Entering the European market for groundnuts

Food safety certification, attention to sustainable production and reliable, frequent laboratory tests create a positive image for groundnuts exporters to Europe. Sustainable production can provide additional advantages for new suppliers. The strongest competitors for new groundnuts suppliers are Argentina, the United States and Brazil.

Contents of this page

1. What requirements and certifications must groundnuts comply with to be allowed on the European market?

What are the mandatory requirements?

All foods sold in the European Union (EU) must be safe for human consumption. The European safety authorities must approve additives if there are any. Additives should comply with the specifications outlined in Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008. Levels of harmful contaminants, such as pesticide residues and mycotoxins, are limited. Consumer labels should make it obvious that groundnuts can cause allergies.

Contaminants control in groundnuts

The EU places strict controls on contaminants in food, especially on aflatoxins, per Commission Regulation (EU) 2023/915 on the maximum levels for certain contaminants in food. This regulation came into force on 25 May 2023. Annex I provides the maximum levels of regulated contaminants.

The regulation aims to ensure that these substances are present at levels that are can be achieved through good agricultural, fishing and manufacturing practices, while also considering the associated health risks.

Groundnuts must be tested and comply with these rules before they are imported. The regulation is frequently updated. There are also specific contaminant limits for individual products. The most common requirements regarding specific contaminants in groundnuts are related to the presence of mycotoxins, pesticide residues, lab-made chemicals, microbiological organisms and heavy metals.

Acrylamide is a chemical that can form in some foods during high-temperature cooking processes, such as frying, roasting and baking. In groundnuts, it can form during roasting, which is a common way of processing peanuts. The European Commission has set levels for acrylamide in various foods under Regulation (EU) 2017/2158. While this regulation does not set a specific maximum amount for groundnuts, this indicates the importance of managing acrylamide levels in food products.

Border control

Groundnuts are subject to import duties, customs controls and checks in accordance with EU Customs Code (Regulation (EU) No 952/2013). In the event of repeated non-compliance, the products can only be imported under stricter conditions, such as having to be accompanied by a health certificate and analytical test report.

Products from countries that have shown repeated non-compliance can also be subjected to temporary increases of official controls at borders. The list of affected countries is provided in Annex I of Regulation (EC) 669/2009. Currently (June 2023), the inspections list for the presence of aflatoxins includes groundnuts from Bolivia (50% frequency of physical and identity checks), Madagascar (50%), Senegal (50%) and the United States (10%).

Annex II of the regulation lists groundnuts from countries subject to special conditions for entry into the EU due to contamination risk. It focuses on aflatoxin risks for groundnuts from Argentina (5% frequency of checks), Brazil (10%), China (20%), Egypt (20%), Ghana (50%), Gambia (50%), India (10%) and Sudan (50%).

Mycotoxins

Fungi can produce aflatoxins in groundnuts in the field or during storage, especially in warm and high humidity conditions. Aflatoxins are stable compounds that are not eliminated during roasting or cooking. This means products made from peanuts can contain aflatoxins.

The contamination with mycotoxins was the main reason groundnut shipments were rejected at the border. In 2022, the Rapid Alert System for Food and Feed (RASFF) recorded 121 border rejections for peanut shipments. Aflatoxin contamination was the cause of all but five of these rejections. The highest number of rejections were for groundnuts from Egypt (35), followed by the USA (25), Argentina (22) and India (21).

The maximum level of aflatoxins for groundnuts intended for direct human consumption must be below 2 μg/kg for aflatoxin B1 and below 4 μg/kg in terms of total aflatoxins content (B1, B2, G1 and G2). However, a higher content is allowed if the groundnut products are not intended for direct human consumption, according to Commission Regulation (EU) 2023/915. In these cases, the ground nuts must be sorted or treated before reaching the market.

Pesticides residues

The EU has set maximum residue levels (MRLs) for pesticides in food products. Products containing higher pesticide residues than allowed will be withdrawn from the European market. However, excessive residues of pesticides are not very common in the groundnut trade. This is because groundnut shells are usually removed before consumption.

The EU frequently updates a list of approved active substances for pesticides. In 2022, the European Commission approved 27 new regulations that modified this list through new approvals, extensions, renewals, amendments and restrictions.

In 2022, the Rapid Alert System for Food and Feed (RASFF) recorded five border rejections for groundnut/peanut shipments from Brazil, which contained the haloxyfop herbicide or haloxyfop residue.

Microbiological contaminants

The presence of very low levels of salmonella and E. coli in ready-to-eat or processed foods, including groundnuts, is a major cause of foodborne illness. Groundnuts processors should consider salmonella and E. coli as major public health risks in their hazard analysis and critical control points (HACCP).

Tips:

- Read the Codex Alimentarius Standard for Peanuts (PDF), which was last amended in 2019. As aflatoxins are a major concern for groundnut exporters, be sure to dry the pods as fast and as well as possible before storage. You should also maintain low moisture content during transport and storage.

- Read more about MRLs on the European Commission website on Maximum Residue Levels. Consult ongoing EFSA reports and opinions on specific active substances and their MRLs.

- Equip yourself with quick aflatoxin testing options like Vicam testing solutions to control the level of aflatoxins in all phases of the production process.

What additional requirements do buyers often have?

Quality requirements

Groundnut quality is determined by general and specific quality factors. General standards require groundnuts to be safe and suitable for human consumption and free from abnormal flavours, odours, living insects and mites. Specific standards address aspects like mouldy, rancid or decayed kernels, organic and inorganic matter, filth, contaminants, moisture content, hygiene and the percentage of defective products by weight.

Defects for in-shell groundnuts include empty, damaged and discoloured pods, according to the Codex Alimentarius Standard for Peanuts (PDF). Defects for groundnut kernels include damaged, discoloured and broken or split kernels. The industry has defined several other criteria for quality but some of them, such as taste and flavour, are subjective.

Groundnut quality requirements are defined by several standards. The most widely used standard in Europe is the standard defined by the United Nations Economic Commission for Europe (UNECE) which is based on the United States standards. UNECE standards for peanut kernels (PDF) and inshell peanuts (PDF) were updated in 2022. The most important criteria used to define the quality of groundnuts can be found in Table 1.

Table 1: Common criteria defining groundnut quality

|

Grading or sizing |

Grading categories for groundnuts are not officially defined in the EU. The US grading classification is often used. In this standard, grades are defined by the number of groundnuts counted in one ounce (i.e., 38/42 or 40/50). The size is combined with the name of the groundnut type or variety (such as super jumbo Virginia in shell 9/11). |

|

Type (variety) |

The most cultivated groups are Runner (commonly grown in the United States and Argentina), Spanish (most grown in South Africa), Hsuji (Spanish-type, round variety grown in China) and Virginia (large kernel type used in gourmet snacks). |

|

Form |

The most common forms are in-shell and kernels. Kernels may be presented as whole (red skin or blanched) or splits (regular or blanched splits). |

|

Classing |

In accordance with the UNECE provisions concerning tolerances, peanut kernels (PDF) and inshell peanuts (PDF) are classified into 3 classes: extra class, class I and class II. |

Source: Autentika Global

Food safety certification

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will not work with you if you cannot provide the food safety certification that they require.

Most European buyers will ask for Global Food Safety Initiative (GFSI) recognised certification. GFSI does not provide food safety certification. Instead, it recognises a number of certification programmes that meet the GFSI benchmarking requirements. For groundnuts, the most popular certification programmes, all recognised by GFSI, are as follows:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

You can find the full list of food certification programmes that meet the benchmark requirements set by the GFSI on the initiative’s website. Food certification systems are constantly developing. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements, so there are no major discrepancies in their requirements. However, certain retailers may prefer one certification over another, or demand additional certifications based on internal policies.

For example, British buyers often require BRCGS, while IFS is more common for German retailers. These preferences are sometimes historical. For example, IFS was initially developed as a joint venture of the French retail association FCD and the German retail association HDE. Also, note that food safety certification is only one element of scrutiny. Major buyers will usually visit or audit production facilities before starting a business relationship.

Corporate Social Responsibility

Firms have different requirements for social responsibility. Some companies will need you to adhere to their code of conduct or common standards, such as the Sedex Members Ethical Trade Audit (SMETA) standard. SMETA provides a globally recognised way to assess responsible supply chain activities, including labour rights, health & safety, the environment and business ethics. Other alternatives include the Ethical Trading Initiative’s Base Code (ETI), amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Packaging requirements

Jute and polypropylene bags are the most frequent types of export packaging for in-shell groundnuts and vacuum-sealed bags in cartons for kernels. The choice of packaging material mainly depends on the shipment size, the type of groundnut product and the importer’s requirements. Jute and polypropylene bags usually hold 25 to 50 kilograms. They are widely used due to their durability and cost-effectiveness. Bulk shipments are usually used for large-scale industrial buyers. They can involve shipping in containers that hold up to several tonnes.

For processed groundnut products, retail sizes can range from small, 200-gram vacuum-sealed packets to larger 1 kg containers or pouches. Retail packaging is often completed in the importing country, allowing for language-specific labelling and compliance with local packaging regulations.

Labelling requirements

Labelling requirements for bulk packaging of groundnuts and their products are designed to provide essential information during transport and to aid traceability. The requirements are simpler than those for retail, but they are still regulated. The type of peanut and the product name must be shown on the label. It is common to include the crop year too. Information about bulk packaging must be given either on the packaging or in accompanying documents. Bulk package labelling should contain the following information:

- Name of the product;

- Lot identification;

- Name and address of the manufacturer, packer, distributor or importer;

- Storage instructions. Storage and transport instructions are very important due to the high oil content and sensitivity to high moisture, which can negatively influence quality if not handled properly.

Table 2: Bulk package labelling information

|

Identification |

Packer and/or dispatcher: Name and physical address (such as street/city/region/postal code and, if different from the country of origin, the country) |

|

Nature of produce |

• ‘In-shell peanuts’ or ‘Raw in-shell peanuts’ or ‘Raw Peanut Kernels’ or ‘Raw Blanched Peanut Kernels’, etc. • Name of the variety (optional). |

|

Origin of produce |

Country of origin and, optionally, district where grown or national, regional or local place name. |

|

Batch code or Lot identification: |

• A unique code identifying the specific batch or lot of groundnuts. This is for traceability purposes and allows for efficient product recall if necessary. • Lot identification and the name and address of the manufacturer, packer, distributor or importer. May be replaced by an identification mark. |

|

Commercial specifications |

• Class • Size (if sized) • Crop year (optional) • ‘Best before’ followed by the date (optional). |

|

Allergen information |

Given that groundnuts are recognised allergens, it should be stated that the package contains groundnuts. This is critical for safety during storage and processing. |

|

Storage and transport conditions |

If necessary, any special conditions for the storage of the groundnuts should be indicated (such as ‘Store in a cool, dry place’). These are very important due to the high oil content and sensitivity to high moisture, which can negatively influence quality if not handled properly. Favourable travel temperature range. |

Source: Autentika Global

In the case of retail packaging, product labelling must comply with the EU Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and clear legibility. Please note that this regulation lists groundnuts as products that cause allergies or intolerances and, as such, allergen information must be clearly visible on the retail packaging.

Tips:

- Read our study about buyer requirements for processed fruit and vegetables for a general overview of buyer requirements in Europe.

- Read more about transport and storage requirements for groundnuts on the Germany Transport Information Service website and on the CargoHandbook website.

- Do a self-assessment through the small producer starter kit (PDF) from the amfori BSCI website.

What are the requirements for niche markets?

The European Green Deal is a comprehensive plan created by the European Union to make Europe climate neutral by 2050. The Green Deal emphasises sustainable practices and the promotion of organic farming. For small and medium enterprises (SMEs), it means there could be increased scrutiny of the environmental impact of their groundnut production processes. Exporters that can demonstrate sustainable farming practices, reduced carbon footprint, or organic production might have a competitive advantage. This might also imply a greater need for certification.

The EU’s trade policy is also expected to align with the Green Deal. While the specifics are yet to be clarified, this could mean more emphasis on sustainability clauses in trade agreements and potentially more support for businesses transitioning to greener practices. Hence, some requirements for niche market certifications today, may become more mainstream requirements in the future. In anticipation of these changes, SMEs can adopt sustainable farming practices and aim for sustainability certifications.

Organic groundnuts

European legislation specifies that if you want to market your groundnuts as organic, they must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before you can put the EU’s organic logo on your products. This also applies to the logos of certifying organisations, like the Soil Association in the United Kingdom and Naturland in Germany.

Organic farming in the EU is expanding quickly, thanks to rising consumer interest in organic goods. To address this, the EU implemented new organic legislation as of January 2022. It strengthens the control system, boosting consumer trust in EU organic products and setting the same standard for local and imported organic products. Moreover, a wider range of products can now be marketed as organic under these guidelines.

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Every batch of organic products imported into the EU has to be accompanied by an e-COI, under the Annex of the Commission Regulation that defines imports of organic products from third countries.

For equivalent countries (including Argentina, India and Tunisia) certificates are issued by the control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

One of the primary challenges is the management of weeds in organic peanut production. Organic farming rules prohibit the use of synthetic herbicides, which makes weed control a significant challenge. Successful weed management in certified organic peanut production depends on having an integrated system, not a single form of weed control. While organic certification can lead to premium prices for peanut products, it also presents significant challenges that need to be managed carefully.

Sustainability certification

One common sustainability certification scheme is Fairtrade International. It has developed a specific standard for nuts for small-scale producer organisations. Fairtrade International also defines terms of payment and sets Fairtrade minimum and premium prices for conventional and organic peanuts.

Rainforest Alliance is another globally recognised certification. It has merged with UTZ to form a combined certification programme. Groundnut farmers adopting Rainforest Alliance 2020 Certification Programme standards contribute to global efforts to combat climate change and deforestation. Groundnuts are included in the Rainforest Alliance Certified Crops list of 2023.

A group of predominantly European companies and organisations formed the Sustainable Nut Initiative in 2015. The Sustainable Nut Initiative is a pre-competitive platform open to all actors in the nut supply chain that want to achieve a more sustainable nut sector.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) impose specific diet requirements. If you want to supply Jewish or Islamic ethnic niche markets, you need Halal or Kosher certification schemes.

There are several organisations that provide Kosher certification in Europe. Examples include the Kosher London Beth Din (KLBD) that provides guidelines on how to obtain the certification. Halal certification in Europe can be obtained through certifying bodies, such as Halal Certification Services (HCS), which provides certification services.

Vegan certification

Obtaining vegan or vegetarian certifications is essential for groundnut exporters. This is because interest in veganism and vegetarianism in Europe is increasing. Consumers want products that align with their dietary preferences. Certification ensures compliance with vegan standards.

The Vegan Society is a UK-based organisation that promotes veganism. They offer a Vegan Trademark to certify that products are free from animal ingredients and have not been tested on animals. The Vegetarian Society is another UK-based organisation that offers two types of certifications – one for vegetarian and another for vegan products. The V-Label is an internationally recognised label for vegan and vegetarian products.

Tips:

- Consult the Sustainability Map database for sustainability labels and standards.

- Check the guidelines for imports of organic products into the European Union to familiarise yourself with the requirements of European organic traders.

- Read our study on Trends on the European Processed Fruit, Vegetables and Edible nuts Market for an overview of the development of sustainability initiatives in European markets.

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and bodies in the EU/EEA/CH and equivalents.

- Keep up-to-date on evolving changes in the European Union’s organic legislation on the European Commission’s Legislation for the organics sector page.

2. Through what channels can you get groundnuts on the European market?

Groundnuts, a versatile and popular product, make their way onto the European market through various channels. Groundnuts are mostly eaten as a snack in Europe. They are also used to produce peanut butter and as an ingredient in the food processing industry. Peanut oil, although an important product worldwide, is very rarely produced in Europe because it is mostly imported from Brazil, Senegal, Argentina and other producing countries.

How is the end-market segmented?

The European end market for groundnuts can be broadly segmented based on quality (standard and high) and use. Groundnuts are used as ingredients for processing by the food industry and for snacks for direct consumption. In both segments, there is demand for groundnuts of different quality. Higher-quality groundnuts are characterised by their larger size, uniformity, better flavour and aroma, ideal moisture content, purity and certifications, among other traits.

The largest groundnut segment in Europe is that of snacking. 60-70% of imported groundnut kernels in Europe are sold as snacks, predominantly as roasted, salty snacks. Groundnuts kernels are also increasingly used by food processing industries as ingredients.

Figure 1: End-market segments for groundnuts in Europe

Source: Autentika Global

Snack segment

European savoury snack sales are still feeling the fallout of the COVID-19 pandemic, supply chain issues, the Ukraine war and high inflation. With food prices on the rise, sales could slow in growth and focus more on value. The expectations are that consumer spending should remain resilient thanks to hybrid working models and more time being spent at home.

Sales of salted snacks are on the rise (PDF) in key European markets, such as Italy, Germany, UK, France and Spain, according to an IRI 2022 report. Snacks with groundnuts could benefit further because protein/energy claims and healthy ingredients are becoming increasingly popular among snack consumers. Health has become a much more important trend in daily nutrition according to the European Snacks Association (ESA). The association expects more growth in free-from products and protein-packed snacks.

The snacking industry is also actively developing a range of roasting flavours to diversify the offer and match consumer taste preferences. Various types of salty and sweet coatings are used to produce innovative snacks. Another trend is the increasing offer of unsalted, dry-roasted (including in-shell nuts) and unroasted peanuts as healthier option compared to salted snacks.

Food processing segment

The food processing segment uses large quantities of groundnuts. The food processing segment is expected to grow in the coming years thanks to market trends that favour nut consumption. The European nut ingredients market is segmented by applications. The food processing segment serves confectioneries, bakery products, snacks, bars and desserts, alongside other products. The snacks and bar segment has seen the highest rise in the consumer market due to wellness and health trends.

Rising demand for healthier, nutrient-rich foods and vegan products drives this market segment, with significant investments being made by key players to expand their production capabilities. Europe’s confectionery market is projected to grow by 3.5% by 2027.

The most common groundnut ingredient users include the following:

- The confectionery industry mainly uses groundnuts to produce chocolate snacks. Some leading chocolate snack brands that use peanuts are Snickers (by Mars) and Reese’s peanut butter cups (Hershey’s), but there are many other similar products in Europe. These are often produced as private labels for retail chains.

- The bakery industry use groundnuts for spreads on cakes, cookies and in pastries.

- Peanut butter is often imported, but it is also increasingly produced in many European countries.

- Protein and fruit-nut bars are increasingly offered as an alternative to sugar-rich and chocolate snacks. Peanuts are often used as an ingredient as a vegetable source of protein.

- Other segments - Groundnuts are also used in other segments, such as pet food and bird feed. Groundnut pieces are also a popular topping on ice cream.

Tips:

- Monitor market developments within the European snack segment by visiting the news section of the European Snack Association.

- Search the list of exhibitors who took part in the specialised trade fair Fi Europe 2022 to find potential buyers for your groundnuts within the food ingredient segment.

- Watch the 2023 Deutsche Welle documentary for more insight into the competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

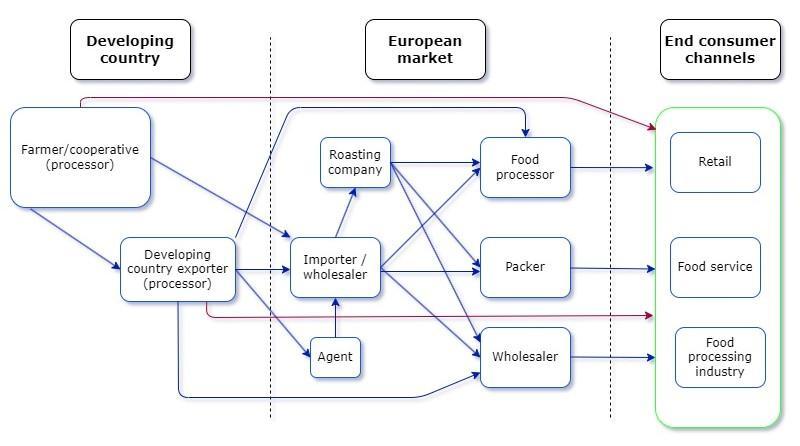

Through what channels do groundnuts end up on the end market?

The most important channel for groundnuts in Europe is represented by specialised nuts importers. There are also several alternative channels, such as agents, food processors and foodservice companies.

Roasting and packing firms are important players in the snack segment. Some of them specialise in selling roasted, salted and spiced peanuts for other brands, private labels and for bulk sales. Examples include Omnitrade, (Germany) Ireco (Luxembourg), Trigon Snacks and Roasting company (UK). Europe’s leading snack and roasting firm is Intersnack, which owns lots of snack brands in different countries, including Ültje (Germany) and KP snacks (UK).

Figure 2: European market channels for groundnuts

Source: Autentika Global

Importers/Wholesalers

In most cases, importers also act as wholesalers. They often sell groundnuts to roasting companies who process and pack them in consumer packages. Some importers are also equipped with processing and packing equipment, so they can supply retail and foodservice channels directly. They are responsible for coordinating the purchasing, shipment and entry of the product in the destination market. Dutch importers and wholesalers include Aldebaran Commodities and ProNut. Zieler & Co. is a German peanut importer and wholesaler.

Importers have a good knowledge of European markets, and they monitor the situation in groundnuts producing countries closely. As such, they are a good place to go to for help, as they can tell you about market developments and provide practical advice. Groundnut importers normally import other types of edible nuts and dried fruit too, so offering other products can increase your competitiveness.

For new suppliers, the challenge is to establish long-term relationships with well-known importers, as they usually work with selected suppliers. Established importers perform regular audits and visits to producing countries. As a new contact, you would need to offer the same quality but possibly better prices than your competitors. You might also benefit from some having unique selling points that differentiate your product.

Importers and food manufacturers adapt to demand from the retail sector. These shifting demands shape the groundnut supply chain dynamics from the top down. Pressure translates into lower prices but also into added value aspects, such as ‘sustainable’, ‘natural’, ‘organic’, ‘vegan’, ‘fair trade’ and traceable products.

Agent/broker

Agents involved in the groundnut trade typically perform two types of activities. Agents normally act as independent companies that negotiate on behalf of their clients and as intermediaries between buyers and sellers. Typically, they charge 2-4% commission for intermediary services.

Another type of activity is the supply of private labels for retail chains in Europe. For most suppliers from developing countries, it is difficult to participate in the strict private label tender procedures. For these services, some agents participate in procurement procedures put out by retail chains in cooperation with their groundnut suppliers. Examples of groundnut agents in European markets include MW Nuts (Germany), Global Trading (the Netherlands), Cardassilaris Family (Greece), QFN (the Netherlands) and Belfruduis (Belgium).

Retail channel

Retailers rarely buy directly from developing-country exporters. However, there are some cases where developing-country exporters (processors) pack directly for private labels or their own label brands. Be aware that the European retail sector is split into discounters and higher-level segments. Consolidation, market saturation, strong competition and low prices are key characteristics of the European retail food market.

Leading food retail companies in Europe differ per country. The companies with the largest market shares are Schwartz Gruppe (Lidl and Kaufland), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands).

Foodservice channel

The foodservice (hotels, restaurants and catering) is usually supplied by specialised importers (wholesalers). The foodservice segment often requires specific packaging sizes of 1-5kg of groundnuts, which differ from bulk and retail packaging packs.

World cuisines, healthy food, vegan trends, demand for plant protein and food enjoyment are the major forces that drive the foodservice channel in Europe. The fastest-growing business types are likely to be new fast foods, street food, pop-up restaurants, international cuisines and sandwich bars.

Tips:

- Look through the members’ list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM) to find buyers from different channels and segments.

- Keep on top of new demand trends from retailers for sustainable, vegan and affordable products. Make your firm more competitive by investing in certification schemes that buyers need.

What is the most interesting channel for you?

Nut, dried fruit and specialised groundnut importers are some of the best contact points for exporting groundnuts to the European market. This is particularly relevant for new suppliers because supplying the retail segment directly is very demanding and needs a lot of quality-related and logistical investments. Brokers, agents and importers are also aware of the newest market requirements.

For well-equipped, price-competitive and producers with other unique selling points, packing groundnuts for private labels can be an option. Be aware that private label packing is often done by importers contracted by retail chains in Europe. In order to have full control of the processing process, it is easier to roast and pack groundnuts for the snack segment within Europe. As labour costs in Europe are higher, importers of groundnuts sometimes look for more cost-effective roasting operations in Eastern Europe or in developing countries.

3. What competition do you face on the European groundnuts market?

Which countries are you competing with?

Emerging groundnut suppliers to Europe should monitor Argentina. This country is the dominant supplier to Europe but has also been growing its exports. Argentina and the US are the main suppliers to the European market. They supply more than 70% of all groundnuts to Europe and are followed by China, which has a 10% market share. Leading suppliers export most groundnuts as kernels, except for Egypt, which exports most in-shell.

Source: Autentika Global, GTA, 2023. *Groundnut products from Table 1

Argentina is the dominant supplier of groundnuts to Europe

Argentina is the leading European supplier of groundnuts and the world’s largest exporter of groundnuts. India is a close second in terms of exported volume. It mostly sells groundnuts to South-East Asian countries. Similarly, the United States exports mainly to Mexico and Canada. Argentina exported 622,000 tonnes of groundnuts in 2022. The USDA expects Argentina’s 2023-2024 groundnut production to increase. Check out Argentina’s historical groundnut production figures and estimates for future output from the USDA Foreign Agricultural Service.

Argentina’s 2022-23 crop of groundnuts (in-shell form) fell to 1.15 million tonnes, down by 14%. The country’s farmers harvested groundnuts from 380,000 hectares in 2022-23, down 7%. The La Niña climate event has affected Argentina’s groundnut sector because it has caused long periods of drought over the last few years. Some Argentinian growers have also switched to grain cultivation because of the war in Ukraine.

Argentina’s market does not have a strong culinary tradition with peanuts. 80% of Argentine groundnut exports are destined for Europe. In Europe, the Netherlands is the main market. It imports more than half of the Argentinian supply (264,000 tonnes in 2022). Exports to Europe have remained stable over the last 3 years, reaching 513,000 tonnes in 2022.

Around 90% of Argentinian groundnut production is concentrated in the southern part of Cordoba province. Cordoba Peanuts are protected by a designation of origin. Runner and High Oleic Runner are two leading groundnut types produced in Argentina.

The Argentinian National Food Safety and Quality Service (SENASA) has established a mechanism of control for groundnuts exported to the EU. Before groundnuts are loaded for export, the aflatoxin content has to be certified. Certificates are issued by officially registered certification bodies, such as JLA and SGS Argentina. JLA starts its aflatoxin analysis service at the groundnut unloading/collection points.

The Argentine groundnut sector’s interests are represented by the Argentine Peanut Chamber (APC). To improve groundnut research and cultivation, the APC established the Argentine Peanut Foundation. Argentina’s groundnut industry guarantees the quality of their industrial processes by implementing domestic and international certification standards.

The United States: the second world exporter

With a crop of 2.88 million tonnes (in-shell), the United States is the fourth-largest producer of groundnuts. The country consumes between 75-80% of groundnuts locally. More than half of all groundnuts are processed into peanut butter. Georgia accounts for more than half of all US production, followed by Alabama, Florida and North Carolina. The USDA expects the United States’ 2023-2024 groundnut production to increase. Check out the historical figures and estimates of future groundnut production from the USDA Foreign Agricultural Service.

Runner type groundnuts account for more than 80% of production. However, Virginia, Spanish and Valencia-type peanuts are also grown in the US. Runners are mostly processed into peanut butter. Runners are grown in all major groundnut producing states. The Virginia type is grown mainly in Virginia and the Carolinas.

The United States exported 83,000 tonnes of groundnuts to Europe in 2022, mostly to the Netherlands. In 2022, one third of US exports to Europe consisted of in-shell groundnuts, mainly to Germany and Spain. The United States’ peanut butter exports to Europe have fallen significantly, from 7,100 tonnes in 2018 to 1,300 tonnes in 2022. This is partly due to a surge in peanut butter imports from India.

Figure 4: Blanched processed groundnut kernels and typical US processed groundnut products

Source: ‘k7236-3’ by USDAgov is licensed under CC BY 2.0

The production and export of United States groundnuts are supported by the American Peanut Council (APC), which established the Peanut Research Foundation. The APC promotes the consumption of peanuts and develops international markets for United States peanuts. The council is also present in the United Kingdom and Germany.

Brazil: a rising force in South America

Brazil is the second-largest peanut producer and exporter of Latin America, with 890,000 tonnes (in-shell basis) produced in the 2022-2023 season. Brazil exports around 250,000 tonnes of raw groundnut kernels and less than 10,000 tonnes of processed groundnuts per year.

São Paulo state hosts over 90% of the peanut production and has two annual peanut crops. Peanuts are mostly grown in rotation with sugar cane. In 2022, Brazil increased its exports to 293,000 tonnes, with the Russian Federation accounting for one third of purchases. The USDA expects Brazil’s 2023-2024 groundnut production to remain stable. Take a look at the latest estimates of groundnut production in Brazil from the USDA.

Brazil exported 70,000 tonnes of groundnuts to Europe in 2022, mostly destined for the Netherlands, followed by the UK, Spain and Poland. Brazil regularly participates in leading trade events in Europe thanks to strong support from the Brazilian Trade and Investment Promotion Agency (APEX). The peanut industry’s interests are represented by the Brazilian Association of Chocolate, Peanut and Candy Industries (ABICAB). ABICAB manages the Pró-Amendoim programme, which promotes the safety of groundnut products.

China, the leading groundnuts producer

China was the top producer of groundnuts in 2022-2023 with in-shell production reaching 18.3 million tonnes. Shandong is the key groundnut producing area followed by Henan, Hebei, Guangdong and Jiangsu provinces. There are many cultivars grown in China, but the cultivar most exported by China is called ‘Hsuji’. It has a round shape and red skin. Around half of the peanuts produced in China are used for crushing and the production of peanut oil.

The production of groundnuts in China is supported by the Shandong Peanut Research Institute, which has developed commercially grown cultivars. There are also several organisations that focus on improving groundnut production in China, including the Specialized Committee for Nuts and Roasted Seeds and the Oil Crops Research Institute.

In 2018, China exported 380,000 tonnes of groundnuts, including 46,000 tonnes to Europe. The largest share (42%) was exported to the Netherlands, followed by Spain, the UK and France. Chinese firms participate in leading European trade fairs with help from the Chamber of Commerce of Foodstuffs and Native Produce (CFNA). The USDA expects China’s 2023-2024 groundnut production to remain stable. Refer to the latest estimates of groundnut production in China from the USDA Foreign Agricultural Service for more information.

Nicaragua, emerging developing-country supplier

Nicaragua’s groundnut exports to Europe remained stable at around 38,000 tonnes per year, from 2018 to 2022. The United Kingdom is the main market for Nicaraguan groundnuts, but its imports fell from 27,000 tonnes in 2018 to 17,000 tonnes in 2022. In the same period, exports to the Netherlands tripled to 9,500 tonnes. Shelled groundnuts accounted for 99% of all exported quantities in 2022.

Nicaraguan groundnut (in-shell) production reached 193,000 tonnes in the 2022-2023 market year. Most groundnuts are produced in Chinandega and Leon. Peanuts are one of Nicaragua’s main export commodities. Less than 2% of the total groundnut production stays in the domestic market. Nicaraguans do not consume many peanuts or peanut oil, and African palm oil is consumed more than Nicaraguan oil.

Groundnuts compete with sugar cane for limited arable land along the West coast. This is an important constraint for significant production expansion. Nicaragua’s 2023-2024 groundnut production is expected to increase as worsening political conditions and economic instability improve the risk-reward calculations of peanuts compared to other crops. Consult the latest estimates of groundnut production in Nicaragua from the USDA Foreign Agricultural Service.

Egypt, in-shell supplier

Egypt exported 33,000 tonnes of groundnuts to Europe in 2022. More than 55% were exported to Italy (18,000 tonnes), followed by Germany at 10,000 tonnes. Two thirds of Egyptian exports are shelled groundnuts. Egypt’s 2023-2024 groundnut production is expected to remain stable. Consult the latest estimates of groundnut production in Egypt from the USDA Foreign Agricultural Service.

Tip:

- Keep an eye on annual groundnut supply and demand figures published by the Argentinian Peanut Chamber. This will help you spot opportunities or risks.

Which products are you competing with?

There are many peanut producing, processing and exporting firms and the most competitive ones are based in producer countries. Leading global players such as Olam International organise production in more than one country. Spain’s Importaco Group took over leading Italian supplier Besana in 2020, creating the largest European alliance in the nut sector. A quick overview of some leading companies per supplying country is given below.

Argentina

Argentinian groundnut production and export is characterised by the relatively small number of large processors. Some 13 companies account for more than 90% of peanut exports from this cluster with a strong dominance of companies based in Córdoba province.

Aceitera General Deheza (AGD) is a leading Argentinian groundnut firm. It is the largest exporter of edible peanuts worldwide and accounts for one quarter of the human consumption grade peanuts that Argentina exports. AGD is food safety and social compliance certified (BRC, SMETA and Ethical Trading Initiative).

AGD exports 60% of the total Argentinian export of peanut oil and produces confectionery grade and regular peanut butter. AGD organises its own production, but it also buys groundnuts from farmers. In the processing segment, AGD uses fully mechanised lines in its seven industrial sites and invests in sustainable production. The firm owns a 230-hectare forest, a biomass plant, relies on crop rotation and carefully manages water usage.

Other large companies include Maniagro (40,000 tonnes of annual exports of peanuts), Prodeman (140,000 tonnes of in-shell production), Olega (130,000 tonnes per year), Lorenzati Ruetsch y Cía (sells confectionery and blanched peanuts, peanut oil), Servicios Agropecuarios, Manisel, Insa Indelma and Cotagro.

The United States of America

Golden Peanut and Tree Nuts (a subsidiary of Archer Daniels Midland) is a major sheller and processor of peanuts with headquarters in Georgia. Golden’s primary product lines include raw shelled and in-shell peanuts, peanut flour, various peanut oils, pecans, and peanut seeds. Golden operates processing plants in the major growing areas of the United States, Argentina and South Africa and is a leading supplier of peanut products worldwide.

Other large USA companies include Premium Peanut (with the largest shelling capacity in the world), Hampton Farms (the leading roaster of in-shell peanuts in the United States), Birdsong Peanuts, Galdisa USA (peanut processor and ingredient supplier) and Andalucia Nuts.

China

Examples of leading exporters in China include Rizhao Golden Nut Group (with 40,000 tonnes of annual output), Rizhao Yatai Foodstuffs, Jilin City Changrong Agricultural & By Products Corporation, Qingdao Shengde Foods Foodlink, Shandong-based Junan HuiFeng Foodstuffs and peanut butter manufacturer Jixing Foods.

Companies from other supply destinations

Other groundnut suppliers to Europe include:

- Nicaragua – Comasa (80% of the supply) and Cukra Industrial (19%).

- Brazil – Coplana (raw, blanched, paste), Beatrice Peanuts, Jazam Peanuts, Santa Helena, Ostinato.

- Egypt – Green Valley (the leading peanut company in North Africa), Nutsland, Kernile.

Tips:

- Explore the competition. Check out the websites of Argentina’s leading groundnut producers and exporters from the Argentinian Peanut Chamber member list. Explore the list of leading US shellers, blanchers and ingredient suppliers, and brokers who export or assist with exports of US peanut products.

- Visit leading European trade fairs regularly to meet competitors and potential customers. Examples are ANUGA, SIAL or FI.

- Seek out potential trader partners in target markets in the International Nut & Dried Fruit Council (INC) membership list.

- Check out the annual raw and processed groundnut export data from Brazil’s ABICAB association.

Which products are you competing with?

The competitive landscape for groundnuts in the European market mainly comes from nuts and seeds. The most important substitutes include almonds, cashews, pistachios, walnuts, and sunflower and pumpkin seeds.

Almonds are perceived as being more upscale and are used in luxury confections and gourmet products. However, almonds are usually more expensive than groundnuts and price fluctuations are larger. Cashews, pistachios and walnuts are also nutritionally rich. They are also used in many forms, from baking to snacking. However, all these nuts tend to be more costly than peanuts. They are also under threat from climate change.

Seeds are a lower-cost alternative to groundnuts, with a different nutritional profile. They also have a different texture and flavour profile. Additionally, they lack the protein content that groundnuts have.

Groundnuts are unique in terms of taste, aroma and price point, and they are very popular. With recent inflation, peanuts have become an attractive replacement for other, more expensive nuts.

Tips:

- Read the CBI’s almonds study and CBI’s cashew study to understand the almonds and cashew industries and learn about promotional tools used by suppliers.

- Promote versatility and availability of your product. Groundnuts also have uses ranging from snacks, baking to confectionery. Showcase this to potential buyers.

4. What are the prices for groundnuts on the European market?

Depending on the country, retail chain and brand, prices of groundnuts sold to final consumers vary significantly across Europe. The prices of salty roasted peanuts are usually in the range of €5-10/kg, but this is very different from commonly imported raw kernels, which are processed after importing. Prices also differ depending on the type of imported product.

An overview of the range of peanut price movements between 2020 and 2023 in Europe is given below:

- Brazilian and Argentinean 40/50 runners, CFR NW Europe, ranged from €1,400/tonne in early 2020 to €1,660/tonne in May 2023

- Chinese Hsu-jis 40/50, CIF NW Europe, rose from €1,700/tonne in early 2020 to €2,100/tonne in August 2022, dropping back to €1,700/tonne in May 2023

- Chinese Virginia blanched 25/29, CIF NW Europe, moved from €1,500/tonne in early 2020 to €2,000/tonne in October 2022, dropping back to €1,770/tonne in May 2023

- UK import prices of groundnuts ranged from €1,200/tonne in early 2020 to €1,892/tonne in December 2022. There was a sudden sharp dip below €600/tonne in December 2020 and in August 2022.

In 2023, global peanut markets face a disappointing Argentinian crop and the civil war in Sudan. These two events are likely to raise prices. If the Sudanese conflict does not end soon, export prices for China might see new highs, which could influence the global market price. Long term, groundnut exporters should keep an eye on the Argentinian supply shortage to determine pricing trends.

A general average price breakdown for groundnuts in Europe should look like this:

Source: Autentika Global, 2023

Tips:

- Subscribe to S&P Global Commodity Insights, a respected market information service for food ingredients. The service provides timely updates on groundnut export prices.

- Monitor peanut prices in the US market with the help of free USDA weekly reports on US average peanut prices and sales. Take a look at the USDA’s free weekly data on peanut stocks and processed products.

- Follow the free monthly updates about global peanut supply and stock levels that influence prices. These updates are published in the USDA’s Oilseeds: World Markets and Trade report.

- Free and up-to-date data on peanut supply, use, export and pricing can be found in the Oil Crops Outlook.

- Look at the free peanut ticker price, which runs continuously on the Bohemia Nut company’s web page.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research