Entering the European market for dried mushrooms

Sustainable production and the collection of mushrooms from wild, unpolluted areas create a positive image for emerging suppliers from developing countries. Having food safety certification for drying facilities is important to gain trust from European importers. China is the leading global supplier of dried mushrooms. Peru, India and East European countries are major suppliers of wild-harvested mushrooms, such as porcini, chanterelle, black trumpets and morels.

Contents of this page

1. What requirements must dried mushrooms comply with to be allowed on the European market?

All foods sold in the European Union must be safe. There are limits on the permitted levels of harmful contaminants, such as poisonous mushrooms, irradiation or pathogen microorganisms. However, meeting legal requirements is just the first step to successfully exporting to Europe. Dried mushroom suppliers also have to meet buyer requests related to quality, food safety certification and sustainability in the supply chain.

What are the mandatory requirements?

The additives in food must be approved. The levels of harmful contaminants, such as radioactivity, pesticide residues and heavy metals, are limited as well.

Control the presence of contaminants regularly

The European Commission Regulation sets the maximum levels for certain contaminants in food products. This regulation is frequently updated. Apart from the limits set for general food products, there are several specific contaminant limits for specific products, including dried mushrooms. The most common requirements regarding contaminants in dried mushrooms are related to foreign bodies (such as insects), radioactivity, heavy metals, pesticide residues and microbiological organisms.

Be sure that your dried mushrooms are free of insects and other foreign materials

The presence of foreign materials (such as insects or stones) is 1 of the most common issues in the dried mushroom trade. Therefore, strict controls must be performed. Additional checks for poisonous mushrooms should be carried out too. Metal detectors are recommended for checking for the presence of foreign materials in mushroom drying facilities. In the European Union (EU), there are no official limits for foreign bodies in dried mushrooms, but traders sometimes set a limit of 1-2% impurities.

Check radioactivity

Mushrooms absorb radiation very easily, especially ones grown in the wild. This is a particular problem after nuclear incidents. Many reports have described high levels of radioactive caesium being found in wild mushrooms harvested around Europe after the Chernobyl nuclear incident and in Japan before and after the Fukushima Daiichi nuclear accident. Buyers in Europe commonly ask for radioactivity contamination tests for imported mushrooms. Limits for radioactive components should be checked in laboratory tests before exporting.

Use good hygiene and sanitary practices when harvesting and processing mushrooms

Microbiological contaminants (such as bacteria and viruses) can be transmitted from animals or people to mushrooms. The European regulation on microbiological criteria for foodstuffs defines the control, sampling and maximum levels of microbiological contaminants in food. In line with this regulation, European importers will ask exporters of dried mushrooms to do laboratory tests to check for the presence of microorganisms, such as salmonella, listeria, E. coli and staphylococcus.

Check the presence of heavy metals

Apart from microbiological testing, the most common tests are for the increased content of heavy metals like cadmium, lead and mercury. The maximum limit for cadmium in fresh oyster and shiitake mushrooms is 0.15 mg/kg. Exporters should use a dehydration factor to check the limits.

Avoid additives and pesticides

Dried mushrooms in Europe should preferably be free from any additives or pesticide residues. Normally, wild-harvested mushrooms contain no pesticide residues. However, some suppliers use undeclared additives (such as sulphites) to preserve the colour of dried mushrooms. During 2020 and 2021, 3 cases of undeclared and elevated sulphite content were reported for imported dried mushrooms from Vietnam and Thailand. This is considered a serious risk for human health as sulphites are allergens.

Labelling requirements

The label should indicate the dried mushroom name, together with the scientific name. It is common practice to note the name of the variety, crop year and best before date on the label. The type of product should be indicated too, such as ‘whole’, ‘caps’ or ‘sliced’. In the case of dried jelly mushrooms, a different style description can be used, such as ‘cluster’, ‘single’, ‘strip’ or ‘square’. It is also common to include the harvesting and drying time (year and month) and to indicate if the mushrooms are wild-harvested or cultivated.

Product labelling must meet the European Union Regulation on the provision of food information to consumers. This defines the nutrition labelling, origin labelling, allergen labelling and the minimum font size for mandatory information. Retail packs must be labelled in a language that consumers in the European target country can easily understand – generally, the country’s official language. This is why European products often have multiple languages on the label.

Comply with the legislative requirements on sustainability

Some of the most relevant European legislation related to environmental and social sustainability has been incorporated into the European Green Deal (EGD). The EGD includes legislative changes, and it has a timetable that outlines when they will come into force. The Farm to Fork Strategy, the Biodiversity Strategy and the Circular Economy plan are the most relevant policies for the fruit, vegetable and nut processing sector. Specific legislation related to dried mushroom processing and trade are described in:

- Organic food regulation;

- Sustainability labelling of food products;

- Corporate Sustainability Due Diligence Directive (PDF);

- Packaging and packaging waste.

Tips:

- Only perform laboratory tests in ISO/IEC 17025:2005 accredited laboratories.

- Store your dried mushrooms in proper conditions (low humidity, cool temperatures), away from strong odours, grain or other sources of contamination.

- Refer to the Codex Alimentarius for practical guidelines on how to meet the requirements of European food safety legislation. For dried mushrooms, consult the Code of Hygienic Practice for Low-Moisture Foods (PDF) and the Code of Hygienic Practice for Dehydrated Fruits and Vegetables including Edible Fungi (PDF).

- To be prepared for the legislative changes in line with the EGD and Farm to Fork Strategy,

read the CBI’s Tips to go green and Tips to Become a socially responsible supplier.

What additional requirements do buyers often have?

In addition to mandatory requirements, many private requests are equally important. These include compliance with food safety, quality and sustainability standards.

Offer quality in line with the standards

There is no specific European standard that defines quality criteria for dried mushrooms. In practice, the Codex Alimentarius Standard for Dried Edible Fungi is used instead.

The basic quality requirements for dried mushrooms are:

- Absence of insect damage;

- Absence of foreign materials;

- Moisture content (a maximum of 12% for dried mushrooms, 13% for dried shiitake mushrooms and 6% for freeze-dried mushrooms);

- Sizing (different for every type of dried mushrooms);

- Styles (whole, whole caps without stems or cut into different shapes);

- Quality class (defined by uniformity and tolerances).

Get food safety certified

European buyers will often ask dried mushroom suppliers to provide proof of food safety. The different food safety certification schemes for mushroom drying facilities ensure safe production. The most recognised private food safety certification schemes include International Featured Standards (IFS), British Retail Consortium Global Standards (BRCGS) and Food Safety System Certification (FSSC 22000).

Offer safe and properly measured packaging

There are no general rules for export packaging, but dried mushrooms are usually packed in polyethylene plastic bags inside cardboard boxes. Within Europe, the size of packaging is different depending on mushroom type. The size of bulk packaging can be up to 25 kg, but for more delicate mushrooms (such as small morel caps), the packaging is usually smaller. The selected packaging size should conform with conventional pallet sizes (800 x 1,200 mm and 1,000 x 1,200 mm).

Retail packaging usually weighs between 20 and 30g for wild-harvested dried mushrooms. Cultivated dried shiitake are often packed in slightly larger packages, around 100g. Retail packaging includes plastic bags, plastic containers, paper bags, foil bags and glass jars.

Take care of people and nature

The demand for sustainably sourced food in Europe is growing. In order to help consumers make more environmentally friendly choices, more labelling systems are being developed such as Eco Score, Eco Impact, Planet Score, Enviro Score and Foundation Earth. Sustainability standards have also been developed for wild-harvested food, such as Fair Wild. With regard to wild mushrooms, the Fair Wild initiative aims to ensure that there is no overharvesting and that all collectors and workers are treated fairly.

Some companies have their own codes of conduct that everyone they deal with has to comply to. Other companies use 1 or more common standards. Some examples include the Supplier Ethical Data Exchange (SEDEX), the Ethical Trading Initiative (ETI) and the Business Social Compliance Initiative code of conduct (amfori BSCI). If dried mushrooms are intended for the retail segment, suppliers have to follow a specific Code of Conduct developed by retailers.

Tip:

- Get food safety certification for your drying facility. Carefully select a certifying company and talk with your preferred buyers about their certification preferences.

What are the requirements for niche markets?

Organic dried mushrooms

Organic certification schemes are becoming more popular in Europe, and exporters of these products are achieving better selling prices. However, these prices are not often much more when it comes to wild-harvested mushrooms, as the product is already perceived as organic, even without certification.

To market dried cultivated mushrooms as organic in Europe, they must be grown with organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can place the European Union’s organic logo, and the logo of the standard holder on the packaging. Standard holders include the Soil Association in the United Kingdom and Naturland in Germany. If you follow the rules of the biodynamic certification of Demeter, you will be able to sell organic dried mushrooms at a higher price.

To receive organic certification for wild-harvested mushrooms, you can certify an area where wild mushrooms are collected. This process is quite simple, but harvesters must be sure that the mushrooms are collected in areas that are not close to agricultural fields treated with chemicals. In some countries, forests may be sprayed against invasive moths. Wild-harvested mushrooms in those areas cannot be certified as organic.

If you are aiming to export products to Europe, be aware of important new rules that may impact your business. The New EU organic regulation entered into force on 1 January 2022. This regulation involves more than 20 secondary acts that regulate the production, control and trade of organic products in more detail. Some of the important acts to be aware of are detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) propose specific dietary restrictions. If you want to focus on Jewish or Islamic ethnic niche markets, consider implementing Halal or Kosher certification schemes.

Tips:

- Read the training materials on the new organic regulation (by Alliance for Product Quality in Africa project) to prepare for the new rules on time.

- Read our study on Trends on the European Processed Fruit and Vegetables Market for an overview of developments among the sustainability initiatives in the European market.

- Consult the Sustainability Map database for information on a range of sustainability labels and standards.

2. Through what channels can you get dried mushrooms on the European market?

How is the end-market segmented?

In Europe, dried mushrooms are mostly used for home cooking and as an ingredient in the food processing industry. There are no exact data, but the retail segment makes up an estimated 70% share of the European dried mushroom market, leaving the remaining 30% for the food industry. Within the food industry, they are used mostly in dehydrated soups or as an ingredient in dried mixtures (such as for risotto and pasta). In the retail segment, dried mushrooms are mostly sold in supermarkets, ethnic shops and in health food stores.

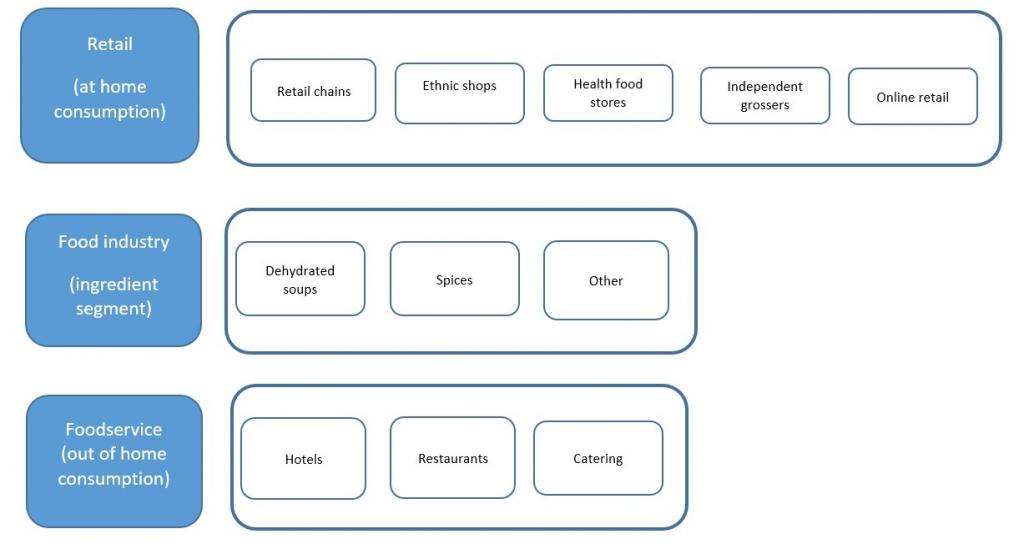

Figure 1: End market segments for dried mushrooms in Europe

Source: Autentika Global

Retail (home consumption)

Retailers sometimes buy directly from developing-country exporters. However, in most cases, they are supplied by intermediaries like specialised distributors. A recent development is the polarisation of the retail sector into discounters and high-level segments. Consolidation, market saturation, strong competition and low prices are the key characteristics of the European retail food market. Online retail sales of food increased significantly after the COVID-19 pandemic.

Several types of sub-segments (points of sale) of the European dried mushrooms retail segment include:

- Retail chains – The best-selling dried mushrooms in mainstream supermarkets include wild-harvested mushrooms (such as porcini), dried mushroom mixtures and Asian mixtures. The companies that hold the largest market shares in Europe are the Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands).

- Ethnic shops – These are a very important market segment for selling Asian mushrooms, such as black fungus, white fungus, white back black fungus, shiitake and flower shiitake. Some examples of well-established Asian supermarket chains that sell dried Asian mushrooms include Tang Frères (France), Wah Nam Hong (the Netherlands), Wing Yip (the United Kingdom), Go Asia (Germany) and Hoo Hing (the United Kingdom).

- Health food stores – Often sell collected and/or organic dried mushrooms. They also are the main outlets (aside from pharmacies) for medicinal mushroom products, such as powders and food supplements.

- Online retail – Often an extension of existing retail traders or specialised shops (such as Biotiva). Online retail orders dramatically increased after 2020.

Food industry (the ingredient segment)

Food industry processors use dried mushrooms as an ingredient. The largest users of dried mushrooms in the European food industry include:

- Producers of dehydrated soups, sauces and mixes – Mushroom is a favourite flavour among European consumers of dehydrated soups. These soups are made with dried mushrooms as an ingredient, including both cultivated and wild-harvested. It must be noted that dehydrated soup producers often use freeze-dried mushroom powders and concentrates as well as small pieces of air-dried mushrooms. The leading European brands of dehydrated soups are Knorr (Unilever) and Maggi (Nestlé).

- Producers of spices and spice mixtures – Dried mushrooms are a frequent ingredient in spice mixtures. However, the quantities used are much smaller than those used in dehydrated soups.

- Other uses – These include dry mixtures for the preparation of various meals, such as risotto and pasta. Some very popular products include brands from Italian-based companies, like Gallo and Scotti. A large, separately classified sub-segment includes producers of food supplements. Powdered mushroom extract is a very common ingredient in the food supplement industry. Mushroom extracts are usually produced from mushroom powders using solvent extraction processes.

Foodservice (out-of-home consumption)

Specialised importers (wholesalers) usually supply the foodservice channel (hotels, restaurants and catering). World cuisines, healthy food and food enjoyment are the major driving forces in the European foodservice channel. The fastest-growing business types are likely to be new, healthier fast food, vegan restaurants, street food, pop-up restaurants and international cuisines.

Restaurants mainly use fresh or preserved button mushrooms that are available throughout the year. They also use rehydrated porcini and morel mushrooms, as their fresh availability is limited.

Dried shiitake and other types of Asian mushrooms are often used in Asian restaurants the same way as fresh ones after rehydration. Some mushrooms serve specific roles in niche foodservice segments. An example is the matsutake mushroom, which is mainly consumed by the ethnic Japanese population. It is mainly found in high-end Japanese restaurants. It is preferred fresh, but it is sometimes used dried due to low availability.

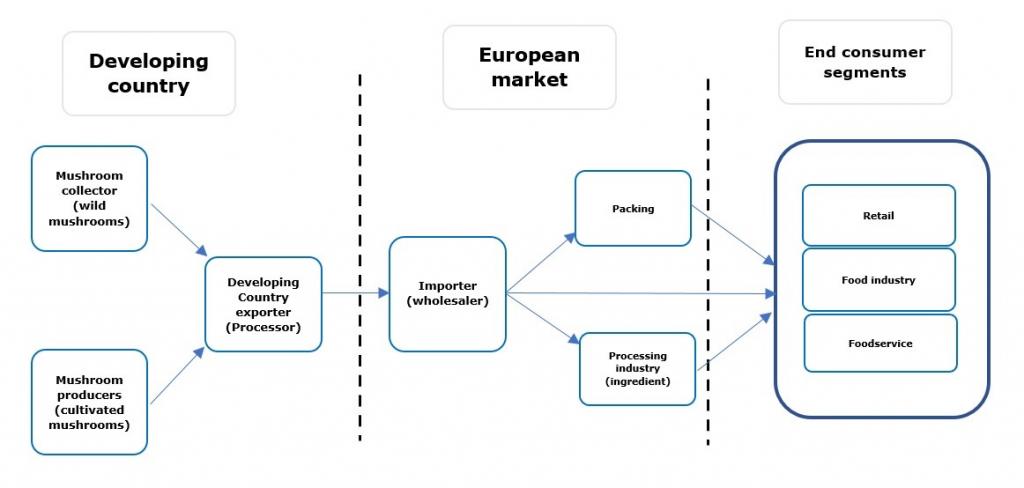

Through what channels do dried mushrooms end up on the end-market?

Specialised importers represent the most important market channel for dried mushrooms in Europe. After being imported, dried mushrooms reach different market segments, as described in Figure 1. In some cases, segments are supplied directly, without an intermediate importer. However, specialised importers or wholesalers are the first entry point to Europe for most dried mushroom exporters from developing countries.

Figure 2: European market channels for dried mushrooms

Source: Autentika Global

Importers / Wholesalers

Importers often act as wholesalers. They pack dried mushrooms for retail sale and occasionally resell them to packing companies or food processors. Importers usually have a good level of knowledge of the European market, and they monitor the situation in dried mushroom producing countries closely. Therefore, they are your preferred contact, as they can inform you timely about market developments and provide practical advice for your exports.

The position of importers and food manufacturers is under pressure from retail. Requirements from the retail industry determine supply chain dynamics from the top down. This pressure translates into lower prices and added value aspects, like ‘sustainable’, ‘natural’, ‘organic’ and ‘fair trade’ products. Because of this, transparency is necessary in the supply chain. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred developing-country suppliers.

Dried mushroom importers usually have various specialisations. Common specialisations include:

- Specialised mushroom traders – focus on the mushroom trade and do not trade other products in large quantities. Some examples include Niklas (Germany), Borde (France) and Funghi Funghi (Belgium).

- Traders of wider ranges of food ingredients – examples include Leathams (the United Kingdom), Sabarot (France) and Henry Lamotte (Germany).

- Traders of Asian mushrooms – examples include Heuschen & Schrouff Oriental Foods Trading (the Netherlands), Oriental Merchant (the Netherlands) and SeeWoo (the United Kingdom).

- Importers of spices, dried herbs and dehydrated vegetables – examples include Euroma (the Netherlands), Proderna (Germany) and Fuchs (Germany).

Agents/brokers

Agents involved in the dried mushrooms trade typically carry out 2 kinds of activities. Agents act as independent companies that negotiate on behalf of their clients, and as intermediaries between buyers and sellers. For their intermediary services, they usually charge a commission of 2-4% of the sales price. They are also active in the supply of private labels for retail chains in Europe. For these services, some agents, in cooperation with their suppliers, participate in procurement procedures put out by retail chains.

Food processing industry

Food processing companies mostly buy dried mushrooms through specialised importers, not by direct trade.

What is the most interesting channel for you?

Specialised dried mushroom importers are usually the best contact for exporting dried mushrooms to Europe. This is especially relevant for new suppliers, as directly supplying the retail segment is very demanding and requires a lot of quality-related and logistical investments. However, for well-equipped and price-competitive producers, packing for private labels can be an option. As the cost of labour in Europe increases, importers of dried mushrooms sometimes search for more cost-effective packing operations, such as those in developing countries.

Tips:

- Study exhibitor lists of large trade fairs like ANUGA, SIAL and Alimentaria to find potential buyers for your dried mushrooms. To supply private supermarket labels, search for opportunities at PLMA.

- Look for suppliers at specialised foodservice events, such as SIRHA and Internorga, to reach the foodservice segment.

- Search the exhibitors list of the specialised trade fair Fi Europe to find potential buyers of mushroom products, such as freeze-dried mushrooms and mushroom powders.

3. What competition do you face on the European dried mushrooms market?

Which countries are you competing with?

The main competitor for emerging dried mushroom suppliers in Europe is China. There are several other competitors too, depending on the type of dried mushroom. For dried Agaricus mushrooms, the main competitors are Poland and the Netherlands. For wild culinary European mushrooms, the main competitors are Eastern European countries such as Romania, Bulgaria, Serbia, Bosnia and Herzegovina and North Macedonia. For Asian mushrooms, aside from China, the main competitors are India and Vietnam.

Leading European suppliers include Germany and Italy, but they are not considered to be significant competitors, as they are mostly transit countries for imported dried mushrooms. Germany is an insignificant producer and mainly re-exports dried mushrooms, so it is not a direct competitor. On the other hand, Italy produces reasonable quantities of wild-harvested dried mushrooms, although the produced quantity is insufficient. Italy also imports much more than it exports. Other emerging competitors include Canada, Chile, Turkey and Peru.

Source: ITC TradeMap

When analysing competition outside Europe, apart from China, the main suppliers to Europe include Peru, Bosnia and Herzegovina, India, Serbia and the Russian Federation.

Source: ITC TradeMap

China: the leading producer of dried mushrooms

China accounts for more than 80% of the global export of dried mushrooms. In 2022, China exported more than 60,000 tonnes of dried mushrooms at a value of €982 million. The leading destinations for Chinese dried mushroom sales in 2022 were Vietnam, with a 25% share, followed by Thailand (14%) and Japan (12%). Europe accounts for only 5-7% of Chinese dried mushroom exports, with Italy as the main destination, followed by France, Germany and the Netherlands.

More than a half (54%) of Chinese dried mushroom exports account for dried shiitake, followed by dried wood ears (34%), dried jelly fungus (7%), other mushrooms (2%), dried porcini (2%) and dried morels (0.4%). However, the most exported Chinese dried mushroom to Europe is dried porcini, which accounts for one third of exports. Yunnan province produces more than 20,000 tonnes of porcini mushrooms every year; half are processed by freezing and drying.

China is the largest producer of fresh and dried mushrooms in the world. China’s mushroom industry has grown rapidly in recent years. The major producers are the provinces of Fujian, Zhejiang, Henan, Hubei, Hunan, Sichuan, Jilin and Heilongjiang. Industrial mushroom production facilities can be found in many provinces, and a large number of these facilities are situated in Fujian, Jiangsu and Shandong.

China is famous for its technology, production and export of shiitake mushrooms. There are several types of dried shiitake, which are usually classified according to the presence of cracks and cap thickness. Some common types are flower mushrooms (largest cracks), winter mushrooms (no cracks), thick mushrooms (thicker caps) and several others. White flower mushrooms are the most expensive kind of shiitake.

China produces several other mushroom types. Many of them preferred fresh, although they are also frequently dried. These include king oyster mushrooms, enoki, shimeji, straw mushroom and cloud ear. China is also the leading producer of several types of medicinal mushrooms, such as cordyceps, reishi and maitake. Yunnan province is famous for its wild expensive matsutake mushrooms, which are mostly exported to Japan. In addition to its own production, China also imports and re-exports cordyceps and matsutake from Bhutan.

China has a huge level of experience in mushroom production, as well as 1 of the most advanced biotechnology production systems in the world. Chinese biotechnology companies have developed an artificial production system for wild mushrooms, such as morels. Some of the companies in Europe (such as France Morilles) have transferred the technology for cultivated morel production from China to Europe. China also recently produced its first cultivated porcini mushrooms, which are normally only found in the wild.

Peru is increasing its export to Europe

Europe is the main market for Peruvian dried mushrooms exports, accounting for more than 70% of its total exports. Since 2018, Peruvian dried mushroom exports have increased at a stable annual rate of 18%, reaching 851 tonnes in 2022. The main target market for Peruvian dried mushrooms export is Germany with a 31% share, followed by France (21%), Brazil (19%), Poland (10%) and Argentina (10%). Peru has gained the most market share in Germany, increasing its export from 96 tonnes in 2018 to 266 tonnes in 2022.

The main mushroom exported from Peru is a variety of porcini mushroom, used for drying and export. Pine forest mushrooms are classified as ‘Suillus luteus,’ although they were previously known as ‘Boletus luteus’. This mushroom is also known as ‘slippery jack’. The production process is slightly more complicated compared to common porcini, as the top skin of the mushroom must be removed before slicing and drying. They are prized for their buttery and nutty flavour.

Serbia: a well-recognised supplier of dried wild mushrooms

Serbia is the leading exporter of dried wild mushrooms from southeastern Europe, followed by Bosnia and Herzegovina and North Macedonia. The most exported type of dried mushrooms from Serbia is porcini, followed by chanterelles. Other dried wild mushrooms are also exported, such as black trumpets, Lactarius and, to a much lesser extent, truffles. Due to the relatively short distance from the majority of the European target markets, wild mushrooms are also exported fresh.

The export of dried mushrooms from Serbia fluctuates due to seasonal climatic changes, but it is usually in the range of 200 to 300 tonnes. In 2022, Serbia exported 285 tonnes of dried mushrooms, worth €10.4 million. Most Serbian dried mushrooms (39%) were exported to Italy, followed by Germany (16%), Poland (11%) Bosnia and Herzegovina (11%), France (9%) and the United States of America (8%).

Bosnia and Herzegovina: a focus on the Swiss market

Bosnia and Herzegovina’s dried mushroom range is very similar to the Serbia’s. It mostly consists of porcini, chantarelles and other wild-harvested forest mushrooms. However, the target markets are different compared to Serbia, as Switzerland is the main export market. After China, Switzerland imports most of its dried mushrooms from Bosnia and Herzegovina. In 2022, Bosnia and Herzegovina exported 192 tonnes of dried mushrooms. Of this, 26% was exported to Switzerland, followed by Italy (20%), Germany (16%) and France (14%).

India: a focus on dried morels

India’s exports to Europe mostly focus on valuable dried morels. In 2022, India exported more than 309 tonnes of dried mushrooms, at a value of €6.6 million. Around 25% was exported to Europe. In terms of quantity, the main market was Nepal with a 36% export share, followed by Bhutan (24%), Germany (11%) and France (9%). However, in terms of value, the main market for Indian mushrooms is France, followed by Switzerland. This is because of the higher price of dried morels targeted for the European market.

Internal European competition: Poland, Bulgaria and Romania

Poland is the world’s largest fresh button mushroom exporter. In addition to fresh mushrooms, Poland has also increased its dried mushroom exports. The Polish export market increased from 800 tonnes in 2018 to more than 1,000 tonnes in 2022. Poland exported most of its dried mushrooms to Germany (48%), followed by Italy (16%), France (14%) and the United Kingdom (6%).

Some Polish companies have taken advantage of the large fresh button mushroom production to dry some quantities. As button mushrooms are less popular as a culinary ingredient, they are often milled or transformed into powders for dehydrated soups or dried ingredient mixtures. Polish companies also process and export dried Boletus mushrooms (‘Borowik’ in Polish).

Another 2 important European suppliers are Bulgaria and Romania. Bulgarian and Romanian dried mushroom companies specialise in collecting and processing wild mushrooms. Usually, they work with a network of collectors that harvest fresh mushrooms and sell them to processing companies. The most harvested and processed species are chanterelles, morels, porcini and black trumpets. Some companies harvest and process expensive forest truffle mushrooms.

Bulgaria is slightly ahead of Romania in terms of exported quantities. On the other hand, Romania’s export value is higher. In 2022, Bulgaria exported 455 tonnes of dried mushrooms, worth €8.3 million, while Romania exported 406 tonnes, worth €10.4 million. Italy is the leading export market for both countries.

Tips:

- Read more about developments in the Chinese mushroom industry on the specialised portal, China Edible Mushrooms Net. Here, you can also read news about the global edible mushroom industry.

- Visit the specialised trade event Mushroom Expo to learn more about Chinese mushroom suppliers, and cultivation and processing technology.

- Monitor dried mushroom offers from Chinese competitors on the B2B portal Alibaba.

- Stay up to date with developments in the medical mushroom industry by participating in the Medical Mushroom Conference.

- To learn more about the cultivated mushroom industry in Europe, take a look at the website of the European Mushroom Growers Group.

- To learn more about European wild fungi, take a look at the news, members and articles of the European Mycological Association.

Which companies are you competing with?

Companies in China

Most Chinese dried mushroom suppliers also export fresh mushrooms, although some of them only specialise in dried mushroom production. According to industry estimates, there are around 500 mushroom processors. Aside from the production of culinary mushrooms, China is famous for its wild collection of medicinal mushrooms, such as cordyceps and reishi. It is important to mention that Chinese companies also provide mushroom production technology and export inoculated shiitake mushroom spawns, such as Qihe Biotech.

Baixing Food is 1 of the most active export companies in the dried mushroom trade in the European market. Baixin Food has 1 of the largest organic mushroom farms in China. Since its establishment in 1996, they have invested in edible mushroom research and the production of mushroom enzyme. The company exports several types of wild and cultivated organic mushrooms, as well as cultivated morels. Baixin Food developed the retail brand ‘Vigorous Mountains’ for the export market.

Examples of other dried mushroom exporters from China include: Dalian J&N Foods, Zhejiang Tianhe Food, Denis Food Processing, Jinzhu Manjiang, Yimen Kangyuan Fungal Industry and Fortune Foods.

Companies in other supplying countries

- Peru – More than 500 farmers from Inkawasi near Cusco are involved in the harvesting and processing of dried mushrooms. Important exporters are Comercializadora Verde de Alimentos, Aromatico Inversiones and the cooperative Jalca Verde, Heirs Food and Export Food & Spice.

- Serbia – Companies from Serbia usually buy wild mushrooms (mostly Boletus) from harvesters and process them through air-drying. Some of them have also developed wild fruit and herb businesses, and some also produce frozen berries. Examples of Serbian dried mushroom exporters include Interfood 60, Strela, Inter Funghi, Pamin, Interfood 20 and Moravac.

- Bosnia and Herzegovina – Bosnian companies work in a similar way to Serbian companies, mostly buying fresh wild mushrooms from harvesters. Examples include Smrcak, Gljiva Komerc, Frutti Funghi and Boletus.

- India – Examples of Indian dried mushroom suppliers include Sai Saffron Exports, Kashmir Forest Foods and Aries Foods and Fruits.

- Polish, Bulgarian and Romanian companies – Notable examples of Polish dried mushroom companies include the Jantex group, Jampol, Kasol J.A, Fungopol, Danex, Nasza Chata, Tagros Polska and Polgrzyb and Royal Brand. Bulgarian suppliers include MID Biotrade, Paris Direkt, Fungorobica, Denely Comerc, Thracian Truffles and Hide. Some examples of Romanian dried mushroom companies are Gradina Paduri, Hongos Basoan, Verovita, Rom Funghi, Ecotravio and Claufunghi Mario.

Tip:

- Inform European importers and consumers about your dried mushroom production. Consumers of mushrooms like to hear about wild and unpolluted areas where mushrooms are harvested and produced, and about the people and communities harvesting them.

Which products are you competing with?

The main products competing with dried mushrooms are fresh mushrooms. With the development of storage and logistic technologies, there are more wild and exotic fresh mushrooms available in the European market. For example, several years ago, shiitake mushrooms were mostly imported dried from China and Japan. However, recently, they have been imported fresh and produced in Europe in large quantities. Importers of fresh mushrooms have also started to import smaller quantities of fresh medical mushrooms, such as cordyceps.

The most consumed and easily available type of fresh mushroom in Europe are button (Agaricus) mushrooms. Button mushrooms cannot easily substitute wild mushrooms, as wild mushrooms have more flavour, so they are the preferred option for mushroom lovers. The harvesting season for wild mushrooms is short so the demand for wild mushrooms is mostly satisfied with dried products.

Tips:

- Read the specialised portal Mushroom Business to stay informed about the developments in the fresh cultivated industry in Europe.

- To learn more about competitors from the fresh segment, visit the specialised trade event in the Netherlands Mushroom Days.

- Visit the leading fresh produce trade event Fruit Logistica. Here, you can learn about competitors from the fresh mushroom segment and meet some dried mushroom exporters.

4. What are the prices for dried mushrooms on the European market?

Price developments are different depending on the types of dried mushrooms, producing countries and product quality. As a result, it is only possible to give a very rough, general overview of price developments for the whole dried mushroom sector. Cost, Insurance and Freight (CIF) price will represent approximately 25% to 50% of the retail price for a retail pack of dried mushrooms, depending on the mushroom type. The margins for luxury mushrooms (such as morels and forest truffles) is higher than more common dried mushrooms (such as shiitake or porcini).

Retail prices in European supermarkets vary depending on the type of dried mushroom. Price examples for the common retail packs of dried mushrooms are:

- Porcini – €60-250 p/kg

- Shiitake – €70-260 p/kg (the price in Asian supermarkets is significantly lower)

- Morels – €400-600 p/kg

The export price of dried cultivated shiitake mushrooms from China is generally lower compared to the prices of European wild-harvested dried mushrooms. For example, the average export price of dried shiitake from China (FOB based) during 2022 was €15/kg, while the FOB price of dried porcini from Eastern Europe was between €36 and €40 per kg.

The price breakdown given below is an approximate indication. There are many factors that contribute to the price, such as quality, variety, origin, food safety certification costs, consultants, social security, taxes, sales and network margins.

Table 1: Dried mushrooms retail price breakdown

|

Steps in the export process |

Type of price |

Price breakdown |

Example (porcini), 1 kg |

|

Raw material price |

Harvesters’ price/ |

35% |

€25 |

|

Processing, packing and export of dried mushrooms |

FOB price |

50% |

€35 |

|

Storing, handling and shipping |

CIF price |

57% |

€40 |

|

Selling to retail |

Wholesale price (incl. value-added tax) |

70% |

€50 |

|

Retail sales of the final packed product |

Retail price |

100% |

€70 |

Note: The raw material price assumes that 10 kg of fresh mushrooms is necessary to produce 1 kg of dried mushrooms.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research