The European market potential for natural ingredients for digestive health products

Europe is an attractive, growing market that combines product development and innovation with more traditional and established products. Its large manufacturing industry and consumer market rely on high levels of imports of medicinal and aromatic plants (MAPs), saps and extracts. Germany, Italy, France, the United Kingdom, Spain and the Netherlands are the largest national markets. There are lots of opportunities for ingredient suppliers in developing countries but also many hurdles stemming from the regulatory environment.

Contents of this page

- Product description

- What makes Europe an interesting market for natural ingredients for Digestive Health products?

- Which European countries offer the most opportunities for Digestive Health ingredients?

- Which trends offer opportunities or pose threats in the European natural ingredients market for Digestive Health products?

1. Product description

A wide range of botanicals are used to enhance digestive health in Europe. Each acts on different parts of the digestive system and address different conditions.

The most commonly used botanicals include:

- Peppermint, mint (Mentha spp.)

- Senna (Senna alexandrina)

- Rosemary (Rosmarinus officinalis)

- Fennel (Foeniculum vulgare)

- Milk thistle (Silybum marianum)

- Caraway (Carum carvi)

- Liquorice (Glycyrrhiza glabra)

- (Black) Psyllium (Plantago spp.)

- Ginger (Zingiber officinale)

- Aloe vera (Aloe spp.)

- Turmeric (Curcuma longa)

- Boldo (Peumus boldus)

- Artichoke (Cynaria scolymus)

- Roman chamomile (Chamaemelum nobile)

- Chamomile (Matricaria chamomilla L.)

- Green tea (Camellia sinensis)

- Fumitory (Fumaria officinalis)

- Star anise (Illicium verum)

- Anise (Pimpinella anisum)

- Cinnamon (Cinnamomum spp.)

- Cactus (Opuntia spp.)

Some of these botanicals have an EU Herbal Monograph and can be used in herbal medicinal products. However, most can only be used as food supplements.

Digestive Health segment

The digestive system refers to the group of organs and glands that work together to change food into the energy and nutrients the human body needs for growth and cell repair. Good digestive health allows the digestive system to perform these functions and keep the body healthy. Digestive health is also associated with mental health, skin health and a well-functioning immune system.

Many health problems can affect the digestive system. Some are severe and sudden, called acute conditions, while others last a long time, called chronic conditions. Acute conditions are often caused by bacteria or are related to food intake. They can cause symptoms like abdominal pain, changes in bowel habits, indigestion and heartburn. More severe and chronic conditions include Irritable Bowel Syndrome (IBS), Inflammatory Bowel Syndromes (e.g. Crohn’s disease and ulcerative colitis), gastroesophageal reflux disease (GERD), peptic ulcers and Coeliac disease.

Digestive Health and natural health products

Treatments for conditions that affect digestive health vary depending on their cause and severity. Many conditions in the digestive system are treated in consultation with physicians using conventional medicine rather than with herbal products or supplements.

Consumers tend to use natural health solutions for mild digestive problems and to improve general digestive health. In line with changing lifestyles and diets, many consumers choose over-the-counter (OTC) medicines and food supplements. The choice of product depends on whether the consumer wants to improve overall digestive health (preventive) or to relieve specific symptoms (curative).

Food supplements are particularly popular as they are seen as safer and healthier than synthetic ones. To improve digestive health, food supplements (or functional foods) that contain prebiotics or probiotics have become more popular. For mild digestive discomfort, consumers also use herbal infusions to relieve symptoms and provide a feeling of wellbeing. A variety of food supplements based on botanicals are used as laxatives.

There are also herbal medicinal products for digestive problems, but they are less common, and fewer are available to European consumers. Moreover, innovation and product development are much more limited compared to food supplements due to the extensive regulatory processes this segment requires.

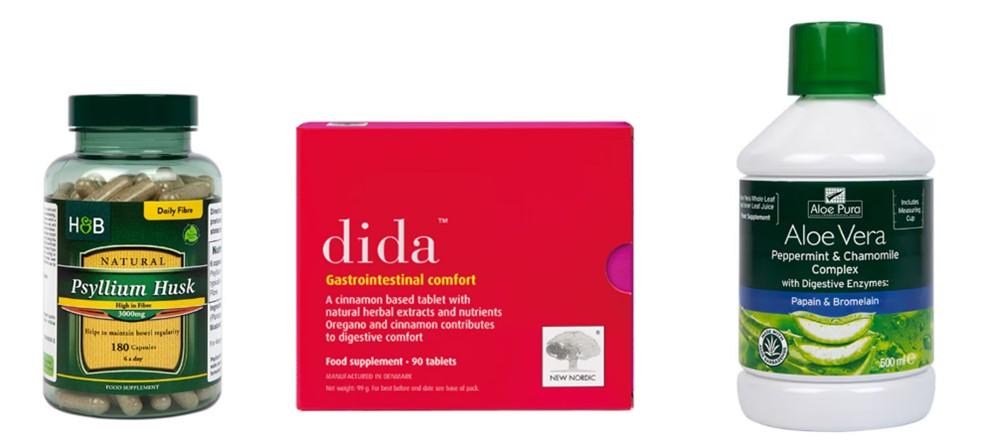

Figure 1: Examples of food supplements for digestive health

Source: Holland & Barrett, 2024

Figure 2: Examples of herbal medicines for digestive health

Sources: Schwabe and Boots, 2024

Tips:

- Look at the list of EU Monographs to find out whether the plant species you export can be used in medicinal products in the European Union, and what specific therapeutic areas it can be used in. You can search the database by using the product’s botanical name.

- Be careful when making health claims about your products. These are regulated in the European Union (EU). Check the European Union (EU) portal on health claims to see what is allowed for food products.

- Note that not all botanicals are allowed in food supplements. Look at positive lists of species that are allowed in food supplements (e.g. the BELFRIT list) or check what is allowed by EU regulation with health authorities and experts.

- Do not make medicinal claims for your ingredient in your product documentation or marketing materials if you are targeting the food supplements market. Claims in food supplements can relate only to function (e.g. slimming or weight control) and risk reduction. For example, you cannot claim that your ingredient prevents or cures specific digestive issues, but you can stress that a certain species can help maintain good digestive health. You should also ensure you have the research to back up your claims.

- Visit Examine for more information on research into the health benefits of your specific ingredient and to access scientific resources.

2. What makes Europe an interesting market for natural ingredients for Digestive Health products?

Digestive health is a large and expanding category in the European market for health products, which has a high level of product development and innovation. Traditional products and ingredients for digestive health are important in an ageing market in which there are ever more cases of gastrointestinal disorders. Europe is also a major importer of medicinal and aromatic plants (MAPs), saps and extracts used in health products, which it uses to supply its large manufacturing industry and consumer market.

Digestive Health is a large and growing category in Europe

Europe is a growing market for digestive health products. Estimated at $14.1 billion (USD) in 2023 (around €13 billion), the digestive health market in the region is forecasted to grow at an annual rate of 7.3% from 2024 to 2030. Growth is driven by consumer awareness of the link between digestive and general health and the growing number of gastrointestinal disorders among the ageing European population.

Over 332 million people are estimated to be living with digestive disorders in Europe, which has led to an enormous economic and social burden. The highest rates are reported in Eastern Europe and less affluent parts of Western Europe.

As a result, European consumers are turning to natural solutions with proven efficacy to support their digestive health. This has led to increased demand for food supplements, functional foods and other products that contain natural ingredients, such as probiotics, prebiotics, fibre and enzymes. Germany, France and the United Kingdom are the largest markets, with Italy and Spain following closely. Scandinavia and the Benelux region also show growth.

Digestive health is an innovative market with many new product launches. For example, at Vitafoods 2024, German-based Symrise launched its latest digestive health products. GutBalance+ is a gummy food supplement that contains cranberry polyphenols. HappyBelly Shot is an on-the-go product that contains prune juice concentrate.

Next to innovation, digestive health is an area of traditional products that have a consolidated market position. For example, Swiss-based company Bayer’s Iberogast was launched more than 60 years ago and has been through clinical trials with more than 50,000 patients. It uses six of the most researched botanical extracts (Iberis amara, Angelica archangelica, Matricaria chamomilla, Carum carvi, Silybum marianum, Melissa officinalis, Mentha piperita, Chelidonium majus, Glycyrrhiza glabra) to relieve multiple digestive symptoms like abdominal pain, cramps, heaviness, bloating, flatulence and nausea.

Europe is a major importer of medicinal and aromatic plants (MAPs) and saps & extracts

Europe imported a total of 219,000 tonnes of medicinal and aromatic plants (MAPs) in 2023, worth €1.3 billion. European import volumes have remained relatively stable over the years. They increased at an average year-to-year rate of 0.6% between 2019 and 2023, while import values increased at an average annual rate of 8%.

In 2023, 47% of the value of all European imports originated from developing countries, up from 44% in 2019. India, Egypt, Morocco, Kenya and China are some of the largest non-European suppliers of MAPs to Europe.

Europe’s largest importer of MAPs is Germany, with over 30% of all of European MAPs in 2023. After Germany, the largest importers in volume are Spain (11% of European total), France (9.7%), the United Kingdom (8.1%), Poland (7.4%) and Italy (6.9%).

These MAPs are used by Europe’s manufacturing industry. Europe is home to some of the most prominent product and ingredient manufacturers in the global nutraceutical industry. As a result, innovation and the development of new botanical-based products are continually progressing.

Source: ITC Trade Map, 2024

Europe is also a major importer of saps and extracts of botanical origin. In 2023, European imports of vegetable saps and extracts were worth €1.2 billion, representing around 34% of global imports. Between 2019 and 2023, imports spiked in value, at 4.3%, and reported a smaller growth of 1.9% in volume.

The share of imports from developing countries is relatively small, but it has increased in recent years. In 2019, only 10% of total European imports of saps and extracts originated in developing countries. This increased to 14% in 2023. China, India, Vietnam, Mexico, Madagascar and Kenya are the largest developing countries that supply saps and extracts to Europe. Note that suppliers from these countries and other economies outside Europe compete with the competitive European extraction industry.

Europe’s largest importer of saps and extracts is Germany, which accounted for around 22% of European imports in 2023. Other large European importers of saps in 2023 include Italy (12%), France (11%), Spain (11%), the Netherlands (9%) and Spain (5%).

Source: ITC Trade Map, 2024

Tips:

- Read to the CBI study on the demand for natural ingredients for health products on the European market for more trade data on herbal medicinal products and food supplements.

- Check online sources like the ITC Trade Map and the EU Access2Markets for more trade statistics on MAPs.

- Check the latest market trends in online magazines, such as Nutra Ingredients: Gut/digestive health, Nutraceuticals World and Vitafoods Insights.

3. Which European countries offer the most opportunities for Digestive Health ingredients?

Germany, Italy, France, the United Kingdom, Spain and the Netherlands are the largest markets for natural ingredient exporters targeting digestive health. They present significant incidences of digestive disorders among their populations and have herbal medicine and food supplement markets that stimulate sales of digestive health products.

Germany

Digestive issues affect around 61% of Germans. The most common digestive complaints are heartburn (36%), stomach pain and diarrhoea (around 25%), and nausea and vomiting (20%).

Germany shows the highest consumer acceptance of complementary and alternative medicine (CAM) treatments, next to Switzerland. Apart from cultural aspects that drive consumption, the popularity of these treatments is high in these countries because some CAM treatments are covered by health insurance. Germany is an important market for herbal medicine, which is recommended by community pharmacies. In total, there are 845 herbal medicinal products that have completed marketing authorisation and registration procedures. Germany is home to traditional herbal medicine companies of all sizes, such as Schwabe, Pascoe and Schaper & Brümmer.

Food supplements also play an important role: Germany is the second largest consumer market in Europe. The market was valued at $14 billion (USD) in 2022. Continued growth is expected, at an average year-on-year growth of 6.7%, reaching $23 billion in 2030. About one third of Germans regularly consume food supplements as part of their daily routines. There is a growing number of food supplements for digestive health in Germany. Examples of German brands that offer digestive health supplements include Salus Haus: IntestCare, Bioherba: Stomach, gallbladder and digestion and Nature Love: Digestion and Metabolism.

Natural and organic health supplements in Germany are viewed as safer and of higher quality. A survey conducted for Food Supplements Europe revealed that nearly 60% of respondents in Germany considered organic, natural or GMO-free labelling important when choosing food supplements.

Germany has a strong tradition of cultivating and using medicinal herbs (440 medicinal plants are cultivated in Germany), such as chamomile, fennel and peppermint. Domestic production does not meet demand, and the country is the largest importer of medicinal and aromatic plants (MAPs) in Europe. Germany imported nearly 67,000 tonnes of MAPs in 2023, valued at €401 million. Between 2019 and 2023, import volumes decreased at an average annual rate of 2.2%, while the value increased at a rate of 8% over the same period. Germany’s main supplying countries were Egypt (12% of imports), Poland (10%), India (10%) and China (6.4%). Large MAP importers in Germany include Martin Bauer, Kräuter Mix and Galke.

Germany is also the largest importer of saps and extracts in Europe. Companies like MöllerPharma, Anklam Extrakt, AromaPlant and Flavex Naturextrakte combine years of tradition and technical expertise. In 2023, Germany imported 7,900 tonnes of saps and extracts, valued at €250 million. Between 2019 and 2023, German imports increased at an annual rate of 3.3% in volume and 4% in value. China, which accounts for 15% of German imports, was the only non-European supplier in the top five global suppliers. Ireland, Spain, France and Switzerland were the main European suppliers. Other important suppliers from developing countries include India (6%), Kenya (4%) and Madagascar (4%).

Italy

Around 90% of Italians suffer from gastrointestinal disorders, with gastroesophageal reflux (44%), followed by heartburn (36.8%), abdominal pain (32.4%), bloating (28.1%), diarrhoea (27.1%), digestive difficulties (25.7%) and constipation (25.4%) being the most common symptoms.

Due to regulatory circumstances, the herbal medicine market in Italy is limited. However, active companies include Aboca, which offers treatments for bloating, IBS and acid reflux. Prodeco Pharma provides specific product lines for intestinal and gastric disorders and diarrhoea.

Italy is the largest food supplement market in Europe. Around 73% of Italians used supplements at least once in 2023. The sector was worth over €4.5 billion in 2023. This market’s focus on digestive health products is clear, with probiotics representing the largest supplement sales category. Sales exceeded €537 million in 2023. Among the main future trends for the sector in Italy is female health, in particular for the support of the gastrointestinal system.

Examples of food supplements on the Italian market that target digestive health include Dr Taffi (e.g. Aloe vera-based probiotic), Boiron (several products targeting digestive health, using ingredients such as fennel, rosemary and other) and Naturando (anti-nausea and anti-reflux, using ingredients like caraway, lemon balm and ginger).

Approximately 73% of surveyed Italians indicated that organic, natural or GMO-free labelling was important to them when selecting food supplements. This is significantly higher than the European average of 56%.

Although Italy produces some medicinal herbs, including chamomile, sage, hyssop, fennel and gentian, the country is one the main importers of MAPs in Europe, and second only to Germany as an importer of saps and extracts. Italy’s MAP imports reached €94 million (15,000 tonnes) in 2023, growing from €70 million in 2019. Italy’s main MAP supplier in 2023 was India, the only emerging economy in its top suppliers. India is followed by Germany, Austria, France and Poland. Italian imports of saps and extracts reached €143 million (8,400 tonnes) in 2023, growing from €93 million in 2019. Its main suppliers in 2023 were China and Vietnam, followed by France and Germany.

There are a few established companies that trade in MAPs and saps and extracts in Italy, such as Minardi and Carlo Sessa.

France

It is estimated that digestive disorders affect half of the French population, with issues such as stomach aches, bloating, diarrhoea and nausea being very common. Women are more prone to these disorders, with 54% experiencing at least one, compared to 41% of men. Regarding more serious chronic conditions, it is estimated that at least 4% of the French population are affected by irritable bowel syndrome.

Next to Germany, France is a leading market for herbal medicine in Europe, even though herbalists have been banned in the country since 1941. France is also the third-largest European market for food supplements. In 2023, the French food supplements market was worth €2.7 billion, up 3% compared to the year before. The supplements market in France is expected to grow at an average annual rate of 6.1% from 2023 to 2028. About 72% of French people consider food supplements to be effective in fighting diseases and supporting their health.

Consumer interest in probiotics is one of the main reasons for the growth in supplements. Interestingly, research shows that two out of three food supplements in France are of botanical origin. Between 2022 and 2023, sales grew by over 10% in pharmacies, 9% in drugstores and 6% in supermarkets. Growth is also driven by online distribution channels.

An example of a brand that offers digestive health products based on botanicals is Laboratoire Naturveda, which also has an online shop. Other interesting companies include Les Trois Chênes (which uses fennel, ginger and anise), Nutergia Laboratoire and Arkopharma (which uses artichoke, fennel and rosemary in its “Digestion” line).

In purchase decisions, 68% of French respondents indicated that they find it important for food supplements to be labelled as organic, natural or non-GMO. This potential is clear in Biocoop, France’s leading organic retailer, which has responded to this demand by developing its own range of 100% organic food supplements.

France is the third largest European importer of MAPs and saps and extracts. It also produces medicinal plants such as lemon balm, mountain arnica and sage. French imports of MAPs reached almost €123 million in 2023 (21,000 tonnes), having increased significantly from €91 million in 2019. Around 13% of imports are sourced through Germany, but its main suppliers include emerging economies like India, Morocco, China and Turkey. French imports of saps and extracts reached €127 million in 2023 (7,700 tonnes), decreasing from €139 million in 2019. Its main suppliers in 2023 were Spain and Italy, followed by China and India. France is home to important companies that are involved in the cultivation, processing and trade of MAPs and saps and extracts, such as Nateva and PhytoFrance.

United Kingdom

43% of the UK population have experienced digestive problems during their lifetimes, but only 59% of them have visited a doctor to discuss their issues. The most common digestive symptoms are abdominal pain (63% of cases), diarrhoea (55%), bloating (53%), flatulence (44%) and constipation (44%). A Mintel report indicates that this number is even higher and digestive disorders affect 86% of British adults.

Herbal medicine has a long history in the UK, with roots in folk healing practices and medicinal traditions imported by immigrant populations (e.g. traditional Chinese and Ayurvedic medicine). The British Herbal Medicine Association has a members list that contains companies involved in herbal medicine in the UK and in other countries. Herbal medicine products in the UK can be recognised by a registration number on the pack (either “THR” or “PL” followed by a series of numbers or letters). Two examples of companies that offer herbal medicine products include HRI (its HRI Milk Thistle product is used to relieve indigestion) and Natures Aid (“Digest Feeze” uses milk thistle as a key ingredient).

The UK population’s growing focus on health has driven demand for vitamins and food supplements. Specifically for the online vitamin and food supplement retailing industry, revenue is expected to reach £1.4 billion by 2025, growing by 1.3% between 2024 and 2025. The diversity of companies involved in food supplements is very high, with examples including Healthspan (which offers health products that use milk thistle, artichoke, peppermint oil and more) and Vitabiotics (which offers health products that use cinnamon, artichoke, turmeric and more). Examples of companies active in Ayurvedic medicine and food supplements include Essential Ayurveda and Maharishi Ayurveda.

Private labels are also important for the UK’s supplement market. Retailers such as Boots and Holland & Barrett have successfully introduced their own brands to consumers. They offer a wide range of digestive health products such as Boots’ turmeric, peppermint and ginger-based supplements and Holland & Barrett’s milk thistle, peppermint, aloe vera, ginger and cinnamon-based supplements.

There is growing interest in herbal teas in the UK, in line with the growing interest for functional beverages. The organic segment of the tea sector is growing. Examples of fully organic UK brands that offer functional herbal teas include Pukka Herbs and Clipper.

The United Kingdom is one of the main importers of MAPs in Europe, accounting for around 8% of total imports in 2023, valued at €103 million (18,000 tonnes). This presents an increase from €71 million in 2019. Its main suppliers in 2023 were India and Kenya, which together accounted for around 20% of total UK imports. Another top supplier is China, which occupied fourth place amongst the UK’s main MAP exporters in 2023, just behind Germany.

The UK’s imports of saps and extracts reached €181 million (18,000 tonnes) in 2023, having declined significantly from €207 million in 2023. Its main supplier in 2023 was the United States of America, followed by the emerging economies India and China. Germany and France complete the list of the UK’s top five suppliers of saps and extracts.

There are a few key players that supply MAPs and/or saps and extracts to the UK market, including the Organic Herb Trading Company, a member of the British Herbal Medicine Association and the Herbal Apothecary, which supplies several herbs and extracts, and manufactures products like tinctures and capsules.

Spain

It is estimated that around half of the Spanish population suffers from digestive disorders. There are more specific statistics for individual disorders. For example, irritable bowel syndrome (IBS) affects 7.8% of the Spanish population and twice as many women as men.

Spain has a rich tradition of herbal medicine, and the population has good knowledge about wild-collected medicinal plants. There are 1,376 documented wild plants in Spain that show potential medicinal uses. In a study conducted in Madrid between 2018 and 2019, it was documented that most participants (nearly 90%) had used medicinal plants to treat health disorders in the previous year. A total of 78 plants were recorded in this study, the most used being German chamomile (Matricaria recutita), valerian (Valeriana officinalis), linden (Tilia spp.) and Aloe vera (Aloe spp.). Soria Natural is a Spanish company that offers single herb extracts for medicinal use. These include artichoke (Cynara scolymus L.), boldo (Peumus boldus Molina) and milk thistle (Silybum marianum (L) Gaertn) extracts for digestive health.

The Spanish food supplement market is the fifth largest in Europe. Consumption of dietary supplements in Spain amounted to over €2 billion in 2023. Around 75% of the Spanish population reported having consumed some type of supplement in 2023. In terms of growth, it is the third-fastest growing market in Europe. It grew by 5% between 2022 and 2023. This growth is mainly driven by Spain’s ageing population, more chronic diseases, allergies and intolerances, and growing interest in improving health. Approximately 59% of respondents in Spain indicated that organic, natural or GMO-free labelling was important when selecting food supplements. This is slightly higher than the European average of 56%.

Vitamins and mineral supplements are the most important category, but supplements with plant extracts are also very popular. About 50% of Spaniards who consume dietary products do so at the recommendation of a doctor and 37% at the advice of a pharmacist. The members’ page of the Spanish Association of Food Supplements contains a long list of companies involved in this sector, and it can be an interesting starting point for further research into this market.

Spain is an important importer of MAPs. In 2023, Spain was Europe’s second largest importer of MAPs. Total imports amounted to €97 million (24,000 tonnes). Between 2019 and 2023, imports were relatively stable, showing a slight year-to-year decline of 0.7%, while import values increased at a rate of 3.2%. Spain’s main supplying countries were Morocco (24% of total imports), Poland (10%), Egypt (8.4%) and the USA (5.9%).

Spain has an important MAP processing industry. For example, Select Botanical offers a wide range of botanical extracts and active ingredients to the pharmaceutical, nutrition and health, and cosmetics industries. Its product list contains a large number of species that target digestive health. One example of a Spanish trading company is Gonmisol, which offers a wide variety (1,200+ ingredients) of raw materials, extracts and active pharmaceutical ingredients.

The Netherlands

In 2019, nearly one in four people in the Netherlands had visited their general practitioner for stomach, liver and/or bowel problems. This amounts to more than 3.8 million people and has resulted in costs of more than €3.7 billion, representing around 3.8% of total healthcare expenditure in 2019.

Herbal medicine is common in the Netherlands. Almost a third of Dutch citizens used herbal remedies in 2022, often alongside medications, according to recent research conducted by Kantar in 2023. One popular brand of herbal medicine is A.Vogel. It produces around 70% of its own raw materials and sources the remaining botanicals. The company has a special line dedicated to digestive health, which uses ingredients like artichoke (Cynara scolymus), dandelion (Taraxacum officinalis), boldo (Peumus boldus) and milk thistle (Silybum marianum).

The food supplement market is also dynamic. In 2022, 41% of Dutch adults used food supplements, spending a total of €1.6 billion, according to the Healthy Lifestyle Monitor by market research company Multiscope. Nearly 2,600 supplements are registered in the Dutch Dietary Supplement Database. There are several food supplement manufacturers in the Netherlands, including private-label manufacturers, such as SKEL Supplements. Famous brands include Royal Green, which offers products that contain ginger, turmeric and other botanicals for digestive health, and Mattisson Lifestyle, which offers digestive health products that contain fibres like psyllium (Plantago ovata), chicory, acacia and agave.

The Netherlands is also the European trade hub for natural ingredients, home to several companies specialised in importing and distributing health and food ingredients. The country was the fifth largest European importer of saps and extracts in 2023 at €106 million, up from €61 million in 2019. Examples of companies active in the import of MAPs and saps and extracts for the health market include Health Ingredients Trading and VNK Herbs.

Tips:

- Determine which market offers the best opportunities for your company. You can get market information from sector associations that you can find on the European Federation of Associations of Health Product Manufacturers website and the online product portfolios of brands or distributors and retailers.

- Read CBI’s study on tips on how to find buyers in the European natural ingredients for health products market for valuable information on how to approach European buyers.

4. Which trends offer opportunities or pose threats in the European natural ingredients market for Digestive Health products?

The fast-growing digestive health market offers many opportunities, especially within the food supplement market, in which there are regular innovations in ingredients. Second, herbal infusions introduce consumers to new ingredients. Lastly, the regulatory environment in Europe is becoming stricter, restricting supply and product development opportunities.

Digestive Health grows in Europe, and provides opportunities for new ingredients

Europe is a growing market for digestive health products. As mentioned previously, this market was estimated at $14.1 billion (USD) in 2023 (around €13 billion), and it is forecasted to grow at an annual rate of 7.3% from 2024 to 2030. The growth in demand for digestive health products, particularly with the food supplement sector, has opened space for a few botanical ingredients. Despite these opportunities, exporters still face difficulties with consolidating their position in the European market compared to more established ingredients and to achieve consumer recognition.

One good example is baobab (Adansonia digitata) fruit, harvested from the ancient baobab tree native to Madagascar, mainland Africa and Australia. Baobab was approved by the Novel Food regulation in 2008. Nowadays, it is commonly marketed in the European food supplement market as an ingredient that improves digestion, increases energy levels and supports immune and general health. Despite overcoming a regulatory hurdle in Europe, baobab markets outside Africa remain underdeveloped, and international consumers still need to be educated on its benefits and taste. For example,a 2018 survey of UK consumers showed that only 23% of consumers had heard of baobab, just 26% of whom had actually tasted it. At the same time, brands like Aduna (UK), Matahi (France) and Baola (Germany) continue to support and promote the product, remaining an important link between exporters and consumers. More information about the market for baobab in Europe can be found in our study on exporting baobab to Europe.

The popularisation of Digestive Health botanicals in herbal infusions

The strong growth of the herbal infusion market in Europe drives the familiarisation of consumers with natural ingredients for digestive health. In addition to boosting demand for botanicals, this development leads to increased consumer awareness, lower risk perception and enhanced credibility of botanicals and their associated benefits in the wider health product market.

Since the 1990s, European tea companies have been experimenting with herbal and fruit tea blends. This has led to more diverse product lines, addressing different health areas and aspects, and higher demand for botanicals with specific health benefits. Among some of the main European markets for infusions that combine herbs, flowers and fruit are Germany, Poland, the United Kingdom and France.

Digestive health is one of the main categories of herbal infusions in Europe. These products use botanical ingredients that are well-known to consumers, and that have associated digestive benefits. For example, German-based Yogi Tea’s herbal infusion Stomach Ease combines fennel, ginger and other ingredients that soothe the digestive system. British company Pukka Herbs’ Digestion and After Dinner products use fennel (Foeniculum vulgare), ginger (Zingiber officinale), liquorice (Glycyrrhiza glabra), mint and peppermint (Mentha spp.), dandelion root (Taraxacum officinale) and other ingredients to aid the digestive process. Both Yogi Tea and Pukka herbs build on the Ayurvedic tradition and principles in their ingredient selection and claims.

Focusing on the laxative functions of its ingredients, Dutch brand Zonnatura’s product Natuurlijke Stoelgang (Natural Bowel Movement) combines fennel seed (Foeniculum vulgare), green oat straw (Avena sativa), hibiscus blossom (Hibiscus spp.), dandelion leaf and root (Taraxacum officinale), rosehip (Rosa spp.) and star anise (Illicium verum).

Supermarket brands have also tapped into the trend, and they have produced private label herbal infusions that address digestive health with well-known ingredients. For example, French retailer Carrefour’s Infusion Digestion Légère (Light Digestion Infusion) combines star anise (Illicium verum), anise (Pimpinella anisum), bitter and sweet fennel (Foeniculum vulgare), and liquorice (Glycyrrhiza glabra).

In addition to the above-mentioned ingredients, other botanicals like chamomile flowers (Matricaria chamomilla and Chamaemelum nobile), senna leaves (Senna alexandrina) and marshmallow root (Althaea officinalis) are also commonly used in herbal infusions related to digestive health.

Despite the growing popularity of the herbal infusion market and its contribution to the popularisation of ingredients related to digestive health, it is important to note that the claims for botanical ingredients used in tea and herbal infusions have yet to be evaluated by the European Food Safety Authority (EFSA).

Increased scrutiny on botanicals on the European market affects Digestive Health ingredients

Botanical ingredients are constantly under scrutiny by European authorities due to the potential risk they pose to consumers. This scrutiny restricts supply and product development opportunities. Halfway through 2024, experts from 26 national food safety agencies in the EU produced a report on substances that should not be used in food supplements or used to a limited extent. Of the 13 substances shortlisted as posing a risk to human health, a few are present in digestive health botanicals and commonly used in food supplements. These include cinnamon (due to its coumaric content), turmeric (due to its curcumin content) and black pepper (due to its piperine content). This creates the risk of the EU taking steps to prohibit or restrict their use in the future, according to Article 8, Regulation No. 1925/2006.

Food safety is a key issue in the European market, and it has led to constant food safety assessments. This makes it essential for exporters to stay up to date with European regulations and developments. This also underscores the importance for exporters to have complete technical dossiers on their products. Technical dossiers provide detailed information about your ingredient, which can help regulators evaluate their safety and suitability for use in food supplements. They also show buyers that your product complies with EU requirements, and it is safe for consumption and consistent, and of high quality.

This increased scrutiny may also provide opportunities and room for other botanicals with digestive health benefits and that have established use in the European market, such as fennel and peppermint.

Tips:

- Stay informed on regulatory changes in the European Union. You can do this by following the food supplement page of the European Food Safety Agency and the food supplement page of the European Commission.

- Identify and analyse common issues that affect the entry of your ingredients into the European market. Search the EU’s Rapid Alert System for Food and Feed (RASFF) database for examples of withdrawals from the market and reasons for these withdrawals.

- Find out about the local practices in your country in relation to botanicals that support digestive health. Traditional uses can be a good starting point when determining new ingredients for the digestive system. For new ingredients, check if there is a history of medicinal use of at least 30 years (15 in the EU).

- Promote your products and educate both consumers and buyers on their health, social and ecological benefits. Look at the company B’Ayoba (Zimbabwe) website for an example of simple and effective communication on both technical and impact data about their baobab products.

Gustavo Ferro, associate expert of ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research