Entering the European market for coconut water

Offering high-Brix coconut water with a good flavour profile at a competitive price creates a positive image for new suppliers. It is very important to pasteurise coconut water as soon as possible after collection and to pack it quickly in aseptic packaging. Food safety and organic certification, and implementation of corporate social responsibility standards, provide additional advantages for new suppliers. The strongest existing competitors for new suppliers to Europe come from the Philippines, Thailand and Sri Lanka.

Contents of this page

- What requirements and certifications must coconut water comply with to be allowed on the European market?

- Through what channels can you get coconut water on the European market?

- What competition do you face on the European coconut water market?

- What are the prices for coconut water on the European market?

1. What requirements and certifications must coconut water comply with to be allowed on the European market?

What are mandatory requirements?

All foods sold in the European Union, including coconut water, must be safe. This applies to imported products as well. Levels of harmful contaminants, such as bacteria, are limited. It should also be clear from the labelling and laboratory tests if coconut water contains sugar or any other additives.

Contaminant control in coconut water

The European Commission Regulation sets maximum levels for certain contaminants in food products, while the European regulation on microbiological criteria for foodstuffs sets limits for pathogenic micro-organisms. The most common requirements regarding contaminants in coconut water are related to the presence of foreign bodies (such as husk fibres), microbiological organisms and chemical composition.

Microbiological contaminants

Coconut water is low in acid, so it supports the rapid growth of a wide range of bacteria unless quickly sterilised. The standard procedure before exporting includes laboratory testing for the presence of pathogenic micro-organisms. While Salmonella and Clostridium bacteria must be absent from coconut water samples, a very low tolerance of less than 10 cfu/g is allowed for other types of bacteria, yeasts and moulds.

Some buyers may allow higher microbiological limits if coconut water is exported as frozen and additionally sterilised after imports to Europe. In that case, export packaging must be clearly labelled to indicate that the coconut water is not intended for immediate consumption.

Pesticide residues

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. It regularly publishes a list of approved pesticides authorised for use in the European Union.

Product composition

European authorities can reject products if they have undeclared or unauthorised extraneous materials, or if the levels of these materials are too high. The main legislation regulating the composition of juices, including coconut water, is the European Fruit Juice Directive. Since May 2024, this directive officially recognises the juice extracted from coconuts as ‘coconut juice’ but also allows the product to be called ‘coconut water’. According to the directive, the minimum Brix level for reconstituted coconut water (from concentrate) must be 4.5.

According to the EU Fruit Juice Directive, the product cannot be declared as coconut water/juice, as adding preservatives to juices is forbidden in Europe. If antioxidants are used (such as citric or ascorbic acid), this must be declared too. Otherwise, the coconut water will be removed from the market.

One of the most common problems in the coconut water trade is the addition of undeclared sugar, preservatives and water. Although those additives and ingredients can be added, the labelling must then be changed to ‘nectar’ or ‘drink’ to avoid misleading consumers. Some of the most famous brands add those components to coconut water and fail to correctly label it. Some examples:

- Coconut water imported from Brazil by the leading brand Sococo and reported to the RASFF portal in 2023 due to undeclared sodium metabisulphite;

- Leading brand Vita Coco has added sugar and ascorbic acid (vitamin C) to its ‘Original’ product;

- The Naked coconut water brand sold in the USA has added coconut flavour. Although this is allowed in the USA, the labelling must be changed for the EU market to comply with EU criteria;

- A recent case in 2025 concerned the Coconaut coconut water brand in Poland. The coconut water was marketed as pure and young, but official analyses showed that it did not meet the AIJN Code of Practice in terms of L-malic acid, citric acid and sucrose content. This indicates the addition of sugar and flavour.

Quality requirements

The composition and quality of fruit juices, including coconut water, are covered by the European Fruit Juice Directive. According to this directive, the name ‘fruit juice/coconut juice’ is reserved for products that have not been sweetened, whereas ‘fruit nectars’ are allowed to be sweetened. It must also be clearly indicated on the label if a product has been obtained from concentrated juice.

For coconut water specifically, there is no official European standard which must be followed. The detailed reference guideline for coconut water was finalised in 2019 by AIJN. This document is available upon subscription to AIJN. There are also several guidelines published by some producing countries (the Philippines, Sri Lanka, Jamaica and India).

The main criteria used to determine the quality of coconut water are:

- Brix level – depends on the variety and maturity of the coconut. The Brix level normally decreases with maturity. The suggested minimum Brix level is above 3.5°. Some varieties (such as Thai Nam Hom) can have values over 8° in young coconut water. The price of coconut water commonly increases with its Brix level. The minimum Brix level for reconstituted coconut water is 4.5. It is also recommended as the minimum level for single-strength coconut water, but the industry also accepts water with lower Brix levels;

- Flavour profile – depends on the coconut variety, its maturity and the processing method. However, the flavour of coconut water in Europe is now quite standardised due to pasteurisation. This means that the flavour may be different compared to the flavour of juice consumed directly from young coconuts in South America, Africa or Asia;

- Turbidity – increases with maturity and the time between harvesting and processing;

- Colour – coconut water should be transparent. If oxidation occurs, the water can turn brown. Coconut water can also turn pink. This only happens to young coconut water due to polyphenol oxidation. According to the Tetra Pak Coconut Handbook, it is an indication of cracks in young coconuts;

- D/L Lactic acid – increases with fermentation when coconut water is not quickly processed after collection. It can give the coconut aroma an unpleasant smell.

Packaging requirements

Coconut water can be packed in bulk or in retail packaging. For bulk packaging, aseptic filled bags are commonly packed in 180 to 250 litre drums.

Packing can be done by coconut processing factories, but coconut water can also be bottled after bulk imports to Europe. Preserving technologies such as UHT and microfiltration are used. In producing countries, Tetra Pak is the packing solution that is used most. For example, this includes Tetra Brik or Tetra Prisma, but other solutions, like Elopak or SIG, are also used.

To minimise thermal impact on coconut water quality, UHT systems are mostly used for retail packaging, but other technologies are used too, such as microfiltration. It is important to extract and pack coconut water shortly after harvesting (preferably in less than two days). After extraction, it is important to cool the water immediately to stop any enzymatic and bacteria activities and to process/pack the water in the shortest possible time.

The content of the packaging must correspond with the indicated quantity (in weight or volume) on the label. Importers will check size and weight to ensure that pre-packed products are within the limits of tolerable errors.

Labelling and product composition

Depending on the type of coconut water produced, the bulk product must be labelled as ’coconut water’, ’coconut juice’ or ’concentrated coconut water’. Retail packed products must be labelled as ‘coconut water’, ’coconut juice’ or ’coconut water made from coconut water concentrate’. Bulk package labelling must contain the following information:

- Name of the product;

- Lot identification;

- Best-before date;

- Name and address of the manufacturer, packer, distributor or importer;

- Storage and shipping instructions.

Lot identification and the name and address of the manufacturer, packer, distributor or importer may be replaced by an identification mark.

In case of retail packaging, product labelling must be in compliance with the European Union Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and clear legibility (minimum font size for mandatory information). Coconut water is not listed as a product causing allergies. In soft drinks, sulphites can be used, and they must be visible as a potential allergen (at concentrations of more than 10 mg/litre).

Tips:

- Read about coconut water quality criteria and production processes in the Tetra Pak Coconut Handbook, especially if you aim to pack your coconut water in retail packaging;

- Control and test your coconut water by following analytical methods published by the International Fruit and Vegetable Juice Association (available upon subscription);

- Subscribe to the Code of Practice of the European Fruit Juice Association to access the reference guideline for coconut water and many analytical methods used for quality control.

What additional requirements do buyers often have?

Food safety certification

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will not work with you if you cannot provide some type of food safety certification.

For coconut water, the most popular certification programmes are:

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000);

- International Featured Standards (IFS);

- SGF Voluntary Control System.

Also, note that food safety certification is just the first step in starting to export to Europe. Serious buyers will usually visit/audit your production facilities within the first few years of cooperation.

In the fruit juice industry, the specific sector certification is voluntary SGF certification, which aims to achieve more safety, quality and fair competition in the fruit juice sector through industrial self-regulation. SGF certifies fruit processing companies, packers and bottlers, traders and brokers for fruit juices, as well as transport companies and cold stores.

For bulk coconut water suppliers, an important part of the SGF certification system is called IRMA (International Raw Material Assurance). For the whole supply chain, the ideal situation should look like this: farmers are GlobalGap certified, fruit processors are IRMA certified and bottlers are certified by IQCS (International Quality Control System for juices and nectars). Apart from fruit processors, IRMA certification is also applicable to traders/brokers, transport companies, producers of semi-finished products and storage facilities.

Sustainability requirements

There is an increasing demand for sustainably sourced food in Europe. To help consumers make more ecological choices, various labelling systems have been developed, such as Eco-Score, Eco Impact, Planet-score, Enviroscore and Foundation Earth. Along with requirements related to environmental impact, demand is increasing for a more transparent and fair supply chain.

One way to show that you take care of farmers and workers is to get certified using standards like Fairtrade, Fair for Life or Rainforest Alliance. Fairtrade is the most-used ethical certification for processed coconut products.

Fairtrade International developed a specific standard for oilseeds and oleaginous fruits for small-scale producing organisations. Aside from issues related to working conditions, the standard defines a specific Fairtrade Minimum and Premium Price for conventional and organic coconuts for processing. Fairtrade prices and premiums are defined for all production regions, and there is a specific price structure for Pacific coconuts.

Some companies require adherence to their own Code of Conduct, others require adherence to one or more common standards. Common standards include independent audits such as SMETA (by SEDEX), the Ethical Trading Initiative (ETI) and BSCI (by amfori). If coconut water is intended for direct retail sales, suppliers will have to follow a specific Code of Conduct developed by retailers.

Tips:

- Stick to the rules. New laboratory testing methods can easily discover the addition of non-permitted sugars and other additives in coconut water. It takes a long time and a lot of money to build a good reputation in the European market, but it can be lost very quickly if you are caught with adulterated or substandard products;

- Get food safety certification. However, check with importers and experts if the food safety certification company you consult is appreciated by European buyers. Examples of independent, internationally accredited certification companies include SGS, CIS, TÜV and Bureau Veritas;

- Read our study about buyer requirements for processed fruit, vegetables and edible nuts for a general overview of buyer requirements in Europe.

What are the requirements for niche markets?

Organic coconut water

To market coconut water as organic in Europe, processed coconuts must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can place the European Union’s organic logo on the packaging, as well as the logo of the standard holder, for example Soil Association in the United Kingdom or Naturland in Germany. A specific niche opportunity to sell organic coconut water at a higher price is to follow the rules of Demeter's biodynamic certification.

If you are aiming to produce and export organic coconut water to Europe, be aware of important new rules that may impact your business. The new EU Organic Regulation entered into force on 1 January 2022. This regulation is accompanied by more than 20 secondary acts that further regulate the production, control and trade of organic products. Some of the important acts to be aware of are detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Figure 1: Example of ethical messaging on coconut water

Source: Coconut Merchant

Figure 2: SGF IRMA certification

Source: SGF

With the support of the European Fruit Juice Association (AIJN), companies work together to increase social and environmental standards at the farming and processing stages by rolling out sustainability certifications throughout the supply chain. AIJN established the Sustainable Juice Platform to support, guide and inspire juice stakeholders to integrate corporate social responsibility throughout the supply chain.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) propose specific diet restrictions. If you want to focus on these ethnic niche markets, consider the implementation of Halal or Kosher certification schemes.

Tips:

- Read the training materials on the new organic regulation (by the Alliance for Product Quality in Africa project) to prepare for the new rules;

- Read our study on trends in the European processed fruit and vegetables market for an overview of developments in sustainability initiatives in the European market;

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

2. Through what channels can you get coconut water on the European market?

Most coconut water in Europe is sold through the retail channel. Many companies pack coconut water through subcontracting agreements in producing countries, but some import bulk products and pack it in Europe. Also, coconut water is increasingly sold to the beverage industry, such as fruit juice and (sports) drink manufacturers.

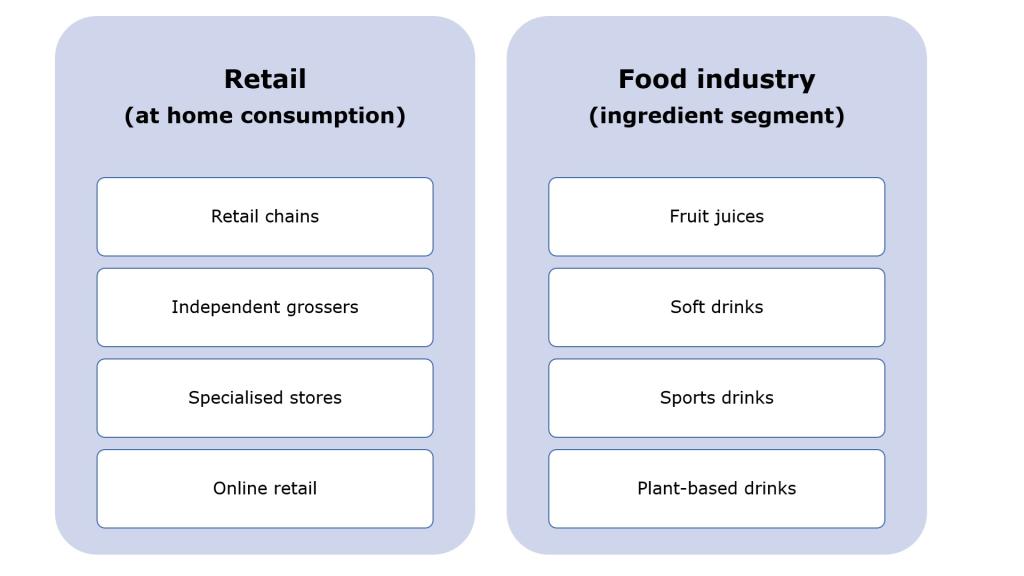

How is the end market segmented?

The largest quantities of coconut water in Europe are sold through the retail channel, mostly through supermarkets and discounter formats. The beverage industry also uses coconut water as an ingredient in drinks. At the moment, food service has an insignificant share. Some small quantities of coconut water are served by a limited number of ethnic restaurants (mostly Thai), including from fresh coconuts.

Figure 3: End-market segments for coconut water in Europe

Source: Autentika Global

Retail

Some retail chains have set up direct contract operations with processors in producing countries to sell their own private label coconut water. Still, in the majority of the cases, they are supplied via intermediaries such as specialised distributors. Consolidation, market saturation, strong competition and low prices are key characteristics of the European retail food market.

Several types of subsegments (points of sale) of the European coconut water retail segment include:

- Retail chains – the companies that hold the largest market shares in Europe are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group (cash & carry), Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands). The majority of coconut water brands sold in retail chains represent independent brands, but some chains have started to introduce their own private labels;

- Specialised stores – including organic food shops, ethnic shops, sports nutrition and beverage shops. Some organic shops are part of the specialised organic food retail chains. Organic coconut water is also sold in drugstores, such as dm or Rosmann. Ethnic shops selling Asian food also offer opportunities for entering the market, without competing with the leading retail brands;

- Ethical stores – a niche segment that provides opportunities for Fairtrade and ethically certified suppliers. Sales of Fairtrade-certified products are strong in the United Kingdom and Scandinavian countries;

- Vending machines – a frequent place for purchasing refreshing beverages in Europe. Coconut water is not sold through vending machines very frequently, but this channel can provide promotional opportunities. In order to use this channel, developing country suppliers should make arrangements with a specialised distributor who can then make contracts with vending machine operators;

- Online retail – often part of the offer of existing retail traders or specialised shops. There are general online supermarkets like Ocado and a few specialised online shops like Coconut Merchant.

Food industry

The food industry segment that is relevant for coconut water sales consists mainly of different beverage manufacturers. It is expected that this food industry segment will continue to grow, due to increasing demand for reduced sugar and plant-based drinks. The most common final users of coconut water include the following:

- Fruit juice and soft drink producers are using coconut water to reduce calories in juices. Still, only a few brands use coconut water as an ingredient, but it is expected that the number of juice varieties with coconut water will increase;

- Sports drink producers have started to introduce isotonic drinks based on coconut water in order to offer more natural hydration solutions. The most famous example of sports drink containing coconut water is Prime;

- Plant-based drink (such as dairy replacement drinks) producers use coconut water to give natural sweetness to no-sugar-added products.

Food service

The food service segment still offers limited possibilities for selling coconut water. The food service segment is usually supplied by specialised distributors. Currently, coconut water is served in a relatively small number of restaurants, including ethnic South East Asian restaurants. Interestingly, some opportunities can be found among suppliers of cocktail bars, as several cocktails use coconut water as an ingredient.

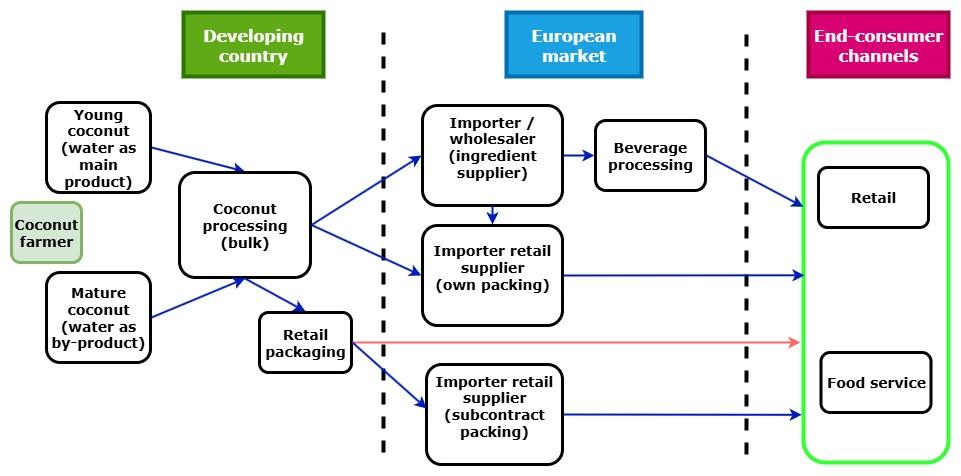

Through what channels does coconut water end up on the end market?

The most important channel for coconut water in Europe is represented by retail suppliers (branded coconut water) and beverage ingredient importers. Some importers might be interested in establishing long-term cooperation and packing coconut water directly in producing countries. There are also several alternative channels, such as ethnic food importers, agents, vending machines or food service suppliers.

Figure 4: European market channels for coconut water

Source: Autentika Global

Importer (wholesaler/ingredient supplier)

Importers specialised in supplying the beverage industry commonly import coconut water in bulk packaging. Those importers only act as trading companies and resell the imported coconut water without any further processing. Some importers are also processors and create customised solutions for food industry users (as described in the segments chapter above).

Importer (retail supplier)

Supplying retail chains with packed and branded coconut water provides the highest added value, but competition in the retail segment is high, as discussed in the first part of this study. In most European markets, only two to three brands have most of the market share. For new suppliers, the challenge is to establish long-term relationships with well-known brands, as they usually already work with selected suppliers.

Packed coconut water has the best flavour when it is packed shortly after harvest. Because of that, many brands prefer to pack coconut water in producing countries. Still, some retail brand owners import bulk coconut water and perform packing operations in Europe. Some companies have developed their own processing technology to obtain the best quality from the imported bulk water.

Specific types of importers are suppliers of Asian and other ethnic supermarkets and shops. Those types of importers provide direct access to niche markets without the need to compete with strong brands present in the mainstream retail segment.

Retail channel

Retailers rarely buy directly from developing country exporters. However, there are some cases where developing country exporters (processors) pack directly for a private label or even own label brands, such as Spanish leading retailer Mercadona.

Fruit juice bottling and blending companies can be specialised in the supply of private labels for retail channels. In many cases, juice companies with established brand names also produce juices and nectars for private labels.

Agent/broker

The role of agents involved in the coconut water trade is not as significant as in other processed fruit and vegetable sectors. Agents normally act as independent companies that negotiate on behalf of their clients and as intermediaries between buyers and sellers. Typically, they charge commissions of 2-4% of the sales value for their intermediary services.

Tips:

- Study exhibitor lists for large European trade fairs such as ANUGA, SIAL and Alimentaria to find potential buyers;

- Understand the pressure from retailers for sustainable products and make yourself more competitive by investing in certification schemes related to CSR, organic or food safety. Food safety certification is a minimum requirement if you want to reach the retail segment;

- Explore your possibilities for supplying European retailers by visiting PLMA, a specialised private label show;

- Search through the members' list of the European Vending & Coffee Service Association to find companies offering opportunities to sell coconut water through the vending machines channel.

What is the most interesting channel for you?

The most interesting channel depends on the type of packaging, price and quality of the coconut water you produce. If you have modern retail packaging machines, retail channel suppliers and distributors can be a good option. However, you do not need to focus on one channel only. Exporting bulk coconut water to European packers or ingredient suppliers is a good option for processors that do not offer retail packaging solutions.

Ingredient suppliers and European packers sometimes use coconut water from different origins to make their own blends. For example, mixing cheaper low-Brix types with more expensive, flavour-rich coconut water can enable more stable flavour profiles.

3. What competition do you face on the European coconut water market?

Which countries are you competing with?

The main competitors for emerging coconut water suppliers in Europe are coconut processors from Southeast Asian countries, followed by Brazil. The leading exporter of coconut water to Europe is the Philippines, followed by Thailand, Sri Lanka and Brazil. Despite being a large coconut processor, Indonesia does not export significant quantities to Europe due to customs duties. Vietnam is increasing its export to Europe but still has a relatively small market share.

The Philippines: Leading supplier of coconut water to Europe

The Philippines is the second-largest coconut producer in the world, with a production of 14.89 million tonnes in 2023. This came from 3.66 million ha, according to the country’s statistics authority PSA. The largest quantities are produced in Luzon, Southern Mindanao and the Eastern Visayas. In the Philippines, large quantities of coconut water are obtained as a by-product of coconut milk, desiccated coconut and virgin coconut oil processing.

The impact of climate change is a concern for the Philippines. The country was ranked 4th in the long-term climate risk index in 2021. Its coconut production is exposed to many risks, according to the Philippine Coconut Industry Roadmap 2021-2040. These risks include strong and super typhoons, severe drought caused by El Niño, and the exotic pest Cocolisap.

Since 2020, exports of not-from-concentrate (NFC) coconut water from the Philippines increased at an annual rate of 7% and reached 148 thousand tonnes in 2024, with a value of €116 million. In addition, in 2024 the Philippines exported nearly 16 thousand tonnes of coconut water concentrate. Less than 5% of exported NFC coconut water is obtained from young coconuts, while more than 95% is obtained from mature coconuts.

Source: Autentika Global and the Philippine Statistics Authority

The leading destination for Filipino NFC coconut water is the USA, with a 68% share in quantity, followed by the UK (18%), Canada (8%), the Netherlands (2%), France (1%) and China (1%). NFC coconut water exports from the Philippines to Europe mostly go to the UK due to Vita Coco trade operations in that country. The UK imports 86% of NFC coconut water, followed by the Netherlands (9%), France (3%) and Spain (1%).

Source: Autentika Global, ITC Trademap and Philippine Statistics Authority

Thailand: Highly valued and retail-packed products

Thailand is the world's sixth-largest producer of coconuts. A specific characteristic of Thai coconut water production is the large share that is produced from young coconuts, where the coconut water is the primary product. It is different to many other countries, where coconut water is produced together with other coconut products. Thailand also imports some coconut water from Vietnam and packs it for export. Thai coconut water has good flavour and high Brix, especially when it comes from the fragrant Nam Hom variety.

Many international brands source coconut water from processors in Thailand. One of the reasons is the presence of companies equipped with retail packing lines, such as laminated cardboards and cans. For example, the brand of Coca Cola (Zico) packs its coconut water at two locations in Thailand. Also, several Thai companies have managed to export coconut water under their own brands to European retailers.

Thailand is slightly reducing its coconut processing facilities, and a few factories have been moved to Indonesia. However, coconut water export is still growing at a fast rate. Over the last years, Thai exports of NFC coconut water almost tripled, increasing from 166 million litres in 2022 to 454 million litres in 2024. Thailand also exports 47 thousand litres of coconut water concentrate.

Thailand mostly exports to non-European destinations. The main market for Thai coconut water is China, with a 45% share, followed by the USA (35%), Taiwan (3%), Singapore (3%), Hong Kong (2%) and Laos (2%). Exports to Europe, although not the primary market for Thailand, are growing at a fast rate. In 2024, Thai exports to Europe reached 22 million litres of NFC coconut water. The leading export destination was Spain, with an 18% share, followed by the UK (10%), the Netherlands (7%) and France (5%).

Source: Autentika Global and Thailand’s trade statistics

Sri Lanka: Strong organic offer

Coconuts in Sri Lanka are harvested from 1.09 million acres. Most of the coconut production is concentrated in small holdings (in total 917,307 acres). Annual production amounted to 3.383 million coconuts in 2023. An estimated 1.319 million coconuts are used by the industry annually. Sri Lankan processors invest strongly in organic certification and the country is currently the leading supplier of organic-certified coconut water to Europe.

There are several institutions that represent the interests of the sector, including the Ceylon Chamber of Coconut Industries (CCCI). The CCCI is the umbrella organisation for Sri Lanka’s coconut industry. The CCCI has eight founding members, including the Coconut Milk Manufacturers Association. The sector is also supported by the country’s Coconut Research Institute.

The export of coconut water from Sri Lanka is growing at a stable rate, rising from 5.5 million litres in 2022 to 8.7 million litres in 2024. Although the USA is the leading target country for Sri Lankan coconut water, most of the coconut water (nearly 60%) is exported to Europe. In 2024, the main European market for Sri Lankan coconut water was the Netherlands, with a 41% share, followed by Germany (35%), France (13%) and Spain (6%). Most of the Sri Lankan coconut water that is imported by the Netherlands is re-exported to Germany.

Brazil: Focused on the US market

Brazil is the world's fourth-largest producer of coconuts and the first country to develop the international market for coconut water. Brazil distinguishes itself from its Asian competitors by producing green coconuts, focusing its production on the extraction of coconut water without significant production of other coconut products. It is estimated that Brazil is the largest processor of coconut water today. However, Brazilian coconut water processors are significantly more present in the United States than in Europe. The USA imports 95% of the Brazilian supply.

Within Europe, the market for Brazilian coconut water is also concentrated. The Netherlands imports the biggest quantities. In 2024, Brazilian export of coconut water to Europe reached 370 thousand litres. 61% of this quantity was imported to the Netherlands, followed by Italy (14%), Germany (11%), Sweden (5%) and Belgium (3%).

Source: Autentika Global and ITC TradeMap

Which companies are you competing with?

Currently, most quantities are processed by large processors, making it difficult for smallholders to compete. However, there are several initiatives to support smaller processors in the production of added-value products, such as coconut water.

Companies from the Philippines

Axelum Resources Corporation manufactures a full range of coconut products including desiccated coconut, coconut milk powder, coconut cream, coconut milk, coconut water, reduced-fat coconut, coconut oil and virgin coconut oil. Coconut water makes up approximately 20-30% of the company’s gross revenues, according to annual reports. Axelum sold around 25 million litres of coconut water in 2019. The main production facility is located in Medina, but it owns manufacturing and distribution facilities in the United States and Australia as well.

Axelum has signed a contract with All Markets (Vita Coco brand), which made them the second Vita Coco coconut water supplier after a company in Brazil. The coconut water is packaged using a PrismaTetra packing machine, the first of its kind in the Philippines. The company also packs its own coconut water (‘Fiesta’ label) and packs water for several other brands and private labels.

Century Pacific Agricultural Ventures is another large coconut processor from the Philippines. The company is part of the Century Pacific Food group, which, aside from coconut products, also produces fish, meat and dairy products. It has its own coconut water brand, Aqua Coco.

Other coconut water processors and exporters from the Philippines include Sambu Group, Franklin Baker, Peter Paul Philippine Corporation, AgriNurture, Primex, Superstar Coconut, Weambard, Pepsi Cola, Profood International, SC Global Products, Ahya Coco, Roxas Sigma Agriventures and Celebes Coconut Corporation.

Companies from Thailand

Universal Food PLC, more commonly known as UFC, is one of the most successful exporters of coconut water from Thailand. UFC produces a wide range of products in two factories in the Lampang and Nakhon Pathom provinces. UFC has managed to become one of the recognised brands in Europe, selling packed coconut water in several retail chains. Another European retail market success story is that of Thai company Theppadungporn Coconut, which sells its brand Chaokoh to the Spanish retailer Mercadona.

Other examples of coconut water processors and exporters from Thailand include Thai Coconut PLC, Kona Enterprises, Tipco, NP Agri, Asiatic Agro Industry (Cocomax brand), Tropfin, All Coco and Malee.

Companies from Sri Lanka

One of the most notable coconut water processors in Sri Lanka is Silvermill Group, which also packages coconut water with Tetra Pak machines for the Vita Coco brand. The full list of coconut water exporters from Sri Lanka can be found on the website of the Sri Lankan Coconut Development Authority.

Companies from Brazil

It is estimated that Brazil has the largest domestic consumption of packed coconut water in the world. The Kerococo brand (by Pepsico) and Ducoco (by Ducoco Alimentos) are two market leaders in Brazil. Kerococo is present in chains like McDonalds. Ducoco Alimentos is not exporting significant quantities of coconut water to Europe. Pepsico is present in Europe in some countries with coconut water brand ‘Naked’.

Brazilian coconut water processors do not have a strong presence in Europe yet. This may change soon, as the Grupo Aurantiaca company, maker of the Obrigado brand, is planning to expand to Europe. Aurantiaca has established a subsidiary representation in the Netherlands (Aurantiaca Europe BV) to do so.

Tips:

- Use the services of your national export promotion agency and actively participate in the creation of export strategies;

- Visit the website of the International Coconut Community to stay updated on developments in the coconut processing industry in major producing countries.

Which products are you competing with?

The biggest competition for coconut water comes from other plant drinks and sports drinks. Plant drinks around the world are becoming more popular, including birch tree water, aloe vera water, cactus water, maple water and watermelon water. Still, those types of drinks do not have a significant presence on the European market. Fresh young coconuts are the major product competitor to bottled coconut water in producing countries, but due to their high price, they are rarely sold in Europe.

Other direct competitors to coconut water are rehydrating sports drinks. Although they can be described as more artificial, they can be created in more customised ways to suit specific needs of athletes. For example, coconut water is an effective rehydration solution after exercising, but sports drinks can be created to benefit athletes before and during exercise as well. For example, a recent study suggests that coconut water is not better than plain water for improving performances during exercise.

4. What are the prices for coconut water on the European market?

Depending on the country, retail chain and brand, export prices of coconut water vary significantly across Europe. Coconut water is often produced together with other coconut products from the same nuts. Generally, the coconut water export price increases with the Brix level.

Retail prices of coconut water in Europe range from €2 to €5 per litre, depending on the brand and packaging. As mentioned above, this cannot be taken as price orientation for the export price. What is important to understand is that a retail brand can be packed in the producing country and exported to Europe, packed in Europe from NFC coconut water or produced from concentrated coconut water. Each option has a different price structure.

Table 1: Coconut water price breakdown per litre

| Steps in the export process | Type of price | Price breakdown | Example (1 l) |

|---|---|---|---|

| Production of coconuts | Farmer price | 5% | €0.15 |

| Processing and packing of coconut water | FOB price | 30% | €0.9 |

| Storing, handling and shipping | CIF price | 33% | €1 |

| Selling to the retail segment | Wholesale price (including value-added tax) | 50% | €1.5 |

| Retail sales of the final packed product | Retail price | 100% | €3 |

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research