Entering the European market for mango butter

Mango butter is a relatively niche product for use in cosmetics. However, European customers have the same requirements and expectations as for any other vegetable oil. Because mango butter is usually processed in the country of origin, you will be competing with other producers. You therefore need to make your offer as attractive as possible to European importers. This means providing high levels of service, excellent quality and low risk, as well as demonstrating sustainability and social responsibility.

Contents of this page

- What requirements and certifications must mango butter for cosmetics comply with to be allowed on the European market?

- Through what channels can you get mango butter on the European market?

- What competition do you face on the European market for mango butter?

- What are the pricesfor mango butter on the European market?

1. What requirements and certifications must mango butter for cosmetics comply with to be allowed on the European market?

First of all, you need to understand the legal requirements in the European Union (EU) for mango butter used in cosmetics (and for any substance used as a cosmetic ingredient). You can find these in the European legislation on cosmetic products. Companies supplying cosmetics to Europe must ensure that all substances used in those products comply with the requirements.

In particular, you need to be familiar with three important regulations.

- The EU Cosmetics Regulation (EC 1223/2009). This is the primary regulation for cosmetic products for the EU market. Its main aim is to protect human health to a high level. You should focus in particular on Chapter 4 and Annexes I to VI.

- Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH). This regulation protects both human health and the environment. It includes measures to promote alternative methods for assessing the hazards associated with chemical substances.

- The EU Classification, Labelling and Packaging Regulation (CLP) (EC 1272/2008) Again, this regulation aims to protect human health and the environment. But it also facilitates the free movement of substances, mixtures and products. It is the only legislation in force in the EU for the classification and labelling of substances and mixtures.

If you want to sell to customers in the United Kingdom (UK), it now has its own regulations for cosmetics sold there. And for the ingredients used in them. These include UK REACH and GB CLP. Although the UK has left the EU, nothing has changed in terms of the safety of cosmetic and personal care products. The UK Regulation is still aligned with the strict EU rules. Importantly, the ban on using animals to test ingredients and products remains firmly in place.

More details of the above regulations can be found in the CBI Buyer Requirements Study

Companies that supply ingredients to European importer-distributors or manufacturers of cosmetic products need to understand all the regulations affecting them.

Think about your customer’s position, too. It has to sell on ‘your’ mango butter to its own customers. They could be manufacturers, other distributors or the consumers of end products containing mango butter.

As well as the existing technical requirements, new regulations are going to be introduced soon. These cover sustainability, human rights, the climate and the environment. The European Green Deal will also impact global supply chains that reach the European Union. In addition, many European companies have their own requirements for their suppliers – particularly in niche segments. On the other hand, you can expect customers active in niche segments to pay more for the quality that they want.

As a company supplying ingredients for use in cosmetic products, you are operating in the chemicals sector. So the regulations for that sector also apply to you. Two very important regulations in this respect are REACH and the CLP.

REACH

REACH defines procedures for collecting and assessing information about the properties and hazards of chemical substances. Companies need to register their substances, and to do this they need to work together with other companies that are registering the same substance. REACH only applies to European companies. Non-EU companies are not subject to its requirements, even if they export their products to the European Union.

Whilst REACH covers all chemical substances imported or manufactured in the EU, certain categories are exempt from its registration procedures. These include vegetable oils such as mango butter.

Other aspects of REACH do still apply to mango butter, though. For example, its requirements for Safety Data Sheets (SDSs). Any chemical substance transported into or within the EU, including mango butter, must have an SDS.

CLP

The CLP is based on the United Nations’ Globally Harmonized System of Classification and Labelling of Chemicals (GHS). Many countries have made this part of their own law. The CLP’s requirements will therefore be familiar to non-EU companies that need to classify, label, package and transport chemicals in their own countries. CLP data is included on the Safety Data Sheet.

One aspect of the European management of the CLP legislation that can help non-EU companies is that the CLP notifications made by EU manufacturers and importer-distributors are published by the European Chemicals Agency (ECHA).

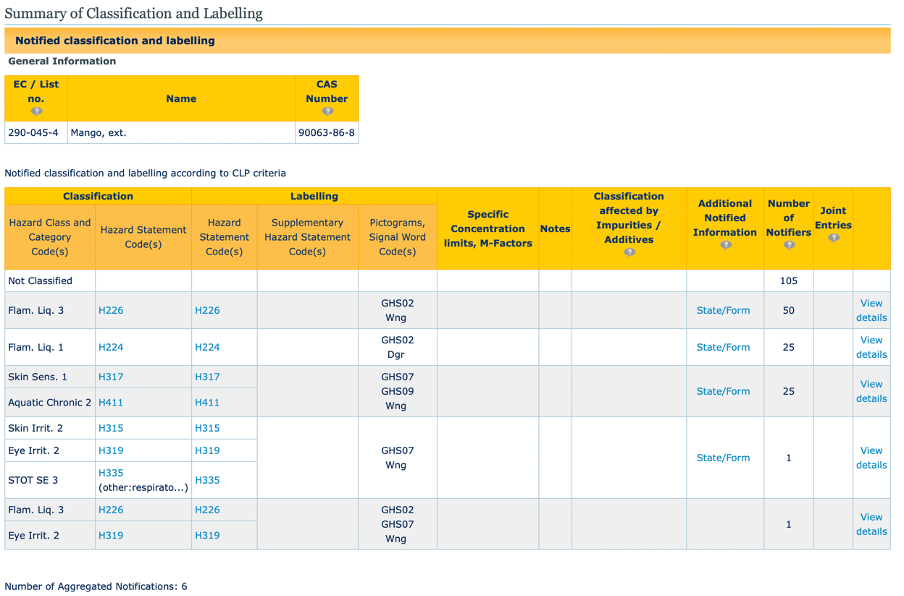

Below is the CLP summary for mango extracts (CAS number 90063-86-8, including mango butter) as published by ECHA.

Figure 1: CLP summary for mango extracts

Source: ECHA CLP database.

Note that CAS number 90063-86-8 covers a wide range of mango extracts, not just mango butter: “Extractives and their physically modified derivatives such as tinctures, concretes, absolutes, essential oils, oleoresins, terpenes, terpene-free fractions, distillates, residues, etc., obtained from Mangifera indica, Anacardiaceae.”

Some of these extracts, such as essential oils, are classified as flammable and some may irritate the skin. Mango butter itself is not classified as hazardous. According to the table above, 105 European companies have notified the ECHA of their imports of mango butter. In all, there have been 102 notifications of imports of other (hazardous) forms of mango extracts.

It is important to note that companies have to produce their own data for their own notifications. They cannot use the data already published in another notification. For further information, you will find extensive resources on the ECHA website. And UNIDO has published a guide to understanding CLP.

Tips:

- Consider what your customer needs from you in order to make its own sales activities successful.

- Keep up to date on developments in the European cosmetics industry by referring to the European Commission website on cosmetics. This contains information about ingredients as well as cosmetic products.

- Familiarise yourself with the three main regulations that relate to your products: the Cosmetics Regulation, REACH and the CLP. The ECHA has published guidance on the last two of these.

- Make sure that you have prepared a Safety Data Sheet for your mango butter. See the CBI workbook for preparing a technical dossier for cosmetic ingredients.

- If no-one in your company is technically qualified to prepare a Safety Data Sheet, contact local technical service providers in your country. Also read the ECHA guidance.

- See the ECHA CLP database for notifications made by European importer-distributors and manufacturers.

- Use the CBI market studies to find out more about market requirements.

Technical documentation

To comply with the EU’s legal requirements, European buyers of mango butter for cosmetics need you to provide a well-prepared technical dossier. This not only demonstrates your commitment to quality and reliability, but also your concern for sustainable and ethical sourcing.

The technical dossier should include the following items.

- A Technical Data Sheet (TDS).

- A Safety Data Sheet (SDS).

- A Certificate of Analysis (CoA).

- A fatty-acid profile

- An allergen declaration.

- Information on traceability back to origin.

- Responsible sourcing policies and practices.

- Records of certifications awarded and standards applied.

The allergen declaration for vegetable oils is used by the cosmetics industry because of the possible risk of allergic reactions to certain proteins found in oil seeds. These can remain in the oil if it is not properly pressed or refined. The declaration is not a legal requirement, but a precaution taken by the cosmetics industry based on experience from the food industry, even though it has been shown that vegetable oil does not cause allergic reactions in the vast majority of susceptible people. The cosmetics industry is extremely concerned about allergic reactions from the use of its products. See the box below for further information.

Allergens

Peanuts are a well-known food allergen. The European Food Safety Authority (EFSA) advises people who are allergic to peanuts to avoid crude peanut oil as well, because it may contain traces of peanut protein. But the EFSA also reports that refined peanut oil has not been found to trigger allergic reactions. It therefore concludes that the risk of a severe adverse reaction to highly refined peanut oil seems to be low, but cannot be ruled out entirely.

A safety assessment of vegetable oils for the cosmetics industry reports that even unrefined mango butter used as a flavouring, which is likely to contain significantly more proteins than other edible fatty acid oils, causes very few known cases of allergic reaction.

Even though the science thus raises no major concerns in this regard, manufacturers of cosmetics still take the precaution of requesting an allergen declaration from their suppliers of vegetable oils. This should state that the oil contains no detectable quantities of protein. From the above, it seems likely that analysis of an unrefined, cold pressed oil may well detect protein and so it is not possible to make the requested declaration. On the other hand, fully refining a vegetable oil (including bleaching and deodorisation) should reduce its protein content to undetectable levels. This is why most manufacturers of cosmetics demand fully refined oils. Some, however, are happy to buy cold-pressed and filtered products.

Another useful reference when developing technical documentation for mango butter is the Safety Assessment of Plant Derived Fatty Acid Oils. This contains typical reported properties and fatty acid profiles for 244 vegetable oils and butters, including mango butter, as well as data on other fatty acid derivatives of natural oils. It also reports on basic toxicological tests carried out on the oils and butters, and assesses their results. Mango butter was found to be non-irritating and not to sensitise the skin, even when used at 9% concentration in a body-care product. In fact, all the fatty acid oils that were tested proved safe for use in cosmetics.

Tips:

- Read the CBI study on preparing a technical dossier for cosmetic ingredients, which provides information and guidance. This should give you an advantage in your journey to enter the European market.

- Make sure you know how to prepare the Technical Data Sheet and Safety Data Sheet for your mango butter.

- Identify local laboratory services that can prepare a Certificate of Analysis, including an analysis of protein content for the allergen declaration. If none is available, ask the business support organisations in your country for advice.

Quality and consistency requirements

In addition to their standard quality, European buyers of vegetable oils in the cosmetics industry are particularly concerned about adulteration, contamination and traceability.

Three analytical techniques are available to check the identity of an oil: saponification value, iodine value and fatty acid profile. Your certificate of analysis should include all three of these parameters. The Safety Assessment report includes typical values for each of them, which you can use as a reference.

In addition, you should provide evidence of traceability to the source. And also evidence that only mango kernels were processed through the oil press.

Heavy metals are another quality criteria for buyers of vegetable oils. In principle, substances like lead, mercury, antimony, arsenic and cadmium are strictly prohibited in cosmetic products (see Annex II of EU Regulation 1223/2009). However, trace amounts are permitted if they are technically unavoidable and do not pose a risk to human health. But maximum concentration values have not yet been established at the EU level; each country still sets its own limits. As an example, table 1 shows the figures for Germany.

Table 1: Maximum permitted concentrations of heavy metals in cosmetics (Germany)

| Heavy metal | Maximum permitted concentration in cosmetics, in mg/kg or parts per million (ppm) |

| Antimony | 0.5 |

| Arsenic | 2.0 |

| Cadmium | 0.1 |

| Lead | 1.0 |

| Mercury | 0.1 |

| Nickel | 10 |

Source: Cosmetics Design.

Including data on heavy metal content in your specification and certificate of analysis allows a manufacturer to calculate the impact on the heavy metal content of the final product. It should not be necessary to analyse heavy metal content more than once or twice per year, unless requested by your customer or you change the source of your raw material or your processing equipment.

European buyers routinely test products they purchase to ensure that they meet quality requirements. And they may refuse to pay for products that fail the tests. They also test samples provided by prospective exporters when deciding whether or not to do business with them.

Consistently high-quality vegetable oils that conform to set specifications are important to European buyers, because for them quality is a core value underpinned by the cosmetics regulations.

Tips:

- Know how you are going to prove the purity and identity of your mango butter. Anticipate these questions from your prospective customers and provide the information before they ask.

- Before you ship a sample to a prospective buyer, make sure that it conforms to the specification you have already provided or are sending with the sample.

- Prepare a fatty acid profile for your mango butter.

- Carry out heavy metal and pesticide analyses at least once a year, and more frequently if you change your sources of raw material, equipment or processing method.

- Only make commitments and reach agreements with buyers if you can guarantee to meet them. Failing to meet agreed commitments may damage or even end your business relationship with the buyer.

Quality management

When assessing the credibility of prospective exporters, European buyers of natural ingredients for cosmetics are increasingly considering their quality management standards. Adopting these gives you credibility because it shows your commitment to delivering high-quality ingredients, as well as giving your company a positive image. It can also help to demonstrate your compliance with mandatory requirements.

At the very least, you should have a documented HACCP (Hazard Analysis and Critical Control Points) system. But also consider adopting quality standards for your production methods, such as ISO 22000 and ISO 9001:2015 from the International Organisation for Standardisation (ISO) and Food Safety System Certification (FSSC) 22000.

Tips:

- Inform European buyers of the standards you meet and provide details on your website and marketing materials. This may give you an advantage over your competitors, since buyers look for these standards when assessing exporters. The Indian company Manorama Industries is an example of an exporter doing just that.

- Study the HACCP requirements and prepare a HACCP manual for your business.

Labelling and packaging

Your product labelling should include the following information:

- International Nomenclature Cosmetic Ingredient (INCI) name and product name.

- Name and address of exporter.

- Batch code.

- Place of origin.

- Date of manufacture.

- Best before date.

- Net weight.

- Recommended storage conditions.

- If you export organic mango butter: your organic certification number with the name/code of the certifying body.

European buyers require good-quality mango butter. So consider the following packaging tips to preserve the quality of your products in transit:

- Use drums that conform to UN standards.

- Ensure that containers such as drums are clean and dry before filling them.

- Flush the headspace with nitrogen.

Other ways to preserve quality include making sure that your mango butter is kept at the right temperature throughout the supply chain and always storing it in a dry place, in the shade.

Tips:

- Speak to European buyers to find out if they have any preferences or specific requirements concerning labelling and packaging. Consider meeting with them to increase your chances of entering the European market.

- Use UN standard drums and canisters for your mango butter. Check the grade required with your drum provider. Shipping information is also included in section 14 of the Safety Data Sheet.

- Inform your logistics provider that your mango butter needs to be kept in a cool, dry place on its journey to Europe, in order to preserve its quality.

- Make sure that certified organic mango butter is kept physically separate from non-organic products to prevent cross-contamination.

Payment terms

Payment is at the heart of trade and presents risks for all parties involved. Before trading with European buyers, conduct risk assessments of the payment terms on offer. As an exporter of mango butter, minimise your risks whilst working to meet the needs of your buyers.

There are several possible methods of payment. But letters of credit (LCs) are generally considered the safest form for both importer-distributors and exporters. This is because an LC allows both parties to contact a neutral arbitrator, usually a bank, to resolve any issues. For the exporter, the chosen bank acts as a guarantor of full payment as long as the goods have been dispatched. If a buyer does not pay as agreed, to avoid further losses the exporter should find new buyers and pay for the return of the goods.

Depending on their needs, importer-distributors and exporters can choose between several categories of LC, with different terms of payment. They include standby, revocable, irrevocable, revolving, transferable, non-transferable, back to back, red clause, green clause and export/import. For exporters, standby LCs are considered the safest form and so they are frequently used in international trade. This is because they offer security for both importer-distributors and exporters who have little trading experience with one another. Other payment terms include cash in advance, documentary collection and open account.

Many buyers will not use letters of credit, however, so you may have to consider other payment terms. One common alternative is 50% upon delivery to the shipper and the remaining 50% upon approval of the goods. Also consider taking out export credit insurance. Check what is available in your own country.

When negotiating with your customer, make sure you discuss and agree the Incoterms (International Commercial terms) that will apply to the order. Incoterms are a set of 11 internationally recognised rules which define the responsibilities of sellers and buyers. For example, they specify who is responsible for paying for and managing the shipment, insurance, documentation, customs clearance and other logistical activities.

Tips:

- Minimise your risks while working to meet the needs of European buyers. First assess your own needs, then speak to buyers to find out their needs. Finally, work out a compromise which satisfies both sides. Do not agree to terms you cannot meet.

- Learn about and use Incoterms. They are critical when negotiating payment and delivery terms with potential buyers. In the event of a dispute, the agreed Incoterms will be very helpful.

Delivery terms

Before agreeing delivery terms with European buyers, you need to carefully consider three important factors: delivery time, volume and cost. This is because failure to meet agreed terms could end your trading relationship with a buyer.

- Delivery time. European buyers prefer shorter delivery times. Air freight is usually faster than sending goods by sea. It is also more reliable with regard to on-time delivery.

- Delivery volume/quantity of order. The volume of your order is an important factor to consider when choosing a mode of transport. Larger quantities are often cheaper to ship by sea. With smaller volumes, air freight can be less expensive as margins shrink.

- Cost of delivery. When shipping larger volumes, sea freight is usually four to six times cheaper than sending goods by air. The price of your shipment is unlikely to increase substantially if you increase the volume.

Tips:

- Be open-minded and flexible. Remember that there may well be tensions and trade-offs with European buyers, especially if you are doing business with them for the first time.

- Read the CBI’s tips for organising your exports of natural ingredients for cosmetics to Europe for guidance on practical matters, such as customs, tariffs, transportation and documentation.

What are the requirements for niche markets?

Organic, natural and fair trade

Although there is no official certification scheme for organic cosmetics, there is growing demand in the European cosmetics market for certified organic ingredients. More and more products and ingredients are being certified as ‘natural’ and ‘organic’ by private bodies. The leading organic and natural standards for cosmetics are:

Both of these private standards have established definitions for organic and/or natural ingredients and final products.

There are at least ten other natural and organic standards for cosmetics in Europe. They include Demeter and Organic Farmers and Growers.

The ISO has also introduced a two-part natural and organic standard for cosmetics and cosmetic ingredients (ISO 16128, parts 1 and 2). After purchasing the standard itself, you can apply it to your supply chain without paying certification costs. While this self-certification has been criticised because it lacks independent verification, it also has positive aspects. Above all, it is a low-cost way to demonstrate your natural and organic credentials. This lowers barriers, which in turn should increase the number of companies developing natural and organic products. A number of major companies already use ISO 16128.

There are various certification labels for environmental and social standards, too.

- Fairtrade International Although there are official Fairtrade prices for mango fruits and pulp (organic and conventional), there is not one specifically for mango butter or kernels. But the organisation does state how much fair trade premium should be added to the market price of mango kernels.

- FairForLife. A number of companies are already FairForLife certified for mango butter. One example is Manorama Industries.

- UEBT, the Union for Ethical Biotrade, which certifies practices that respect people and biodiversity in the way ingredients are grown, collected, studied, processed and commercialised.

Tips:

- Consider obtaining natural and/or organic certification for your essential oils. That is likely to give you an advantage in the European market.

- Visit the ICADA website for more information about ISO16128.

- Visit the NaTrue and COSMOS websites for information on obtaining their certification.

- Once you have been certified, let European buyers know. That is likely to make you more appealing as a supplier, and so ease your entry into the European market

- Look at the ITC Standards Map for information about certification schemes popular in the European consumer market for cosmetic products and their natural ingredients. This will help you make a more informed choice when assessing if there is a business case for you to obtain certification.

2. Through what channels can you get mango butter on the European market?

As an exporter, it is important to know how the European end market for vegetable oils is segmented, how the oils reach that market and which channel is the most interesting for you. This knowledge will help you in your journey.

Most vegetable oils and butters used in cosmetics are refined. This is done to produce an oil consistent in colour, odour and other quality characteristics, which reduces the risk of batch-to-batch variation in the manufacture of the final cosmetic product. So the majority of importers to Europe are companies with their own refining facilities. The unrefined oil or butter is kept in storage until needed, then refined shortly before being shipped to the manufacturer.

European companies selling mango butter include GustavHeess Oils, ParodiNutra, and IMCD. Details of some of the other well-known importers can be found in our market analysis study for mango butter .

If you have access to refining operations in your own country, or you can arrange for a toll-refining service, this may create opportunities to sell your refined, bleached and deodorised mango butter directly to the European cosmetics industry. However, that will require careful analysis of the costs and logistical requirements. Manufacturers usually order smaller quantities on a regular basis, and will not tolerate late or incomplete deliveries. Unlike the big importers, they do not require large volumes on an infrequent basis. So study the feasibility of your plans carefully.

How is the end-market segmented?

Vegetable oils and butters can be used in nearly all cosmetics, although the concentration will vary from product to product. As the supplier of an ingredient, you have little or no say over the products your oil is used in. That is decided by the manufacturer.

When promoting your mango butter in particular, however, remember that it is most suitable for skin-care products, especially body, hand and face creams. So refer to these rather than shampoos and conditioners that contain low percentages of vegetable fats. Or perfumes, which rarely contain vegetable oils or butters at all (with the exception of solid perfumes).

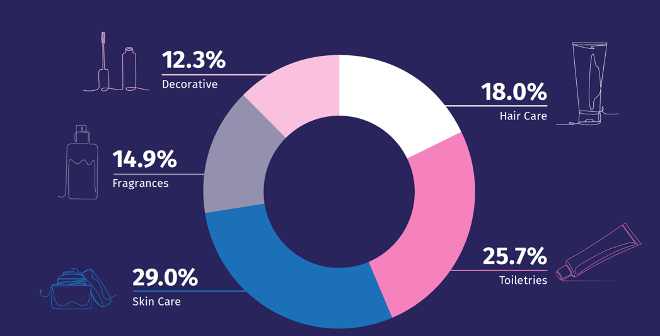

Figure 2 shows how the cosmetics market is segmented in Europe. Skin care is the largest segment, followed by toiletries, hair care, fragrances and make up (‘decorative’).

Figure 2: European cosmetics market 2021: market share by product category (%)

Source: Cosmetics Europe Market Performance Report 2021, p. 12 (https://cosmeticseurope.eu/cosmetics-industry/).

Tips:

- If you have your own refining capability, study the market requirements of downstream manufacturers and smaller importer-distributors. But remember that there can be logistical challenges in meeting their delivery requirements. The costs could be too high.

- Prepare your trade offers to suit the needs of importer-distributors (large and small) and the other types of company mentioned above. Note that the latter groups often want to place smaller but more frequent orders of identical specification.

- To find more buyers, study trade fair catalogues (e.g. in-cosmetics, SCS Formulate) and the membership lists of trade bodies like the Alliance of Chemical Associations, as well as websites that specialise in promoting ingredients (e.g. SpecialChem/Cosmetics and ULProspector).

- See the CBI’s tips for finding buyers in the European cosmetics market for a list of trade fairs in this sector.

Trough what channels does mango butter end up on the end market?

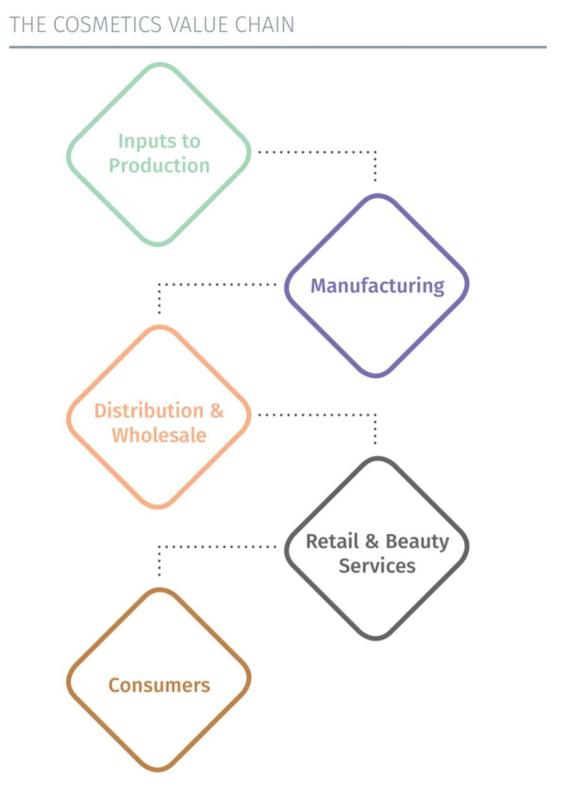

The cosmetics and personal care industry value chain has five levels.

- Inputs to production. Companies that provide the raw materials used to make cosmetics and personal-care products.

- Manufacturing. Product manufacturers, as well the providers of support services such as marketing and IT.

- Distribution and wholesale.

- Retail and beauty services.

- Consumers. Individuals who purchase cosmetics and personal-care products represent the final link in the value chain.

Figure 3: The cosmetics value chain

Source: Cosmetics Europe

Tips:

- Focus your buyer research on importer-distributors of cosmetic ingredients, using information from industry associations as well as details of the exhibitors on trade fair websites.

- In your marketing, draw attention to the use of mango butter in products with the highest concentration of vegetable oil.

What is the most interesting channel for you?

As an exporter of mango butter, the most interesting sales channel for you is importer-distributors in Europe. This is because they not only buy the largest volumes for onward distribution but they also already have experience dealing directly with exporters from developing countries. So they understand the challenges and constraints associated with the supply, processing, testing and delivery of raw materials.

Given that most vegetable oils need to be refined before they are used in cosmetics, you should also look for companies with their own refining facilities.

3. What competition do you face on the European market for mango butter?

Your competition is other suppliers of mango butter from those countries where mangoes are available in surplus quantities.

What companies are you competing with?

The world’s main sources of mango butter are India and China. Even though mangoes grow widely throughout the tropics, very few other countries supply mango butter in large quantities.

The three most important countries for mango production are India, Indonesia and China. It is estimated that India produces nearly 25 million tonnes of mango fruit a year. But less than 1% of this quantity is released for international trade. Indonesia, on the other hand, is thought to produce around 3.6 million tonnes a year and is the major supplier of mango fruit to the world. China produces around 2.4 million tonnes for local consumption and export.

As for mango butter for the cosmetics market, most is supplied by Indian companies. It is often then refined in Europe. But India also exports mango butter to countries that are important producers of the fruit themselves, such as Nigeria and Kenya. This would suggest there are opportunities for manufacturers in those other countries to start producing mango butter from their own crop.

Tips:

- Carry out market research to identify companies exporting mango butter to Europe. Start with your country, then your region and then further afield.

- To find out more about these companies, study their websites. Ask yourself what you can learn from them and what is missing from your own offer.

- Find out what support is available in your own country from industry associations, government agencies and other business support organisations. Is your country one of those in which CBI is active?

- If your country produces mangoes but does not yet export mango butter, carry out a feasibility study to find out if you could establish a profitable export business.

Which companies are you competing with?

As your main customers are the European importer-distributors of mango butter, your competition is other producers of mango butter outside Europe. As noted above, India is a major supplier. So you are competing mostly with Indian companies. All successful exporters to the European market have met their buyers’ expectations in terms of price, quality and reliability. To increase your market share, you will need to pay attention to these aspects.

Different buyers have slightly different definitions and expectations when it comes to price, quality and reliability. For example, a company that uses organic mango butter in its products will be prepared to pay organic grade prices. Some customers will expect reliable delivery of their orders within 10 days, say, while others might be prepared to wait 8-12 weeks. You can expect the prices paid in these different scenarios to be different.

Basic requirements are becoming more and more stringent. Especially regarding sustainability, social responsibility and traceability. These are now expected by buyers.

As mentioned above, few countries other than India and China export mango butter in large amounts.

Below we look at two companies exporting this product, one in India and the other in Ghana. Each supplies an interesting range of ingredients, but they take different approaches to promoting their business.

Manorama Industries Limited is one of India’s many producers of mango butter. But it stands out because it supplies retail chain The Body Shop as part of its Community Fair Trade programme. Manorama’s expertise lies in the supply of tree butters and oils to the food, cosmetics and veterinary industries. Apart from mango butter, it offers a wide range of other vegetable butters, fats and oils, including sal, kokum and mahua butter and karanja oil. Many of its raw materials are sourced from the wild and collected by women, mainly from tribal communities. On its website Manorama Industries publishes details of its responsible sourcing policy, the benefits to the communities it works with and product traceability and quality, as well as describing how each raw material is suited to a particular industry based on its properties and benefits.

Spearson Limited is a company based in Kumasi, Ghana – not a major mango-butter exporting country. Spearson processes a wide range of natural ingredients for the cosmetics and pharmaceuticals industries. Among those it processes itself, in Kumasi, is mango butter. In fact, Spearson supplies two types. As well as butter from the species Mangifera indica – the product’s most common source and the main focus of this study – it also makes a version extracted from the African bush mango (Irvingia gabonensis). Other products from Kumasi include ximenia butter, kombo butter and moringa oil. This range reflects Spearson’s focus on the supply of innovative specialist raw materials from West Africa. The company focuses on its product and keeps its advertising low key. It provides no public information about traceability and responsible sourcing. The business owner has a LinkedIn page and offers a product catalogue via a WhatsApp for business number.

Tips:

- Beyond price, quality and reliability, buyers are eager to be involved with suppliers and supply chains that make a difference. Where are you making a difference? How can you communicate that? What can you do to go beyond minimum requirements?

- Consider working with local agencies to support you in your social responsibility activities. This also helps you to build credibility as a third-party contributor.

- Make sure you have a professional website with well-prepared content, which clearly informs potential buyers of your strengths and your unique selling points (USPs).

Which products are you competing with?

All vegetable oils, including mango butter, have the same basic chemical properties. They are fatty acid oils with a triglyceride structure and emollient properties. Emollients soften or smooth the skin. In this respect, mango butter competes with all other vegetable oils and butters. When creating a body cream, for example, a cosmetic scientist can use any vegetable oil. But for a body butter the use of a vegetable butter adds to the overall impression of a rich, emollient cream that moisturises the skin with a beautiful fragrance.

At the same time, the different fatty acids found in different oils have different effects on the skin. In this respect, mango butter has a profile similar to shea and cocoa butter – two well-known cosmetic ingredients. Unrefined mango butter contains about 3% unsaponifiable matter, such as phytosterols and polyphenols. These have anti-inflammatory and antioxidant properties, which are beneficial in cosmetics. So mango butter is in demand for its protective, softening, soothing and moisturising properties.

Due to its relatively high concentration of stearic acid (a property it shares with shea and cocoa butter), mango butter has a solid consistency at room temperature. Also like shea and cocoa butter, it melts at body temperature or upon contact with skin. This is a desirable quality for cosmetics.

You will also be competing with other products at the level of the supply chain and with regard to traceability and social responsibility. Some buyers are looking particularly for suppliers and supply chains that involve local communities, or for evidence of additional benefits through participation in socially responsible networks.

Tips:

- Learn more about the chemistry of vegetable oils so that you understand how to promote and differentiate your mango butter based on its chemistry, its fatty acid composition and its other properties.

- Build a marketing story emphasising your social and environmental performance.

4. What are the pricesfor mango butter on the European market?

For most ingredients used in cosmetics, very little published data is available about export market prices. The exceptions are commodities with their own HS (harmonised system) product code, like castor oil, cocoa butter, coconut oil, olive oil, palm oil and a few others. Mango butter does not have an HS code and so finding accurate price information takes some effort.

Using internet searches, though, it is possible to find out the prices that artisan or small-scale cosmetics manufacturers are charged. These are for larger quantities than retail packs, but less than the amounts handled by importer-distributors. They are for pure butters that can be applied directly to the body or used in the manufacture of finished cosmetic products.

Table 2: Small-scale distributors’ online prices (examples, in pounds sterling )

| Company | Naissance | Mystic Moments | Soapkitchen |

| Product | Mango butter | Mango butter | Mango butter |

| Quantity (other pack sizes available) | 1 kg 500 g | 200 kg 500g | 25 kg 500 g |

| Online price, 21 October 2022 (rounded) | £19/kg £12/500 g | £1,935/200 kg £11/500 g | £264/25 kg £9/500 g |

| Equivalent price per kg (rounded) | £19-24 | £10-11 | £11-£18 |

Source: Fair Venture Consulting.

Assuming a 50% mark-up between FOB (free on board) and the distributor’s selling price, it is possible to estimate the FOB price. From the above data, this works out at approximately £7-16 per kilogram FOB.

Care needs be taken when drawing conclusions from this data. There are several unknowns, including the quantities exported (volume breaks) and any additional processing that may have been carried out between export and retail sale.

Tips:

- Study the price information that can be derived from databases such as the ITC Trade Map and Eurostat.

- Make sure that you have detailed and accurate costs of production for your mango butter, then add a reasonable margin on top. How does the result compare with published import prices?

- Know how to calculate prices for different Incoterms.

- Know how your product and value proposition compare with your competition. Be clear and confident with the buyer about your quality, USPs and differentiators.

- Prepare your price lists before going into a meeting with a buyer. Have different prices ready for different payment terms, Incoterms and price breaks (discounts for larger orders).

This study was carried out on behalf of CBI by Fair Venture Consulting.

Please review our market information disclaimer.

Search

Enter search terms to find market research