The European market potential for mango butter

Mango butter has a wide range of applications in skin and hair care. Its composition makes it a viable alternative to shea butter and cocoa butter in personal care products. However, it is a more niche ingredient than those alternatives.

Contents of this page

1. Product description

Mangifera indica, the mango tree, provides the seed from which the butter or oil is extracted. Mangoes grow widely in tropical climates. The main producers are India, Indonesia, China, Mexico and Pakistan. India, China and the USA are the world’s main sources of mango butter. The top-4 countries in Africa for mango production are Malawi, Egypt, Nigeria and Kenya. Typically, mango butter is a by-product of the mango fruit processing industry, although non-commercial varieties are also used.

Figure 1: A mango fruit

Source: Pixabay

Mango butter is extracted by expeller pressing or cold pressing the kernels that are removed from the dried mango stones. The oil-bearing mango seeds are placed inside a hydraulic press, where they are subjected to high pressure and friction to release their oils, which seep through small openings at the bottom of the pressing barrel. Due to the kernels’ relatively low oil content (10-12%), they may require two passes through the equipment.

The European cosmetics industry uses mango butter because its properties are ideal for a range of cosmetic products. Mango butter has protective, softening, soothing and moisturising properties.

The typical fatty acid profile of mango butter is shown in Table 1 below. Unrefined mango butter contains about 3% unsaponifiable matter, such as phytosterols and polyphenols. These have anti-inflammatory and antioxidant properties, which are beneficial in cosmetics. After refining, however, these components are reduced or removed.

Mango butter has a similar fatty acid composition to cocoa butter and shea butter.

Table 1: Fatty acid compositions of mango, cocoa and shea butter

| Mango butter | Cocoa butter | Shea butter | |

| Palmitic acid | 5-8% | 24-29% | 3-9% |

| Stearic acid | 33-48% | 34-36% | 30-50% |

| Oleic acid | 35-50% | 30-40% | 38-50% |

| Linoleic acid | 4-8% | 2-4% | 3-8% |

| Arachidic acid | 1-7% | - | 2.5-3% |

Source: Safety assessment of plant-derived fatty acids

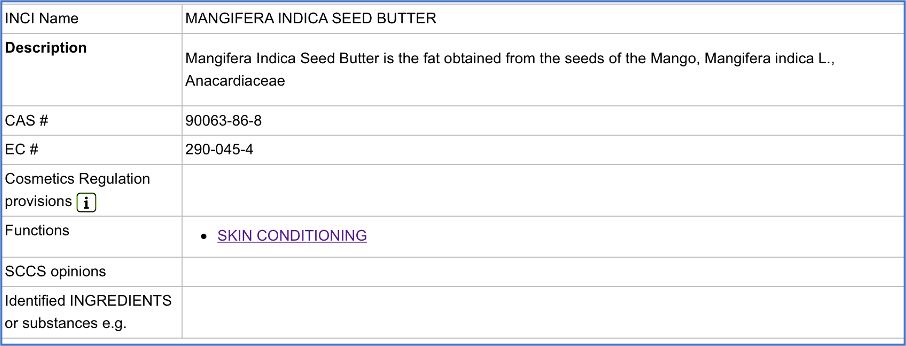

Ingredients used in European cosmetics are often referred to by their INCI name. INCI stands for the International Nomenclature for Cosmetic Ingredients, a system managed by the Personal Care Products Council (PCPC). CosIng, the European Commission’s database for information on cosmetic substances and ingredients, is derived from INCI; its website is the best place to look up cosmetic ingredients by their INCI names. See figures 2 to 4 for examples of CosIng entries. For more information, read the CBI workbook for preparing a technical dossier for cosmetic ingredients.

In the cosmetics industry, mango butter is referred to by its INCI name: MANGIFERA INDICA SEED BUTTER.

Figure 2: CosIng entry for mango butter

Source: CosIng

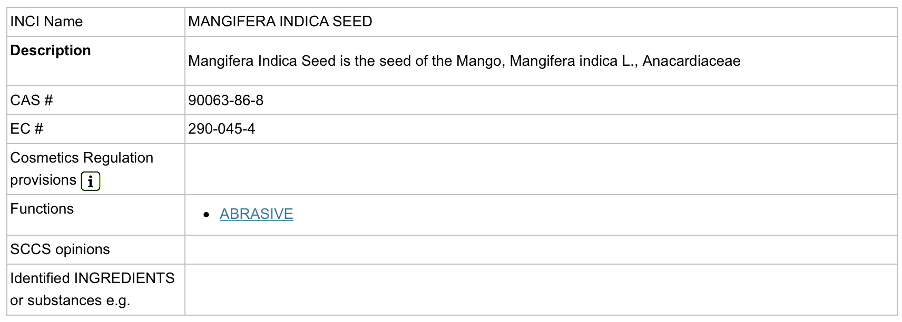

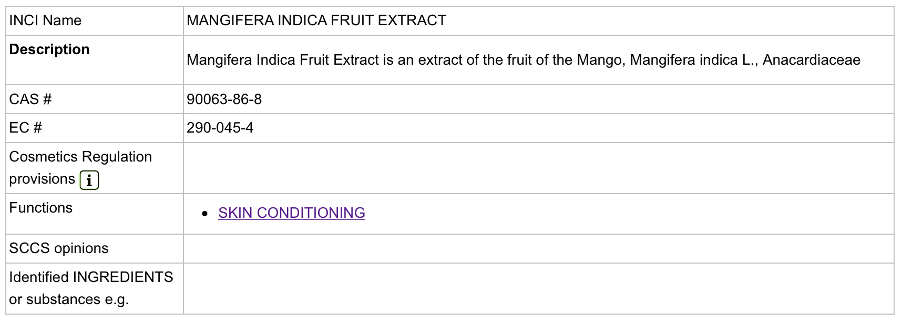

This name is also used on the labels of finished cosmetic products containing mango butter. CosIng has 19 other entries for cosmetic ingredients that contain or are derived from mango. These include mango seed and mango fruit extract. Their entries are shown below.

Figure 3: CosIng entry for mango seed

Source: CosIng

Figure 4: CosIng entry for mango fruit extract

Source: CosIng

Mango butter can be used in all categories of cosmetic products except perfumes, which usually do not contain vegetable oils.

Due to its relatively high concentration of stearic acid (a property it shares with shea and cocoa butter), mango butter has a solid consistency at room temperature. Also like shea and cocoa butter, it melts at body temperature or upon contact with skin. This makes it suitable for a wide range of cosmetic products.

- Body creams

- Hand creams

- Hair treatments and masks

- Massage bars

- Lip balms

- Cleansing lotions

- After-sun care products

- Colour cosmetics

Besides skin-care products, mango butter has a numerous applications in hair care. It can be used as a hair and scalp conditioner, and due to its emollient (softening and smoothing) properties it keeps hair looking healthy by reducing breakage and dryness. The vitamins and minerals it contains nourish the hair and scalp and promote hair growth. Mango butter can help control frizz and lock in moisture.

Mango butter is available in refined and unrefined forms. Unrefined mango butter contains a higher amount of unsaponifiable matter. This means that it has more soothing and conditioning properties than the refined product.

As with shea butter, the refined form of mango butter is more commonly used by the cosmetics industry. Refining produces a butter with a uniform colour, odour and composition. It is therefore preferred by cosmetic product formulators.

Mango butter is traded under HS codes 15159040 and 15159060. Both of these also cover many other vegetable fats and oils. Moreover, some companies import whole dried mango kernels for oil extraction in Europe. These are classified under HS Code 120799, which also includes other seeds/kernels. As a result, no specific import data for mango butter or kernels is available.

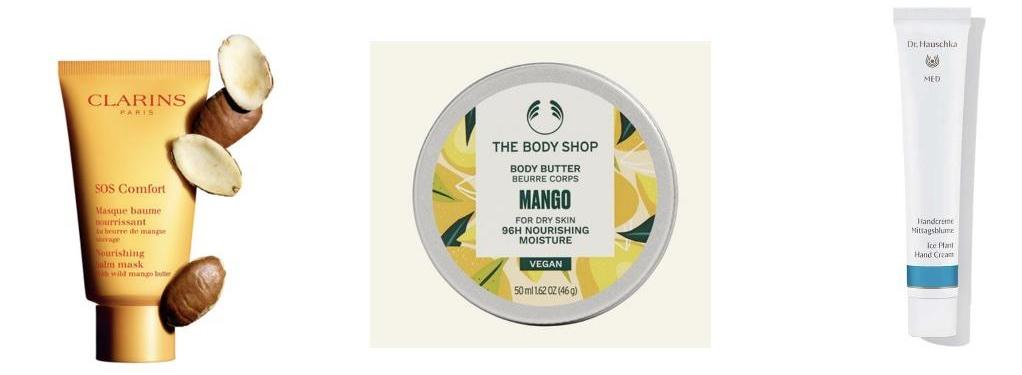

Figure 5: Examples of mango butter products sold in Europe

Sources: Clarins, The Body Shop, Dr Hauschka

Tips:

- Make sure that you can obtain enough mango seeds to supply at least 5 tonnes of mango butter a year.

- Make sure that your mango processing and oil extraction technology can extract the oil efficiently from the kernels. Most likely, you will be adding mango butter to an existing range of vegetable oils and butters.

2. What makes Europe an interesting market for mango butter?

Mango butter provides cosmetic products with effective skin-care properties. In all age groups, more and more people are applying products to protect their skin against the harsh effects of the weather and dry environments. So demand for these products is growing. As an effective alternative to shea butter, which is now found in so many products, mango butter offers similar characteristics but has a more exclusive image. European personal care formulators prefer to use refined mango butter due to its consistent characteristics. Mango butter is more expensive than some competing products, such as shea butter and cocoa butter.

In addition to its cosmetic benefits, there is growing interest in mango butter because of: (a) increasing demand generally for natural ingredients in the European cosmetics sector; and (b) the need for ingredients that differentiate higher-end cosmetics from the more mass-produced products available on the high street and in supermarkets. Cosmetics companies can meet both these needs by using exotic and fruit-related ingredients in their formulations. Mango butter is also finding applications in segmented personal care products, such as anti-ageing creams. Hence from the above list of product types, the product brand may also make anti-aging claims where this is substantiated.

According to data published by Cosmetics Europe, the European cosmetics and personal care market is (along with the USA) one of the largest in the world. In 2021 it was worth €80 billion. After a drop in 2020 because of the Covid-19 pandemic, this was a welcome recovery. See figure 5 below.

The largest national markets for cosmetics and personal care products within Europe are Germany (€13.6 billion), France (€12.0 billion), Italy (€10.6 billion), the UK (€9.9 billion), Spain (€6.9 billion) and Poland (€4.0 billion).

Source: Cosmetics Europe market performance reports 2017-2021 (https://cosmeticseurope.eu/cosmetics-industry/)

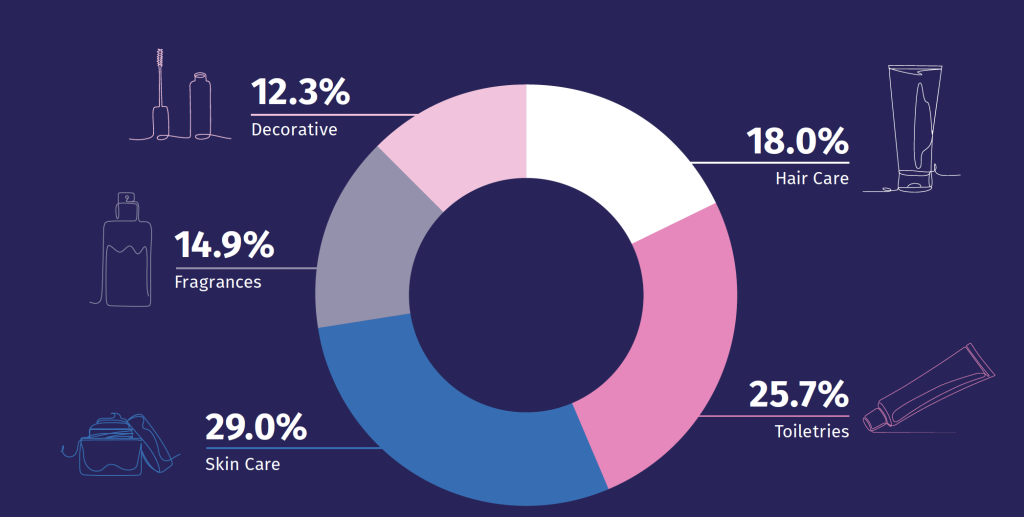

Skin care is the most important segment in the European market, representing nearly 30% of total retail sales (see figure 7). Skin-care products are also the main destination for mango butter; they tend to contain the highest percentages of vegetable oils and butters, which means that their manufacturers need to buy those ingredients in large quantities. Under the right conditions, however, mango butter can also be included in the whole range of cosmetic products apart from perfume sprays and the like. On the other hand, solid perfumes could be formulated with mango butter. In the toiletries segment, mango butter could be used to make mango butter soap.

Figure 7: European cosmetics market 2021: market share by product category (%)

Source: Cosmetics Europe Market Performance Report 2021

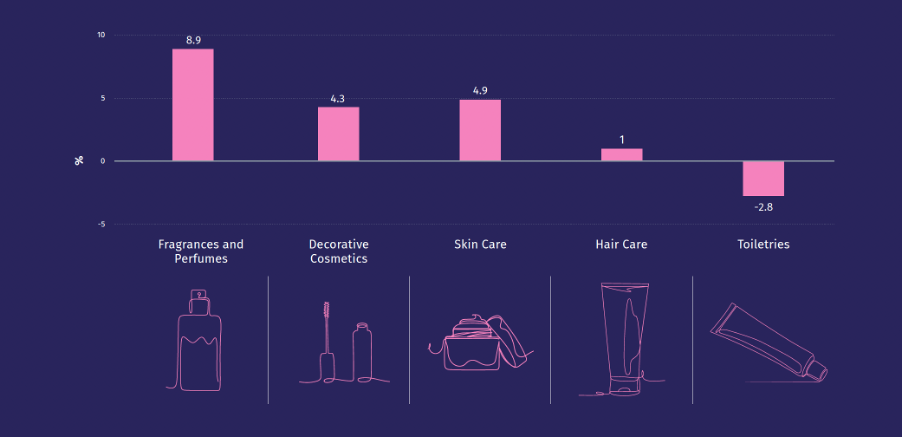

In figure 8 below, we see that sales grew in all segments except toiletries between 2020 and 2021. This is encouraging news for suppliers of cosmetic ingredients used in skin-care products, including mango butter.

Figure 8: European cosmetics market 2021: market changes by product category 2020/2021 (%)

Source: Cosmetics Europe Market Performance Report 2021

During the pandemic, the cosmetics sector in Europe experienced a drop in overall sales. The Cosmetics Europe Market Performance Report 2020 (page 10) compares the figures for 2019 and 2020. Apart from Norway, Lithuania and the Czech Republic, all European countries saw sales fall. In Italy and Spain the decline was nearly 10%.

Between 2020 and 2021, however, the situation reversed almost completely. Nearly every country saw its year-on-year sales increase again. The only exceptions were Germany and the UK. The biggest rises were in Estonia, Italy and Poland, by 9.4%, 8.8% and 8.2% respectively.

Most major cosmetic brands use mango butter. They include The Body Shop, Clarins and Dr Hauschka. This creates interest in the ingredient and encourages other brands to include it in their own products. Internet searches reveal that many companies now offer cosmetic products containing mango butter. Another relevant feature of the industry is that nearly all the major suppliers of cosmetic ingredients in Europe sell mango butter. See the next section for more details.

No specific import data is available for mango butter. It is grouped with other vegetable oils under HS codes 15159040 (crude fixed vegetable fats and oils[TC1] ) or 15159060 (vegetable fats and oils, refined or unrefined[TC2] ). Both cover a large number of different oils, making it impossible to draw meaningful conclusions about any particular type.

As an alternative, we can look at the figures for skin-care products. After all, they are the biggest user of mango butter in Europe. Understanding this market should therefore give us an insight into demand for mango butter.

Cosmetics Europe publishes European market data for each of its product categories. Table 2 lists (in order) the six largest national markets by retail value for the skin-care category. The same six countries are the leading markets for cosmetics as a whole, but in a different order. Germany, for example, is the biggest market overall but ranks third for skin-care sales. Italy, on the other hand, is third overall but in 2021 had the highest retail sales for skin care.

Table 2: Sales of skin-care products and cosmetics as a whole by country (top 6 only), 2021

| Country | Retail sales of skin-care products 2021 (€ millions) | Total sales of cosmetics 2021 (€ millions) (rank) | Per capita spending on skin care | Per capita spending on all cosmetics |

| Italy | 3,834 | 10,640 (3) | €65 | €180 |

| France | 3,804 | 11,967 (2) | €56 | €177 |

| Germany | 3,184 | 13,604 (1) | €38 | €164 |

| UK | 2,576 | 9,885 (4) | €38 | €145 |

| Spain | 1,985 | 6,898 (5) | €42 | €146 |

| Poland | 1,129 | 4,004 (6) | €30 | €106 |

Source: Cosmetics Europe Market Performance Report 2021 (https://cosmeticseurope.eu/cosmetics-industry/)

It is also useful to understand the European market in terms of the distribution of small and medium-sized enterprise (SME) manufacturers of cosmetics, as shown in figure 9. These companies are likely to be producing more niche cosmetics, with higher price points that can accommodate more expensive ingredients like mango butter. The six countries with the most SME manufacturers are the same as those listed in table 2, although again in a different order.

Source: Cosmetics Europe Market Performance Report 2021, p. 7 (https://cosmeticseurope.eu/cosmetics-industry/)

Tips:

- Search the internet to better understand what products contain mango butter. Note who makes them, as some of these companies may be interested in buying directly from you.

- When approaching European buyers, make sure you know the characteristics and properties of mango butter and how it compares with shea butter and cocoa butter. Also make sure that you know about the similarities and differences between cosmetic formulations, as this can help to justify price differences.

- For more information, read the CBI study on demand for natural ingredients for cosmetics on the European market.

3. Which European countries offer most opportunities for mango butter?

Mango butter is increasingly popular in skin-care products in Europe, as a high-value alternative to shea butter. Based on the sales figures for these products, the six most promising European markets for your mango butter are Italy, France, Germany, UK, Spain and Poland. The same six countries also had the highest total sales of cosmetic products in Europe in 2021, as well as the largest numbers of SME manufacturers. This combination makes them a good starting point in your search for buyers. Below are brief descriptions of their individual markets. In all these countries, buyers are especially interested in supply chains that can demonstrate their sustainability and social responsibility.

At the same time, also look for and approach European importers of cosmetic ingredients that do not yet deal in mango butter. Use the information in this market study to prepare your offer.

Italy – highest sales of skin-care products in 2021

As Europe’s third-largest market for cosmetics (€10,640 million in 2021), Italy is interesting for you as an exporter. Moreover, it recorded the highest sales of skin-care products of any European country in 2021 (€3,834 million). This equates to a spend per capita of €65. Sales have revived significantly since the pandemic.

Italy has 667 SME manufacturers of cosmetics, the third-highest number in Europe. Most prefer to buy from local distributors rather than directly from the country of origin, but each will have its own policy in this respect.

Well-known suppliers of mango butter in Italy are Fratelli Parodi, Esperis spa and Gale & Cosm. Gale & Cosm also produces a water-soluble version of mango butter, which can be used in shower gels, shampoos and conditioners.

France – second-biggest cosmetics market, with well-known suppliers of vegetable oils and butters

France recorded the second-highest sales of skin-care products in Europe in 2021 (€3,804 million), equivalent to a spend per capita of €56. Its total cosmetics market was worth €11,967 million, second only to Germany. These figures represent a modest return to growth after a decline during the pandemic.

France has more SME manufacturers of cosmetics than any other country in Europe: 1,173. This fact, combined with the size of the market, suggests that some of those companies are producing high-value skin-care products well-suited to relatively expensive ingredients like mango butter.

Well-known suppliers of mango butter in France include Biocosmethic, Sophim and Interchemie.

Germany – biggest cosmetics market, with many well-known suppliers

Germany is the biggest cosmetics market in Europe, with total retail sales of €13,604 million in 2021. Skin-care products accounted for €3,184 million of that – a spend per capita of €38. As such, Germany is only the third-largest market in this particular segment. Moreover, it only has 443 SME manufacturers of cosmetics. This is the sixth-highest number in Europe, and just one third of the figure for France. Although Germany has experienced two consecutive years of negative sales growth, it remains an important market for cosmetic ingredients and also supplies neighbouring countries.

Well-known German companies that supply mango butter in various grades include All Organic Treasures, Gustav Heess, Henry Lamotte and SanaBio.

United Kingdom – outside the EU but still a major market, with many important suppliers

The UK is Europe’s fourth-biggest market in Europe for cosmetics as a whole, and also the fourth-biggest for skin-care products (sales €2,576 million in 2021). Business has started to improve after the pandemic, although the UK – like Germany –has experienced two years of negative sales growth. Nonetheless, it remains an important market for cosmetic ingredients despite exports to Europe being affected by Brexit.

Brexit is the term used to describe the UK’s withdrawal from the EU on 31 January 2020,after 47 years as a member. Following a transition period, that change took full effect on 1 January 2021. It has created barriers to trade and cross-border exchanges between the EU and UK that did not previously exist. To regulate cosmetics products, the UK has established Schedule 34 of the Product Safety and Metrology Statutory Instrument. The UK and EU regulations still follow the same ten key principles, so they maintain the same fundamental approach to the safety and compliance of cosmetic products across the European geographical area. At the same time, the UK now has its own specific requirements with regard to the administrative aspects of product safety, compliance, labelling and market surveillance.

There are a lot of SME manufacturers of cosmetics in the UK, many of them producing innovative high-value products. Well-known companies that supply mango butter include Croda, Naissance and O&3. It is interesting see how these three business differentiate their offers.

Spain – fifth-biggest cosmetics market in Europe, with good recovery since Covid-19

The Spanish cosmetics market was valued at €6,898 million in 2021. The sector experienced a 9.9% drop in sales in 2020 due to the pandemic, but achieved 7% growth between 2020 and 2021. For skin-care products, Spain ranks as Europe’s fifth-largest market. And it holds the same position for overall sales of all cosmetic products.

One well-known supplier of mango butter in Spain is Bidah Chaumel. It offers a range of grades, from crude through to organic refined.

Poland – growing importance as a manufacturer of cosmetics

Poland is the sixth-largest cosmetics market in Europe. Total retail sales in 2021 were €4,004 million. After a 4% drop in sales in 2020, attributed to the pandemic, growth returned in 2021. In fact, the figure of 8% was the third-highest rise in Europe.

Poland has 733 SME manufacturers of cosmetics, second only to France. One company that sells mango butter wholesale in the Polish market is Natural Poland.

Most of the leading importers of mango butter are in western European countries, although the example of Poland shows that it is important to broaden your search for buyers across the whole continent. Particularly to importer-distributors that do not yet trade in mango butter. This is seen as a more exotic alternative to shea butter, not least because consumers associate it with the mango fruit now widely eaten in Europe. Be prepared to deliver large volumes of mango butter, especially when supplying to countries like the Netherlands, Germany and France.

Tips:

- Make sure that you can supply mango butter reliably in the quantities ordered. European processors usually want larger quantities.

- Focus on building long-term relationships with buyers. Larger European companies want to enter into partnerships with their mango butter suppliers. Be open to them visiting your facilities on a regular basis.

- See the CBI’s Tips for finding buyers for more information about building and maintaining relationships with European buyers.

4. Which trends offer opportunities or pose threats on the European market for mango butter?

The most important current trend in the European cosmetics industry is the growing demand for natural and sustainable products. Where possible, manufacturers are looking to increase the natural and certified organic ingredient content of their products. And to develop products that suggest health and wellness. The unique characteristics of mango butter as a cosmetic ingredient suit this trend perfectly, especially in combination with sustainable and ethical sourcing. So demand is set to keep on increasing.

Natural ingredients

The 2022 Kantar Global Report on The Evolving Beauty Consumer reaches the following conclusion.

“Consumers are becoming more conscious of what goes into the products they buy. The perception of beauty has become more holistic, and health driven, with a focus on internal wellness and environmental harmony at the core of many consumers’ decision-making process.”

The importance of including natural ingredients in cosmetics has been growing consistently around the globe, especially in Europe. France, Germany, Spain and the United Kingdom (UK) are the four biggest European markets for cosmetics. In all of these countries, the percentage of users who say that they buy a particular face or body product because it contains natural or naturally produced ingredients has increased in the past five years.

Mango butter is a natural ingredient and so fits this trend perfectly. The products shown in figure 5 are good examples of how it is marketed with that in mind.

Sustainability

Sustainability is another must for cosmetic ingredients today. Buyers expect their suppliers to be able to demonstrate that they are working sustainably. However, sustainability is a broad term. So what exactly is required, and how do you decide where to invest your resources in order to be sustainable?

When searching the internet for new customers, you will see that nearly every potential buyer has a section on sustainability. As a rule, this describes its strategy and activities to be sustainable. Furthermore, the best companies have a baseline and measure their progress. You need to do the same.

There are now plenty of resources available on how to go about developing, implementing, measuring and communicating what you are doing when it comes to sustainability.

One good place to start is the United Nations. It has identified 17 Sustainable Development Goals (SDGs). These address the global challenges of poverty, inequality, climate change, environmental degradation, peace and justice. More and more companies are referring to the SDGs in their own policies and communications.

For example, L’Oréal – the world’s largest cosmetics company – states on its website that it contributes to 16 of the 17 UN Sustainable Development Goals.

Figure 10: L’Oréal and the Sustainable Development Goals

Source: L’Oréal

Other trends and developments

Over the next few years the European cosmetics industry is going to have to evolve in response to the European Green Deal, the European Chemicals Strategy for Sustainability and the Corporate Sustainability Due Diligence Directive. The starting point for all these developments is the key role that companies play in building a sustainable economy and society.

The European Green Deal involves a series of actions around climate, agriculture, energy, industry and the environment. The aim is to transform the EU into a modern, resource-efficient and competitive economy, ensuring “no net emissions of greenhouse gases by 2050, economic growth decoupled from resource use and no person and no place left behind”. As part of the Green Deal, the European Commission has also developed a Chemicals Strategy for Sustainability; this includes a revision of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) legislation.

The Corporate Sustainability Directive aims to foster sustainable and responsible corporate behaviour and to anchor human rights and environmental considerations in companies’ operations and governance. The new rules are designed to ensure that businesses address adverse impacts of their actions, not just directly but throughout their value chains inside and outside Europe. They cover everything from child labour and the exploitation of workers to pollution and biodiversity loss.

While neither of these proposals affects you as an exporter directly, in the sense that the obligations are placed on European companies, indirectly they will have an impact if you are part of an international supply chain to Europe. The European companies you work with will expect you to cooperate with their compliance activities.

In the specific case of mango butter, under the current REACH regulations it is exempt from registration due to its inherent safety and low impact on the environment. The upcoming changes are not expected to introduce stricter requirements for vegetable oils. But in the future there may be greater focus on the environmental impact of sourcing ingredients internationally, including the carbon footprint of these activities. This is another good reason to enhance the sustainability of your whole supply chain.

Tips:

- Emphasise the sustainability and traceability of your supply chains.

- Use tools like SEDEX, UN Global Compact and align your company with the SDGs.

- Familiarise yourself with trends in the cosmetics industry. Websites like Cosmetics Business are a good source of information.

- See the CBI study of trends in the market for natural ingredients for cosmetics to find out more about opportunities for suppliers of these products from developing countries.

Case study – Manorama Industries, India

Manorama Industries supplies mango butter to retail chain The Body Shop as part of its Community Fair Trade programme. On its website, the company describes how it works with local women’s co-operatives to collect mango kernels. The text (below) highlights fair trade, community development, traceability and sustainability.

Originated in the forests of India, mango is a seasonal fruit that is abundant across the country during the Indian summer months from May-July. We directly source mango kernels through a dedicated supplier network that relies on collections from thousands of villages in the central states of India.

We have been working with hundreds of local women’s cooperatives and have collaborated with self-help groups to uplift their livelihoods. These women hand-collect the mangoes from the forest. Then they hand-peel the flesh and dry the seed in the sun to reduce moisture and prevent rancidity, keeping the ingredient hygienic. After that they crack the seeds and take out premium-quality wild mango kernels. Finally, the mango kernels reach our production facility for extraction of their nourishing oil.

Manorama also provides training to the cooperatives on harvesting methods. We help protect India’s mangoes while providing a sustainable source of income. During harvesting season, these women carry 10-20 kg of fruit every day.

We take responsibility towards all our stakeholders very seriously, including providing fair compensation to our sustainable sourcing partners. Therefore, we have an end-to-end traceability system in place that allows us to accurately identify the source of our raw materials.

Tips:

- Promote your sustainability activities and achievements on your website.

- Search the internet to see how your customers and your competitors communicate about sustainability.

- Make sure that your ethical and sustainable activities have a baseline (a starting point, so that you know what progress you are making), are measurable and are evidence-based.

This study was carried out on behalf of CBI by Fair Venture Consulting.

Please read our market information disclaimer.

Search

Enter search terms to find market research