The European market potential for essential oils

Essential oils are important natural sources of components used in fragrances and flavourings. They are also used in aromatherapy products, often as blends with other essential oils. In cosmetics they are used as fragrance components, and often for their ‘active’ cosmetic properties as well. There is increasing demand, too, for niche essential oils for the cosmetics and fragrance industry. This report focuses on opportunities for frankincense and patchouli oils in the European cosmetics market.

Contents of this page

1. Product description

Essential oils are natural complex substances, typically produced by steam distillation of leaves, stems, bark, flowers, wood and resins. More than 300 essential oils are used in the fragrance and flavouring industry. They are concentrated chemicals and so usually have to be diluted before use. Otherwise they can cause skin and eye irritations and other undesirable effects. At the same time, they have a long history of use in traditional medicine and aromatherapy. Essential oils should never be consumed, except under qualified medical supervision.

In cosmetics, essential oils can be added directly to products such as creams, lotions, soaps and massage oils. In all products of this kind, the perfume or fragrance is a very important factor. Typically, but not always, fragrances are created using a blend of synthetic aromas and the natural substances derived from essential oils.

Some essential oils, such as patchouli, can be added directly to a perfume or other final product as a pure whole oil. This method is becoming more popular as consumer interest in more natural products grows. In perfumes, it is more common to use individual components of essential oils rather than the whole oil. In the aromatherapy sector, essential oils can be categorised by their overall aroma – for example, spicy, floral or woody. Or by their claimed effects on mood and well-being, ‘relaxing’ or ‘energising’.

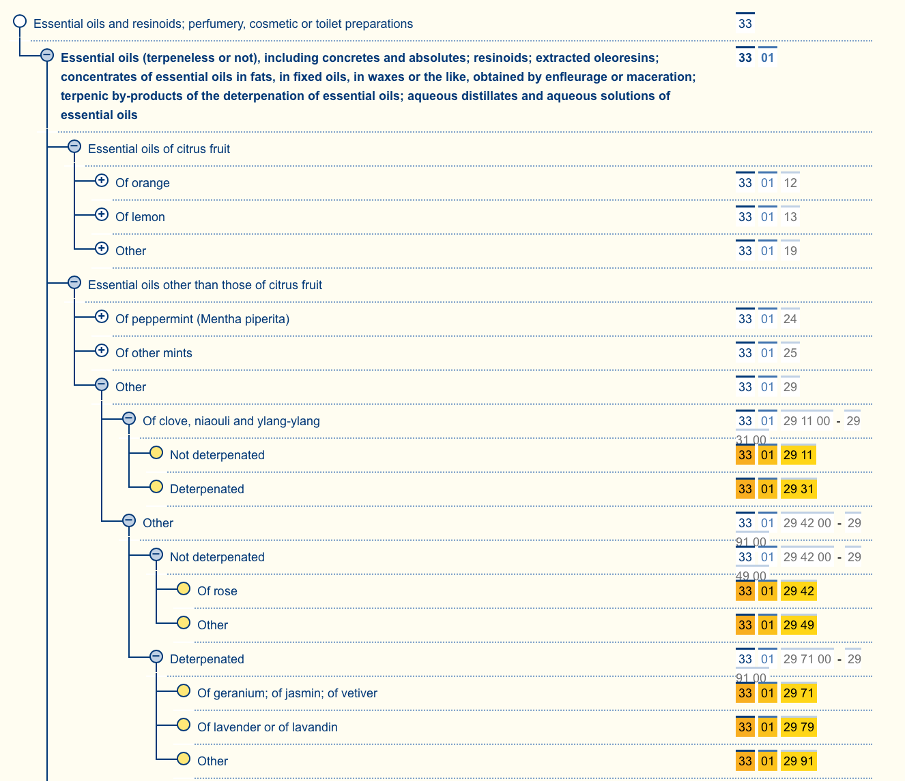

The commodity codes (or HS codes) for essentials oils are listed below.

Figure 1: HS codes for essential oils

Source: Access2Markets.

The most common essential oils are citrus and peppermint varieties. Most of these have their own specific HS codes. They are used mainly in the food industry. However, most of the 300+ essential oils used in the flavouring and fragrance industry are grouped under HS code 330129. One effect of this clustering is that it is not possible to obtain specific trade data for the majority of essential oils. The exceptions are rose oil and lavender oil, which have their own subcategories.

In this study we discuss two essential oils in more detail: frankincense and patchouli oils. Both of these fall under HS code 330129.

Frankincense oil

Frankincense oil is extracted from the resin of the Boswellia carterii tree, which is found in many countries across Africa, the Middle East and Asia. There are various species of Boswellia, but only B. carterii produces a resin suitable for cosmetics. Steam distillation is used to extract the essential oil from the resin. As well as being used in cosmetics and aromatherapy, frankincense is traditionally burned as incense, especially in religious ceremonies.

In aromatherapy, frankincense oil is thought to have calming and meditative properties. Like all essential oils, it should not be used undiluted on the skin. There are reported health benefits of frankincense oil, too. These, however, fall outside the scope of the cosmetics sector. Different regulations apply to substances that have medicinal properties or are used in therapeutic concentrations.

In perfumes, frankincense oil is used as a fixative. It evaporates slowly and fixes the perfume, so that it lasts a long time.

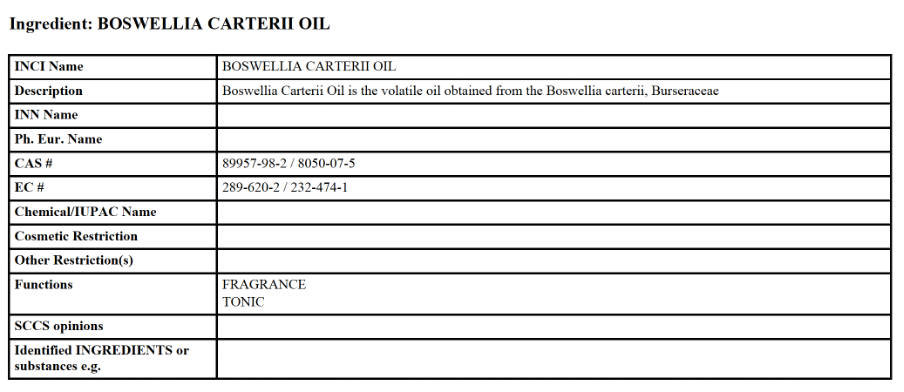

All ingredients used in the European cosmetics industry are often referred to by their INCI name. INCI stands for the International Nomenclature for Cosmetic Ingredients. CosIng is the official cosmetics ingredient database of the European Commission; it is derived from the INCI database maintained by the Personal Care Product Council. CosIng lists more than 15,000 ingredients used in the manufacturing of cosmetics and provides information about permitted, restricted and banned substances. In the CosIng database, you can look up cosmetic ingredients by their INCI names.

In CosIng, frankincense oil is listed as BOSWELLIA CARTERII OIL.

In addition to INCI, the other important reference for a cosmetics ingredient is its CAS number. CAS stands for Chemical Abstracts Service, which is a division of the American Chemical Society (ACS). CAS numbers are used throughout the world to provide a unique, unmistakable identifier for chemical substances. They are particularly useful when there are many possible systematic, generic, trade or common names for the same substance. In recognition of the importance of CAS numbers, CosIng database entries include them where available.

The CAS numbers for frankincense oil are 89957-98-2/8050-07-5 (see figure 2).

Figure 2: CosIng entry for frankincense oil

Source: CosIng

As figure 2 shows, the CosIng entry shows the substance’s INCI name as well as its CAS number. It also includes a description and lists typical functions. This information can be used to prepare a technical dossier for the ingredient. Note that it is not always possible to find a substance’s INCI name in the CosIng database by searching for its common name. For example, you will not find the above entry for frankincense oil by using ‘frankincense’ as the search term. The word ‘frankincense’ does not appear at all in this database entry. So it is not found by that search.

Another useful reference for essential oils is the ISO standards. These are described in more detail in our Market Entry Study. There is no ISO standard for frankincense oil, however. But ISO4720:2018 does provide information on the recommended nomenclature for essential oils.

Patchouli oil

Patchouli oil comes from a plant in the Lamiaceae family. This includes many fragrant species, among them mint and lavender. There are also many species of patchouli. Pogostemon cablin is the one grown for its essential oil, because of its superior properties and yields. It originated in Indonesia, and even today 90% of all the patchouli used worldwide comes from Indonesia (source: IFEAT socio-economic report on patchouli).

Patchouli is a bushy herb grown in the tropical regions of Asia. It has a heavy and strong scent. Its oil is usually extracted by steam distillation of the shade-dried leaves. Originally, patchouli was used in the perfume industry. But it is now used in aromatherapy as well.

In cosmetics, patchouli oil can be used in hair-care products, skin-care products and deodorants. In perfume, patchouli oil is the most widely used raw material apart from citrus fragrances. It is used mainly as a base note and as a fixative. In his book The Essential Oils, Ernest Guenther described patchouli oil as “one of the most important and valuable perfumers’ raw materials”.

Patchouli oil is traded under HS code 33012949. Its trade data is included in HS code 330129.

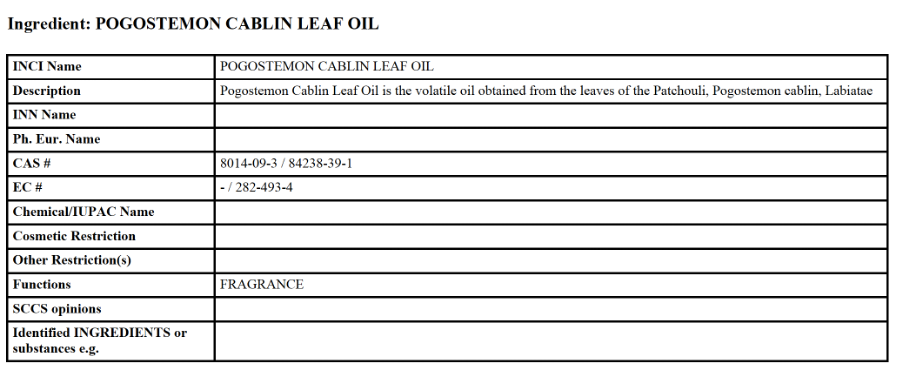

Figure 3 shows the entry for patchouli oil in the CosIng database. This product also has an ISO standard (ISO 3757/2002).

Figure 3: CosIng entry for patchouli oil

Source: CosIng

Tips:

- Make sure your product descriptions and claims are in line with legal requirements and commercial expectations. Make no medicinal claims, and ensure that you include all necessary technical data including INCI names and CAS numbers.

- Familiarise yourself with the beneficial properties your essential oils. Study aromatherapy websites such as Tisserand and Neal’s Yard Remedies to find out how these products are marketed to consumers.

- Check your competitors’ websites to keep up to date with what they are doing.

2. What makes Europe an interesting market for essential oils?

The European cosmetics market offers interesting opportunities for suppliers of essential oils from developing countries. There is a growing demand for niche essential oils in the fragrance and aromatherapy segments. Consumers are becoming more conscious of what goes into cosmetic products, and there is an increasing focus on wellness and environmental harmony. European imports of essential oils continue to grow, a trend that is likely to continue.

In 2021, more than €103 million of essential oils in HS code category 330129 were exported to the European Union (EU) by African countries. This represented 89% of all essential oil exports from Africa in that year, and 18% of Europe’s total imports. Africa is therefore an important supplier of essential oils to Europe.

Table 1: Summary of EU imports of essential oils in 2021

| HS code | Product | EU imports, 2021 (€) | Main exporters to EU | Imports from Africa, 2021 (€) | Main African exporters to EU |

| 330129 | Clove, niaouli, ylang- ylang and other essential oils | 568,981,000 | USA, China, Indonesia | 103,296,000 | Egypt, Morocco, Madagascar |

| 330112 | Orange essential oil | 158,976,000 | Brazil, USA, Mexico | 3,183,000 | South Africa, Cote d’Ivoire, Morocco |

| 330119 | Other citrus essential oils | 74,653,000 | Mexico, USA, Peru | 2,213,000 | Cote d’Ivoire, South Africa, Morocco |

| 330113 | Lemon essential oil | 185,370,000 | USA, Argentina, Uruguay | 846,000 | South Africa, Cote d’Ivoire, Morocco |

| 330125 | Other mint oils | 61,668,000 | India, USA, China | 811,000 | Egypt, Madagascar, South Africa |

| 330124 | Peppermint oil | 37,354,000 | USA, India, China | 97,000 | Egypt, Madagascar, South Africa |

Source: ITC Trade Map.

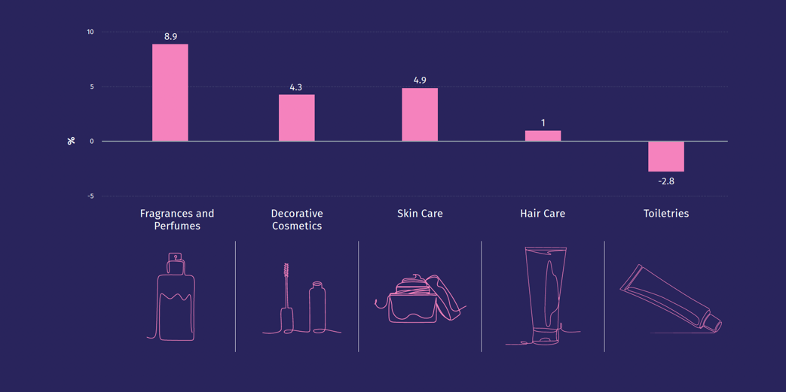

Unlike demand for perfume and fragrances, European demand for essential oils for cosmetic products as a whole – including aromatherapy – has been increasing. According to data published by Cosmetics Europe, in 2020 the European cosmetics market had a total retail value of €76.7 billion. Within this market, fragrance sales were €10.5 billion – 14% less than in the previous year (see figure 4). However, this fall in demand for fragrances and perfumes at the retail level has not affected imports of essential oils. As figure 5 shows, imports of HS 330129 oils rose steadily between 2019 and 2021. This suggests that manufacturers have been using more essential oils across a greater range of cosmetic products.

Figure 4: European cosmetics market 2021: market changes by product category 2020/2021 (%)

Source: Cosmetics Europe Market Performance Report 2021, p. 11 (https://cosmeticseurope.eu/cosmetics-industry/).

While the market for perfumes and fragrances has been shrinking as a whole, demand for artisanal and niche fragrances is on the rise. Although they have only a small share of the overall market, these products are seen as being higher in quality as they use a higher concentration of extracts. Their growth is being driven by greater consumer demand in Europe for natural high-quality products. According to Market Research Future, the global natural fragrances market is expected to reach US$48.3 billion by 2030, representing a compound annual growth rate (CAGR) of 7.5% in the period 2020-2030.

The overall cosmetics market in Europe shrank by 2% between 2018 and 2020, but the natural and organic market grew by 7%. In 2018 the natural and organic cosmetics market in Europe was valued at €3.64 billion. In 2020 that rose to €3.89 billion. At the same time, bear in mind that this is still only 5% of the total European cosmetics market. So mainstream cosmetics remain an important destination for natural ingredients.

According to market-research organisation Kantor in its Global e-Report for 2022, the importance of including natural ingredients in cosmetics has grown consistently around the globe – and especially in Europe. France, Germany, Spain and the United Kingdom (UK) are the four biggest European markets for cosmetics. In all of these countries, the percentage of users who say that they buy a particular face or body product because it contains natural or naturally produced ingredients has increased in the past five years.

The import value of essential oils in HS code category 330129 increased in 2020, then dropped by 1% in 2021 to a total of €963 million. This represents a 7% net increase in imports since 2017. The higher-priced essential oils included in this category are used mainly in the perfume and personal care industries. Fragrances, cosmetics and aromatherapy generate about one third of the demand, according to the European Federation of Essential Oils (EFEO).

The European essential-oils market is expected to grow in the coming years. Increasing consumer demand for products made from natural ingredients is a major driver. France, Germany, Ireland, the UK and the Netherlands are the main importing nations in Europe.

Tips:

- Refer to the current trends in your promotional materials. A good way to do this is to write short articles and publish them on social media, making sure that you acknowledge the sources of information.

- Focus on buyers that offer their customers a wide range of essential oils. These buyers tend to source niche oils and to supply small to medium-sized perfumers. By supplying niche oils, you can justify the price premium which artisanal manufacturers of cosmetics and perfumes are willing to pay.

- Know your supply chain. Provide information about traceability right back to the point of origin of the raw materials.

- Visit trade fairs to look for buyers. Examples include in-cosmetics and Vivaness. See the CBI’s tips for finding buyers in the European cosmetics market for useful information and guidance about ways to enter the European market.

3. Which European countries offer the most opportunities for essential oils?

The European countries that offer the best opportunities for suppliers of essential oils for the cosmetics industry (other than citrus and mint oils), especially patchouli and frankincense, are France, Germany, the UK, the Netherlands, Spain and Switzerland. They are the largest importers of these HS 330129 essential oils. Germany, France, the UK and Spain have the largest consumer markets in Europe for all cosmetic products as a whole (skin care, hair care, toiletries, decorative cosmetics and fragrances).

France is by far the largest importer of these essential oils. The combined imports by Germany (€132 million) and UK (€115 million) were still less than the French figure in 2021, €253 million. Imports by the Netherlands totalled €96 million, those by Spain €88 million and those by Switzerland €82 million.

France – Europe’s leading importer of essential oils

France is the most important importer of HS 330129 essential oils. It has held this leading position for at least the past five years. Exports to France in this category exceeded €253 million in value in 2021, and totalled approximately 4,400 tonnes in volume.

By import value, the most important suppliers to France are Indonesia (10%), India (9%), China (8%), Spain (8%) and Turkey (6%). These are all relatively low percentages, which suggests each of the supplying countries occupies a specific niche by offering only a few essential oils rather than a wide range.

For example, as mentioned above, Indonesia is a major supplier of patchouli oil. So we can surmise that most of its 10% is made up of patchouli oil (together with nutmeg, clove and vetiver oils, which are other important, high-value essential oils from Indonesia). Over the past five years, these imports have remained relatively steady. And we can expect that to continue in the next few years, too.

In Africa, the most important suppliers to France of HS 330129 essential oils are Morocco, Madagascar, Egypt, Tunisia and South Africa. African countries account for 24% of France’s total imports of these products. Their total value has fallen in the past four years, however, from €80 million to €60 million. Imports from all the main supplying countries with the exception of Madagascar have remained relatively steady over the past five years, in terms of both value and volume.

In the case of Madagascar, the volume of exports to France has decreased from 594 to 371 tonnes, but with no significant decrease in their total value. Madagascar has long been known for its traditional essential oils, such as ylang-ylang, clove and palmarosa. It is only more recently that Malagasy producers have begun making and exporting new types, like geranium, niaouli and helichrysum.

France is a very interesting market for exporters from developing countries. It buys a wide range of niche essential oils. At the same time, origin is important to French importers; they associate this with quality and authenticity. As Madagascar has already done, though, with some effort it is possible to diversify into ‘non-traditional’ essential oils when their quality, price and reliability is right. According to Cosmetics Europe 2020 data, France also has the EU’s highest number of small and medium-sized manufacturers of cosmetic products, including fragrances.

Many of the French companies involved in the import, distribution and processing of essential oils are members of Prodarom, the National Association for Manufacturers of Aromatic Products. Prodarom is also the French affiliate of IFRA, the International Fragrance Association. Its headquarters are in the town of Grasse, at the heart of the French fragrance and flavouring industry.

Germany – the second-largest importer

Germany is Europe’s second-largest importer of HS 330129 essential oils. Its imports in 2021 were worth €130 million, close to the annual average for the past five years. Their total volume was 3,300 tonnes. This figure has also remained steady over the past five years.

The top-5 suppliers to Germany are France (21%), China (15%), the USA (11%), India (6%) and Indonesia (5%). The first three of these account for nearly 50% of imports. Which reveals that the structure of Germany’s supply chain is quite different from France’s. Nevertheless, the full list of countries that sell to Germany is similar to the French one. So it is always worth contacting German importers, because although their major suppliers are in France, China and the USA, that does not rule out opportunities for companies from other countries. Provided, of course, that their quality, price and reliability meet the buyer’s requirements.

In Africa, Germany’s main suppliers are Egypt, Madagascar, Tunisia, South Africa and Morocco. These are the same countries as in the French top 5, although not in the same order. By value, African countries account for approximately 8% of Germany’s imports of HS 330129 essential oils. But these have fallen in past three years, from €14 million in 2019 to about €11 million in 2021. Of the five African countries listed, Egypt and Morocco have seen their exports to Germany decline less than Madagascar and South Africa.

Some of the well-known importers of essential oils in Germany are Axxence, Frey+Lau, Symrise, Ter Ingredients and Voegele.

The UK – the third-largest importer

The United Kingdom was Europe’s third-largest importer of HS 330129 essential oils in 2021, taking a total of 3,051 tonnes with a value of €115 million. This latter amount has fallen steadily in the past five years, but volumes have increased. France, China and the USA are the country’s top-3 suppliers.

UK imports of HS 330129 essential oils have decreased in value by 13% since 2017, from €132 million to €115 million. But the overall volumes imported have increased by 14%. While it is not possible to precisely explain the reasons for the decline in value, it is worth noting that – according to market performance data published by Cosmetics Europe – total retail sales of all cosmetic products in the UK have fallen by 10% since 2018, from €10.9 billion to €9.8 billion. And the fragrance and perfume category has shrunk by 12%, from €2.0 billion to €1.8 billion).

The five biggest suppliers to the UK account for more than 60% of all its imports in this category: France (22%), China (20%), USA (8%), Spain (6%) and Hungary (6%). Like Germany, the UK sources most of its essential oils from a relatively small number of countries. In volume terms, its five main suppliers are China (1,051 tonnes), France (407 tonnes), Brazil (233 tonnes), USA (226 tonnes) and Indonesia (183 tonnes).

Africa accounts for 8% (€9.6 million) of the UK’s total imports of HS330129 essential oils. Its main sources there are Egypt (€4.1 million), South Africa (€1.8 million), Tunisia (€1.3 million), Morocco (€0.74 million) and the Comoros (€0.55 million). By both value and volume, imports from Africa have declined overall in the past five years. At the country level, the picture is more mixed: imports from Egypt have fallen, but those from South Africa have increased.

The UK has many well-known companies that use natural ingredients, including essential oils, in their products. For example, The Body Shop, Lush, Neal’s Yard Remedies and Tisserand. It also has many companies that produce fragrances and fragrance components. You can find a list of these on the IFRA UK website. Well-known UK importers include Treatt, Augustus Oils, O&3 and Naissance, and there are also many small and medium-sized companies. UK traders dealing specifically in HS code 330129 products are listed on the UK Trade Info website.

The Netherlands – the fourth-largest importer

The Netherlands is Europe’s fourth-largest importer of HS 330129 essential oils: 1,819 tonnes in 2021, with a total value of €96 million. Their volume has increased steadily over the past five years. The USA, France, China, Indonesia and Germany are the Netherlands’ main suppliers.

Dutch imports have increased by 77% in value terms in the past five years, and nearly doubled in volume (up 95%). The country’s main supplier is the USA, with a 41% share. Next come France (25%), China (9%) and Indonesia (6%). This means that 81% of all imports in this category come from just five countries. Compared with the markets described above, this is a high degree of concentration.

Imports of HS 330129 essential oils from Africa amounted to €765,000 in 2021, or 0.8% of the total. Their overall volume was a mere 20 tonnes, or approximately one container load. The main African suppliers to the Netherlands are South Africa, Egypt, Tunisia, Ghana and Morocco. The reason for these low figures could be that the Netherlands does not have a large cosmetics manufacturing industry of its own and other European countries are easily able to import the products they need directly, without having to buy from an intermediary country. In fact, as figure 10 shows, the Dutch also import some essential oils from Germany and France.

At the same time, of course, the Netherlands does buy small quantities of HS 330129 essential oils from many countries around the world. So it is still important to include Dutch buyers in your marketing activities. Two well-known Dutch companies that trade in essential oils are De Lange and IMCD. Members of the Netherlands Flavour and Fragrance Association (NEA) may also import certain essential oils in this category.

Spain – the fifth-largest importer

Spain is Europe’s fifth-largest importer of HS 330129 essential oils. Over the past five years these imports have remained steady, at about €80 million annually. The most important exporting nation to Spain is Indonesia. Its share of the Spanish market increased in 2021 to almost 25%, a trade worth €21 million.

The five main exporters to Spain in 2021 were Indonesia (24%), France (17%), China (11%), the Netherlands (7%) and India (6%). In other words, 65% of Spanish imports of HS 331029 essential oils come from just five countries.

Africa accounts for about 10% of Spanish imports, totalling approximately 200 tonnes a year. This is the second-highest percentage in the European top 6 of importing countries. But in volume terms, Indonesia’s exports to Spain were still more than three times greater (629 tonnes) than the figure for all Africa. This, however, is a reflection of the high demand for the essential oils produced by Indonesia – such as patchouli, clove and nutmeg – rather than a result of other competitive factors like quality and price. Africa’s five main suppliers to Spain in 2021 were Tunisia, Egypt, Morocco, South Africa and Madagascar.

The Spanish market is an important one for suppliers of essential oils. Spain has a thriving fragrance and flavouring industry, represented by the Spanish Association for Fragrance and Food Flavourings (AEFAA). Its members are important potential customers for suppliers of essential oils. Leading traders in this category include Indukern, Lluch and Ventos.

Switzerland – the sixth-largest importer

Switzerland is Europe’s sixth-largest importer of HS 330129 essential oils. Its imports have declined very slightly over the past five years, from €84 million to €82 million. Between 2020 and 2021, though, they increased by 3% in value and by 11% in volume, to 1,620 tonnes.

The top-5 exporters to Switzerland account for 63% of its market for HS 330129 essential oils: France (26%), Indonesia (19%), the USA (6%), India (6%) and China (6%). France is the biggest source by value (€22 million), Indonesia the largest by volume (357 tonnes). That volume increased by 34% in 2021, with its value rising 28%, to €16 million.

In value terms, African countries represent 9% of total imports in this category. Africa’s major exporters to Switzerland are Egypt, Madagascar, South Africa, Morocco and Tunisia. The overall value of their Swiss market declined by 7% in 2021, but its volume grew by 20% to 141 tonnes. This indicates that most or all the increase in volume consisted of lower-value essential oils. Swiss imports from South Africa have shown a steady increase over the last five years, as that nation continues to develop its essential-oils industry to compete with Australia and Europe, in particular. By contrast, there have been only minor fluctuations in levels of imports from other African countries.

Switzerland is the home of Firmenich, the biggest privately owned fragrance and flavouring company in the world. So it is not surprising that this country is one the of six leading European importers of HS 330129 essential oils, despite being only fifteenth by the size of its population. Firmenich is also a leader in developing sustainable supplies of essential oils, and in traceability in its the supply chain. This is creating a ripple effect across the whole industry. And like many of the major flavouring and fragrance companies, Firmenich has offices in its major source countries. They include Indonesia, India, Colombia and Mexico.

All the major Swiss companies in this sector are members of the Swiss Flavour and Fragrance Industry Association. Other well-known traders of essential oils in Switzerland include Damascena and Ecsa Chemicals.

Tips:

- Develop lists of potential buyers in at least the six countries above.

- Keep up to date with industry developments by reading the websites of IFEAT and IFRA on a regular basis.

- Monitor the topics major companies and company associations are talking about and reporting, especially with regard to sustainability.

4. Which trends offer opportunities on the European market?

There is a growing demand for essential oils that meet high standards of sustainability. This does not necessarily mean that you need certification, but you will need to document your activities – especially with regard to environmental impact. Traceability back to the origin of the raw materials is also important.

Sustainable production

There is a growing demand for supply chains in the cosmetics industry to be sustainable and traceable. This trend is driven by increasing consumer awareness, and their demand for environmentally friendly products. Sustainable production of frankincense and patchouli oils is becoming an important market factor.

Boswellia carterii trees are dying because of overharvesting. Since frankincense production is the main source of income for some disadvantaged communities in mountainous regions of Somalia, the farmers are under heavy economic pressure. As a result, the trees are cut (to extract resin) multiple times and they are not given the usual one-year rest period between harvests. In addition, the increasing demand for frankincense oil is pushing up prices. That puts pressure on farmers to produce more.

This situation leaves Boswellia trees vulnerable to insect attacks and decreases their germination rate. Such unsustainable practices could have severe consequences for frankincense oil production. A recent study published by Nature Sustainability concludes that production will decrease by half in the next twenty years, and that Boswellia woodlands around the world will have shrunk by 90% between now and 2070.

Suppliers of frankincense from developing countries should join sustainability schemes such as FairWild or obtain organic certification. One disadvantage of FairWild certification is that it requires constant monitoring and is rather data-intensive, which could make it hard to comply with in the rural communities that produce frankincense. Organic certification might improve production methods and increase traceability.

Producers of patchouli oil also face a lot of sustainability challenges. They include agricultural practices, climate change, soil nutrient depletion and the vulnerability of farmers. But various sourcing partnerships have been formed to encourage sustainable sourcing of patchouli. Two of these have been introduced by Givaudan and Firmenich. Firmenich sources its Indonesian patchouli in partnership with Indesso.

Sustainability practices in the essential oils industry are certain to become more important in the coming years. Suppliers therefore need to adopt sustainable production methods and/or join certification schemes.

Tips:

- Invest in sustainability practices when supplying frankincense and patchouli oils, and also other essential oils. European buyers are looking for suppliers that adhere to sustainability standards and practices. They like to use this information in their own marketing, especially when approaching customers.

- Review the responsible sourcing policies of Firmenich, Givaudan and other major companies. Implement their requirements as much as you can.

- Consider adopting sustainability standards, such as FairWild and/or organic certification. These add credibility to your products, allowing you to charge a premium. Make sure that you present all your certifications on your marketing materials.

- See our Market Entry study on essential oils for more information on market requirements.

Personalised and niche fragrances

In recent years, there has been a trend towards the personalisation of fragrances. This is gaining in popularity because it allows consumers to connect a scent with their own personality at an emotional level. It also gives them a greater sense of choice and control. The personalisation trend is especially popular with millennials.

The niche fragrances market is the fastest-growing part of this industry. As the mainstream market becomes more and more saturated, niche fragrances offer a unique form of personalisation. Discerning consumers are willing to pay higher prices for a scent that is customised to their needs.

In many cases, these new scents are being created from alternative ingredients. The goal is to create a unique fragrance sensation for the customer. Another new phenomenon is associating a scent with a place or a memory. This trend is becoming popular in the retail sector, in parallel with the growth in stand-alone perfumeries.

For example, the British personal care company Lush has created a range of personal care products containing patchouli oil from Indonesia. The patchouli scent is associated with the hippie movement of the 1960s.

Personalisation is also a great way to develop trust and create relationships with consumers. This trend is likely to gain further momentum within the fragrance industry in future. With the rising disposable incomes of millennials and the growing demand for high-quality cosmetic products among European consumers, the demand for niche essential oils is only expected to increase.

Producers of essential oils from developing countries can take advantage of this trend by supplying niche essential oils to Europe. There is a lot of competition in this market, though, especially in orange, lemon and peppermint oils. But when it comes to niche oils, European buyers are willing to source from smaller suppliers. The minimum volume requirements are also lower for these products. The most promising essential oils include patchouli, ylang-ylang, neroli and frankincense.

Tips:

- Familiarise yourself with the latest trends in the fragrance industry. Websites like Cosmetics Business are a good source of information on emerging trends, for example, as are blog posts and online articles.

- See the CBI study of trends in the market for natural ingredients for cosmetics to find out more about opportunities for suppliers of these products from developing countries.

This study was carried out on behalf of CBI by Fair Venture Consulting.

Please review our market information disclaimer.

Search

Enter search terms to find market research