Entering the European market for coconut oil

New coconut oil exporters that want to enter the European market need to put their products through regular laboratory tests. The strongest competitors for suppliers of crude coconut oil are from the Philippines and Indonesia. The strongest competitors for organic virgin coconut oil are from Sri Lanka.

Contents of this page

1. What requirements and certifications must coconut oil comply with to be allowed on the European market?

All food products sold in the European Union (EU) must be tested for safety. Alongside proof of compliance with Europe’s food safety regulations, there is increasing demand for sustainably produced oils. This study outlines the most important market requirements for coconut oil but, for a general overview, read the CBI study on buyer requirements for processed fruit and vegetables.

What are the mandatory requirements?

You need to comply with established maximum levels for harmful contaminants to export to Europe. For coconut oil, fatty acid and sterols composition is an important quality indicator. One of the most important recent developments is the European Due Diligence legislation. It specifies that you have to comply with certain social and environmental requirements.

Contaminants control in coconut oil

You should regularly check the European Commission Regulation to check the maximum levels for contaminants. Bear in mind that it is updated frequently.

Check the levels of mineral oil hydrocarbons

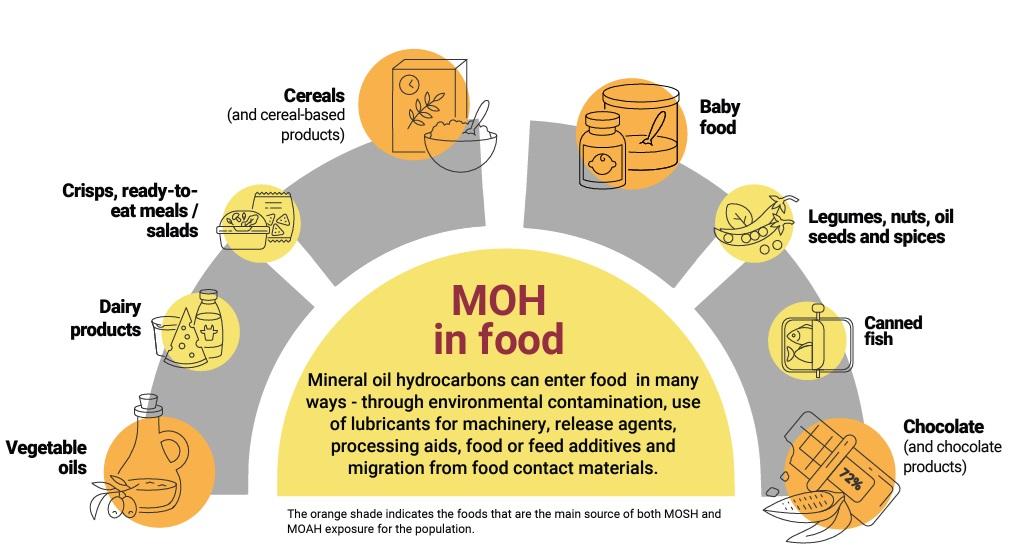

Mineral Oil Saturated Hydrocarbons (MOSH) and Mineral Oil Aromatic Hydrocarbons (MOAH) are edible oil contaminants that can harm human health. Official limits have not been set yet, but they are expected soon. The proposed maximum MOAH level in oils is 2 mg/kg, and many European buyers already check for this.

Figure 1: Mineral oil hydrocarbons in food

Source: European Food Safety Authority infographic document (Photo credits: Shutterstock.com)

Be aware of contamination risks during processing

Processing contaminants should not be present in virgin coconut oil. For processed coconut oil, the maximum levels are:

- Glycidyl esters (GE): 1000 μg/kg or 500 μg/kg if oil is used in baby food.

- Sum of 3-monochloropropanediol (3-MCPD) and 3-MCPD fatty acid esters: 1250 μg/kg.

- Polycyclic aromatic hydrocarbons (PAHs): Benzo(a)pyrene – 2 μg/kg and sum of PAHs – 20 μg/kg.

Only use food grade materials in packaging and transport

If you use plastic packaging to transport bulk coconut oils, it is important to check the limits for plastic materials and articles intended to come into contact with food. The rules on food contact materials are being revised. When coconut oil is transported in bulk in tankers by sea, only food grade coatings can be used (stainless steel is usually recommended). Zinc silicate-coated tanks are not used for crude oil unless the maximum acid value is 1. Tankers must be cleaned well, and drinking water must be used to wash off cleaning agents.

Make your own check list to assess contamination risks along the supply chain

Most of the European discussion about contaminants of edible oils concerns MOSH, MOAH, 2- and 3- MCPD Esters and GE. However, they are not the only ones. Other contaminants to check for are:

- Pesticide residues: The European Union maintains a list of approved pesticides that are authorised for use and sets the maximum residue levels (MRLs). High pesticide MRLs are not very common for coconut oil, as copra is protected by the thick protective levels of mesocarp and endocarp. However, many European importers request detailed MRL laboratory tests.

- Microbiological contaminants: The European regulation on microbiological criteria for foodstuff sets the limits for pathogenic micro-organisms, their toxins and metabolites.

- Dioxins: The contamination risk is increased when copra is near open fire or when bleaching earth is used.

- Aflatoxins: Contamination is possible when copra is not sufficiently dried.

- Hexane: Can be found if used as an extraction solvent.

- Heavy Metals: The risk of contamination is higher when bleaching earth is used.

Ensure safe handling of coconut oil

The EU regulates the manufacturing and imports of chemical substances through the REACH regulation. For the bulk coconut oil trade, a safety data sheet must accompany the shipment. You can find more about the requirements for the compilation of safety data sheets in the annex of the REACH regulation. Your safety data sheet needs to include all 16 sections mentioned in the annex.

Tips:

- Follow the FEDIOL code of practice for the management of mineral oil hydrocarbons (PDF).

- Be sure to only perform laboratory tests in ISO/IEC 17025:2017 accredited laboratories.

- Read the FEDIOL chain risk assessment for coconut oil (PDF) to identify and prevent potential contamination throughout the whole supply chain.

Always declare your coconut oil properly

Selling fake or falsely declared food in Europe is considered a crime. Authenticity tests on coconut oil are performed to prevent fraud. Common forms of fraud include adding palm oil, false organic certification and false quality grading.

Follow labelling rules

The bulk label should use coding for each lot. Labelling should indicate the product name, country of origin, style, lot code, net weight and shelf life. Allergen warnings also need to be visible on bulk packaging. More details can be provided in the accompanying packaging documents.

In the case of retail packaging, product labelling must comply with the European Union Regulation on the provision of food information to consumers. This regulation defines the nutrition, origin and allergen labelling and minimum font size for mandatory information. Retail packaging must be labelled in a language easily understood by consumers in the European target country.

European health claims regulations prohibit claims that foods can cure illnesses. Currently, authorised health claims relevant for coconut oil only concern essential fatty acids and linoleic acid (if the content is at least 1.5 g/100g).

Tip:

- Read more about the transport and storage conditions for coconut oil on the websites of Transport Information Service and Cargo Handbook. The latter contains recommendations for bulk oils and fats.

Comply with the legislative requirements on sustainability

Some of the most relevant European laws and legislation related to environmental and social sustainability are part of the European Green Deal (EGD). The EGD includes legislative changes, with a schedule that outlines when they will come into action. The most relevant specific legislations for coconut oil are:

- Organic food regulation

- Sustainability labelling of food products (under discussion)

- Corporate Sustainability Due Diligence Directive

- Packaging and packaging waste

The most recent legislation on due diligence officially entered into force in June 2024. It is one of the most important laws for suppliers from developing countries. Companies need to be able to demonstrate that they are aware of the environmental and human rights risks in their supply chains.

What additional requirements do buyers often have?

In addition to mandatory requirements, food safety, quality and sustainability standards have become important.

Meet specific quality characteristics

In most cases, buyer requests for specification will be in line with international standards, such as the Codex Alimentarius Standard for Named Vegetable Oils (PDF) or the FEDIOL Specification for Coconut Oil (PDF). The main chemical features related to quality are: fatty acids and sterols composition, moisture, iodine value, peroxide value, saponification value, colour, presence of impurities and melting point.

Lauric acid content is a specific quality indicator for coconut oil. It should not be high. The Sri Lankan standard has a 1% maximum limit on free fatty acids expressed as lauric acid. The Malaysian standard imposes a limit of 1% for lauric acid for Grade 1 coconut oil and 3.5% for Grade 2. However, the lauric acid content can be higher, and some companies set the limit at 4%.

Offer different packaging options

Most crude coconut oil is transported unpacked in sea tankers. Stainless steel tankers with heater and nitrogen blanketing are most popular. Another option for bulk oil transport includes ISO tanks with frames that allow a transfer from trucks to ships. To save space after the oil is unloaded, foldable flexi tanks are also used. Medium bulk packaging uses steel drums and intermediate bulk containers (IBC tanks). Bulk packaging can vary in size. It can range from 200 kg (drums) to over 20 tonnes (flexi tanks).

Glass jars are preferred as retail packaging for virgin coconut oil on the European market, mostly due to consumer preferences and the impression of quality. Coconut oil is also packed in plastic packaging, such as bottles or buckets. Bag-in-Box is the preferred packaging for the foodservice sector, although it is not very frequently used for coconut oil in Europe. The sizes of retail-packed virgin coconut oil can vary, but they are most commonly between 200 and 500 ml.

Get food safety certified

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established importers will refuse to work with you unless you have some type of food safety certification. Serious buyers will also usually visit or audit your production facilities before buying.

Most European buyers will ask for certification recognised by the Global Food Safety Initiative (GFSI). For coconut oil, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

Invest in sustainability

There is increasing demand for sustainably-sourced food in Europe. To help consumers make more ecological choices, more labelling systems are being developed, such as Eco Score, Eco Impact, Planet Score and Enviro Score. There is also increasing demand for more transparent and fair supply chains.

One way to show that you take care of farmers and workers is to get Fairtrade, Fair for Life or Rainforest Alliance certified. Fairtrade is the most common ethical certification for coconut oil, especially for suppliers from Sri Lanka. Fairtrade International guarantees a minimum price and premium prices for processing per coconut.

Some companies require adherence to their codes of conduct; other companies require adherence to common standards. Common standards include independent audits, such as SMETA (by SEDEX), the Ethical Trading Initiative (ETI) and BSCI (by amfori). If the coconut oil is intended for direct retail sales, suppliers will have to follow a specific code of conduct developed by retailers.

Tips:

- Use rapid test kits for 3-MCPD and GE as a risk control operation in your food safety system.

- Read CBI’s Tips to Go Green and Tips to Become a Socially Responsible Supplier to become familiar with the growing market demand for sustainability.

- Read the CBI study on trends in the European processed fruit and vegetables market for an overview of developments regarding sustainability initiatives in the European market.

- Invest in your relationships with farmers and support them in applying good agricultural practices to improve the quality of their produce.

What are the requirements for niche markets?

Consider organic certification

To market coconut oil as organic in Europe, the coconuts must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can use the European Union’s organic logo on the packaging, as well as the logo of the standard holder (e.g. Soil Association in the UK, Naturland in Germany). One way to sell organic coconut oil at a higher price is to follow the rules of the Demeter biodynamic certification.

If you aim to produce and export organic coconut oil to Europe, be aware of important new rules that may affect your business. The new EU organic regulation is now in force. This regulation also involves more than 20 secondary acts that regulate the production, control and trade of organic products in more detail. Some of the important acts to be aware of are detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Consider ethnic certification

Islamic (Halal) and Jewish (Kosher) dietary laws impose specific dietary restrictions. If you want to focus on Jewish or Islamic niche markets, you should consider implementing Halal or Kosher certification schemes.

Tips:

- Read the training materials on the new organic regulation (by the Alliance for Product Quality in Africa project) to learn about the new rules.

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

2. Through which channels can you get coconut oil on the European market?

If you want to offer standard quality crude coconut oil in big volumes, European oil refineries are a good entry point. However, independent specialised oil and fat traders can provide better opportunities for organic and virgin coconut oil suppliers.

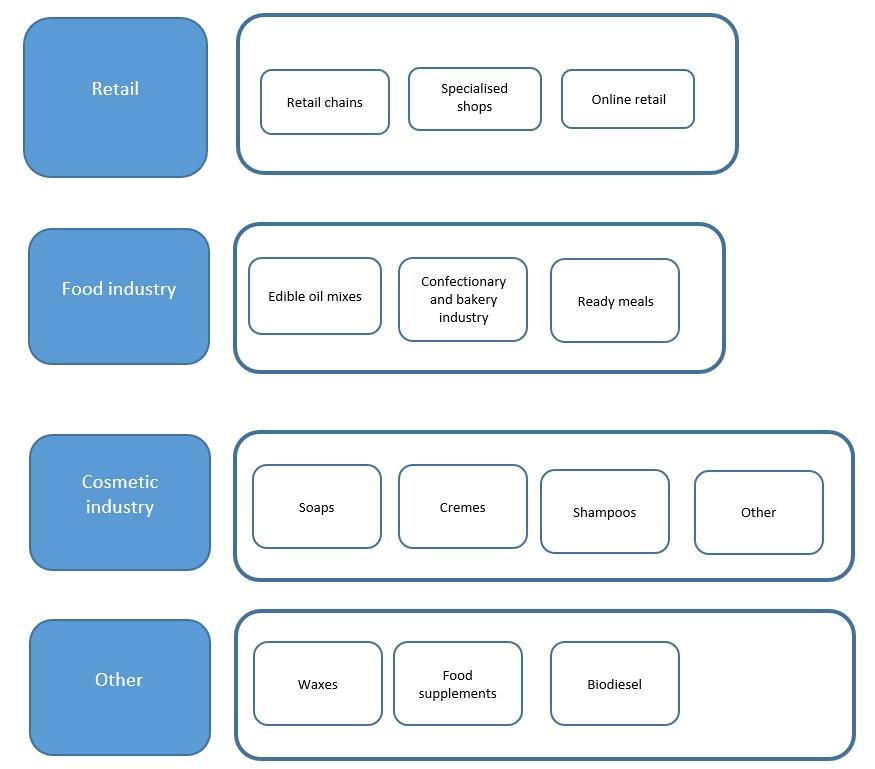

How is the end market segmented?

Refined bleached and deodorised (RBD) coconut oil is mostly used as a food ingredient in applications like edible oil mixes, confectionery, ice cream and in the bakery industry. It is also used in plant-based dairy alternatives. Virgin coconut oil is the most sold type of coconut oil in the retail segment.

Figure 2: End-market segments for coconut oil in Europe

Source: Autentika Global

Retail

Retailers sometimes buy from developing-country exporters directly. However, in most cases, they use intermediaries like specialised distributors. One recent development is the polarisation of the retail sector into discounters and high-level segments.

Several sub-segments (points of sale) for the coconut oil retail segment in Europe are given below.

- Retail chains – The main development for the leading mainstream retailers is the growing share of private label coconut oils, including organic. The companies that hold the largest market shares in Europe are the Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold Delhaize (Delhaize, Albert Heijn and several other brands).

- Specialised organic and health food shops – These are relevant for suppliers of certified organic virgin coconut oils. Many organic shops are a part of specialised organic food retail chains. Some import directly. Some European shops that sell organic coconut oil are also drugstores (e.g. dm and Rossmann) or food supplement stores (e.g. Holland & Barrett).

- Specialised ethnic shops – These shops provide specific opportunities for entering the market without competing with the leading retail brands. The most relevant types of ethnic shops for coconut oil sales are Asian supermarkets.

- Specialised ethical shops – This is a niche segment that provides opportunities for Fairtrade and ethical-certified suppliers.

- Online retailers – Online trade is often part of the business of regular supermarket chains. Specialised online retailers include companies like Ocado (the UK) and KoRo (Germany).

Food industry

The food industry in Europe is a major user of coconut oil. The primary users are leading European refineries and processors like Cargill, Unigra and AAK. They sell RBD coconut oil to different industry segments and produce special applications.

- Special oils and fats production – European refineries and laboratories make customised solutions using coconut oil as an ingredient for different food industry segments. As veganism in Europe increases, alternatives for dairy fats are becoming more important. In food applications, coconut oil can also be sometimes used in a “blend” with other vegetable oils that are rich in polyunsaturated fatty acids (PUFA). These blends have an improved nutritional profile due to their higher PUFA content.

- Chocolate and confectionery industry – Coconut oil melts quickly and provides a pleasant mouthfeel.

- Ice cream industry – Coconut oil has a fast crystallisation rate and does not chip off ice cream during eating.

- Nut roasting – RBD coconut oils have high stability and are well suited for roasting.

- Plant-based alternative food – Coconut oil has a relatively similar fatty acid composition to dairy butter, so it is a good substitute. It is also used as a plant-based alternative for other dairy products including grated cheese, cream cheese, cheese for frying, vegan ice creams and vegan chocolate desserts.

Food service

The food service segment in Europe (hotels, restaurants, catering) is not a large user of coconut oil. It consists mainly of Asian restaurants that request specific packaging (3–5 litre containers).

Non-food industries

Non-food industries are not the focus of this study but it is worth mentioning that coconut oil is used in cosmetic products for skin and hair. Lauric acid can hydrate both. Coconut oil has a very pleasant flavour and is also used as a flavour enhancer. A side product of RBD processing is the Coconut Fatty Acid Distillate, which is used as an ingredient in soap production. Coconut oil can also be used as an ingredient in plant-based waxes, such as aromatic and decorative candles.

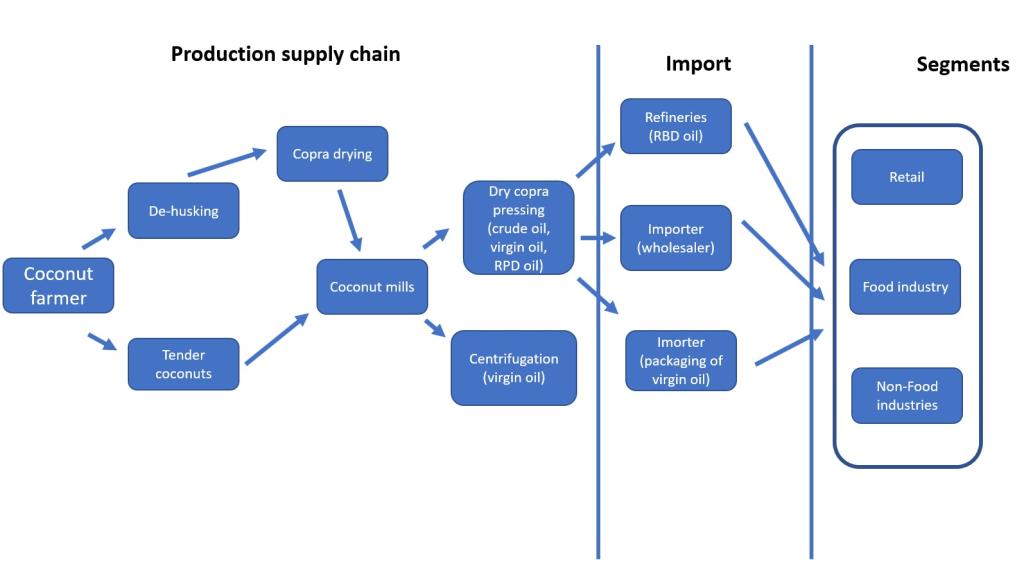

Through which channels does a product end up on the end market?

In terms of volume, large refineries are the most important channel for coconut oil in Europe. They import crude coconut oil and process it for different industry applications. These channels are the most suitable for relatively large producers. However, specialised oil traders are better suited for companies that sell quality organic and virgin coconut oil.

Figure 3: European market channels for coconut oil

Source: Autentika Global

Refineries

Most crude coconut oil is imported then processed by large European refineries. The refineries import different types of oils for refining. Some also produce chemicals and biodiesel. Cargill, AAK, Unigra, Bunge Lodgers, ADM and Olenex are some of the largest refineries in Europe that process coconut oil.

Refineries provide opportunities for crude oil processors that can meet strict quality requirements. There is growing demand for sustainable sourcing and fair payments for farmers. Several of the refineries mentioned are members of the Sustainable Coconut Partnership.

Importers (Wholesalers)

Unlike large refineries, many edible oil importers import bulk oil suitable for direct consumption. Instead of buying bulk oil in tankers, wholesalers usually buy oils in medium bulk packaging, such as barrels. The importers often re-pack coconut oil in retail packaging and sell it to European supermarkets. Some of them supply the cosmetic industry. Some wholesalers actively trade coconut products, such as Helios Ingredients and Catz International.

Wholesalers provide better opportunities for small and medium coconut oil processors. However, they also have strict requirements. As large quantities of coconut oil are sold to retailers in Europe, organic certification is a common requirement. Organic coconut oil traders include All Organic Treasures, Tradin Organic, Henry Lamotte Oils and Care Naturkost.

Edible oil bottlers

Edible oil bottling companies often sell multiple oils and offer them to the retail market. This includes oilseed crushing companies and olive oil producers, such as Spack, Acesur, Edible Oils Limited (EOL) and Huilerie Cauvin.

What is the most interesting channel for you?

The best channel depends on your product specialisation. If you want to offer large quantities of bulk crude oil and provide transparency throughout your supply chain, European refineries and edible oil processors are a good option.

Specialised edible oil traders and packers are the best contacts for new suppliers who want to reach the retail segment more easily. Specialised importers usually know the European market well and monitor the situation in coconut oil-producing countries closely. As edible oil traders often compete in public procurement calls by European supermarkets, they must comply with their codes of conduct. This means you need to invest in food safety certification, organic certification and certifications regarding working conditions and environmental performance.

Tips:

- Study the exhibitor lists of large trade fairs, such as ANUGA and SIAL of Food Ingredients Europe to find potential buyers for your coconut oil. If you aim to supply supermarket private labels, search for opportunities at PLMA.

- If you produce organic virgin coconut oil, consider exhibiting at specialised organic food exhibitions, such as Biofach, Natural & Organic Products Europe and Natexpo.

- Understand the demand for sustainable products and become more competitive by investing in various audit schemes, such as ones that involve corporate social responsibility (CSR) practices.

3. What competition do you face on the European coconut oil market?

As most coconut oil is produced in the Philippines and Indonesia, you should expect fierce competition, especially from large multinational companies. However, if you aim to export added value oil, such as virgin, organic and Fairtrade certified, your main competitors will be Sri Lanka and the Pacific countries.

Which countries are you competing with?

The main competitors for bulk crude and RBD coconut oil suppliers are the Philippines and Indonesia. They supply over 95% of the European market. However, there is still space in the market for virgin, organic and Fairtrade-certified oil. In this segment, the leading supplier is Sri Lanka, followed by the Solomon Islands, French Polynesia, Ivory Coast and Ghana. Other emerging suppliers include India, Vietnam and Thailand.

Source: Autentika Global and ITC TradeMap

The Philippines, the leading world supplier of coconut oil

The Philippines is the largest producer of coconut oil in the world. In the Philippines, 2.5 million farmers grow coconuts on 3.6 million hectares. Around 80% of commercially produced coconuts are processed into coconut oil. Despite current temporarily lower production caused by El Niño, coconut production is forecasted to increase in the medium term. According to the Coconut Farmers and Industry Development Plan by the Philippine Coconut Authority, the Philippines will have 100 million coconut trees by 2028.

Smallholder farmers carry out production with minimal fertilisers. The crushing of copra in the Philippines is constantly increasing, reaching 2.7 million tonnes in 2023. According to the United Coconut Association of the Philippines, there are 62 copra mills in the country. In 2023, the production of coconut oil reached 1.7 million tonnes. Crude and RBD oil account for around 90% of produced oil, while virgin coconut oil makes up the remaining 10%. Some coconut mills also produce oleochemicals for the cosmetic industry and coco methyl ester for biodiesel.

Around 75% of the coconut oil produced is exported. In 2023, the Philippines exported 1.13 million tonnes of coconut oil, valued at €1.08 billion. Most Filipino coconut oil exports are crude (70%), followed by refined and virgin. In 2023, the leading export destination was the Netherlands (39% of all coconut oil exports), followed by the United States (24%), Italy (8%), Spain (6%) and China (5%). Italy was the fastest growing export destination. Filipino exports to Italy increased from 19,000 tonnes in 2019 to 95,000 tonnes in 2023.

Indonesia, diversified export

Currently, Indonesian coconut production is slightly higher than that of the Philippines, with 3.7 million hectares of coconut plantations. However, the crushing of copra is smaller. This is because Indonesian producers use a larger coconut share for other processing operations, such as coconut milk for domestic consumption. Most copra used for crushing into oil is sourced from Sumatra and the North Sulawesi province. Similar to the Philippines, most coconuts are produced by smallholder farmers.

The crushing of copra in Indonesia is relatively stable, with an average volume of 1.63 million tonnes. In 2023, it was estimated that Indonesia produced around 1.03 million tonnes of coconut oil. Although most copra is pressed into oil by a few multinational companies, the sector is more diversified compared to the Philippines, with many smaller processors. Exports are also more diversified. While more than half of all coconut oil from the Philippines is exported to Europe, Indonesian exports to Europe account for only around 20%.

Exports of coconut oil from Indonesia have increased at an annual rate of 5% since 2019. Exports reached 740,000 tonnes in 2023, valued at €687 million. Around 97% of exports are crude and refined oil; less than 3% is virgin coconut oil. The leading export destination for Indonesian coconut oil in 2023 was Malaysia, with a 23% export share, followed by the Netherlands (19%), the United States (14%), China (14%) and Sri Lanka (10%).

Sri Lanka, the leader in virgin coconut oil export

According to FAO data, Sri Lanka is the fifth largest coconut oil producer, after the Philippines, Indonesia, India and Brazil. Around 20% of coconuts harvested are used for coconut oil production. The primary concern for the coconut industry is the scarcity of coconuts in the country. Around 70,000 tonnes of copra are crushed into oil, resulting in around 44,000 tonnes of coconut oil. This is not sufficient for local processing capacities. Sri Lanka imports an additional 95,000 tonnes of coconut oil. This was mostly imported from Indonesia in 2023.

Sri Lankan coconut processors have recognised the importance of differentiating their exports to compete with the Philippines and Indonesia. Thus, the country has become one of the leading exporters of virgin coconut oil. More than 72% of exported coconut oil is shipped as virgin. This also accounts for organic-certified oil. The country is the leader in Fairtrade coconut oil certification. In 2024, there were 34 Fairtrade-certified coconut processors in Sri Lanka.

The leading Sri Lankan export destination is the United States of America, which accounts for one-third of its total coconut oil export, followed by Germany (10%), Slovenia (6%), Australia (6%) and the Netherlands (6%). Sri Lankan exports to Europe reached more than 12,000 tonnes in 2022 but decreased to less than 9,000 tonnes in 2023 due to bad weather conditions. Due to its specialisation and smaller exports of crude oil, Sri Lanka is gaining higher export prices compared to its competitors from other countries.

Malaysia, the third global supplier

Although Malaysia is the 11th largest global producer of coconuts, it has much larger processing capacities than several countries with more coconut trees. This is because Malaysia is the second largest producer of palm oil. Many palm oil processors use their own facilities and equipment for copra processing. Every year, Malaysia crushes around 30,000 tonnes of copra and produces around 18,000 tonnes of coconut oil. Selangor, Johor and Perak are the main coconut producing states in Malaysia.

In 2023, Malaysia exported 166,000 tonnes of coconut oil. This is significantly higher than the local oil processing capacities because Malaysia imports more coconut oil than it exports. Some of the re-exported coconut oil is shipped from facilities in Malysia to facilities in other countries owned by the same companies.

The main type of exported coconut oil from Malaysia is RBD oil, which accounts for almost 90% of exports. Large quantities of RBD oil are processed from crude oil imported from the Philippines and Indonesia. In 2023, the main target market for Malaysian coconut oil was the Netherlands, which has a 12% export share, followed by Türkiye(11.8%), Sri Lanka (10.8%), the United States (10.2%) and China (10%).

Tips:

- Participate in World Coconut Day activities to learn more coconut industry developments, market trends and to network with other coconut processors.

- Consider organic and Fairtrade certifications to avoid direct competition with Filipino and Indonesian companies.

Which companies are you competing with?

In the bulk trade of crude and RBD coconut oil, the market is concentrated around a few industry leaders that have integrated supply chains. These companies may seem like competitors for coconut oils producers, but they also buy crude coconut oil for refining. This means they can also be potential buyers. The segment of virgin coconut oils is more diverse, with hundreds of exporters from Sri Lanka, the Pacific Islands and Africa.

Cargill

Cargill is the global leader in the production of coconut oil. It aims to achieve an integrated supply chain in major coconut processing countries. With a network of copra buying stations in the Philippines and Indonesia, Cargill transfers and crushes copra in locally-owned mills. Cargill Oil Mills in the Philippines is the largest global coconut oil processor and exporter. In terms of the European market, most coconut oil is exported to the Cargill refinery in the Netherlands (in Rotterdam). Cargill also has refineries in Germany and Belgium.

Challenged with increasing sustainability requirements, Cargill has joined forces with six multinational companies to strengthen sustainable coconut production in the Philippines. Through this project, they have developed a training manual that focuses on sustainable agricultural practices and improving farmers’ incomes. Despite making efforts to promote a sustainable supply chain, Cargill is often criticised for sustainability issues, such as deforestation, having a negative impact on the environment and exploiting developing countries.

Willmar International

Willmar International is the leading agrifood company in Africa and Asia, headquartered in Singapore. The company operates five copra crushing plants and seven refineries in Indonesia and the Philippines. They also process some crude coconut oil from Papua New Guinea and the Pacific Islands. The company has developed a Coconut Responsible Sourcing Policy. In 2021, Willmar joined a project initiated by the Netherlands Enterprise Agency with other industry leaders to protect children’s rights in the coconut supply chain in the Philippines.

Samar Coco Products Manufacturing

Samar Coco Products is a specialised Filipino coconut oil processor. At present, the company operates two factories located in a coastal area in the Central and Southern Philippines. These two facilities have a combined capacity of 17,000 tonnes of crude coconut oil and 9,000 tonnes of copra cake per month. The factories have also invested in refining equipment that can produce 6,000 tonnes of RBD oil and 180 tonnes of coconut fatty acid distillate per month.

TMOMI and DBCOM

Third Millennium Oil Mills and Davao Bay Coconut Oil Mills are parent and subsidiary companies specialised in crushing copra and the production of coconut oil. Their oil mills have a combined annual crushing capacity of 420,000 tonnes of copra and 80,000 tonnes refining capacity. The companies have a range of food safety standards and organic certifications.

Primex Coco

Primex Coco is a group of processing companies in the Philippines that produces desiccated coconuts, coconut milk, coconut oil and banana chips. The company has an international presence in partnership with different traders in the United States, Canada, Australia and Japan. The UK-based company T.M.Duché & Sons represents them in Europe. They process coconut oil in four mills, with three mills that produce crude oil. New Davao Oil Mills also refine crude oil.

Musim Mas

Musim Mas is one of the leading coconut oil producers and exporters in Indonesia. The company is based in Singapore, but it has a network of operations and marketing offices around the globe. They produce a large range of oleochemicals, including biodiesel. In Europe, they have offices and facilities in Italy, Belgium, the Netherlands and Germany.

Sanmik Food

Sanmik Food is one of the largest exporters of virgin coconut oil from Sri Lanka. The company is Australian-owned but their main processing plant for coconut oil is located in Sri Lanka. Alongside coconut oil, the company produces a wide range of retail products and ingredients. They have processing factories in China, the Philippines, Vietnam and Myanmar.

The companies mentioned above are only a few industry leaders; there are many others. Some other notable names are: Oleo Fats Incorporated (the Philippines), Golden Union Oil (Indonesia), Mewaholeo Industries (Malaysia), Hddes Extracts (Sri Lanka), Serendipol (Sri Lanka) and Consolidated Business Systems (Sri Lanka).

Which products are you competing with?

The main competing products for RBD coconut oil are other refined vegetable oils. In Europe, the most consumed vegetable oil is rapeseed oil, followed by sunflower oil. Traditionally, palm oil was the second-most consumed oil, but consumption has significantly decreased over the last decade due to its negative public image. The reasons for this image are environmental concerns and the new deforestation regulation. As coconut oil is not affected by this regulation, there is an opportunity to substitute some palm oil with RBD coconut oil.

Due to its distinct scent, virgin coconut oil has no definitive substitute. However, if odour is not important for consumers, it can be substituted with butter of a similar consistency and structure. In terms of health benefits, olive oil has a much better-established image than coconut oil. Several other oils are also promoted for their health benefits and may compete with coconut oil. Those include ghee, avocado oil, grapeseed oil and nut oils.

In the cosmetics segment, competing products include argan oil, avocado oil, jojoba oil and macadamia oil. Some of these oils, especially nut oils (hazelnut, walnut and almond) and pumpkin seed oil, belong in the high-end segment and fetch higher prices than coconut oil. Chia oil and sacha inchi oil, which are mostly used in cosmetics, are also increasingly being sold as food products.

Tip:

- Visit the websites of the Federation of European Vegetable Oils Industry (FEDIOL), European Association of Dairy Trade (Eucolait) and the European Dairy Association (EDA) to better understand the competition.

4. What are the prices of coconut oil on the European market?

Coconut oil prices vary according to the type of oil. Crude coconut oil has the lowest price while organic-certified virgin coconut oil has the highest. Coconut oil prices are mostly influenced by production volumes in the leading processing countries. Over the last five years, Filipino and Indonesian crude coconut oil prices have sat between USD 1,100/t and 1,300/t CIF Rotterdam. At the end of 2021, the price reached USD 2,200/t, while in 2019 it went down to around USD 640/t.

The price breakdown below is a very rough indication, considering that many different factors affect production costs. These include quality, variety, origin, food safety certification costs, consultants, social security, taxes and sales network margins. The table is based on the average yearly prices in 2024 (until August) for virgin coconut oil sourced from Sri Lanka.

Table 1: Coconut oil retail price breakdown

| Export process steps | Type of price | Price breakdown | EVOO price per litre (example) |

| Copra buying price | Raw material price | 10% | €2.13/2kg (based on the assumption that 2kg of copra yields 1 litre of oil) |

| Crushing and production of bulk oil | FOB or EXW price | 15% | €3/kg |

| Import, shipping, handling and storing | CIF price | 16% | €3.15/kg |

| Packing | Wholesale price (value-added tax included) | 50% | €10/kg |

| Retail sales of the final packed product | Retail price | 100% | €20/kg (average for 500 ml packaging) |

Tips:

- Monitor weekly price updates from the International Coconut Community website.

- Check the international prices of coconut oil in the FAO price tool. In the selection menu, choose “coconut oil” from commodities and the supply country.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research