The European market potential for shea butter

The shea butter market is very competitive. There are many producers and suppliers of shea butter across sub-Saharan Africa. However, the cosmetics industry offers opportunities to differentiate yourself from other suppliers since European cosmetics companies are becoming more interested in natural, quality, and ethical ingredients, including shea butter.

Contents of this page

1. Product description

Shea butter, also known as Karité butter, is a vegetable fat extracted from shea nuts. When shea butter is used as an ingredient in cosmetic products, it is listed as Butyrospermum Parkii butter, following the COSING database of registered names for cosmetics ingredients (or INCI names).

The fat is obtained from the fruit of the shea tree, a member of the Sapotaceae family, which is famous for its soaping properties. Formerly, the shea tree was also known as Butyrospermum Parkii and belonged to the genus Butyrospermum, which means "butter seed". However, this botanical name was replaced. The Shea tree is now classified as Vitellaria paradoxa and 2 subspecies are distinguished: paradoxa and nilotica for West and East African trees, respectively. The International Cosmetic Ingredient Nomenclature Committee makes every effort to provide consistent nomenclature with as few amendments over time as possible. Any change to an INCI name will require all companies to print new ingredient labels for all products with that ingredient. However, there is a procedure to update INCI names, and in the future, the new botanical name for shea butter may be adopted as the INCI name.

Shea trees are native to sub-Saharan Africa in a region known as the shea belt. The region extends from West to East Africa, from Senegal to Kenya. These areas are characterised by daytime temperatures ranging from 24˚ to 38˚C and a mean annual rainfall of between 500 - 1,400mm. Most commercial harvesting takes place in Ghana and Burkina Faso, and most exports go through the port of Tema in Ghana.

Figure 1: Shea belt region (distribution of shea trees in Africa)

Source: ProFound, 2023

Shea trees are not cultivated, but instead, they are naturally grown and traditionally managed in parklands. Parklands are the main agricultural systems in the shea belt, and they host a wide variety of tree and shrub species. Shea trees are classified as a vulnerable species due to factors including overexploitation for timber, fuelwood and charcoal production, and land clearing for commercial agriculture. Preserved and protected parklands therefore represent a conservation opportunity for shea and other indigenous trees. Commercial buyers may be keen to ensure that their purchases of shea butter come from sustainable sources.

Shea butter that originates from West Africa has a different composition compared to shea butter from East Africa. This is not surprising as even plants of the same species can have different compositions due to different climates and different soils. Table 1 lists the fatty acid composition of West and East African shea butter. The fatty acid profile is particularly useful in characterising the functional performance of the butter in cosmetic formulations and on the skin. Typically, pure unmodified shea butter from East Africa has a softer consistency than pure unmodified shea butter from West Africa. However, by far the most important source of shea butter is West Africa. If you are offering shea butter from East Africa to a buyer who normally buys shea butter from West Africa, you may have to explain the reason for the different fatty acid composition.

Table 1: Fatty acid composition of shea butter

|

Component |

West African shea |

East African shea |

|

Oleic acid (Omega-9) |

40 - 50% |

47 - 67% |

|

Stearic acid |

36 - 50% |

21 - 38% |

|

Linoleic acid |

4 – 8% |

4 - 9% |

|

Palmitic acid |

2 - 8% |

2 - 8% |

Source: DLG Naturals TDS, The Soap Kitchen COA, and PRAAN Naturals, 2023

About 90% of all shea exported from Africa is used in the food industry. In Africa, shea butter is used as a cooking fat, while globally, shea butter is used as an edible ingredient in fats, pastries, and confectionery. The international food industry mainly processes the butter into stearin, derived from the high concentration of stearic acid, and uses it as a cocoa butter replacement. In this sense, it is mostly considered as a commodity competing with other cocoa butter replacers.

In the cosmetics market, shea butter is used for its excellent emollient properties (skin softening). The shea butter gets these properties from its composition of 95% or more triglycerides or fatty acids. According to the European Commission cosmetic ingredient database COSING, shea butter has skin conditioning and viscosity-controlling properties. Pure shea butter also has a high concentration of unsaponifiables (5-7%), which are reported to have soothing and antioxidant properties.

According to the Global Shea Alliance, about 10% of shea exports are used in the global cosmetics industry. It is estimated that about 20-25,000 tonnes of shea butter are used each year in the cosmetics industry around the world. Shea butter is widely used by cosmetics brands and can be found in body care and face care products, such as:

- Skincare: Lotions, creams, moisturizers, baby oils and sun care;

- Haircare: Shampoos and conditioner;

- Decorative cosmetics: Lip balms and lipsticks; and

- Toiletries: Soaps and cleansers.

Figure 2: Examples of products containing shea butter in the European cosmetics market

Source: The Body Shop and L’Occitane

Table 2 lists the classification names and codes for shea butter. These codes and ingredient names are used as product identifications in documentation (as listed in COSING and with Chemical Abstracts Service (CAS) number) and in trade (Harmonised system codes).

Table 2: Classification of shea butter

|

Source |

Classification |

|

International Nomenclature Cosmetic Ingredient (INCI) names, according to COSING (European Commission database with information on cosmetic ingredients) |

COSING lists 29 ingredients known as or derived from shea butter, including: Butyrospermum Parkii butter Shea butter glycerides Hydrogenated shea butter |

|

Chemical Abstract Service (CAS) numbers |

194043-92-0 (Butyrospermum Parkii Butter / Shea Butter Glycerides) 91080-23-8 (Butyrospermum Parkii Butter Extract) 225234-14-0 (Butyrospermum Parkii Butter Unsaponifiables) 226993-83-5 (PEG-60 and PEG-75 Shea Butter Glycerides) |

|

Harmonised system (HS) codes |

1515.90 (other fixed vegetable fats and oils and their fractions, refined or not, not chemically modified) 1207.92 (‘shea nuts’ / ‘karite nuts’, broken or not). However, no trade is recorded under this code 1207.99100 (oil seeds and oleaginous fruits, broken or not). Several African countries record trade of shea nuts under this code |

Source: ProFound, 2023

2. What makes Europe an interesting market for shea butter?

Shea butter is a key ingredient widely used in the global cosmetic industry for its skin conditioning and moisturizing properties. Europe is one of the world’s largest markets for cosmetics, with a value of €88 billion in 2022. It is also estimated to be one of the largest markets for shea butter for cosmetics, with growing imports of vegetable oils and oil seeds.

Growing European imports of vegetable oils and oil seeds

No specific European trade data is recorded for shea nuts and butter. Instead, shea butter imports are part of a larger product group with other vegetable oils and fats which are also used in cosmetics (see HS codes under the section ‘product description’), such as argan oil, Brazil nut oil, moringa oil, marula oil, and so on.

It is assumed that these aggregate imports of vegetable oils largely reflect shea butter imports for 2reasons. First, they exclude the most used vegetable oils in cosmetics (soybean, olive, sunflower, among others). Secondly, shea butter is more widely used and demanded in Europe compared to most of the other exotic vegetable oils included in this group. Focusing only on the imports of vegetable oils (HS code 151590) from Ghana and Burkina Faso could provide a more specific and accurate indicator of shea butter imports, as these are the 2 leading suppliers of shea butter in the world, and it is logical to assume that most HS code 151590 imports are shea butter.

According to ITC Trade Map, European imports of vegetable fats and oils amounted to €1,271 million and 430 thousand tonnes in 2022. The EU countries and the UK represent the bulk (more than 90%) of total European imports. Between 2018 and 2022, European imports grew on average 12% per year in value and 2.9% in volume. This growth is lower than that recorded globally, which may be explained by the growing Asian market for shea.

Shea nuts can also be considered within the group of other oil seeds and oleaginous fruits. In fact, multiple African countries record their trade of shea nuts under this name. Based on ITC Trade Map data, in 2022, Europe imported 165 thousand tonnes of oil seeds and oleaginous fruits (HS code 120799), with a total value of €580 million. Between 2018 and 2022, the volume of imports showed no growth, but the value of imports grew at an average rate of 12% per year.

Europe is the world’s second-largest market for cosmetics

In 2022, for the first time in many years, Europe became the world’s second-largest cosmetics market, being overtaken by the USA. In 2022, the European cosmetics market dominated between a quarter and a third of the global cosmetics market, which was valued at more than €250 billion. Europe's share in the world cosmetics market is given as a range rather than a single value because the 2 data sources, although reliable, report different shares. This may be due to differences in their calculation methods.

Source: L’Oréal 2022 Annual Report

In recent years, this market grew 13% in value, from €77.6 billion in 2017 to €88 billion in 2022. Just in 2021-2022, the European market for cosmetics grew at an average rate of 7.8%, outpacing the 6% global market growth. According to our calculations, the European market is expected to continue growing at an average rate of 1.5% per year until 2030.

Source: CBI, 2023

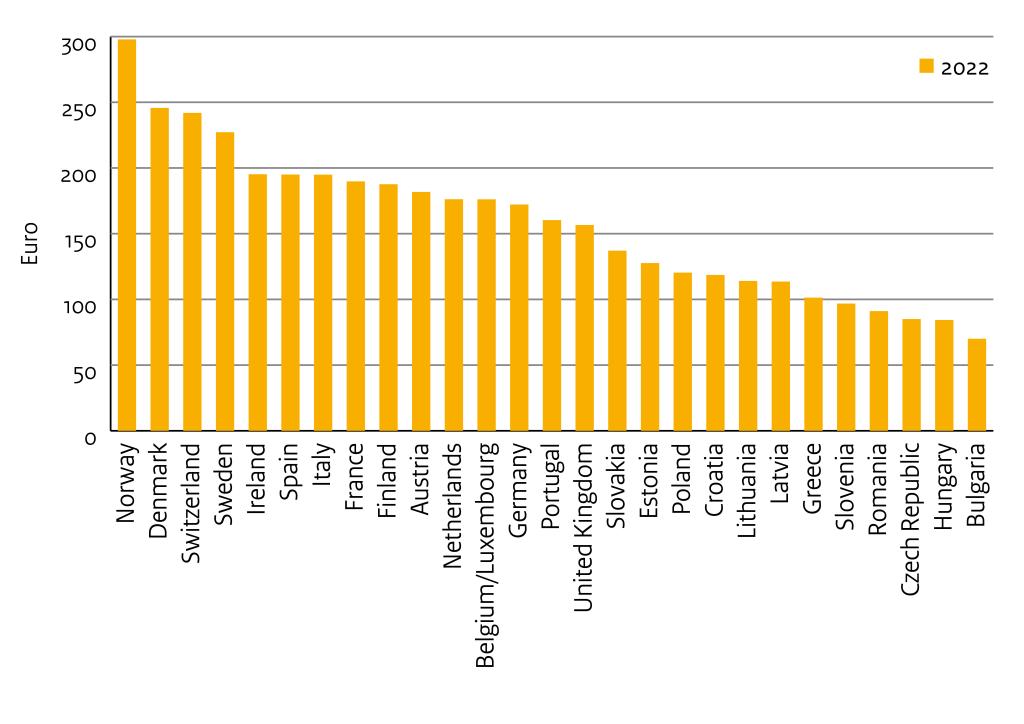

Europe stands out for its production and per capita consumption of cosmetic products. In 2022, cosmetics manufacturing alone accounted for some €11 billion in this region. In the same year, European per capita spending on cosmetics averaged about €168, according to our calculations, below the US per capita spending estimated at €290 per year. Norway is the European country with the highest per capita consumption, followed by Denmark and Switzerland.

Figure 5: Cosmetics per capita consumption in Europe, by country, 2022, in €

Source: Own calculations using data from CTPA and Eurostat, 2023

At a continental level, Europe is also among the largest markets for natural and organic cosmetics. In 2020, the European natural and organic cosmetic market was valued at €3.89 billion, representing 38% of the total world market value. This market is growing rapidly due to rising consumer awareness regarding the perceived consumer benefits of natural cosmetics and their increasing availability in mainstream retail channels. As an illustration, the Soil Association indicates that the UK organic health and beauty market has grown for 12 consecutive years now, at an average rate of 47% each year, rising from €37 million in 2012 to €171 million in 2022. This market is expected to continue growing over the next years.

The skincare segment drives the European cosmetics market

The skincare segment is the largest segment of the global cosmetics market, accounting for 41% of the total sales of cosmetics in 2022. In Europe, the skincare segment has the highest market value of the cosmetics industry, reaching €25.6 billion in 2022 (29% market share). Skincare products can use the highest percentages of shea butter compared to other categories. For example, L’Occitane claims that their Ultra Rich Body Cream and other products contain 25% shea butter.

The European skincare market segment has performed very well, sometimes recording higher growth than the overall market. As an illustration, in 2020, the European cosmetics market declined by 4.8% compared to 2019, whereas the market for skincare products increased by 10% to 20% in 2020 in the European region. The European skincare market is predicted to continue growing, driven by an increased usage of cleansers, moisturizers, and exfoliators reported by skincare users. There are many opportunities for vegetable fats such as shea butter in this market segment since shea is already used in a wide range of creams, lotions, and butters due to its emollient properties.

Within the skincare segment, anti-ageing cosmetic products stand out due to an increasingly ageing population in Europe and the desire of younger consumers to prevent skin ageing. Consumers are driving the demand for anti-ageing creams and serums in which unrefined shea butter is used extensively thanks to its moisturizing properties to reduce wrinkles and smooth the skin. This supports the forecast growth in demand for shea butter and cosmetic products containing shea butter.

Tips:

- See our study on the demand for natural cosmetic ingredients in Europe to find more information on relevant markets, sales, imports and potential products in the natural cosmetics segment.

- Check our study on tips for doing business. You will find specific features of European buyers and businesses that may help you increase your chances of exporting.

- Stay informed about the latest developments in the skincare segment to identify new opportunities. For instance, by reading industry media, such as Cosmetics Design Europe.

3. Which European countries offer most opportunities for shea butter for cosmetics?

Europe accounts for about a quarter of the global cosmetics market and about 38% of the global natural/organic cosmetics market. Within Europe, Germany and France are the largest markets for cosmetics and have the most natural product launches and a strong focus on innovation. Italy and Spain are also important markets for conventional and natural cosmetics, with increasing African imports of vegetable oils and butters such as shea butter, together with The Netherlands.

Germany is the largest market for cosmetics in Europe

Germany is Europe’s largest market for cosmetics, valued at €14.3 billion in 2022. It also has the largest market share of European natural and organic cosmetics. Germany is the second largest European exporter of cosmetics and stands out globally with a 6.2% share in total beauty products exports.

In 2022, Germany imported 1,792 tonnes of vegetable oils at a value of €101 million. This accounted for 8.0% of total European vegetable oil imports in value and 4.1% in volume. However, between 2018-2022, imports of these products have fallen on average by 1.7% each year in value and by 4.2% in volume. This drop is associated with the negative impact of the COVID-19 pandemic.

About 1,100 tonnes were imported directly from the shea belt countries, especially Ghana (484 tonnes) and Burkina Faso (353 tonnes), which is highly likely to be imports of shea butter. The volume imported from Ghana is decreasing rapidly at an average annual rate of 19% between 2018 and 2022, while imports from Burkina Faso are growing steadily at an average annual rate of 16% since 2018.

One of the leading cosmetics manufacturers in the German market is Dr. Hauschka. This skincare company manufactures natural products with ingredients sourced from fair trade and sustainable production. Dr. Hauschka sources shea butter from southwestern Burkina Faso. The shea butter used is not only certified organic but is also fair trade certified. As a result, the company pays higher prices to producers and invests in social issues and village development initiatives.

France is Europe’s second-largest market for cosmetics

France is the second-largest market for cosmetics in Europe, valued at €12.9 billion in 2022. France is the main exporter of cosmetics in Europe, along with Germany. In 2022, both countries dominated over 50% of total EU exports, with a shared value of €13.6 billion. France is also among the world’s leading exporters of beauty products. In 2021, France had a 17% share in global beauty product exports.

France is the largest importer of vegetable oils in Europe. In 2022, French imports accounted for a share of 18% in value and 17% in volume of total European vegetable oil imports. Since 2018, imports have grown at an average annual rate of 1.4% in volume and 11% in value, reaching 73 thousand tonnes at a value of €235 million in 2022.

Most of the shea butter imports by France come from other EU countries, except for Burkina Faso, which is France's third main supplier. In 2022, 7,134 tonnes of vegetable oils were imported from Burkina Faso. It is assumed that most of this volume corresponds to imports of shea butter. In 2022, a total of 9,396 tonnes were imported from Africa, representing an average annual growth of 10% from 2018. Over 8,400 tonnes came from shea belt countries and can therefore be associated with shea imports.

In France, there are several manufacturers of natural cosmetic products, with beauty and personal care products made from shea butter and other derivatives. Some of the most important manufacturers are L’Occitane en Provence, Typology, Caudalie, French Girl Organics, Nuxe, SO’BiO étic, Mademoiselle Bio, and Lady Green Paris.

L’Occitane, one of the leading French manufacturers, sources its shea butter from Burkina Faso. Since the 1980s, this company has had a partnership with women producers in this country. It is estimated that more than 10 thousand women work in partnership with L’Occitane, which buys several hundred tonnes of shea butter every year.

Figure 6: Video - L’Occitane partnership with the women of Burkina Faso

Source: L’Occitane en Provence - YouTube

The growing UK cosmetics market proves resilient against market pressures

The British market for cosmetics is one of the largest markets for cosmetics and personal products in Europe. The British cosmetics market was valued at €10.5 billion in 2022, corresponding to a 5.4% growth compared to 2021. According to the Soil Association, the UK organic beauty and wellbeing market also grew at a rate of 6.8% in 2021-2022, exceeding €173.7 million in retail sales.

Due to Brexit, the UK now has its own cosmetics regulation, and for the time being, this is very similar in terms of requirements. The UK's exit from the EU didn’t have a negative impact in terms of sales, revenues, or trade of cosmetics. The UK has a thriving manufacturing base for cosmetics. In 2022, the country had the largest number of manufacturing SMEs (1,413) in Europe, which are key drivers of innovation and economic growth in the cosmetics industry. In addition, the country’s population size, which is the main driver of cosmetics sales, has continued to grow at the usual rate.

In 2022, the United Kingdom imported 19 thousand tonnes of vegetable oils at a value of more than €57 million. Over 16 thousand tonnes were supplied by EU countries, and 404 tonnes came directly from Africa. Imports from Africa remained relatively stable between 2018 and 2022. Ghana is the main African supplier, with 165 tonnes imported by 2022, corresponding to an average annual growth of 15% since 2018.

An example of a leading British manufacturer formulating with shea butter is The Body Shop. This company has been working with a women’s shea butter association in Ghana for over 25 years. The Body Shop provides a fair price to producers and pays a premium to invest in community projects. Bazousou and Akoma are other examples of natural cosmetics manufacturers in the UK working with shea butter. Both companies source shea butter from farmer’s cooperatives in Côte d’Ivoire and Ghana, respectively. Akoma’s shea butter is certified Fairtrade, which means producers are paid a fair price.

Increasing imports of shea butter in Italy and Spain

Italy and Spain are also major markets for cosmetics in Europe. In 2022, Italy ranked as the third-largest market for cosmetics (€11.5 billion), while Spain was the fifth largest (€9.3 billion). Moreover, sales of cosmetic products in both countries are growing significantly. Between 2021 and 2022, the Spanish cosmetics market grew at a rate of 23%, while Italy recorded a 12% growth.

Italy and Spain are among the top 5 European importers of vegetable oils in terms of value, with shares of 8.5% and 8.2%, respectively. The value of vegetable oil imports from these countries has grown strongly in the last 5 years. This is especially true for Spain, which registers an average annual growth rate of 45%, while Italy grew on average 19% each year. The volume of imports also shows a positive trend. Between 2018 and 2022, Spain imported 31 thousand tonnes, corresponding to an average growth of 37% each year. In the same year, Italy imported 28 thousand tonnes and recorded an average annual growth rate of 8.9%.

The growth of vegetable oil imports from African countries is even more impressive. Between 2018 and 2022, Italian imports of vegetable oils from Africa increased, on average, 143% each year, reaching a total volume of 3,294 tonnes. On the other hand, Spain had an average annual growth rate of 110%, with a total of 2,646 tonnes of vegetable oils imported in 2022.

The Spanish company Maison Karité offers a portfolio of vegan, sustainable, biodegradable, and certified organic or natural cosmetic products. Maison Karité also sells pure handmade shea butter, unrefined, without any additives, certified organic and vegan, which is sourced from women's cooperatives in Ghana. Maison Karité supports a group of 72 Ghanaian women through the sponsorship of facilities and equipment to promote the mechanisation of their shea butter operations.

The Netherlands is the largest import hub for vegetable oils from non-European countries

The Netherlands is the second largest importer of vegetable oils in Europe, both in value and volume. It is also among the top 5 importers in the world. The Netherlands has a share of 11% in the total value of European imports and 13% in terms of volume. In 2022, Dutch imports of vegetable oils reached a volume of 57 thousand tonnes (€141 million), representing an average annual growth of 3.0% in volume and 8.5% in value since 2018.

This country is the major European import hub for vegetable oils from non-European countries. More than 50% of Dutch imports of vegetable oils come from countries outside Europe. In 2022, 42% of total vegetable oil imports were sourced from African countries. Ghana is the main supplier of vegetable oils to the Netherlands, accounting for 74% of vegetable oil imports from Africa and 31% of total vegetable oil imports. Other relevant African suppliers are Burkina Faso (6.8%) and Ivory Coast (1.7%). Since 2018, the volume of African imports of vegetable oils has been growing moderately, at an average rate of 1.5% each year.

Tips:

- Focus on Western European countries as they import the highest volumes of exotic vegetable oils. They also have the largest cosmetics markets.

- Consider supplying organic shea butter when targeting markets like Germany, Italy, the UK, and France.

- Be flexible in your offer to European customers. Don’t get fixed on large minimum order quantities. Offer solutions that make you an attractive supplier and look to the long term.

4. Which trends offer opportunities or pose threats on the European shea butter market for cosmetics?

The growing demand for natural ingredients and natural cosmetics is stimulating the demand for shea butter in Europe. Sustainability practices and ethical sourcing are becoming important to European buyers and consumers, who are increasingly interested in health, wellness, and the environment.

Growing consumer inclination toward wellness and health

The beauty and cosmetics market is driven by a growing trend of wellness. Euromonitor’s study identifies wellness as one of the top 10 trends shaping consumer behaviour, attitudes, and consumption choices in the long term.

Consumer values and preferences are shifting towards a more holistic approach where health and prevention are prioritised. Most consumers perceive or define beauty as “looking healthy”, and they are demanding products that are good for their skin with a focus on health, wellness and environmental implications. Shea butter as a cosmetic ingredient and the sourcing of shea butter fits well within this overall context.

While wellness has long been an important trend, the pandemic accentuated its importance as consumers felt more vulnerable. In response to this growing trend, industries are merging their traditional portfolios with new health needs. In addition, many cosmetic brands are adopting sustainable and eco-friendly practices in their supply chains. Driven by the European Green Deal and related regulations, this is becoming more of an obligation.

The boundaries between beauty and wellness are expected to continue blurring in the coming years. In fact, the wellness sector is forecasted to grow at an average rate of 10% per year until 2027. Shea butter suppliers in developing countries should therefore take advantage of the connection between shea butter and health and wellness to create business opportunities.

Rising consumer awareness of the social and environmental impact of cosmetics

Aside from their personal health, consumers are increasingly concerned about how they interact with the world. Consumers are raising awareness of the impact of cosmetic products on communities and the environment. Several manufacturers are aligning themselves with this trend. They are now becoming more interested in the story behind cosmetic ingredients.

Shea butter combines several elements for an interesting marketing story, such as:

- Traditional use: Although they cannot make any medicinal claims, cosmetics manufacturers use information on traditional medicinal uses of shea in their product descriptions and stories.

- Manufacturing techniques: Shea butter is often produced using traditional methods, which gives a more natural and personal character to the products. However, only a small group of ethical cosmetics manufacturers explicitly promote the handcrafting of their shea butter to position themselves as ethical suppliers.

- Benefits to local communities: Collection of shea nuts is an important source of income for many people in areas where few other income options exist. Also, shea butter is mainly produced by women. In 2022, more than 3000 women leaders were managing shea cooperatives. In this sense, cosmetics manufacturers often showcase shea production as an activity to empower women and their communities.

- Sustainability: Shea trees grow naturally in protected parklands, and seeds are wild harvested. Sustainable harvesting is a differentiating and relevant factor. The economic value of the trees provides protection against cutting the trees for other purposes. In 2022, 1,205 hectares of shea parklands were protected. Additionally, shea parklands may be useful for combating climate change since they are an important carbon sink.

It is advisable for shea butter suppliers to tell the story of their ingredient and address the information to both customers and consumers. Some shea butter suppliers in developing countries are already building on this trend to create business opportunities for themselves. The Savannah Fruits Company, for example, is a company based in Ghana that works with local women's cooperatives and offers a fully traceable supply chain and multiple certified products. The Savannah Fruit Company provides detailed information on its socially and environmentally responsible practices and even claims to contribute to several SDGs.

Increasing popularity of natural ingredients to boost shea demand

The demand for natural and organic cosmetics is rising sharply due to growing consumer inclination toward ‘cleaner, greener beauty’, especially among millennials and Gen Z. By 2021, searches for ‘natural ingredients makeup’ increased 180% year on year. The European cosmetics market has a strong focus on natural and organic. In fact, Europe has the highest number of products and companies certified as COSMOS organic, the most widely used international standard.

There’s a strong public perception in Europe that natural ingredients are safer and healthier than synthetic substitutes. Thus, consumers are paying more attention to ingredient formulations, especially in the skincare segment. In 2022, 19% of global consumers were influenced by ingredient formulation when purchasing skincare products. As stated by Spate’s Top Rising Ingredients Report, there is a strong interest in natural oils, and consumers are consistently searching for them in different cosmetics segments. Within the skincare segment, shea butter is among the top trending ingredients. In 2022, shea butter achieved an average monthly volume of 42.3 thousand searches, recording one of the top 5 highest search volumes from skincare products consumers.

To meet consumers’ evolving needs, key market players are launching natural products and many organic skincare products as well. However, some conventional cosmetics brands use natural ingredients at low percentages to make a marketing claim. The increasing demand for natural and organic products offers opportunities for shea butter, since shea butter is itself an increasingly popular ingredient in cosmetics.

Rapid growth in digital channels creates opportunities for shea butter in cosmetics

The lockdowns caused by the COVID-19 pandemic accelerated the shift towards a more digital world and triggered changes in online shopping behaviour. In 2022, global online cosmetics sales increased by 7% and accounted for a 27% share in the global beauty market.

Online commerce is playing an increasingly important role in the European market for beauty and personal care products. It is estimated that 29% of the total revenue generated by this market will come from online sales by 2023. European countries have the highest number of buyers of beauty products through online channels. The share of online shoppers in EU countries such as Poland (67%), Portugal (51%), Spain (50%) and France (47%) significantly exceeds the world’s average percentage of online cosmetics shoppers (45%).

The growing online market is expected to boost the shea butter cosmetic sector in Europe. It facilitates the purchase and sale of cosmetic products, which in turn may drive up demand for cosmetic ingredients like shea butter.

Online commerce also offers benefits to suppliers of shea butter. Digital channels allow you to easily communicate with buyers, promote your business and offer your products through online marketing.

Tips:

- Have a look at ourstudy about trends for natural ingredients for cosmetics for more market trends and information on organic and fair-trade cosmetics.

- See our study on buyer requirements for natural ingredients for cosmetics for more information on certifications for natural/organic cosmetics. Always discuss these options with your buyers. It only makes sense to certify your shea butter according to natural cosmetics standards if the final product is also certified.

- Be prepared to support any statements that you make with documentation. Increasingly, you also need to prove your policies on Corporate Social Responsibility (CSR).

- Check the website of the Global Shea Alliance for trade information, market trends and industry news. This organisation is dedicated to creating a sustainable shea industry worldwide.

Fair Venture Consulting and ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research