Entering the European market for shea butter

The European market has the world’s most robust and protective legal framework regarding regulation of cosmetic products. This legislation also contains certain minimum requirements for cosmetic ingredients. If you want to export your shea butter to Europe, you must consider the legal and additional buyer requirements regarding quality and packaging. Usually, the main entry channel is through European distributors. Given that the shea butter market is very competitive, meeting the basic requirements and demands of the market is not enough. You will need to focus on the basics plus your unique selling proposition to stand out from other companies targeting Europe.

Contents of this page

- What requirements and certifications must shea butter comply with to be allowed on the European market for cosmetics?

- Through what channels does a product end up on the end-market?

- What competition do you face on the European shea butter for cosmetics market?

- What are the prices for shea butter on the European market?

1. What requirements and certifications must shea butter comply with to be allowed on the European market for cosmetics?

You can only export shea butter to the European Union (EU) if you meet EU requirements. For a complete overview of these standards, refer to our study on buyer requirements for cosmetic ingredients for cosmetics or consult the specific requirements for your product in Access2Markets by the European Commission.

Buyer requirements can be divided into:

- Mandatory requirements: Legal and optional requirements you must meet to enter the market;

- Additional requirements: Those you need to meet to stay relevant in the market; and

- Niche requirements: Applying to specific niche markets.

Legal and optional requirements

Specific mandatory requirements for cosmetic ingredients are found within the cosmetics legislation for final products. European cosmetics legislation (Regulation (EC) 1223/2009) covers the safety of cosmetic products, aiming to protect human health and the proper function of the internal cosmetics market. In addition to the basic requirements for ingredients, this regulation contains annexes with more than 1,600 ingredients that are prohibited or restricted in cosmetic products sold in the EU. Restricted ingredients have specific conditions of use and warnings. They also have a maximum concentration that can be used in the product ready for use. Shea butter and other shea derivatives are not included in these annexes.

The European legal requirements demand manufacturers to prepare a Cosmetic Product Safety Report before placing a cosmetic product on the EU market. These documents require data on the composition, and other quality and safety parameters of the ingredients used. Thus, suppliers need to provide well-structured product documentation on the physical-chemical composition, including presence of impurities, microbiological quality, and toxicological profile. Required detailed documentation includes:

- Specification (check this example for shea butter);

- Certificates of Analysis (CoA);

- Safety Data Sheets (SDS);

- Genetically Modified Organism (GMO) certificate (if requested);

- Certificate of origin (if requested).

Registration, Evaluation and Authorisation of Chemicals (REACH)

Registration, Evaluation and Authorisation of Chemicals (REACH) (Regulation (EC) 1907/2006) was implemented to ensure a high level of protection of human health and the environment from chemicals manufactured and used in the European Union. Chemical substances that fall within the scope of REACH need to be registered with the European Chemicals Agency (ECHA) by the importer or manufacturer. Cosmetic ingredients (including natural ingredients) are chemical substances and need to follow registration processes unless they are exempt. Registration applies to importers and manufacturers of non-exempt substances who import or manufacture more than 1 tonne per year.

Pure shea butter and all other unmodified vegetable fats and oils are exempt from registration regardless of the quantities imported or manufactured. In contrast, shea derivatives such as shea butter oleyl esters and shea butter cetyl esters are chemically modified fats and must be registered by the EU manufacturer or importer unless volumes remain lower than 1 tonne per importer per year. There is a procedure where a non-European company can register their substances with ECHA. It is not mandatory, but more related to the commercial opportunity to sell a non-exempt substance with a registration number to downstream manufacturers.

Classification, Labelling and Packaging of chemicals (CLP)

The Classification, Labelling and Packaging of chemicals regulation (CLP) aims to ensure that the hazards presented by chemicals are clearly communicated to workers and consumers in the EU through classification and labelling of chemicals. The regulation requires European manufacturers and importers to classify, label and package hazardous chemicals appropriately in their substances and mixtures before placing them on the market. CLP is the European legislation derived from the UN Globally Harmonised System of Classification and Labelling of Chemicals (GHS). Most countries have established their own similar legislation based on GHS. Hazard labels and safety data sheets are used to communicate the presence of a hazard to the user. CLP sets detailed criteria for the labelling elements. You can also discuss this requirement with the freight forwarder or transport company, who will usually be happy to advise you.

Tips:

- See our study on buyer requirements for natural ingredients for cosmetics for more information on mandatory requirements and restrictions for certain substances used in cosmetics.

- See our workbook on Preparing a technical dossier for cosmetic ingredients for more information and tips on documentation requirements.

- Avoid adulteration (intentional addition of undeclared substances to a product). Strict controls are in place in most countries to detect potential adulterants. European buyers generally send samples to laboratories to analyse their purity. If there are undeclared substances in your product, it is very likely they will be detected. In case of detection, the product becomes useless for the buyer, you will not be paid, and you can lose your business and reputation.

- Work with a local university department or laboratory to determine the composition of your shea butter. You need to include this in your product documentation.

Additional requirements

In addition to mandatory requirements, buyers often have additional requirements related to quality, food safety, and sustainability. In general, European buyers increasingly demand transparency and traceability along the supply chain, which has consequences for you as a supplier. Regarding quality, note that the processing of nuts is very important, as it largely determines the quality of the butter.

Quality requirements

Most manufacturers expect shea butter for cosmetics to meet certain quality requirements, such as low level of impurities, low free fatty acids (FFA) and low peroxide value. The highest quality shea butters are usually associated with the lowest amount of free fatty acids and the lowest peroxide values. A high free fatty acid and peroxide value suggests that significant damage has occurred to the moisturizing fraction and therefore butter with these characteristics is considered to be of low quality.

The level of impurities accepted in natural ingredients and shea butter is determined by the legal limits for prohibited substances inadvertently present in cosmetic products. Regulation (EC) No 1223/2009 allows the non-intended presence of a small quantity of a prohibited substance that is technically unavoidable in good manufacturing practice, provided that the final cosmetic product is safe for human health.

The quality of shea butter mainly depends on the right processing of the nuts. Handcrafting, expelling, and cold pressing are all suitable processing methods. All processors need to ensure that the quality of the shea nuts and storage of the butter keeps the critical quality parameters to the required maximum levels. Normally, whatever method is used, shea butter will be refined and deodorised before use in cosmetics.

Most cosmetic manufacturers prefer colourless and odourless ingredients with a long shelf-life. Unrefined shea butter has a creamy, pale-yellowish, or ivory colour and may even have a green hue. Therefore, a lot of shea butter used in cosmetics is refined to remove the colour and odour. It may also go through a fractionation process to improve the melting and crystallisation properties.

Some general recommendations for shea production and processing include:

- Process fruits within a week. Remove the fruits from the nuts. Wash the nuts to remove traces of the fruit. Nuts need to be soaked in boiling water for 30-40 minutes and quickly sun-dried after that. De-husk them within 3-4 days and clean them of impurities. If you do not process them right away, store them in clean jute sacks to minimise contamination. Once the nuts have a moisture content of under 7.0%, place them in well-ventilated warehouses.

- Process shea nuts in a way that matches your buyers’ preferences and specifications. Shea butter can be hand-crafted or produced with mechanical processing.

Quality management standards

European buyers of shea butter for cosmetics often expect suppliers to follow Hazard Analysis & Critical Control Points (HACCP) principles in their processing facilities, to ensure product safety for cosmetic applications.

Good Manufacturing Practices (GMP) are not obligatory for cosmetic ingredient producers, but compliance can provide a competitive advantage. The European Federation for Cosmetic Ingredients has developed guidelines to help producers implement GMP in their companies. It also offers their own certification scheme. Following basic practices of GMP, as well as HACCP, will help you to deliver a good and reliable level of quality.

On top of that, some European buyers of cosmetic ingredients want suppliers to follow more complete safety standards. These are often the same standards used by the food industry. Examples of these (food) safety management systems include:

- ISO 22000, food safety management system certification;

- Food Safety System Certification (FSSC22000), based on ISO 22000 and aimed specifically at food manufacturers.

Sustainability

European buyers face increasing pressure by EU legislation to make sure their supply chains are sustainable and transparent. The most important emerging developments to be aware of are the European Green Deal and the corporate sustainability due diligence directive. Both proposals will indirectly affect you if you are doing business with European companies.

Partly because of these developments, 1 of the primary considerations for European buyers is the presence of a transparent supply chain that can be easily traced. Buyers want guarantees that the product they buy can be traced back to the source to ensure good social and environmental practices along the chain.

Suppliers should show good Corporate Social Responsibility practices such as developing a code of conduct and improving performance in key areas (for example, improving working conditions in supply chains and limiting damage to the environment). Have a look at social responsibility and sustainability platforms such as the Supplier Ethical Data Exchange (SEDEX). These platforms provide tools and guidance for suppliers and organisations to operate ethically and to source responsibly. They also facilitate the sharing of this information with potential customers. These are now becoming standard requirements and hence without them most buyers will not be interested in you.

Labelling requirements

Suppliers of shea butter need to include product documentation and labelling to meet legal and buyer requirements. Labelling must include:

- Product name / International Nomenclature Cosmetic Ingredient (INCI) name;

- Chemical Abstracts Service (CAS) number;

- Batch code or number;

- Place of origin;

- Name and address of exporter;

- Date of manufacture;

- Best before date;

- Net weight or content;

- Recommended storage conditions; and

- If you produce organic shea butter, include the name/code of the inspection body and certification number.

Label your products in English, unless your buyer wants you to use a different language.

Packaging requirements

Along with legal requirements on packaging of chemicals, European buyers have their own packaging requirements to preserve the quality of products. When exporting shea butter, suppliers should use containers made of a material that does not react with components of the butter (such as lacquered or lined steel, aluminium). You can also use polythene lined boxes.

Clean and dry the containers before loading the butter. The containers should be sealed airtight and be tamper-proof to prevent oxygen exchange and reduce butter decay over time.

Prepare bulk shea butter for transportation in 1 of the following manners:

- 10 or 25 kg plastic-lined cardboard cartons;

- 25 kg plastic buckets;

- 50 – 200 litre metal or plastic drums; or

- 900 kg IBC (Intermediate Bulk Container), flexitank or isotanks.

Other general recommendations regarding packaging are:

- Always ask your buyer for their specific packaging requirements;

- Re-use or recycle packaging materials, for example, use containers made of recyclable material;

- Store containers in a dry, cool place to prevent quality deterioration;

- Physically separate organic certified shea butter from shea butter that is not certified.

Figure 1: Examples of shea butter packaging

Source: Noble Shea Butter ; TradeBoss.com, 2023

Tips:

- Set up a registration system for individual batches of your shea butter, whether they are blends or not, and mark them accordingly to ensure traceability.

- See Codex Alimentarius for named vegetable oils for a good general information about quality standards for oils and butters.

- Make sure to follow good agricultural and collection practices to produce good quality shea butter. You should also apply good post-harvest and processing practices. See the Global Shea Alliance quality guidelines and ARSO’s Africa regional codes of practice for shea kernel and shea butter for more information on harvesting and handling shea nuts. Be aware that you must be a member to access some information.

- Keep facilities and equipment clean to prevent contamination with foreign materials and produce your shea butter with a minimum of impurities.

- You can refine the butter yourself if you have the facilities or work with a (European) refiner.

Requirements for niche markets

Consumer concerns about environmental and social issues are stimulating international buyers, particularly European buyers to become stricter in their requirements for the sustainability of production. Many buyers are increasingly looking for ingredients with voluntary standards and certifications, especially in niche markets where certification of sustainable practices is a buyer’s requirement. Buyers also want to know the ethical story (community support, biodiversity preservation) of an ingredient so that they can tell their customers.

The following table presents some cosmetic ingredient standards required or valued by buyers, according to the niche market they belong to.

Table 1: Standards and certifications for cosmetic ingredients in niche markets

|

Niche market |

Standards |

Description |

|

Natural cosmetics |

Natural cosmetics is the largest and most important niche market. The definition of natural and organic cosmetics is based on private sector standards, namely NaTrue and Cosmos. Both standards apply only to final cosmetic products. However, they still have consequences for natural ingredients used in final products. Natural ingredients and raw materials can be Cosmos certified if they comply with an organic content, while non-organic ingredients can apply for Cosmos approval. The same applies to the NaTrue standard, according to which a raw material can be NaTrue-certified or approved, depending on whether it comes from organic agriculture or not. Manufacturers of natural cosmetics prefer shea butter that has not been treated with chemical solvents. However, where necessary, both standards require that solvents used to purify shea must be natural or naturally derived substances. Extraction with the following agents is permitted: carbon dioxide, ethanol of plant origin, fats/oils of plant origin, glycerine of plant origin, Natural Deep Eutectic Solvent, and water. As such, hexane extraction of shea butter would not be allowed for natural cosmetics. |

|

|

Organic cosmetics |

|

Organic is another important niche market, closely related to the natural cosmetics one. To market shea butter in Europe as an organic ingredient, you need to implement organic farming techniques and have your facilities audited by an accredited certifier. Requirements on organic production and labelling are specified in the EU Regulation 848/2018. These should be referred to in addition to the organic cosmetic standard. Currently, many buyers in the European natural cosmetic market value or even demand an organic certificate for shea butter. This supports their marketing story and their claims that their product is natural, while strengthening their image as a responsible company. It also gives third-party-certified traceability, which is increasingly important. In addition to NaTrue and Cosmos, other relevant standards to the organic cosmetics market are Soil Association Organic, BDIH and ICEA certifications. BDIH requires raw materials of plant origin to be organic-certified, while ICEA demands ingredients of natural origin from certified organic agriculture. You can also use the ISO 16128 standard part I and part II as an alternative minimum self-certifiable standard for natural and organic cosmetic ingredients and products. This is especially interesting for smaller producers, if certification according to a private standard is too expensive or not required, and is growing in popularity. |

|

Fair production |

|

Certified fair-trade production is a small niche market in terms of cosmetic ingredients. It covers important issues like human and workers’ rights, community well-being, biodiversity conservation and local development. European cosmetics manufacturers are becoming increasingly interested in transparent and sustainable supply chains. The most common certificate is Ecocert’s Fair for Life. This standard is the fair trade scheme with most participants from the shea industry. Fairtrade is another well recognised standard in this niche market. There is a product-specific standard for oilseeds and oleaginous fruit where shea nuts and shea butter are included. Products carrying the Fairtrade label indicate that producers are paid a Fairtrade Minimum Price. The Fairtrade minimum price of shea butter ranges between €2,440-€3,000 per tonne. |

Source: ProFound, 2023

Tips:

- Read our study on the offer in social certifications to learn more about the European market with regard to social certification standards.

- Read the CBI study about the European Green Deal to learn more about this legislation and its impact on exporters and suppliers.

- Consult the databases of COSMOS and NATRUE to learn more about the products, ingredients and companies that have been certified or approved.

- Find out if there is a market for your products before you certify them. Although buyers value an organic certificate for the ingredients, applying for organic certification is not interesting for every producer. Only small and medium-sized enterprises (SMEs) in developing countries who can deal with certification, conversion and administrative costs should get certified. This applies mostly to producers supplying considerable volumes, those able to share costs with cooperative members/organic buyers, or those who produce organic already by default.

Source: Cosmetic, Toiletry & Perfumery Association (CTPA), 2022

Shea butter is mainly found in the skincare cosmetics segment. Skincare is the largest segment in the European cosmetics market. It dominates almost 30% of the market and showed positive growth (6.4%) between 2021 and 2022. This segment recorded the third highest growth. Shea butter is commonly used in skin products due to shea’s skin conditioning properties. Shea butter is marketed as moisturizing and with the ability to soften the skin in several products, including face creams, body lotions and lip balms.

Other important segments are hair care products and toiletries. These segments dominate respectively 18% and 24% of Europe’s cosmetics market. Between 2021 and 2022, the hair care segment grew 4.9% while the toiletries segment grew 3.4%. Some cosmetics manufacturers already use shea butter in shampoos and conditioners. Shea butter is also used traditionally in soaps.

Moreover, the butter is also sold to consumers directly through do-it-yourself (DIY) packs containing shea butter and other cosmetic ingredients. These packs enable consumers and small cosmetics manufacturers to make their own shea butter-based cosmetics. Some of the main online shops selling DIY packs containing shea butter in Europe are: The Soap Kitchen (United Kingdom) and DIY Soap (Netherlands).

Tips:

- To find potential buyers in each segment, study trade fair catalogues (for example, in-cosmetics), as well as websites that specialise in promoting ingredients (for example, SpecialChem).

- Familiarise yourself with the beneficial properties that shea butter offers the cosmetics industry, such as its emollient properties. Shea butter’s emollient properties are among its major selling points for the European cosmetics market.

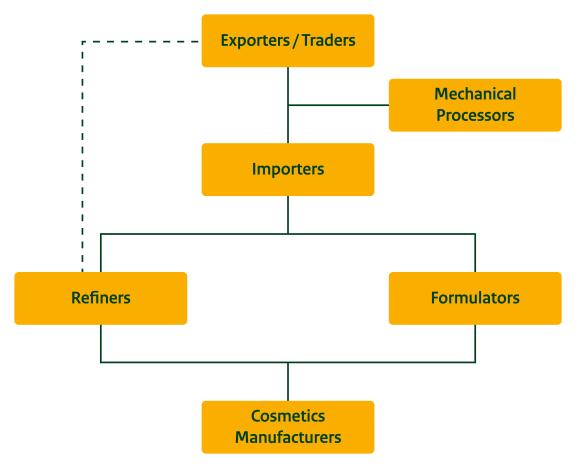

2. Through what channels does a product end up on the end-market?

More than half of all global shea export is processed in West Africa and exported as shea butter or derivatives. The remainder is exported as nuts. Note that the transport of kernels is relatively expensive compared to the transport of butter. That is why international extraction facilities need large volumes of thousands of tonnes of shea kernels to make the import cost efficient. Those companies importing kernels usually have very strong relationships with existing suppliers and limited interest in new suppliers.

This factsheet focuses on the export of shea butter. The shea kernels are often mechanically processed into butter in countries of origin by mechanical processors. Trade in shea butter in Europe is relatively concentrated with a few players responsible for the import of large amounts for the food and cosmetics sectors. Currently, importers account for a large part of the trade in shea butter.

Figure 3: Main European distribution channels for shea butter

Source: ProFound, 2023

Importers

Importers are the main entry point for shea butter into the European market. They usually source their shea butter directly from exporters, which they then supply to European refiners, or sometimes directly to cosmetics manufacturers. Importers typically deal with various ingredients and focus on building strong relationships with suppliers to ensure a steady supply of raw materials.

Importers handle all necessary documentation, including specifications and certifications. However, the supplier still has to provide these documents. Importers also conduct quality checks to ensure the imported ingredients meet standards and regulations. Each batch is usually tested. It is recommended that exporters also carry out their own checks before exporting.

An example of a large-scale importer of shea butter is the multinational Cargill. An example of a more specialised importer handling a wide variety of ingredients for the natural cosmetic ingredients market is All Organic Treasures (AOT, Germany). They have been sourcing from and supporting female shea butter producers in Burkina Faso since 2012. Other examples include the French specialty cosmetic ingredient importer Aldivia, which sources shea butter from Burkina Faso and Mali, and the UK-based ingredients supplier Kerfoot, which sources shea butter from Ghana.

There are also importers for which shea butter is their core ingredient. Examples of these include:

- SheaTree – East African shea butter importer and distributor of natural cosmetics in Czech Republic. The company already sources shea butter from the factory Guru Nanak Oil Mills in Uganda but is interested in buying from more suppliers. SheaTree is organic certified and has a fair-trade certification in progress.

- Butter Wise – Dutch importer of West African natural and traceable ingredients. Butter Wise trades conventional, refined, and organic Fair for Life-certified shea butter from Northern Ghana. This company is the preferred distributor of The Savannah Fruits Company, a Ghanaian company producing shea butter among other products. Butter Wise also trades other organic products such as African black soap, baobab oil, cocoa butter, and coconut oil.

Refiners

For use in cosmetics, shea butter needs to be refined to remove odour and colour. This is commonly done in Europe. Refining also improves the shelf life and stability of the cosmetic product it is used in. It is very rare for smaller exporters to supply European refiners directly. The main reason for this is that small exporters usually cannot provide sufficient volumes, while their delivery times and prices are too high. Refiners are only interested in the supply of full container loads (20 tonnes).

Examples of refiners on the European market are AAK, ZOR, Special Refining Company and Natura-Tec.

Formulators

Formulators are companies or laboratories who create and develop cosmetic products by following existing formulas to mix ingredients. Formulators usually use tolling services of refiners to refine shea butter and then supply the refined shea butter to cosmetics manufacturers. Examples of formulators on the European market are Alban Muller and MS Lab.

Cosmetics manufacturers

It is very rare for small exporters from developing countries to supply cosmetics manufacturers directly. Most cosmetics manufacturers are not interested in importing unrefined shea butter and then using toll refining services to refine shea butter on their behalf. This is mainly the case because of the complications of getting the shea butter refined, the minimum quantities needed, and efficiencies of scale.

Cosmetic manufacturers demand shea butter that is refined, bleached, and deodorised in most cases, which they will import from European refiners or importers. Be aware that if you want to supply shea butter directly to a manufacturer, they will have higher expectations for quality since there is no intermediary processing stage.

Although it is rare for cosmetics manufacturers to import directly, several brands do prefer to identify their own source/origin of shea butter. They typically make arrangements with distributors/importers to source the raw material, so manufacturers can use it in their products without having to deal with imports.

Examples of cosmetics manufacturers using shea butter are Maison Karite Sociedad (Spain), Naturally Tribal Skincare (UK) and Bioturm (Germany).

What is the most interesting channel for you?

European importers and distributors are your most important entry point into the market. In Europe, most of the cosmetics manufacturers source their raw materials from refiners, wholesalers of cosmetic ingredients and formulators. Distributors supply the butter to refiners or processors, or directly to cosmetics manufacturers for certain products. Currently, distributors account for a large part of the trade in shea butter.

Tips:

- Consider linking up with other producers if you cannot export sufficient quantity and quality of shea butter yourself.

- Target European ingredient importers or refiners that specialise in small, speciality oils if you can produce shea butter with a unique selling point. If you supply certified shea butter, check the websites of buyers to find out if they work with certified ingredients. Buyers that do not are unlikely to pay a premium for certification.

- See the industry overview of the Global Shea Alliance for more information on shea butter’s value chain.

- Visit and participate in trade fairs to test market receptivity, get market information, and find potential business partners. The most relevant trade fairs in Europe are in-cosmetics (travelling trade fair), Beyond Beauty (Paris, France) and SANA (Bologna, Italy). For organic producers, Vivaness is an interesting trade fair (Nuremberg, Germany).

- See our studies on finding buyers for natural ingredients for cosmetics to access more information.

3. What competition do you face on the European shea butter for cosmetics market?

The shea butter market is very competitive, and market entry barriers for shea butter are low. The 3 main factors that determine a buyer’s decision to buy 1 product are price, quality, and reliability. Different grades of shea butter will have different prices. Whatever grade you are supplying make sure that you can do it for a profit after accounting for all the costs. Quality and reliability are also key considerations. Quality is now a much broader term and includes sustainability and responsibility in the supply chain as well as classic quality parameters. With so many competitors, and easy switching costs, make sure your price, quality and reliability are always optimal.

Which countries are you competing with?

In 2022, global exports of shea nuts and shea derivatives from producing countries grew to USD 75 million, corresponding to a 1.4% increase from the previous year. Although exact regional and national data are not available, estimates suggest that most shea nuts and derivatives on the international market originate in West Africa. Collection of shea nuts in West Africa is estimated at 800,000 tonnes. A large share of this is consumed locally and does not enter international markets. The remainder is exported as shea nuts, butter, and fractions (stearin).

Data on vegetable oil exports largely reflect shea butter exports and provide a rough understanding of their behaviour. In general, West African countries dominate vegetable oil exports to Europe. It is therefore assumed that they also dominate shea butter exports to this market.

Source: ITC Trade Map, 2023

Ghana

Ghana is among the world’s largest producers of shea with a yearly average production of between 60,000 tonnes and 94,000 tonnes of shea nuts. This country also hosts most of Africa’s shea processing facilities. Ghana is an important regional trading point and some countries such as Nigeria, Mali, and Burkina Faso transport their produce through Ghana.

Since 2010, Ghana has had by far the largest share of shea exports. Based on ITC Trade Map data, Ghana was the major exporter of vegetable fats/oils (HS code 151590) to Europe with exports amounting to €64 million in 2022. In 2020, Ghana dominated the market with about 50% of shea kernel exports from Africa and over 150 thousand tonnes exported to the world.

Ghana’s shea industry is currently benefiting from the Kolo Nafaso programme of AAK, the world’s leading supplier of value-added vegetable oils and fats. This programme is supporting women to gain a fair price with no intermediaries. This is a good example of what manufacturers are looking for.

Burkina Faso

Burkina Faso is another major producer of shea. Shea has an important socio-cultural role in Burkina Faso and is relevant in the national economy because it is among the main export products after cotton and livestock products. For several years, shea trade from Burkina Faso was a monopoly ruled by the Government’s Caisse de Stabilisation department. Only until 1991, the Government disengaged from production, processing and marketing, and shea trade is increasingly liberalised.

Today, Burkina Faso is Africa’s second-largest exporter of vegetable fats and oils including shea butter. In 2022, exports of vegetable oils to Europe amounted to €16.5 million and 10 thousand tonnes, registering a yearly average growth rate of 8.6% in volume and 7.7% in value since 2018.

An example of a shea butter producer in Burkina Faso is Olvea Burkina Faso, which belongs to the French Olvea group. The company's production site is 1 of the first green plants in the country. All logistical and production stages have been designed to reduce the carbon footprint and achieve optimal energy self-sufficiency.

Olvea Burkina Faso buys shea nuts from women collectors and produces around 2,500 tonnes of shea butter per year. The company offers conventional (COSMOS approved), organic, and fair trade (Fair for Life) certified shea butter. Shea butter is then eco-refined in France.

Nigeria

Nigeria is among the largest producers of shea nuts in the global market. Shea butter is grown in about 21 states of the 36 available in Nigeria. This country has positioned itself as 1 of the leading exporters of shea butter in the world. In 2022, Nigeria exported €2 million of vegetable fats and oils (HS code 151590), accounting for 1,865 tonnes.

No Nigerian exports to Europe were recorded in 2022. However, Europe was the destination for 84% of Nigeria's export volume in 2021. Nigerian exports of vegetable oils to Europe show a significant average annual growth of over 10% in value since 2019. Italy and the Netherlands are the main European importers.

Currently, a CBI project called Shea Nigeria is being implemented in the country. The project helps 12 Nigerian small and medium-sized enterprises (SMEs) and cooperatives to establish themselves in European Union (EU) and regional markets. This project focuses on fairly-sourced shea from women farmers and seeks cooperation with different Business Support Organisations in the sector. The National Shea Association of Nigeria (NASPAN) is an important partner of this project, working to strengthen Nigeria's shea industry and to guarantee that Nigerian citizens benefit from shea marketing.

Ivory Coast

This country is a medium-sized producer of shea. Exports of shea and other vegetable oils from Ivory Coast are growing outstandingly. Over the past 5 years, exports to Europe grew at an annual average rate of 75% in volume and 65% in value. In 2022, Ivorian exports of vegetable oils reached a total value of €2 million and an estimated volume of 1,132 tonnes in 2022.

Benin

Benin is another medium-sized producer of shea. During the last decade, this country’s market share increased considerably. In 2020, Benin held the second-largest share of shea kernel exports from Africa. Benin's exports of vegetable oils to Europe grew steadily until 2020. However, in 2021, there was a drop of 55% which may be related to the delayed effects of the covid-19 pandemic. A moderate growth of 8.0% in export value and 10% in export volume was observed during 2021-22, with a value of €1.3 billion and a volume of 1.2 thousand tonnes in 2022. The positive trend is expected to continue in the short term.

The Association Karité Benin is an important player in the national shea industry. The association develops appropriate criteria for quality standards, provenance definitions and processing procedures, as well as tree management and agricultural practices for nut production.

Kenya

Kenya was originally a small shea producer country but now is considered as a potential source of shea. Although Kenya is not a West African country, exports of vegetable oils like shea butter have shown significant growth in recent years. Between 2018 and 2022, the volume of Kenya’s vegetable oils exports to Europe grew at an annual average rate of 54%, reaching 6.5 thousand tonnes and €31 million exported in 2022. In the last year alone, exports value rose 50% from €14 million in 2021 to €31 million in 2022.

Tips:

- Check out the competition. Carry out some market research to identify companies exporting shea butter to Europe. Start with your country.

- Work out how you can be different and provide your customer with an improved value proposition.

- Find out what support is available in your own country from industry associations, government agencies and other business support organisations.

Which companies are you competing with?

The market for shea butter is very competitive. You will face competition from many other West African and East African producers. African producers compete with you on the market for shea butter, and in terms of getting access to sufficient raw materials. You will also face strong competition from large-scale European companies producing shea butter. Moreover, European buyers have a lot of negotiating power because they can choose from a wide range of suppliers.

As a supplier you need to have a well-organised and reliable supply chain which assures you can supply stable quantities of shea and produce a high-quality shea butter. However, to stand out with your company and product on the market, you need to find your unique selling point. You can do this with marketing stories, organic and/or fair-trade certifications, Corporate Social Responsibility (CSR) policies, excellent traceability or by positioning shea butter as a specialty product, among others.

Companies in Ghana

Ideal Providence Farms (IPF) is a Ghanaian company, established 20 years ago. IPF is committed to environmental and social sustainability and works in line with the United Nation’s Sustainable Development Goals (SDGs). As part of its Corporate Social Responsibility (CSR) policy, the company has benefited multiple rural communities by providing scholarships for higher education, building water systems and kindergarten schools, and giving access to electrification.

The company manages 4 organic-certified farms (ECOCERT) located in different regions of the country. IPF is a member of the International Federation of Organic Agricultural Movements (IFOAM). IPF cooperates with some 800 women in Ghana to collect organic shea nuts and produce organic shea butter.

The Savannah Fruits Company (SFC) is headquartered in Tamale, Ghana. It is currently working with 140 cooperatives and about 40.000 women in Ghana and Burkina Faso to sustainably produce and export natural products to the international food and cosmetics markets. Among others, SFC supplies crude, unrefined and refined handcrafted shea butter which can be certified organic or “Fair for Life”.

SFC is a member of the Global Shea Alliance and works with several NGOs on the preservation of national reserves. This company has a strong focus on offering a fully traceable supply chain from the collection of nuts to the shipping worldwide. SFC buys the butter from local women cooperatives and exports it to Europe to refine or filter it and repackage it according to international standards. The European distributors Butterwise, Kerfoot, and All Organic Treasures are known for their close cooperation with the SFC in Ghana. The SFC supplies them with the required shea butter.

Companies in Burkina Faso

Agrifaso is a distinguished supplier of certified organic shea butter, hibiscus, and dried ginger to the pharmaceutical, cosmetics and food industries in Europe. Agrifaso works with women shea collectors in 10 villages in South-West Burkina Faso from whom it buys shea kernels directly. The company does most of the processing of nuts on site and only refining takes place in Europe.

Agrifaso is a major producer and supplier of shea butter in Burkina Faso and in the global cosmetics market. The company currently supplies shea butter to the leading German manufacturer Dr. Hauschka. This is a long-term relationship that has been in place since 2001. Agrifaso’s shea butter is not only organic, but also fair trade-certified since 2019. Agrifaso is also the first and only company in Burkina Faso to be UEBT-certified for shea butter. This label focuses on botanicals and stands out for the ethical sourcing of ingredients. The UEBT standard includes criteria on biodiversity conservation, equitable sharing of benefits, respect for human and workers’ rights, among others. Olvea Burkina Faso was created in 2008 in Bobo Dioulasso. This company is part of the Olvea Group, a well-known French supplier of vegetable oils and fish oils. Olvea Burkina Faso buys the shea nuts directly from women collectors, produces the butter locally, and does eco-refining in France. The company can produce about 2,500 tonnes of shea butter per year. Olvea Burkina Faso offers refined shea butter that can be Cosmos-approved, certified as an organic farming product, or fair for life-certified. Since 2020, this company has been a member of the Global Shea Alliance Executive Committee.

Companies in Nigeria

Jean Edwards Oils Ltd (JE Oils) is a manufacturer of agricultural derived oils. This company was established in 2020 and is headquartered in Abuja. It is now a local and global supplier of unrefined and refined premium shea butter, and also peanut oil. It mainly exports shea to other African countries, but also has offices in the United Kingdom. Jean Edwards Oils is 1 of the Nigerian SMEs participating in the CBI Shea Nigeria project aimed at supporting organisations that want to establish themselves in the European Union and regional markets.

Other companies participating in CBI's Shea Nigeria project include:

- Ates Okwy Ltd, a company specialising in the production of exportable premium quality organic unrefined shea butter, and the sourcing of shea nuts, cashew nuts and tiger nuts.

- Oklan Best Ltd, an export company producing organic shea butter, yam products, beans, palm oil, ginger, among others. Oklan Best is FDA-certified to export agricultural products to the US.

- Salid Agriculture Nig Ltd, a company producing and exporting quality shea nuts and butter. It is currently building a processing and refining plant with the capacity to process up to 100 tonnes/day of shea nuts into butter.

Company in Benin

Wakapou is a fair and responsible company based in Cotonou, Benin. Wakapou produces premium-quality organic shea nuts and butter for the cosmetics, pharmaceutical and food industries. The company works in partnership with West African women’s cooperatives to harvest shea nuts. The company follows fair trade rules and offers a price premium for quality. Wakapou is committed to reducing their environmental impact, supporting sustainable development of local communities, and building long-term relationships. Wakapou has the capacity to produce, store and ship 300 tons of certified organic shea butter per year. It also offers its own line of cosmetic creams based on shea butter and enriched with other oils such as baobab, carrot coconut, and ginger.

Tips:

- Organise your supply chain to differentiate your company on the market. Make sure that your supplies are traceable and well-documented. Prepare detailed documentation on product, technical, safety and efficacy data, as well as professional samples. Increase your capacity for safety testing and monitoring to do so.

- If you work with suppliers, give them clear standards on the collection and/or processing of seeds you buy from them in your own specifications. Also, establish clear agreements on the amount and quality of shea nuts you buy from your suppliers that match your specifications and supply contracts.

- Always be available for communication. Be open and honest in your communications and promptly answer questions and requests from your (potential) buyers.

- Demonstrate that you are a reliable supplier in terms of quality consistency, delivery, packaging, service delivery and supply security.

- See our study on tips for doing business for more information and tips.

Which products are you competing with?

Suppliers of vegetable butters of different origins provide strong competition in cosmetics markets. However, as a low-priced, highly effective triglyceride fat, shea butter has several advantages. For example, shea butter’s low price allows it to be incorporated in relatively high concentrations which will translate into higher demand. The butter also combines good availability with a very reasonable price and interesting marketing story. In fact, shea is perceived to be more sustainable than other competing fat sources.

The main substitute product for shea butter is cocoa butter. However, according to industry sources, many formulators are not substituting but blending cocoa butter and shea butter to combine their properties in a cost-efficient way. Other exotic butters and oils with similar properties and common uses include: illipe butter, murumuru butter, cupuacu butter, mango butter and kokum butter.

Figure 5: Shea butter, cocoa butter, and mango butter

Source: Shutterstock, 2023

Have a look at Table 2 for some considerations for product substitution by looking at shea’s competitive advantages over other butters.

Table 2: Examples of product substitution for shea butter

|

|

Shea butter |

Cocoa butter |

Murumuru butter |

Mango butter |

|

Properties |

Emollient; several types of fatty acids including oleic, palmitic, stearic, arachidic and linoleic acids; vitamin E; solid at room temperature; viscosity controlling. |

Emollient; high fatty acid content including oleic, palmitic, and stearic acid; solid at room temperature; smells like chocolate; viscosity controlling and emulsion stabilising. |

Emollient; rich in fatty acids such as lauric, myristic and oleic; solid at room temperature. |

Emollient; skin conditioning; similar fatty acid composition to cocoa and shea butters. |

|

Main uses |

Soaps, lotions and creams, hair conditioners, lip balms. |

Lip balms, body butters and moisturizers. |

Creams, soaps, shampoos. |

Body creams, hair treatments, lip balms, cleansing lotions, colour cosmetics. |

|

Price |

Price ranges around €5 – €8 per 500g. The price of shea butter is lower compared to other butters. Shea has a long shelf life of up to 2 years. |

Price for cocoa butter ranges from €10.7 to €11.9 per 500g. Cocoa butter has a long shelf life of 2-5 years.

|

The price for mango butter is approximately €13.4 per 500g. Mango butter typically lasts 2 years depending on storage conditions. |

Source: ProFound, 2023

Whether your shea butter can replace other natural ingredients depends on its properties, its origin, relevant market trends, price level, what the manufacturer plans to use the shea butter for, the positioning of their brand and company image. Once a manufacturer has included your shea butter in a cosmetic product, substitution with new ingredients becomes more difficult and expensive.

Tips:

- Differentiate your product by excellence in terms of CSR, sustainability, and traceability, or by providing additional services compared to your competitors.

- Investigate and show how shea butter can substitute other oils and butter, by comparing the properties of shea butter and its alternative.

- Build and communicate the strong marketing story of shea, focusing on a tradition of use or production, its origin, or how it offers benefits to local communities.

4. What are the prices for shea butter on the European market?

The international market price for shea butter is affected by the price for cocoa butter, considering shea butter’s main use is as a cocoa butter substitute (equivalent). This is especially true for the food segment. However, in the beauty and personal care segment, shea pricing is less sensitive and often has a higher value due to direct consumer demand and awareness.

Conventional unrefined shea butter is traded at prices as low as €2.0 per kg to €2.4 per kg. However, shea butter would usually be refined before use in a cosmetic product, for which prices are higher. Conventional refined shea butter was sold at € 8,1 per kg in 2022.

Prices of shea nuts and butter do not only depend on the quality characteristics of the products. Volumes are another major factor in price setting. Most international trade in shea takes place in 20-foot or even 40-foot containers. These contain 20 or 40 tonnes of shea butter respectively. The large scale of this trade allows for smaller margins and lower prices. When importers need less than 20 tonnes, prices go up.

Organic and fair-trade certification add value to shea butter, especially for cosmetic uses. A price premium can be paid by European companies that are interested in organic ingredients as well as social and environmental responsibility practices. Prices for organic-certified shea butter were up to €10.9 per kg for unrefined butter and €12 per kg for refined butter in 2022. However, be aware that certified butters have higher costs in the chain and are produced in lower volumes.

Prices vary significantly between the stages and actors of the value chain. Big processors and exporters in Africa often buy shea nuts from intermediaries at approximately €330 per tonne and sell shea butter at a price of more than €1.000 per tonne to European distributors and manufacturers. Based on data from the Global Shea Alliance, intermediaries buy shea in 85 kg bags from collecting women and pay a price of €20-25 per bag.

Tips:

- Stay up to date on cocoa butter prices to anticipate price changes for shea butter. You may ask your buyers for this information.

- Be open to offering discounts to buyers who order large volumes of shea butter. European buyers are used to getting discounts when placing larger orders. However, to avoid incurring losses, make sure to include discounts in your original price calculations, so you do not sell at a lower price than your costs.

- Certification schemes can enable you to charge a premium for your shea butter. Make sure you can justify your price with relevant certifications.

ProFound – Advisers In Development and. Fair Venture Consulting carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research