7 tips for doing business with European buyers of processed fruit and vegetables

If you want to successfully export processed foods to Europe, you should pay attention to what European buyers like and need. A deeper understanding of European buyers and their preferences helps SMEs offer products that buyers and their customers want. It also drives suppliers to adopt new business practices. This type of connection helps firms build a stronger market presence, boosting their long-term growth and profitability in Europe.

Contents of this page

- Cultivating trust and partnership with European food importers

- Navigating the competitive European market: pricing strategies and considerations

- Winning the European market: key selling points for exporters

- Boost European exports with professional assistance

- Processed food is a face-to-face business, but a website gives you global visibility

- Let your products speak for you – Send samples

- Make sure your product documentation reflects buyer needs

1. Cultivating trust and partnership with European food importers

Understanding and adapting to the European business culture is essential for exporters from other continents. Europe has some unique customs, expectations and behaviours. By understanding these details, exporters can build strong relationships with buyers and conclude negotiations successfully.

For example, punctuality tends to be highly valued in Europe. Being late to meetings or missing deadlines reflects poorly on your business. European business culture also values exchanging business contact details, following proper email etiquette, dressing professionally, and proving your company's pledges.

To prepare for business meetings with European firms, you can consult online cultural guides. Commisceo Global offers free country-specific guides on cultural awareness, etiquette and business practices. CultureMee also offers free business culture tips on individual European markets, as does GlobalNegotiator. Passport to Trade 2.0 offers both free and paid business culture guides for SMEs on 31 European markets.

The Country Commercial Guides (CCGs), created by the U.S. government, are an excellent source of business customs. Select a country from CCG's country guide page and then go to its Business Travel section.

English is often used as a common language in business transactions. However, firms that can do business in the local language may have an advantage. This is particularly true when dealing with smaller buyers.

To open communication with potential business partners, start with a professional and short email introducing your firm and products. Attaching a presentation can be an effective approach. This can be followed by setting up a call to discuss further. Try to contact the commercial department or relevant executives directly. Face-to-face, in-person meetings are most highly valued, as they help build trust and understanding between parties.

Always keep in mind that there are cultural differences between countries in Europe. Be aware that cultural recommendations and generalisations are not true for every company or situation.

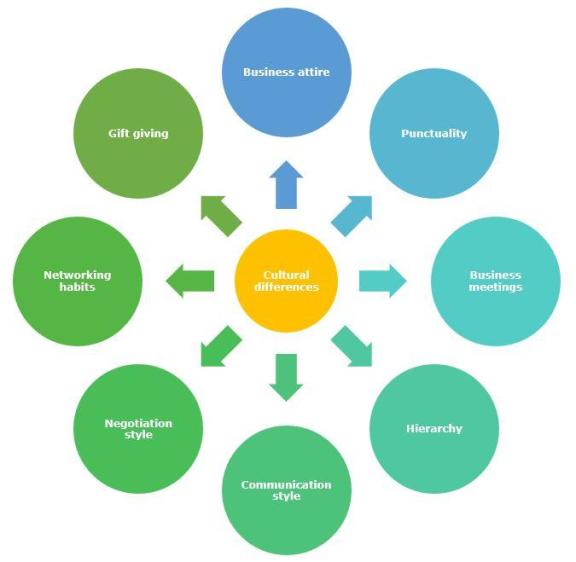

Figure 1: Eight areas of cultural differences to be aware of

Source: Autentika Global

Business attire

Formal business attire is expected for meetings in the UK and Germany. By contrast, a more relaxed dress code in seen in Spain and the Netherlands, where business-casual attire is acceptable. The dress code for lunch and dinner in the Czech republic would be formal business attire, such as a dark coloured suit for men and an equivalent professional look for women.

Punctuality

Punctuality is highly valued in Germany and Switzerland, and being late can be perceived as disrespectful. By contrast, Italy and Spain may have a more relaxed attitude towards time. Arriving late for an appointment in Luxembourg is considered rude and disrespectful. If you are delayed, make sure to call in advance to inform your meeting partner and offer your apologies.

Hierarchy

In France and Belgium, business interactions may be more hierarchical, with decisions made by senior management. In Nordic countries like Sweden and Denmark a flatter organisational structure is more common, with a collaborative decision-making approach. In countries with a family-oriented culture, like Greece, the business community is characterised by small, family-owned companies.

Communication style

In the Netherlands, communication is generally more direct, while in France or Spain it may be more formal. Be mindful of local customs. Greeks may often interrupt when speaking: no offence is intended, it is a common aspect of local communication.

Business meetings

Meetings in Germany and Austria are rather structured and formal, with a clear agenda. In Southern European countries like Greece and Portugal meetings may be more informal and relationship-focused. Also, structure and order are less relevant in trade fairs like ANUGA or SIAL, where time for meetings is very limited.

Negotiation style

In Scandinavian countries like Sweden and Finland, negotiations may be more consensus-driven and focused on finding a win-win solution. By contrast, in France and Italy negotiations may be more competitive, with a focus on achieving the best possible outcome for one's own company. Come prepared and be confident, but not forceful; for example, Czech managers may be sensitive to this.

Networking style

In the UK and Ireland, informal networking events, like after-work drinks or pub gatherings, play a significant role in building business relationships. In Germany and Poland networking may be more formal and conducted at industry events or conferences.

Gift giving

In some European countries, like Italy or Spain, presenting a small gift at business meetings may be a customary gesture. In other countries, like Sweden or the Netherlands, gift-giving is not as common and may even be perceived as inappropriate in some business contexts.

Tips:

- Do not underestimate the cultural differences between your company and your European partners. Although handshakes are a typical greeting in Europe, be sensitive to possible rapid changes after the COVID-19 pandemic. If someone is wearing a mask or it is flu season, they might prefer a fist bump.

- Speak clearly but not too loudly. Voices should be kept at a comfortable volume. Customers in some countries may be uncomfortable with loud communication, which can be perceived as intimidating.

- Do not touch your business partners apart from handshaking.

- Wear a business or business-casual suit to first meetings and trade events. Afterwards you can dress more casually. Wearing a business suit is not of crucial importance in Europe.

2. Navigating the competitive European market: pricing strategies and considerations

The European market is highly competitive and has strict quality and safety standards. To enter the market, exporters need pricing strategies that are both competitive and profitable. This means thinking about product positioning, target market segments, competition, and production and shipping costs. For instance, offering organic or sustainably sourced products can justify a higher price point, as these features appeal to a growing share of environmentally conscious consumers.

Businesses in this sector typically work with net prices. This allows both parties to have a clear understanding of the product's base price before considering any additional expenses or fees. Including price scales per quantity can incentivise bulk orders, which can lead to cost savings for both exporter and importer.

Prices for commodities vary, especially for agri-food commodities. Some factors to consider are weather, climate, seasonal changes, competition, geopolitical events and consumer demand.

Prices fluctuate in the European processed fruit and vegetables market too. Dominant suppliers can shift the market. These include California (almonds and prunes), Burkina Faso (dried mango), Turkey (hazelnuts, dried grapes and apricots), Costa Rica (NFC pineapple juice), India (mango puree), and Vietnam (cashew nut kernels). When yields in those countries are high, prices go down and vice versa.

Keep an eye on sudden political, economic or weather events that may disrupt supply from major origins. This can lead to sudden price swings. Monitor events such as strikes, wars and major climatic patterns.

Be aware of seasonal trends. For example, cold stores that still hold last year's frozen crop or tanks that hold juice from the previous season will have to be emptied to absorb the new crop. Hence market prices can be influenced by the timing of the crop harvest in rival producer countries.

Export prices are defined by the Incoterms® rules. These are standardised trade terms published by the International Chamber of Commerce (ICC). When you compare prices with other supply destinations, it is better to use C-terms and D-terms as a basis for comparison. Ex-Works and F-terms do not include logistics and customs costs, which differ between countries. Incoterms® rules are not a replacement for a sales contract because they do not address certain key areas. Make sure you cover those areas with your sales contract.

When making a quote, select Incoterms® rules that are favourable for you. This might depend on volumes. If you trade large quantities, you can get better offers from transport and insurance companies. In that case, the Cost, Insurance and Freight (CIF) price will be more competitive for you. If you have little export experience, it is safer to offer the price based on Ex-Works or F-terms only. With Ex-Works the buyer bears the full costs and risk involved in bringing the goods to the destination, so it's a net price.

Figure 2: Key trade factors beyond Incoterms® 2020

Source: Autentika Global

To help you decide the best terms for your company, download a free and easy-to-use graphic tool from the ICC. Or you can check out the handy Incoterms® 2020 practical A4 wallchart. The official Incoterms® rules app is available for Android and iPhone. The ICC also offers an overview of sales documents used for exports (PDF). To understand this better, watch a useful video from the International Trade Administration on how to manage export shipping costs and risk with Incoterms® 2020.

Send a quote after including all costs and a margin in your price, according to current market conditions.

Figure 3: Most important elements needed in a quote

Source: Autentika Global

Product description – You do not need to include a complete product specification in your quote. Send it as an attachment. However, include basic grades and quality information related to your offer. Several criteria explain the offer, such as variety (frozen fruit, purees or concentrates with high brix readings are better priced), size (dried fruit and edible nuts are sold per size grades) or class (defined by industry standards).

Attach an in-house Certificate of Analysis (CoA) or an external CoA from an accredited laboratory as proof that the product complies with the EU legislation and other relevant certificates that support your claims.

Shelf life – This depends on product type, and it is often based on industry experience. There are no industry standards defining shelf life, so this is your own responsibility. Traders often require products that have not exceeded more than one-third of their total shelf life, in order to meet the expectations of retailers.

Price – Should be stated in the currency that is most favourable for you (usually USD or EUR), although European buyers prefer quotes in EUR. It must be clear which Incoterms® are used for the price and which unit is used (usually net weight in kg or tonnes).

Businesses typically provide quotations using net prices. Net prices exclude any taxes, duties or additional fees that may apply. This allows buyers to understand the actual cost of the product. This practice is common in international trade, as taxes and duties may vary significantly depending on the destination country.

Price scales per quantity are also commonly used in this sector. Offering tiered pricing based on quantity allows suppliers to motivate buyers to purchase larger volumes. This pricing strategy is attractive to both parties. Suppliers can increase their sales and achieve economies of scale, while buyers can lower their buying costs.

Packaging – Specify type, size and container load. Container load can indicate how many cargo units (such as pallets) are placed into the container.

Payment – You should indicate payment terms, but you can also negotiate payment terms later. For example, if a buyer asks for deferred payment, you can negotiate a higher price if you were to need the services of an export insurance agency. Check our product-specific studies to find more information about their prices.

Date of expiry of your quote – You don't always need to specify a date. Sometimes you can indicate that the offer is valid for as long as the product is available. In that case, indicate that your price offer is not final, to avoid problems with frequent price fluctuations. Also, provide an estimated supply lead time if possible.

Table 1: Example of specific product information for a quotation

| Grade and origin of organic dried mango slices | Grade A: 1-2 cm width, 5-8 cm length Grade B: 1-2 cm width, 3-5 cm length |

| Shelf life | 12 months from production date, stored in a cool, dry place, away from direct sunlight. |

| Quality and origin | Sulphite-free, moisture maintained at 15-20% Keitt variety, origin Kenya |

| Quantity | Up to 10,000 kg organic dried mango slices per month |

| Terms | FOB Mombasa, Kenya |

| Packaging | 1 kg vacuum-sealed bags, in cartons containing 10 bags each (10 kg/carton). Custom packaging options available upon request |

| Price | Quantity 1,000 - 4,999 kg: €8.50/kg Quantity 5,000 - 9,999 kg: €8.00/kg Quantity 10,000 kg and above: €7.50/kg |

| Certifications | EU Organic by ECOCERT (Copy attached) |

| Terms of payment | Wire transfer (SWIFT) or letter of credit (LC) at sight. 30% advance payment upon order confirmation, remaining balance to be paid upon shipment. |

| Date of offer expiry | Quote is valid for 30 days. Prices subject to change without prior notice |

| Estimated supply lead time | 20 days lead time after advance payment |

Source: Autentika Global

Keep in mind that margins can vary significantly depending on factors like product type, quality, market demand, and level of value addition. However, as a rough estimate, typical gross margins can range from 10% to 30%. Be flexible if your business allows for it.

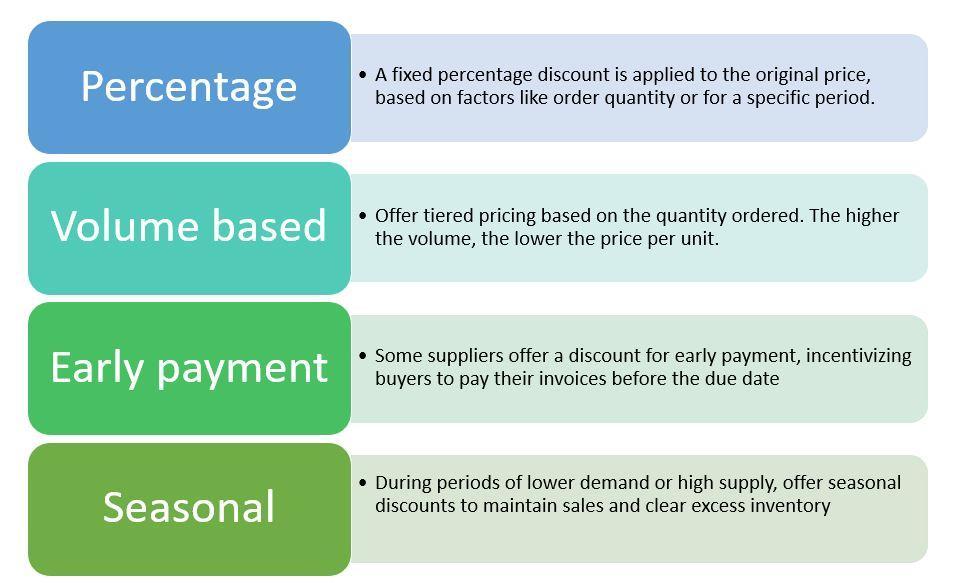

If you wish to attract and retain buyers, consider several types of discounts. Different types of promotions work best, depending on the state of supply and demand in the market and a company's position in the market. Offering discounts should be done with a specific purpose: attracting an important buyer or reducing inventory.

In some cases, discounts might range from 5% to 20%, depending on the product, market conditions, and individual supplier-buyer relationships. Top-selling products may have lower discounts due to higher demand, while products with lower demand or excess inventory may have higher discounts to encourage sales.

Figure 4: Different types of discounts offered by suppliers

Source: Autentika Global

Tips:

- Monitor reliable and up-to-date news sources about market trends. Some traders and organisations publish news about supply and price fluctuations, for example Chelmer Foods (dried fruit and nuts), Bohemia Nuts (peanuts), MarketWatch (orange juice concentrate), INC (nuts), GTA (nuts), FAO (tropical fruits), IOC (olive oil), Funguys Gourmet (dried mushroom trends).

- Consider subscribing to the S&P Global Commodity Insights, a respected market information service for processed fruit, vegetables and edible nuts. The service offers timely updates on export prices.

- Cooperate with producers of equipment for the processing of fruit and vegetables. Those companies often have good information about yields, harvest and prices in countries they supply to.

3. Winning the European market: key selling points for exporters

SMEs from developing countries that want to export to Europe must consider several factors to create an effective sales pitch and marketing materials. These include finding unique selling points (USPs), matching buyer requirements, and leveraging provenance stories. When defining your USP, look for things that make your products stand out from the competition. European buyers value certain USPs, including:

High-quality products: Emphasise premium quality, taste and freshness. Extra virgin olive oil (EVOO) makers can follow the latest trends in Flos Olei, considered the most important publication in the sector. Flos Olei organises annual international competitions. Fruit processing firms can emulate Tunisian dates producer Biosca Tamara, that promotes quality through good fruit selection, regular laboratory testing and certifications.

Sustainability: Highlight eco-friendly production methods, such as reduced water usage, organic farming practices and renewable energy. For example, Blue Skies Juices Ghana ensures its suppliers work on the preservation of forests. This is evident in its publicly available food safety and quality policy (PDF). The firm makes ice cream in Ghana with tropical fruits, while advancing 10 UN sustainable development goals (SDGs).

Fair trade: Showcase the positive impact of fair trade practices on local communities, such as improved working conditions and fair wages for workers. Maputo-based Sunshine Nut Limitada has a marketing story that centres on their 'sunshine approach' to cashew nut production. The approach focuses on uplifting local communities by creating jobs, offering training, and supporting smallholder farmers.

Product innovation: Offer unique flavours, textures, and packaging solutions that differentiate your products from competitors. Research on olive oil indicates that bottle size shows a strong inverse relation with price, with larger bottles less expensive than smaller ones. In the EVOO segment, olive oils with intense flavourings are worth significantly more than delicate oils.

Pro-active risk mitigation: Obtain relevant certifications, such as organic, fair trade, or GlobalG.A.P., to build trust and credibility with European buyers. Malawi-based Afri-Oils Ltd, trading as Afri-Nut, is a groundnut processing and export firm that took action to address high aflatoxin levels in Malawi groundnuts. The company provides training to growers, focusing on increasing yield and reducing aflatoxin levels.

Price: There is nothing wrong with promoting your price as lower than that of the competition. However, make sure buyers understand that your lower price does not automatically mean lower quality.

Product uniqueness or provenance: Base your USP on very specific characteristics of the product you offer. It can be a unique variety with desirable qualities but which isn’t widely known (like mango from Pakistan, Cordyceps mushrooms from Bhutan or exotic jungle nuts from Indonesia).

Natural and unique environment: many developing countries have clean nature and lower use of pesticides. This USP is used by pine nuts from the Siberian Taiga and Bhutan, promoting itself as the first organic country.

If your country is recognised for a specific product, you can connect your brand to the brand of your country. Brand campaigns from developing countries include Superfoods Peru (Peruvian functional food), Beautiful Country Beautiful Fruit (South African fruit) and the Avocados from Mexico campaign.

A good way of aligning USPs with buyer requirements is to focus on your strengths. Emphasise product quality, safety and certifications. For example, the Sri Lankan firm Adamjee Lukmanjee & Sons specialises in the production and export of processed coconut products. Their marketing story revolves around their long history, commitment to quality, and compliance with food safety standards.

Provenance plays an important role in the sector, especially for the European market. European consumers and buyers are interested in the origin, production methods and quality of the products they purchase. For example, Tunisia's Les Moulins Mahjoub produces and exports high-quality olive oil, apricot and fig jam, grapefruit and lemon marmalade, and canned artichokes. They have built a strong brand and marketing story through their commitment to artisanal production methods, organic farming practices and family values, and preservation of the flavours and quality of Tunisian olive oil.

Tips:

- Be honest and transparent. Do not advertise products or services you cannot deliver. Also, never sell products that are different from the product specification.

- Work on your USP with a team. A USP must be accepted as a shared value by all company staff. Make sure you include all levels of your firm in the process of USP creation. It is a team-building process.

- Communicate your brand consistently on all your media platforms, including your website, emails, newsletters, quotations, letters and business cards.

- Participate in innovative product competitions at leading European trade events such as ANUGA or SIAL. Or you can opt for industry-specific competitions such as Flos Olei for olive oil.

4. Boost European exports with professional assistance

There are many business support organisations (BSOs) that can support your firm's exports. They might be national or regional, located in your target market, or at an international level. Some organisations (like CBI) have programmes that assist with exports to Europe. National export-promotion organisations fund activities such as export market research, training on export-related skills, participation in trade fairs and matchmaking activities.

European and international BSOs

Some of the most important European and international BSOs helping exporters in developing countries are:

Centre for the Promotion of Imports from developing countries (CBI). A Dutch government-funded organisation that supports entrepreneurs become successful exporters to the European market. CBI offers market information for products and services, export coaching programmes and technical support. CBI informs and influences policymakers, and involves importers in the development and implementation of programmes.

The Swiss Import Promotion Programme (SIPPO). A government-funded organisation that supports BSOs to expand the export promotion services they offer to their export-ready member companies. SIPPO does not focus on individual companies. Check out SIPPO's local offices in its target countries. For other countries, SIPPO offers its Trade Promotion Academy e-learning platform for free.

The Import Promotion Desk (IPD). A German government-funded organisation that offers sustained and structured promotion of the import of certain products and services from selected partner countries. They bring together the interests of German importers with those of exporters from emerging growth markets.

International Trade Centre (ITC). An agency of the United Nations based in Geneva. It offers SMEs in developing countries trade-related practical training, advisory services and business intelligence data. ITC maintains an online list of countries in which it works on fruit- and vegetable-related projects.

Development agencies and programmes from Scandinavian countries are focused on bilateral trade projects and trade with the EU. These include Open Trade Gate Sweden, Finnpartnership, Danida and Norad. The Swedish agency offers excellent free market studies on specific Swedish markets.

West Africa Trade & Investment Hub (Trade Hub). A USAID-backed trade facilitation activity designed to boost exports and competitiveness in West Africa. Trade Hub encourages private-sector growth in export agriculture and agricultural processing. Determine your company's eligibility on TradeHub's SMART platform.

Institute for Agriculture and Trade Policy (IATP). Supports fair and sustainable food, farming, and trade systems.

National trade and export support organisations

Always start by checking sources of support in your own country. State export promotion agencies, chambers of commerce or embassies that your country has in target markets can help you with promotional activities.

Examples of organisations that could help are the Kenya Export Promotion & Branding Agency, Jordan Exporters Association (JEA) and Moroccan Investment and Export Development Agency. The Kenyan agency offers several e-learning courses to help guide exports and market intelligence.

Figure 5: Kenya Export Promotion and Branding Agency website

Source: Kenya Export Promotion & Branding Agency website, screenshot by Autentika Global

Being part of a sustainable development programme in your country can help showcase your efforts in the field. This may increase your chances of doing business with European buyers. These programmes help prove your commitment to environmentally friendly and socially responsible practices.

Some practical steps to incorporate such practices include:

- Obtain relevant certifications like Fair Trade, Rainforest Alliance or UTZ to demonstrate your sustainable practices.

- Implement traceability systems to ensure transparency in your supply chain.

- Collaborate with sustainability-focused organisations like GLOBALG.A.P. and join programmes like the Sustainable Agriculture Initiative (SAI) Platform.

- Publicise your sustainability efforts to potential buyers (website, sustainability report, social media).

Regional and continent-focused NGOs and organisations

Some important BSOs based or focused on developing countries and helping exporters in those countries are:

TradeMark Africa (TMA). Its mission is to increase sustainable and inclusive intra-African trade and exports to the rest of the world. It is known for its programmes to build export capability with export adviser services.

Africrops! supports sustainable agriculture and trade development in Africa, with a focus on organic products.

Agribusiness Market Ecosystem Alliance (AMEA). Focuses on strengthening professional farmer organisations and agribusinesses in Africa, Asia and Latin America to create sustainable market systems.

Sector-specific associations

Sector-specific associations also deal with export-promotion activities. These may include setting up joint stands at trade fairs, organising export missions or doing market research for member companies, which may in turn offer market support and data. Some resources may be free, but usually only members fully benefit from membership. Among the most relevant organisations are:

Table 2: Examples of sector-specific associations

| Name | Description |

| European Fruit Juice Association (AIJN) | An umbrella association for all European fruit juice industries with an international membership. |

| European Association of Fruit and Vegetable Processors (PROFEL) | PROFEL represents over 500 companies in 12 European countries through national associations or direct company membership. |

FRUCOM (representative body of European traders in dried fruit & nuts, processed seafood, and processed fruit & vegetables)

| FRUCOM stands for FRUits, COnserves (cans), Miel (honey). Today, the association represents mainly the trade in dried fruit & nuts, processed seafood, and processed fruit & vegetables. |

| European Snacks Association (ESA) | European producers and traders of savoury snacks, including edible nuts. |

| International Nut and Dried Fruit Council (INC) | INC promotes the sustainable growth of nuts and dried fruit globally to improve consumption and benefit the businesses involved. |

| International Fruit and Vegetable Juice Association (IFU) | Assembles more than 200 members from 80+ countries, including national/regional associations and companies. |

| African Cashew Alliance (ACA) | An association of nearly 130 African and international companies promoting a globally competitive African cashew industry. |

Source: Autentika Global

Tips:

- Seek personal contact with export promotion organisations in your country. This makes it easier for you to understand their support services. Enrol in programmes that can benefit your firm.

- Check whether your target European markets have diaspora organisations of people from your country. Sometimes these groups can also be a large consumer base for a specific product.

- Explore export promotion programmes for processed fruit and vegetables on the BSO websites.

- Establish contact with commercial representatives of your country's embassies in your target markets.

Find instant help in our pragmatic studies

CBI has created several studies in which you can find additional information about doing business in Europe.

Tips:

- Read the European market analysis studies about various processed fruit and vegetables products. You will find useful data about product specifications, the markets with the best potential and much more.

- Consider contacting CBI and asking for help, or even proposing new studies or programmes that can be developed.

- Read our Tips for Organising Exports of processed fruit and vegetables to Europe to find practical tips related to logistics.

- Read our Tips for Finding Buyers on the Processed Fruit and Vegetables market to produce your list of buyers matching your offer.

5. Processed food is a face-to-face business, but a website gives you global visibility

When working with European traders, keep in mind that they appreciate a practical approach and personal contact. Direct marketing is a marketing approach that you can use to promote your offer to processed fruit and vegetable buyers. Several methods can be used for establishing contact, such as phone calls, direct mail (like sending a printed brochure), email, LinkedIn messages and meetings at trade fairs.

You should only communicate with a preselected list of potential customers so that you can focus resources on the ones that are most likely to become actual customers. Your success rate will depend a lot on pro-activeness and skills (instincts) in selling. The best way to build experience is to actively pursue potential buyers and learn from each interaction. Keep an eye on competitors and what they are doing successfully.

Steps to follow:

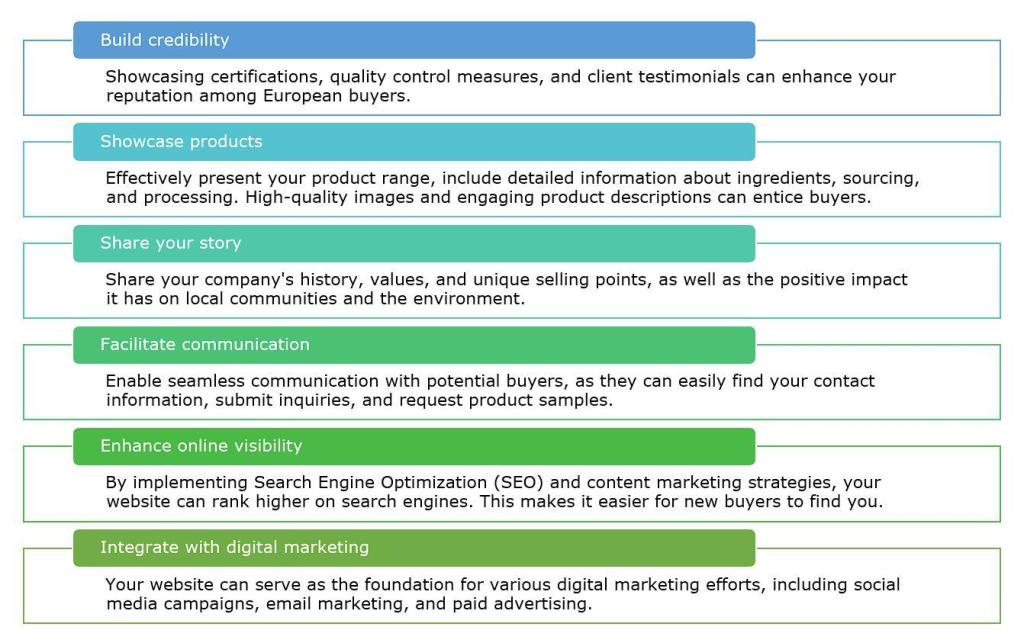

Create and maintain a professional website to keep business flowing

Expanding your business to European markets requires a strategic approach. Keep in mind that a professional website is a good component of any such strategy. In the digital age, your website serves as a digital face of your company, offering potential buyers easy access to and multiple looks at your products, values and story.

This may help companies from developing countries, as they may face unique challenges in breaking into foreign markets. Also, given the amount of information that needs to be exchanged with buyers, a website is a cost-effective source of information.

Figure 6: Website essentials for export success

Source: Autentika Global

Create a list of targets

Focus on countries with high demand for your products. Do not forget to consider factors like consumer preferences, market trends, import regulations and potential export barriers.

Check out our Tips for Finding Buyers on how to compile a list of potential buyers. When you create a list of buyers that match your offer, opt for a direct marketing approach. First target those who are most likely to have an interest in your offer. Focus on people that you personally met at trade events. Continuously maintain a list of potential buyers by actively seeking new contacts.

Create a contact plan - Which communication channel can reach your target audience?

Should you send a letter and a brochure? Is there enough budget allocated for this channel? For processed fruit and vegetable companies there is an effective solution: a phone call followed by an email. A call allows you to briefly introduce yourself and the company personally, and may be more effective in catching the target's attention than an email or letter.

Make sure you are talking to the right person at the company. This can be an executive or staff member for purchasing decisions in the market segment that you serve, or someone higher up. If whoever you are talking to is not the right person, ask for an introduction to them at the buyer company.

After the first contact, if a potential buyer shows interest, send a follow-up email. This is used to provide more information and address all the issues that the buyer wants to learn more about. To lower international calling costs, use internet-based voice call software such as Skype or Viber. For online calls with multiple participants taking part with phones or computers, consider using platforms that suit your partner. Zoom, Microsoft Teams, WhatsApp and Google Chat allow you to share documents and presentations during the meeting.

Customise your USP - How can you add value?

Make use of the USP you created (explained under Tip 3). Do not randomly call companies from your list and offer the same thing to all of them. Focus on the specific benefits of doing business with you. If your target is a supplier in the foodservice segment, for example, you can offer them specific packaging solutions (such as canned fruit packed in 5-10 kg cans or juices packed in a bag-in-a-box).

Before picking up the phone, collect as much information as possible about your potential buyer, their type of client and the market they serve. Information about their future plans and activities provides hints about which qualities the customer values and what they might need. Keep in mind that for different buyers you can highlight different aspects of your offer, but always be consistent and truthful.

Focus on effective communication with a customer engagement plan

If your potential client shows interest, follow up. One approach is to offer product samples. The next step could be to provide a free study visit to your company.

Tips:

- Establish personal connections: use phone calls, emails and trade fairs to engage with potential European buyers of processed fruits and vegetables.

- Maintain a professional website: include a content management system, reliable web hosting and SEO features, and integrate social media accounts to showcase your products and values.

- Target quality contacts: compile a list of potential buyers who match your offerings and maintain this list by actively seeking new contacts.

- Customise your unique selling proposition (USP): research each potential buyer and tailor your pitch to emphasise the specific benefits of doing business with your company.

6. Let your products speak for you – Send samples

Your samples are your most important promotional tool to present your firm after a successful initial contact. A sample should meet your customer needs as well as a quality level that you can commit to in larger volumes.

Even the best promotion will not help if your product is not in line with buyer expectations. Since COVID-19, buyers are more used to receiving samples from suppliers. Professional buyers will usually visit your plant and ask for a product sample at that time, but sending samples is also a valid method to engage buyer interest.

Samples should reliably represent your product and the quality you are offering. Send sample products from normal product batches that you are preparing for exports. Ensure that the samples are professionally packaged and labelled. The best way to prepare a sample is to follow standard methods of sampling such as ISO 7002 (for agricultural food products) and to follow Codex Alimentarius General Guidelines on Sampling (PDF).

Follow the next 10 steps to send your samples properly:

- Communicate with your potential buyer about sample preferences – Ask your buyer about their expectations regarding product type, grade, size and class. This helps you tailor your samples to their needs. Providing a full range of grades can showcase your product variety.

- Take a representative sample from the export lot – Follow the ISO 2859 standard sampling procedure (search for "ISO 2859-1:1999(en)" on the ISO website) for accuracy. For liquid products (e.g. juices or purees), mix the content well before sampling, as the brix level may vary. For non-liquid goods, take smaller quantities from various parts of the batch.

- Ensure the sample size is sufficient for buyer inspection – Common sample sizes are between 250g and 1kg for dried fruit and nuts, and 0.5L for juices. For expensive products like pine nuts or dried mushrooms, smaller sizes (e.g. 50g) are acceptable. If sending multiple grades of a product, you can send larger samples with individual sizes packed separately: you could send a 2kg sample with eight sizes of dried fruit, each size packed in 250g bags.

- Pack your sample securely – Prevent contamination by using clean materials similar to those used in regular shipments. For example, pack frozen or dried fruit and vegetables in polyethylene foil and cardboard boxes, and use aseptic packaging for juice and puree samples.

- Label the sample to trace it – By giving the sample a code, you can trace it to its batch. This way you can ensure that your buyer will receive the same product after the sample approval.

- Attach product specification – Send your sample with a product specification (also called technical data sheet). When describing product parameters, you should indicate a relevant standard for specific parameters. For example, if you state that your product has aflatoxin levels below 2.0 μg/kg, mention that this is in line with regulation (EC) 1881/2006 (PDF) and that the sample is taken according to regulation (EC) No 401/2006. Include laboratory test results together with your sample.

- Discuss the shipping costs and shipping method with your potential buyer – While buyers usually expect you to cover shipping costs, you can negotiate sharing expenses for expensive shipments or high-value samples. Always communicate costs upfront to avoid unpleasant surprises.

- Attach a proforma invoice with a symbolic value – A proforma invoice is an obligatory document for customs clearance. Indicate a symbolic value for your sample, such as €0.1 or even zero. Consult your buyer and share the proforma invoice in advance.

- Use the track-and-trace service of shipping companies – Reputable shipping companies (such as DHL or Fedex) offer tracking services. Check whether there are better alternatives in your local market. Ensure the sample is addressed to the right person in the buyer's organisation to avoid misplacement.

- Follow up and be patient – After confirming delivery, request feedback. The sample approval process may involve several departments, so be prepared for delays. Answer any questions they may have.

7. Make sure your product documentation reflects buyer needs

Exporters of processed fruit, vegetables and edible nuts from developing countries need to plan how to organise their product documentation. The information needs to structured in a way that is economical, easy to maintain, easy to follow, and appealing to European buyers.

Use standardised formats and terminology

Use a standardised format and terminology for your product documentation. Research how buyers in your target market present their products, which traits they list, and how rival wholesalers present their products. Clear product information makes it easy for potential buyers to understand and compare your offerings.

To understand buyer needs, look at the leading players in your market and how they market their products to end consumers. This will give you clues about what additional information is of interest to your potential buyer. These might be things that you can include as supplementary information in your datasheets.

For example, Frozen Juices Spain sells juice concentrates and not-from-concentrate juices. It offers product catalogues online with specifications for each type of frozen juice, NFC juice and puree concentrate (PDF).

Highlight key product features

Emphasise the most important features of your products, such as quality, uniqueness, taste and safety. These are often the main criteria European buyers consider when making purchasing decisions.

SunOpta, a global supplier of organic fruit ingredients, highlights key product features such as organic, non-GMO and allergen-free, making it easier for buyers to identify the right products. Look at how the company details all available product options for its smoothie and sherbet bases.

Germany's Döhler showcases its fruit and vegetable ingredient solutions with a clear emphasis on unique features like natural, sustainable and innovative, appealing to buyer interests. Check out how Döhler informs buyers that its vegetable ingredients are the smarter choice.

Include detailed product specifications

Provide comprehensive product specifications, including all relevant information that buyers wish to see. This includes (but is not limited to) size, weight, packaging, shelf life and nutritional information. This information helps buyers make informed decisions and ensures your products meet their requirements.

Cap'Fruit, a French company, includes comprehensive product specifications for their fruit purees, including brix levels, acidity and recommended usage: for its frozen banana puree it provides product reference numbers for different packaging formats, packaging information, added sugars and organic status, and a complete PDF data sheet.

Display certifications and compliance

European buyers value certifications and compliance with international standards. Include details about relevant certifications, such as organic, fair trade or non-GMO, in your product documentation. Spain’s Biosabor dedicates an entire webpage to its numerous product certifications and lets buyers and consumers download copies of its most up-to-date certifications.

Make documentation easily accessible online

Ensure that your product documentation is readily available on your company's website for potential buyers. For example, Cap'Fruit provides detailed and complete PDF data sheets for all of its products, such as frozen banana puree, IQF frozen Mecker raspberry and aseptic mango puree. You can check out their entire product range and then consult the company's online PDF documentation for a product of your interest. Agrana Fruit offers buyers quick and easy downloads of its brochures, certificates, folders and presentations as PDF files. It even offers user-friendly drop-down filters for years, file types and document categories.

Use high-quality product images

Include high-quality images of your products in your documentation. Clear, appealing visuals help buyers picture your products and can influence their purchasing decisions. For example, Spain's Allmendras Llopis uses high-quality images to illustrate its product range. It also describes each type of product and discloses the available packaging for each product offering.

Tips:

- Keep your documentation organised and up to date. Product documentation should be easy to understand, concise, and appealing to European buyers.

- Highlight your product features, such as quality, aroma, taste and safety, to attract buyers' attention.

- Provide comprehensive product specifications, including size, weight, packaging, shelf life and nutritional information.

- Use high-quality, professional images if possible, as this can influence buyers' purchasing decisions.

Read more about how to make a payment in our Organising Exports of Processed Fruit and Vegetables to Europe study.

To identify potential European buyers, check out our Tips to find buyers study.

This study was carried out on behalf of CBI by Autentika Global.

Please review our market information disclaimer.

Search

Enter search terms to find market research