7 tips for finding buyers in the European processed fruit and vegetables market

The processed fruit and vegetables market is one of the largest European food sectors. It has an import value of almost €40 billion and counts thousands of players. There are many ways to identify potential buyers among the many players. The tips below provide you with a short but detailed guide on how and where to find buyers for your processed fruit and vegetable products. However, finding a buyer does not guarantee that you will sell your products to them. This depends on many factors, some of which are out of your control.

Contents of this page

- Filter your long list of buyers according to your offer

- Attend trade fairs and industry events to meet your buyers face-to-face

- Find buyers among the members of processed fruit and vegetables associations

- Help your potential buyers find you on the Internet

- Make an initial list using company databases

- Participate in digital B2B platforms

- Find organisations that can provide support for your export

1. Filter your long list of buyers according to your offer

Importers of processed fruit and vegetables can be categorised according to several criteria. It is important to understand that not all the categories are suitable for emerging exporters from developing countries. For example, some European companies already have long-term relationships with leading exporters from larger producing countries. Sometimes they even promote offers from specific countries. As a result, these buyers will want to work with you to avoid damaging their current relationships.

There are also buyers that are constantly looking for new suppliers in order to loosen dependency on the countries that dominate the global market. Those companies may be a better fit for your offer, especially if your product isn't usually associated with your country of origin. On the other hand, there is a risk that the buyers will not be committed to you and will buy their products somewhere else if they find better prices or higher-quality products in terms of process, composition or sustainability.

Generally, importers of processed fruit, vegetables and nuts can be classified according to the types of buyers listed below. Keep in mind that this is not a strict classification, as most of the buyers perform different activities and fit into more than one category.

Product and sector specialisation

Some importers trade with a range of products from different sectors (e.g. frozen fruit, dried fruit, grains) while some only deal with one type of product (e.g. frozen vegetables). Usually it is easier to focus on specialised importers, as they are familiar with the products, market and competition, and can inform you about important market developments. However, this does not always strictly apply.

Table 1: Types of buyers according to level of product specialisation

| Narrow product focus | Sector focus | Diverse | |

| Frequency | Rare | Most common | Medium |

| Illustration | Importer of specific tropical dried fruits | Importer of dried fruit and edible nuts | Importer of juice ingredients, frozen products and canned products |

| Points to consider | Highly specialised knowledge and range of specific quality requests. | Good product and market knowledge. Often directly involved in the supply of retail chains. High-quality requests. | Often source from many origins. Be ready for high competition. |

| Examples | Mango Trading Company | Seeberger | Binder International |

Source: Autentika Global

Market activity specialisation

Generally, importers of processed fruit, vegetables and edible nuts can be divided into two broad groups. The first group consists of bulk traders that re-sell products after import without any processing. Another group processes products or uses them as ingredients. Ingredient users usually do not import products themselves but buy from European wholesalers. However, there are also many companies doing value addition such as roasting, retail packing and labelling. These companies are usually also direct importers.

In most cases, bulk traders and wholesalers are the preferred option for suppliers from developing countries, as they have more options for selling your products.

Table 2: Types of buyers according to market activity

| Bulk traders and wholesalers | Ingredient users | Value addition before retail packing | |

| Frequency | Common | Common for juice ingredients, oil, jams and frozen products. Less common for dried fruit and nuts. | Common |

| Illustration | Importer of specific ranges of edible nuts and dried fruit. | Producer of jams (importer of frozen fruit as ingredient). | Snacks and nuts roasting company (roasting, salting, flavouring, retail packaging). |

| Points to consider | Have good knowledge about product origins and market requirements. Usually trade high quantities so full container loads are common request. | Good product and market knowledge. High and specific quality requirements. Often source from European traders. | When importing directly, very often search for long-term partnerships. Not easy to build new supplier relationships with. |

| Examples | August Töpfer | Zentis | Intersnack |

Source: Autentika Global

Market segment specialisation

Some companies are equipped with packing facilities and can sell directly to retailers (under their own brand or private label). Other companies specialise in supplying the foodservice segment (hotels, restaurants, catering, institutions). Although many suppliers from developing countries prefer to directly supply the retail segment, this can be very difficult due to high pressure for lower prices, high quality and certification demands.

Niche segments can also provide good opportunities for developing country exporters. Buyers working with suppliers of sustainably sourced and processed products can be a good fit for smaller suppliers who cannot compete on price and the large quantities offered by big suppliers. However, the market for some of these products (for example Demeter-certified) is quite limited.

Table 3: Types of buyers according to market segment

Mainstream retail (own brand) | Mainstream retail (Private label) | Foodservice | Other (specialised, niche, online, etc.) | |

| Frequency | Common | Common | Rare | Rare (depends on segment) |

| Illustration | Importer of olive oil. | User of concentrated juices, purees and other juice and soft-drink ingredients (bottling and product development). | Supplier of olive oil to hotels, restaurants and catering companies. | Producer of baby food (importer of purees and dried fruit). |

| Points to consider | Have high quality demands imposed by retail chains. Good market knowledge. Tend to cooperate with well-known suppliers. | Often the same company supplying the market with their own brand. Prices are low. | Specific quality and packaging requirements. Usually buy from European supplier instead of importing from non-European countries. | Special certification requirements, frequent audits. |

| Examples | Salov | Refresco | Olijf Bedrijf | HiPP |

Source: Autentika Global

Specialised importers are particularly relevant for new suppliers, as supplying the retail segment directly is very demanding and requires many investments in quality and logistics. However, for well-equipped and price-competitive producers, packaging for private labels can be an option. But note that private label packaging is mostly done by importers that have contracts with retail chains in Europe.

Tips:

- Read our product-specific studies to learn more about channels and segments for specific products and to find examples of buyers from the various categories.

- Be aware that selling directly to retail channels often means higher investments (such as renting a warehouse in the target market), participation in competitive procurement calls, and the possibility of supplying small quantities frequently (e.g. weekly) and on short notice.

2. Attend trade fairs and industry events to meet your buyers face-to-face

Companies use trade events to promote their offers, find potential buyers and meet existing customers. One of the main advantages of a trade fair is that companies can meet potential customers face-to-face. This is particularly important in the processed fruit and vegetables sector, as it helps build trust.

Bear in mind that participating in a trade event abroad can be expensive. Therefore, you should only invest in event participation after making a cost-benefit calculation. Instead of exhibiting, you can visit select events and search for potential buyers among exhibiting European companies. Study the list of exhibitors before your visit and make appointments with potential buyers. Also, establishing contact with buyers before the exhibition will save you the time you need for first introductions and will make communication easier.

Apart from trade fairs, some of the best opportunities for networking with potential buyers can be found at conferences and annual meetings of relevant European associations. Each of the subsectors within the processed fruit and vegetables market in Europe is organised in the form of European and international associations. There are specific trade associations for processed products (jams, canned and frozen), for juices, and for dried fruit and edible nuts. The leading trade events you should consider visiting are elaborated on below.

Trade Fairs

Food trade fairs in the European Union include some of the largest exhibitions worldwide: in previous editions, SIAL Paris welcomed over 7200 exhibitors from 120 countries and had a record attendance of more than 300 thousand visitors from 194 countries.

- Anuga – The largest trade fair for food and beverages in the world. It takes place in Cologne, Germany every other year in odd years, and hosts relevant sections for processed fruit and vegetables, including a beverages section for fruit juice concentrates and purees, a frozen food section (for frozen fruit and vegetables) and the delicatessen fine foods section (for jams, edible nuts, dried fruit and canned produce).

- SIAL – Held every other year in Paris, France. It is a general trade fair of food and beverages, with a high participation of French exhibitors. It has sections similar to Anuga for processed fruit and vegetables, and a strong focus on innovations in the food industry.

- Biofach – A trade fair focused exclusively on certified organic products. It is surprisingly large for such a specific niche and takes place every February in Nuremberg, Germany. Processed fruit and vegetable exporters can be accommodated in the international pavilions. Biofach also organises an annual conference about developments in the global organic industry and sustainability.

- Alimentaria – International food fair mainly attended by Spanish exhibitors. However, it does provide a lot of opportunities for finding new buyers. Another benefit is that it provides insights for the hospitality segment as it is jointly organised with HOSTELCO (the foodservice trade fair). It is organised every other year in Barcelona, Spain.

- Tuttofood – International food fair with a strong focus on Italian exhibitors but also has international participants. A tailored B2B programme is organised during the exhibition. It is held every other year in Milan, Italy.

- Food Ingredients Europe (FIE) – A smaller trade fair focusing exclusively on ingredients, including raw materials and semi-finished products offered for sale to the food industry. It is held at a different European location every year.

- Natural & Organic Products Europe – A relatively small trade fair, yet offers good opportunities for products labelled as 'natural' or 'organic'. It takes place every year in London, England.

- Nordic Organic Food Fair – A relatively small fair compared to the leading events, but provides very good opportunities for suppliers of organic food to Scandinavian markets (Sweden, Denmark, Norway and Finland). It is held every year in Malmö, Sweden.

- ISM Sweets & Snacks – The world's leading trade fair for sweets and snacks, held every third year in Cologne, Germany. It is especially relevant for industrial suppliers of dried fruit and edible nuts.

- PLMA – The world's leading trade fair for private label manufacturers. It takes place every year in Amsterdam, the Netherlands. It is the most relevant trade fair for companies willing to supply products to European retail chains. To this end, companies must have food safety certifications and meet specific retailer requirements in terms of safety, quality, and social and environmental requests. Certain retail customers also require you to have specific packing and labelling equipment.

European buyers visit these fairs and also travel outside the European Union to look for new suppliers. Among the most relevant non-European annual trade fairs attended by European processed fruit and vegetables buyers are Gulfood (Dubai, United Arab Emirates), FOODEX Japan (Tokyo, Japan) and World Food Moscow (Moscow, Russian Federation). Koelnmesse, the organiser of ANUGA, also runs two important trade shows in China, Brazil and India called Anufood. The African trade show that attracts the most interest from European traders is Food Africa (Cairo, Egypt). In addition, the German Fairtrade Messe company organises three trade shows in Nigeria, Ghana and Ethiopia.

Industry events

The European and international trade associations organise regular trade events. Those events provide opportunities to match with traders focused on only one product group and are less crowded than the large trade fairs. Some of these events are specifically organised as B2B events, but the majority also include congresses with presentations about industry-relevant and up-to-date topics and market analysis. The most relevant events you should consider attending are:

- World Nut and Dried Fruit Congress – Relevant for suppliers of nuts and dried fruit and organised by the International Nuts and Dried fruit Council. It has product-specific market presentations and round tables, and provides opportunities for networking with many industry players. Participants can also use promotional opportunities and rent rooms for business meetings. It is organised each year at a different location.

- IFU Juice Conference – Relevant for suppliers of fruit and vegetable juices and juice ingredients. It provides the opportunity to meet and engage with other juice industry professionals from around the world. It is held each year at varying locations.

- Polaris Meetings – Relevant for suppliers of frozen fruit and vegetables, and since 2023 for suppliers of nuts and dried fruit. Events are very focused on B2B meetings without conferences and presentations. Polaris provides opportunities to meet potential buyers in a structured setting. Meetings are pre-arranged within reserved time slots. The events are organised each year at varying locations.

- Juice Summit – Relevant for suppliers of juices and ingredients. It is organised by the European Juice Association and provides updates about the European market and trends. It provides opportunities to meet industry professionals during the opening evening and during breaks between presentations. It is held every other year in Antwerp, Belgium.

- Snackex – Relevant for suppliers of edible nuts. This is the only trade event fully focused on savoury snacks and nuts. It provides opportunities to meet industry professionals, such as importers and roasting and packing companies. It is organised by the European Snacking Association and held each year at varying locations.

- Metal Packaging Europe or the international conference on Food and Beverage Packaging – It can provide interesting matching opportunities for suppliers of canned fruit and vegetables.

Tips:

- Save money and check out the possibility of exhibiting at the European trade fair through your country's national stand. National stands are commonly organised by your country's export promotion organisations. There are international export support programmes that fund participation in some events.

- Search for potential buyers on the trade fair exhibitors' list. Use these links to see the exhibitors' lists for ANUGA, SIAL and BIOFACH. Make a list of potential contacts and prepare short questions to ask during the visit so you can filter the buyers that match your offer.

- Obtain as many confirmed appointments with potential customers as possible. First-time visitors and exhibitors often overlook this step. Some trade events, like BIOFACH, Anuga and SIAL, offer matchmaking services on their website.

- Social media sometimes allow attendees of an event to communicate with each other. Try to find out if the organiser of the event uses social media tools. SIAL, Anuga and Biofach have smartphone applications specifically created for particular events.

3. Find buyers among the members of processed fruit and vegetables associations

The European processed fruit and vegetables sector has several industry associations that represent the interests of member companies. These associations can be good sources for finding potential buyers, as they tend to have extensive networks. Some of them even offer international memberships and participation in annual conferences, where suppliers can meet with potential buyers directly.

A good way to start engaging with associations at an international and European level is to look for membership possibilities. European associations put information on their websites about national association members. In turn, the national associations provide information on their websites about their members, which can be target companies for your offer (see list below). You should focus on the national associations in the markets that provide the best opportunities for your offer. To find out which markets these are, read our study on the demand for processed fruit and vegetables.

European and International Associations

- European Fruit Juice Association (AIJN): An umbrella association for the European industry with an international membership. Provides information about European legislation, product guidelines, sustainability and more. Search the list of members to find national associations and companies.

- European Association of Fruit and Vegetable Processing Industries (PROFEL): Provides statistics about the European processed fruit and vegetables sector, information about legislation, and a list of companies and national associations.

- FRUCOM: The European federation of trade in dried fruit and edible nuts, processed fruit and vegetables, processed fishery products, spices and honey. Search the list of members to find national associations and companies. FRUCOM allows membership of non-European companies and associations.

- European Snacks Association: Represents European savoury snack producers and traders, including those of edible nuts. Search the list of members to find national associations and snack nut companies.

- International Nut and Dried Fruit Council (INC): Statistics and information about the international nuts and dried fruit industry. To access a database of members, you must be subscribed.

- International Fruit and Vegetable Juice Association: Provides technical guidelines and organises workshops for the industry. Search the list of members to find potential buyers. Also consider becoming a member to access more information and participate in networking events.

National Associations

- Waren-Verein – Association of German importers and brokers of processed fruit and vegetables, honey and related products. You can search the list of trade members. Consider becoming a member, as they allow international membership. Waren-Verein organises a European Trade meeting with networking opportunities each year.

- NZV - Dutch Association for trade in dried fruit, nuts, spices and related products (in Dutch only). For information about membership and members, contact the NZV secretariat.

- NDFTA – The United Kingdom's National Dried Fruit Trade Association. Provides networking opportunities, promotes consumption and informs members about legislative developments. You can search the list of members or consider becoming a member.

- UNILET – French association of frozen fruit and vegetables companies (in French only). Find a list of French frozen fruit and vegetables companies in the list of vegetable processors.

- VEGEBE – Belgian association of frozen and other vegetable processors and traders. Search the list of members to find potential partners.

- ADEPALE – French processed fruit and vegetables industry (in French only). Search the list of members (Adhérents) to find potential partners in the canned, frozen and prepared fruit and vegetables sectors.

- VDF – German Fruit Juice Association (in German only). You can search the lists of members to find fruit juice producers (bottling and blending companies) and raw material suppliers (such as purees or concentrates traders).

The largest demand for processed fruit and vegetables in Europe comes from Germany, the Netherlands, France, the United Kingdom and Italy. You should focus your search on sector associations in those countries. Read our product-specific studies for more precise information about the various European markets.

Tips:

- Follow the leading processed fruit and vegetables associations listed above. Keep track of the relevant events they promote and check out their newest releases and research findings.

- Look at each association's member list, as they can provide you with potential prospects for your marketing campaign. Carefully look at the websites of members to see whether they fit your profile. It is better to have a short list of promising potential buyers than a long list without further expectations.

- Contact the staff of the associations to find out more about the possibilities and data their members can provide.

4. Help your potential buyers find you on the Internet

After you define your offer and understand the needs of your buyers, it is time to make your unique selling proposition visible on the Internet. The best way is to start with your website. Ideally, your website should attract the attention of visitors in your target markets, create a desire for your offer and, last, convert the visitor into a paying customer. One way to do this is by lining up your unique selling proposition with a strong message on the homepage of your website, with catchy images, videos and interesting content.

An example of a successful online promotion is ARDO, a Belgian frozen vegetable company. Their homepage clearly presents what the company is offering. Also, there are two attention-grabbing buttons ('product finder' and 'more about ARDO') on the home page, to encourage visitors to further explore the website. ARDO also offers a subscription to its newsletter and promotes its social network pages (Facebook, LinkedIn, Instagram and YouTube). Their unique selling propositions are also visible (innovation, entrepreneur of the year, sustainability).

After you create a website, you need to make it more visible to your potential buyers. This can be done through Search Engine Optimisation (SEO). SEO is the process of improving the online visibility of a website in search engine results. Having a good website is essential, but it is even more important for you to ensure that European buyers can easily find your company. If someone is searching for the product you are offering, your offer should appear on the first page of major search engines.

European buyers search for new suppliers by typing the product name into a search engine (usually Google). Next to the product name, they add words such as 'exporter', 'producer' or 'supplier'. Sometimes the name of the country is also used, especially if the buyer is looking for products of a specific origin. For example: 'cashew nuts producer Ivory Coast'. You should understand that it is very important for your company to be on the first page of the search results for this type of search.

Creating a website is the first step and the basis of your online promotional activities. However, for successful promotion it is not enough to only have a website. You should also use social networks to promote your product(s). Social media platforms represent a real-time communication tool for your company to interact with potential buyers abroad. The most popular social platforms recommended for you are LinkedIn, Facebook, YouTube, X and Instagram.

Tips:

- Invest in content-writing skills or contract professionals to create content for your website. If you want to do it yourself, you can find many instructional books or online courses on e-learning platforms like Udemy or LinkedIn Learning.

- Engage with SEO consultants. Also invest in personal training and training for your staff in SEO techniques (e.g. use of keywords, tags, analytics, Google Ads).

- Go to the LinkedIn learning centre for more information about what you can do with LinkedIn.

- Use X during trade fairs to increase visibility among potential buyers. One effective viral marketing tool is letting users win a price by re-tweeting your message (for example a link or an announcement).

5. Make an initial list using company databases

Several general and food-specific databases make it easier for suppliers to find names and contacts of buyers. This should be the first step when you start searching for buyers. Keep in mind that none of these databases are complete. Even a paid database can miss some relevant companies from the markets you are targeting. You should use them in combination with other tips given in this document to make your search shorter and easier.

The most popular company databases relevant for processed fruit and vegetables exporters are:

- EUROPAGES – A directory of European companies. You can search by sector (e.g. 'dried fruit' or 'fruit and vegetables juices'). You can filter your results and select only companies that are traders and not manufacturers (e.g. 'agent', 'distributor' or 'wholesaler').

- Wer liefert was (Who Supplies What) – A leading business-to-business (B2B) online marketplace in Germany, Switzerland and Austria. Search for products or companies and filter your results by company size and activity. Use German names for the products in your search, in addition to English names.

- Organic-Bio – A database of companies selling and buying organic products.

- Kompass – A large database of companies that is available by subscription. You can apply several filters to find potential buyers. You can perform a basic search free of charge by typing the product name and selecting 'importers' in the list of results to narrow down your search.

Tips:

- Also use ITC TradeMap to find names of international buyers. In the first step, select your product on the homepage (using the product name and the HS code). In the second step, select a target market from the drop-down list and click on 'Companies'. In the final step, click on the product categories to see potential buyers and their contacts.

- When making your list of companies using databases, do not send the same email to all of them. This will be considered 'spam' by most buyers. Instead, write personalised emails and follow up on your email with a phone call to check if the person received your email.

- Carefully study the websites of the companies you found in the databases. Also search for additional information about the companies on the Internet to better understand whether they are a good match for your company. Perform a search in the language of the country where your target company is headquartered.

- After sending the first email, follow up with a telephone call to increase the response rate and to check whether the contacted company is really relevant for you.

6. Participate in digital B2B platforms

The processed fruit and vegetables trade is a face-to-face business. Most long-term partnerships are still made after personal introductions, an analysis of samples, and factory visits. However, after the travel restrictions imposed by the COVID-19 pandemic, the amount of business conducted online increased. Currently almost every trade fair also provides an opportunity for online participation, called a 'hybrid' event. One B2B platform connected to a special event is talque, which is used during the online editions of Biofach.

In the processed fruit and vegetables sector, B2B marketplaces are mainly used to connect European buyers and suppliers from other continents, but the actual overseas orders are not commonly placed online. Online orders are frequently used by food operators within Europe (such as processors or home delivery restaurants) but very rarely for imports from countries outside of Europe, as the export of food commonly requires customs procedures, certificates of origins, transport documentation and other checks.

Another way to find buyers is to use matchmaking services. Some of these services are free of charge but most ask for a subscription or some other fee. Some online matchmaking platforms relevant for exporters of processed fruit and vegetables are:

- Frozen B2B – An online marketplace for frozen food. Available by subscription, although some simple searches are allowed free of charge.

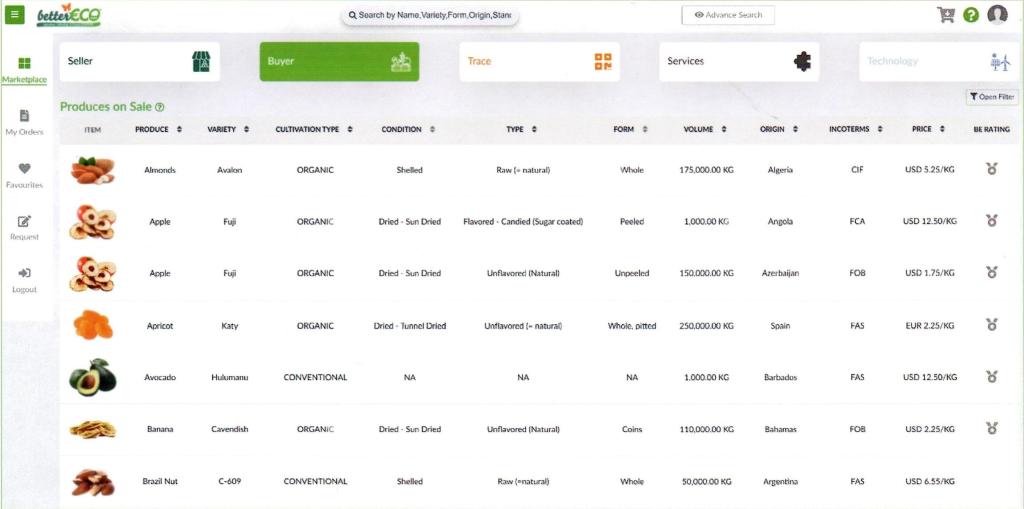

- BetterECO – B2B trading platform with integrated traceability. Especially relevant for suppliers of sustainably produced dried fruit and edible nuts. Subscription is required.

- Saladplate – Created by the famous international event organiser Informa Markets. It is open to international participation but Asian traders make up the majority of participants.

- GreenTrade – An online marketplace for organic food. Search current buyer announcements under several categories relevant for processed fruit and vegetables (e.g. 'fruit and vegetable', 'grocery products', 'drinks'). To see the contact information of the company, you need to subscribe.

- Biolinked – A B2B e-marketplace for small and mid-sized organic food suppliers.

- Alibaba – A leading non-product specific e-commerce B2B platform.

- Tridge – A market intelligence and online sourcing hub.

- 21food – A leading food B2B e-marketplace located in China.

Figure 1: Screenshot of the B2B trading platform betterECO

Source: Autentika Global/betterECO

You can use B2B marketplaces to increase your chances of finding buyers. To boost your chances for export, follow our tips for successful participation in trade events. You should search for buyers outside as well as inside a platform. Although most of the platforms have developed different tools for B2B matchmaking, many international processed fruit and vegetables traders are not part of B2B marketplaces (yet). Therefore, you need to invite your potential buyers to participate.

Tips:

- Visit the websites of the leading trade fairs in Europe to check whether they are planning to organise online events.

- Before paying for a subscription to a B2B platform, ask the managing team how many buyers of your products are included in the platform, either as a visitor or a supplier. Ask for a trial subscription to check whether the platform is suitable for you and your product.

- Ask for free vouchers or coupons during the B2B events connected with trade fairs. Usually, organisers provide a number of free tickets for exhibitors. You should offer the free tickets to potential buyers to participate in online meetings with you.

7. Find organisations that can provide support for your export

There are many business support organisations (BSOs) that can assist your export activities. They can be located in your own country or in your target market, or they can perform support activities on an international level. Some of these organisations have customised export promotion programmes (such as CBI) specifically focused on export to Europe and targeted at specific regions. National export promotion organisations usually fund activities such as export market research, participation in trade fairs and matchmaking.

The best-known international BSOs supporting exporters in developing countries are:

- Centre for the Promotion of Imports from Developing Countries (CBI) – A government-funded organisation that supports more than 800 entrepreneurs in becoming successful exporters on the European market. They offer market information for various products and services, export coaching programmes and technical support, inform and influence policymakers, and involve importers in the development and implementation of their programmes.

- The Swiss Import Promotion Programme (SIPPO) – A government-funded organisation that supports BSOs in improving their services for exporting companies, strengthening their own institutional set-up, and connecting to an extensive network.

- The Import Promotion Desk (IPD) – A government-funded organisation from Germany that aims to offer sustained and structured promotions for the import of certain products and services from selected partner countries. They bring together the interests of German importers with those of exporters in emerging growth markets.

- International Trade Centre (ITC) – United Nations agency based in Geneva (Switzerland), dedicated to supporting the internationalisation of small and medium-sized enterprises around the globe. Most of the activities are aimed at supporting exporters from developing countries.

- Enterprise Europe Network (EEN) – Founded by the European Commission, aiming to help companies offering all kinds of products and services to innovate and grow internationally. You can check whether your country has a focal point in EEN.

Although these BSOs can help you with your export activities, you should always start by checking the possibilities of obtaining support from your own country. Organisations such as export promotion agencies, chambers of commerce or embassies of your country in your target markets can help you with promotional activities. Also, some sector-specific associations deal with export-promotion activities.

Tips:

- Establish personal contacts with the staff of an export-promotion organisation located in your country.

- Check if there is a diaspora organisation for your country located in Europe. Diaspora refers to the members of a population who have moved abroad but who maintain close ties to their homeland. The diaspora can play an important role in trade, and diaspora members can create connections between your company and potential buyers.

- Check export promotion programmes for processed fruit and vegetables on the CBI website. Also, contact IPD, SIPPO and ITC to check for any export support projects suitable for your company.

- Do not forget to contact local organisations within your own country. Local establishments such as regional chambers of commerce, regional development agencies and business support offices in local towns and districts can also provide you with contacts and include your company in export support projects.

This study was carried out on behalf of CBI by Autentika Global.

Please review our market information disclaimer.

Search

Enter search terms to find market research