Entering the European market for rosehip oil

The European market has the world’s most robust legal framework for cosmetic products. To export your rosehip oil to Europe, you have to understand the legal context in which European buyers operate. This includes regulations such as the EU Cosmetics Regulation and REACH. Rosehip oil is mainly sold through importers. It is used in skincare and hair care products. Aligning your company to buyers' quality requirements and sustainability demands will help you compete with other companies from Chile, South Africa, Lesotho and Bulgaria.

Contents of this page

1. What requirements and certifications must rosehip oil meet to be allowed on the European market?

To export rosehip oil to the European Union (EU), you have to comply with several requirements. While no legal obligations apply to non-EU countries, you should understand the EU regulatory context and your buyers’ requirements.

For a detailed overview of all applicable requirements, please refer to our study on buyer requirements for cosmetic ingredients for cosmetics or consult Access2Markets.

What are the mandatory requirements?

There are no applicable legal obligations for non-EU countries. However, it is important that exporters that want to enter the European market are familiar with the following regulations and operate accordingly. By doing so, you can facilitate the tasks of companies subject to these regulations. European buyers appreciate this proactive approach. It can make you a more attractive trading partner and help you reduce barriers to market entry.

EU Regulation (EC) No 1223/2009 on Cosmetic Products

European cosmetics legislation (Regulation (EC) 1223/2009) sets out rules to ensure the safety of cosmetic products. These rules protect human health and the proper functioning of the internal cosmetics market. Specific requirements for cosmetic ingredients can be found in the cosmetics legislation for final products. This regulation also contains annexes listing more than 1,600 ingredients that are prohibited or restricted in cosmetic products sold in the EU. Restricted ingredients are subject to conditions of use and warnings, as well as a maximum concentration in ready-for-use preparation. Ximenia oil is not included in this list of annexes.

Annex I of the Cosmetics Regulation provides a non-exhaustive guide to the minimum requirements for cosmetic ingredients for manufacturers. These requirements specify what suppliers of cosmetic ingredients need to ensure to successfully sell to manufacturers. This annex also outlines what you need to comply with to sell to the European importer as an exporter.

Before placing a cosmetic product on the EU market, the European legislation requires manufacturers prepare Cosmetic Product Safety Reports. These documents require data on the ingredients’ composition and other quality and safety parameters. Suppliers have to provide well-structured product documentation on the physical-chemical composition, including impurities, microbiological quality and toxicological profile. This documentation includes:

- Technical Data Sheet - TDS (e.g. TDS from Unifect)

- Certificates of Analysis - CoA (e.g. The Soap Kitchen's CoA)

- Safety Data Sheets – SDS (e.g. The Soap Kitchen’s SDS)

- Organic certification, where applicable

- Microbial tests (if requested)

- Phytosanitary certificates (if requested)

- Genetically Modified Organism (GMO) certificate (if requested)

- Certificate of origin (if requested)

EU Regulation (EC) 1907/2006 on Registration, Evaluation, Authorisation, and Restriction of Chemicals

Registration, Evaluation and Authorisation of Chemicals (REACH) (Regulation (EC) 1907/2006) aims to protect human health and the environment from chemicals manufactured and used in the European Union. Cosmetic ingredients, including natural ingredients, are chemicals. If they fall within the scope of REACH, the importer or manufacturer needs to register them with the European Chemicals Agency (ECHA). Registration applies to importers and manufacturers of non-exempt substances that import or manufacture more than one tonne annually.

Rosehip oil is exempt from REACH registration regardless of imported or manufactured quantities because it is considered a non-chemically modified vegetable oil. However, you still need to provide a Safety Data Sheet with information about the oil’s properties, potential hazards, and safe handling practices.

EU Regulation (EC) 1272/2008 on Classification, Labelling, and Packaging of Chemicals

The Classification, Labelling and Packaging of chemicals regulation (CLP) aims to ensure that the hazards presented by chemicals are communicated to workers and consumers in the EU through classification and labelling of chemicals. The regulation requires European manufacturers and importers to classify, label and package hazardous chemicals appropriately in their substances and mixtures before placing them on the market.

The CLP is a piece of EU legislation derived from the UN Globally Harmonised System of Classification, Labelling of Chemicals (GHS). Most countries have also derived legislation based on UN GHS guidance. This has created a kind of safety net between individual states.

Hazard labels and safety data sheets communicate the presence of hazards to users. Even though Ximenia oil is not hazardous, you have to label it correctly. Labels should include the product name, INCI name, CAS number, batch code, place of origin and storage conditions.

Global Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES)

To trade plant materials and their derivatives, you have to check their status on the CITES database. Your product will be stopped at the border if it does not comply. You have to comply with requirements on trading plant resources that have been agreed internationally under the Convention on International Trade in Endangered Species of wild fauna and flora (CITES). While there are no restrictions on rosehips, importers may ask if you source wild-harvested rosehips, so it is best to be aware of CITES and know whether the product is in one of the appendices. This does not apply to cultivated rosehips.

Tips:

- Read our study on buyer requirements for cosmetic ingredients for cosmetics to learn about all the requirements that suppliers have to meet.

- See our workbook on preparing a technical dossier for cosmetic ingredients for more information and tips on documentation requirements.

- Provide buyers detailed information on composition, quality, traceability and sustainability. You also have to show where your product comes from and where it is processed.

- Regularly check the EU’s list of prohibited substances in cosmetics to make sure your natural ingredients comply.

What additional requirements and certifications do buyers often have?

European buyers and importers expect consistent, high-quality products. They expect their suppliers to comply with agreed-on packaging and labelling requirements and adopt certain sustainable practices.

Quality requirements

The quality of rosehip oil can be judged by its colour and aroma. Good-quality rosehip oil should be a shade between golden amber and reddish-orange. This indicates it has not been bleached and may be 100% virgin. The aroma is characteristic and a key factor in determining whether it is truly pure and natural. Many people expect it to smell like roses, but it has an herbaceous, earthy aroma.

Several factors can influence the quality of rosehip oil. These include the method of extraction, storage and preservation. To produce top-quality rosehip oil, you should carefully select where your rosehips are grown and how they are harvested. The rosehip seeds should be cold and fresh pressed from harvest to preserve the oil’s quality. The extraction method is crucial as it determines the quality. Exposure to heat, air, water and light can all affect the quality. Keep the oil fresh, in a cool place and out of direct sunlight. Also avoid leaving it unsealed for prolonged periods. You should also regularly test your oil for free fatty acid (FFA) and Peroxide values during storage.

Importers will check the quality of pre-shipment samples and the quality of the delivered order to ensure that they match the specifications and Certificates of Analysis (CoA) sent by the supplier. The samples must match your documentation and the agreed specification. You should avoid adulteration as most countries have strict controls to detect potential adulterants. Undeclared substances, contamination, adulteration, prohibited substances in your samples or a mismatch with your CoA will cause major problems. If it concerns your order delivery, there is a high risk that you will not be paid or lose your business.

Table 1: Fatty Acid profile of rosehip oil

| Fatty Acid | Specifications (%) |

| Palmitic Acid | 2–8 |

| Stearic Acid | Max 3 |

| Oleic Acid | 10–30 |

| Linoleic Acid | 35–50 |

| Alpha-Linolenic Acid | <35 |

| Arachidic Acid | Max 2 |

Source: ProFound, 2024

Quality management standards

European buyers often prefer suppliers who follow recognised quality management standards like HACCP and Good Manufacturing Practices (GMP). These practices help ensure product safety and consistency, improve your credibility as an exporter and show your commitment to providing high-quality rosehip seed oil. Additionally, it helps showcase compliance with mandatory requirements.

European buyers of rosehip oil for cosmetics expect suppliers to follow Hazard Analysis & Critical Control Points (HACCP) principles in their processing facilities to ensure product safety for cosmetic applications.

Good Manufacturing Practices (GMP) are not required for cosmetics ingredient producers. However, compliance can provide advantages. The European Federation for Cosmetic Ingredients has developed guidelines to help producers implement GMP in their companies. It also offers a certification scheme. Following basic GMP and HACCP practices will help you deliver a good and reliable level of quality.

Another relevant international standard is ISO 9001:2015 on quality management systems. This standard applies to every organisation, regardless of size or industry. It specifies the requirements for a quality management system based on various quality management principles. It helps organisations demonstrate their ability to provide consistent, high-quality products and services that meet regulatory and customer requirements.

Sustainability requirements

European buyers face increasing pressure from the EU to make sure their supply chains are sustainable and transparent. The most important new developments to be aware of are the European Green Deal and the Corporate Sustainability Due Diligence directive. Both proposals will indirectly affect you if you do business with European companies.

Partly because of these developments, one of the primary considerations for European buyers is the presence of a transparent supply chain that can be easily traced. Buyers want guarantees that products can be traced back to the source to ensure good social and environmental practices along the chain.

Suppliers should show good Corporate Social Responsibility practices. For example, they should develop a code of conduct and improve performance in key areas, by improving working conditions in supply chains and limiting damage to the environment. Look at social responsibility and sustainability platforms like the Supplier Ethical Data Exchange (SEDEX). These platforms provide tools and guidance for suppliers and organisations to operate ethically and to source responsibly. They also facilitate the sharing of this information with potential customers. This means adopting CSR practices can help you meet buyers’ expectations.

Labelling requirements

Suppliers of rosehip seed oil need to include product documentation and labelling to comply with legal and buyer requirements. Labelling must include:

- Product name/International Nomenclature Cosmetic Ingredient (INCI) name

- Chemical Abstracts Service (CAS) number

- Batch code or number

- Place of origin

- Name and address of exporter

- Date of manufacture

- Best before date

- Net weight or volume

- Recommended storage conditions

- Organic certification number, along with the name/code of the certifying inspection body if you export organic-certified rosehip oil.

Label your products in English unless your buyer wants you to use a different language.

Packaging requirements

European buyers have packaging requirements to preserve product quality. Make sure to ask buyers about their packaging requirements. Rosehip oil is usually transported in glass bottles or aluminium cans for smaller quantities(e.g. 1 kg or 5 kg). For larger quantities(e.g. 25 kg, 190 kg and 920 kg), the oil can be packaged in canisters, buckets, HDPE drums and intermediate bulk containers (IBCs). Be sure to label them correctly with the date of manufacture to ensure proper stock rotation.

To maintain the oil’s integrity, the packaging should be airtight to prevent oxidation and contamination. Closures must be leakproof to ensure no spillage or exposure to air. To further extend the oil’s shelf life, nitrogen or another inert gas can be flushed into the containers' headspace, minimising the presence of oxygen.

Tips:

- Always ask your buyer for their specific packaging requirements to ensure you meet their expectations. Packaging requirements can vary from buyer to buyer, so it is important to communicate and agree on terms and conditions. Sticking to these agreements will ensure a reliable supply chain.

- See the Codex Alimentarius for named vegetable oils for good general information about quality standards for oils.

- Check our study on tips for organising exports for information on international payment terms and customs policy.

- Read our study on the impact of the European Green Deal (EGD) on exporters and suppliers to understand the obstacles and opportunities that the EGD and its related regulations may present.

- Train the collectors you work with to collect rosehips that grow above 1 metre in height on established plants. Always leave at least 10% of the fruit on the bush to ensure a sustainable harvest.

What are the requirements for niche markets?

Concerns about environmental and social issues, government policies and regulations mean European buyers have become stricter in their requirements for sustainable production. Ever more buyers want ingredients with voluntary standards and certifications, especially in niche markets where certification of sustainable practices is a buyer requirement.

Figure 1: Niche certification standards for the European cosmetic sector

Source: Cosmos Standard, UEBT, NaTrue, Fair for Life and FairWild

The natural cosmetics market is the largest and most important niche market. The definition of natural and organic cosmetics is based on private sector standards NaTrue, Cosmos, ISO 16128-1 and ISO 16128-2. Natural ingredients and raw materials can be COSMOS certified if they comply with specific organic content. Non-organic ingredients can only apply for COSMOS approval. The same applies to the NaTrue standard, according to which a raw material can be NaTrue-certified or approved depending on whether it comes from organic agriculture or not.

Organic is another important niche market closely related to the natural cosmetics market. To market rosehip oil in the EU as an organic ingredient, producers need to use organic farming techniques and have their facilities audited by an accredited certifier. Requirements on organic production and labelling are specified in the EU Regulation 848/2018. Relevant standards in the organic cosmetics market include NaTrue, Cosmos, Soil Association Organic, BDIH Certified Natural Cosmetics and ICEA Eco Bio cosmetics. Specifically for ingredients, BDIH requires raw materials of plant origin to be organic certified, while ICEA demands ingredients of natural origin from certified organic agriculture.

Certified fairtrade production is a small niche market in terms of cosmetic ingredients. It covers important issues, like human and workers’ rights, community wellbeing and local development. The fairtrade market for rosehip oil is small and there are almost no rosehip oil suppliers with certifications like Fair for Life.

Small producers for whom private certification standards are too expensive or unnecessary can also choose other self-certifiable standards. The ISO 16128 standards, part I and part II, provide guidelines on the definitions and criteria for natural and organic cosmetic ingredients and products. These minimum standards allow new market entrants to demonstrate what they can do.

Tips:

- Consult the COSMOS and NATRUE databases to learn more about the products, ingredients and companies that have been certified or approved.

- Find out if there is a market for your products before you certify them. Although buyers value an organic certificate for ingredients, applying for organic certification is not interesting for every producer. Only SMEs in developing countries who can deal with certification, conversion and administrative costs should get certified. This applies mostly to producers supplying considerable volumes, those able to share costs with cooperative members and organic buyers, and those who produce organic already by default.

- Learn more about fairtrade certifications and standards in our study on social certifications.

2. Through which channels can you get rosehip oil on the European market?

Rosehip oil is mainly used in skincare and hair care products in Europe. The primary channel to enter the market is through importers and distributors that buy natural ingredients directly from exporters.

How is the end-market segmented?

In terms of industry use, the end market for cosmetics can be divided into five main product categories: skincare, toiletries, hair care products, fragrances/perfumes and decorative cosmetics.

Source: Cosmetics Europe & Euromonitor International, 2023

Rosehip oil is mainly found in the skincare cosmetics segment, the largest segment in the European cosmetics market. It makes up 29% of the market and recorded the third highest growth (10%) between 2022 and 2023. Rosehip oil is widely used in skincare products due to its skin conditioning and emollient properties. Its composition of vitamins A and E stimulates collagen production and provides lasting hydration, while key acids enhance skin cell turnover. It is marketed as a moisturising, hydrating, anti-ageing and anti-inflammatory ingredient for beauty products.

Another important segment for rosehip oil is hair care products. Some cosmetic manufacturers use rosehip oil in shampoos and conditioners. The presence of essential fatty acids and vitamin E promote healthy hair growth and moisturise the scalp, preventing conditions like dandruff. This segment makes up 18% of Europe’s cosmetics market. Between 2022 and 2023, the hair care segment recorded a growth rate of 8.1%.

Tips:

- Study trade fair catalogues (e.g. in-cosmetics) and websites that specialise in promoting ingredients (e.g. SpecialChem) to find potential buyers in each segment.

- Get familiar with the beneficial properties that rosehip oil offers the cosmetics industry, such as its emollient and skin conditioning properties.

Through which channels does a product end up on the end-market?

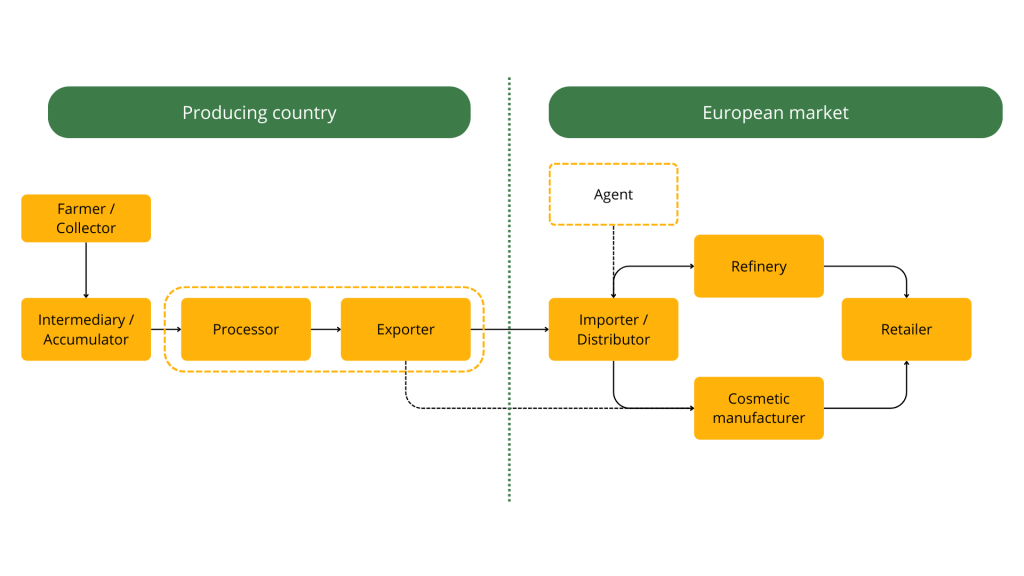

The figure below shows the export value chain for rosehip oil. The figure shows that processing and exporting in countries of origin are often combined in the same company. It is uncommon for exporters of rosehip oil to sell to European consumers directly. Currently, most rosehip oil enters the European market through importers and distributors.

Figure 3: Main European distribution channels for rosehip oil

Source: ProFound, 2024

Importers/Distributors

Importers and distributors are your main target customers. They make cosmetic ingredients available on the EU market, buying directly from exporters, often in large quantities. Distributors work as intermediaries in the supply chain and downstream entities in the distribution channel. They check the quality of the oil to ensure it meets EU standards. They also refine it, either themselves or through refiners, before selling to cosmetic manufacturers for their products. However, exporters should also carry out their checks before exporting.

Some examples of European distributors/importers already dealing in rosehip oil include:

Unifect – British supplier of cosmetic ingredients. The company has a portfolio of more than 2,000 different products. It provides organic rosehip seed oil, which it sources directly from South Africa.

Interfat – Spanish distributor and manufacturer of ingredients. A global supplier of natural oils and oleochemicals. It specialises in raw materials. Interfat sells organic and conventional rosehip oil, which it imports from Chile and China. It works with companies that do the processing and refining before they market it.

Flavex – German manufacturer of raw materials and ingredients that specialises in the production of botanical extracts using carbon dioxide extraction technology. This company has been serving the cosmetic, perfume, food and nutraceutical industries for more than 35 years with a wide range of high-quality plant extracts. It offers rosehip oil and other carbon dioxide extraction oils with organic, vegan, halal, kosher and COSMOS-approved and certified certifications.

Gustav Heess GmbH – German distributor and manufacturer that was created in 1897. It is known for the quality of its vegetable oils for the cosmetic, pharmaceutical and food industries. It sells rosehip oil, which it imports from South Africa. Before being marketed, it is shipped to Germany and the Netherlands, where it is processed.

All Organic Treasures – German distributor and manufacturer of high-quality ingredients for organic and natural cosmetics. AOT sells organic rosehip oil imported from a family business in southeast Bulgaria and South America. All AOT oils are organic certified, COSMOS certified, COSMOS approved and Kosher.

Refinery

Once in Europe, rosehip oil often undergoes a second processing stage. Refining is commonly carried out in Europe. This is done because of the high quality requirements in the market and the need for oils that are standard in terms of colour and odour. Refiners source rosehip seed oil from importers, distributors and directly from exporters. Note that some importers are also refineries, and some importers use refineries’ toll refining services. Refineries package the refined oil for retail sales in smaller packages, as requested by manufacturers or brands. Examples of refineries include AAK (Sweden), ZOR, Special Refining Company (the Netherlands) and Natura-Tec (France).

Manufacturers

Manufacturers produce cosmetic products and market them under their name or brand. Most cosmetic manufacturers source their raw materials from refiners, distributors and wholesalers. It is not common for small exporters from developing countries to supply refiners and manufacturers directly.

Cosmetic manufacturers use rosehip oil in products like body scrubs, moisturisers, serums, shampoos, conditioners and anti-ageing face creams. Manufacturers that already use rosehip oil in their beauty products include Fushi Wellbeing, Trilogy, Pacifica Beauty and L’Oréal Paris.

Some cosmetic brands focused on sustainability may choose direct sourcing as it aligns with their business philosophy. Through direct sourcing, buyers can guarantee transparent and short supply chains. Note that buyers that supply directly may have higher expectations for quality and logistics since there is no intermediary processing stage.

What is the most interesting channel for you?

European importers and distributors are your most important entry point into the market. Distributors usually arrange for refining before selling certain products to cosmetics manufacturers. Generally, the most successful way to access markets is to create a network of distributors in different European countries.

Tips:

- Consider linking up with producers if you cannot produce sufficient quantities and quality of rosehip oil yourself.

- Target European ingredient importers or refiners that specialise in small, speciality oils if you can produce rosehip oil with a unique selling point.

- Check buyers’ websites to find out if they work with certified ingredients. Buyers that do not are unlikely to pay more for certification.

- Visit and participate in trade fairs to test market receptivity, get market information, and find potential business partners. The most relevant trade fairs in Europe are in-cosmetics (travelling trade fair), Beyond Beauty (France) and SANA (Italy). For organic producers, Vivaness is an interesting trade fair (Germany).

- See our studies on finding buyers for natural ingredients for cosmetics for more information.

3. What competition do you face on the European rosehip oil market?

The European rosehip oil market is very competitive. There are many suppliers from different countries in this industry. Key players include producers from Chile, South Africa and Eastern Europe. There are also alternative oils that have similar benefits, which add to the competition. To succeed, it is important to meet the high quality and regulatory standards and to offer something unique that makes your rosehip oil different from local and international competitors.

Which countries are you competing with?

Rosehip (Rosa canina and Rosa rubiginosa) is native to Europe, northwest Africa and western Asia. However, it has been introduced to other regions and is now widespread. Very little information is available on the global market for rosehip oil. However, based on global distribution and industry sources, it is estimated that Chile, Lesotho and South Africa dominate the market.

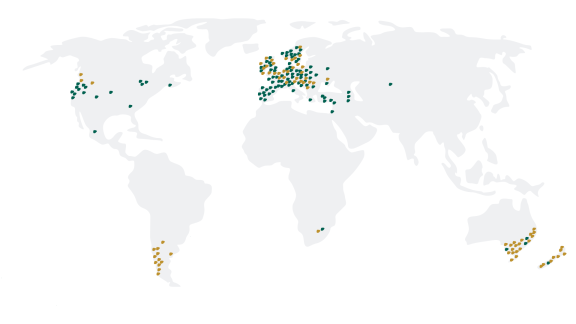

Figure 4: Global distribution of Rosa rubiginosa and Rosa canina in 2024

Source: ProFound with data from GBIF, 2024

Chile

Chile is one of the world’s largest producers of rosehips. The plant is widely available, and it is estimated that Chile supplies the largest quantity of rosehips to the world market.

Several species of rose were introduced to Chile from southern Europe and North Africa by Spanish colonists. These species are widespread in Chile, thanks to the country’s optimal climate. Today, Rosa rubiginosa is the most common species, while Rosa canina is found in small groups.

For centuries, the indigenous Andean people of Chile have used the nutritional and anti-inflammatory benefits of rosehip seed oil in their skin and hair care regimes. In the 1970s, government intervention created an export market for rosehip, marketing it as an ingredient in herbal teas and foods, oils, cosmetics and natural medicines. Today, rosehip is one of Chile’s most exported non-timber forest products (NTFP), employing thousands of harvesting families and generating significant income.

Although there is no specific data on rosehip oil trade, it is estimated that most rosehip oils on the market today come from Chile. In 2023, Chile exported 363 tonnes of vegetable oils, under HS code 151590. Chilean exports decreased on average by 6% per year between 2019 and 2023. The highest volume was recorded in 2020, when 2,418 tonnes were exported. In 2023, a significant share of exports went to Europe, mainly to Italy (87 tonnes), Spain (53 tonnes) and Germany (9 tonnes). Rosehip oil is believed to be a significant part of this exportable supply, particularly exports to Spain, which has historically been the main market for Chilean rosehip oil.

South Africa and Lesotho

Rosehip is widespread in Lesotho and South Africa. The plant is present in seven of South Africa’s nine provinces. Of these seven, three provinces (Eastern Cape, Free State and KwaZulu-Natal) have significantly higher plant populations. These three provinces surround the landlocked country of Lesotho, where rosehip thrives in cooler mountainous climates.

One particular species of rosehip (Rosa rubiginosa) is considered an invasive plant in both South Africa and Lesotho. Legislation allows the harvest and sale of all wild fruits of invasive plants but not their cultivation. Rosehips are therefore collected from the wild and sold to companies and exporters who refine the product and supply international markets with seeds, hulls and oil.

While this affects the supply of rose hips and limits the product’s economic potential, there is a cosmetic market for rosehips. South Africa and Lesotho export significant quantities of rosehips. Developed countries are the largest markets.

The fact that rose hips are sourced from the wild enables companies to advertise their rosehips and rosehip products as organic. Rosehips are the second most harvested wild organic product in Africa and the most important in sub-Saharan Africa.

In 2023, South Africa exported 2,778 tonnes of vegetable oils under HS code 151590. South African exports grew on average by 13% per year between 2019 and 2023. The highest volume was recorded in 2022, when 4,158 tonnes were exported. In 2023, a significant share of exports went to Europe, mainly to Germany (230 tonnes), Portugal (215 tonnes), Italy (117 tonnes) and Spain (109 tonnes).

Bulgaria

In 2023, Bulgaria exported 195 tonnes of vegetable oils under HS code 151590, compared to 46 tonnes exported in 2019. Bulgarian exports have grown by 43% per year on average over the past five years. The highest volume was recorded in 2022, when 429 tonnes were exported. Almost all of Bulgaria’s vegetable oil exports are destined for Europe, due to its proximity and its logistical facilities. In 2023, the main importers of Bulgarian vegetable oils were Norway (79 tonnes), Greece (44 tonnes) and United Kingdom (24 tonnes).

Which companies are you competing with?

Granasur (Chile)

Granasur, established in 2010, is a Chilean company that produces high-quality natural, organic and refined products. These products are mainly for the cosmetic, nutraceutical and food industries. Granasur sells its products worldwide. It has customers in Germany, France, Italy, the UK, Spain and other countries. Granasur is committed to environmental sustainability. The company follows the ISO 14001:2004 standard, which focuses on managing and reducing environmental impact. They have also invested in reforestation projects in Chilean Patagonia.

Granasur is especially known for its rosehip products, which are collected from the Patagonia region. They offer conventional and organic rosehip oil. This shows their commitment to high standards. Besides rosehip oil, Granasur also produces other oils, like jojoba, grape, cucumber and Chilean hazelnut.

Forestal Casino (Chile)

Forestal Casino is a Chilean company that specialises in producing and exporting high-quality natural raw materials to over 12 countries. The company operates 30 land plots in southern Chile. These are dedicated to harvesting various products across three key categories: infusions and medicinal herbs, cosmetic oils and culinary products. Forestal Casino produces cold-pressed and refined rosehip oil.

Forestal Casino upholds fair trade and sustainability as core principles. It holds certifications including USDA Organic, Rainforest Alliance, EU Organic, HACCP and JAS. As a member of the Union for Ethical BioTrade (UEBT), the company is also committed to respecting biodiversity, supporting fair trade and ensuring the ethical use of natural resources.

Afrika Botanicals (South Africa)

Afrika Botanicals is a prominent exporter and importer. It supplies bulk botanical products and natural oils for the cosmetics and pharmaceutical industries. The company adheres to fair labour practices and is committed to the principles of the CITES convention, which ensures the ethical sourcing and trade of its products. Afrika Botanicals also complies with ISO 26000:2010 standards on social responsibility, reflecting its dedication to sustainable business practices.

The company manages the entire supply chain process, from documentation and product sampling to packaging, labelling and delivery. Afrika Botanicals also offers its own cosmetic range online. The company supplies rosehip oil sourced from South Africa and Lesotho.

Zuplex Botanicals (South Africa)

Zuplex Botanicals is a South African manufacturer. It specialises in producing active extracts from African botanicals. The company is deeply involved in every stage of the process, from the ethical cultivation of botanicals to advanced product research and development to the manufacturing of high-quality extracts. Zuplex offers a range of African oils and botanicals. It is particularly well known for its production of active ingredients sourced from these natural resources. Zuplex offers rosehip oil and rosehips that are ethically sourced in the mountains of Lesotho from organic wild stocks.

Zuplex follows the rules of the Nagoya Protocol, which ensures that benefits are shared fairly when using genetic resources. The company has a Biotrade and Bioprospecting permit from the South African Department of Environmental Affairs, covering about 80 native plant species. All Zuplex’s cosmetic extracts are COSMOS-approved. This means they meet high standards for natural and organic products. The company’s production facility is also fully certified under FSSC 22000, ensuring high food safety standards.

Afrinaturals (South Africa)

Afrinaturals is a South African company that specialises in the sourcing, processing and distribution of high-quality natural ingredients, particularly indigenous African plant-based products. It caters to wholesalers, retailers, product developers and content suppliers in various industries, including cosmetics and cosmeceuticals. The company offers a wide range of essential oils, botanical resins, butters and pressed oils.

Committed to ethical practices, Afrinaturals operates under a policy of fair labour and ethical trading. The company has also participated in projects for organisations such as the CBI and the Belgian Government, further cementing its reputation as a responsible and reliable supplier in the global market.

Which products are you competing with?

Argan and cacay oils are strong competitors with rosehip oil in the European cosmetics market because they all offer similar skin benefits. These oils are rich in essential fatty acids, vitamins A and E, and antioxidants. This makes them popular choices in skincare and hair care products.

Table 2: Example of product substitution for rosehip oil

| Rosehip oil | Argan oil | Cacay oil | |

| Properties | Skin conditioning, emollient, astringent, anti-aging, anti-inflammatory properties. Rich in vitamins A and E. | Skin conditioning, emollient, antioxidant, anti-ageing, and anti-inflammatory properties. Rich in vitamins A and E. | Skin conditioning, emollient, hair conditioning, and antioxidant properties. Rich in vitamins E and F. |

| Fatty acid profile | Abundant in linoleic acid (35–50%) and alpha-linoleic acid (18–38%). | Most of the fat content of argan oil comes from oleic (45–50%) and linoleic acids (26–35%). | Abundant in oleic acid (10–20%) and linoleic acid (58–85%). |

| Main uses | Moisturisers, facial serums, eye creams. | Serums, hair masks, lotions, hand and nail creams. | Cleansing oils, facial creams, eye oils, body washes and lotions. |

| Price | Average price per litre: €60. Shelf life of 2+ years. | Average price per litre: €24. Shelf life of 1–2 years. | Average price per litre: €65. Shelf life of 2–3 years. |

Source: ProFound, 2024

Tips:

- Differentiate your product by excellence in terms of Corporate Social Responsibility (CSR), sustainability, and traceability, or by providing additional services compared to your competitors.

- Investigate and show how rosehip oil can substitute other oils and butters, and by comparing the properties of your oil and its alternatives.

- Build and communicate your rosehip marketing story, focusing on traditional use and benefits to local communities.

4. What are the prices of rosehip oil on the European market?

Rosehip oil is considered a relatively expensive carrier oil due to the large quantity of rosehips required to extract the oil. The global supply of rosehip oil is limited, which drives up its price on the international market. As a result, rosehip oil can be quite costly. According to industry sources, European wholesale prices for rosehip seed oil typically range from €40 to €70 per kg, with an average price of around €60 per kg.

Industry experts suggest a 40% margin between the price at which the oil is sold by the exporter (FOB price) and the wholesale price at which it is sold in Europe. This difference includes costs like shipping, duties and the importer’s profits. According to this margin, the import price of rosehip oil is estimated to be around €25 per kg.

Organic certification can add value to rosehip oil for cosmetics. European companies interested in organic ingredients, as well as social and environmental responsibility practices, can pay a premium for organic rosehip oil. This premium can range from an additional €2 to €20 per kg, depending on the certification and the supplier.

The retail prices for rosehip oil are even higher. A 100 ml bottle of organic rosehip oil can sell for approximately €14. Skincare products that incorporate rosehip oil are priced between €20 and €40.

Table 3: Price breakdown of rosehip oil

| Link in the value chain | Volume | Price |

| Retail price of organic unrefined rosehip oil | 100 ml | €14 |

| Wholesaler price for rosehip oil | 1 kg | €60 |

| Import price of rosehip oil | 1 kg | €25 |

Source: ProFound, 2024

Tips:

- Explore the possibility of obtaining certification schemes, like organic and fairtrade, which are becoming more popular on the European market. They may allow you to charge more for your rosehip oil.

- Consider offering potential buyers discounts. This could help you establish long-term partnerships with them. To avoid losses, include discounts in your original price calculations so you do not sell at a loss.

ProFound – Advisers In Development and Fair Venture Consulting carried out on behalf of the CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research