Entering the European moringa market

To enter the European market for moringa, you must meet mandatory requirements set by the European Union (EU). You also should meet the common additional requirements that European buyers and niche markets have, as this will help you access the European market. The European market for moringa can be divided into food supplements and food products.

Contents of this page

- What requirements and certifications must moringa for natural health products comply with to be allowed on the European market?

- Through what channels can you get moringa on the European market?

- What competition do you face on the European moringa market?

- What are the prices for moringa on the European market?

1. What requirements and certifications must moringa for natural health products comply with to be allowed on the European market?

What are mandatory requirements?

You can only export moringa to the European natural health product market if you comply with the European Union’s mandatory legal requirements for natural ingredients for health products. Failure to comply will stop your moringa from entering the European market.

European legislation does not allow the use of moringa in herbal medicinal products or the use of moringa seed oil in food supplements. As such, this study does not cover these applications of moringa.

If the moringa you produce is used in food supplements, you must comply with:

- European General Food Law, which requires all foods marketed in the EU to be safe and traceable

- Food safety requirements, including those on maximum residue levels (MRLs), contaminants in food and microbiological contamination of food, food hygiene as outlined in the EU’s Hazard Analysis and Critical Control Points (HACCP).

- EU food supplement legislation, which lays down requirements on the composition and labelling of supplements.

- National positive lists for botanicals, which specify whether a botanical is already allowed in food supplements, such as the BELFRIT (Belgium, France and Italy) list which lists the moringa plant.

There have been several registered food safety issues with moringa in the EU’s Rapid Alert System for Food and Feed, which resulted in action being taken, including border refusals.

Although Moringa oleifera is not considered a Novel Food, other moringa species are. This legislation requires that consumer safety needs to be assured for ingredients that were not consumed within the EU before 15 May 1997.

In September 2019 the European Food Safety Authority (EFSA) raised safety objections for Moringa stenopetalaas (African moringa), effectively preventing it from being sold as a traditional food, a specific category under Novel Food regulation. The EFSA could not ascertain whether this species could pose a risk for human consumption due to a lack of information.

Tips:

- See the CBI study What requirements must natural ingredients for health products comply with to be allowed on the European market? It provides further information and guidance on mandatory requirements as well as broader requirements to enter the European market for this sector.

- Visit the Access2Markets for more information on import rules and taxes in the European Union. Use Harmonised System Code 07129090 for other dried vegetables and mixtures of vegetables, and HS Code 1219086 for other medical plants and parts of plants.

- Contact Open Trade Gate Sweden if you have specific questions concerning rules and requirements in Sweden and the European Union.

- Check the EU’s Pesticide database for food products where you can find MRLs for moringa pods (nr. 0260030-005), seeds (0401070-001) and leaves (0632030-003).

Sustainable sourcing

Sustainable sourcing is important to buyers given the supply shortages affecting an ever-increasing number of cultivated, but especially wild-collected species. You can stand out from the competition by implementing Good Agricultural and Collection Practices (GACP) to demonstrate sustainable sourcing. Although this is only mandatory for herbal medicinal products, it is also crucial for ingredients used in food supplements like moringa.

Demands for sustainable sourcing are expected to increase as a result of the European Green Deal (EGD) launched in 2019. The EGD is a package of actions to reduce greenhouse gas emissions and minimise the use of resources while achieving economic growth. This means that products sold in the EU market will need to meet higher sustainability standards. As a supplier, you may need to put more rigorous traceability systems in place in order to provide the information that your buyers need from you.

Tips:

- For production of raw plant materials, check the Guideline on GACP for Starting Materials of Herbal Origin (GACP). These are based on the WHO GACP Guidelines.

- Start gathering supply chain traceability information and consider sharing this information with your buyers so that together you can identify and address potential gaps. You can refer to this briefing from Proforest for more information on how to achieve traceability in your supply base and what types of information your buyers are looking for.

- See the CBI study ‘The EU Green Deal – How will it impact my business?’ for more information on the EU Green Deal and its implications.

Documentation

European buyers of natural ingredients require exporters to provide them with well-structured and organised product and company documentation. Buyers use it to verify whether you meet their requirements. The technical dossier should include Technical Data Sheet (TDS), Safety Data Sheet (SDS) and Certificate of Analysis (COA).

Table 1: Content of the Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA)

| Safety Data Sheet (SDS) | Technical Data Sheet (TDS) | Certificate of Analysis (CoA) that matches |

| Product name, description, and classification | Product name, description, and classification | Specifications mentioned in the TDS |

| Hazard identification | Quality that you guarantee to supply | Pre-shipment samples approved by buyer |

| Information on safety measures | Information on applications | Contractual agreements with buyer |

| Certificates |

Tips:

- Ensure that any samples that you send buyers match your documentation. This is because samples are assessed against documentation. For example, do not send samples of lower quality than what you have stated in your documentation.

- Review examples of technical documentation for moringa, such as the technical dossier from Cambridge Commodities or specifications from Amazonas Naturprodukte, as well as this Safety Data Sheet (SDS) for moringa leaf powder and Certificate of Analysis (CoA) for organic moringa powder.

- See the CBI workbook for preparing a technical dossier and technical documents for a cosmetic ingredient for more information on documentation. Certain documentation requirements, such as Technical and Safety Data Sheets, will be similar for health ingredients.

What additional requirements do buyers often have?

Quality requirements

The use of moringa is based on its composition, and so European buyers have specific requirements on composition and nutritional profile. Buyers will usually request a Certificate of Analysis to verify that your moringa meets their quality requirements.

Table 2: Template for Certificate of Analysis

| Type of specification | Example of specification | Explanation of specification |

| Appearance | Fine powder | |

| Colour | Green | The dried powder must look ‘fresh’ |

| Flavour | Characteristic | Flavour is subjective |

| Moisture content | 8-10% | A low moisture content prevents mould and browning |

| Particle size | 50-100 μm | Particle size preferences differ between buyers |

| Heavy metals | ||

| Lead (Pb) | <3.0 mg/kg | Legal limit for food supplements |

| Cadmium (Cd) | <1.0 mg/kg | Legal limit for food supplements |

| Mercury (Hg) | <0.1 mg/kg | Legal limit for food supplements |

| Microbiological activity | ||

| Total plate count | Max 1,000 cfu/g | n.a. |

| Yeast and moulds | Max 100 cfu/g | n.a. |

| Salmonella | Absent | n.a. |

| E.Coli. | Absent | n.a. |

Moisture content must be around 8-10% to prevent mould and browning. Buyers favour high levels of nutrients in moringa and especially high levels of antioxidant activities. The nutritional profile is your main sales argument for moringa powder.

Growing, harvesting, processing and packaging all affect the nutritional profile of moringa powder. The drying process has a particularly significant effect on the nutrients in moringa. Buyers therefore prefer drying methods that preserve as many nutrients as possible. Lower temperatures (~40 degrees Celsius) and shorter exposure to heat (<24 hours) generally result in the preservation of more nutrients.

Several European buyers have complained that they have stopped sourcing moringa because of quality issues. One trader in Germany stated that they “have just tried to find it [moringa] and we have tested a lot of this from different suppliers and then it came out that nothing that we had received was really up to our expectations in our quality standards, so we have stopped it. We never received it in economic quantities, we never got past the sample stage.

To minimise variations in quality, you can also develop Standard Operating Procedures (SOPs), which include instructions on how to conduct specific activities in production.

Tips:

- Invest in the quality of your products before entering the market. You must have at least an HACCP system in place for food safety management. You need to show that your product complies with international standards supported with a certificate of analysis.

- Minimise significant variations in your product quality. Develop SOPs and train collectors and processing staff. Use incentives to ensure that they observe your specifications on harvesting and post-harvest processes, such as offering a higher price for higher-quality raw materials.

- Work together with a local university or laboratory to test your moringa. This can help determine the nutritional composition of your product. This must be included in your product documentation.

- Inform your buyer if you add any substances to your product for preservation. Indicate this clearly in your product documentation. If you fail to do this, buyers may view this as adulteration.

- Consider becoming a member of a moringa association in your country. The benefits of membership include help getting organic certification, which European buyers are increasingly demanding. The Moringa Development Association of South Africa and Association Béninoise du Moringa are two examples of industry associations. Note, there is usually a membership fee for these associations.

Quality management standards

European buyers of natural ingredients for health products increasingly use quality management standards when assessing the credibility of prospective exporters. These are applied alongside the mandatory HACCP standards. Adopting such standards can give your company added credibility and reputation, as it shows your commitment to delivering high-quality products. It also helps to demonstrate that you comply with mandatory requirements.

Examples include:

- International Organization for Standardization (ISO) 22000 food safety management system certification;

- Food Safety System Certification (FSSC) 22000.

Tips:

- Consider carefully whether to comply with the above standards and certifications. Verify whether your buyer truly demands compliance, whether compliance will facilitate market access or enable you to charge a better price, and whether it will benefit your company’s supply security or internal processes. Also consider whether you can gain your buyer’s trust in another way.

- Display the certification wanted by buyers on your website and marketing materials because it gives you an advantage, as buyers use such certification to assess exporters.

Organic ingredients

Across Europe there is growing consumer demand for organic products, a trend that is expected to continue. Many importers consider organic certification as the standard for moringa, because of frequent quality issues.

Many European buyers will not even consider trading with a producer that does not have organic certification. For example, a German importer of moringa said: “Without the organic certification I don’t think you’re really able to compete. You’d have to have a really good story and tell people why you’re not certified organic.”

To market your moringa as organic on the European market, you must meet European Union regulations. You can find information on EU organic certification on the IFOAM website.

Demand for certified ingredients for health products on the European market is expected to continue to grow. As an exporter of moringa from a developing country, you should consider organic certification when targeting the European market.

Tips:

- Consider converting to organic production methods and getting certification as this is becoming a standard requirement for moringa. For example, the South African company Botanica produces organic moringa leaf powder.

- Consult the ITC Sustainability Map for a full overview of certification schemes used in this sector.

Labelling requirements

To export moringa to the European market you must comply with the following labelling requirements:

- The name, address and telephone number of supplier

- Product name and identification, including CAS (chemical abstracts service) number

- Batch code

- Country of origin or place of provenance

- Date of manufacture

- Best-before date

- Net weight

- Storage conditions or conditions of use

If you export organic moringa you must also list the name and/or code of the inspection body and the certification number. Label your products in English, unless your buyer wants you to use a different language.

Tips:

- Set up a registration system for individual batches of your moringa whether it is a blend or not. Mark them accordingly to ensure traceability.

- Check the section on labelling and packaging guidelines in Access2Markets for further information about labelling requirements. The information is presented under ‘product requirements’.

Packaging requirements

Your packaging will need to preserve product quality and prevent contamination. Buyers therefore prefer suitable packaging for the volume ordered, such as a kraft paper bag lined with high-density polyethylene or polypropylene bag that can hold 25 kilograms for an order of that size.

General requirements that you will have to take into account include:

- Always ask your buyer for their specific packaging requirements.

- If you produce moringa powder, package your product in waterproof material. For example, use paper bags that are lined with plastic. Preferably use an eco-friendly lining (such as bio-degradable or recyclable lining). Importers have been steadily banning certain packaging materials for sustainability reasons, as well as to reduce the cost of purchasing and disposing of packaging. Using biodegradable packing materials can give you an advantage on the market and, for some buyers, it may even be a requirement.

- Store bags or containers in a dry, cool place to prevent quality deterioration.

- If you offer certified-organic moringa, keep it physically separated from moringa that is not certified.

Tips:

- Only agree to meet specific packaging requirements of European buyers if you can actually do so.

- Consider using recycled and/or recyclable packaging materials because environmental sustainability is becoming increasingly important to European buyers. Read the guide on packaging to reduce environmental impact for information and guidance on ways to do this.

Payment and delivery terms

For both importers and exporters, Letters of Credit (LC) is thought to be the safest payment term. An LC lets both parties contact an impartial arbitrator, usually a bank, to solve any issues. For the exporter, as long as goods have been dispatched the chosen bank is a guarantor of full payment once goods have been dispatched. Other payment terms include cash in advance, documentary collections and open account.

When agreeing delivery terms with European buyers you must carefully consider the delivery time, volume/quantity of the order and costs. Larger buyers and distributors commonly order moringa in container loads, with around 10-22 tonnes per delivery, according to one buyer. Smaller buyers often buy quantities of 1 tonne or more directly from EU distributors, rather than importing it directly. Importing of a small quantity is not usually cost-effective due to the freight and logistics costs.

The International Chamber of Commerce has developed a set of international commercial terms (Incoterms). These provide guidance on delivery terms and other trade aspects such as packaging or preparing a certificate of origin. The most common Incoterms for moringa are FOB (Free on Board) and CIF (Cost, Insurance and Freight).

Tips:

- Make sure the payment terms you agree on meet your needs as a supplier of ingredients. Do not commit to payment terms that harm your business.

- Conduct risk assessments of the available payment terms before trading with European buyers to help minimise your risks.

- Inform your logistics provider of the special conditions under which your moringa needs to be transported throughout the import-export process. If you cannot assure the right transport conditions, the quality of your products may have deteriorated by the time they reach your buyer.

- Use the Freightos freight calculator to get instant international freight rate information for shipping freight by ship and air. Doing so will allow you to make a more informed decision before agreeing delivery terms with buyers.

- See the CBI study on organising your export of natural ingredients for health products to Europe for guidance on available payment and delivery terms used by this sector.

What are the requirements for niche markets?

Meeting environmental and social standards

European consumers and retailers are putting increasing pressure on companies to ensure their products are made in accordance with social and environmental standards. Some European health product manufacturers have made meeting environmental and social standards part of their policy and strategy.

Whether or not European moringa buyers are interested in certified ingredients depends on the type of health product they produce and how they communicate regarding sustainability with their customers. If moringa is presented as a food product, such as in powder form, certification is more common than for moringa that is sold in tablet/capsule form.

Examples of fair-trade standards include Fairtrade International, Ecocert Fair Trade and Fair for Life

Tips:

- Visit the ITC Sustainability Map for a full overview of certification schemes in the sector.

- Consider UNCTAD BioTrade Initiative as an environmental standard for your moringa. Having additional environmental certifications can help you.

- See the CBI study ‘What is the current offer in social certifications and how will it develop?’ for more information and tips on social sustainability standards.

2. Through what channels can you get moringa on the European market?

On the European market, moringa leaves and leaf powder are used in the food and food supplement industries.

How is the end-market segmented?

The European moringa market can be segmented by end-users for food supplements and the food industry. Figure 1 gives example of moringa products on the European market according to end-user segmentation.

Figure 1: End-market segmentation for baobab products

Sources: Purasana, Bol.com, Holland & Barrett, Amazon.co.uk

Food supplements

Global demand for moringa ingredients was estimated at US$5.8 billion in 2018 and predicted to grow by 8.9% between 2019-2025. Of the total global market of US$10 billion in 2025, the European market is predicted to be US$2 billion. Moringa powder is sold in the form of capsules or powder.

Moringa powder is used in food supplements because of its beneficial health properties. Based on its composition, moringa is commonly marketed in the EU as supporting immune health, improving general health and increasing energy levels.

Europe has many food supplements manufacturers. In addition to several large (multinational) players, many local players exist as well. Examples of manufacturers include Pharma Nord (Denmark), A. Vogel group (Switzerland), Abtei (Germany), Purasana (Belgium), Naturando (Italy), Natures Aid (UK) and Simply Supplements (UK).

Food industry

Moringa leaves and leaf powder are used by the food industry because of their functional and nutritional properties. For example, the meat sector uses moringa leaf, seed and powder as preservatives and antioxidant additives, while the bakery sector uses it for nutritional fortification. Retailers also selling moringa-based products, such as moringa tea made from moringa leaves.

Tips:

- See the CBI study on Which trends offer opportunities of pose threats on the European natural ingredients for health product market. This report gives you useful information about the European health products market and will help increase your chances of market access.

- Visit trade fairs to test if the industry is open to your product, get market information, and find potential buyers. They will also give you the chance to speak to end-users and distributors, and to and gauge your competition, especially the way they are marketing their products. See the CBI study tips for finding buyers in the natural ingredients for health products sector for an overview of trade fairs in this sector.

Through what channels does moringa end up on the end-market?

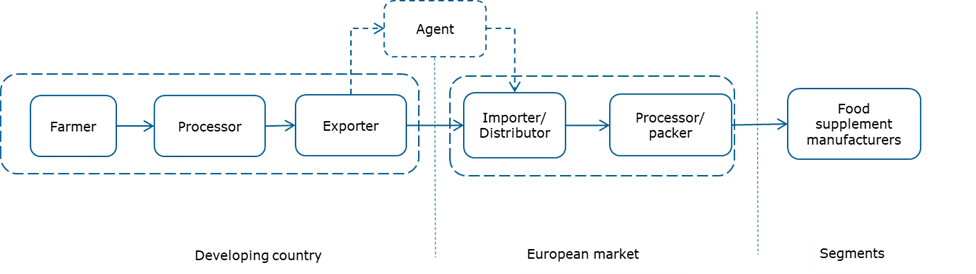

Figure 2 shows the export value chain for moringa on its journey to the European market. This figure shows that farming, processing and exporting activities in countries of origin are often combined in the same company. Similarly, many European importers combine different activities. They can often package moringa under their own label or under the label of their customer.

The production process of moringa powder starts with moringa leaves being stripped from the moringa tree, after which they are washed, drained, dried (room / solar / mechanical), milled, sieved to become leaf powder.

Figure 2: Export Value Chain for Moringa

Source: ProFound

Importer / Distributor

The majority of moringa enters the European market through importers. European importers/distributors usually deal in a wide range of natural ingredients. Their expertise is in the global sourcing of natural ingredients, ensuring the quality and documentary and regulatory compliance, along with selling to processors and natural health product manufacturers. Some importers in Europe import moringa leaves and process them in Europe.

Leading importers/distributors of moringa on the European market include Tradin Organic, Bio Import Europa, Green Origins and Organic Herb Trading Co. These importers/distributors specialise in trading and supplying organic moringa to European natural health product companies.

Agents

An export agent is a firm or an individual that handles most of the exporting activities on behalf of an exporter, usually for a commission. Unlike importers/distributors, agents do not buy products themselves but contact potential customers on your behalf to sell your products. Agents can be found in developing countries as well as in Europe; however, it is not that common for companies to use agents on the European market. As an exporter from a developing country, you can work with agents who represent and act on your behalf on the European market.

Other channels

European processors play a relatively small role in the moringa value chain. Since moringa leaves need to be processed soon after harvesting, most processing takes place in the country of origin. European processors may be involved in the standardisation of moringa leaf powder for protein content or the content of specific vitamins, for example.

Tips:

- Consider expanding your moringa product range. For example, consider including organic moringa, as this will help you find a wider range of customers because some importers/distributors only import organic products.

- Be prepared to send consistently high-quality samples of your product to prospective buyers, who will then test your samples to assess whether you are a credible exporter of moringa. This is standard practice on the European natural health products market.

- Be prepared to meet new buyers who are interested in directly sourcing moringa from you if you are able to supply larger volumes.

- Make the most of the experience and knowledge of specialist European importers and agents rather than approaching food supplement manufacturers directly.

What is the most interesting channel for you?

Importers/distributors are the most interesting channel for you as an exporter of moringa from a developing country. This is because importers/distributors have expertise importing and distributing moringa on the European market, a good understanding of the European health products market, and an established customer base in terms of supplement companies. European importers/distributors also have storage facilities and an established logistics network. This can be very helpful if you are a small or medium-sized exporter of moringa from a developing country that is just starting to export to Europe.

If you have the human resources/staff available, you could supply end-product manufacturers directly and get a better price. To supply these players directly, you must have impeccable company and product documentation, and you will need to ensure a consistent quality and quantity. You will also need to improve your logistics so that you can deliver smaller quantities at a short notice, and convince manufacturers to add another supplier instead of using an existing supplier, which will be difficult.

Tips:

- If you cannot produce sufficient quantities of moringa for European importers, determine whether you can consolidate your offer with other moringa producers in your country.

- See the CBI study tips for finding buyers in the natural ingredients for health products sector for useful information and guidance on finding buyers in channels through which you can enter the European market – particularly importers/distributors, who are your main entry point into the European market.

3. What competition do you face on the European moringa market?

What countries are you competing with?

It is estimated that India accounts for around 80 percent of the global moringa supply. Moringa is also produced in countries such as the Philippines, Bangladesh, Pakistan, South Africa, Ghana, Mozambique, Kenya, Zambia, Pakistan, Brazil and Peru.

Exporters in countries that produce smaller amounts of moringa and who are asked to produce moringa in large volumes and meet high standards of quality, including certified-organic moringa, often face difficulties when in the collection, standardisation and certification processes. Because farmers tend to be small-scale and dispersed, collection and inspection are expensive and it is difficult to achieve a uniform quality. African moringa usually meets requirements on pesticides but can suffer from microbiology issues according to one moringa buyer.

India

India’s strong market position is due to its long tradition of including moringa in people’s diets. Today, moringa leaf powder is produced by large plantations at a comparatively low price. India’s national government, as well as its individual states, also actively support the country’s moringa industry.

Challenges that the Indian agricultural industry faces include a lack of access to good-quality seeds, mechanisation, marketing channels, capital and storage facilities and climate change.

Industry sources have highlighted that Indian moringa is sometimes of poor quality and contaminated, specifically with pesticide residues, even in certified-organic moringa. Several European buyers complained that they had to stop importing moringa from India citing inconsistency and lack of quality, bribery and corruption. Speedy delivery can also be an issue when sourcing moringa from India. However, Indian moringa suppliers offer very competitive prices.

Buyers have indicated that recently there have been issues in contamination with Ethylene Oxide (ETO) gas in Indian shipments of various products. This gas is sometimes used to sterilise spices and packaging materials. The EU’s Rapid Alert System for Food and Feed (RASFF) also checks for ETO contamination in moringa from India. One buyer of moringa indicated that Indian companies are increasingly targeting the US market for moringa as a result of these contamination issues and disagreements with the EU over certification standards. This could provide opportunities for suppliers from other countries.

South Africa

Several parts of South Africa have ideal climatic, agricultural and environmental conditions for moringa cultivation. The South Africa’s Department of Science and Innovation has been working with the Moringa Development Association of South Africa to develop the country’s moringa industry. For example, by establishing moringa farms where moringa trees have been planted and farmers are trained.

According to industry feedback, European buyers find it easier to work with South African suppliers because of their native English and high level of professionalism. With regards to the nutritional profile, there is no difference between moringa coming from South Africa and India. However, South African moringa is a bit more expensive. Moringa production in South Africa is relatively well-developed.

Ghana

There are large and small-scale moringa farms established in the country. Ghana’s government as well several Non-Governmental Organisations (NGOs) are supporting and developing the country’s moringa industry. Examples include the Moringa Association of Ghana together with NGOs are helping farmers cultivate and process moringa.

A lot of moringa powder from Ghana is exported to the UK market. Ghana supplies moringa oleifera. However, the production of moringa in Ghana is hampered by land degradation, pests and disease.

Mozambique

Moringa production in Mozambique is still in in a developing stage. The commercial production is expected to grow with governmental support. The supply chain of moringa in Mozambique is still underdeveloped. Moringa farmers lacking cultivation and processing knowledge and climate change.

Industry sources have highlighted a lack of flights to Europe, long waiting times for delivery via shipping, language barriers and safety concerns as challenges European buyers face when importing from Mozambique. Production of moringa takes place on a small-scale in the country.

Kenya

Kenya has an established commercial moringa production industry that is continuing to develop. In recent years, a number of organisations have been supporting Kenyan farmers cultivate moringa. For example, the International Tree Foundation NGO has helped farmers plant more than 25,000 moringa trees and provided training on cultivating moringa.

Moringa production in Kenya is still in an early stage. Both Moringa oleifera and Moringa stenopetala (African moringa) are cultivated in Kenya. Moringa is also consumed by local communities. There is a potential for further development of moringa production. However, moringa cultivation is threatened by pest attacks and disease.

Zambia

The NGO CELIM Zambia is leading a project that aims to plant around 75,500 moringa trees, as well as providing farmers practical training on cultivating moringa successfully. The Zambian government is also focusing on moringa production as part of its plans to develop the country’s economy. Lack of access to capital and essential knowledge on producing and processing moringa in a way that complies with European quality standards are some of the main obstacles that Zambian farmers face.

Exporters of moringa from Zambia are not capable of supplying larger volumes when compared to countries like India. The production of moringa is still developing. Exporters of moringa sometimes struggle to meet the quality standards that European buyers have.

Tips:

- Find out if your country has programmes helping exporters like you harvest, cultivate, process and/or export moringa. You can do this by contacting government ministries of trade in your country. They sometimes provide assistance to help you export moringa.

- Consider joining organisations in your country that help cultivate, process and export moringa. Examples include the Moringa Association of Ghana and Moringa Development Association of South Africa.

- Compare your products and company to competitors from other supplying countries. You can use the ITC Trade Map to find exporters in each country, and compare market segments, prices, quality and target specific countries. Use the Harmonised System Code 07129090 for other dried vegetables and mixtures of vegetables and HS Code 1219086 for other medical plants and parts of plants.

What companies are you competing with?

For smaller suppliers it will be very difficult to compete with Indian companies on price. Therefore, you need to develop a unique selling point (USP) for your moringa. This could be:

- High quality: European buyers struggle to source high-quality moringa, meaning moringa with a high concentration of nutrients (such as antioxidants activities and vitamins), bright green in colour instead of brown or yellow, and with a good taste profile.

- Organic certification: India dominates the market for conventional leaf powder, but struggles to meet strict European requirements for organic moringa. According to European buyers, several shipments of organic moringa from India contained pesticides that are banned in the European organic market. These problems have resulted in stricter checks on Indian organic moringa, creating opportunities for other suppliers with an organic certificate.

- Marketing story: maybe you work with smallholder farmers or support rural communities, for example.

Indian companies

One of Fresh Mantra Organics LLP’s key strengths is its commitment to exporting high-quality EU Organic certified moringa to the European market. The company also has ISO 22000:2018 Food Management Systems certification specifically for manufacturing and supplying organic food and food supplements. This is another of the company’s key strengths. Other moringa companies from India include Aayuritz, Mother Herbs and Organic India.

Indian companies also compete in the standardisation of moringa. Some even produce ingredients registered as intellectual property. For example, Sabinsa produces a standardised ingredient from dried Moringa oleifera leaves with a standardised minimum level of antioxidant activity.

Mozambican companies

MoSogari is able to export high-quality certified organic moringa to the European market, which has been cultivated and processed in accordance with its Corporate Social Responsibility (CSR) policy. The company’s CSR policy concerns capacity building and creating food and health awareness, and it strives to meet the United Nation’s Millennium Development Goals in the local community.

Zambian companies

One of Moringa Initiative Ltd.’s key strengths is its ability to export high-quality moringa. The company also provides benefits and services to its employees; these include training, childcare and free housing and healthcare on its on-farm basic clinic. In addition, the company provides a monthly allocation of moringa to all employees.

Examples of other African companies that are entering the market for moringa include:

- Botanica Natural Products from South Africa

- Moringa Connect from Ghana

- me Moringa from Kenya

- Moringa Malawi from Malawi

These companies differentiate their moringa products from Indian products by focusing on quality and an interesting marketing story. There is also a producer of organic-certified moringa on the island of Tenerife, which is part of the European Union. This company uses its European location as a USP.

Tips:

- Consider obtaining certification that proves you meet organic, social and environmental standards. Examples include, European Union (EU) Organic, Ecocert Organic, Ecocert Fair Trade, Fairtrade International and Fair for Life certification.

- Ensure you have an online presence and that your website is up-to-date. Prospective European buyers frequently use the internet to find and assess prospective companies of moringa for natural health products before doing business with them.

What products are you competing with?

Which products you will compete with on the European market depends on how the products are used. This section includes three examples of products with a high nutrient content which are marketed for a wide range of health benefits. Barley grass and the seaweeds spirulina and chlorella have a similar taste profile to moringa. Turmeric is another ingredient that originates from India, is marketed for a very wide range of health benefits in Europe, similar to moringa.

Barley grass

Barley grass derived from Hordeum vulgare (commonly known as barley), is a rich source of vitamins A, B and C, iron and calcium, and antioxidants; it lowers sugar levels, and protects against bacterial and viral infections. Barley is cultivated in several countries around the world; with Russia, Australia, Germany, France and Ukraine being the largest producers according to FAO. A key strength of barley grass powder is that it contains an exceptional range of nutrients including Vitamin B1 and C, and calcium, and it is rich in fibres.

Research found that barley grass powder is the best functional food for cell nutrition and detoxification in nutritional and health products all over the world. In recent years, there is growing consumer awareness about the health benefits of barley grass. As such, barley grass powder is a threat to moringa. However, climate change is a key issue the barley grass industry faces, as it is sensitive to extreme drought and heat. This is one of its key weaknesses.

Figure 3: Barley grass

Source: Canva

Spirulina and chlorella

Edible algae, such as spirulina and chlorella, is a niche market that is predicted to grow as European consumers become more aware of the nutritional benefits of seaweed. Edible seaweed falls into several categories such as red, green and brown algae. In recent years, there has been increasing demand for green algae spirulina and blue-green algae chlorella because of their wide range of health benefits. Spirulina and chlorella are therefore competitor products to moringa.

The health benefits of spirulina include being high in omega-3 fatty acids, riboflavin, thiamine, iron and copper. The health benefits of chlorella include riboflavin, thiamine, iron and copper. Spirulina and chlorella are therefore rival products to moringa.

Figure 4: Spirulina tablets and powder

Source: Canva

Tips:

- Familiarise yourself with products competing with moringa that are available on the European market and learn about their strengths and weaknesses. You can do this by reading the CBI study on turmeric.

- Position yourself against competing products by highlighting the strengths of your company and your moringa. For example, highlight its high quality – which you can prove by the certification you hold – as well your company’s Corporate Social Responsibility, if applicable. MoSogari is a Mozambican company that does this well.

- Build a marketing story for your moringa which places emphasis on its key strengths. The Zambian company Moringa Initiative Ltd is a company that does well, as it clearly informs prospective buyers about moringa’s key strengths.

- See the CBI study on exporting seaweeds or marine algae for more information on these products.

4. What are the prices for moringa on the European market?

The market price of moringa has increased slightly in the last couple of years because of growing demand. The market is dominated by moringa from India. The wholesale price (FOB) of moringa powder ranges from USD 3.5-6 per kilogramme. Organic moringa powder is priced at (FOB) USD 8-30 per kilogramme. The CIF price of moringa oil ranges between EUR 20-40 per litre.

However, there is still a lot of cheap low quality moringa on the market. Price of moringa hugely depends on the quality.

An importer of moringa stated: “There’s a huge difference in quality – I’d say that really defines pricing. So if you have high-quality products you can really get good prices as a producer but if you have low quality and you’re competing with India or Cambodia or South American producers, well then prices can only go one way and that’s down.”

Figure 5 gives an example of the price breakdown for moringa exported from Zambia to Germany, which is sold on the Dutch market through an online retailer.

Tips:

- Certification schemes like organic and fairtrade which are becoming increasingly popular on the European market can allow you to charge a premium for your moringa. Make sure you can justify your price with relevant certifications. Organic certification offers a significant opportunity for you as an exporter of moringa in developing countries.

- Consider offering potential buyers discounts as this could help you establish long-term partnerships with them. To avoid losses include discounts offered in your original price calculations so that you do not sell at a lower price than your costs.

This study was carried out on behalf of CBI by ProFound – Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research