Entering the European market for canned fruits and vegetables

The European market offers promising opportunities for exporters from developing countries. Europe’s emphasis on product quality, sustainability and traceability presents unique challenges but also opens doors for exporters who can meet its standards and consumer preferences. With Europe’s growing demand for healthy, convenient and ethically sourced food products, exporters can find significant opportunities. The focus should be on catering to the varied tastes and environmental expectations of Europe’s price-conscious consumers.

Contents of this page

- What requirements and certifications must canned fruits and vegetables meet to be allowed on the European market?

- Through which channels can you get canned fruits and vegetables on the European market?

- What competition do you face on the European canned fruits and vegetables market?

- What are the prices of canned fruits and vegetables on the European market?

1. What requirements and certifications must canned fruits and vegetables meet to be allowed on the European market?

General information on buyer requirements for processed fruit and vegetables can be found in our study about buyer requirements on the European processed fruit and vegetables market. The sector-level requirements are analysed further on the product level for canned fruits and vegetables.

What are mandatory the requirements?

Canned fruit and vegetable products that are sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. Only approved additives are allowed, and products must conform to maximum levels for harmful contaminants. The most common requirements regarding contaminants are related to pesticide residues, microbiological organisms, preservatives and food additives.

Due to the significant optimisation of processing lines and sterilisation used in canning, microbiological contamination is rare in the European market, although it is possible. However, physical and chemical contamination can be present. There were 16 canned fruit and vegetable notifications reported by the European Rapid Alert System for Food and Feed (RASFF) between 2018 and 2023.

A phytosanitary certificate is necessary for the import of fresh and frozen fruits and vegetables into the EU. However, this does not apply to canned versions of these products according to Regulation (EU) 2019/2072.

Contaminant control in canned fruits and vegetables

The European Union (EU) places strict controls on contaminants in food, as per Regulation (EU) 2023/915, which places limits on maximum levels for certain contaminants in food. This regulation is updated frequently. Apart from the limits for general foodstuffs, there are also several specific contaminant limits for specific products. For canned food products, there is one important limit on inorganic tin (maximum 200 mg/kg).

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products. It also maintains a list of pesticides that are authorised for use. In 2023, the European Commission approved 36 new implementing regulations that modified this list through new approvals, extensions and other changes.

Food canning operations, particularly washing, blanching, peeling and cooking processes, can lead to a significant reduction in pesticide residues. Some studies estimate that these activities can reduce residue levels by 10 to 82%. Keep in mind that boiling and canning showed an increase in residues under certain conditions.

Other contaminants

Reasons for canned foods to undergo border rejections and market withdrawals from the European market often relate to corroded packaging, excessive preservative and colouring content, and the migration of materials from the packaging into the foodstuff. One example of an incident related to canned fruit and vegetables is the June 2022 market withdrawal notification from Slovakia concerning a shipment of canned apricots from China. The detected tin content level was 243.14 mg/kg – ppm, above the permitted maximum of 200 mg/kg – ppm.

Product composition

European authorities can reject products if they have undeclared, unauthorised or excessive levels of extraneous materials. There is specific legislation for additives (for example, colours, thickeners) and flavourings, that lists which E numbers and substances are allowed. Authorised additives are listed in Annex II of the Food Additives Regulation. Other annexes of the regulation list food enzymes, flavourings and colourants.

Some canned fruit or vegetable products may be produced with a sulphite treatment. Sulphites are used as an antioxidant to prolong shelf life. Sulphur dioxide and sulphites are considered allergens under Regulation (EU) No. 1169/2011. As a result, their presence must be indicated on the label if the level exceeds 50 mg/kg (white vegetables, including pulses and processed mushrooms) or 100 mg/kg (bottled whiteheart cherries, vacuum packed sweetcorn). Maximum levels are expressed as SO2.

Tips:

- Find the suitable Codex Alimentarius Code of Hygienic Practice for the fruit and vegetable products that are of interest for your company.

- Read more about MRLs on the European Commission website on Maximum Residue Levels. Read the ongoing reviews of MRLs in the EU so you are prepared for potential changes in the MRLs.

What additional requirements and certifications do buyers often have?

Quality requirements

The most common quality requirements for canned fruits and vegetables are the following:

- Normal colour, flavour and odour;

- Uniform size;

- Specific composition of the packing medium;

- Minimum fill of 90% of the volume of the packaging.

Codex Alimentarius Standards for quality requirements for canned fruits and vegetables are listed in Table 1 below.

Table 1: Codex Alimentarius standards for canned fruit and vegetables

| Type of product | Codex Alimentarius standard |

|---|---|

| Fruit | Canned applesauce Canned pineapple Canned raspberries Canned strawberries Canned fruit cocktail Canned tropical fruit salad Canned chestnuts and canned chestnut purée Canned stone fruit (apricots, peaches, plums, cherries) Certain canned citrus fruits (grapefruit, mandarin oranges, sweet orange and pumelo) Certain canned fruits (mangoes and pears) |

| Baby foods | Canned baby foods |

| Vegetables | Canned bamboo shoots Pickled fruits and vegetables Certain canned vegetables (asparagus, carrots, wax beans, green peas, palm hearts, processed peas, sweet corn, baby corn, mushrooms) Preserved tomatoes |

| Vegetable preparations | Regional Standard for Canned Humus with Tehena Regional Standard for Canned Foul Medames Regional Standard for Tehena |

Source: Autentika Global

Food safety certification

Although European legislation does not explicitly require food safety certification for canned fruits and vegetables, most European food importers do require it. Well-established importers will not be interested in your products if you cannot provide the necessary certification. Most European buyers will ask for certification recognised by the Global Food Safety Initiative (GFSI). GFSI recognises a few certifications that meet the GFSI benchmarking requirements. For canned fruits and vegetables, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000);

- Safe Quality Food Certification (SQF).

Make sure to check which certifications are currently recognised by the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements. However, certain retailers may prefer one type of certification over another, or demand additional certifications based on their own internal policies. Major buyers will also usually visit or audit production facilities before starting a business relationship.

For example, UK-based processed foods producer R.H Amar & Co sells BRCGS-certified canned artichoke hearts (PDF) from Peru under its Cooks & Co brand. French family-owned organic brand Markal sells organic canned pineapple slices from Sri Lanka that are IFS-certified.

Corporate social responsibility (CSR) certification

Companies have different requirements for CSR. Many importers will ask canned fruit and vegetable suppliers to follow a specific CSR code of conduct. Most European retailers have their own codes of conduct, such as Lidl (PDF), Rewe, Carrefour (PDF), Tesco and Ahold Delhaize.

Other companies may insist on following common standards, such as the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone, without an audit, is not very complicated or expensive. Other CSR alternatives include Ethical Trading Initiative’s Base Code (ETI), the amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Packaging requirements

Packaging used for canned fruits and vegetables must:

- Protect the taste, colour and other quality characteristics of the product;

- Protect the product from bacteriological and other contamination (including contamination from the packaging material itself);

- Not pass on any odour, taste, colour or other foreign characteristics to the product;

- Be corrosion-resistant (in case of tin cans).

Manufacturers must prevent the migration of unsafe levels of chemical substances from the packaging material to the food. Bisphenol A (BPA) is used to produce epoxy resins found in protective coatings and linings for food and beverage cans and vats. In April 2023, the European Food Safety Authority (EFSA) published a re-evaluation of the safety of BPA, significantly reducing the tolerable daily intake (TDI) of BPA in food contact materials from its previous assessment in 2015. The TDI is now around 20,000 times lower than before.

Consumer packaging varies between aluminium cans, plastic containers, glass jars and plastic pouches. Products in B2B consumer packaging are packed in trays and cartons in various sizes depending on the product and the buyer’s requirements. There are no general rules for the export size of the packaging, so packaging varies from retail sizes of around 400 g (for retail sale) to around 3 kg (for the food service sector).

Labelling requirements

The name of the food must clarify the precise nature of the product as well as any special properties it may have. All ingredients contained in a prepackaged food must be listed on the packaging. The ingredients are listed in descending order of weight.

The following labelling is used in the trade of canned fruits and vegetables:

- Type of product, including style (whole, halves, quarters, slices, pieces, diced, and so on.) and whether the fruits are ‘peeled’ or ‘unpeeled’;

- Defined minimum drained weight;

- Shelf life;

- Composition of the product (packing medium, additives);

- For non-retailer packaging, specifications including crop year and variety.

Information on non-retail packaging must be given either on the container or in accompanying documents. This package labelling must contain the following information:

- Name of the product;

- Lot identification;

- Name and address of the manufacturer, packer, distributor or importer;

- Storage instructions.

However, the lot identification and the name and address of the manufacturer, packer, distributor or importer may be replaced with an identification mark.

In the case of retail packaging, product labelling must comply with the EU Regulation on the provision of food information to consumers. This regulation clearly defines nutrition labelling, origin labelling, allergen labelling and legibility (minimum font size for mandatory information).

On 1 April 2020, new EU rules requiring food businesses to label foods with the country of origin or place of provenance of primary ingredients came into effect. These requirements are set out in Regulation (EU) 2018/775 and apply alongside existing rules in the Food Information Regulation (EU) 1169/2011.

Canned lupin beans are considered an allergen, and this must be indicated on the packaging. Allergens also include sulphites, which are used in the production of canned beans. Sulphites need to be indicated as a potential allergen if levels exceed 10 mg/kg or 10 mg/l. Canned vegetables are sometimes produced together with sauces and spices. Some spices, such as celery, mustard and cumin, are potential allergens and must be indicated on the packaging. For more information on food allergen labelling and information requirements for consumers in the EU, read this European Commission Notice.

Tips:

- Find and download the suitable Codex Alimentarius Standards for canned fruit and vegetable products that your company produces or exports (check Table 1).

- Consult the Sustainability snapshot for canned fruits (PDF) published by the Sustainability Consortium.

- Keep an eye on the EFSA page on BPA and possible changes in BPA regulations, including changes in safety assessments and possible reductions in the tolerable daily intake.

- Consult the useful EU-wide uniform food labelling page provided by the German ministry of food and agriculture and the latest updates on food labelling from the European Commission. If exporting to the UK, consult official UK labelling guidance.

- Refer to industry examples of product technical sheets. For example, this technical sheet for canned pineapple (PDF) from Australian company FTA and this technical sheet for quartered natural artichoke hearts (PDF) from Swiss company Henri Probst.

What are the requirements for niche markets?

Organic canned fruits and vegetables

To market canned fruits and vegetables as organic in Europe, they must be grown using organic production methods that conform to European legislation. Growing and processing facilities have to be audited by an accredited certifier before you can put the EU’s organic logo on your products or the logo of the standard holder (for example, the Soil Association in the UK, Naturland in Germany or Agriculture biologique in France).

Figure 1: Organic canned sweetcorn sold in European supermarkets

Source: Autentika Global

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Every batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex of the Commission Regulation that defines imports of organic products from third countries.

For equivalent countries (including Argentina, India and Tunisia) certificates are issued by control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Sustainability certification

Two commonly used sustainability certification schemes are Fairtrade Standards and Rainforest Alliance. Fairtrade international certifies the production of a variety of Fairtrade vegetables, from artichokes to zucchini and palm hearts.

Ethnic certification

If you want to focus on the Jewish or Islamic ethnic niche markets, implement Halal or Kosher certification schemes. Several organisations provide Kosher certification in Europe. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain the Kosher certification. Halal certification in Europe can be obtained from certifying bodies like Halal Certification Services (HCS), which provides certification services.

Econutrena is a Sri Lanka-based exporter of organic canned fruits. They have obtained both Kosher and Halal certifications for their products.

Tip:

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH and control bodies and authorities for equivalence.

2. Through which channels can you get canned fruits and vegetables on the European market?

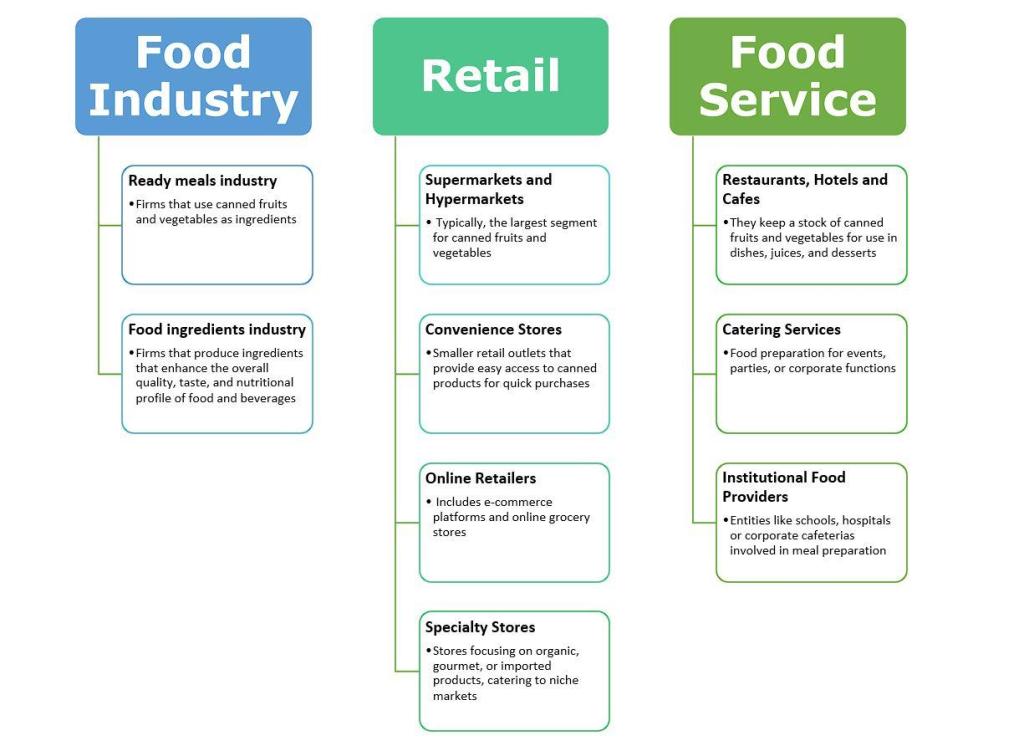

Compared to other processed fruits and vegetables, canned fruits and vegetables are not used as often as ingredients in the food processing industry. Large quantities are sold directly in the retail segment under importer company and private label brands, and through the food service segment.

How is the end market segmented?

Statistics on the precise breakdown of canned fruits and vegetables sold directly through the retail segment and sold to the food processing industry are not easily available. There are large differences between the different types of canned fruit and vegetable products.

Figure 2: End market segments for canned fruits and vegetables in Europe

Source: Autentika Global

Retail

The market share for canned fruits held by supermarkets and hypermarkets is projected to remain particularly high. Product sales from these businesses are expected to increase because of growing customer reliance. Retailers sometimes buy from developing country exporters directly, but intermediaries are involved in most cases.

Leading food retail companies in Europe differ per country. These outlets are usually very important for sales of canned fruits and vegetables. The companies that hold the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold.

Keep in mind that several retail alliances coordinate buying operations in Europe:

- Coopernic (includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group)

- Carrefour World Trade or CWT (includes Carrefour, Système U, Match and Cora)

- AgeCore (Colruyt – cooperation on national brands and private label, Conad, Eroski and Coop Switzerland)

- European Marketing Distribution or EMD (Colruyt – cooperation only on private label, Pfäffikon, Countdown Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia)

- Epic Partners (Edeka, Système U, Esselunga, Picnic, Migros, Jerónimo Martins and Ica)

Industrial

Canned fruits and vegetables are used by 2 segments of the food processing industry:

- The ready meals industry is a significant user of canned vegetables – mainly for pizzas, pastas, soups and fresh and frozen meals;

- The food ingredients industry uses canned vegetables. Other food sectors, such as the baby and infant food industries, use a variety of preserved fruit and vegetables.

Food service

The food service segment is usually supplied by specialised importers (wholesalers). Food service often requires specific packaging in the range of 1–5 kg, which is different from bulk or retail packaging sizes.

Tips:

- Consult trade magazines and publications, such as Food Safety News, that publish articles on alerts related to the canned fruit and vegetables markets that are relevant to your exports.

- Search the list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for canned fruits and vegetables within the food ingredient segment.

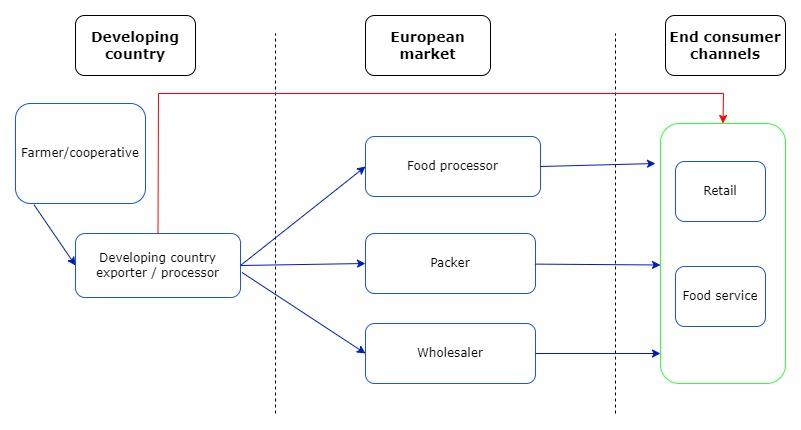

Through which channels does a product end up on the end-market?

Large quantities of canned fruits and vegetables are sold in the retail segment under importers’ brands, private label brands or in the food service segment. Importers are the most important channel.

Figure 3: European market channels for canned fruits and vegetables

Source: Autentika Global

Importers/Wholesalers

Importers and wholesalers often serve as the preferred contact points for exporters from developing countries. They have established networks and understand local market dynamics, regulations and consumer preferences. They can provide access to various retail outlets, supermarkets and specialised stores, which might be challenging for a new exporter to achieve independently.

Partnering with established importers and wholesalers can also significantly reduce the market entry costs and risks for canned food exporters, as some marketing and distribution activities can be costly and risky for exporters to undertake on their own.

Food manufacturers (ingredients)

Canned fruits and vegetables are not used as ingredients by the food processing industry in Europe as often as other fruit and vegetable products. Some examples of more frequently used canned products are mushrooms, garlic and tomato paste.

Direct supply to food retail or food service

Retailers that focus on specialty, gourmet or organic canned food can be more open to direct relationships with exporters. They often look for unique products that differentiate their offerings from mainstream supermarkets. Retailers that specialise in ethnic or international foods are also more likely to engage directly. Large retailers are expanding into this segment by offering products that cater to consumers who like international cuisines.

Figure 4: Canned Asian style vegetables sold by a major European retailer

Source: Autentika Global

The food service segment makes up a significant share of the European market for canned fruits and vegetables. This segment requires bigger packaging (up to 5 l) and non-branded products of a specific quality. Reaching the food service segment directly is difficult, so you should search for specialised food service suppliers.

Examples of importers of canned fruits and vegetables in European countries include: EMN Europe (which has a presence in 18 European countries), OttoFranck (Germany), Victor-Konserven (Germany), Clama (Germany), Kreyenhop & Kluge (Germany), Henry Lamotte (Germany), Natco Foods (UK), Gama (UK), Goodies Foods (UK), Indo European Foods (UK), S.O.P International (UK), J.L. Machado (Portugal), Opa Distribution (France) and Agidra (France).

Tip:

- Watch the 2023 Deutsche Welle documentary for more insight into the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

What is the most interesting channel for you?

Collaborating with importers and wholesalers is often considered the most accessible and least risky channel for exporters from developing countries. However, this channel might offer lower margins compared to direct sales.

Specialised canned fruits and vegetables importers are excellent contact points for exporting to Europe, especially for new suppliers. Supplying the retail segment directly is very demanding and requires a lot of quality and logistical investment. Importers usually have good knowledge of the European market. As a result, they are the best contacts to have, as they can inform you about market developments and provide practical advice.

Direct supply to food retail or service and food manufacturers may appeal more to exporters that target niche markets or those that have the capacity to meet specific quality or volume requirements. Growing European demand for certain exotic fruits and vegetables is a good opportunity.

3. What competition do you face on the European canned fruits and vegetables market?

The canned fruits and vegetables market is dominated by European countries. Italy, Spain, the Netherlands, Belgium, Greece and Germany are your key competitors in the main markets, followed by Türkiye, China, Thailand, Costa Rica, Morocco and Indonesia.

Source: Autentika Global, GTA *Italy, Spain, Netherlands, Belgium, Greece and Germany, 2024

Which countries are you competing with?

Big European suppliers: Italy and Spain dominate the market

Italy is by far the largest supplier, exporting more than 2 million tonnes to Europe. Canned tomatoes are Italy’s number one canned export product. Italy exports €1.6 billion to Europe annually; canned tomatoes represent 65% of Italy’s export value. Other large exports to Europe include canned shelled beans (213 million EUR) and canned vegetables and mixtures (166 million EUR).

Industrial tomatoes were grown on 68,500 hectares in 2023, a 5% larger area than in 2022. The major canneries are predominantly privately owned and located in the south of the country. Italy’s canning activities are more centred near Naples, with a smaller presence in Bologna in the north.

The most popular tomato is the plum-shaped tomato, and many varieties are used for canned tomatoes, from early to late varieties. Generally, there are 3 types of canned tomatoes – whole peeled, diced tomatoes and fine crushed tomatoes, where dicing is smaller than 5 mm.

Spain’s prominence as a large producer of canned fruits and vegetables is due to its favourable climate, vast agricultural land and long tradition of farming and food processing. The Spanish production of canned fruits mostly takes place in the region of Murcia. Peaches are the main type of produce, followed by mandarins, apricots and pears. Spain is one of the 2 largest producers of canned peaches in the EU. Together with Greece, the countries accounted for more than 90% of the total European production. Canned pears from Spain are known for their sweetness and texture.

For vegetables, most growing and production takes place in the Murcia and Valencia regions. Other well‑known areas are Navarra and La Rioja; the latter mainly because of preserved asparagus, peppers and artichokes. Spain’s largest export product is canned olives. Exports to Europe total €364 million, which is around 45% of the total export value (€808 million). Canned tomatoes are the second largest export product, with €561 million, including €435 million to Europe.

Türkiye: The fastest growing large developing-country exporter to Europe

Türkiye's canned product exports are significant, with a strong emphasis on tomato paste and pickles. Türkiye exported 395,000 tonnes of canned fruits and vegetables to Europe in 2022, with an average annual growth rate of 10.4% between 2018 and 2022. The value of these exports reached €570.9 million, after experiencing an annual growth of 15.9% in the same period. The processing and preserving of fruits and vegetables is well-developed and accounts for a 15.7% share of the food processing industry according to a USDA 2023 country report on Türkiye.

Türkiye exported €138 million worth of canned cucumbers and gherkins to Europe in 2022, in what is proving a rapidly growing sector. Almost all exports of canned cucumbers are destined for the European market. Türkiye's canned olive exports to Europe are also increasing significantly. Exports totalled €101 million in 2022, up from €69 million in 2018. Two-thirds of Türkiye's canned olive exports are destined for European markets.

Canned citrus exports have practically doubled over the past 5 years, reaching €52 million in 2022, up from €27 million in 2018. More than 95% of these exports are destined for buyers in Europe.

Türkiye's canned fruit and vegetable exporters are supported by the Türkiye Exporters Assembly (TİM), which is the umbrella organisation for Turkish exports. The industry is also supported by the Federation of All Food and Drink Industry Associations of Türkiye (TGDF).

China: A growing supplier of processed tomatoes and sweetcorn

China has remained the world’s largest producer and exporter of canned food for years. The country exported 423,000 tonnes of canned fruits and vegetables to Europe in 2022. These exports grew at an average rate of 3.9% per year between 2018 and 2022.

China’s exports of processed tomatoes to Europe have almost quadrupled from €48.6 million in 2018 to €171.1 million in 2022, propelling the commodity to the top spot in the ranking. The country accounts for 70% of the total canned asparagus exports in the world, and exports to Europe rose by more than 50% from €99 million in 2018 to €152 million in 2022.

China’s annual export volume of canned oranges has been more than 250,000 tonnes for years, accounting for between 60% and 70% of the world’s total.

One of the products that has seen booming exports to Europe is Chinese canned sweetcorn. Exports have risen almost eightfold from €4.7 million in 2018 to €36.3 million in 2022. Sweetcorn exports have almost overtaken canned bamboo shoot exports to Europe, which more than doubled to €39.8 million in the same period.

Interests of the industry are supported by the China Canned Food Industry Association (CCFIA). Members of the Beijing-based CCFIA include major canned manufacturers, research institutes, inspection organisations and equipment manufacturers. Their names are listed on the website.

Thailand: An important supplier of canned pineapple to Europe

The Thai government wants the country to become a key global player in the ‘Future Food’ market by designating food and beverages as one of the 5 targeted industries under the ‘Thailand 4.0’ strategic economic development plan. The development plan aims to invest in research and development (R&D) and innovation to strengthen Thailand’s leading position in the food industry and enhance the value of Thai food exports, according to a 2023 USDA report.

The Thai Food Processors’ Association (TFPA) promotes the national processed foods sector. The country’s canned pineapple exports amounted to 281,000 tonnes in 2023, a sharp decline from 393,000 tonnes in the preceding year. Two-thirds of exported canned pineapple is in retail packaging and the rest in other formats. Canned pineapple exports to Europe increased, despite small dips in 2019 and 2020, rising from €110 million in 2018 to €149 million in 2022.

Thai canned sweetcorn exports are on the rise and reached 237,000 tonnes in 2023, according to the TFPA. The value of canned sweetcorn exports to Europe has varied between €20 and €30 million in the same 5-year period but reached a peak value of €30 million in 2022. Exports of other canned fruits from Thailand are growing rapidly as well, rising more than 25% over 5 years to €51 million in 2022.

Tips:

- Identify the biggest importers of your product in selected large or fast-growing European markets.

- Be prepared to face strong competition if you export canned fruits and vegetables that are grown in Europe. However, you can learn from developing countries that have entered the European market, such as South Africa (canned apricots), the Philippines (fruit cocktails), China (fruit cocktails, peaches, pears, beans and mandarins) and Thailand (sweetcorn).

- Get information about the industry and export strategies of fast-growing countries from their sectoral associations, such as the CCFIA news page or the TFPA exports statistics page.

Which companies are you competing with?

There are many producing, processing and export companies of canned fruits and vegetables that supply the European markets. Every company has its own strategy for exporting to the European market.

European companies

Many multinational companies in the canning industry are very active in Europe and have European branches or are headquartered in Europe. In the canned fruits segment, well-known names include Del Monte, Groupe Mom (with its Materne fruit compotes brand) and Dole. Del Monte is the largest trader of canned pineapples in Europe and the world.

Conserve Italia, from northern Italy, is a huge Italian cooperative that brings together over 14,500 farmers and represents one of Europe’s largest agri-food companies. Spain’s Conservas Ferba originally focussed on asparagus, mushrooms and artichokes, but today it processes many fruits and vegetables that can be sourced in its regions.

In the canned vegetables segment, some of the largest players include Bonduelle, General Mills, Eureden, Orkla and HAK. Several of them also operate in Europe, such as Bonduelle and HAK. Napolina has a product range with over 140 products, including canned tomatoes, tomato purées, beans and pulses.

Germany has many canned vegetable facilities. Many are second-generation family businesses. Their product ranges often include products that are popular in Germany, such as gherkins, beetroot, capsicum and celery. Many canned vegetable production facilities in Germany are located in the south, specifically, in Lower Bavaria. Examples of companies in this region are:

- Eggerstorfer: a small family company with 50 employees and IFS certification;

- Straubinger Konserven: a small IFS-certified family company, which focusses on gherkins and cabbage (‘sauerkraut’);

- Meiko: a small family company that produces canned pickles, pickled vegetables and fruits.

Turkish companies

Türkiye's food manufacturing industry has not only benefitted from sustained economic growth in the country but has also been a major driver of growth for over a decade. The number of Turkish companies active in processing and preserving fruits and vegetables increased from 2,615 in 2018 to 3,553 in 2021.

The leading companies in the country’s canned food segment are Tat, Tamker, Yort Konserve, Tukas Gida, Penguen Gida, Nordes and Tat Gida.

Chinese companies

Canned food is produced by more than 46,000 companies in China, with the province of Guangdong topping the list with over 14,000 of these companies. China’s fruit and vegetable canning industry has a very strong focus on exports. Typically, their range is larger than that of European manufacturers, while their locations are strategically chosen from a raw-material perspective. Some examples:

- Acroyali: produces canned fruits, fruit jams, canned vegetables, canned beans and nuts;

- Fresh Food: has 5 production lines with a 10,000-tonne capacity per year for canned mushrooms, corn, lychees, longan fruits and water chestnuts;

- Zhangzhou Trading: produces canned mushrooms, garlic and other products;

- Shandong Lixing Tin Food: produces many canned vegetable products with numerous certifications (IFS, Kosher, and so on) and offers private label production for exports all over the world;

- Leason Food (Dalian Linjiapu Food): a canning industry in northeast China and a manufacturer of canned apples and canned strawberries for exports, supplying Heinz, Wal-Mart and the UK market.

Thai companies

Local players in Thailand, such as TIPCO, Malee Group and UFC, are expected to continue leading the processed fruit sector due to the country’s abundant production of fresh, high-quality fruit. Other canned fruit exporters to Europe include Kuiburi, Prime, Prosper, Praft, Trofco and Sunlee. Thai Bae International is an important canned fruit and sweetcorn exporter.

Tips:

- Visit leading European trade fairs, such as ANUGA, SIAL and FI Europe, to see what the competition is doing.

- If you are interested in offerings from competitors in other countries, check out this online canned food manufacturers’ directory. You can also add the details of your own company to the directory.

Which products are you competing with?

Your principal competition comes from fresh and dried fruits and vegetables. For example, the excellent availability of fresh pineapple in European supermarkets is a factor that affects canned pineapple sales.

Frozen fruits and vegetables are also strong competitors that can be easily packed and do not require the use of metal for canning, which is an additional cost for canneries. While canned produce can be kept at ambient temperatures, frozen produce needs to be kept in a freezer. On the other hand, a can, once opened, needs to be consumed within a few days. Comparatively, frozen produce can be taken from the package in the necessary portion size, and the remainder can be put back in the freezer.

Tips:

- Read CBI’s study on the European demand for fresh fruit and vegetables to learn more about the competition from fresh products.

- Read CBI’s study on frozen fruits or vegetables (for example, frozen vegetables, frozen berries, tropical frozen fruits) to learn more about the competition from these products.

4. What are the prices of canned fruits and vegetables on the European market?

The range of canned fruits and vegetables is wide, and margin indications are just rough estimates. Additionally, comparisons between competing countries are not easy due to differences in product types, packaging sizes and other factors.

The Cost, Insurance and Freight (CIF) price represents roughly between 25–50% of the retail price. This also depends on the number of intermediaries between the exporter and retailer. Canned products are relatively finished products and need less extra processing and packaging in Europe. As a result, the difference between the CIF price and the shelf price for canned products is lower than for many other processed fruits and vegetables.

A rough indication of margins in the value chain is shown in Table 2. The table also shows what this means in absolute terms for a pot of sliced pickles and a can of mango slices sold in a European supermarket.

Table 2: Sample structure of the retail price of canned sliced pickles and canned mango

| Steps in the export process | Type of price | Margin % | Sliced pickles in 360 g jar | Canned mango slices in 425g can | ||

|---|---|---|---|---|---|---|

| Absolute margin in EUR | Price / kg in EUR (drained) | Absolute margin in EUR | Price / kg in EUR (drained) | |||

| Production of fruit or vegetables | Raw material price (farmers’ price) | 5–15% | - | 0.60 | - | 2.40 |

| Handling, processing and selling canned products | FOB or FCA price | 30–40% | 1.20 | 1.80 | 0.90 | 3.30 |

| Shipment | CIF price | 5% | 0.20 | 2.00 | 0.15 | 3.45 |

| Import, handling, distribution | Wholesale price (value added tax included) | 10–15% | 0.40 | 2.40 | 0.45 | 3.90 |

| Retail sale | Shelf price | 40–50% | 1.60 | 4.00 | 1.95 | 5.85 |

Source: Autentika Global

Margins and prices in the value chain depend on several factors, such as:

- Origin (country);

- Quality (depends on season and country);

- Global supply and demand;

- Conventional or certified: fairtrade and organic mango slices are more expensive than conventional;

- Spot price of raw material versus contract prices: in the case of canned pineapple from Thailand, for example, spot raw material prices fluctuate from week to week. Canned pineapple processors may also have (year/half-year) contracts with their international customers. The FOB prices in such contracts may follow the prices of the raw material, usually with an inbuilt contractual delay;

- Retailer’s pricing strategy. For certain products, retailers prefer to keep stable prices for end consumers even when import prices fluctuate.

Tips:

- In-depth market pricing information is available from paid market information portals like S&P Global Connect.

- Compare your offer with key competitors for your products in target markets. This is not a one-time operation. Price levels should be monitored over time and over different stores, channels and countries.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research