The European market potential for rosehip oil

Europe is the third largest cosmetics market in the world. It has a growing natural and organic segment. Consumer interest in natural cosmetic oils and the established demand for skincare products in Europe offer excellent opportunities for rosehip oil in the European market. Western European countries, such as France, offer the greatest opportunities for rosehip oil because they are the main vegetable oil importers and have large cosmetic industries and markets.

Contents of this page

1. Product description

Rosehip oil is a highly valued natural oil extracted from the seeds of wild rose bushes. The oil is obtained from the small, reddish-orange fruits known as rosehips, which develop after the rose petals have fallen. Rosehips mainly come from Rosa rubiginosa and Rosa canina, commonly found in the southern Andean region, the highlands of Lesotho, South Africa, Europe and western Asia. Both species have moisturising and anti-inflammatory properties, and they may have anti-ageing properties. However, they differ in their content of essential fatty acids and active compounds.

Extracting rosehip oil typically involves cold pressing the seeds. This ensures that the oil retains its nutrient-rich composition. Cold pressing is favoured because it does not involve heat. This could degrade the oil’s essential fatty acids and vitamins. Rosehip seed oil can also be obtained using carbon dioxide extraction.

Rosehip oil has an earthy and pungent herbal aroma, a natural orange-to-reddish colour and a slightly viscous consistency. It is a carrier oil, known for its high content of essential fatty acids. These acids include omega-3, omega-6 and omega-9. It is also rich in vitamins A, C and E, and antioxidants. These components give rosehip oil powerful skin conditioning and emollient, humectant and astringent properties, according to COSING. Rosehip oil from Rosa rubiginosa also contains trans-retinoic acid. This acid is known for its ability to restore and regenerate tissues, decrease wrinkles, help acne and even normalise pore size.

Figure 1: Example of a wild rose bush with rosehips

Source: Unsplash, 2021

Rosehip oil has been used as a restorative beauty treatment in South America and South Africa for generations. It has gained global recognition and is widely used in the cosmetics industry. Rosehip oil is popular in skincare products for its skin regeneration properties. It also has the ability to improve skin texture and tone, reduce the appearance of scars and stretch marks, and reduce inflammation. Rosehip oil is also valued for its moisturising properties. It penetrates deep into the skin and provides moisture without leaving a greasy residue. This makes it suitable for all skin types, including oily and sensitive skin.

It is ideal for a range of products because it is a mild oil and is easily absorbed. In Europe, it can be found in facial serums, moisturisers, body oils and soaps, and it is even found in hair care products, like shampoos.

Figure 2: Examples of products that contain rosehip seed oil on the European cosmetics market

Source: Witlof, L’Oréal Paris, Pixi Beauty & Herbal Essences

Table 1 lists the classification names and codes for rosehip oil. These codes and ingredient names are used as product identifications in documentation (as listed in COSING and with the Chemical Abstracts Service number) and in trade (Harmonised System codes).

Table 1: Classification of rosehip oil

| Source | Classification |

| International Nomenclature Cosmetic Ingredient (INCI) names according to COSING (European Commission database with information on cosmetic substances and ingredients). | COSING lists the INCI names for multiple ingredients known as or derived from rosehip oil, including:

|

| Chemical Abstract Service (CAS) number | 84603-93-0; 84696-47-9 |

| EINECS | 283-652-0 |

| Harmonised system (HS) codes | 1515.90 (other fixed vegetable fats and oils and their fractions, refined or not, not chemically modified) |

Source: ProFound, 2024

2. What makes Europe an interesting market for rosehip oil?

The European consumer market is the world’s second largest cosmetic product market. Europe is also a major importer of natural ingredients and vegetable oils, such as rosehip oil. The market for natural and organic products is well established in Europe. It also has good growth projections, although it represents a small percentage of the total market.

Europe is one of the world’s largest markets for cosmetics

On a continental scale, Europe is the world’s third largest cosmetics market, worth €96 billion in 2023. In the same year, the European cosmetics market made up at least 24% of the global cosmetics market, which was valued at around €525 billion. While the US leads the global market in terms of annual revenue (€102 billion), the European market stands out in terms of per capita spending. This was estimated to be €169 in 2023, according to Cosmetics Europe & Euromonitor International. Per capita spending has increased steadily since 2021, at an average annual rate of 8.3%.

Source: L’Oréal 2023 Annual Report

The cosmetics market is experiencing continuous and significant growth in Eastern and Western Europe. Over the past five years, the European market has grown on average by 4.7% per year in value terms. In 2022 and 2023, the European market for cosmetics grew at an average rate of 7.5% and 9.1%, respectively, outpacing the global market growth in both years. Annual growth is now higher than it was in the years before the COVID-19 pandemic. This indicates the industry is robust and that the value of the market will continue to grow. In fact, the European market is expected to keep growing at an average annual rate of 2.1% between 2023 and 2027.

Source: L’Oréal 2023 Annual Report

The cosmetics market is experiencing continuous and significant growth in Eastern and Western Europe. Over the past five years, the European market has grown on average by 4.7% per year in value terms. In 2022 and 2023, the European market for cosmetics grew at an average rate of 7.5% and 9.1%, respectively, outpacing the global market growth in both years. Annual growth is now higher than it was in the years before the COVID-19 pandemic. This indicates the industry is robust and that the value of the market will continue to grow. In fact, the European market is expected to keep growing at an average annual rate of 2.1% between 2023 and 2027.

Source: ITC Trade Map, 2024

In 2023, €299 million worth of vegetable oils were sourced from developing countries, representing a 23% share of global import value. This share represents a decrease from 29% in 2020. This is likely due to fewer direct imports from these countries caused by high vegetable oil prices between 2020 and 2022. Although the share has decreased, Europe still controls a significant portion of global imports from developing countries. As such, it should be considered an important target market for vegetable oils, including rosehip oil. The average annual growth rate of imports from developing countries was 6% between 2019 and 2023. Despite steady growth since 2019, there was a decrease of -6.7% in 2022 and 2023 when prices began to fall.

Source: ITC Trade Map, 2024

Europe is among the world’s largest markets for natural and organic cosmetics

Europe is one of the largest markets in the world for natural and organic cosmetics. In recent years, the European cosmetics industry has been moving towards more sustainable and natural products. This shift has led to the rise of organic and eco-friendly personal care brands as consumers become more aware of the ingredients they use and their impact on the environment.

Although natural and organic cosmetics still account for less than 5% of total cosmetics sales, the European natural cosmetics market is expanding rapidly due to the perceived benefits of natural cosmetics and their increasing availability in mainstream retail channels. Sales of natural and organic cosmetics have grown at an average of 7% per year over the past five years.

While 2023 was a tough year for organic beauty due to consumer price sensitivity and economic challenges, most brands anticipate growth in the years ahead. Sales of natural cosmetics are forecasted to grow steadily at an average rate of 5.7% per year over the next few years, reaching €3.23 billion by 2028. This will be driven by growing demand for clean and natural beauty products, focusing on eco-friendly options with plant-based ingredients and sustainable sourcing, as well as stricter measures against greenwashing.

Source: Statista, 2024

Europe’s large natural and organic cosmetics market presents a significant opportunity for organic rosehip oil. The shift towards organic and eco-friendly beauty and personal care products has led to increased demand for natural ingredients. Several companies already produce organic rosehip oil. The European market, with its focus on natural beauty, has more demand for this product than other regions. The focus makes it an ideal market for organic rosehip oil.

Skincare and hair care segments create opportunities for ingredient innovation

Skincare is one of the best-performing categories in the European market. In 2023, the European skincare category was valued at €27.7 billion. According to Cosmetics Europe, this segment is the largest in the European market, dominating 29% of the total market. This far exceeds other segments like toiletries (24%) and hair care (18%). This is significant because the size of the skincare market is closely linked with the quantities of ingredients used to make skincare products.

The skincare segment grew by 10% between 2022 and 2023. While this growth seems impressive, it is lower than that of colour cosmetics and fragrances. However, the skincare segment offers several advantages and opportunities for natural ingredients. For one, it uses a much wider range of ingredients, with consumers typically using between four and six products in the segment. At the same time, skincare has been the main category for ingredient innovation. Rosehip oil is a popular ingredient due to its skin conditioning, emollient, humectant, astringent properties and skin restoration properties. It can be found in several skincare products, such as creams, serums and moisturisers. This versatility creates good opportunities for it in the European market.

Hair care is also an interesting segment. The hair category is growing in value, recording 8.1% growth between 2022 and 2023. This segment also has a strong focus on ingredient innovation, driven by the ‘skinification’ of hair, by which consumers pay more attention to hair health. Given the structural similarities between skin and hair, the use of rosehip oil in hair care is becoming more popular. Rosehip oil promotes scalp health thanks to its nourishing properties. It keeps the hair hydrated and elastic, and it reduces the effects of oxidation due to its antioxidants. The amount of natural oil-based ingredients used in hair care products is generally not as high as in skincare.

Tips:

- See our study on the demand for natural cosmetic ingredients in Europe to find more information on relevant markets, sales, imports and potential products in the natural cosmetics segment.

- Check our study on tips for doing business. You will find specific features of European buyers and businesses that can help you increase your chances of exporting.

- Keep informed about the latest developments in the skincare segment to identify new opportunities. You can read industry media, such as Cosmetics Design Europe.

- Use the rich tradition of rosehip oil in natural cosmetics when promoting your product. Highlight its history of use and proven benefits in your marketing materials. This approach can help differentiate your ingredient from competitors and get European buyers’ attention.

3. Which European countries offer the most opportunities for rosehip oil?

Western Europe continues to lead the European cosmetics market, accounting for around 80% of the annual market value. Germany is the largest European cosmetics market, followed by France and Italy. The UK market is expected to grow the fastest in the coming years. Meanwhile, the Netherlands and Spain stand out as suppliers to the rest of Europe, with large and growing imports of vegetable oils from developing countries.

France is Europe’s largest importer of vegetable oils like Ximenia oil

France is the second largest market in Europe for cosmetics and personal care products. It had a market value of €13.7 billion in 2023, making up 14% of the European market. The French beauty and personal care market grew by 6.3% between 2022 and 2023, below the regional average. The market is forecasted to grow by more than 2% annually over the next five years, increasing its market value by almost €1.7 billion by 2028.

France has the largest number of SME cosmetics manufacturers per country, with 1,917 in 2023, representing 21% of the total SMEs in Europe. This is relevant as SME manufacturers are often drivers of innovation, especially in terms of the use of natural ingredients. They tend to seek unique, high-quality ingredients to differentiate themselves in a competitive market, sometimes establishing relationships with suppliers from developing countries. The largest segments in the French market are skincare (31%), toiletries (25%) and fragrances (22%). Skincare was the second fastest growing segment after fragrances, with a growth rate of 6.6% between 2022 and 2023. Hair care grew at 4.3% during the same period. France is also among the top ten countries in terms of per capita consumption, with each French person consuming an estimated €202 in 2023.

France is the largest importer of vegetable oils in Europe, accounting for 16% of total European imports. In 2023, France imported 72,283 tonnes of vegetable oils (HS code 151590) worth €235 million. The imported volume has remained steady over the last five years. Between 2019 and 2023, French imports grew by an average of 0.6% per year in volume, while the import value increased significantly at an average rate of 11% per year. In 2023, France imported €55 million worth of vegetable oils from developing countries. This accounted for 23% of the total import value. French imports from developing countries remained stable, showing a slight average growth of 0.7% per year since 2019.

Source: ITC Trade Map, 2024

France has a growing market for organic and natural cosmetics. In 2023, the value of the natural cosmetics market in France was €313 million, representing an average annual growth of 4.9% since 2018. The sector is expected to continue to grow, reaching a value of €394 million in 2028. This growth is driven by factors such as the expansion of distribution channels, the increase in online customer reach and consumers’ desire for natural beauty and wellbeing. The French natural and organic cosmetics market is one of the largest in Europe. In 2022, 57% of French consumers used natural and/or organic personal and beauty products. France also has a large supply of these products. To date, there are 17,054 products with the COSMOS signature in France (the leading standard worldwide for organic and natural cosmetics), representing 48% of all products with this signature in the world.

This makes France one of the most attractive markets for the export of rosehip oil. Some of the industry sources interviewed recognise that, in their experience, France has some of the most potential for rosehip oil in Europe.

Netherlands is the largest European importer of vegetable oils from developing countries

The Netherlands is one of the largest markets in Europe for cosmetics and personal care products, valued at €3.4 billion in 2023, with a 3.5% share of the European market. The Dutch beauty and personal care market is forecasted to grow by 2% annually over the next five years, increasing its market value by almost €200 million. The Netherlands also has many SMEs, with 401 in 2023. This is relevant because SMEs often drive demand for innovative natural ingredients.

The largest segments in the Dutch market are toiletries (27%), skincare (21%) and fragrances (19%). The skincare segment was the second fastest in terms of growth, with an 8.6% increase between 2022 and 2023. Hair care grew by 7.1% during the same period. The Netherlands is among the top ten countries in terms of per capita consumption, with each Dutch person consuming an estimated €189 in 2023.

The Netherlands is the second largest importer of vegetable oils in Europe. In 2023, the Netherlands imported 63,851 tonnes of vegetable oils (HS code 151590) worth €157 million, accounting for 14% of all European imports. Between 2019 and 2023, Dutch imports grew on average by 4.4% per year in volume and 8.1% in value. In 2023, the Netherlands imported €80 million of vegetable oils from developing countries, accounting for more than half of the total import value. The Netherlands has the largest share of imports from developing countries in Europe. It has also shown significant growth in recent years. Between 2019 and 2023, Dutch imports from developing countries grew by 12% per year on average. This growth remained steady even during the COVID-19 pandemic, with a notable 22% increase in 2022 and 2023, suggesting a positive outlook.

Spanish imports of vegetable oils showed one of the highest growths in Europe

Spain is the fifth largest market for cosmetics and personal care products in Europe, valued at €10.4 billion in 2023, with an 11% share of the European market. The Spanish beauty and personal care market grew by 12% in 2023, exceeding the regional average and placing Spain among the top ten countries in terms of growth. The market is forecasted to grow between 1 and 2% annually over the next five years, increasing by almost €1.3 billion by 2028.

The largest segments in the Spanish market are skincare (33%), toiletries (21%) and fragrances (19%). The skincare segment was the fastest growing between 2022 and 2023, with a growth rate of 14.3%. Hair care grew by 9.8%. In 2023, Spain had the third highest per capita consumption in Europe, with an estimated €216 per person.

Spain is the fifth largest importer of vegetable oils. In 2023, Spain imported 35,187 tonnes of vegetable oils (HS code 151590) worth €104 million, accounting for 7.8% of the total imported volume in Europe. Spain has one of the highest growth rates in imports in the region. Between 2019 and 2023, Spanish imports grew on average by 32% per year, while the import value grew at an average annual rate of 31% during the same period.

In 2023, Spain imported €34 million worth of vegetable oils from developing countries, accounting for 32% of the total import value, which is one of the largest shares in Europe. Spanish imports of vegetable oils from developing countries have shown remarkable growth over the last five years, growing on average by 25% per year between 2019 and 2023, more than doubling the imports recorded in 2019 (€14 million).

Italian imports of vegetable oils show significant growth

Italy is the third largest market in Europe for cosmetics and personal care products, valued at €12.5 billion in 2023, with a 13% share of the European market. The Italian beauty and personal care market grew by 9.4% in 2023, more than the regional average. However, it is not expected to see any significant growth over the next five years, with a projected decrease in market value of around €200 million by 2028.

Italy has the second largest number of SMEs in Europe. It had 952 in 2023, representing 11% of the total SMEs in Europe. The largest segments in the Italian market are skincare (36%) and decorative cosmetics (20%). Between 2022 and 2023, the skincare segment grew by 8.8%, and hair care grew by 5.5%. Italy ranked fourth in per capita consumption in 2023, with an estimated €212 per person.

In 2023, Italy imported 28,296 tonnes of vegetable oils (HS code 151590) worth €111 million, accounting for 6.2% of total European imports. Italian imports showed significant growth, with an average annual increase of 18% in volume and 29% in value between 2019 and 2023. In 2023, Italy imported €26 million worth of vegetable oils from developing countries, which accounted for 24% of the total import value. Imports from these countries showed significant growth, increasing at an average rate of 9.8% per year between 2019 and 2023.

United Kingdom is a leading market for organic and natural cosmetics in Europe

The UK is the fourth largest market in Europe for cosmetics and personal care products, valued at €11 billion in 2023, with an 11% share of the European market. The UK beauty and personal care market grew by 9.7% in 2023, surpassing the regional average. It is expected to grow by more than 3.5% annually over the next five years, increasing its market value by almost €2.4 billion by 2028.

The UK is the third largest country in terms of the number of SMEs, with 880 SMEs in 2023, representing 9.8% of the total SMEs in Europe. The largest segments in the UK market are toiletries (28%), skincare (25%) and fragrances (21%). The skincare segment was the fastest-growing, with an 11.8% increase between 2022 and 2023. Hair care grew by 7.3% during the same period. The per capita consumption in the UK was €162 in 2023.

In 2023, the UK imported 22,057 tonnes of vegetable oils (HS code 151590) worth €55 million, accounting for 4.9% of total European imports. Between 2019 and 2023, UK imports grew at an average annual rate of 4.7%. In 2023, the UK imported €18 million worth of vegetable oils from developing countries, which accounted for 33% of the total import value. UK imports from these countries grew at an average rate of 5% per year between 2019 and 2023.

The UK is a leading market for organic and natural cosmetics in Europe. According to the Soil Association, the UK organic health and beauty market has grown by an average of 9.5% per year over the past five years, rising from €103 million in 2018 to €162 million in 2023. 2023 was the first year to see a downturn in the market, linked to the cost-of-living crisis, the aftermath of the pandemic, and the effects of Brexit. Despite this, the outlook for 2024 and beyond is positive, with a large share of certified natural and organic brands expecting growth in the coming years.

Germany is the largest cosmetics market in Europe

Germany is the largest national market for cosmetics and personal care products within Europe, with a market value of €15.9 billion in 2023. It dominates 17% of the European cosmetics market and is among the top countries in terms of SME cosmetics manufacturers, with 611 companies in 2023.

The German beauty and personal care market grew by 11% between 2022 and 2023, surpassing the regional average and placing Germany among the top ten countries with the largest growth. The market is forecasted to grow by over 1% per year in the coming years, increasing by €1.8 billion by 2028. Germany is also one of the top ten countries in terms of per capita consumption, with each German consuming an estimated €187 in 2023.

The largest segments in the German market are toiletries (31%), hair care (23%) and skincare (21%). Between 2022 and 2023, skincare grew by 8.6% Hair care grew by 9.9%.

In 2023, Germany imported 17,110 tonnes (€84 million) of vegetable oils (HS code 151590), accounting for 3.8% of European imports. Between 2019 and 2023, German imports of vegetable oils decreased, on average, by 10.4% per year in volume and 6.2% in value. Germany imported almost €26 million in vegetable oils from developing countries, indicating that 30% of the import value is sourced from these regions. German imports from developing countries grew at an annual average rate of 3% between 2019 and 2022.

Germany is Europe’s most significant market for natural and organic cosmetics. More than 70% of German consumers consider sustainability when buying cosmetics and personal care products. In particular, the demand for products without parabens, silicones and microplastics has increased. More Germans choose natural and sustainable products over chemical ingredients. In 2022, 52% of German consumers reported using natural and/or organic personal and beauty care products. There is a large supply of these products in the country, with 2,596 products having a COSMOS signature, being either natural or organic and 3,932 NATRUE-certified products – the highest number of NATRUE-certified products per country in the world.

Germany’s natural cosmetics market is thriving thanks to growing consumer demand for sustainable beauty products. In 2024, the value of this market amounts to €342 million. Looking ahead, the market is forecast to grow at an average annual rate of 5.28% to reach €414 million by 2028.

Tips:

- Focus on Western European countries as they import the highest volumes of exotic vegetable oils (HS code 151590). They also have the largest cosmetics markets.

- Be flexible in your offer to European customers. Do not get fixed on large minimum order quantities. Offer solutions that make you an attractive supplier and look to the long term.

- Consider obtaining NATRUE certification or approval for your rosehip oil. Offering ingredients with these recognitions can be very valuable to potential buyers.

4. Which trends offer opportunities or pose threats in the European rosehip oil market?

Rosehip oil has become very popular and is now considered a key ingredient in effective skincare routines. The trend towards skin minimalism and this ingredient’s popularity on social media are likely to boost demand for rosehip oil.

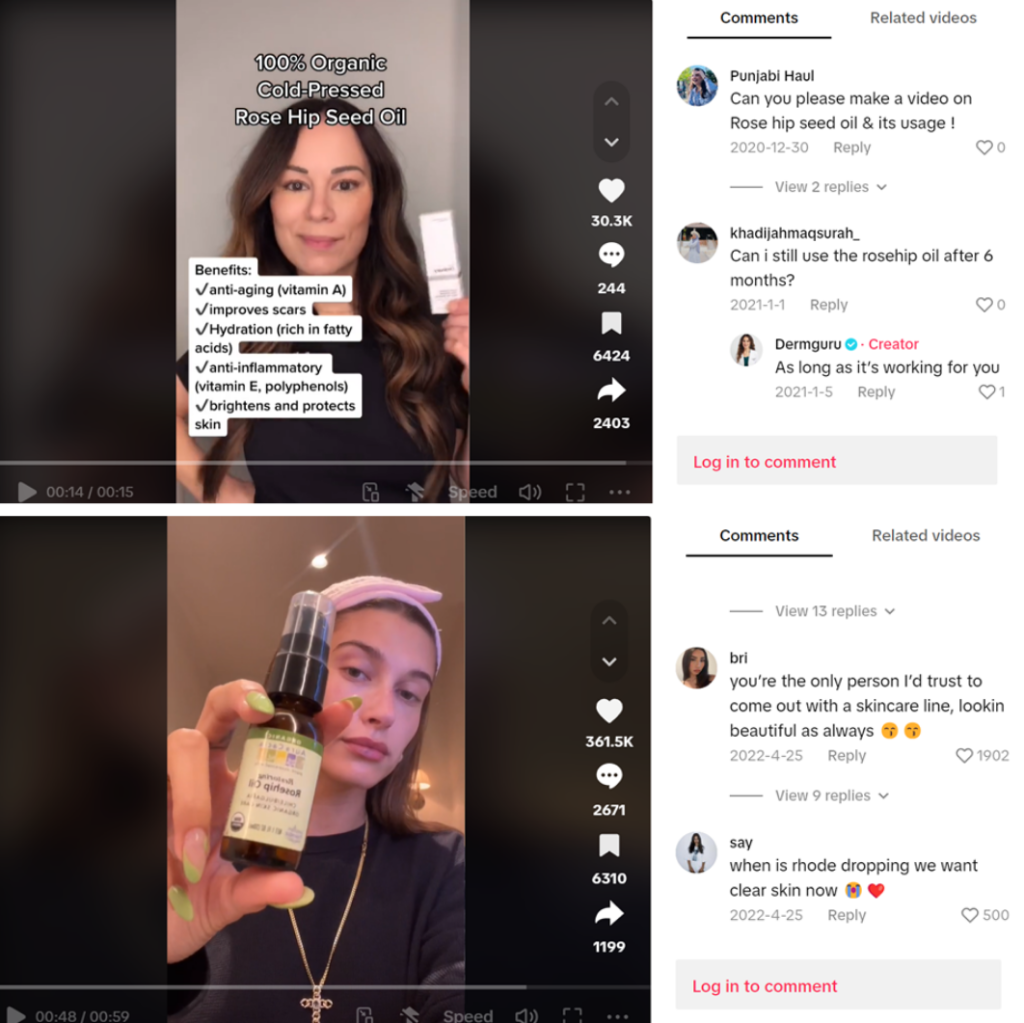

Rosehip oil’s popularity remains high, driven by social media and influencers

Since 2020, there has been a major online trend around rosehip oil, particularly on social media. This trend started when influencers, beauty bloggers and skincare enthusiasts began to highlight the benefits of rosehip oil. They began to talk about rosehip oil as a product that they used in their daily beauty routines and that had significant benefits for various skin problems. This greatly increased its popularity.

Skincare influencers began sharing their personal experiences with rosehip oil on platforms like TikTok, Instagram and YouTube. Hashtags like #rosehip became popular, with thousands of posts dedicated to its benefits. To date, there are over 321,000 posts that use #rosehip on Instagram and over 6,990 posts that use #rosehipoil on TikTok.

Figure 9: Examples of influencers promoting rosehip oil on social media

Source: Hailey Bieber TikTok, 2022 and Dermguru TikTok, 2020

Social media buzz has driven demand for rosehip oil. Social media influencers have emerged as key figures in shaping skincare trends and revolutionising consumer preferences. By sharing their personal stories and expertise, skin influencers encourage their audiences to follow their skincare routines with confidence. This is especially true in times of economic uncertainty when consumer spending is tight. In addition, influencers and social media play an important role in product discovery in the beauty and personal care sector because influencer marketing allows consumers to learn about products before they buy.

The graph below shows the relative search interest in the term ‘rosehip’, measured on a scale from 0 to 100 (100 being the highest level of popularity, 0 the lowest). The popularity of the term ‘rosehip’ reached an all-time high in 2020. Over the last year, the interest in the term ‘rosehip’ has remained high, peaking at the end of 2023. Although there is a downward trend thereafter, it is not a drastic decline and appears to be stabilising. Overall, this reflects the popularity of the term ‘rosehip’, which could indicate a loyal consumer base or new applications and uses for rosehip oil.

Source: Google Trends, 2024

The multi-functional benefits of rosehip oil make it stand out in minimalist beauty

The minimalist beauty trend, often referred to as ‘skinimalism’, represents a shift away from the extensive, multi-step skincare routines that were popular in previous years. Instead, consumers want simpler, more streamlined beauty regimens that focus on fewer products with higher efficacy. This trend aligns with a broader cultural movement towards minimalism, sustainability and mindfulness, where consumers seek to reduce excess and focus on essentials. It has also been caused by restrictions on how much European consumers can spend because they have had less disposable income.

Consumers want multi-functional products that can serve multiple purposes, reducing the need for a large number of items in their skincare or makeup routines. Skinimalism prioritises maintaining healthy skin with fewer but higher-quality products. This has led to an increased demand for products that can offer multiple benefits.

Rosehip oil is a versatile ingredient known for its moisturising, anti-ageing, anti-inflammatory and skin-repairing properties. Consumers who want to simplify their routines can choose rosehip oil as a single product that meets several needs. Consumers look for products containing rosehip oil as an ingredient, but many buy it in a dropper bottle and apply it directly to the skin. This simplicity is at the core of skinimalism. This trend offers a significant opportunity for rosehip oil to position itself as a key ingredient in streamlined skincare routines.

Growing demand for sustainable, ethically sourced, and organic ingredients in the European cosmetics market

Sustainability has taken centre stage in the European cosmetics market. Consumers have become more environmentally conscious and are increasingly looking for sustainable cosmetic products. This is reinforced by the European Green Deal and regulations that push cosmetics brands and manufacturers to adopt sustainable practices. European companies now face increasing pressure to ensure that their ingredients are responsibly sourced and meet high standards for social and environmental sustainability.

The demand for natural and organic cosmetics is rising sharply, driven by the public perception that natural ingredients are safer and healthier than synthetic alternatives. Consumers are increasingly studying labels and looking for ingredients that are sustainably sourced and organic. Searches for ‘natural ingredients makeup’ have increased by 180% in recent years, indicating that people are actively seeking greener beauty options. Natural oils have seen a surge in interest as they align with this movement toward ‘cleaner, greener beauty’.

For European brands, transparency is no longer optional: it is essential. Companies are expected to report on their social and environmental impact throughout their entire supply chains. This means that suppliers have to provide clear information about their processes and demonstrate that they meet sustainability standards. One approach buyers employ to ensure supplier adherence to sustainability standards is the use of certified ingredients. In addition to certification, buyers may also require compliance with their code of conduct.

Rosehip oil fits well into the trend of sustainability, especially if it is sourced through organic farming or wild harvesting. This helps protect biodiversity and supports rural communities. As with any natural ingredient, rosehip oil suppliers should emphasise the positive social and environmental impact of their practices. To meet EU expectations, they should also set themselves challenging targets so they keep improving their sustainability efforts.

Zuplex Botanicals is a South African company. It has successfully tapped into this trend by focusing on the ethical sourcing and production of their natural ingredients, including rosehip oil. They follow the Nagoya Protocol, which ensures the fair sharing of benefits with local communities that harvest these resources. Their rosehip oil is sourced from wild plants in the mountains of Lesotho. This helps the environment and rural communities. Many of their ingredients are COSMOS-approved. This shows their commitment to organic and eco-friendly practices. By focusing on transparency, ethical sourcing and sustainability, Zuplex meets the growing demand for natural ingredients with strong sustainability values.

Tips:

- Educate potential buyers on the uses and benefits of rosehip oil to help them promote it effectively and build interest in the European market.

- Read our study about trends for natural ingredients for cosmetics for more market trends and information.

ProFound – Advisers In Development and Fair Venture Consulting carried out this study on behalf of the CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research