Entering the European market for turmeric

The European market for turmeric health products is divided into 2 segments, each with its own market-entry channels and requirements. India controls the global supply of turmeric. However, in the last decade several other supplying countries have gained a position in the European market. Prices of turmeric vary from region to region, country to country, and by quality.

Contents of this page

1. What requirements must turmeric for natural health products comply with to be allowed on the European market?

What are mandatory requirements?

Turmeric can be used in food supplements and herbal medicinal products: each segment has its own separate market access requirements. This study covers both segments and clarifies which requirements you need to comply with for each segment. You can only export turmeric to the European natural health product market if you are compliant with the mandatory legal requirements of the European Union (EU) for natural ingredients for health products.

If your turmeric is used in food supplements, you must comply with:

- European General Food Law, which requires all foods marketed in the EU to be safe and traceable;

- Food safety, which includes requirements on Maximum Residue Levels (MRLs), contaminants in food and microbiological contamination of food and food hygiene as outlined in the EU’s Hazard Analysis and Critical Control Points (HACCP);

- EU food supplement legislation, which lays down requirements on composition and labelling of supplements;

- National positive lists for botanicals, which specify whether a botanical is already accepted for use in food supplements. Examples include BELFRIT (Belgium, France and Italy) and the Pflanzenliste (Germany). The rhizome of curcuma longa and its essential oil are listed on the BELFRIT and the German positive list.

There have been several registered food safety issues with turmeric in the EU’s Rapid Alert System for Food and Feed that resulted in action being taken, including its seizure. Industry sources suggest adulteration is a key food safety issue for turmeric from India and Bangladesh, particularly when supply is low.

If your turmeric is used in herbal medicinal products, you must comply with:

- EU legislation on Herbal Medicinal Products in Directive 2004/24/EC;

- Rules governing medicinal products in the EU, including allowed marketing claims.

There are several other requirements for turmeric in herbal medicinal products. It must also comply with:

- Good Agricultural and Collection Practices (GACP) for raw plant materials

- Good Manufacturing Practices (GMP) for extracts or active substances used as starting materials

- The medicinal use of turmeric as stated by the European Medicines Agency (EMA). This states that turmeric can be used in herbal medicinal products to relieve mild problems with digestion.

Tips:

- Check for common causes of border rejection and product withdrawals on the EU’s Rapid Alert System for Food and Feed database. Examples for turmeric include contaminants, such as lead and unauthorised food ingredients.

- Be ready to demonstrate traceability by documenting your value chain. Traceability is based on the ‘one step back-one step forward’ principle; you must trace food that is used for consumption throughout the value chain.

- See the CBI study ‘What requirements must natural ingredients for health products comply with to be allowed on the European market?’. This study provides further guidance on mandatory and broader market entry requirements for this sector.

- Visit the Access2Markets Portal (previously known as the EU Trade Helpdesk) for more information on import rules and taxes in the European Union.

- Contact Open Trade Gate Sweden if you have specific questions about rules and requirements in Sweden and the European Union.

- See the European Union herbal monograph on turmeric for more information on the authorised claims and forms.

Convention on Biological Diversity (CBD)/Access and Benefit-Sharing (ABS)

To export turmeric to the European Union (EU) you should check whether you have to establish Access and Benefit Sharing (ABS) agreements. These ‘mutually agreed terms’ detail the terms and conditions of access and use of genetic resources and/or traditional knowledge and supply of raw materials. European companies have to comply with ABS legislation in sourcing countries. Although ABS agreements are most important for wild-collected ingredients, buyers will expect you to be aware of and compliant with your country’s regulations on this topic.

Sustainable sourcing is important to buyers, as they are facing supply shortages for an ever-increasing number of cultivated and, especially, wild-collected species. You need to demonstrate sustainable sourcing by implementing Good Agricultural and Collection Practices (GACP). This is mandatory for herbal medicinal products.

Tips:

- Visit the Convention of Biological Diversity (CBD) website for useful information on ABS, including country profiles.

- Put a procedure in place to check whether ABS applies. Contact the competent authorities in your country as a starting point.

- For production of raw plant materials, check the Guideline on GACP for Starting Materials of Herbal Origin (GACP). These are based on the WHO GACP Guidelines.

Documentation

European buyers of turmeric expect exporters to provide them with well-structured and organised product and company documentation because this is used to verify if your turmeric meets their requirements. For example, when asked about documentation in an interview, a European buyer of turmeric replied: “we ask for all the relevant documentation as this is a necessity”.

You must therefore provide buyers with documentation when trying to establish yourself in the European market. Doing so gives you credibility, as it makes you look organised and well prepared, which is key to forming long lasting relationships with buyers.

European buyers of turmeric for health products expect exporters to provide them with a Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA). Table 1 shows what is included in the SDS, TDS and CoA, to help you prepare these three pieces of documentation.

Table 1: What is contained in Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA)

| Safety Data Sheet (SDS) | Technical Data Sheet (TDS) | Certificate of Analysis (CoA) that matches |

| Product name, description and classification | Product name, description and classification | Specifications mentioned in the TDS |

| Hazard identification | Quality that you guarantee to supply | Pre-shipment samples approved by buyer |

| Information on safety measures | Information on applications | Contractual agreements with buyer |

| Certificates |

Acquire an SDS, TDS and CoA for your turmeric and have them ready for European buyers. Additionally, when approaching buyers, inform them of any documentation you have.

Tips:

- Ensure your documentation is up to date and always readily available, as European buyers expect this.

- Review examples of technical documentation for turmeric extract, such as the Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA). For a full list of documents required, consult Access2Markets. There you can select your specific product code and read about requirements depending on the end-market segment. Be aware that all requirements for a specific product are listed; you should analyse which requirements apply to your specific market or application.

- See the CBI workbook for preparing a technical dossier and technical documents for a cosmetic ingredient for more information. Several documentation requirements, such as Technical and Safety Data Sheets, will be similar for health ingredients.

Classification, Labelling and Packaging (CLP) of chemicals

As certain turmeric products are classified as hazardous, you will have to comply with specific legislation on the classification, labelling and packaging (CLP) of your ingredient. In that case, your SDS also needs to include risk phrases and safety phrases, depending on the hazard classification of your turmeric product. Risk phrases indicate the main risks and hazards, while safety phrases indicate the safety measures that need to be taken because of those risks and hazards.

In your SDS for curcuma longa extract, include the following risk phrases:

- R36 – Irritating to eyes.

- R40 – Limited evidence of a carcinogenic effect.

And these safety phrases:

- S22 – Do not breathe dust

- S36/37 – Wear suitable protective clothing and gloves

- S46 – If swallowed, seek medical advice immediately and show this container or label

In your SDS for curcuma longa oil, include the following risk phrases:

- R43 – Causes burns.

- R52/53 – Harmful to aquatic organisms, may cause long-term adverse effects in the aquatic environment.

- R65 – Harmful: may cause lung damage if swallowed.

And safety phrases:

- S24 – Avoid contact with skin

- S37 – Wear suitable gloves

- S62 – If swallowed, do not induce vomiting: seek medical advice immediately and show this container or label

Tips:

- Check the database of the European Chemicals Agency for more information on the hazard classification for the specific turmeric product you supply.

- Check the Your Europe website for more information on CLP legislation and your obligations.

What additional requirements do buyers often have?

Quality requirements

Quality is important to European buyers of turmeric, with one buyer commenting that “quality is the main focus for us”. The main quality requirement that buyers of turmeric have concerns its levels of curcumin content and antioxidant activity. European buyers seek turmeric with higher levels of curcumin content because it is connected to the anti-inflammatory activity of turmeric, which is important when formulating natural health products.

On average, roots contain around 3% curcumin. One buyer of turmeric commented that it is possible to have turmeric with a 4% or higher curcumin content, but that these products are difficult to obtain. The percentage of curcumin in turmeric varies widely based upon the geographical location, climate and growing conditions it is harvested and/or cultivated in, even within a country. Processing also influences the percentage of curcumin.

There are about 30 varieties of turmeric grown in India. Allepey and Madras are the most common ones. The Suvarna variety has a very high curcumin content of about 8.7%.

Speak to European buyers to find out their specific requirements, and meet those requirements. Buyers expect structured company and product information, including Technical Data Sheets, to prove that you meet their requirements. So be prepared to provide this.

European buyers regularly test products they buy, usually on a per batch basis, to ensure that products meet quality requirements and are not adulterated or contaminated. A European buyer of turmeric stated in an interview that “we analyse the products… we also test in our facilities… we check for adulteration”. European buyers also test samples provided by prospective exporters when deciding whether to do business with them.

So always ensure that all products you send to your buyers meet their quality requirements and are not adulterated or contaminated. If you fail to do so, buyers will probably reject the products they ordered, you will bear the financial consequences, and your business relationship with them will probably end.

Turmeric of a consistently high quality is important to European buyers, as it is key to the manufacturing of natural health products. Quality in the health products sector is expected to become more important in the coming years. To minimise variations in quality, you can also develop Standard Operating Procedures (SOPs), with instructions on how to conduct specific activities in production.

Buyers therefore prefer a high-quality turmeric product across all orders in suitable packaging as per order volumes. For example, turmeric powder in polypropylene (PP) lined kraft bags that can hold 25 kilograms for an order of that size.

Tips:

- Standardise, and minimise significant variations in, your product quality. Develop SOPs and train collectors and/or farmers and processing staff. Use incentives to ensure that they follow your specifications on harvesting and post-harvesting processes, such as a higher price for higher quality raw materials.

- Work together with a local university or laboratory to test your turmeric. They can help determine the chemical composition of your product. Make sure to include this information in your product documentation.

- Inform your buyer if you add any substances to your product for preservation. Clearly indicate this in your product documentation. If you fail to do so, buyers may see this as adulteration.

- Only agree to meet specific requirements of European buyers if you can actually fulfil them. Failing to do so could end your business relationship with them.

- Make sure you have up-to-date documentation that is readily available, as buyers will use documentation to assess the quality of your product.

Quality management standards

European buyers of natural ingredients for health products increasingly using quality management standards when assessing the credibility of prospective exporters. These are in addition to the mandatory HACCP standards. Adopting quality management standards gives your company credibility, as it shows your commitment to delivering high quality ingredients, and it boosts your image. It also helps to prove that you comply with mandatory requirements.

So as an exporter of turmeric, consider adopting quality management standards. Examples include:

- International Organization for Standardization (ISO) 22000 food safety management system certification;

- ISO 9001:2015 quality management systems certification (mandatory if your turmeric is used in herbal medicinal products);

- Food Safety System Certification (FSSC) 22000.

The importance of quality management in the health products sector is expected to increase in the future. Quality is very important to European health product manufacturers who want to ensure they meet consumers’ needs.

Tips:

- Carefully consider the need to comply with the above standards and certifications. Verify whether your buyer truly demands compliance, whether compliance will facilitate market access or offer you a better price, or whether it will benefit your company’s supply security or internal processes. Also determine whether you can gain your buyer’s trust in another way.

- Display certification sought by buyers on your website and marketing materials because it gives you an advantage, as buyers use standards to assess exporters.

European Green Deal

In 2019, the European Commission launched the European Green Deal (EGD). The EGD is a package of actions to reduce greenhouse gas emissions and to minimise the use of resources while achieving economic growth. This means that products sold in the EU market will need to meet higher sustainability standards.

Laws are being discussed that will make European manufacturers more explicitly responsible for explaining where and how they produce their products and what impacts these have on people and the environment. This might mean that you need to put more rigorous traceability systems in place to be able to deliver the information your buyers demand of you.

- Start gathering supply chain traceability information and consider sharing this information with your buyers so that, together, you can identify and address potential gaps. You can refer to this briefing from Proforest for more information on how to obtain traceability in your supply base and what types of information your buyers are looking for.

- See the CBI study ‘The EU Green Deal – How will it impact my business?’ for more information on the EU Green Deal and its implications.

Labelling requirements

To export your turmeric on to the European market you must comply with the following labelling requirements:

- The name, address and telephone number of supplier

- Product name and identification, including CAS (Chemical Abstracts Service) number

- Batch code

- Country of origin or place of provenance

- Date of manufacture

- Best-before date

- Net weight

- Storage conditions or conditions of use

- Relevant hazardous symbol (see Figure 1) if you export curcuma longa extract and essential oil because they are classified as hazardous

Figure 1: Hazard labels for curcuma longa extract and essential oil

If you export organic turmeric, your labelling needs to include the name and/or code of the inspection body and the certification number. Label your products in English, unless your buyer wants you to use a different language.

Tips:

- Set up a registration system for individual batches of your turmeric, whether it is a blend or not. Mark them accordingly to ensure traceability.

- Check the section on labelling and packaging guidelines in Access2Markets for further information about labelling requirements. Information is presented under ‘product requirements’.

- Check the database of the European Chemicals Agency for more information on the hazard classification for specific products.

Packaging requirements

Packaging requirements may differ per buyer and per product. Your packaging will need to maintain product quality and prevent contamination. There are some general requirements you will have to take into account. These include the following:

- Always ask your buyer for their specific packaging requirements.

- If you produce powdered turmeric, package your product in waterproof material. For example, use paper bags lined with plastic. Preferably use an eco-friendly lining (such as bio-degradable or recyclable lining). Importers have been steadily banning certain packaging materials for sustainability reasons and to reduce costs associated with the purchasing and disposal of packaging. Using biodegradable packing materials can be a market opportunity and, for some buyers, it may even be a requirement.

- In the case of extracts, use containers of a material that does not react with components of the extract (such as lacquered or lined steel, stainless steel or aluminium).

- Clean and dry the containers before filling them with turmeric to prevent contamination.

- Store bags or containers in a dry, cool place to prevent quality deterioration.

- If you offer organic-certified turmeric, physically separate it from turmeric that is not certified.

Tips:

- Only agree to meet specific packaging requirements of European buyers if you can meet them. Failing to do so could end your business relationship with them.

- Consider using recycled and/or recyclable packaging materials, as environmental sustainability is becoming increasingly important to European buyers. Read the guide on packaging to reduce environmental impacts for information and guidance on ways to do this.

Payment terms

There are several methods of payment. However, for both importers and exporters, Letters of Credit (LC) are considered the safest payment term. An LC lets both parties contact a neutral arbitrator, usually a bank, to resolve any issues. For the exporter, the chosen bank is a guarantor of full payment once goods have been dispatched. Stand-by LCs are frequently used in international trade as they provide security to both importers and exporters who have little trading experience with each another.

Other payment terms include cash in advance, documentary collections and open account.

Tips:

- Conduct risk assessments of the available payment terms before trading with European buyers to help minimise your risks.

- See the CBI study on organising your export of natural ingredients for health products to Europe, which provides guidance on payment terms used in this sector.

Delivery terms

When agreeing delivery terms with European buyers, you must carefully consider delivery time, volume/quantity of order and costs. European buyers generally prefer shorter delivery times. Air cargo is often faster than sea freight, but also more expensive. Sea freight is useful for high-volume shipments, where you will be required to fill a container-load. Since the global COVID-19 pandemic, transportation costs and delays have remained a challenge for exporters.

The global COVID-19 pandemic has created logistical challenges for exporters in developing countries. Delays and higher transport costs are two of the main challenges facing exporters. For example, a European importer of turmeric commented that “we have experienced higher transportation costs”. Challenges for exporters are likely to continue for the foreseeable future as countries around the world recover from measures related COVID-19.

The International Chamber of Commerce has developed a set of international commercial terms (Incoterms). These provide guidance on delivery terms and other trade aspects such as packaging or preparing a Certificate of Origin. Your transport method is also part of these Incoterms and can influence your decisions about the price and contract that you offer.

The Incoterms also specify responsibilities regarding insurance and risk of the transport. You can take out shipment insurance to protect your products during the entire journey from you to your customer. Commonly covered risks include theft and damages. You will need to agree with your buyer who is responsible for the insurance.

Tips:

- Inform your logistics provider about any special transport conditions for your ingredients throughout the import-export process. The quality of your products could deteriorate before they reach your buyer if you cannot assure the right transport conditions.

- Use the Freightos freight calculator to get instant international freight rate price information for shipping freight by ship and air. Doing so will allow you to make a more informed decision before agreeing delivery terms with buyers.

- Consult the website of the International Chamber of Commerce for more information on Incoterms.

- See the CBI study on tips for organising your export of natural ingredients for health products to Europe, which provides guidance on delivery terms used in this sector.

What are the requirements for niche requirements markets?

Organic ingredients

Across Europe there is growing consumer demand for organic products, a trend expected to continue. Many buyers are therefore demanding organic ingredients for their natural health products. As an exporter of turmeric you should therefore consider getting organic certification , as it increases your chances of entering the European market.

To market your natural ingredients as organic on the European market, you must meet European Union regulations. Although the UK left the European Union in January 2021, the EU has agreed to recognise the UK as equivalent for organics until 31 December 2023.

Figure 2: The EU organic logo

Source: ec.europa.eu (2022)

Tips:

- You can find information on EU organic certification on the IFOAM website.

- Ensure you have a Certification of Inspection (COI) that is up-to-date to with the latest changes made by the EU, because it is a mandatory requirement if you want to trade organic turmeric on the European market.

- Inform prospective buyers if you already have a COI. You should also display it and the organic certification logo on your company website and marketing materials. This will make you more appealing to buyers. Phal Flor Export is a company in a developing country doing this.

Environmental and social standards

European consumers and retailers are increasingly putting pressure on companies to ensure that their products are made according to environmental and social standards. European buyers of turmeric are therefore requesting suppliers meet environmental and social standards.

As an exporter, one way you can do this is by gaining verification and certification that proves you meet environmental and social standards. With regard to environmental sustainability, consider meeting UNCTAD BioTrade Initiative and implement the BioTrade Principles. To prove you meet social standards, acquire FLO Fairtrade certification or meet Fair for Life standards.

European buyers might also expect you to comply with company and supplier codes of conducts, as well as ISO 26000 guidance on social responsibility.

Figure 3: Logos of environmental and fair trade certifications

Source: Fair for Life and Fairtrade International (2022)

Tips:

- Acquire verification and certifications that prove your turmeric for health products meets environmental and social standards. Doing so will help you find opportunities in the European market, as the demand for certified turmeric is increasing.

- Inform prospective buyers about certification you have proving that you meet environmental and social standards and display this on your company website and marketing materials.

- See the CBI study ‘What is the current offer in social certifications and how will it develop?’ for more information and tips on social sustainability standards.

- Consult the ITC Standards Map for a full overview of certification schemes used in this sector.

- Consider obtaining certification such as ISO 14001:2015 Environmental management systems, as it shows that you uphold environmental responsibilities.

2. Through what channels can you get turmeric on the European market?

The commercial production of turmeric takes place in several countries around the world, including India, Peru, Madagascar, Costa Rica, Vietnam and China. On the European market for health products, turmeric can be used in food supplements and herbal medicinal products.

How is the end market segmented?

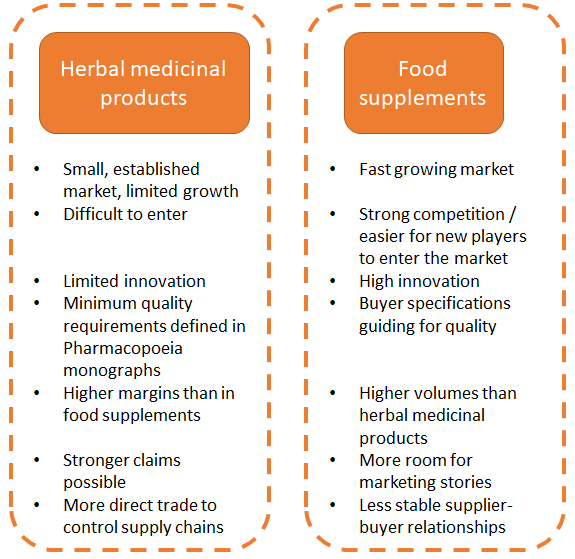

The end market for turmeric can be segmented into 2 main segments: food supplements and herbal medicinal product. You absolutely need to know in which segment your turmeric ends up, as there are big differences in related legislation.

The difference between herbal medicinal products and food supplements is not always clear. This mainly depends on how a product is marketed. Only herbal medicinal products can make a medicinal claim, meaning that they can be used for treating a specific condition. In addition, the content of active ingredients or compounds differs between the 2 segments. Figure 4 presents the segments for turmeric products on the European market.

Figure 4: End market segments for turmeric in Europe

Source: ProFound

The European turmeric market is expected to be worth US$ 41 million (€ 38.3 million) by 2027. Europe is expected to be the fastest growing region, with a forecast Compound Annual Growth Rate (CAGR) of 13% until 2027. Increasing consumer awareness about turmeric’s health benefits is a key driver for this growth. Increasing life expectancy and the growing number of health-conscious consumers are other factors driving growth. Turmeric health products are increasingly sold via online retail channels. Turmeric health products can be segmented into food supplements and herbal medicines.

Food supplements

Turmeric in its powdered, liquid and curcumin extract forms (usually of pharmaceutical grade) is used in food supplements and pharmaceuticals. Turmeric food supplements are made from the dried rhizome and contain a mixture of curcuminoids. Curcumin, the active ingredient, is a major component of turmeric, and the effects of turmeric are commonly attributed to curcuminoids. Brands are offering turmeric supplements with technologies to boost bioavailability—an important goal because of curcumin’s difficulty in being absorbed as it is metabolised quickly.

Turmeric has several health benefits. In food supplements, turmeric is mainly used for immune support, digestive health and joint health. Other applications include liver support, cognition, mental well-being and heart health. For example, Simply Supplements sells turmeric supplements because of its anti-inflammatory properties to support gut and joint health.

Turmeric is used in health products that boost immunity. According to industry sources, the demand for natural ingredients such as turmeric with immune boosting properties has increased during the COVID-19 pandemic, especially in Europe. Industry experts expect this to continue in the foreseeable future.

Herbal medicinal products

In European herbal medicinal products, turmeric can be used to relieve digestive disturbances, such as feelings of fullness, slow digestion and flatulence. Turmeric can be used as a powder, tincture or dry extract in various herbal preparations which are laid down in an EU herbal monograph.

As an exporter of turmeric in a developing country, you must provide European buyers with a product which is of the highest quality, as this is essential to the manufacturing of natural health products. Additionally, speak to buyers to find out if they have specific requirements concerning turmeric’s active properties, and consider meeting those requirements.

Tips:

- Familiarise yourself with turmeric’s nutritional profile and the beneficial health properties it offers to the health product industry. This is important because they are two of turmeric’s key selling points and European buyers often ask questions about this.

- Look for credible literature sources on the benefits of turmeric. Use these references in your product documentation and marketing materials. You can find various scientific studies on platforms such as sciencedirect.com, NCBI and Google Scholar.

- See the European Union herbal monograph on turmeric for more information on its properties, authorised forms and applications.

- Consult the CBI study on Exporting immune-boosting botanicals to Europe for more information about demand for natural ingredients with immune-boosting properties.

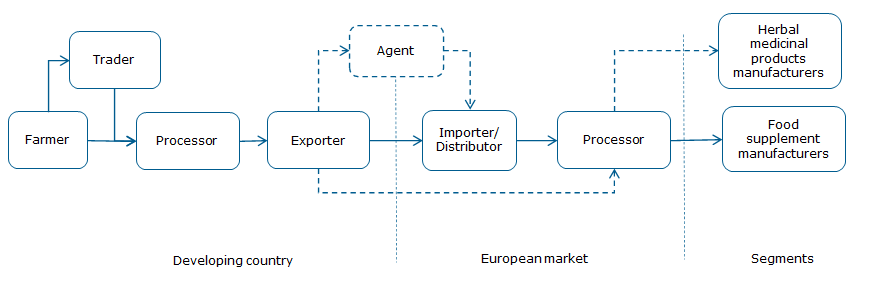

Through what channels does turmeric end up on the end-market?

Figure 5 shows the export value chain for turmeric on its journey to the European market. Turmeric can enter the European market in a powdered, liquid and curcumin extract form.

If you have limited resources and facilities, you can offer turmeric that is processed in 4 steps; these are curing, drying, polishing and colouring. Processing turmeric to extract curcumin requires considerable resources and facilities due to the complexity of the process. This is even more so the case with larger quantities. This process includes milling, solvent extraction, filtration, desolventisation, turmeric oleoresin and crystallisation.

Figure 5: Export value chain for turmeric for health products

Source: ProFound

Importer/Distributor

As a processor/exporter of turmeric, your main entry points to the European turmeric market are importers/distributors. European importers/distributors often deal in a wide range of natural ingredients. Their expertise is in the global sourcing of natural ingredients, ensuring the quality and documentary and regulatory compliance, along with selling to processors and natural health product manufacturers.

The British company Supplement Factory is a leading importer/distributor of turmeric in Europe. It uses turmeric’s curcumin content in its natural health products. Other importers/distributors of turmeric in the European market include Nexira and Forward Farma BV. Some importers/distributors specialise in trading and supplying organic turmeric to European natural health product companies. BioImport is one company doing so.

Agents

An export agent is a firm or an individual that undertakes most of the exporting activities on behalf of an exporter, usually for a commission. In contrast to importers/distributors, agents do not buy products themselves but contact potential customers on your behalf to sell your products to. Agents can be found in developing countries as well as in Europe. However, it is not that common for companies to use agents in the European market. As an exporter from a developing country, you can work with agents who represent and act on your behalf on the European market.

Processors

Europe has a large processing industry. Processors mainly buy their raw materials from importers and distributors. Processing varies from basic processing to isolation and modification of specific molecules. Processors sell ingredients to the end-product manufacturers of herbal medicinal products and food supplements, sometimes via ingredients distributors.

However, processors and end-product manufacturers are increasingly sourcing key ingredients directly, instead of via importers. They do this to guarantee quality, price and a reliable supply over time for ingredients with high supply risks. These can be ingredients that are used in high-volume end-products, ingredients with a high-risk supply situation or ingredients with a crucial active component.

If you have the human resources/staff available, you could supply processors or end-product manufacturers directly and get a better price. You must have impeccable company and product documentation, and you need to ensure a consistent quality and quantity. Moreover, you will need high-quality logistics systems so you can deliver smaller quantities at short notice. You also need to convince manufacturers to add another supplier instead of using an existing supplier, which will be difficult. If you are a small supplier, it may be easier for you to trade through smaller processors. They often require lower quantities and are still important to the industry.

Tips:

- Be prepared to send high-quality samples to prospective buyers, who will test your samples to assess whether you are a credible exporter of turmeric. Doing so will give you an advantage when you are seeking to enter the European market.

- Consider expanding your turmeric product range, for example by adding organic turmeric. This will probably increase your chances of entering the European market, as some importer/distributors only import organic products.

- Be prepared to meet prospective buyers who are interested in purchasing larger volumes if you are in a position to do so.

What is the most interesting channel for you?

As an exporter of turmeric in a developing country, importers/distributors are the most interesting channel. Dutch company Tradin Organic is a leading importer of organic turmeric in Europe. Other importers of turmeric on the European market include Dr. Behr GmbH (Germany) and Curcumaxx (France).

The European finished natural health products market is another interesting channel for exporters. For example, Ayusri Health Products is an Indian company exporting finished curcumin capsules to the European market.

Tips:

- See the CBI study on tips for finding buyers in the natural ingredients for health products sector for useful information and guidance on finding buyers in channels through which you can enter the European market. Particularly importers/distributors, who are your main entry point into the European market.

- Visit trade fairs to test if the industry is open to your product, get market information and find potential buyers. Trade fairs will also give you an opportunity to speak to end-users and distributors, and to assess your competitors, especially the way they are marketing their products. Examples include Vitafoods, Nutraceuticals Europe and Health Ingredients Europe.

- Advertise your turmeric on online platforms, because this is where many small buyers order turmeric in bulk according to their needs. Alibaba and Go4WorldBusiness are examples of such online platforms.

3. What competition do you face on the European turmeric market?

Eurostat data from 2021 showed that India was the largest exporter to export turmeric to Europe in terms of volume. Following India, Eurostat data showed that Peru, Costa Rica, Vietnam, Madagascar and China were the largest exporters to export turmeric to Europe in terms of volume respectively. All these leading exporting countries have an established turmeric industry and have the ideal climatic conditions for its cultivation.

Harvesting seasons differ among top-exporting countries like China (October-December), India (January-May) and Indonesia (August-October). This impacts the competitiveness of your product.

What countries are you competing with?

India

One of India’s key strengths is that its government supports the Indian turmeric industry. This is done by the Spices Board of India, a flagship organisation for the development of Indian spices under the Union Ministry of Commerce and Industry. For example, the Spices Board of India established the Turmeric Task Force Committee. They implemented a project to support turmeric farmers in the Telangana state with integrated pest management, certification and training. In addition, the Tamil Nadu state government has expressed its goal to set up a Turmeric Research Institute.

India’s other strengths include governmental policies, low costs, along with the development of rural areas. It could therefore become easier for Indian producers to export turmeric to the European market. However, climate change has a negative impact on the Indian turmeric supply. Droughts and floods have destroyed turmeric yields and led to fluctuating prices in recent years.

Another key challenge the Indian turmeric industry faces is the adulteration of turmeric with lower-cost botanical ingredients, starches, chalk powder, cassava, and synthetics which negatively affects its quality.

According to a European buyer of turmeric from India, contamination with ethylene oxide (ETO) gas has also been an issue in turmeric from India. This gas is sometimes used to sterilise spices and packaging materials. However, the same buyer expects this problem to be solved soon. The Indian Spices Board has developed guidelines for exporters to prevent ETO contamination.

The global COVID-19 pandemic has caused disruption to supply chains, creating several challenges to Indian producers and exporters of turmeric. For example, one exporter of turmeric stated: “we had some logistical problems getting goods from factories to ports… some areas of India have restrictions and so transportation has been an issue”.

Adulteration, along with the likely impact of COVID-19, particularly higher transport costs and longer delivery times, will probably affect the perception of European buyers. This is because buyers expect a high-quality product delivered on time at a reasonable cost.

Peru

Peru’s strengths include its membership of the Pacific Alliance Trade Bloc, being rich in agricultural resources, a developing agricultural sector, and its governments commitment to improving infrastructure. As such, it could become easier for Peruvian producers of turmeric to export to the European market.

However, climate change and deforestation are two key challenges the Peruvian turmeric industry faces because they are endangering turmeric cultivation and production. Other challenges Peru faces include the negative impact of COVID-19 on its agricultural sector, particularly disruption to supply chains, inadequate infrastructure and widespread corruption. European buyers perceive Peru favourably due to its favourable business climate.

Madagascar

One of Madagascar’s key strengths is its production of good quality turmeric which contains high levels of curcumin with a strong smell and taste. Another strength is its government support of the turmeric industry, for example through public-private partnership projects. It could therefore become easier for producers of turmeric in Madagascar to export to the European market.

However, climate change is a key challenge the industry faces because it endangers turmeric cultivation. Another key challenge Madagascar’s turmeric industry faces is the country having high levels of poverty which has resulted in the growth of subsistence farming. Other key challenges Madagascar faces include poor infrastructure, political instability along with unsustainable land management practices.

From 2011 to 2021, Eurostat data show that Madagascar’s exports to the EU almost tripled in volume and value due to an improved trade and investment climate and due to its trade agreement with the EU. This is likely to have a favourable impact on the way European buyers perceive Madagascar.

Thailand

Thailand’s key strengths include its rich agricultural resources along with its government commitment to improving infrastructure. Thus, it could become easier for Thai producers of turmeric to export to the European market.

However, climate change, particularly changing temperatures and more unpredictable rainfall is a key challenge Thailand’s turmeric industry faces because it endangers turmeric cultivation. Other challenges Thailand faces include poor infrastructure, political instability and a large informal economy which makes exporting difficult.

The COVID-19 pandemic has caused disruption to international supply chains, particularly longer delivery times and increased transport costs because of quarantine and lockdown measures. COVID-19 is a challenge for Thailand’s agricultural sector. In an interview, a European buyer of turmeric from Thailand stated that “we have experienced higher transport costs”.

European buyers of Thai turmeric have a favourable perception of Thailand. One buyer commented in an interview that their overall experience of importing turmeric from Thailand has been “very good” because “it’s been quite straightforward” as they “haven’t had any issues”.

China

China’s key strengths include it having suitable conditions for turmeric cultivation and high levels of infrastructure, which is essential to exporting goods successfully. China’s other strengths are its government support for its agriculture sector, for example through the provision of subsidies, and market price support programmes. As a result, it may become easier for Chinese turmeric producers to export to the European market.

However, Chinese producers of turmeric face challenges, such as a loss of agricultural land, declining soil quality and pollution. Recent research revealed that European perceptions of China have been worsening in recent years, and have worsened further since the start of the COVID-19 pandemic.

Indonesia

Turmeric is widely cultivated in Indonesia due to it having favourable conditions for its cultivation; this is one of Indonesia’s key strengths. In recent years Indonesia’s government has been developing its agricultural industry, and it has made commitments to continue doing so; this is another of Indonesia’s key strengths. Thus, it may become easier for Indonesian producers to enter the European market.

However, compared to countries such as India, which dominates the global production of turmeric, Indonesian exporters may not be capable of supplying large volume orders. Other challenges facing Indonesia include climate change, its high exposure to natural disasters and a lack of infrastructure, which can make it difficult to export goods.

Indonesia is a member of the regional trading bloc ASEAN. A study from 2021 found that 57% of EU business community members are looking to expand their current level of operations within ASEAN.

Tips:

- Find out if your country has programmes helping exporters like you harvest, cultivate, process and export turmeric. Do this by contacting government ministries of trade in your country as they sometimes provide assistance to help you export your turmeric.

- Consider joining the Global Curcumin Association because they offer a range of assistance to exporters of turmeric from developing countries like you.

- Position yourself against competing countries. For example, turmeric adulteration is a key challenge the Indian turmeric industry faces, thus ensure your turmeric is unadulterated and notify European buyers of its higher quality compared to countries where adulteration is an issue.

- Compare your products and company with those of competitors from other supplying countries. You can use the ITC Trade Map to find exporters per country, and compare market segments, prices, quality and target specific countries.

What companies are you competing with?

Many established companies export turmeric to the European market. A professional website with well-prepared content is something established companies have. The chosen companies named below all have one. Their websites will include sections informing prospective buyers about the companies themselves, how they source and process their turmeric along with its technical details, as well as the certifications they hold, accompanied by professionally taken photographs. As a result, European buyers are likely to perceive these companies positively.

Indian companies

Indian companies will be your main competitors for the raw material. They can offer products at a low price. Companies from India are the main developing country suppliers of turmeric extracts. If you produce an extract yourself, they will be strong competitors. Some Indian companies even have patented ingredients based on turmeric on the European and North American markets. It will be difficult to compete with these companies. You would need to invest a lot in research & development to develop intellectual property of your product and to obtain patents.

One of Suminter India Organics key strengths is its commitment to exporting high-quality natural and organic ingredients in socially responsible and environmentally sustainable conditions. Another of its key strengths is the wide range of certification proving the turmeric complies with international standards. For example, Suminter India Organics holds European Union (EU) Organic, Good Manufacturing Practice, British Retail Consortium Global Standard for Food Safety and Fairtrade certification, and its turmeric is produced and processed according to HACCP guidelines.

The company has a range of turmeric products, for example organic turmeric powder with a minimum curcumin content of 2% and 4%, which gives it a wider prospective customer base. The company also displays a comprehensive and detailed product description on its company website and has its own processing facility and in-house quality assurance department. These are two of the company’s other key strengths.

Peruvian companies

IREN PERU is a Peruvian company exporting turmeric to the European market. One of the company’s key strengths is its integration into Grupo Iren, which has a distribution facility in Spain. This simplifies the logistics for European buyers. The company’s commitment to sustainability and responsibility towards people and environment is another of its key strengths.

Elisur Organic is another exporter from Peru selling certified fresh turmeric to countries like Spain, Germany, the Netherlands, Italy and the United Kingdom. One of its key strengths is its company promotion and marketing. The company participates in international trade fairs and publishes its trade fair agenda on the company website. It has been present at Fruit Logistica, Fruit Attraction and Biofach, for example. Its marketing materials, including videos and pictures of its products and Corporate Social Responsibility (CSR) activities, help to create a professional and credible impression among prospective buyers.

Malagasy companies

Phal Flor Export is a company from Madagascar that exports turmeric to the European market. One of Phal Flor Export’s key strengths concerns its commitment to exporting high-quality organic turmeric, with it holding European Union organic and Ecocert Organic certification. Another of Phal Flor Export’s key strengths concerns its commitment to upholding social responsibility standards, with it having Ecocert Fairtrade certification.

Jacarandas also exports (organic) turmeric powder and slices to the European market. The company’s key strengths include its distribution facility in France and quality control by European laboratories, which European buyers tend to regard as more reliable. Another key strength is the vertical supply chain integration. Jacarandas is responsible for the turmeric from harvest to distribution, which guarantees quality and traceability.

Tips:

- Consider acquiring certification that proves the high quality of your turmeric. For example, Good Manufacturing Practice, British Retail Consortium Global Standard for Food Safety certification along with following HACCP guidelines.

- Consider acquiring certification that proves you meet and uphold organic, social and environmental standards. For example, European Union (EU) Organic, Ecocert Organic, Ecocert Fair Trade, Fairtrade, Fair for Life and Fair Wild certification.

- Ensure that you have an online presence and that your website is up-to-date. This is because European buyers frequently use the internet to find and assess exporters of turmeric for natural health products before doing business with them.

What products are you competing with?

Ginger, ginseng and moringa have been identified as competitors of turmeric. Just like turmeric, these botanicals have healthy nutritional profiles and well-researched health benefits. All 3 are used for similar applications in food supplements, mainly for immune support. Other products competing with turmeric are vitamin and mineral supplements and probiotics.

Ginger

Ginger is widely cultivated in parts of the world which have ideal conditions for its growth, specifically tropical and semi-tropical conditions. Most of the global production of ginger is in India. However, importers of ginger have concerns about the quality and cleanliness of India’s ginger, particularly its adulteration. This is a key weakness. Ginger is also widely cultivated in other countries such as Nigeria, China, Indonesia and Nepal, with this being its strength.

Ginger is used in food supplements because of its wide range of health benefits, which is another of its key strengths. The health benefits of ginger include improving digestion, blood sugar levels, and harmful cholesterol levels along with reducing inflammation, nausea and menstrual pain. The health benefits are similar to those of turmeric. According to Eurostat, European imports of ginger from developing countries totalled more than 152 thousand tonnes in 2020, roughly 40 thousand tonnes more than in 2016. The European ginger market is expected to further increase in the next few years due to increasing consumer awareness of its health benefits, along with its growing use in the healthcare industry and spices industry. Ginger is therefore a threat to turmeric.

Many companies export both turmeric and ginger. For example, Iren Peru and Elisur Organic have turmeric as well as ginger in their product portfolios.

Figure 7: Ginger

Source: pilipphoto / Shutterstock.com

Ginseng

China, South Korea, the United States and Canada are the largest producers. There are several species of ginseng, each with their own benefits, that are found and cultivated globally. This is a key strength because it offers formulators choice. For example, Asian ginseng is considered to stimulate the nervous system and enhance cognitive performance whilst American ginseng is thought to regulate hormones, relieve stress, and stimulate the immune system. It competes with turmeric for its immune-boosting properties.

A weakness of ginseng is its unpleasant taste and flavour. Asian ginseng specifically represents a niche product due to a lack of consumer awareness in Europe. However, according to Mintel, American ginseng is in the top 5 of most popular functional ingredients.

Figure 8: Ginseng

Source: tarapong srichaiyos/ Shutterstock.com

Moringa

The moringa plant is native to regions of northern India and Pakistan. India is the world’s largest supplier of moringa, but European importers have strong quality concerns about Indian supply. This is a major weakness. However, the moringa plant is now found across tropical zones in Africa, Asia, islands in the Pacific and the Caribbean, and South America and is also cultivated in other parts of the world. This is a major strength.

Moringa is becoming increasingly popular in the European market for food supplements because of its wide range of health benefits. Health benefits of moringa include it being an excellent source of vitamins and minerals and rich in antioxidants. This overlaps with the nutritional profile of turmeric.

The European market for moringa remains young and underdeveloped. This is a key weakness compared with the vast popularity of turmeric. However, the European food supplement market and global moringa products market are both expected to increase in the coming years. Moringa could therefore potentially be a greater threat to turmeric in the future.

Figure 9: Moringa

Source: Rostovtsevayu / Shutterstock.com

Tips:

- Position yourself against competing products. Do this by highlighting key strengths for both your company and turmeric to European buyers, for example its high quality and the fact that consumers are familiar with turmeric.

- See the CBI study on moringa to learn about its strengths and weaknesses.

- Build a marketing story for your turmeric that places emphasis on its key strengths, for example its high quality as well as any certifications it holds. The Indian company Suminter India Organics does this, as it clearly informs prospective buyers about its turmeric strengths.

4. What are the prices for turmeric on the European market?

The prices of turmeric vary greatly between regions. A buyer of turmeric from India indicates that the market price for turmeric powder has increased to FOB (Free on Board) USD 2.00 to 2.50/kg in 2022. Whereas in other regions, the FOB prices of turmeric powder can reach USD 3-4/kg. Prices for turmeric from India fluctuated in 2020. Pharmaceutical grade turmeric capsules are priced at (FOB) USD 60-100 per kilogramme. The development of turmeric prices will depend on weather conditions and market demand for turmeric.

Interviews with European buyers and importers of turmeric suggest that the market price of turmeric has increased since the global COVID-19 pandemic because of the disruption it has caused to supply chains. Especially in terms of increased transportation costs and delays in receiving orders. For example, an importer of turmeric from Thailand commented: “we have experienced higher transportation costs”. Disruption to supply chains is expected to continue because of lockdown and quarantine measures introduced during the COVID-19 pandemic.

Tips:

- Factor in the implications of COVID-19, particularly increased delivery costs, in your price calculations. If you fail to do so, you could end up with financial loses.

- Monitor the price development of turmeric from India. If you cannot compete with prices from India, make sure the quality of your turmeric is high. This is how you can set yourself apart from your competitors.

- Consult Spices Board India for information about the worldwide spices market, including up-to-date price information.

- Certification schemes can enable you to charge a premium for your turmeric. Ensure you can justify your price with relevant certifications.

This study was carried out on behalf of CBI by ProFound - Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research