Entering the European market for Ayurvedic ingredients for health products

To enter the European market for Ayurvedic ingredients, you must meet the legal requirements set by the European Union (EU) as well as specific buyer requirements. The first steps to entering the European market are ensuring that you can provide products of uniform quality with high product safety and having all the required documentation in order. Importers and distributors are the main channels by which exporters enter the market. India is by far the largest and most dominant player in this market, given that Ayurveda originated there.

Contents of this page

- What requirements and certifications must Ayurvedic ingredients comply with to be allowed on the European market for health products?

- Through what channels can you get Ayurvedic ingredients on the European health products market?

- What competition do you face on the European Ayurvedic ingredients market for health products?

- What are the prices for Ayurvedic ingredients?

1. What requirements and certifications must Ayurvedic ingredients comply with to be allowed on the European market for health products?

You can only export Ayurvedic ingredients to European Union (EU) members if you meet the relevant EU requirements. For a full overview of these standards, refer to our study on buyer requirements for natural ingredients for health products or to the specific requirements for your product in Access2Markets by the European Commission.

Buyer requirements can be divided into:

- Mandatory requirements: legal and non-legal requirements you must meet to enter the market;

- Additional requirements: standards you will need to meet to stay relevant in the market;

- Niche market requirements: applying to specific niche markets.

Mandatory requirements

This study focuses on food supplements, since this is how Ayurvedic ingredients are mainly used. If your Ayurvedic ingredients are used in food supplements, you must meet the following legislation:

- European General Food Law, which requires all foods marketed in the EU to be safe.

- Food safety, which includes requirements on maximum residue levels (MRLs), contaminants in food and microbiological contamination of food, and food hygiene as outlined in the EU’s Hazard Analysis and Critical Control Points (HACCP).

- EU food supplement legislation, which lays down requirements on the composition and labelling of supplements.

- Novel Food Regulation, which regulates and assures the consumer safety of ingredients that were not consumed within the EU before 15 May 1997. Check the Novel Food Catalogue based on the Union List, and seek expert advice to determine whether there is any history of the use of your botanical in the EU.

- National positive lists for botanicals to determine whether your ingredient is already allowed in food supplements. Examples include the BELFRIT (Belgium, France, and Italy) and Germany lists.

The use of extraction solvents for foodstuffs and food ingredients is regulated by Directive 2009/32/EC. Annex I provides a list of the authorised extraction solvents for use in food and the conditions of use. For example, extraction using sulphur dioxide is not authorised. Remember that extraction processes can amplify even minimal pesticide residues present in your product. It is therefore important to monitor your laboratory tests carefully to ensure that you meet the MRLs.

Irradiation is an effective method of sterilising Ayurvedic herbs, but generally trust in food radiation is low among European buyers and consumers and it is perceived as potentially harmful. As a result, importers usually do not accept irradiated herbs.

CITES and the Nagoya Protocol

You need to comply with the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES). CITES regulates the trade in (for example) endangered plants collected from the wild and provides guidance on species for which trade is prohibited or restricted. Check whether your ingredient is listed in Annex A or Annex B of Regulation (EC) No 338/97. If so, you need an export permit from your local CITES authority. You will also need an import permit from the country you are exporting to.

The Nagoya Protocol of the Convention on Biological Diversity (CBD) provides guidelines for accessing and utilising genetic resources and traditional knowledge in access and benefit-sharing (ABS) agreements. Many countries have signed this protocol and incorporated it into their own national law. If your country has done this, you will need to meet these national laws. European companies are legally required to follow the law in force in your country regarding access and benefit sharing. They will expect you to be aware of and compliant with your country’s legislation in this area. Check the information regarding your country: you can find the information regarding India here.

Figure 1: Video – The Nagoya Protocol and ABS, explained in simple terms

Source: Naturvårdsverket, 2018

Additional requirements

Potential buyers need proof of the safety of your product and that it meets their quality and sustainability requirements before they buy from you. If European companies or authorities find out that the safety of your Ayurvedic ingredient cannot be guaranteed, they will remove your product from sale.

Quality requirements and documentation

Many buyers have quality requirements that go beyond the relevant legislation. These may relate to the active ingredient content, moisture content or maximum residue levels. These are set out in buyer specifications. To show that you meet these specifications, the buyer will require clear company and product information, including detailed technical data sheets.

Depending on the product concerned, European buyers may have specific requirements on composition and nutritional profile. Buyers will usually request a Certificate of Analysis to verify that your product meets their quality requirements. Harvesting, processing, and packaging will all affect the nutritional profile of your products.

European buyers regularly test the products that they buy, usually on a per-batch basis, to ensure that they meet quality requirements and are not adulterated or contaminated. They will also test samples provided by new suppliers. Many European buyers lose their interest if a new supplier delivers a low-quality product: you have one chance to convince these buyers of your company and your product, and you will need to supply the same quality consistently to keep your client. To minimise variations in quality, you could put standard operating procedures (SOPs) in place, including instructions on how to carry out certain production processes.

Examples of the documentation expected by buyers are:

- Technical Data Sheet – TDS (see this Ashwagandha powder TDS);

- Certificates of analysis – CoA (example: organic Bacopa monnieri CoA);

- Safety data sheet – SDS (see this Ashwagandha root powder SDS);

- GMO certificate (if requested); and

- Certificate of origin.

Food safety management

In addition to the required HACCP standard, European food industries increasingly want suppliers to follow more rigorous food safety standards or food safety management systems. Following Good Manufacturing Practices (GMP) is a good starting point. Further expectations for a quality management system are set out in the industry (management) standard ISO 9001:2015.

Examples of food safety management systems include:

- ISO 22000, food safety management system certification;

- Food Safety System Certification (FSSC22000), based on ISO 22000 and aimed specifically at food manufacturers;

- International Food Safety (IFS), with several standards concerning food safety;

- BRCGS food safety standard.

Sustainable practices

One of the primary considerations for European buyers when selecting product suppliers is a transparent supply chain that is easy to trace. Buyers want guarantees that the products they buy match the product specifications provided and can be traced back to their source. European buyers are also facing increasing pressure from EU legislation to make sure their supply chains are transparent and can be tracked easily.

This means you should have information on production and labour practices available, as well as environmental issues. European buyers may also ask you to meet the standards of their code of conduct. Buyers expect their suppliers to provide them with all the necessary information.

Labelling requirements

To export your Ayurvedic ingredients to the European market, you must meet the following labelling requirements:

- Name, address and phone number of exporter;

- Product name and identification, including the chemical abstracts service (CAS) number;

- Batch code;

- Place of origin;

- Date of manufacture;

- Best before date;

- Net weight;

- Recommended storage conditions;

- Relevant hazard symbol if you export extracts that are classified as hazardous (see the section on documentation above).

If you supply organic ingredients, your label will also need to include the name/code of the inspection body and certification number. Label your products in English, unless your buyer wants you to use a different language.

Packaging requirements

Packaging must be safe for consumer health and for the environment. Specific packaging requirements may differ between buyers and between products. Your packaging must maintain product quality and prevent contamination. Here are some general requirements you will have to take into account:

- Always ask your buyer about their specific packaging requirements.

- Re-use or recycle packaging materials to help meet requirements of the European Green Deal. For example, use bags or containers made from recyclable material, such as kraft paper for powders and metal for extracts.

- If you produce powdered Ayurvedic ingredients, package them in waterproof material. For example, use paper bags that are lined with plastic. Preferably use an eco-friendly lining (such as bio-degradable or recyclable lining).

- In the case of extracts, use containers made of a material that will not react with components in the extract (such as lacquered or lined steel, stainless steel, aluminium).

- Clean and dry the containers before filling them with Ayurvedic ingredients to prevent contamination.

- Store bags or containers in a cool, dry place to prevent any deterioration in quality.

- If you supply organic-certified ingredients, separate these physically from products that are not certified as organic.

Requirements for niche markets

Verifying and/or certifying sustainable production can add value to your product but is a niche market in the health industry. Standards and requirements for social and environmental sustainability include:

- Organic production: as sales of organic products increase, you may want to obtain organic certification for your Ayurvedic ingredients. Organic certification acts as a quality control system and can enhance your reputation for quality. Regulation (EC) 2018/848 sets out the rules for organic production and labelling in Europe. Refer to this list of recognised control bodies and control authorities issued by the EU to ensure that you always work with an officially recognised accredited certifier.

- Verification and/or certification of sustainable production: These include standards for environmental sustainability such as UNCTAD BioTrade Initiative and FairWild. Examples of social sustainability include Fairtrade International, Fair for Life, and Union for Ethical BioTrade.

- Implementation based on ISO 26000 guidance on social responsibility.

Figure 2: Examples of certification standards for sustainable production

Source: Fairtrade International, FairWild, Fair for Life, UNCTAD and UEBT, 2023

Tips:

- Before you decide to certify your products as organic, find out if there is a market for your products. Can you earn back your investment? Talk to (potential) buyers about whether they are interested in organic-certified Ayurvedic ingredients.

- Standardise and minimise variations in the quality of your product. Develop SOPs, and train collectors and/or farmers and processing staff. Use incentives to ensure that they follow your specifications on harvesting and post-harvest processes, such as a higher price for higher quality raw materials. See the WHO guidelines on good herbal processing practices for more information.

- Consider working with a local or national university to test the properties of your product. They can help determine its nutritional content and composition. This information should be included in your product documentation.

- Put in place a traceability system and keep samples for each of your suppliers to trace the origin of the product just in case a quality problem arises.

2. Through what channels can you get Ayurvedic ingredients on the European health products market?

On the European market, Ayurvedic ingredients are mainly used in the food supplements industry. Health products on the European market that contain Ayurvedic ingredients are mainly offered as pills that provide a certain dosage, powders and herbal teas. Remember that most of the Ayurvedic ingredients referred to in this study are not permitted in herbal medicine products, even though this sector is included in the market segmentation section below. The most important channel by which to reach the European market is through an importer and distributor. These source ingredients from a wide range of suppliers and countries.

How is the end-market segmented?

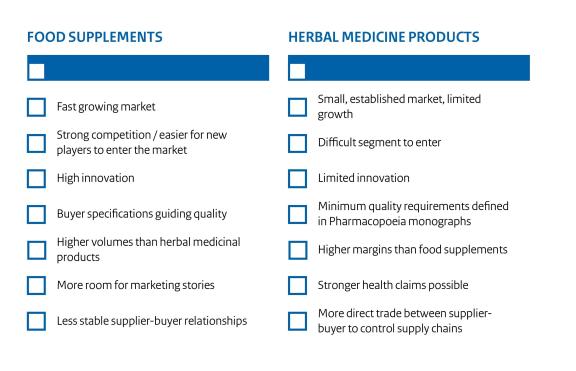

The end market for natural ingredients for health products can be segmented into two main segments:

- Food supplements; and,

- Herbal medicine.

The ingredients listed in the study on the European Market Potential for Ayurvedic ingredients (ashwagandha, Bacopa monnieri, gotu kola, triphala, tulsi and bitter melon) cannot be used in herbal medicines, but there are several other Ayurvedic ingredients that can be. It is essential to know which segment your Ayurvedic ingredients will end up in, because there are important differences in the legislation, quality parameters and certification requirements. You can check these by checking whether your ingredient is listed in the European Medicines Agency (EMA), and whether the European Union has adopted an EU herbal monograph for it.

The difference between a herbal medicine product and a food supplement is not always clear. It mainly depends on how a product is marketed. Only herbal medicine products can make medicinal claims, meaning that they can be used to treat a specific health condition. In addition, the content of active ingredients or compounds varies between the two segments.

Figure 3: End-market segments for Ayurvedic ingredients in Europe (food supplements are the main market segment for Ayurvedic ingredients)

Source: ProFound, 2023

Food supplements

This study focuses on the market for food supplements, as this is the most relevant market for Ayurvedic ingredients. An enormous number of food supplements, including Ayurvedic ingredients, is for sale in Europe. Almost all supplement manufacturers offer products containing Ayurvedic ingredients because there are so many available. The quality requirements for entering the market for food supplements are less rigorous than those for herbal medicine products.

The food supplements sector has more room for innovation as new Research & Development (R&D) and product development are key. Manufacturers are interested in sourcing new ingredients to differentiate themselves on the market, diversify their supply base, reduce their sourcing risk, and improve margins. Although food supplements are often based on traditional recipes, more and more companies are innovating by adding new ingredients which are unfamiliar as supplements in Europe. In general, the UK and France are more open to the introduction of new products than Germany or Italy.

Because this is a trend-sensitive segment, there is a risk that ingredients that are popular today may lose out to a new ingredient or ingredient category tomorrow. This means that the effort that you put into marketing your Ayurvedic ingredient in Europe involves the risk of not earning back your investment. Another factor to consider is that because the quality requirements for ingredients are lower than for herbal medicine products, so are prices.

Europe has many food supplements manufacturers. In addition to several large (multinational) players, many local players exist as well. Examples of manufacturers include Pharma Nord (Denmark), A. Vogel group (Switzerland), Abtei (Germany), Purasana (Belgium), FutuNatura (Italy), Natures Aid (UK) and Simply Supplements (UK).

Herbal medicine products

The market for herbal medicine products is largely composed of product mainstays for which clinical evidence exists and which have a strong consumer following (such as turmeric (Curcuma longa L.) and ginseng root (Panax ginseng)). The European herbal medicine and CAM industries are investing in new product development, extraction technologies and research into medicinal plants. Nevertheless, given the strict requirements, product development in Europe is very limited.

As a result of the strict quality control requirements of health authorities, herbal medicine product manufacturers maintain a close control over their value chains. Manufacturers of herbal medicine products tend to stay with the same suppliers of raw materials, making it difficult for new producers to enter the market. In general, it is risky and expensive for manufacturers to change suppliers. Except in the case of products that are hard to source, buyers are unlikely to switch to cheaper suppliers outside Europe, because the prices for European extracts are acceptable. In addition, buyers need to control and document the quality of all active substances throughout their supply chain (in a Common Technical Document, or CTD). Many developing country suppliers find it difficult to meet the relevant quality and legislative requirements.

Examples of herbal medicine product manufacturers in Europe include Salus Haus (Germany), Schwabe (Germany) and Tilman (Belgium).

Tips:

- See the CBI study on buyer requirements for natural ingredients for health products for more information on requirements that apply to herbal medicine.

- Read the CBI study on the threats and opportunities in the European natural ingredients for health product markets. This will provide you with useful information about the European health products market as well as information that can increase your chances of market access.

- Visit trade fairs to find out whether the industry is open to your product, gain more market information, and find potential buyers. Trade fairs will also give you the chance to speak to end users and distributors, and to assess your competition and how competitors market their products. See the CBI study on tips for finding buyers in the natural ingredients for health products sector for an overview of trade fairs in this sector.

- Look at local practice for potential traditional or innovative Ayurvedic ingredients. What do people use to ‘stay healthy’ in your country? Build up a file on traditional uses and support this with clinical tests. You can use this kind of information to approach European traders, ingredient processors and food supplement manufacturers.

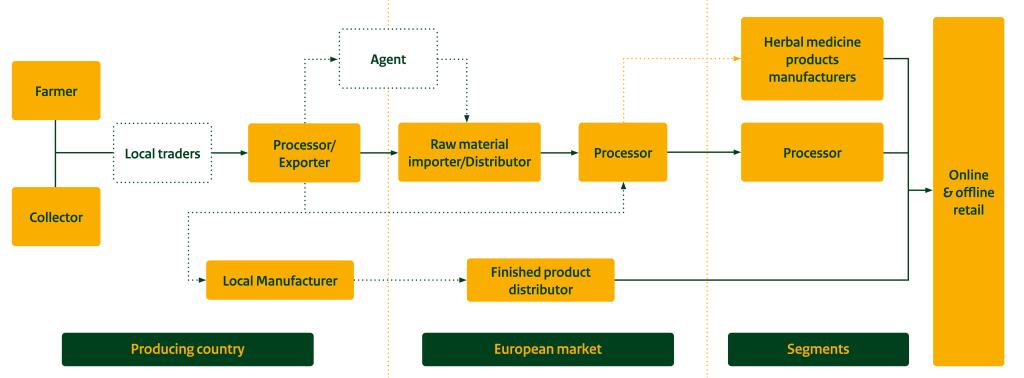

Through what channels do Ayurvedic ingredients end up on the end-market?

Figure 4 shows a simplified value chain for Ayurvedic ingredients, from production to the European end market. The plants can be cultivated or collected from the wild. Commonly, exporters also include processing activities. They may source raw materials from local traders or directly from farmers and/or collectors.

Figure 4: Export value chain for Ayurvedic ingredients

Source: ProFound

Importers or distributors of raw material

In general, European importers and distributors are your most important entry point for the market. They may trade in up to 500 different species, as well as other ingredients. Some will supply a wide variety of conventional, organic and/or fair-trade ingredient lines. Their clients include processors and manufacturers of cosmetic, supplement, food, and herbal medicine products.

Specialisation is becoming less common among importers and distributors, but some European players specialise by:

- Focusing on only one sector – for example ingredients for food supplements, herbal medicine products or cosmetics;

- Limiting the products that they offer – for example, only producing extracts or active principles, or offering ingredients from a particular region;

- Focusing on certified ingredients – for example, organic, FairWild and various fair-trade labels.

You can trade your Ayurvedic ingredients through either general or specialist players, depending on the:

- Size of your company;

- Type of products you supply;

- Certification and documentation required.

Examples of European companies that source ingredients from emerging economies are:

- Extractors and traders such as the Martin Bauer Group (Germany)

- Distributors such as IMCD (the Netherlands)

- Specialist organic importers such as Organic Herb Trading Co (UK) and Tradin Organic (Netherlands)

Agents

An export agent is a firm or individual that undertakes most of the exporting activities on behalf of an exporter, usually for a commission. In contrast to importers/distributors, agents do not buy products themselves but contact potential customers on your behalf to sell your products. Agents can be found in producing countries as well as in Europe. As an exporter from a producing country, you can work with agents who represent and act on your behalf on the European market. You can look for commercial agents on the website of Internationally United Commercial Agents and Brokers (IUCAB).

Processors and manufacturers

Europe has many companies that process ingredients. They mainly buy their raw materials from importers and distributors. Processing varies from basic processing to the isolation and modification of specific molecules. Processors sell ingredients to the end-product manufacturers of herbal medicine products and food supplements, sometimes via ingredient distributors.

Increasingly, however, processors and end-product manufacturers are also sourcing key ingredients directly, instead of going through importers. They do this to guarantee quality, price, and a sustainable supply for ingredients with a high supply risk. These may be ingredients that are used in high-volume end products, with a high-risk supply situation, or ingredients with a crucial active component.

If you have sufficient staff to guarantee a consistent level of service, you may consider supplying processors or end-product manufacturers directly in order to obtain a better price. Supplying these players directly requires both a consistent quality and quantity of supply and good company and product documentation. You will need good logistics to enable you to deliver small quantities at a short notice when required. You will also need to convince the manufacturers to expand their supplier network instead of using an existing supplier, which can be difficult but is not impossible.

If you are a small supplier, it may be easier for you to trade through smaller processors. These often require lower quantities and still play an important role in the industry. Moreover, the quantities required for many less-traded medicinal and aromatic plant species are, and will continue to be, limited.

Examples of processors and manufacturers on the European market that import raw material directly from origin are Indena (Italy), Naturex and Greentech (France).

Finished product distributor

Some of the finished products marketed as Ayurvedic products that are available on the European market are imported directly from producing countries, mainly India. These products are mainly sold on the European market through online retail channels, such as Sat Nam and AyurMarket.eu. This means that you could consider selling your raw material to a local manufacturer of Ayurvedic products.

Examples of well-established manufacturers of Ayurvedic products in India are Siddhayu and Maharishi Ayurveda. Both companies sell their products around the world.

The choice of selling your raw materials to a local manufacturer or to a European importer will depend on your business philosophy, capacities, and needs. Factors to consider include the fact that establishing contact with a local manufacturer may be easier and less costly. Selling to local manufacturers may also lead to faster payments than when you export your products.

On the other hand, selling your raw material directly to European importers can give you access to a broader international market, and selling abroad could enable you to negotiate higher prices for your raw materials. However, this will depend on your negotiation skills, your relationship with your buyer, the characteristics of your product and the market conditions.

Figure 5: Example of a finished product of Siddhayu, manufactured in India

Source: Siddhayu

Tips:

- Consider whether you will be able to become a trusted, long-term supplier for larger players on the European market. Ask potential buyers what assessment they have for such suppliers and about their application process.

- Be prepared to send high-quality samples to prospective buyers, who will test your samples to assess whether you are a credible exporter. This will give you an advantage when seeking to enter the European market.

What is the most interesting channel for you?

As an exporter of Ayurvedic ingredients in a producing country, importers/distributors are the best channel. They provide:

- Global sourcing;

- Analysis and quality control;

- Rectification;

- Blending;

- Product documentation; and

- Sales to processors and end-product manufacturers.

It is important to realise that European importers and distributors are becoming bigger and more powerful, and they may therefore demand additional services from their suppliers (such as audits and certifications) at lower prices. Large buyers also want to limit the number of suppliers that they source from, focusing on those that can supply a particular quantity reliably and provide quality documentation.

In general, large buyers work with suppliers that have passed a buyer’s pre-assessment process. Becoming a buyer’s preferred supplier can give you some stability on the market, boost your sales, and enhance your company’s reputation. However, you will also need to meet the demand for larger volumes and very high service expectations.

If you can show that you are a reliable partner and can provide a high-quality product that meets volume and delivery requirements, these companies can offer good opportunities for market entry.

Tips:

- Research the market to find the right company or division within a company or network. Begin by looking at company websites and making contact at trade fairs.

- Visit trade shows to connect with European buyers. You can use this opportunity to get contact details and network with buyers that source Ayurvedic ingredients. Examples include Vitafoods, Nutraceuticals Europe, SANA, and Health Ingredients Europe.

- Make sure that you can meet the demands of large buyers for additional services before targeting them. Can you meet their demands regarding quantity, delivery schedules, documentation, financial reporting and auditing, price and quality?

- Look for small or specialist traders if you cannot meet additional demands from large buyers. This is especially relevant if you are a small producer or a processor without a marketing and sales team.

- See the CBI study on tips for finding buyers in the natural ingredients for health products sector for useful information and guidance on finding buyers.

3. What competition do you face on the European Ayurvedic ingredients market for health products?

India is by far the largest producer and exporter of Ayurvedic ingredients. However, you may also face competition primarily from Asian countries, but also from African and Latin American suppliers, since the category of Ayurvedic ingredients covers such a wide range of ingredients.

Which countries are you competing with?

As well as India, other competitive suppliers to Europe include major producers of botanicals and their extracts, such as China. There may also be competition from countries with an extensive system of traditional medicine and a high level of biodiversity, such as Sri Lanka, Nepal, Vietnam, and Thailand.

Table 1: European import values for MAPs and botanical extracts for selected countries, 2022, in thousands of euros

|

MAPs |

Botanical extracts |

|

|

India |

163,448 |

75,523 |

|

China |

69,747 |

235,302 |

|

Thailand |

10,800 |

1,884 |

|

Vietnam |

2,547 |

91,487 |

|

Sri Lanka |

2,407 |

129 |

|

Nepal |

288 |

15 |

Source: ITC Trade Map, 2023

India: The birthplace of Ayurveda

Ayurveda originated in India over 3,000 years ago, making India the largest and most important supplier of Ayurvedic ingredients. India is able to supply all the ingredients that fall into this category.

India is Europe’s largest supplier of medicinal and aromatic plants (MAPs). In 2022, India supplied 13% of the total value of European imports of MAPs, up from 8.9% of total European supplies in 2018. With regard to botanical extracts, India supplied 6.1% of the total value of European imports in 2022, an increase from 4.9% in 2018. This means that India ranks as the fourth-largest non-European supplier of botanical extracts to Europe, after China, Vietnam, and the United States. The share of Indian imports into Europe grew partly due to its rich heritage in herbal medicines and growing awareness of and interest in Ayurveda in Europe.

Imports also grew because India has an abundant availability of ingredients, strong manufacturing expertise, and a clinical research industry. Suppliers in India can produce and process at a significant scale. Moreover, India has a sophisticated processing industry that produces extracts and some patented ingredients on the European market. The Indian online magazine ‘Express Pharma’ predicts that India will become a global leader in the nutraceutical industry, both in terms of being a growing market and as a supplier of ingredients to the rest of the world.

India’s other strengths include government policies, low costs, and the development of rural areas. The Indian government actively promotes Ayurvedic medicines at a global level. Since 2014, India has had a Ministry of Ayush which aims to revive knowledge of India’s ancient systems of medicine while promoting the development and propagation of the systems and their products. It may therefore become easier for Indian producers to export Ayurvedic ingredients to the European market in the future.

However, India also faces challenges. European buyers have concerns over quality and quality consistency, including adulteration. The EU’s Rapid Alert System for Food and Feed (RASFF) portal indicates several notifications of contamination with respect to products from India, including ethylene oxide in spices, food supplements and ashwagandha. This database lists food safety risks notified by national food safety authorities in Europe.

China: Leading supplier of botanical extracts to Europe

Some botanicals used in traditional Chinese medicine are also used in Ayurvedic practices. These include ginger (Zingiber officinale), turmeric (Curcuma longa), frankincense (Boswellia Serrata), bitter melon (Momordica charantia), and gotu kola (Centella asiatica). China can offer some of these products in high volumes at low prices. For example, ginger production is mechanised in China, allowing producers to supply it at a reliable quantity and quality, while also meeting delivery times and food safety requirements.

China is also a strong competitor in botanical extracts used in food supplements. In 2022, China was by far the largest supplier of extracts (excluding opium, liquorice, and hops) to Europe in terms of value. The country accounted for 19% of the value of European imports.

Processors in China also produce extracts from non-indigenous species, buying raw materials from producers in other countries, creating high-volume capacity. This makes China a strong competitor to other exporters. China’s other strengths are its government support for its agriculture sector, for example, through the provision of subsidies and market price support programmes.

However, Chinese producers also face challenges. Research shows that European perceptions of China have deteriorated in recent years and have declined further since the start of the COVID-19 pandemic. European buyers also point to increased interest in buying products or ingredients that are not made in China. There are several reasons for this:

- A growing Chinese market for botanicals means lower volumes are available for exports;

- Buyers are concerned over quality control;

- China’s reputation suffered due to the pandemic, and logistical challenges also made it difficult to source products from China.

Sri Lanka: Ayurvedic tradition and large-scale production of MAPs

In 2022, Europe imported only very small amounts of botanical extracts and medicinal and aromatic plants from Sri Lanka, representing only 0.2% of the total value of imports. Sri Lanka is a significant exporter of MAPs, but most of the country’s exports are destined for India and Pakistan, where the MAPS are most likely processed further and consumed domestically or exported to international markets. The main ingredients grown in Sri Lanka that fall under Ayurvedic ingredients are gotu kola and tulsi, and spices like turmeric, cardamom, and ginger.

In Sri Lanka, Ayurveda is considered a valuable and integral part of the healthcare system, culture, and way of life. For Sri Lankans, it is very common to consume spices and herbs that are part of the Ayurvedic system and are known for their health benefits.

The cultivation of these plants in Sri Lanka is chiefly facilitated through community-based or out-grower systems. In part, this is to facilitate the export of the raw material. The Sri Lankan Export Development Board (EDB) supports companies that have established small-scale farming units with the goal of increasing production. Participating companies have access to firsthand insights into emerging product trends, services, and technologies. Sri Lanka has a regulatory framework in place to oversee the supply and value chain, ensuring the quality and safety of these products.

One specific challenge in Sri Lanka is that the export of ingredients typically involves many actors, with the exception of exporters that have their own plantations or engage in out-grower systems.

Nepal: Heritage in traditional medicine and a wide range of MAPs

Ayurvedic ingredients found in Nepal include Amala (Indian gooseberry) and neem (Azadirachta indica). The country’s position in the global MAPs market is small, however, but MAPs are significant within Nepal’s basket of exports. Nepalese exports of MAPs amounted to 6,800 tonnes in 2022, meaning that Nepal ranked in 29th place globally. In 2016, it ranked at number 49 on exports in this sector. Over the years, the number of processors operating in Nepal has increased, improving its position in terms of export potential.

Nepal is seen as an attractive source of MAPs within the global health market. This is especially due to Nepal’s wide variety of wild-harvested and cultivated MAPs. In addition, the country’s image with its spiritualism, mountainous landscape and rich heritage in traditional medicine is attractive for buyers as it gives ingredients from Nepal an interesting marketing edge.

Nevertheless, the sector faces several challenges in Nepal, which mean that buyers sometimes prefer to source from other countries. One of the main challenges is the country’s underdeveloped infrastructure, particularly since MAPs are mainly produced in mountainous areas. This results in inadequate connections to urban centres and transportation networks. Over-harvesting is another concern, as local communities may not prioritise long-term sustainability.

The sector has seen some foreign investment efforts, which may further boost the export position of Nepal in the world. Examples include the promotion of sustainable trade in Nepal by TRAFFIC. In mid-2023, the Government of Nepal and the World Bank jointly launched a $275 million (€254 million) Accelerating Nepal’s Regional Transport and Trade Connectivity (ACCESS) Project. This project aims to help improve trade and connectivity by reducing trade and transport costs and transit time in selected transport corridors in Nepal.

Vietnam: A large exporter of botanical extracts

Vietnam produces a wide variety of MAPs, many of which are used in the traditional Vietnamese medicine. Some of the MAPs cultivated and wild-harvested in Vietnam are also used in Ayurveda, such as gotu kola, holy basil and bitter melon.

Exports of MAPs to Europe are relatively small, with European imports from Vietnam worth €2.4 million in 2022. With regard to botanical extracts, however, Vietnam was the second-largest non-European supplier to Europe, after China. It supplied 7.3% of total European imports. This shows that Vietnam has a substantial processing industry and can deliver value-added Ayurvedic ingredients.

Supplies of botanical extracts from Vietnam grew very rapidly between 2018 and 2022. The value of botanical extract imports into Europe was just €562,000 in 2018, but had reached over €91 million by 2022. European imports went up in 2021, likely due to the European Union-Vietnam Free Trade Agreement. This agreement entered into force in August 2020, and lifted tariffs on almost all Vietnamese products imported into Europe.

Several international projects have taken place in Vietnam with the aim of developing the sector further. For instance, since 2011, TRAFFIC has been working on fostering community participation in the sustainable collection of MAPs. This included securing commitments from buyers to purchase sustainably harvested products. Helvetas also focuses on creating a sustainable and equitable value chain for medicinal plants in Vietnam. It aims to protect botanical diversity and help Vietnam establish itself as an international supplier of natural products that can sustain and promote biodiversity.

Thailand: Cultivation of a wide range of MAPs

Thailand’s traditional medicine, known as Samunphrai Thai, is influenced by Ayurveda, Chinese medicine, and local knowledge. Some of the herbs widely used in Thai medicine are also important in Ayurveda.

In 2022, Thailand accounted for 0.2% of European imports of botanical extracts and 0.8% of European imports of MAPs. Thailand cultivates a large variety of MAPs, including Holy Basil (tulsi), which is used in Ayurveda.

Thailand’s key strengths include its rich agricultural resources, as well as the fact that most Thai producers of herbs have implemented the GAP and GMP certification schemes. Challenges that Thailand faces include poor infrastructure, political instability and a large informal economy which makes exporting difficult. However, the country has planned several large infrastructure projects, which may improve Thailand’s position as an exporter to the European market.

Tips:

- Find out whether your country has a programme to help exporters to improve the cultivation, harvesting, processing and export of MAPs or botanical extracts. Contact your local chamber of commerce or government ministries of trade to find out.

- Help manufacturers build their story by documenting and visualising your product and company’s unique value proposition. You can base this on your country’s image, or your sustainable wild collection, how you support communities, or the traditional uses of your product. This will also add to your own marketing efforts. Manufacturers can use this information to market their end products in Europe.

- If you can only produce MAPs on a small scale, engage with local processors to sell your products. You could also cooperate with other farmers to share the costs of investing in processing equipment or to reach a sufficient scale to export the product in powder for health.

- Ensure proper harvesting, post-harvesting and processing as well as proper documentation to utilise the opportunities to add value to your product. You can use this to show (potential) buyers that you are a reliable supplier of raw materials for health products and that you can consistently achieve a high standard of quality.

Which companies are you competing with?

Most of the companies mentioned below produce their ingredients in India, and all have a strong track record in supplying Ayurvedic ingredients to the European market. Some examples of companies operating in Sri Lanka, China and Nepal are also provided.

Suppliers from India

Ixoreal Biomed: This is a nutraceutical company with offices in the United States and India. The company was established with one purpose: to promote the awareness and use of ashwagandha. They produce only one product: KSM-66 Aswagandha. This is a full-spectrum extract of ashwagandha (‘full-spectrum’ extract is an extract which maintains the balance of the various individual components in the original herb, without over-representing any one constituent). KSM-66 can be found in hundreds of products in over 40 countries, including many European countries.

The company’s supply chain and production are fully vertically integrated, allowing it full traceability of its product. The company also has several social impact projects at the production level. Production is certified as organic. The company holds a range of quality and food safety certifications such as FSC22000, BRCGS, SQF and ISO9001 and ISO22001, and is also For Life-certified (which certifies its corporate social responsibility).

Arjuna Natural: This is a leading manufacturer of standardised botanical extracts, with over 30 years of experience. Arjuna Natural produces specialty, branded ingredients, as well as standardised ingredients. An example of an Ayurvedic branded ingredient is TRI-LOW, a full-spectrum extract of the bioactive ingredients found in the Indian gooseberry or amla (Emblica officinalis).

The company has stringent quality control in place for raw materials. Other strengths of the company are that it has a CSR policy, and that its manufacturing practices meet international standards. In addition, the company has an inhouse team of experienced scientists that has developed over 100 patents, as well as a global sales and distribution network.

NaturaYuva: is a relatively new company based in Switzerland, founded in 2018. In 2019, it established a sister company in India. The company has a strong focus on sustainability. It aims to support and transform smallholder growers to adopt natural farming or agroforestry farming methods. It works with a large network of smallholder farmers in India.

The company’s long term ambition is “to conserve 3,500+ medicinal plant species and restore 100,000 hectares of degraded land towards regenerative organic agroforestry.” These are propositions that resonate very well with European consumers and manufacturers. The company specifically targets customers in Europe. Their products are all traceable and organic certified.

Cultivator’s: This company was founded in 1988, and is a major Indian supplier of herbs, botanicals, spices, nutraceuticals, supplements and oils to the international market. The company is certified as organic, Fair for Life, FairWild, and their processing facility holds quality and food safety management certificates such as BRCGS, ISO22000 and ISO9001. Cultivator’s has an in-house testing laboratory that complies with international standards. They have European distribution warehouses in Bulgaria and Spain, enabling them to supply their clients fast.

Botanical Healthcare: This company offers both branded and natural organic botanical extracts and powders. AshwaMind is one example of their branded ingredients. It is a full-spectrum extract of the bioactive ingredients found in ashwagandha.

Botanic Healthcare controls the entire supply chain by working closely with their partner farmers and by carefully testing and manufacturing herbal extracts, which can be traced back to their point of origin. Their production facilities are BRCGS, and FSSC22000 certified.

Marudhar Impex: This is one of India’s largest private labelling and manufacturing companies. It offers a wide range of herbal extracts and herbal powders from India for use in food supplements. These include almost all Ayurvedic ingredients, such as ashwagandha, tulsi, and Bacopa monnieri. The company’s strengths include its organic certification and quality assurance with ISO 22000 and Good Manufacturing Practices certifications.

Chinese suppliers that offer Ayurvedic ingredients

FocusHerb is a Chinese supplier of botanical extracts and plant extracts. It sells to customers in the health food, nutraceutical, cosmetics and pharmaceutical industries around the globe. It is organic certified and has obtained several quality system certifications including ISO9001 and ISO22000.

Other examples of exporters of processed herbal ingredients in China are Shaanxi GTL Biotech Co., Greensky Biological Tech. Co., Drotrong Chinese Herb Biotech Co. and Natural Healthcare Group. All these companies have multiple quality system certifications in place.

Sri Lankan suppliers

An example of a Sri Lankan company offering a variety of herbs is Greenfield Bio. The company holds several food safety management certifications and is also Fairtrade and organic certified. EAOS Organics is also from Sri Lanka, and is the country’s largest exporter of essential oils but also exports herbs, such as gotu kola. They hold several certifications including Fairtrade, organic and FSSC 22000.

Nepalese suppliers

One Nepalese exporter of herbs and spices to the European market is Shambhala Herbal & Aromatic Industry. An example of a local Ayurvedic product manufacturer that exports its products all around the world is Everest Ayurveda. This company is Czech-Slovak-Nepalese, with production in Nepal and import and wholesale activities in Czech Republic and Slovakia.

Tips:

- Differentiate yourself in the marketplace by improving your communications in terms of personal sales techniques, business communication, and online and traditional marketing materials. Even after quality and legislative hurdles have been overcome, intercultural communication skills, including trade fair participation, can continue to be a challenge for many suppliers.

- Build long-term and sustainable trading relationships with your buyers. Trust is necessary on both sides: for the supplier and the buyer. Respond promptly and always follow-up. A good website with information on your company, products and certifications can help you do this. Take a look at the website of Arjuna Natural, for instance, to see what type of information they provide.

- Supply consistent quality and quantities at stable prices. This will help you to develop robust supplier/buyer relationships.

- Make sure that quality improvements to your product match buyers’ requirements/specifications and their willingness to pay for them. Quality improvements can be costly, and you need to ensure that you will can an adequate return on your investment.

- For more tips on building trade relationships and finding buyers, see the CBI studies entitled Tips for doing business and Tips for finding buyers in the natural ingredients for health products sector.

Which products are you competing with?

You could be competing with a wide variety of products, depending on how your ingredient is marketed. Remember that your product is linked to ancient Ayurvedic traditions, and many of the below examples are not. Ayurvedic medicine could be your marketing edge, provided this is backed up with scientific proof of the health benefits, of course.

Examples of competitors for your ingredient, depending on your ingredient and the way it is marketed, could be:

- Ingredients that support brain health: the Ayurvedic herb Bacopa monnieri has been used in traditional medicine for longevity and cognitive enhancement. Supplementation can improve memory, at least in the short-term, and there may also be some mental health benefits. Other common supplement ingredients for improving cognition, and thus your competitors, include blueberry, caffeine, Ginkgo biloba, ginseng, Huperzine A, oxiracetam, and theanine.

- Ingredients that reduce anxiety and stress: there is scientific evidence to show that the Ayurvedic herb ashwaghanda can reduce stress and anxiety. Supplements that are your competitors could be magnesium, lavender, kava, saffron, and inositol. There is good evidence that all these ingredients can also help to reduce anxiety levels to a moderate degree.

- Other ancient, traditional systems of medicine: consumers who are looking for ingredients with an ancient tradition may also be interested in other traditional systems of medicine. Examples include Traditional Chinese Medicine (TCM) or Traditional Thai Medicine. Popular herbs in TCM include dandelion, echinacea and ginger. Note that Ayurveda is less widely known than Chinese medicine, but is the fastest growing of the complementary and alternative medicines in Europe.

Build a marketing story for your Ayurvedic ingredients that shows how they differ from rival products. This is especially important if you are targeting the food supplements market. You can base this on histories regarding the ancient use of the ingredient or the nutritional content, by referring to studies and results of clinical trials. Support your story with a literature study on the potential and traditional use of the ingredient on health issues. For example, see the website of KSM-66 ashwagandha (India). This company backs up the benefits of its product with independent research and clinical studies.

Tips:

- Research the market for potential substitutes. Find out how your Ayurvedic ingredients compare in terms of nutritional profile, price, supply security/sustainability and ease/costs of substitution. Make sure that you have this information available when you talk to potential buyers.

- Diversify your product portfolio to reduce risks. Sales of some products, such as those marketed as superfoods, depend to a significant extent on what is currently in fashion.

4. What are the prices for Ayurvedic ingredients?

The price of Ayurvedic ingredients depends on various factors:

- The product and its properties: a botanical with popular properties that is linked to health benefits may sell for a higher price if it has undergone sufficient scientific tests.

- Level of processing: botanicals that are processed into extracts or even branded ingredients fetch a higher price.

- Cost price: price of raw materials and processing costs.

- Exclusivity and novelty versus availability: popular botanicals with a limited availability may sell for a higher price.

- Certification: certified botanicals may sell for a higher price if you can find buyers willing to pay for certified products.

- Buyer relations: your relationship with your (potential) client and your own negotiation skills.

To illustrate, prices for organic ashwagandha root powder are:

- Export prices from India for 25 kilo package: FOB ₹475 (about €5.30) per kilo.

- Sales price on European market for small packs (sold per kilo): £27 (about €32) per kilo.

- Retail sale price on European market for package of 250 gram: € 57.96 per kilo.

Tips:

- Calculate your production costs using a detailed cost breakdown. Do not forget to include additional costs such as customs, loading/unloading, marketing, samples for chemical analysis and internal transport. Add your profit margin to the cost breakdown to find the selling price.

- When pricing your product, consider the maximum price that the market is willing to pay for it, and the existing demand, your cost analysis and break-even analysis. Ensure that the price reflects the quality and delivery conditions.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research