Entering the European market for sesame seed oil for cosmetics

Many suppliers in developing countries already deliver sesame seed oil to the European cosmetics market. To stand out, you need to offer a high level of service and comply with European requirements. The better the service you provide and the closer you meet importers’ expectations, the more likely it is that they will buy from you.

Contents of this page

1. What requirements must sesame seed oil comply with to be allowed on the European market?

What are the mandatory requirements?

First of all, you need to understand the legal requirements in the European Union (EU) for sesame seed oil used in cosmetics (and for any substance used as a cosmetic ingredient). You can find these in the European legislation on cosmetic products. Companies supplying cosmetics to Europe must ensure that all substances used in those products comply with the requirements.

In particular, you need to be familiar with three important regulations.

- The EU Cosmetics Regulation (EC 1223/2009). This is the primary regulation for cosmetic products for the EU market. Its main aim is to protect human health to a high level. You should focus in particular on Chapter 4 and Annexes I to VI.

- Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH). This regulation protects both human health and the environment. It includes measures to promote alternative methods for assessing the hazards associated with chemical substances.

- The EU Classification, Labelling and Packaging Regulation (CLP) (EC 1272/2008). Again, this regulation aims to protect human health and the environment. But it also facilitates the free movement of substances, mixtures and products. It is the only legislation in force in the EU for the classification and labelling of substances and mixtures.

If you want to sell to customers in the United Kingdom (UK), it now has its own regulations for cosmetics sold there. And for the ingredients used in them. These include UK REACH and GB CLP. Although the UK has left the EU, nothing has changed in terms of the safety of cosmetic and personal care products. The UK Regulation is still aligned with the strict EU rules. Importantly, the ban on using animals to test ingredients and products remains firmly in place.

Think about your customer’s position, too. It has to sell on ‘your’ sesame seed oil to its own customers. They could be manufacturers, other distributors or the consumers of end products containing sesame seed oil. What does your customer need from you in order to make its own sales activities successful?

As well as the existing technical requirements, new regulations are going to be introduced soon. These cover sustainability, human rights, the climate and the environment. The European Green Deal will also impact global supply chains that reach the European Union. In addition, many European companies have their own requirements for their suppliers – particularly in niche segments. On the other hand, you can expect customers active in niche segments to pay more for the quality that they want.

As a company supplying ingredients for use in cosmetic products, you are operating in the chemicals sector. So the regulations for that sector also apply to you. Two very important regulations in this respect are REACH and the CLP.

REACH

REACH defines procedures for collecting and assessing information about the properties and hazards of chemical substances. Companies need to register their substances, and to do this they need to work together with other companies that are registering the same substance. REACH only applies to European companies. Non-EU companies are not subject to its requirements, even if they export their products to the European Union.

Whilst REACH covers all chemical substances imported or manufactured in the EU, certain categories are exempt from its registration procedures. These include vegetable oils such as sesame seed oil.

One key part of REACH is Annex II, which contains the requirements for Safety Data Sheets (SDSs). Sesame seed oil needs an SDS to be transported within Europe. Under international transport rules, non-EU companies also need an SDS to ship their chemical substances (including sesame seed oil) to the EU from the place of manufacture.

CLP

The CLP is based on the United Nations’ Globally Harmonized System of Classification and Labelling of Chemicals (GHS). Many countries have made this part of their own law. The CLP’s requirements will therefore be familiar to non-EU companies that need to classify, label, package and transport chemicals in their own countries. CLP data is included on the Safety Data Sheet.

One aspect of the European management of the CLP legislation that can help non-EU companies is that the CLP notifications made by EU manufacturers and importer-distributors are published by the European Chemicals Agency (ECHA).

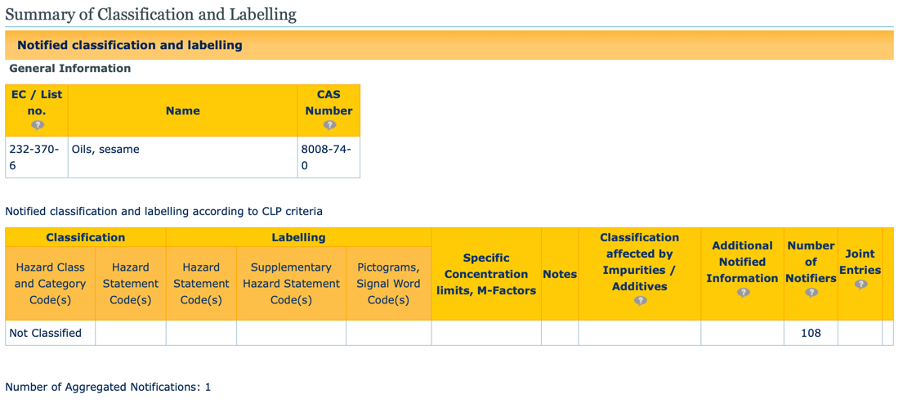

Below is the CLP notification summary published by ECHA for sesame seed oil.

Figure 1: CLP summary for sesame seed oil

Source: ECHA CLP database

Note that none of the 108 importers who have notified ECHA that they are importing sesame seed oil have classified it as hazardous.

It is also important to note that companies have to produce their own data for their own notifications. They cannot use the data already published in another notification. For further information, you will find extensive resources on the ECHA website. And UNIDO has published a guide to understanding CLP.

Tips:

- Keep up to date on developments in the European cosmetics industry by referring to the European Commission website on cosmetics. This contains information about ingredients as well as cosmetic products.

- Familiarise yourself with the three main regulations that relate to your products: the Cosmetics Regulation, REACH and the CLP. The ECHA has published guidance on the last two of these.

- Make sure that you have prepared a Safety Data Sheet for your sesame seed oil. See the CBI workbook for preparing a technical dossier for cosmetic ingredients.

- If no-one in your company is technically qualified to prepare a Safety Data Sheet, contact local technical service providers in your country. Also read the ECHA guidance.

- See the ECHA CLP database for notifications made by European importer-distributors and manufacturers.

- Use the CBI market studies to find out more about market requirements.

Technical documentation

To comply with the EU’s legal requirements, European buyers of sesame seed oil for cosmetics need you to provide a well-prepared technical dossier. This not only demonstrates your commitment to quality and reliability, but also your concern for sustainable and ethical sourcing.

The technical dossier should include the following items:

- A Technical Data Sheet (TDS)

- A Safety Data Sheet (SDS)

- A Certificate of Analysis (CoA)

- A fatty-acid profile

- An allergen declaration

- Information on traceability back to origin

- Responsible sourcing policies and practices

- Records of certifications awarded and standards applied

The allergen declaration for vegetable oils is used by the cosmetics industry because of the possible risk of allergic reactions. It is not a legal requirement, but a precaution taken by the cosmetics industry based on experience from the food industry, even though it has been shown that vegetable oil does not cause allergic reactions in the vast majority of susceptible people. The cosmetics industry is extremely concerned about allergic reactions from the use of its products. See the box below for further information.

Allergens

Peanuts are a well-known food allergen. The European Food Safety Authority (EFSA) advises people who are allergic to peanuts to avoid crude peanut oil as well, because it may contain traces of peanut protein. But the EFSA also reports that refined peanut oil has not been found to trigger allergic reactions. It therefore concludes that the risk of a severe adverse reaction to highly refined peanut oil seems to be low, but cannot be ruled out entirely.

A safety assessment of vegetable oils for the cosmetics industry reports that even unrefined sesame seed used as a flavouring, which is likely to contain significantly more proteins than other edible fatty acid oils, causes very few known cases of allergic reaction.

Even though the science thus raises no major concerns, manufacturers of cosmetics still take the precaution of requesting an allergen declaration from their suppliers of vegetable oils. This should state that the oil contains no detectable quantities of protein. From the above, it seems likely that analysis of an unrefined, cold pressed oil may well detect protein and so it is not possible to make the requested declaration. On the other hand, fully refining a vegetable oil (including bleaching and deodorisation) should reduce its protein content to undetectable levels. This is why most manufacturers of cosmetics demand fully refined oils. Some, however, are happy to buy cold-pressed and filtered products.

Another helpful reference when compiling technical documentation for sesame seed oil is the Codex Alimentarius Standard for Named Vegetable Oils (CXS 210-1999). This is actually a UN Food and Agricultural Organisation (FAO) publication for the food industry, but is also useful for suppliers of sesame seed oil to the cosmetics industry.

Tips:

- Read the CBI study on preparing a technical dossier for cosmetic ingredients, which provides information and guidance. This should give you an advantage in your journey to enter the European market.

- Make sure you know how to prepare the Technical Data Sheet and Safety Data Sheet for your sesame seed oil.

- Identify local laboratory services that can prepare a Certificate of Analysis, including an analysis of protein content for the allergen declaration. If none is available, ask the business support organisations in your country for advice.

Buyer requirements

Quality and consistency

In addition to their standard quality requirements (found in the Codex Alimentarius Standard for Named Vegetable Oils and the Cosmetic Ingredient Review Expert Panel’s safety assessment of plant-derived fatty acid oils), European buyers of vegetable oils in the cosmetics industry are particularly concerned about adulteration, contamination and traceability.

Regarding adulteration, your buyer will want to be sure that the oil they order is the one you deliver. You only have to look in any supermarket at all the different types of near-identical vegetable oils on the shelves – rapeseed, sunflower, maize and so on – to understand that buyers are wary of receiving an expensive oil ‘diluted’ with a cheaper one.

Three parameters are checked to confirm the identity of an oil. These are saponification value, iodine value and fatty acid profile. Your Certificate of Analysis should include all three. The Codex Alimentarius standard contains typical values that you can use as a reference. The safety assessment of plant-derived fatty acid oils includes a typical fatty acid profile. There is also a specific identification technique for sesame seed oil, known as the Baudouin test. This should be positive for sesame seed oil.

In addition, you should provide evidence of traceability to the source. And also evidence that only sesame seeds kernels have been processed through the oil press. In other words, you need to prove that, if it is used for different oils, the press is cleaned thoroughly between their processing.

Heavy metals are another quality criteria for buyers of vegetable oils. In principle, substances like lead, mercury, antimony, arsenic and cadmium are strictly prohibited in cosmetic products (see Annex II of EU Regulation 1223/2009). However, trace amounts are permitted if they are technically unavoidable and do not pose a risk to human health. But maximum concentration values have not yet been established at the EU level; each country still sets its own limits. As an example, table 1 shows the figures for Germany.

Table 1: Maximum permitted concentrations of heavy metals in cosmetics (Germany)

| Heavy metal | Maximum permitted concentration in cosmetics, in mg/kg or parts per million (ppm) |

| Antimony | 0.5 |

| Arsenic | 2.0 |

| Cadmium | 0.1 |

| Lead | 1.0 |

| Mercury | 0.1 |

| Nickel | 10 |

Source: Cosmetics Design.

Including data on heavy metal content in your specification and certificate of analysis allows a manufacturer to calculate the impact on the heavy metal content of the final product. It should not be necessary to analyse heavy metal content more than once or twice per year, unless requested by your customer or if you change the source of your raw material or your processing equipment.

European buyers routinely test products they purchase to ensure that they meet quality requirements. And they may refuse to pay for products that fail the tests. They also test samples provided by prospective exporters when deciding whether or not to do business with them.

Consistently high-quality vegetable oils that conform to set specifications are important to European buyers, because for them quality is a core value underpinned by the cosmetics regulations.

Tips:

- Know how you are going to prove the purity and identity of your sesame seed oil. Anticipate these questions from your prospective customers and provide the information before they ask.

- Before you ship a sample to a prospective buyer, make sure that it conforms to the specification you have already provided or are sending with the sample.

- Prepare a fatty acid profile for your sesame seed oil.

- Carry out heavy metal and pesticide analyses at least once a year, and more frequently if you change your sources of raw material, equipment or processing method.

- Only make commitments and reach agreements with buyers if you can guarantee to meet them. Failing to meet agreed commitments may damage or even end your business relationship with the buyer.

Quality management

When assessing the credibility of prospective exporters, European buyers of natural ingredients for cosmetics are increasingly considering their quality management standards. Adopting these gives you credibility because it shows your commitment to delivering high-quality ingredients, as well as giving your company a positive image. It can also help to demonstrate your compliance with mandatory requirements.

At the very least, you should have a documented HACCP (Hazard Analysis and Critical Control Points) system. But also consider adopting quality standards for your production methods, such as ISO 22000 and ISO 9001:2015 from the International Organisation for Standardisation (ISO) and Food Safety System Certification (FSSC) 22000.

Tips:

- Inform European buyers of the standards you meet and provide details on your website and marketing materials. This may give you an advantage over your competitors, since buyers look for these standards when assessing exporters. The Ugandan company Fairoils is an example of an exporter doing just that.

- Study the HACCP requirements and prepare a HACCP manual for your business.

Labelling and packaging

Your product labelling should include the following information:

- International Nomenclature Cosmetic Ingredient (INCI) name and product name

- Name and address of exporter

- Batch code

- Place of origin

- Date of manufacture

- Best before date

- Net weight

- Recommended storage conditions

- If you export organic sesame seed oil: your organic certification number with the name/code of the certifying body.

European buyers require good-quality sesame seed oil. So consider the following packaging tips to preserve the quality of your products in transit:

- Use drums that conform to UN standards.

- Ensure that containers such as drums are clean and dry before filling them.

- Flush the headspace with nitrogen.

Other ways to preserve quality include making sure that your sesame seed oil is kept at the right temperature throughout the supply chain and always storing it in a dry place, in the shade.

Tips:

- Speak to European buyers to find out if they have any preferences or specific requirements concerning labelling and packaging. Consider meeting with them to increase your chances of entering the European market.

- Use UN standard drums and canisters for your sesame seed oil. Check the grade required with your drum provider. Shipping information is also included in section 14 of the Safety Data Sheet.

- Inform your logistics provider that your sesame seed oil needs to be kept in a cool, dry place on its journey to Europe, in order to preserve its quality.

- Make sure that certified organic sesame seed oil is kept physically separate from non-organic products to prevent cross-contamination.

Payment terms

Payment is at the heart of trade and presents risks for all parties involved. Before trading with European buyers, conduct risk assessments of the payment terms on offer. As an exporter of sesame seed oil, minimise your risks whilst working to meet the needs of your buyers.

There are several possible methods of payment. But letters of credit (LCs) are generally considered the safest form for both importer-distributors and exporters. This is because an LC allows both parties to contact a neutral arbitrator, usually a bank, to resolve any issues. For the exporter, the chosen bank acts as a guarantor of full payment as long as the goods have been dispatched. If a buyer does not pay as agreed, to avoid further losses the exporter should find new buyers and pay for the return of the goods.

Depending on their needs, importer-distributors and exporters can choose between several categories of LC, with different terms of payment. They include standby, revocable, irrevocable, revolving, transferable, non-transferable, back to back, red clause, green clause and export/import. For exporters, standby LCs are considered the safest form and so they are frequently used in international trade. This is because they offer security for both importer-distributors and exporters who have little trading experience with one another. Other payment terms include cash in advance, documentary collection and open account.

Many buyers will not use letters of credit, however, so you may have to consider other payment terms. One common alternative is 50% upon delivery to the shipper and the remaining 50% upon approval of the goods. Also consider taking out export credit insurance. Check what is available in your own country.

When negotiating with your customer, make sure you discuss and agree the Incoterms (International Commercial Terms) that will apply to the order. Incoterms are a set of 11 internationally recognised rules which define the responsibilities of sellers and buyers. For example, they specify who is responsible for paying for and managing shipping, insurance, documentation, customs clearance and other logistical activities.

Tips:

- Minimise your risks while working to meet the needs of European buyers. First assess your own needs, then speak to buyers to find out their needs. Finally, work out a compromise which satisfies both sides. Do not agree to terms you cannot meet.

- Learn about and use Incoterms. They are critical when negotiating payment and delivery terms with potential buyers. In the event of a dispute, the agreed Incoterms will be very helpful.

Delivery terms

Before agreeing delivery terms with European buyers, carefully consider three important factors: delivery time, volume and cost. This is because failure to meet agreed terms could end your trading relationship with a buyer.

- Delivery time. European buyers prefer shorter delivery times. Air freight is usually faster than sending goods by sea. It is also more reliable with regard to on-time delivery.

- Delivery volume/quantity of order. The volume of your order is an important factor to consider when choosing a mode of transport. Larger quantities are often cheaper to ship by sea. With smaller volumes, air freight can be less expensive as margins shrink.

- Cost of delivery. When shipping larger volumes, sea freight is usually four to six times cheaper than sending goods by air. The price of your shipment is unlikely to increase substantially if you increase the volume.

Tips:

- Be open-minded and flexible. Remember that there may well be tensions and trade-offs with European buyers, especially if you are doing business with them for the first time.

- Read the CBI’s tips for organising your exports of natural ingredients for cosmetics to Europe for guidance on practical matters, such as customs, tariffs, transportation and documentation.

Requirements for niche markets?

Organic, natural and fair trade

Although there is no official certification scheme for organic cosmetics, there is growing demand in the European cosmetics market for certified organic ingredients. More and more products and ingredients are being certified as ‘natural’ and ‘organic’ by private bodies. The leading organic and natural standards for cosmetics are:

Both of these private standards have established definitions for organic and/or natural ingredients and final products.

There are at least ten other natural and organic standards for cosmetics in Europe. They include Demeter and Organic Farmers and Growers.

The ISO has also introduced a two-part natural and organic standard for cosmetics and cosmetic ingredients (ISO 16128, parts 1 and 2). After purchasing the standard itself, you can apply it to your supply chain without paying certification costs. While this self-certification has been criticised because it lacks independent verification, it also has positive aspects. Above all, it is a low-cost way to demonstrate your natural and organic credentials. This lowers barriers, which in turn should increase the number of companies developing natural and organic products. A number of major companies already use ISO 16128.

There are various certification labels for environmental and social standards, too.

- Fairtrade International. There is a Fairtrade price for sesame seed (organic and conventional).

- FairForLife. A number of companies are already FairForLife certified for sesame seed oil. One example is Manorama Industries.

- UEBT, the Union for Ethical Biotrade, which certifies practices that respect people and biodiversity in the way ingredients are grown, collected, studied, processed and commercialised.

Tips:

- Consider obtaining natural and/or organic certification for your sesame seed oil. That is likely to give you an advantage in the European market.

- Visit the ICADA website for more information about ISO 16128.

- Visit the NaTrue and COSMOS websites for information on obtaining their certification.

- Once you have been certified, let European buyers know. That is likely to make you more appealing as a supplier, and so ease your entry into the European market.

- Look at the ITC Standards Map for information about certification schemes popular in the European consumer market for cosmetic products and their natural ingredients. This will help you make a more informed choice when assessing if there is a business case for you to obtain certification.

2. Through what channels can you get sesame seed oil on the European market?

As an exporter, it is important to know how the European end market for vegetable oils is segmented, how the oils reach that market and which channel is the most interesting for you. This knowledge will help you in your journey.

Most vegetable oils used in cosmetics are refined. This is done to produce an oil consistent in colour, odour and other quality characteristics, which reduces the risk of batch-to-batch variation in the manufacture of the final cosmetic product. So the majority of importers to Europe are companies with their own refining facilities. The unrefined oil is kept in storage until needed, then refined shortly before being shipped to the manufacturer. Some importers, like GustavHeess Oils and Spack, deal exclusively in vegetable oils. Others handle a wide range of cosmetics ingredients. They include A&E Connock and Huiles Bertin.

Details of some of the other well-known importers can be found in our market analysis study for sesame seed oil.

If you have access to refining operations in your own country, or you can arrange for a toll refining service, this may create opportunities to sell your refined, bleached and deodorised sesame seed oil directly to the European cosmetics industry. However, that will require careful analysis of the costs and logistical requirements. Manufacturers usually order smaller quantities on a regular basis, and will not tolerate late or incomplete deliveries. Unlike the big importers, they do not require large volumes on an infrequent basis. So study the feasibility of your plans carefully.

How is the market segmented?

Vegetable oils can be used in nearly all cosmetics, although the concentration will vary from product to product. As the supplier of an ingredient, you have little or no say over the products your oil is used in. That is decided by the manufacturer.

When promoting your sesame seed oil, it is important that the highest concentrations of this ingredient are found in skin-care products. Especially massage oils, hand creams and face creams. So refer to these products rather than shampoos and conditioners, say, as they contain only low percentages of vegetable oil (although hair oils are an exception). The same applies to perfume products: apart from solid perfumes, they rarely contain vegetable oil.

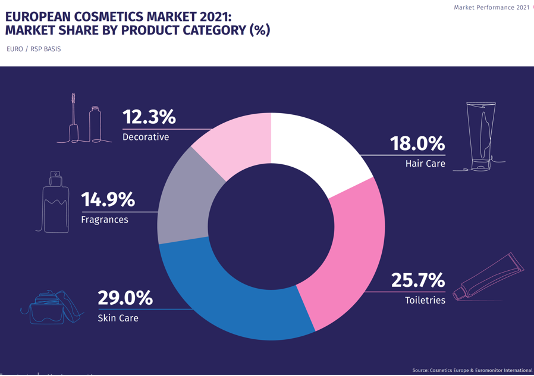

Figure 2 shows how the cosmetics market is segmented in Europe. Skin care is the largest segment, followed by toiletries, hair care, fragrances and make up (‘decorative’).

Figure 2: European cosmetics market 2021: market share by product category (%)

Source: Cosmetics Europe Market Performance Report 2021, p. 12

Tips:

- If you have your own refining capability, study the market requirements of downstream manufacturers and smaller importer-distributors. But remember that there can be logistical challenges in meeting their delivery requirements. The costs could be too high.

- Prepare your trade offers to suit the needs of importer-distributors (large and small) and the other types of company mentioned above. Note that the latter groups often want to place smaller but more frequent orders of identical specification.

- To find more buyers, study trade fair catalogues (e.g. in-cosmetics, SCS Formulate) and the membership lists of trade bodies like the Alliance of Chemical Associations, as well as websites that specialise in promoting ingredients (e.g. SpecialChem/Cosmetics and ULProspector).

- See the CBI’s tips for finding buyers in the European cosmetics market for a list of trade fairs in this sector.

How does sesame seed oil reach the end market?

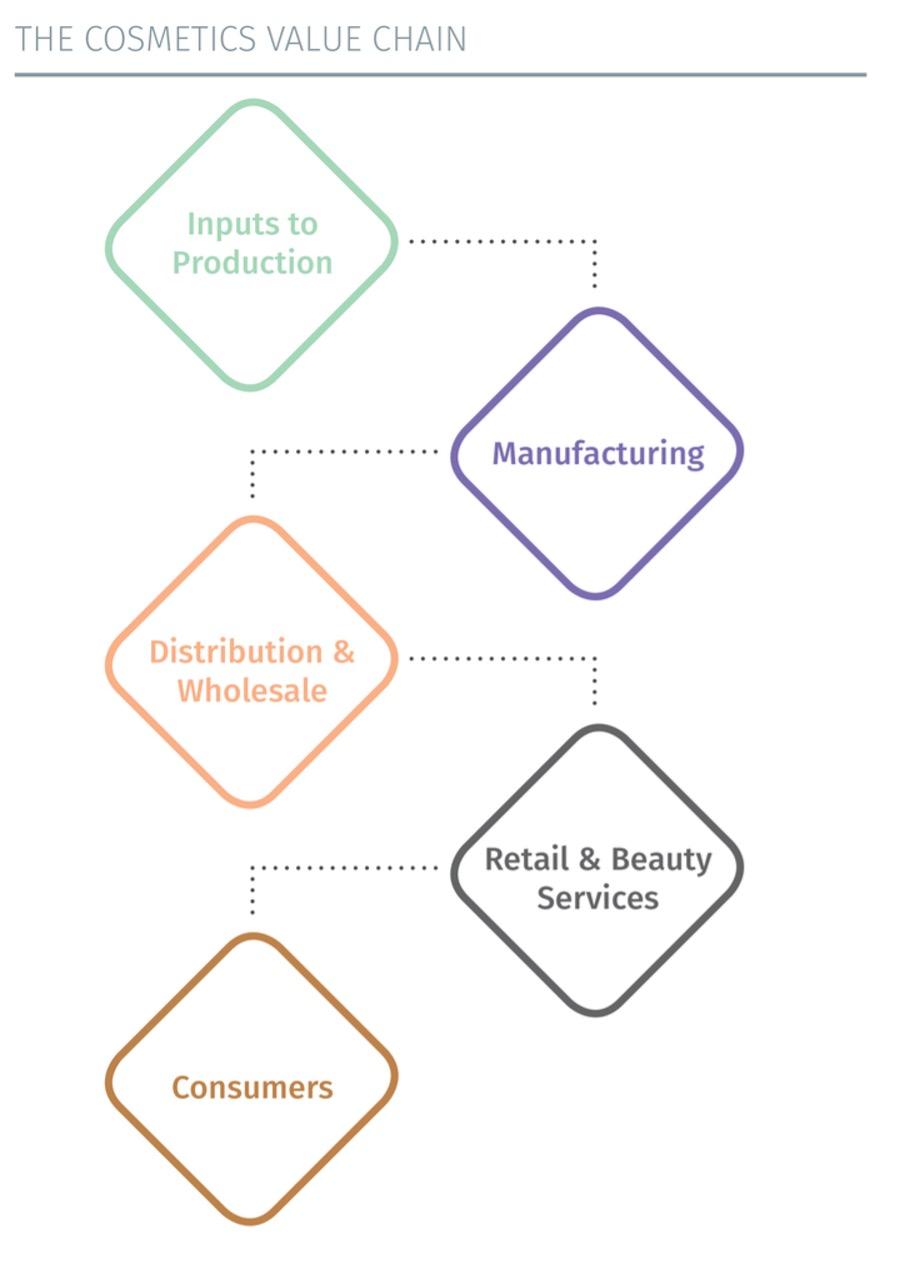

The cosmetics and personal care industry value chain has five levels.

- Inputs to production. Companies that provide the raw materials used to make cosmetics and personal-care products.

- Manufacturing. Product manufacturers, as well the providers of support services such as marketing and IT.

- Distribution and wholesale.

- Retail and beauty services.

- Consumers. Individuals who purchase cosmetics and personal-care products represent the final link in the value chain.

Figure 3: The cosmetics value chain

Source: Cosmetics Europe.

Tips:

- Focus your buyer research on importer-distributors of cosmetic ingredients, using information from industry associations as well as details of the exhibitors on trade fair websites.

- In your marketing, draw attention to the use of sesame seed oil in products with the highest concentration of vegetable oil.

Which channel is most interesting for you?

As an exporter of sesame seed oil, the most interesting sales channel for you is specialist importer-distributors in Europe. This is because they are used to handling large quantities of natural ingredients, and also have experience dealing directly with exporters from developing countries. So they understand the challenges and constraints associated with the supply, processing, testing and delivery of raw materials.

Given that most vegetable oils need to be refined before they are used in cosmetics, you should also look for companies with their own refining facilities.

3. What competition do you face on the European sesame seed oil market?

In your journey to enter the European market, you will be competing with other companies in your own country and elsewhere.

What countries are you competing with?

Sesame seed is grown in many parts of the world with a suitable climate and soil. In Africa alone, there are thirty producing nations. Of these, eleven export sesame seed oil and four (Burkina Faso, Kenya, Somalia and Sudan) are already supplying Europe. But 80% of European imports come from six non-African countries: Mexico, China, Singapore, India, Japan and Taiwan. For more details, see our study of the European market potential for sesame seed oil.

Table 1 lists those countries exporting more than €100,000 worth of sesame seed oil to the European Union and the UK (EU28) in 2017 and 2021. You will see from this that the European market is dominated by exports from Mexico.

Table 1: Countries exporting more than €100,000 worth of sesame seed oil (HS 151550) to the European Union (EU28) in 2017 and 2021

| Exporters | Imported value in 2017 (x €1,000) | Imported value in 2021 (x €1,000) |

| Intra EU trade | 17,506 | 28,972 |

| Mexico | 11,760 | 19,140 |

| China | 3,265 | 5,885 |

| Singapore | 3,959 | 5,859 |

| India | 1,447 | 3,644 |

| Japan | 1,086 | 2,847 |

| United States of America | 2,155 | 1,925 |

| Taipei, Chinese (Taiwan) | 1,015 | 1,855 |

| Korea, Republic of | 742 | 1,377 |

| Burkina Faso | 751 | 1,336 |

| Malaysia | 1,115 | 1,197 |

| Hong Kong, China | 618 | 1,128 |

| Thailand | 298 | 691 |

| Uganda | 135 | 353 |

| Sri Lanka | 64 | 212 |

| United Arab Emirates | 15 | 192 |

| Sudan | 44 | 160 |

| Kenya | 437 | 153 |

| Somalia | 22 | 138 |

| Ukraine | 17 | 109 |

| Türkiye (Turkey) | 279 | 94 |

Source: ITC Trade Map

Mexico

Mexico is the leading supplier of sesame seed oil to Europe, accounting for 40% of its imports. The country’s strength is that its quality, reliability and pricing meet the expectations of European buyers. Its average import price in 2021 was €3.50/kg. Mexico has held a dominant position as the primary exporter to Europe for the past five years. Based on past performance, this looks set to continue and poses a challenge for other countries trying to gain market share. At the same time, there are potential risks when 40% of a commodity comes from just one country. So that represents an opportunity for other countries, as buyers look to reduce their dependence on Mexico.

China

China is the second most important source of sesame seed oil for Europe. It is the world’s biggest producer of this oil and its third largest exporter, but exports to Europe are still only one third of those by Mexico. The average European import price for Chinese sesame seed oil was €5.25/kg in 2021. To a great extent, the volume of imports from the Far East is due to the popularity of Asian food in Europe. Four of the top-6 exporters to Europe are in that region. In the food industry, toasted sesame seed oil is more popular than untoasted oil. So this grade probably accounts for a large proportion of the trade with China and other Far Eastern nations. Toasted sesame seed oil is not used in cosmetics or in aromatherapy.

Singapore

The third-largest exporter of sesame seed oil to Europe is Singapore. It does not produce the seeds itself, but does process approximately 1,000 tonnes of sesame seed oil a year. The average import price is €5.26/kg. Singapore’s position on this list highlights its role as a trading hub, handling exports from other Asian countries.

India

India is Europe’s fourth-biggest source of sesame seed oil. The average import price in 2021 was €2.96/kg. That is the lowest for the six countries included in this study. One reason for that could be much of this oil is unrefined. For comparison, the price of sesame seed oil exported from the Netherlands to other European countries is €4.99/kg. And from France it is €5.95/kg. But it is likely this intra-EU trade is in so-called ‘RDBW’ (refined, bleached, deodorised and winterised) oil, possibly also already packaged for retail sale.

Japan

With approximately 54,000 tonnes of sesame seed oil produced in 2019, Japan is the world’s fifth-largest manufacturer of this product. Yet it ranks only seventieth in the list of sesame seed-producing countries. Of those 54,000 tonnes, Japan exported nearly 3,000 tonnes to Europe in 2021. That puts it in fifth position on the European list of suppliers. The average import price of €5.95/kg suggests that most Japanese oil has already been processed to a higher quality, and possibly prepackaged for the retail market as well.

Taiwan

Finally, Taiwan is Europe’s sixth most important source of sesame seed oil. The average import price in 2021 was €4.39/kg. Taiwan is also the fifth Asian country on the list of the top-6 exporters to Europe. This again highlights that region’s market dominance. As noted above, it is not possible from the import data to work out how much of the oil coming into Europe is used by the cosmetics industry. But that is likely to be considerably less than the food industry uses. Also, from these statistics we cannot distinguish between toasted and untoasted oil.

For you as an exporter from a CBI target country, this data highlight the challenge of trying to build a strong position in the European market. Especially when the dominant supplying countries account for 80% of Europe’s total imports. But below we highlight ways in which you may be able to compete with other suppliers.

Tips:

- Use the ITC Trade Map to collect data on volumes and value of the exports and imports from other countries to Europe.

- To find out more about these companies, study their websites. Ask yourself what you can learn from them and what is missing from your own offer.

- Find out what support is available in your own country from industry associations, government agencies and other business support organisations. Is your country one of those in which CBI is active?

- If your country produces sesame seeds but does not yet export sesame seed oil, carry out a feasibility study to find out if you could establish a profitable export business.

What companies are you competing with?

As your main customers are the European importer-distributors of sesame seed oil, your competition is other producers of sesame seed oil outside Europe. All the suppliers who are successful on the European market meet their buyers’ expectations in terms of price, quality and reliability.

Different buyers have slightly different definitions and expectations when it comes to price, quality and reliability. For example, a company that uses organic sesame seed oil in its products will be prepared to pay organic grade prices. Some buyers will expect a higher quality in terms of the colour or odour, for example. Some will expect to reliably receive their orders within 10 days, others within 8-12 weeks. You can expect the prices paid in these different situations to be different as well.

Basic requirements are becoming more and more stringent. Especially regarding sustainability, social responsibility and traceability. These are now expected by buyers.

Fairoils and Olvea are two companies that export sesame seed oil to Europe. Fairoils is a Kenyan supplier of a wide range of vegetable oils and related products. Its sesame seed oil is produced in Uganda. Olvea is a French firm that also supplies various vegetable oils. It has established a sesame seed oil processing facility in Burkina Faso, integrated with its shea butter operation.

Both companies publish details of their activities to improve sustainability, social responsibility and traceability. Besides considering price, quality and reliability, these businesses want to show how they go beyond the minimum requirements and give something back to the communities they work with.

The quotes below are taken from the Olvea and Fairoils websites. They describe what the companies are doing with local communities, and the benefits of those relationships. This is the kind of information that many consumers in Europe are looking for, so buyers here are interested in working with suppliers that are making a difference within their own supply chains. In many cases, certification can support and verify this. Both Fairoils and Olvea are FairForLife certified, for example. They are also good examples of the companies you are competing with to access the European market.

“Our sesame supply chain relies on producer organisations specialised in sesame on the one hand, and on the existing local network of Olvea Burkina Faso on the other hand. Since 2009, Olvea has been working with producer organisations which were only specialised in shea kernel harvest and production. Women producing shea have also been trained to harvest sesame seeds. Harvesting sesame has diversified their income and activities, since shea and sesame are year-round succeeding crops.

This production chain, which benefits from Olvea’s local experience, is based on transparent and long-term relationships with producers’ organisations with whom Olvea has signed collaboration protocols. These agreements promote sustainable commercialisation, including transparency on market prices as well as training and raising awareness among the producers of agricultural good practices.

In order to support the development of this new production chain, Olvea relies on its long-term partners, ICCO and FMS, as part of a public-private partnership for sustainable entrepreneurship and food safety, cofinanced by Olvea and RVO (the Netherlands Enterprise Agency). This partnership ensures year-round work for 35,000 Burkinabe women and provides them with seeds and training, while improving the quality, quantity and traceability of production.”

“Fairoils’ sesame seed oil project is a real success story, working with low-income subsistence farmers in the Ochero county of Northern Uganda. Fairoils works with a trusted partner in Uganda who provides field officers and extension staff as well, while coordinating the collection of the crop. Additionally, it has involved the instalment of community wells throughout this project area to ensure a more reliable clean drinking water supply, as well as the purchase of oxen to make the ploughing of individual members’ fields easier.

Once the sesame seed has been collected from the farmers in Ochero, it is road-transported east across the Kenyan border to Fairoils’ processing facility in Athi River. Fairoils secures seed at the farm gate and prefinances the purchase of seed to give farmers a secure market and fair price.

Each farmer has, on average, five acres of land on which they farm a variety of crops including millet, sorghum and maize, along with cash crops like cotton and sesame. The farmers, through the field officers, learn new techniques to manage this crop, ensuring they get the best possible yield by managing soil conditions and using more efficient harvesting techniques.”

The key point from these two examples is that both companies have obtained FairForLife certification, although this is not explicitly required. It is important that (a) you know what you are aiming for, (b) you know where you are starting from and (c) you know how to measure progress and success. It is also useful to note that both companies are working with others, especially local people and organisations, to achieve their goals. They are not acting alone.

Tips:

- Beyond price, quality and reliability, buyers are eager to be involved with suppliers and supply chains that make a difference. Where are you making a difference? How can you communicate that? What can you do to go beyond minimum requirements?

- Consider working with local agencies to support you in your social responsibility activities. This also helps you to build credibility as a third-party contributor.

- Make sure you have a professional website with well-prepared content, which clearly informs potential buyers of your strengths and your unique selling points (USPs).

What products are you competing with?

All vegetable oils, including sesame seed oil, have the same basic chemical properties. They are fatty acid oils with a triglyceride structure and emollient properties. Emollients soften or smooth the skin. In this respect, sesame seed oil competes with all other vegetable oils. When creating a body cream, for example, a cosmetic scientist can use any vegetable oil.

At the same time, different fatty acids have more or less superior effects on the skin. As stated in our market analysis study, sesame seed oil is known for the following properties:

- Rich in vitamin E (tocopherol), reported to have firming and anti-inflammatory properties for the skin.

- Rich in fatty acids and lecithin – a highly moisturising and protective mixture for the skin and hair.

- May give slight UV (sun) protection when used in appropriate amounts.

- Contains sesamol, a natural preservative that helps the oil remain stable and highly resistant to oxidation, allowing product blends to last longer.

At the fatty acid level, as well as in terms of microcomponents like the antioxidants sesamol, sesamolin and lignan (sesamin), sesame seed oil is quite unique. These characteristics should be highlighted in your promotional materials.

As a processor of sesame seed oil, you also have to compete with other products at the supply-chain level and in terms of traceability and social responsibility. A fair trade and/or organic-certified sesame seed oil is a different product from an uncertified conventional oil.

Tips:

- Learn more about the chemistry of vegetable oils so that you understand how to promote and differentiate your sesame seed oil based on its chemistry, its fatty acid composition and its other properties.

- Build a marketing story emphasising your social and environmental performance.

4. What are the prices for sesame seed oil on the European market?

As with most ingredients used in cosmetics, there is very little published data on the export market prices of sesame seed oil. But when an ingredient has its own HS code, as this oil does, it becomes possible to approximate its prices.

Based on the import quantities and values published by Eurostat for 2021 (see table), the mean European import price is around €3.21/kg. The range of prices paid is €2.37-€3.77/kg. The average is for all grades and specifications (refined, unrefined, for human consumption and for industrial use). Despite that, it does make a good basic reference point.

In table 2 we present the data for three countries on three different continents: Mexico, India and Burkina Faso. Mexico is the largest exporter to Europe, Mexico and India are among the top-5 suppliers to most European countries and Burkina Faso is in the top 5 for France (see the market potential study for sesame seed oil). So the figures below cover a good range of successful exporters to Europe.

Table 2: Average import prices for sesame seed oil, 2017-2021

| Year | European import price per kg – Mexico (€/kg) | European import price per kg – India (€/kg) | European import price per kg – Burkina Faso (€/kg) | Average European import price (€/kg) Year-on-year trend |

| 2017 | 3.258 | 1.860 | 3.379 | 2.832 |

| 2018 | 3.179 | 2.001 | 5.423 | 3.534 |

| 2019 | 3.831 | 2.729 | 3.637 | 3.399 |

| 2020 | 3.734 | 2.849 | 2.889 | 3.157 |

| 2021 | 3.476 | 2.396 | 3.518 | 3.130 |

Average country trend | 3.496 | 2.367 | 3.769 | 3.210 |

Source: EUROSTAT.

Over the past five years, the average European import price for sesame seed oil has been €3.210/kg. There was no significant change in that price during the Covid-19 pandemic of 2020 and 2021. In fact, the average import prices for Mexico and Burkina Faso fell from 2019 to 2020.

Comparing the country data, oil from Burkina Faso has the highest average import price over the past five years: €3.769/kg. And India the lowest: €2.367/kg.

Looking at the figures, it is possible to speculate that Mexico is the market leader due to its pricing, combined with reliability and good quality. Mexican sources of sesame seed oil offer buyers less risk and better value than their competitors. By contrast, Indian suppliers offer lower quality and are less reliable. Because of this, they cannot charge as high a price as Mexico. Supplies of sesame seed oil from Burkina Faso come with more quality guarantees, including organic and fair trade certification. They represent added value for the buyer – which, combined with a good risk profile, persuades them to accept a higher price.

Sesame seed oil has properties that make it great as a pure massage oil. When sold at retail (online) as 100% pure oil for massage or as a carrier for aromatherapy oils, 100ml bottles can fetch around €4.00-€7.00 (equivalent to €40-€70 for 1000ml, approximately 920g). Roughly speaking, this breaks down as follows.

Table 3: Approximate price breakdown for sesame seed oil

| Link in value chain | Volume | Price |

| Retail price of 100% pure sesame seed oil for massage | 100ml | €5.00 |

| Distributor price for refined sesame seed oil | 100ml | €0.70 |

| Import price of unrefined sesame seed oil | 100ml | €0.35 |

Source: Fair Venture Consulting.

Apart from its use as a pure oil, sesame seed oil is used final cosmetic products. In this case the cosmetics manufacturer buys from a distributor of refined oil.

Tips:

- Study the price information that can be derived from databases such as the ITC Trade Map and Eurostat.

- Make sure that you have detailed and accurate costs of production for your sesame seed oil, then add a reasonable margin on top. How does the result compare with published import prices?

- Know how to calculate prices for different Incoterms. The easiest way to do this is to ask a freight forwarder for quotes for different Incoterms. Practise these calculations before you go into a meeting with a buyer.

- Know how your product and value proposition compare with your competition. Be clear and confident with the buyer about your quality, USPs and differentiators.

- Prepare your price lists before going into a meeting with a buyer. Have different prices ready for different payment terms, Incoterms and price breaks (discounts for larger orders).

Fair Venture Consulting carried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research