil for cosmetics comply with to be allowed on the European market?

This study is about essential oils in general and their use in cosmetics. An essential oil is defined as a “steam-distilled extract from twigs, leaves (patchouli), woods, seeds, exudates (frankincense), fruits, flowers, barks and roots”. IFRA lists 237 oils that meet this definition. In this study we focus on patchouli and frankincense oil, so they are analysed in detail in parts of this report.

First of all, you need to understand the legal requirements in the European Union (EU) for essential oils used in cosmetics (and for any substance used as a cosmetic ingredient). You can find these in the European legislation on cosmetic products. Companies supplying cosmetics to Europe must ensure that all substances used in those products comply with the requirements.

In particular, you need to be familiar with three important regulations:

- The EU Cosmetics Regulation (EC 1223/2009). This is the primary regulation for cosmetic products for the EU market. Its main aim is to protect human health to a high level. You should focus in particular on Chapter 4 and Annexes I to VI.

- Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH). This regulation protects both human health and the environment. It includes measures to promote alternative methods for assessing the hazards associated with chemical substances.

- The EU Classification, Labelling and Packaging Regulation (CLP) (EC 1272/2008). Again, this regulation aims to protect human health and the environment. But it also facilitates the free movement of substances, mixtures and products. It is the only legislation in force in the EU for the classification and labelling of substances and mixtures.

As a company that supplies ingredients for cosmetic products sold in Europe, or an exporter of ingredients to a European importer-distributor or manufacturer, it is vital that you understand the requirements for those ingredients.

If you want to sell to customers in the United Kingdom (UK), it now has its own regulations for cosmetics sold there. And for the ingredients used in them. These include UK REACH and GB CLP. Although the UK has left the EU, nothing has changed in terms of the safety of cosmetic and personal care products. The UK Regulation is still aligned with the strict EU rules. Importantly, the ban on using animals to test ingredients and products remains firmly in place.

Remember that, as a company supplying ingredients for use in cosmetic products, you are operating in the chemicals sector. So the regulations for that sector also apply to you. Two very important regulations in this respect are REACH and the CLP.

REACH

REACH defines procedures for collecting and assessing information about the properties and hazards of chemical substances. Companies need to register their substances, and to do this they need to work together with other companies that are registering the same substance. REACH only applies to European companies. Non-EU companies are not subject to its requirements, even if they export their products to the European Union.

REACH covers all chemical substances imported to or manufactured in the EU. Some classes of chemicals, such as vegetable oils, are exempt from its registration procedures. But essential oils are not exempt.

REACH works as follows. EU manufacturers and importer-distributors of an essential oil form a consortium. In this way they share the cost of preparing the registration dossier for that particular substance. REACH is based on volumes imported or manufactured per year. It has four volume bands: 1-10 tonnes, 10-100 tonnes, 100-1,000 tonnes and greater than 1,000 tonnes. The greater the volume, the more data has to be included in the registration dossier. Upon successful registration of the substance, each company in the consortium is awarded a unique registration number; this allows it manufacture or import the substance up to the agreed volume per year. A non-EU company has the option to obtain a registration number for its substance if its wants to sell to unregistered EU buyers. To do this, the non-EU company has to set up what is known as an ‘Only Representative’ working with an EU entity that can represent the company in the consortium. This is not obligatory, but it can give you a commercial advantage because you are not restricted to selling only to companies that already have a registration number. The disadvantage is that the initial cost can be high: around €40,000-50,000 per substance.

REACH can create business opportunities for non-EU companies, so it is useful to understand how this regulation works and how it could help you. For example, if the total quantity of an essential oil bought by your customer is less than 1 tonne per year, then it can import directly from you without either party needing REACH registration.

A company that wants to import more than 1 tonne per year of an essential oil must either register its imports under REACH or buy from a company that does have REACH registration. That could be your company if you have set up an Only Representative. And if your registration covers the volumes imported each year by your customer.

Another important aspect of REACH is that it contains requirements for the Safety Data Sheet (SDS). All essential oils need an SDS when shipped to and within Europe, so you must provide one. Because an essential oil is a complex mixture, its SDS must include hazard information for its main components as well as the for the product as a whole.

CLP

The CLP is based on the United Nations’ Globally Harmonized System of Classification and Labelling of Chemicals (GHS). Many countries have made this part of their own law. The CLP’s requirements will therefore be familiar to non-EU companies that need to classify, label, package and transport chemicals in their own countries. CLP data is included on the Safety Data Sheet.

One aspect of the European management of the CLP legislation that can help non-EU companies is that the CLP notifications made by EU manufacturers and importer-distributors are published by the European Chemicals Agency (ECHA). It is important to note that companies have to produce their own data for their own notifications. They cannot use the data already published in another notification. UNIDO has published a guide to understanding CLP.

More details of the above regulations can be found in the CBI Buyer Requirements Study.

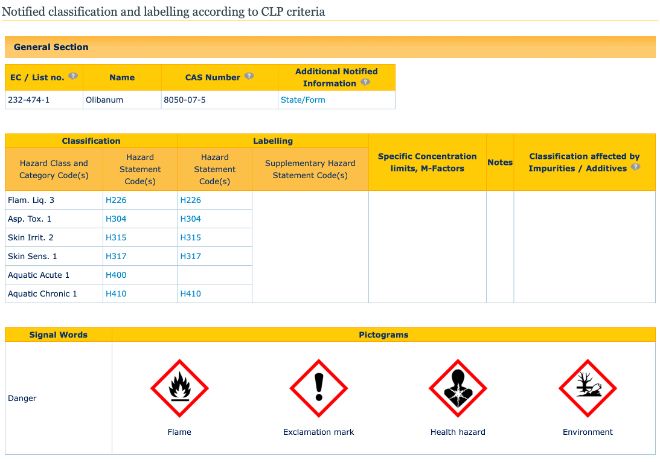

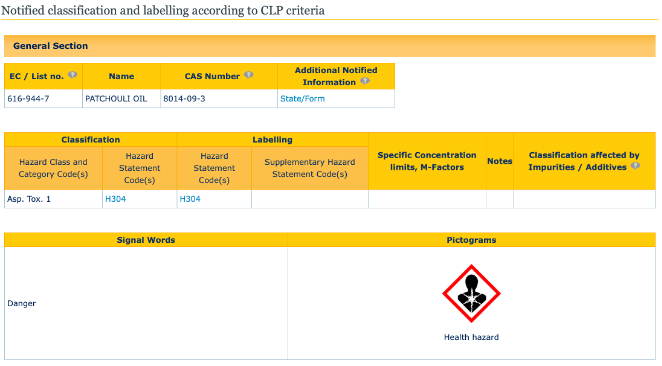

Below are two examples of CLP notifications as published by the ECHA, one for frankincense oil and one for patchouli oil.

Figure 1: A CLP notification for frankincense oil

Source: ECHA CLP database – CLP notification for frankincense oil

Figure 2: A CLP notification for patchouli oil

Source: ECHA CLP database – CLP notification for patchouli oil

Tips:

- Keep up to date on developments in the European cosmetics industry by referring to the European Commission website on cosmetics. This contains information about ingredients as well as cosmetic products.

- Familiarise yourself with the three main regulations that relate to your products: the Cosmetics Regulation, REACH and the CLP. The ECHA has published guidance on the last two of these.

- Make sure you have prepared a Safety Data Sheet for your essential oil. See the CBI workbook for preparing a technical dossier for cosmetic ingredients.

- See the ECHA CLP database for notifications made by European importer-distributors and manufacturers.

Technical documentation

To comply with the EU’s legal requirements, European buyers of essential oils for cosmetics need you to provide a well-prepared technical dossier. This not only demonstrates your commitment to quality and reliability, but also your concern for sustainable and ethical sourcing.

The technical dossier should include the following items:

- A Technical Data Sheet (TDS)

- A Safety Data Sheet (SDS)

- A Certificate of Analysis (CoA)

- An allergen declaration

- Information on traceability back to origin

- Responsible sourcing policies and practices

- Records of certifications awarded and standards applied

The allergen declaration is used by the cosmetic industry to inform manufacturers and consumers about the presence of allergens. There are currently 26 fragrance allergens. If a cosmetic product contains any of these substances above a certain concentration, the manufacturer must declare it on the label. To advise the manufacturer, the supplier of the essential oil should provide an allergen declaration. This states the concentration of each of the 26 known allergens in the essential oil. By doing this, the supplier demonstrates that it is aware of this regulation and is providing a good service for its customer.

Not all essential oils contain allergens. A typical frankincense oil contains four of the 26 allergens, for example, but a typical patchouli oil contains none of them.

The CBI workbook for preparing a technical dossier includes an example of an allergen declaration for essential oils. You can also find examples on the internet, but these are no substitute for carrying out your own analysis. The composition of essential oils can vary from season to season and from place to place.

The EU is currently discussing whether to introduce new regulations for fragrance allergens, and how to do so. Depending on the outcome, this could reduce demand for essential oils. If the EU increases the number of allergens that have to be declared, manufacturers may decide to use lower concentrations of essential oils containing them. Otherwise they would have to publish long lists of allergens on their labels. The effect of this would be to reduce the demand for those essential oils that contain allergens.

Another useful reference when developing technical documentation for essential oils is the ISO standards. These include the chemical parameters for different substances, and typical values for them. They also describe methods for analysing essential oils and provide examples of the typical chromatograms used to identify the different compounds they contain. There is an ISO standard for patchouli oil (ISO3757:2002), but not one for frankincense oil. Buyers of essential oils may refer to ISO standards when asking about your products, or they may have their own standards.

Tips:

- Read the CBI study on preparing a technical dossier for cosmetic ingredients, which provides information and guidance.

- If no-one in your company is technically qualified to prepare a Safety Data Sheet, contact local technical service providers in your country. Also read the ECHA guidance.

- Study examples of Technical Data Sheets, like this one for frankincense oil.

- Identify local laboratory services that can prepare a Certificate of Analysis. If none is available, ask the business support organisations in your country for advice.

- Buy the ISO specifications for your essential oils, if available. Check if your country has adopted these into its own national standards system.

CITES (Convention on International Trade in Endangered Species)

To export essential oils to Europe, you must comply with rules on trading plant resources agreed internationally under CITES, the Convention on International Trade in Endangered Species of Wild Fauna and Flora. This is because the EU has translated CITES into EU law under Regulation 338/97. It is also likely your own country is a signatory of CITES, meaning that your national laws require you to comply with the convention as well.

CITES aims to ensure that international trade in wild animals and plants does not threaten the survival of rare species. The species covered are listed in three appendices to the convention.

- Appendix I includes species threatened with extinction. Trade in these species is permitted only in exceptional circumstances.

- Appendix II includes species not necessarily threatened with extinction, but in which trade must be controlled in order to avoid utilisation incompatible with their survival.

- Appendix III contains species that are protected in at least one country, which has asked other CITES parties for assistance in controlling their trade.

One example of a species in Appendix II of CITES and Annex B of Regulation 338/97 is Aquilaria. Agarwood oil, which is extracted from the wood of Aquilaria, is one of the most valuable essential oils in the world.

The EU regulation can in some cases go beyond the requirements of the CITES convention, so it is important to check it directly. The EU regulation has four annexes. An import permit is required for species listed in Annex A and Annex B, and an import notification is required for those in annexes C and D. Check here to see if your essential-oil plants are listed in any of these annexes. The CITES database also contains information about the EU regulation.

The plant used to make patchouli (Progesterone spp) is not listed in the CITES database.

Boswellia, the source of frankincense, is not yet CITES listed. But it is a wild-harvested product and, due to the scale of the trade in frankincense and increasingly unsustainable harvesting, it is a cause of some concern. CITES has therefore made it a high priority to understand the potential risk to its survival in the wild, and to identify if it meets the criteria for a CITES listing. The EU has also decided that levels of trade in Boswellia require monitoring in order to collect data and consider whether stricter protection might be necessary in the future.

Due to this growing concern about the sustainability of frankincense resin collection, we highly recommend that your frankincense supply chain be certified as sustainable by either Fair Wild or UEBT, or by an EU organic certifier. This will reassure your customers and their customers that the highest possible standards have been followed to ensure sustainable sourcing. And it is all the more important when you consider the number of people in some of the least developed countries in the world who depend on frankincense to live. Losing this species would be very hard for them, as they have few other sources of income.

Tips:

- Visit the CITES website to learn more about CITES. This will give you a better understanding of the legal requirements.

- Determine whether your essential oil requires an import permit or notification permit to enter the European market. Do this by finding out the Latin name of the plant you extract your essential oil from and searching for it in Annex A and Annex B of EU Regulation 338/97. This European list is stricter than the CITES one and so takes precedence.

- Check the CITES species database as well, to see if there are differences between it and the EU regulation.

- Obtain any export permits required by your own national authorities. To find out what you need, contact the relevant CITES authority in your country. If you require an import permit or notification permit, you will need to present it at the EU border. If that is the case, contact local authorities for further assistance.

- Check regularly for any updates to EU Regulation 338/97. Do this by visiting the European Union’s EUR-Lex database.

- Frankincense suppliers: obtain Fair Wild, UEBT or organic certification for your supply chain, as this reassures buyers that your sourcing is sustainable.

Convention on Biological Diversity (CBD) / Access and Benefit-Sharing (ABS)

To export essential oils to Europe, you must comply with requirements under the Convention on Biological Diversity (CBD). This is because the CBD is a part of EU law. It is also likely that your own country is a signatory, meaning that your national laws require you to comply with the convention as well.

The Nagoya Protocol on Access and Benefit-Sharing (ABS) provides guidelines for accessing and utilising genetic resources and traditional knowledge, as well as the fair and equitable sharing of benefits. As with the CBD, European companies must comply with ABS legislation. It is also likely to be part of your national law as well. As an exporter of essential oils for the cosmetics industry, make sure you abide by ABS.

Tips:

- Visit the CBD website, as it offers a range of useful information about CBD and ABS. For example, the country profile function provides information about your country’s position on these international agreements. That can help you as an exporter.

- Another useful resource is the ABS Clearing House. Here you can find how a country is implementing the CBD as part of its own legal system.

Buyer requirements

Quality and consistency

European buyers of essential oils for the cosmetics industry are increasingly demanding products of the finest quality. So you should ensure your essential oils meet high and reliable standards, in both raw material production and manufacturing. You can do this in a number of ways.

Specific requirements for essential oils focus on their consistent composition and chemical profile. For example, frankincense oil should be distilled from sorted batches of similar quality, not mixed. For other essential oils such as patchouli, the International Organisation for Standardisation (ISO) has developed quality standards.

Annex II of the EU Cosmetics Regulation contains a list of substances which are prohibited in cosmetics, and Annex III a list of substances that are restricted (such as the 26 allergens). One example of substances prohibited in cosmetics but found in some essential oils is phthalates. Buyers will check for the presence of these substances. It is good practice for you to test your essential oils for phthalates, so that you only offer products that are phthalate-free. Phthalates are chemicals used in certain plastics, especially flexible plastic tubes. So you must ensure, too, that all your processing equipment is phthalate-free.

European buyers routinely test products they purchase to ensure they meet their quality requirements, as well as testing samples provided by prospective exporters when deciding whether or not to do business with them. One European importer of essentials oils said in an interview, “We always test in-house to make sure the product is of a good standard.” Another told us, “When the goods arrive, we do our own analysis in our own lab.” Essential oils used in health products have to be pure and not contaminated with chemicals or other substances. So never adulterate your products.

Tips:

- Meet the quality standards set by your European buyers. For essential oils used in fragrances, for example, buyers may require that you comply with ISO standards.

- Only make commitments and reach agreements with buyers if you can guarantee to meet them. Failing to meet agreed commitments may damage or even end your business relationship with the buyer.

- Use UN-standard drums and cans for your essential oils. Check the grade required with your drum provider. Shipping information is also included in section 14 of the Safety Data Sheet.

Quality management

When assessing the credibility of prospective exporters, European buyers of natural ingredients for cosmetics are increasingly considering their quality management standards. Adopting these gives you credibility because it shows your commitment to delivering high-quality ingredients, as well as giving your company a positive image. It can also help to demonstrate your compliance with mandatory requirements.

Standards which help showcase the good quality of your essential oils and make them more appealing to buyers include Good Agricultural and Collection Practices (GACP) and the Good Manufacturing Practices (GMP) developed by the European Federation for Cosmetic Ingredients (EFfCI).

Also consider quality standards for production methods, such as ISO 22000 and ISO 9001:2015, Food Safety System Certification (FSSC) 22000 and the Hazard Analysis and Critical Control Points (HACCP) system.

Tip:

- Inform European buyers of the standards you meet and mention them on your website and marketing materials. That may give you an advantage over your competitors, since many buyers look for these standards when assessing exporters. The Indonesian company PT Mitra Ayu Adi Pratama is an example of an essential oil exporter doing just that.

Labelling and packaging

As well as complying with the classification, labelling and packaging (CLP) rules set out in EU Regulation 1272/2008, consider meeting other common labelling and packaging requirements that European buyers have. They include providing the following information on your product documentation and labels, in English unless asked otherwise:

- International Nomenclature Cosmetic Ingredient (INCI) name and product name

- Name and address of exporter

- Batch code

- Place of origin

- Date of manufacture

- Best before date

- Net weight

- Recommended storage conditions

- If you export organic essential oil: your organic certification number with the name/code of the certifying body.

European buyers require good-quality essential oils, so consider the following packaging tips to preserve the quality of your products in transit.

- Use aluminium, lined or lacquered steel containers that conform to UN standards, as they do not react with the components of essential oils.

- Make sure that containers such as drums are perfectly clean and dry before filling them with essential oils.

- Fill the headspace of containers with gases that do not react with components of essential oils – carbon dioxide or nitrogen, for instance.

- Make sure that container sizes match the order volume. For example, 25 litres in a 25-litre container.

Other ways to preserve quality include making sure that your essential oils are kept at the right temperature throughout the supply chain and always storing them in a dry place.

Tips:

- Speak to European buyers to find out if they have any preferences or specific requirements concerning labelling and packaging. Consider meeting with them to increase your chances of entering the European market.

- Inform your logistics provider that your essential oils need to be kept in a cool, dry place on their journey to Europe, in order to preserve their quality.

- Consider recycling or re-using packaging materials. For example, by using containers made of recyclable materials such as metal. This is because environmental sustainability is becoming increasingly important to buyers.

- Make sure that certified organic essential oils are kept physically separate from non-organic products to prevent cross-contamination.

Payment terms

Payment is at the heart of trade and presents risks for all parties involved. Before trading with European buyers, conduct risk assessments of the payment terms on offer. As an exporter of essential oils, minimise your risks whilst working to meet the needs of your buyers.

There are several possible methods of payment. But letters of credit (LCs) are generally considered the safest form for both importer-distributors and exporters. This is because an LC allows both parties to contact a neutral arbitrator, usually a bank, to resolve any issues. For the exporter, the chosen bank acts as a guarantor of full payment as long as the goods have been dispatched. If a buyer does not pay as agreed, to avoid further losses the exporter should find new buyers and pay for the return of the goods.

Depending on their needs, importer-distributors and exporters can choose between several categories of LC, with different terms of payment. They include standby, revocable, irrevocable, revolving, transferable, non-transferable, back to back, red clause, green clause and export/import. For exporters, standby LCs are considered the safest form and so they are frequently used in international trade. This is because they offer security for both importer-distributors and exporters who have little trading experience with one another. Other payment terms include cash in advance, documentary collection and open account.

Many buyers will not use letters of credit, however, so you may have to consider other payment terms. One common alternative is 50% upon delivery to the shipper and the remaining 50% upon approval of the goods. Also consider taking out export credit insurance. Check what is available in your own country.

Tips:

- Minimise your risks whilst working to meet the needs of European buyers. First assess your own needs, then speak to European buyers to find out their needs. Finally, work out a compromise which satisfies both sides. Do not agree to terms you cannot meet.

- Read the CBI’s tips for organising your exports of natural ingredients for cosmetics to Europe for guidance on payment terms used widely in this sector.

Delivery terms

Before agreeing delivery terms with European buyers, you need to carefully consider three important factors: delivery time, volume and cost. This is because failure to meet agreed terms could end your trading relationship with a buyer.

- Delivery time. European buyers prefer shorter delivery times. Air freight is usually faster than sending goods by sea. It is also more reliable with regard to on-time delivery.

- Delivery volume/quantity of order. The volume of your order is an important factor to consider when choosing a mode of transport. Larger quantities are often cheaper to ship by sea. With smaller volumes, air freight can be less expensive as margins shrink.

- Cost of delivery. When shipping larger volumes, sea freight is usually four to six times cheaper than sending goods by air. The price of your shipment is unlikely to increase substantially if you increase the volume.

Tips:

- Be open-minded and flexible. Remember that there may well be tensions and trade-offs with European buyers, especially if you are doing business with them for the first time.

- Learn about and use Incoterms. They are critical when negotiating payment and delivery terms with potential buyers. In the event of a dispute, the agreed Incoterms will be very helpful.

What are the requirements for niche markets?

Organic and fair trade

Although there is no official certification scheme for organic cosmetics, there is growing demand in the European cosmetics market for certified organic ingredients. More and more products and ingredients are being certified as ‘natural’ and ‘organic’ by private bodies. The leading organic and natural standards for cosmetics are:

Both of these private standards have established definitions for organic and/or natural ingredients and final products.

There are at least ten other natural and organic standards for cosmetics in Europe. They include Demeter and Organic Farmers and Growers.

As an exporter of essential oils from a developing country, you can obtain various certification labels for complying with ethical environmental and social standards. Their issuers include:

- Fairtrade International

- FairForLife

- FairWild, which certifies the use of sustainable collection, social responsibility and fair trade practices

- UEBT, the Union for Ethical Biotrade, which certifies practices that respect people and biodiversity in the way ingredients are grown, collected, studied, processed and commercialised.

Tips:

- Consider obtaining natural and/or organic certification for your essential oils. That is likely to give you an advantage in the European market.

- Visit the NaTrue and COSMOS websites for information on obtaining their certification.

- Once you have been certified, let European buyers know. That is likely to make you more appealing as a supplier, and so ease your entry into the European market. Kenyan company Fairoils is an example of an essential oil exporter that has done this.

- Look at the ITC Sustainability Map for information about certification schemes popular in the European consumer market for cosmetic products and their natural ingredients. This will help you make a more informed choice when assessing if there is a business case for you to obtain certification.

- Frankincense suppliers: consider joining a certification scheme to confirm that your harvesting of this species, which is on the CITES watchlist, is sustainable.

2. Through what channels can you get essential oils on the European market?

As an exporter, it is important to know how the European end market for essential oils is segmented, how the oils reach that market and which channel is the most interesting for you. This knowledge will help you in your journey.

How is the market segmented?

When it comes to essential oils used in the broad cosmetics industry, the market can be divided into three main parts: cosmetics proper, fragrances and aromatherapy. Importer-distributors of essential oils sell to companies in all three segments. In addition, essential oils can be used in the food and health product industries.

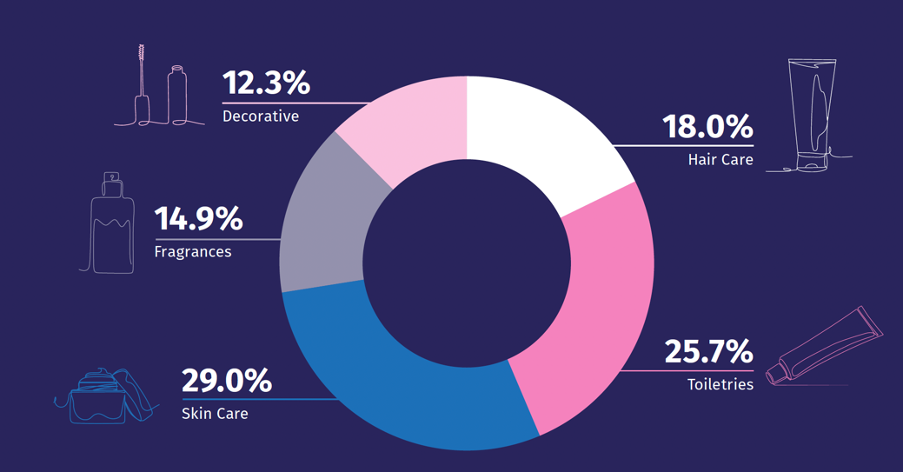

Figure 3 shows how the cosmetics market is segmented in Europe. All of the categories shown use essential oils or their derivatives.

Figure 3: European cosmetics market 2021: market share by product category (%)

Source: Cosmetics Europe Market Performance Report 2021

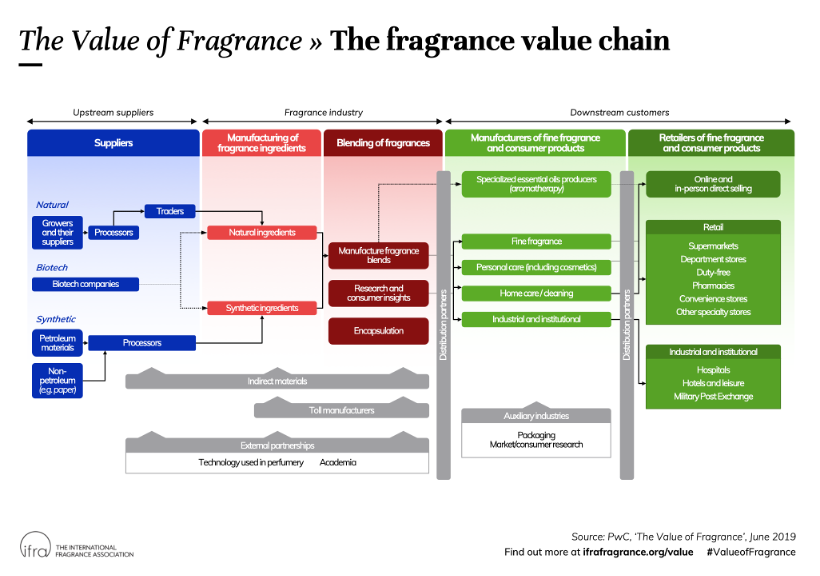

Figure 4: Value chain for the fragrance industry

Source: International Fragrance Association – the value of fragrance

Figure 4 shows the value chain for the fragrance industry. Here, essential oils and other substances are used to prepare fragrances for use in a wide range of final products. They include essential oils for aromatherapy.

The further ‘downstream’ a business is, the smaller the volumes it uses. Supplying small volumes can still be a profitable activity, but it does require more work. Unlike vegetable oils, which usually need to be processed downstream before they can be used in cosmetics, most essential oils are suitable for direct use in cosmetics, aromatherapy and some perfume blends as long as their quality and purity are high.

Tips:

- Prepare your trade offers to suit the needs of importer-distributors (large and small) and the other types of company mentioned above. Note that the latter groups often want to place smaller but more frequent orders of identical specification.

- REACH registration can bring you new business opportunities. But it is not always a legal requirement. If you are registered, you are allowed to sell more than 1 tonne per year directly to unregistered manufacturers and importer-distributors. Consider collaborating with other essential oil companies in your country to share the costs of REACH registration, in order to sell to unregistered European customers.

- Study trade-fair catalogues and the membership lists of trade associations to find more buyers. Examples include in-cosmetics and Prodarom.

- See the CBI’s study on tips for finding buyers in the European cosmetics market for a list of trade fairs in this sector.

How do essential oils reach the end market?

Importer-distributors

Most essential oils enter the European market through importer-distributors. So contacting them is the best way to develop your exports to Europe, where the importer-distributor sells them on to manufacturers of fragrances and cosmetics, to perfumers and to aromatherapists. Details of some of the best-known distributors of essential oils are given in our market potential study.

Manufacturers

Although importer-distributors are the most important channel into the EU market, manufacturers are also worth keeping in mind. We are referring here to the makers of cosmetics and of fragrance and flavour compounds for the cosmetics and food industry.

Some manufacturers of fragrances and flavourings will buy direct from the country of origin. They include Treatt UK, Voegele (Germany) and Biolandes (France). So too will some manufacturers of cosmetics, such as Lush. In both segments, however, manufacturers more usually buy from importer-distributors. There are also some companies, such as Biolandes, that have set up integrated supply chains with their own farms. This gives them greater control over their supply chain.

Perfumers and aromatherapists

The third channel into the EU market is small-scale perfumers and aromatherapists. While the quantities they buy are smaller than importer-distributors or manufacturers want, they can be interested in ordering directly. There are two reasons for this. Firstly, essential oils are used directly (without further processing) in aromatherapy and some can be used directly in perfumes. Secondly, the small quantities required means that their importation is not covered by REACH. The main challenge with this direct trade is international shipping. Due to essential oils’ status as hazardous goods, special precautions need to be taken with their packaging and transport. This adds to the cost of shipping.

Which channel is most interesting for you?

This depends on your situation. If you are a large company, well-established in the export business and looking to increase your sales, the most interesting channel for you will be the large distribution companies. Especially if you already have REACH registration for some of your essential oils. This gives you an advantage, because not only does using your own REACH quota help offset the quota of the large importer-distributors but you can also supply to any company downstream.

Without REACH registration, you have to sell quantities in excess of 1 tonne per year to companies that are registered. Alternatively, you can sell quantities of less than 1 tonne per year to buyers without REACH registration. This group includes a lot of small perfume and aromatherapy companies.

Looking at your company from the buyer’s point of view, it will be interesting to know how your own supply chain is configured. There are three possible options:

- Integrated supply chain: you grow or collect the raw material and process it yourself.

- You buy the raw material from growers or collectors and you process it using your own equipment.

- You buy essential oils processed by other companies, and perhaps add value before export through further processing or other quality improvements. Or you simply blend and export the oils.

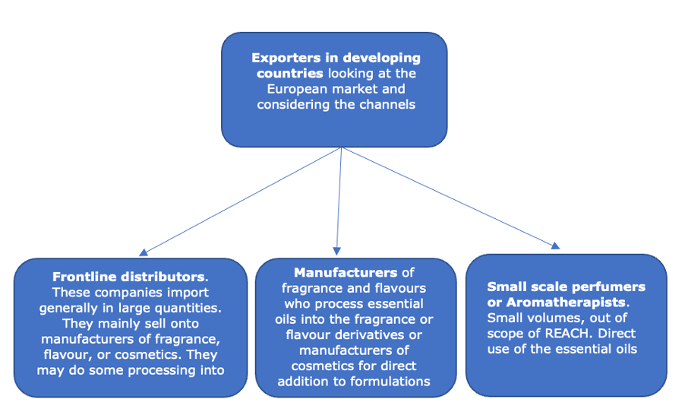

Figure 5: Main possible channels for an exporter of essential oils

Source: Fair Venture Consulting

3. What competition do you face on the European essential oil market?

In your journey to enter the European market, you will be competing with other companies in your own country and elsewhere.

What countries are you competing with?

This section focuses mainly on the countries that supply frankincense and patchouli oils, because their popularity is increasing in the European market.

Many countries supply essential oils

Most countries with similar climates and soils can grow the same essential oils. That is why, for example, you can find tea trees growing in Kenya and South Africa as well as Australia. And patchouli in Indonesia, Madagascar and Rwanda. You can find frankincense in Africa, the Middle East and Asia. Even in the same country, though, there can be differences. A good example is Indonesia, where patchouli grown in Sumatra is quite different from patchouli grown in Sulawesi. Across Africa and the Middle East, there are different qualities of frankincense.

Whilst these essential oils may have the same name or may even be the same species, they might produce very different scents. The cosmetics and fragrance industry is highly focused on how a product smells. The fragrance of your essential oil will make a big difference as to whether or not a buyer is interested in it. Using different distillation techniques, it is of course possible to produce essential oils that are more or less identical chemically. This, however, is one step further away from the consumer expectation of ‘natural origin’.

So while there is competition between countries at one level, at another it may not actually be direct competition. But this does not mean that you need to know nothing about other countries and their production of essential oils. Very much the opposite, in fact. It is very important to know which other countries are producing the same essential oils as you. In your market research on the companies buying essential oils, you will sometimes find out where they are buying from.

If there is an oil-bearing plant that you would like to process into an essential oil not found in your own country, you must follow all the relevant legislation regarding the export and import of plants.

If there are essential oil-bearing plants in your country that are not yet commercialised, then the first step is to find out the composition of the essential oil after distillation. Then use the annexes of the EU Cosmetics Regulation and the IFRA standards to see if any of the components are prohibited or restricted. The presence of a prohibited substance will mean that you cannot export your product to Europe, at least for the cosmetics industry. Otherwise, you should then start to build your technical dossier. In all situations, handle the new essential oil carefully, keep it off your skin, avoid breathing the vapours and keep it away from naked flames.

Somalia and Somaliland for frankincense resin

Much of the frankincense oil sold in Europe is distilled by the importing company.

So suppliers of frankincense oil from Africa and the Middle East are competing with European companies that have distilled their own oil. Typically, supplies of the raw material, frankincense resin, come from Somalia, Puntland and Somaliland.

There are frankincense processing companies in Kenya and Oman.

These companies emphasise the importance of sorting and grading the resin and ensuring traceability to the source by recording all the batches they produce. They also keep good records of their collectors and the quantities collected from different areas. This helps to avoid over-harvesting and so ensure the sustainability of the frankincense-producing trees.

Indonesia is main producer of patchouli

Indonesia is a major producer of patchouli oil, accounting for more than 90% of the world’s supply. India and China are also producers, as are Madagascar and Rwanda. However, most of the patchouli produced in China and India is for local production, not export.

If you are offering patchouli oil from a new country, it may be that the specification is different from the forms already available. Make sure that you have good understanding of the composition of your oil and at least use the ISO standards as a reference.

Tips:

- Find out if your country has programmes to help exporters like you cultivate your essential-oil plants and export the oils themselves. Your national ministry of trade is most likely to have this information, and it may also be able to provide you with export support.

- Consider joining the International Federation of Essential Oils and Aroma Trades (IFEAT) This is the primary industry association for the sector, where you can meet potential customers and access scientific data that may be useful when preparing technical and safety data sheets.

- Find out if there are any essential-oil trade associations in your own country, and consider joining. For example, the Indonesian Essential Oil Council (DAI) is a multi-stakeholder association that aims to serve the industry in Indonesia.

- Consider innovating in your country, but be sure to follow the rules if you are introducing a new plant. And always put health and safety first.

What companies are you competing with?

Because your main customers are the importer-distributors of essential oils in Europe, your competition is other exporters of essential oils that sell to these companies. And because essential oils usually (although not always) come from certain geographical areas, your competitors are probably in the same region as you. So if you want to export patchouli oil, for instance, it is very likely that you are in Indonesia – along with 90% of the other exporters of patchouli oil.

If you want to export frankincense oil, your competitors will mainly be in the Horn of Africa or certain Middle Eastern countries. For example, Lubanchem in Kenya and Ashad Botanix in Oman. In this particular case, you will also be competing with companies in Europe that process frankincense oil from imported resin. Note, too, that some European companies have set up their own local subsidiaries to produce or process essential oils in the source countries. In that case, those companies could also be your competitors.

Internet research should help you find many of these companies. Think in particular of the membership lists published by associations of essential-oil producers/exporters, such as DAI in Indonesia and IFEAT (available only if you are a member). Of course, you cannot be sure from this source whether a company is an exporter or only sells locally, or if it exports to Europe specifically. Company websites may help you answer this question.

Also study how these companies present themselves. As well as matching them on the basics, consider how you can strand out and highlight your unique selling points (USP). Note the critical importance of presenting your ethical and sustainability credentials. Make sure that your website can be found easily in a search engine.

Tips:

- Make sure you have a professional website with well-prepared content, which clearly informs potential buyers of your strengths, your USPs and your knowledge of the essential-oils industry.

- Make sure you meet and uphold social and environmental standards, and that you highlight this on your website. Sustainability and the traceability of raw materials are becoming increasingly important to European buyers.

What products are you competing with?

The main competitors to essential oils are alternative sources or processing methods that can be used to make the same fragrance. For example, the use of chemical synthesis or biotechnology to obtain the fragrance compounds extracted from essential oils. One example is a patchouli-like fragrance extracted from sugar cane using biotechnology. At the same time, although this product sounds promising, it does not appear to have damaged demand for ‘real’ patchouli oil.

Fortunately, consumer expectations are a major driver of cosmetics industry behaviour – and consumers are demanding more natural ingredients in their products. They also care about social and environmental factors. There are claims that biotechnology is a more sustainable than traditional processing method. Up until now, however, advances in technology do not seem to have drawn consumer interest away from traditional processing with social and economic benefits across the whole value chain.

Tips:

- Improve the social and environmental sustainability of your essential oils in order to counter arguments that biotechnology is more environmentally friendly.

- Build a marketing story for your essential oil, emphasising your social and environmental performance.

- Keep up to date with technological developments in the fragrance industry.

4. What are the prices for essential oils on the European market?

There are no reliable public sources of price information at free on board (FOB) level for essential oils. Some importer-distributors, such as Berjé and Ultra NL, do publish market reports on their website. But while these are interesting to read, their price information should be considered only as a general guide to prices at origin. And they provide no details of prices by volume. Also, any published data is out of date the moment it is published.

When pricing your product, your starting point should be a thorough understanding your costs. You should then add a reasonable margin. When you meet buyers to discuss an order, remember that if you are using the same technology as everyone else, your raw material costs and other inputs are the same as your competitors and your value-added services are the same, then your selling price should not be too different from your competition either. Once you know your costs, your break-even point and your profit margins in detail, you can negotiate with confidence. If you know that you have a higher quality product and you are offering it with better standards and better value-added services, then your price can be higher.

Naturally, there is price speculation and manipulation in the market. Buyers will sometimes play suppliers off against one another until they reach the lowest possible price. In recent times, prices have increased due to shortages caused by Covid-19 and climate change. So local buyers (who could be exporters like yourself) may be prepared to pay higher prices to secure their supplies. At the same time, some buyers are always prepared to pay well and offer good payment terms.

At the retail end of the supply chain, prices are published on sellers’ websites. However, the relationship between FOB price and retail price is not straightforward. There are considerable differences in price, depending on the volume/quantity purchased. Furthermore, prices are linked to quality. There are different grades of both frankincense and patchouli oil, and for patchouli another factor affecting the price is the age of the distilled oil.

Table 1: Indicative prices for frankincense and patchouli oils across the value chain

| Indicative prices | ||

| Frankincense oil (€/kg) | Patchouli oil (€/kg) | |

| Exporter | 200-300 | 40-60 |

| Importer-distributor (+40-80%) | 250-400 | 100-175 |

| Online/offline retailer (of the pure oil, typically sold in 10ml bottles). Margins vary widely and depend not only on the retailer’s policies, but also on price and quality. | 800-5,000 | 300-1,200 |

Source: Fair Venture Consulting.

The prices above should be considered a rough guide only.

Importer-distributors’ margins are wide and can depend on whether or not they have to register with REACH. Most large importers-distributors do need to register, as their imports exceed 1 tonne per essential oil per year. Small companies that import less than 1 tonne of any oil per year do not need to register. They may also make final products themselves, without the need to sell the imported oils on to other companies. Retail prices for the pure oils vary widely, too.

Tips:

- Make sure that you have detailed and accurate costs of production for your essential oils, then add a reasonable margin on top.

- Know how to calculate prices for different Incoterms.

- Know how your product and value proposition compare with your competition. Be clear and confident with the buyer about your quality, USPs and differentiators.

- Prepare your price lists before going into a meeting with a buyer. Have different prices ready for different payment terms, Incoterms and price breaks (discounts for larger orders).

This study was carried out on behalf of CBI by Fair Venture Consulting.

Please read our market information disclaimer.

Search

Enter search terms to find market research