The European market potential for sesame seed oil for cosmetics

In the past couple of years, there has been significant growth in wellness and self-care products and practices. The cosmetics industry is well-positioned to take advantage of this trend, with products that focus on well-being. For example, as aromatherapy and massage products. Thanks to its reported benefits for the skin and hair, sesame seed oil is an ideal ingredient for a wide range of products in the skin-care, hair-care and well-being segment. The oil is also easily absorbed by the skin, smoothing and softening it. This could drive an increase in demand for sesame seed oil as a moisturising and protective product.

Contents of this page

1. Product description

Sesame seed oil is extracted from the seeds of the plant Sesamum indicum L. It is one of the oldest oilseeds known to humankind, with records of use dating back 5,000 years. It is thought to have originated in Asia or East Africa (source: Encyclopaedia Britannica).

Sesame has been used in India and Chinese medicine since the eighth century BC. It was once believed to have mystical powers, and still retains a magical quality – as in the expression “open sesame” from the tale of Ali Baba and the Forty Thieves in The Arabian Nights. That was inspired by the way the seed capsules open when dry, allowing the seeds to scatter. Considerable manual labour was needed when harvesting sesame, to prevent the seeds being lost. Only with the development of a non-scattering variety of the plant in the mid-twentieth century did mechanised harvesting become possible. (source: Encyclopaedia Britannica).

Different varieties of sesame seed are grown in different countries. The seed’s colour can range from creamy white to dark brown or black. This appearance does not generally affect the quality of the oil extracted from the seeds. The key requirement for effective extraction is a high oil content. There are two types of sesame seed oil: the first is used in cosmetics and in foods and is extracted from hulled sesame seeds, while the second is extracted from roasted sesame seeds and is used only in foods.

The fatty acid profile is one test used to confirm the identity of a vegetable oil. In cosmetics, it is also used to tell oils apart due to the different properties associated with different fatty acids. Sesame seed oil is high in C18:1 (oleic) (34-45%) and C18:2 (linoleic) (37-48%) fatty acids.

Another way to classify vegetable oils is by their structure – the omega number. Because it is high in oleic fatty acid, sesame seed oil is an omega-9 oil.

Sesame seed oil contains antioxidants (sesamol and sesamolin) and lignans (sesamin) in small quantities. It is these components, especially sesamin, which give it excellent skin-conditioning properties. The antioxidants also help give the oil a longer shelf life. This is another desirable property for cosmetics manufacturers. However, the antioxidants are generally removed during the refining process. Most vegetable oils used in cosmetics are refined, bleached and deodorised to meet the industry’s quality standards. The deodorising process also removes residual protein left over after the oil extraction process. This is important because of the risk of allergic reactions in people who suffer nut and seed allergies. When refined according to the standards in the European Pharmacopoeia, sesame seed oil is commonly used as a solvent for drugs injected under the skin and into the muscles.

Although intended mainly for the food industry, the Codex Alimentarius Standard for Named Vegetable Oils (CXS 210-1999) is also a useful reference for processors of sesame seed oil used in the cosmetics industry. This global standard includes the typical fatty acid profiles of different vegetable oils (see table 1), as well describing identification methods such as the Baudouin test for sesame seed oil. This is typically used to check that it has not been added to other oils. Table 1 shows that the four most important fatty acids in sesame seed oil are linoleic oil (C18:2), oleic oil (C18:1), palmitic acid (C16:0) and stearic acid (C18:0). For a formulator of cosmetic products, knowing the fatty acid profile of their ingredients is important to give those products the right properties.

Table 1: Codex Alimentarius Standard for Named Vegetable Oils (CXS 210-1999).

| Fatty acid | Sesame seed oil (% of total fatty acids) |

| C6:0 | ND |

| C8:0 | ND |

| C10:0 | ND |

| C12:0 | ND |

| C14:0 | ND-0.1 |

| C16:0 | 7.9-12.0 |

| C16:1 | ND-0.2 |

| C17:0 | ND-0.2 |

| C17:1 | ND-0.1 |

| C18:0 | 4.5-6.7 |

| C18:1 | 34.4-45.5 |

| C18:2 | 36.9-47.9 |

| C18:3 | 0.2-1.0 |

| C20:0 | 0.3-0.7 |

| C20:1 | ND-0.3 |

| C20:2 | ND |

| C22:0 | ND-1.1 |

| C22:1 | ND |

| C22:2 | ND |

| C24:0 | ND-0.3 |

| C24:1 | ND |

ND = not detected (£ 0.05%)

Source: Codex Alimentarius Standard for Named Vegetable Oils (CXS 210-1999).

The Baudouin test should be positive for sesame seed oil (negative for the highly refined sesame seed oil used in pharmaceuticals).

Unlike many vegetable oils used in the cosmetics industry, sesame oil has its own six-digit HS commodity code: 151550. See table 2 for the eight-digit classifications for sesame oil fractions. (This substance is listed in the HS classification as ‘sesame oil’, but in the cosmetics industry is generally known as ‘sesame seed oil’).

Table 2: HS classifications for sesame oil

| HS Code | Notes |

| 151550 | Overall total for all classifications. Sesame oil and its fractions, whether or not refined, but not chemically modified |

| 151550 11 | Crude oil for technical or industrial use |

| 151550 19 | Crude oil for human consumption |

| 151550 91 | Refined oil for technical or industrial use |

| 151550 99 | Refined oil for human consumption |

| Total | Total of the classifications |

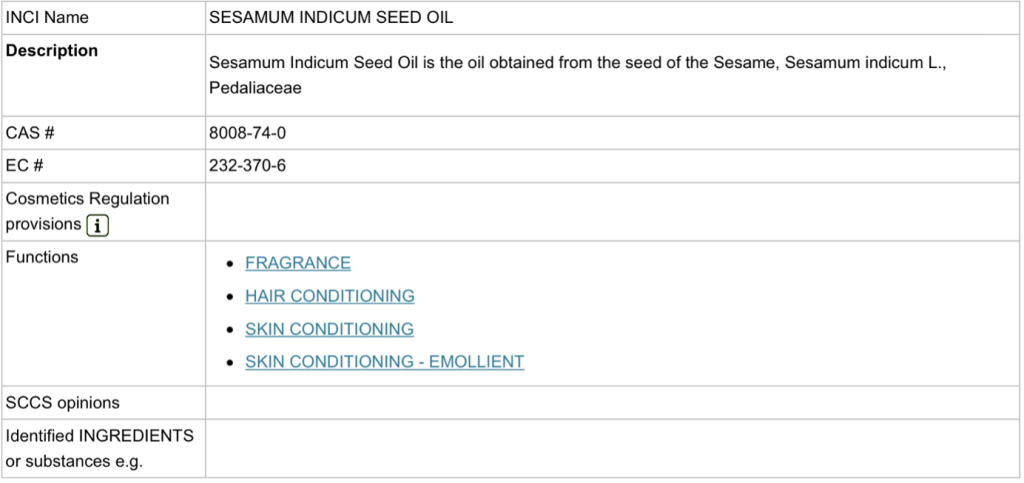

Ingredients used in European cosmetics are often referred to by their INCI name. INCI stands for the International Nomenclature for Cosmetic Ingredients, a system managed by the Personal Care Products Council (PCPC). CosIng, the European Commission’s database for information on cosmetic substances and ingredients, is derived from INCI; its website is the best place to look up cosmetic ingredients by their INCI names. See figures 1 to 3 for examples of CosIng entries. For more information, read the CBI workbook for preparing a technical dossier for cosmetic ingredients.

In the cosmetics industry, sesame oil is referred to by its INCI name: SESAMUM INDICUM SEED OIL. This name is also used on the labels of finished cosmetic products containing sesame seed oil. In the CosIng database are 38 other INCI names for cosmetic ingredients that contain, or are derived from, sesame (including sesame seed). Other INCI names used in cosmetics include:

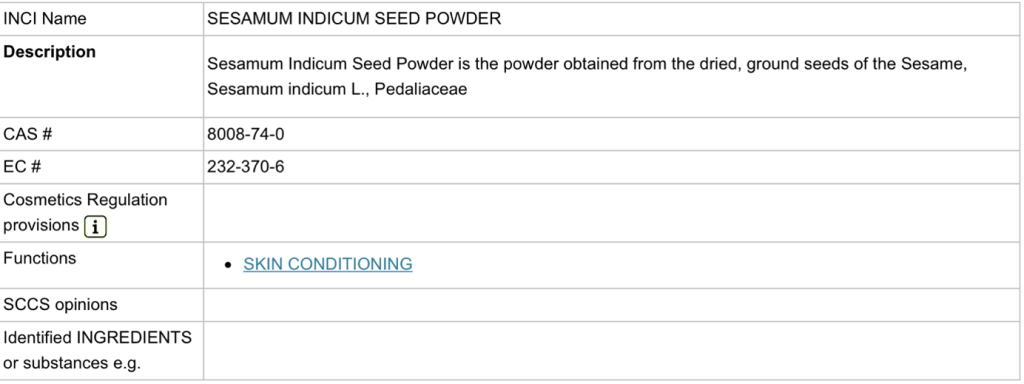

SESAMUM INDICUM SEED POWDER – used to condition the skin by exfoliation

HYDROGENATED SESAME SEED OIL – hydrogenation of sesame oil, to make it solid or spreadable

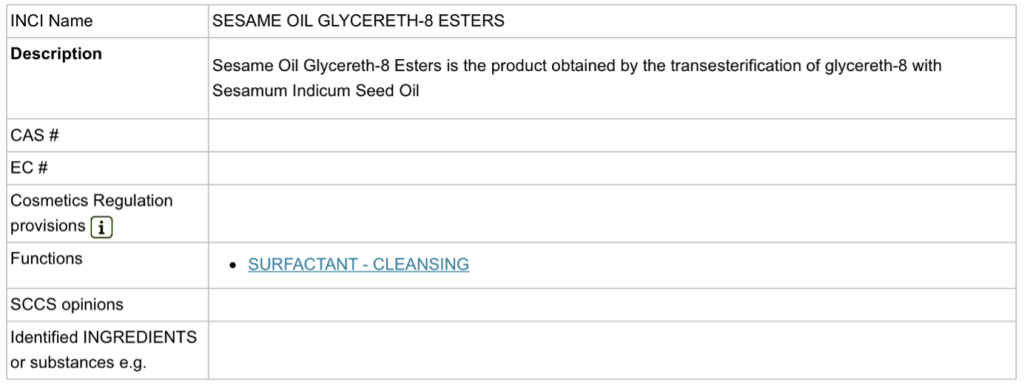

SESAME OIL GLYCERETH-8 ESTERS – a mild soap ingredient made from sesame oil

Sesame seed oil can be used in all categories of cosmetic products except perfumes, which usually do not contain vegetable oils. In particular, it is found in a wide range of skin-care and hair-care products. And in aromatherapy it is used as a massage oil and as a carrier for essential oils.

Sesame seed oil in cosmetics – summary of benefits:

- Rich in vitamin E (tocopherol), reported to have firming and anti-inflammatory properties for the skin.

- Rich in fatty acids and lecithin – a highly moisturising and protective mixture for the skin and hair.

- May give slight UV (sun) protection when used in appropriate amounts.

- Contains sesamol, a natural preservative that helps the oil remain stable and highly resistant to oxidation, allowing product blends to last longer.

Figure 1: CosIng entry for sesame seed oil

Source: CosIng

Figure 2: CosIng entry for sesame seed powder

Source: CosIng

Figure 3: CosIng entry for sesame oil glycereth-8 esters

Source: CosIng

Tips:

- Study how cosmetic brands promote sesame seed oil in their products. Use these descriptions in your own promotional material.

- Study the technical data for sesame seed oil, especially its fatty acid composition and non-saponifiable content. Make sure that you can present your own technical data, based on analysis of your own batches of sesame seed oil.

2. What makes Europe an interesting market for sesame seed oil?

Exports of sesame seed oil to Europe from non-EU countries have increased over the past five years (see figure 4). In 2021 they were valued at €50.73 million. Most of this oil is destined for the food market. But sesame seed oil is used in a wide range of cosmetic products. The fact that it can be sold to both the cosmetics industry and the food industry increases the commercial prospects for businesses supplying it.

Source: ITC Trade Map

The most important import markets for sesame seed oil in Europe are the UK, the Netherlands, France, Germany, Belgium and Switzerland. See figure 5.

Source: ITC Trade Map

Source: ITC Trade Map

The biggest non-EU sources of sesame seed oil in Europe are Mexico, China, Singapore, India and Japan. These five countries represented 76% of all imports in 2021 (see figure 6). Mexico is the largest supplier by far, accounting for 38% of the total (worth €19.223 million).

In Africa, the most important suppliers in the past five years have been Burkina Faso, Uganda, Sudan, Kenya and Somalia. As reported below, however, many other countries in Africa have the potential either to start supplying sesame seed oil or to export more of it to Europe, and so diversify their markets.

Looking at the production data, at the global level Asia is the largest producer of sesame seed oil. Yet most of the world’s sesame seed is produced in Africa.

Combining data from ITC Trade Map and FAOSTAT (2019), table 3 shows those countries in Africa which export sesame seed oil to Europe or to other parts of the world.

Of these eleven countries, only four (Burkina Faso, Kenya, Somalia and Sudan) export to Europe. Another seven (Nigeria, Uganda, Egypt, Ethiopia, South Africa, Togo and Tunisia) have exported elsewhere, but not to Europe. So they have the potential to do so.

(Note that some countries are reported as exporting sesame seed oil by ITC Trade Map even though, according to the FAOSTAT data, they do not produce it. Also, the data in the table is from 2019 in order to align information from the two sources more precisely.)

Table 3: African exporters of sesame seed oil

| Country | Item | Year | Tonnes | Oil exports to Europe | Oil exports to rest of world |

| Ethiopia | Sesame seed | 2019 | 262,654 | NO | YES |

| Nigeria | Oil, sesame | 2019 | 45,690 | NO | YES |

| Egypt | Sesame seed | 2019 | 36,150 | NO | YES |

| Uganda | Oil, sesame | 2019 | 33,200 | NO | YES |

| Sudan | Oil, sesame | 2019 | 23,600 | YES | YES |

| Kenya | Sesame seed | 2019 | 11,637 | YES | YES |

| Togo | Sesame seed | 2019 | 1,838 | NO | YES |

| South Africa | Oil, sesame | 2019 | 697 | NO | YES |

| Burkina Faso | Oil, sesame | 2019 | 660 | YES | YES |

| Tunisia | Oil, sesame | 2019 | 267 | NO | YES |

| Somalia | Oil, sesame | 2019 | 260 | YES | YES |

Source: ITC Trade Map and FAOSTAT

Further analysis reveals that seven countries in Africa produce sesame seed oil but do not export it at all. They are the Central African Republic, Chad, Eritrea, Mali, Mozambique, South Sudan and the United Republic of Tanzania. See table 4.

Table 4: African countries that produce sesame seed oil but do not export it

| Country | Item | Year | Tonnes | Oil exports to Europe | Oil exports to rest of world |

| United Republic of Tanzania | Oil, sesame | 2019 | 34,164 | NO | NO |

| South Sudan | Oil, sesame | 2019 | 28,200 | NO | NO |

| Chad | Oil, sesame | 2019 | 9,067 | NO | NO |

| Central African Republic | Oil, sesame | 2019 | 1,873 | NO | NO |

| Mozambique | Oil, sesame | 2019 | 1,166 | NO | NO |

| Eritrea | Oil, sesame | 2019 | 630 | NO | NO |

| Mali | Oil, sesame | 2019 | 430 | NO | NO |

Source: FAOSTAT

Finally, 14 countries produce sesame seed but not its oil. See table 5.

Table 5: African countries that produce sesame seed but not sesame seed oil

| Country | Item | Year | Tonnes | Oil exports to Europe | Oil exports to rest of world |

| Niger | Sesame seed | 2019 | 97,699 | NO | NO |

| Cameroon | Sesame seed | 2019 | 70,000 | NO | NO |

| Mali | Sesame seed | 2019 | 51,148 | NO | NO |

| Senegal | Sesame seed | 2019 | 24,304 | NO | NO |

| Benin | Sesame seed | 2019 | 10,000 | NO | NO |

| Democratic Republic of the Congo | Sesame seed | 2019 | 4,633 | NO | NO |

| Sierra Leone | Sesame seed | 2019 | 3,347 | NO | NO |

| Angola | Sesame seed | 2019 | 3,141 | NO | NO |

| Cote d’Ivoire | Sesame seed | 2019 | 3,132 | NO | NO |

| Malawi | Sesame seed | 2019 | 3,017 | NO | NO |

| Guinea | Sesame seed | 2019 | 2,262 | NO | NO |

| Gambia | Sesame seed | 2019 | 927 | NO | NO |

| Morocco | Sesame seed | 2019 | 798 | NO | NO |

| Congo | Sesame seed | 2019 | 270 | NO | NO |

Source: FAOSTAT

Most sesame seed oil is used in the food industry. But the trend to use more natural ingredients in cosmetics means that there is likely to be growing demand from cosmetics companies as well. After all, sesame seed oil has unique skin-care properties and a wide range of applications in this sector.

Although the bulk of sesame seed oil is processed in Asia, Africa is the world’s largest producer of sesame seed. The example of Burkina Faso, as the fifth most important exporter of the oil to Europe, shows that it is possible for ‘least developed countries’ to meet European industry requirements in partnership with European companies.

Tips:

- If your country has sesame seed oil but is not exporting it, consider selling to the European market.

- Check that your quality, pricing and volumes meet the expectations of European buyers.

- Consider how to promote your business to respond to the trends in the industry. See the ‘Trends’ section below for more information.

3. Which European countries offer most opportunities for sesame seed oil?

According to recent statistics, Europe’s six largest importers of sesame seed oil are the UK, the Netherlands, France, Germany, Belgium and Switzerland (see figure 7). Together, they represent about 80% of the market for non-European suppliers. In 2021, all except the UK increased their imports. From the available data, however, it is not possible to determine how much of this oil was imported for the cosmetics industry (not least because food-grade oil can also be used in cosmetics).

Source: ITC Trade Map

United Kingdom – the largest importer

The United Kingdom is the largest importer of sesame seed oil in Europe, accounting for 21% of the region’s total imports in 2021. But in that same year their value fell by 16%, from €21.277 million to €17.790 million. This decline may have been due to Brexit (the UK’s departure from the European Union). UK exports to other European countries have shrunk, too, by 30%: from €4.220 million in 2020 to €2.951 million in 2021.

As figure 8 shows, the UK’s biggest supplier by import value is Mexico (€6.599 million in 2021, 22% of the UK import market), followed by China (€1.886 million, 16%) and India (€1.375 million, 11%) In volume terms, Mexico delivered 2,016 tonnes of oil at an average import price of €3,273 per tonne, China 385 tonnes (€4,898 per tonne) and India 438 tonnes (€3,139 per tonne). Most of this oil was destined for the food industry, but cosmetics also took a share.

Overall, non-EU counties account for 78% of UK imports of sesame seed oil by value and 86% by volume.

Source: ITC Trade Map

Only 3% (149 tonnes) of the oil imported by the UK in 2021came from Africa. So there is huge potential for African countries to increase their market share. The most promising approach for them would seem to be a market penetration strategy with a focus on organic-certified sesame seed oil (see ‘Trends’ below). The three leading African exporters to the UK in 2021 were Somalia (111 tonnes), Sudan (34 tonnes) and Egypt (4 tonnes).

UK companies that import sesame seed oil for cosmetics include AAK, Croda (Seatons), Naissance, Northstar and Lipids. More details can be found on the UK Trade Info website.

The Netherlands – the second-largest importer

The Netherlands is Europe’s number-two importer of sesame seed oil (see figure 7), accounting for 18% of the total. As an important distribution hub for the rest of the continent, much of this oil is then re-exported to other European countries. For example, the Netherlands was France’s biggest single supplier of sesame seed oil in 2021.

In that year imports by the Netherlands rose by 50%, from €10.097 million to €15.141 million. This may have been due to European customers switching from British to Dutch suppliers. As noted above, in 2021 the UK saw a 30% drop in its exports to Europe.

By import value, the Netherlands’ main sources of sesame seed oil are Mexico (€5.543 million, 37% of the import market), Singapore (€1.910 million, 13%) and Germany (€1.831 million, 12%); see figure 9. By volume, the figures are 1,544 tonnes from Mexico (giving an average import price of €3,590 per tonne), 334 tonnes from Singapore (€5,718 per tonne) and 336 tonnes from Germany (€5,449 per tonne).

Source: ITC Trade Map

Non-EU countries account for 75% of total imports of sesame seed oil to the Netherlands by value and 80% by volume.

Oil from Africa represented a mere 1% (37 tonnes) of all Dutch imports in 2021. The three largest African suppliers were Egypt (15 tonnes), Cote d’Ivoire (13 tonnes) and Ghana (6 tonnes). As with the UK, this clearly represents an opportunity for African suppliers to increase their market share through a penetration strategy.

Dutch importer-distributors of sesame seed oil for cosmetics include Jan Dekker (IMCD), Spack and Dipasa. As a Mexican company with offices in the Netherlands (and also the USA), Dipasa’s focus is its own suppliers in Mexico and so it is probably not of interest to you. Concentrate instead on other potential buyers.

France – the third-largest importer

France is the third-largest importer of sesame seed oil in Europe. By value, these increased by 12% in 2021, from €12.416 million to €13.957 million. For the past three years, the Netherlands has been France’s main source of this oil (see figure 10); in value terms, in 2021 the Dutch held an 18% share of the French import market. This again highlights the Netherlands’ role as a major distribution hub for the rest of Europe.

Source: ITC Trade Map

By value, the second largest exporter of sesame seed oil to France is Mexico. In volume terms, however, Mexico comes first. It delivered 738 tonnes of oil to France in 2021, with a total value of €2.501 million. By comparison, the Netherlands supplied 581 tonnes worth €2.548 million. This puts the average import value of sesame seed oil from Mexico at €3,389 per tonne. The figure for the Netherlands is €4,385 per tonne.

After Mexico (37%), France’s main sources by share of import value are Singapore (13%) and Germany (12%).

Non-EU countries account for 68% of imports to France by value and 73% by volume. This difference indicates that the average price paid for oil from outside the EU is less than the average paid to all suppliers.

France imports 13% of all its sesame seed oil from Africa (404 tonnes in 2021). Its three leading sources there are Burkina Faso (374 tonnes), Kenya (20 tonnes) and Uganda (4 tonnes).

Burkina Faso is a major non-EU exporter to France. Supplies from there represented 10% of all French sesame seed oil imports in 2021. This was significantly more than in 2018, although there was actually a drop between 2020 and 2021. The average import price per tonne for oil purchased from Burkina Faso was €3,409 in 2021. That compares with €4,256 per tonne for all imports from non-EU countries and €4,524 for imports from all sources.

French importer-distributors of sesame seed oil for use in cosmetics include Aldivia, Diffusions Aromatiques, Huiles Bertin, Olvea and Sophim. These companies offer a range of grades, including organic and fair trade oils.

French partnership with producers in Burkina Faso

Olvea has established a processing centre for sesame seed oil in Burkina Faso, alongside its shea butter plant. It seems highly likely that this is responsible for boosting Burkina Faso’s exports to France.

Olvea originally invested in the supply chain for shea butter from Burkina Faso. That has now been extended to the supply of sesame seed oil. One interesting aspect of this expansion is that the company has trained the women producers who supply it with shea nuts to harvest sesame seeds as well, so that they diversify their income and activities. This is an example of developing social responsibility along the supply chain, an aspect which is of growing importance to consumers in Europe. Of course, it is important that such activities be validated as much as possible – or at the very least that they are well documented. Customers are increasingly alert to the risks of ‘greenwashing’ (false or exaggerated environmental claims).

The certifications Olvea has obtained for its sesame seed oil are shown in the image opposite.

Figure 11: Olvea certifications for sesame seed oil

Source: Olvea

Germany – the fourth-largest importer

Germany has the largest cosmetics market in Europe, and is also a major manufacturer. Because of this, it has many suppliers of cosmetic ingredients. In the case of sesame seed oil, Germany is the fourth most important importer in Europe.

Source: ITC Trade Map

Germany imported 2,573 tonnes of sesame seed oil in 2021, with an import value of €10.85 million. Representing 13% of Europe’s total imports, this amount was 2% higher than in 2020. Volume decreased by 3% in the same period, however, indicating that the average import value had risen.

As with the UK, France and the Netherlands, the number-one exporter to Germany is Mexico. It accounts for 28% of German imports by import value. Next come three European countries: the Netherlands (19%), France (11%) and the UK (5%).

Germany imports represent 3% of its sesame seed oil from Africa (81 tonnes in 2021), most of it from Uganda (62 tonnes), Burkina Faso (6 tonnes) and Kenya (5 tonnes). As with other European markets, there are opportunities here for African countries to increase their share of Germany’s imports – especially bearing in mind that Africa is a major producer of sesame seed and its oil.

Major German companies that import this oil for cosmetics include Gustav Hees and Henry Lamotte.

Belgium – the fifth-largest importer

Belgium is the fifth-largest importer of sesame seed oil in Europe: 1,019 tonnes in 2021, with an import value of €6.185 million. This represents 7% of the all imports to the European region.

The top-3 exporters to Belgium by value are France (49%), Germany (24%) and Mexico (16%); see figure 13.

Source: ITC Trade Map

Non-EU countries delivered 367 tonnes of sesame seed oil to Belgium in 2021, worth €1.312 million: 33% of its imports by volume and 21% by value. The three leading suppliers in this category were Mexico (€999,000), India (€154,000) and Kenya (€54,000).

Imports from Africa totalled 17 tonnes, representing 1.5% of the overall Belgian market. The bulk of this came from Kenya (16 tonnes), most of the rest from Somalia (1 tonne).

It is thus more common for Belgian importers to buy their sesame seed oil from companies elsewhere in Europe than directly from sources outside the EU.

Companies in Belgium that import sesame seed oil for cosmetics include Fairoils, Kreglinger and Mosselman.

Fairoils, whose head office is in Kenya, purchases sesame seed oil from Uganda and Kenya.

Switzerland – the sixth-largest importer

Switzerland is the sixth-largest importer of sesame seed oil in Europe. Its total imports in 2021 were 722 tonnes, worth €4.393 million – 5% of the total for the European region.

The top-3 exporters to Switzerland are Germany (53%), China (19%) and Chinese Taipei (Taiwan; 7%); see figure 14.

Source: ITC Trade Map

Imports from Africa represent 0.7% (2 tonnes in 2021) of the Swiss total. The leading African exporter to Switzerland in 2021 was Burkina Faso.

Swiss companies that distribute sesame seed oil for cosmetics include Covalo. In addition, many of the multinational distributors have offices in Switzerland.

Tips:

- Focus on a market penetration strategy to increase your market share in European countries.

- Make sure you can supply consistently high-quality oil from high-quality seed.

- Prepare the necessary technical documents to prove the quality of your products.

- Check that your prices are competitive.

- Make sure you can demonstrate traceability and sustainability.

- Check out how your competitors promote their sesame seed oil.

4. Which trends offer opportunities on the European sesame seed oil market?

The most important current trend in the cosmetic industry is the use of more natural ingredients in cosmetics, coupled with a focus on wellness. Where possible, manufacturers are looking to increase the natural and certified organic ingredient content of their products. And to develop products that suggest health and wellness. The unique characteristics of sesame seed oil as a cosmetic ingredient suit this trend perfectly, especially in combination with sustainable and ethical sourcing. So demand is set to keep on increasing.

Natural ingredients

The 2022 Kantar Global Report on The Evolving Beauty Consumer reaches the following conclusion.

“Consumers are becoming more conscious of what goes into the products they buy. The perception of beauty has become more holistic and health-driven, with a focus on internal wellness and environmental harmony at the core of many consumers’ decision-making process.”

The importance of including natural ingredients in cosmetics has been growing consistently around the globe, especially in Europe. France, Germany, Spain and the United Kingdom (UK) are the four biggest European markets for cosmetics. In all of these countries, the percentage of users who say that they buy a particular face or body product because it contains natural or naturally produced ingredients has increased in the past five years.

Sesame seed oil is a natural ingredient and so fits this trend perfectly

Sustainability

Sustainability is another must for cosmetic ingredients today. Buyers expect their suppliers to be able to demonstrate that they are working sustainably. However, sustainability is a broad term. So what exactly is required, and how do you decide where to invest your resources in order to be sustainable?

When searching the internet for new customers, you will see that nearly every potential buyer has a section on sustainability. As a rule, this describes its strategy and activities to be sustainable. Furthermore, the best companies have a baseline and measure their progress. You need to do the same.

There are now plenty of resources available on how to go about developing, implementing, measuring and communicating what you are doing when it comes to sustainability. Our aim here is not to tell you what to do, nor even to define what sustainability means. Rather, we highlight some low-cost approaches that can put you on the right track.

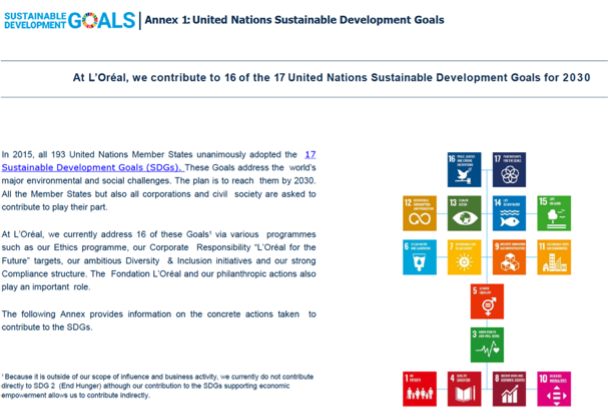

One good place to start is the United Nations. It has identified 17 Sustainable Development Goals (SDGs). These address the global challenges of poverty, inequality, climate change, environmental degradation, peace and justice. More and more companies are referring to the SDGs in their own policies and communications.

For example, L’Oréal – the world’s largest cosmetics company – states on its website that it contributes to 16 of the 17 UN sustainable development goals.

Figure 15: L’Oreal and the Sustainable Development Goals

Source: L’Oréal.

Fairoils is aKenyan company with a sales and distribution office in Belgium. It supplies a huge range of high-quality essential and vegetable oils. They include sesame seed oil. Fairoils partners with thousands of small-scale farmers in Africa, ensuring that they receive a fair, reliable and transparent price for their crops. It has built an integrated supply chain, managing a complete production process that begins at the farm. Fairoils embeds quality and ethical standards every step of the way, and works to create stronger communities in Africa.

Fairoils’ sesame seed oil project is a real success story. Working with low-income subsistence farmers in Ochero county, northern Uganda, the company and its local partner provide field officers and extension staff while coordinating the collection of the crop. In addition, it is involved in the installation of community wells throughout the project area to ensure a more reliable clean drinking water supply, as well as the purchase of oxen to make the ploughing of individual members’ fields easier.

Once the sesame seed has been collected from farmers in Ochero, it is driven across the Kenyan border to Fairoils’ processing facility in Athi River. Fairoils procures crop seed at the farm gate and prefinances the purchase of production seed to give farmers a secure market and fair price.

Always looking for ways to do things better, Fairoils regularly adopts new approaches to reduce waste and improve environmental sustainability. In this effort it works closely with farmers and communities to develop solutions to complex problems.

Fairoils strives continually to reach its own goals and currently meets 16 of the 17 UN Sustainable Development Goals. Its aim is to lift farmers out of poverty by creating a sustainable living income stream without damaging the planet. Fairoils is fair trade certified under the Fair for Life scheme.

Tips:

- Think about how you can be a more ethical and sustainable supplier, then develop a plan of action.

- Using tools like SEDEX and UN Global Compact, align your company with the SDGs.

- Search the internet to see how your customers and competitors communicate about sustainability.

- Make sure that your ethical and sustainable activities have a baseline (to give you a starting point and show the progress you are making), are measurable and are evidence-based.

Fair Venture Consulting carried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research