Exporting Peruvian table olives to Europe

A new Free Trade Agreement between Peru and the EU took effect in March 2013, leading to new opportunities and intensified collaboration between the regions.

Since April 2014 the Centre for the Promotion of Imports from Developing Countries (CBI) supports export development in Peru by running an integrated country programme. By focusing mainly on agricultural sectors CBI is not only able to improve working and living conditions of farmers involved in the production of these goods, but it will also develop and spread the image of Peru as a supplier of sustainable supply chains.

This tailored study about olives is part of CBI’s project for Natural Ingredients for Food, Cosmetics and Processed Foods and is made in partnership with CBI partner PromPeru. This study answers the main research question “What are the opportunities for Peruvian Olives on the European Market?” and sub-questions including:

- What makes Europe an interesting market and what are the requirements?

- Which trends, segments and channels offer opportunities for market entry for Peruvian olives?

- What makes Peruvian Olives (Green Sevillana/Green Ascolano & Peruvian Alfonso Olives) an interesting product to export?

Contents of this page

- Summary

- Product description

- What makes Europe an interesting market?

- What makes Peruvian Olives (Green Sevillana/Green Ascolano & Peruvian Alfonso Olives) an interesting product to export?

- Which segments offer opportunities for market entry for Peruvian olives?

- What trends offer opportunities? What trends pose a threat?

- What requirements must your product comply with?

- What tariffs apply when exporting to Europe?

- What competition do you face?

- Through what channels can you get your product on the market?

- What is the best way to market the Peruvian olive (Green Sevillana, Green Ascolano, and Peruvian Alfonso Olives) to the different channels?

- What are the end-market prices?

1. Summary

- Europe is a highly developed olive market with many buyers and suppliers, and a wide variety of olives and olive-based products. Despite the high degree of competition, buyers are always looking for new unique products which can answer to consumer needs for healthy natural products.

- France, Belgium, Romania and Germany are the most promising olive markets, as they are major consumption markets with a large need for imports.

- With the black Alfonso olives, Peruvian suppliers can offer a Unique Selling Proposition focused on: size, colour and a unique taste. These olives are meant for the premium market segment, possibly interesting for the snack segment when the firmness of the olives is improved, and certainly suitable as culinary ingredient.

- Specific areas for improvement of the Alfonso olives are the firmness and acidity. Earlier harvesting and changes in the process could address these weaknesses and improve the perceived quality of these olives.

- Greek producers of Kalamata olives and other Mediterranean producers of black olives are strong competitors for suppliers of black Alfonso olives. You can face this competition by offering unique products which are different from those of your competitors.

- Competition is even stronger in the market for green olives. Suppliers of Green Sevillana and Ascolano olives will compete with major European suppliers, such as Spanish producers of Manzanilla olives. Marketing of stuffed olives and development of tapenades, purees and marinades offer countless opportunities to create unique products, add value and depend less on direct competition on price.

- Both foodservice providers and retailers are suitable channels to distribute premium olives. In most cases, your best opportunity to supply these channels is through olive distributors and processors. They can help to promote the Unique Selling Proposition of your olives. You can meet many of these companies at trade fairs. They can also help test market receptivity for different olives, types of stuffing and marinades.

2. Product description

The olive fruit is a drupe (or stone fruit) from Olea europaea trees. Olives have a bitter component (oleuropein), a low sugar content (2.6-6%) compared with other drupes (12% or more) and a high oil content (12-30%) depending on the time of year and variety.

These characteristics make olives unsuitable to consume directly from the tree and they have to undergo a series of processes to make them edible. Processes differ considerably from region to region, and also depend on variety. The three main preparation methods are treated olives (Spanish-style), natural olives (Greek-style for black olives) and olives darkened by oxidation (California-style).

Treated olives, or Spanish-style olives, are treated with sodium hydroxide to reduce bitterness. The treatment generally lasts until the lye penetrates the pulp to a depth of two-thirds to three-fourths of the distance from the olive surface to the pit. After alkali treatment, the olives are washed. The washed olives are placed in a brine for lactic acid fermentation.

Natural table olives or Greek-style olives, such as the Peruvian black Alfonso olives, previously washed and graded, are submerged into NaCl solutions (6–10%) on which fermentation takes place. Different variables affect the process:

- the olive cultivar used

- the microbial species present over the fruit surface

- brine concentration

- processing temperature

- disinfection practices.

Debittering is achieved through the diffusion from fruit to brine of the bitter compound oleuropein and its enzymatic hydrolysis. The hydrolysis is carried out by microbial and endogenous enzymes.

Olives darkened by oxidation are green olives or olives turning colour that are preserved in brine, fermented or not, darkened by oxidation (to turn them into black olives) in an alkaline medium and preserved in hermetically sealed containers subjected to heat sterilisation.

The European olive market comprises many distinct olive products. The factors to categorise olive products:

Types of olives

- Green olives: Fruits harvested during the ripening period, prior to colouring and when they have reached normal size

- Olives turning colour: Fruits harvested before the stage of complete ripeness is attained, at colour change.

- Black olives: Fruits harvested when fully ripe or slightly before full ripeness is reached.

Varieties

There are many different varieties of olives, but some of the main table olive varieties sold on the European market include:

- Manzanilla: green firm olive, often stuffed, which has a widely accepted texture and taste

- Hojiblanca: green firm olive

- Gordal: green olive with its large size as its Unique Selling Proposition

- Ascolana: green olive

- Kalamata: medium-sized firm black natural olive

- Volos: black somewhat soft olive.

- Picholine: green olive

Preparation method

- Treated olives (Spanish-style also known as Seville-style)

- Natural olives (natural black olives are also known as Greek-style)

- Olives darkened by oxidation (California-style)

Preservation method

International trade in olives is registered by customs authorities, which use a Harmonised System (HS) to define and code products or product groups. The HS distinguishes between “olives prepared or preserved by vinegar or acetic acid” and “olives otherwise preserved”:

- Olives prepared or preserved with vinegar or acetic acid (HS code 20019065): these ambient olives are preserved with acids and are also referred to as ‘acidified olives’ in this study. They can be offered as plain olives or they can be marinated or stuffed to make them more interesting as snacks. Refer to the section on segments for more details.

- Olives preserved otherwise than by vinegar or acetic acid (HS code 200570) or ‘non-acidified olives’: these include ambient olives preserved by pasteurisation or through the use of additives, and chilled olives. Both ambient and chilled olives in this category can be offered as plain olives or they can be marinated or stuffed to make them more interesting as snacks. Refer to the section on segments for more details.

Pitting and cutting

Olives can be offered with the stone inside or as pitted olives from which the stone has been removed. Additionally, olives can be offered as whole olives or sliced into pieces. Olive tapenades (and olive purees) are pieces of olives possibly mixed with other vegetables, spices, herbs and vegetable oils. Consumers typically use tapenades as spreads for toast and bread. Note that the Harmonised System does not distinguish between these different olive products.

Packaging

Ambient olives are usually canned in tins, glass jars or plastic containers suitable for storage with other preserves. Chilled olives are usually packed in plastic containers ready to be put on the table.

- Sizes of retail consumer packaging range from 150 gr to 1 kg.

- Sizes of typical foodservice packaging range from 1 to 5 kg and the packaging often allows for easy handling (buckets or wide boxes instead of jars).

- In the industrial segment, sizes are usually even larger.

Peruvian olives

Peruvian table olive growers produce different olive varieties including Arauco, Alfonso, Ascolana, Gordal, Manzanilla and Sevillana. The latter is sometimes known as Criolla. The black olive harvest takes place between May to October.

This study focuses on opportunities for green olives, black olives and olive based snacks from developing countries. And within this scope, in particular on Peruvian Alfonso Olives and Peruvian green Sevillana/green Ascolano olives. The Sevillana and Ascolano olives are the main varieties grown in Peru and the Sevillana variety is considered the best variety for canning in Peru and the most popular variety on the domestic market.

Table 1: Summary of specifications for Peruvian Alfonso olives from physico-chemical and microbiological analysis of 6 samples

| Parameter | Value |

| Acidity | pH 3.4-3.6 |

| Salt content | 6.2-7.6% |

| Humidity | 64-73% |

| Texture | 1.42-1.83 kN/100 g |

| Colour | Purple to black |

| Sugar content | < 5 g/L |

| Fat content | mono unsaturated fats (50%), poly unsaturated fats (30%) and saturated fats (20%) |

| Lactic acid | 10.71 – 26.24 g/L |

| Acetic acid | 0.87 – 2.49 g/L |

| Ethanol | 0.94 – 5.15 g/L |

| Citric acid | 0.09 – 0.85 g/L |

| Oleuropein (main phenolic) | 36.33 – 313.22 mg/K |

| Size | 110 – 220 olives / kg (most olives in the range of 130-170 olives / kg) |

Source: Oleica, 2018

Table 2: Characteristics of green Sevillana and Ascolano olives

| Sevillana | Ascolano | |

| Colour | Green to pale green | Green |

| Texture | Relatively firm | n.a. |

| Acidity (Citric acid) | 0.74 gr /100gr | n.a. |

| Ph | 4.8 | n.a. |

| Reducing sugars | 4.8 gr /100gr | 5.0% |

| Humidity | 71.83% | 73.8% |

| Flesh to stone ratio | 6.0-7.5 | n.a. |

| Fibre | 1.81 gr /100gr | n.a. |

| Oleuropeina | 2.25 gr /100gr | n.a. |

| Size | 100 – 120 olives / kg | 100-180 olives / kg |

Source: Universidad Nacional Jorge Basadre Grohmann, 2012; Universidad Nacional De San Agustin De Arequipa, 2013; New Zealand Journal of Crop and Horticultural Science, 1996

Please refer to the section “What makes Peruvian Olives an interesting product to export?” for an analysis of the sensorial characteristics of black Alfonso olives and to Annex 1 for a detailed nutritional analysis and Annex 2 for a more detailed sensorial analysis.

3. What makes Europe an interesting market?

Mediterranean countries have the highest olive consumption levels

Europe accounts for 22% of global table olive consumption and European consumption amounted to 600 thousand tonnes in the season 2017/2018. According to consultancy IRI, green olives dominate the market. The consumption of olives in Europe has a long history, as olive trees are indigenous to the Mediterranean region of Europe which stretches from Portugal to Greece. The figure below shows that consumption of olives is still highest in the European countries along the Mediterranean coast where olives originated (Spain, France, Italy, Greece). In these countries, olives are an essential part of daily food consumption and particularly the ‘tapas’ dining culture. Tapas is the Spanish term for appetizers. Consumers in these countries eat olives in a large variety of settings (e.g. as appetizer before dinner and as a snack on-the-go) and in a wide variety of applications (e.g. many different types of marinades and combinations with other ingredients).

Per capita consumption of table olives in countries outside the Mediterranean region is much lower. During the past decade, however, a growing number of European consumers has discovered the health benefits of the Mediterranean diet. Consequently, olive consumption outside the Mediterranean region is increasing. Especially in North and West European countries, consumer buying power is relatively high and consumers are looking for new experiences, natural snacks and premium products. The growing interest in the Peruvian kitchen, as described in the section on trends below, can offer opportunities for Peruvian suppliers to target these Northwest European consumers. These consumers are interested to try new combinations of olives, stuffing and marinades inspired by Peruvian culinary traditions. In Southern Europe, consumers are more interested in keeping their own rich culinary traditions and buying (new) products from known brands. They are less open to products from new suppliers such as Peru.

Major applications of olives in the Mediterranean diet:

- Salads

- Pizza topping

- Appetizer

- Snack

- Cooking

Based on long-term historic data for the period 1990-2018, olive consumption in traditional South European markets such as Spain, Italy and Greece, is relatively stable or even declining. These are saturated markets which offer few opportunities for new suppliers from Peru. Germany is the main olive market outside the Mediterranean region and consumption in Germany showed considerable growth (16% annually) in the period 2013/2014 to 2017/2018. Growth in consumption in Germany, Belgium and several emerging olive markets in North and West Europe is mainly driven by increased interest in the healthy Mediterranean diet, as described in the trends section below.

Emerging olive markets in Europe, based on growth of consumption between 2013/2014 and 2017/2018, include:

- The Netherlands (+32% annually to 8.1 thousand tonnes in 2017/2018)

- Czech Republic (+25% annually to 5.3 thousand tonnes in 2017/2018)

- Latvia (+65% annually to 3.7 thousand tonnes in 2017/2018)

Based on historical data by the International Olive Council and the trends described in the next section, consumption of table olives is expected to remain relatively stable in the next 3 years.

Mediterranean countries produce more olives than the entire European consumption

European demand for olives is largely met by South European producers. In the season 2017-2018, Europe produced an estimated 875 thousand tonnes of olives. All of the production takes place in countries along the coast of the Mediterranean Sea with a strong concentration in Spain. Spain is known to supply a wide range of olives and olive based products and is especially known for its popular green olives of the Manzanilla, Hojiblanca and Gordal varieties. Greece is the second largest producer of olives and its production of black Kalamata olives is particularly relevant to Peruvian suppliers of Alfonso olives. Kalamata olives are the most widely known type of black olives in Europe.

In the production season 2018-2019, European production is expected to be relatively small due to bad weather conditions in the summer of 2018.

The South European producers control most of their domestic markets and also meet most of the demand in Northern Europe. In 2017, European suppliers accounted for 73% of total European imports of ambient table olives preserved otherwise than by vinegar or acetic acid, which amounted to 516 thousand tonnes / € 717 million.

France, Italy, Germany, Belgium and Romania and have the strongest need for imports to cover demand

The 7 main European importers of non-acidified olives (incl. pasteurised, preserved by additives and chilled olives), account for only 53% of total European imports. This shows that imports are not particularly concentrated and that many other European countries import significant quantities. These markets offer additional opportunities for Peruvian suppliers. Nonetheless, the biggest import markets are France, Italy and Germany. These are major consumption markets and produce less olives than their market needs. In the case of Germany, the olive market is even completely dependent on imports.

Despite the growing consumption in Germany, imports of ambient table olives preserved otherwise than by vinegar or acetic acid remain relatively stable. As shown in the figure below, the increase in demand is mostly met by imports of ambient acidified olives. This could offer opportunities for Peruvian suppliers of acidified table olives.

The United Kingdom (UK) is another major olive consumption market that is completely dependent on imports. Similar to Germany, imports of acidified olives are increasing at the cost of imports of olives otherwise preserved. When targeting these markets, Peruvian suppliers must focus on acidified olives to benefit from the growth in consumption.

In contrast to Germany and the UK, the other main importers of non-acidified olives all registered an increase in imports of these olives. Spain is one of the growing import markets. However, this needs to be put in perspective, because imports by Spain remain very small compared to their consumption. Spanish producers control this market and leave little to no room for Peruvian suppliers. Refer to the section on competition for a more detailed analysis.

The leading suppliers of non-acidified olives were Spain (44% of import volume) and Greece (18%). Spain’s supplies mainly comprise olives of the manzanilla and hojiblanca varieties.

France, Belgium, Romania and Germany have a high interest in imports from developing countries

Developing countries such as Morocco (15%), which mainly supplies non-acidified Picholine olives, Turkey (6%) and Egypt (4%) have a particularly big share (46 thousand tonnes) in imports by France. France is a major consumer of table olives and despite its Mediterranean climate produces relatively small amounts of olives. This makes the French olives relatively expensive and causes importers to source cheaper olives in Morocco and other countries. This makes France a promising export market for Peruvian suppliers despite its domestic production.

To some extent, the situation in the Italian market concerning domestic production and imports is similar to that in France. The difference is that Italy imports only small amounts from developing countries. Italy is most interested in olives from other traditional olive producing countries in Europe, such as Spain and Greece, and offers few opportunities for Peruvian suppliers.

More promising markets for Peru and other developing countries, besides France and Germany, include Belgium and Romania. These are not only considerable consumption markets, they also import relatively large amounts of olives from developing countries. Belgium is a Northwest European market where increasing interest in the Mediterranean diet drives olive consumption. In addition, interest in different ethnic culinary traditions, such as those from Peru, provides opportunities to enter this market.

Based on historic data, imports of olives are expected to remain relatively stable. However, the increase in import tariffs for Spanish black olives by the USA as a counter measure to alleged price dumping may cause a shift in trade flows. The higher tariffs of 35% make olives from the USA and other countries such as Morocco more price competitive and caused exports from Spain to drop from 5.5 thousand tonnes in August-September 2017 to 1.5 thousand tonnes in the same period in 2018. This may force the Spanish producers to look for other markets including European markets. This could lead to substitution of imports from other countries.

Tips:

- Focus your promotion efforts on France, Belgium, Romania and Germany, as these are among the most promising markets for Peruvian suppliers based on above trade statistics. They combine a large consumption with a strong need for imports and an interest in olives from developing countries.

- Offer olives that are distinct from the Spanish, Italian and Greek olives, as these are major suppliers to all European markets and will be strong competitors for you. Refer to the section on competition for more analysis of your competition in the European market.

4. What makes Peruvian Olives (Green Sevillana/Green Ascolano & Peruvian Alfonso Olives) an interesting product to export?

Sensorial analysis of Peruvian Alfonso olives

As part of this CBI study, Oleica, a reputable Spanish laboratory specialised in table olives, analysed 6 samples of black Peruvian Alfonso olives and a Greek Kalamata olive for comparison. A sensorial analysis was conducted together with two tasting panels:

- 10 professional tasting experts

- 103 consumers

Photos: Tasting by experts at Oleica’s laboratory

Source: Oleica, 2018

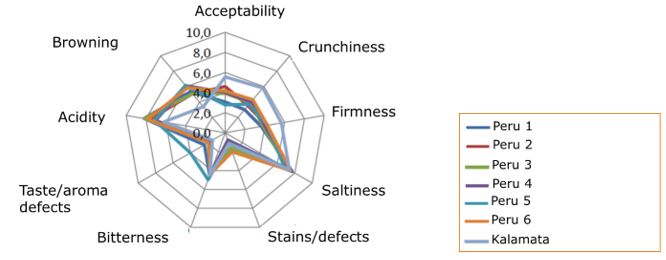

Expert panel identifies firmness, crunchiness and acidity as areas for improvement

The expert panel of Oleica found significant differences between samples for crunchiness, taste/aroma defects, firmness, acidity and acceptability of the product. However, compared to a Kalamata olive from Greece, the overall scores of the Peruvian olives were relatively low for crunchiness and firmness and relatively high for acidity. The low score on texture (1.39 – 1.83 kN /100 g) as measured by Oleica confirmed the findings of the expert panel. Additional areas for improvement are taste defects and browning. The expert panel considered bitterness, which is related to the oleuropein content, relatively low.

Figure 7: Scores by expert panel

Source: Oleica, 2018

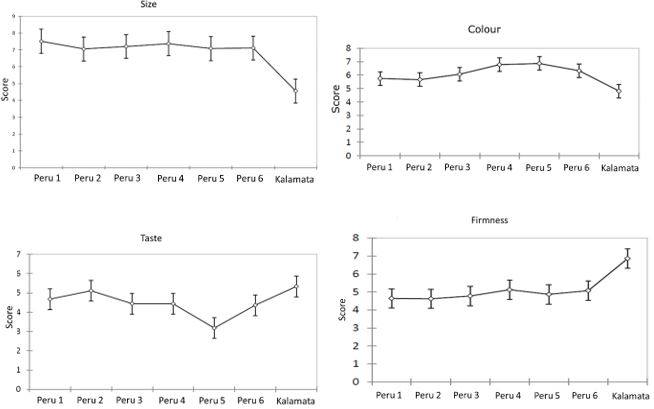

Consumer panel appreciates size and colour

The consumer panel of Oleica confirmed the low level of firmness of the Peruvian olives. These olives scored notably higher on colour and size.

Figure 8: Scores by consumer panel

Based on the analysis by Oleica’s tasting panels, the main attractive characteristics of Peruvian Alfonso olives:

- Big size

- Black to purple colour

As indicated by Oleica and confirmed by a group of olive experts, the appreciation of the taste is subjective and many of the Spanish and Portuguese consumers in the panel of Oleica were not used to eating black olives like the (Peruvian) Alfonso olives or the Kalamata olives. Between 32-39% of them would buy the Peruvian olives (samples 1-4 and 6). Many olives tested by Oleica’s panel score higher and the expert panel found some taste and aroma defects in the Peruvian olives. This means that the Peruvian Alfonso olives are not suitable for the masses. Nonetheless, these percentages on intention to buy and the scores on taste presented in above figure, show that the taste of the olives was appreciated by several consumers in the panel. There will be a niche for these olives.

Olive experts identify several interesting characteristics of Peruvian Alfonso olives

According to a group of olive experts, the big size of the olives are a major strength of the Peruvian Alfonso olives. In Europe, Kalamata olives are the usual benchmark for size and the Peruvian olives are relatively big in comparison to Kalamata olives. Many consumers perceive big olives as premium products. Moreover, the colour of the olives is original and special. The combination of the size and colour make the visual appearance very attractive to a large group of consumers.

The lack of firmness and crunchiness (i.e. bite) makes the olives less suitable for consumption as appetizers and snacks. Moreover, Alfonso olives are difficult to pit due to its large size and curved pit, which can cause many losses and breaks. The softness in combination with their big size also makes the Peruvian Alfonso olives less suitable for marinades, as they can break more easily than smaller-sized olives. Nonetheless, there are interesting references on the market for soft olives which are appreciated by consumers. Volos olives are a good example.

There is a potential to develop many different recipes with the Peruvian olives. Cooking the olives with rice, mayonnaise dishes, octopus, etc. are an interesting application. The unique flavour can combine very well with other ingredients and the softness of the olives is not problematic for this use.

The unique taste of Peruvian Alfonso olives is a strength when selling them to consumers which can appreciate the unique taste.

Main characteristics of green Sevillana and Ascolano olives

Green Sevillana olives have the longest history of production in Peru and have become the main olive variety on the domestic market.

The Sevillana olives are very similar to Manzanilla olives from Spain, which are known for their bright green colour, average to large size, high firmness, high flesh to stone ratio, and the relative ease of detaching the flesh from the stone. Compared to Gordal olives from Spain, the Sevillana variety is smaller. Other characteristics of the Gordal variety are the high flesh to stone ratio and that the flesh is somewhat difficult to separate from the stone.

The Ascolano olives are slightly smaller than the Sevillana olives and their skin is more delicate and wrinkled. The flesh is relatively easy to detach from the stone. The olives have a relatively mild taste and their flavour is described as fruity, spicy, nutty and sweet.

Tips:

- To improve firmness and darkening of the Alfonso olives, improvements for the elaboration of Peruvian olives must be focused on harvesting the olive less mature (earlier in the season) and using CaCl2 and air purging, respectively.

- For ambient olives, subsequent application of a heat treatment (pasteurization) will guarantee a better stability of packed olives, which is necessary to export to places far from the production area. Pasteurization will prevent re-fermentation in the final packed product and thus enable reduction of salt and acidity levels.

- Use acetic acid instead of lactic acid to obtain a quality more similar to European natural black olives.

- Experiment with different yeasts, fermentation processes (e.g. change of water, rotations) and salt content to improve the firmness and taste. Do not adapt the olives too much to other olives on the European market and preserve the unique identity of the product.

5. Which segments offer opportunities for market entry for Peruvian olives?

The statistical analysis above revealed that France, Belgium, Romania and Germany are the most promising markets, as they are major consumption markets with a large need for imports. In this section, the market is segmented by country, sales channel, preservation method and production method to identify promising segments within these countries.

Segmentation by country

In the Mediterranean region including France, consumers are much more accustomed to eating olives than in the rest of Europe. This causes differences in consumer preferences between these regions. In the Mediterranean, the consumption of olives is much more widespread and the average consumers knows a lot more about olives than in the rest of Europe. This translates into different consumer preferences. For example, in the Mediterranean region, many consumers like olives with stones, as the stone improves the flavour. In comparison, consumers in other regions prefer pitted olives, as they find this more convenient to eat and the loss of flavour is not perceived as a major loss of quality by many consumers shopping at large retail chains.

Consumers in different European countries also have different preferences for flavours and ingredients. While there are many possibilities for flavouring and stuffing of olives, certain combinations of olives, flavourings and types of stuffing work better in some countries than others.

Table 3: Common types of stuffing by country

| Spain | France | Germany | Netherlands | Europe general |

| Anchovy and pepper | Different kinds of pepper (e.g. chili, green Jalapeño, bell-pepper), garlic, anchovy | Different kinds of pepper, garlic, almond | Almond, chili pepper, cheese | Anchovy, bell-pepper, almond |

Next to the above types of stuffing, some suppliers offer olives stuffed with lemon, cheese, salmon, orange. Specific combinations of olive varieties, stuffing and marinades are associated with certain origins. Some examples of typical country styles:

- Spanish style: Green Manzanilla olives stuffed with chili peppers

- Greek style: Black Kalamata olives stuffed with feta cheese

- Moroccon style: Picholine olives with lemon and fennel.

Peru has an excellent opportunity to introduce its own country style based on a combination of typical Peruvian flavours ranging from local peppers, artichoke, ancient grains and pulses, to even more exotic flavours. Although stuffing and marinating offers opportunities for both black and green olives, Peruvian suppliers of the soft black Alfonso olives may experience difficulties with breaking of these olives during pitting, stuffing and/or marinating. Green, less mature olives are usually more suitable. Food safety and quality certification is another area of attention for this segment, due to increased food safety risks in processing.

This opportunity on stuffing and marinating olives is relevant for all sales channels, except the industrial users, all preservation methods and all production systems.

Segmentation by sales channel

| Sales channel | Main characteristics |

| Foodservice | Foodservice providers supply olives to hotels, restaurants and bars

|

| Supermarkets | Supermarkets are large retailers offering a wide product range and are often part of a retail chain with a central purchasing organisation

|

| Small shops | Small shops include delicatessen, gourmet shops and farmers markets and offer a narrow assortment compared to the supermarkets

|

| Industrial users | Industrial users are food manufacturers which use olives as ingredients

|

Foodservice segment

The foodservice segment offers much room for premium products. Food service in this case refers to bars, hotels and restaurants where consumers are often interested to try premium products and eat something that they would not make at home. Peruvian black Alfonso olives are unique products in terms of size, colour and taste. They are different from other olives on the European market and can be positioned as a premium olive. Based on the characteristics of the Peruvian black Alfonso olive, Mediterranean dishes and also dips, salads and other gourmet foods are particularly suitable foodservice applications.

Compared to the retail segment, foodservice providers need bigger packaging sizes (usually between 1-5 kg gross weight) and packaging which allows for easy handling (buckets or wide boxes instead of jars).

Small shops segment

The European food retail landscape comprises many small retailers including farmers markets, delicatessen stores and gourmet shops. Especially the delicatessen stores need unique premium products in addition to widely available products such as South European (green) olives. Consumers visit these markets and shops to discover products with a special flavour, such as the black Alfonso olive and will be interested to find out how they can use these Peruvian olives in their cooking. Particularly South European consumers visiting these markets and shops are more knowledgeable about olives and more appreciative of a unique taste (including the stone) than the average consumer shopping at large retail chains. This also explains why price is a less important criterion than in the large retail chains.

Supermarket segment

In Northern Europe, large retails chains dominate the food retail landscape. Especially in the UK and Scandinavian countries, most consumers shop for olives in supermarkets. Some of these supermarkets such as Waitrose in the UK (~14% olive market share) have a large olive category consisting of both mass market products with low prices (€ 1.05) and special products at relatively high prices (€ 4.73). Although many consumers who shop at these supermarkets have little understanding of the differences between olives, some of them prefer to buy the more expensive olives when they want to be sure that they buy a good quality. They perceive the high price as an indication of quality.

Industrial users

Industrial users offer interesting opportunities for Peruvian suppliers of pieces and purees from green Sevillana and Ascolana olives, and black Alfonso olives. Within the industrial segment, manufacturers of tapenades and sauces offer particularly relevant opportunities. Similar to the market for snacks, the market for side dishes and sauces such as tapenades and olive-flavoured dip sauces is under strong influence by the health trend. Increased interest in healthy products and the popularization of the Mediterranean diet drive demand for tapenades.

Tapenades and sauces can contain a wide variety of ingredients and come in different price levels. However, most tapenades are based on cheap olives. As they contain only pieces of olives, the original size, shape and colour do not matter. This offers opportunities to market olives which are not suitable to be sold as whole olives. Olives which score only very few points on the classification index of the IOC, because they are damaged, can still be chopped to serve as ingredients for tapenades or sauces. As the big size and good colours are the main USP of black Alfonso olives, only the inferior qualities of these olives should be chopped for this segment.

The supply of ready-made tapenades and sauces to other sales channels offers additional opportunities. Much like stuffing and marinating of whole olives, tapenades and sauces offer many opportunities to create uniquely Peruvian products and add value. As such products are new to the market, you will have to educate consumers and wholesale buyers to convince them to buy such products.

Segmentation by preservation method

Chilled olives, as opposed to ambient olives, are one of the fastest growing segments of the entire olive market. Chilled olives are not pasteurised and perceived as fresh products by the consumer. Fresh products are perceived as healthier products than preserved products and can benefit from increased demand for healthy products as described in the section on trends below. Chilled olives are particularly interesting as snack olives.

Most consumers prefer (big) firm olives for snacks instead of (small) soft olives. While the European market certainly has niches for soft snack olives such as the Alfonso olives tested by the laboratory Oleica and Volos olives, most opportunities are in the market for firm snack olives. This implies that Peruvian suppliers of Alfonso olives must carefully select firmer olives or improve their harvesting and processing to achieve more firmness. This can open up a much larger market for the Alfonso olives.

Within the market for (chilled) snack olives, stuffing and marinating offer ample of opportunities to diversify products and add ‘premiumness’ to the olives. Refer to the paragraph on stuffing and marinating above for more details.

Segmentation by production system

The European food market consists of conventional foods and organic foods. Organic foods are produced using organic farming methods as laid down in Regulation 834/2007 (to be replaced by Regulation 848/2018 in 2021). The European market for organic foods is growing fast (around 10% annually) and the value of the European organic market was valued at € 30.7 billion in 2016, comprising 37% of the global market.

The supply of organic olives will increase in the next few years and is likely to outpace the increase in demand for organic olives. This poses a risk to the stability of the organic olives market and can eliminate the price premium for organic olives compared to conventional olives. Currently, 24% of the total olive growing area is in conversion to organic farming. The organic olive area will be added to the existing organic olive growing area which already accounts for 7% of the total olive growing area (FiBL, 2018).

Tips:

- Invest in degustation (tasting of olives by buyers or promoters) to promote the unique characteristics of your product and position it as a premium product. Refer to the section “Promotion” at the end of this study for more information.

- Review the range of products offered by a supplier in the target country to quickly identify the successful types of stuffing and/or marinades in that country. For example, the German importer Feinkost Dittmann offers green olives with the following types of stuffing: pepper paste, almond and piri piri.

- Experiment with small batches of different types of stuffing and marinades for your specific olives. Trade fairs offer a suitable platform to test market receptivity and identify successful combinations.

- Only invest in organic production when you aim to position your product as a natural and organic product as described in the next section on trends.

- Team up with a European partner /distributor to optimise your product for the different European markets. Refer to the section on channels and promotion at the end of this study for more details.

- Work on national standards and promotional campaigns for olives from Peru.

- Pitting of the Peruvian Alfonso olives is most feasible when the firmness of the olives is improved in comparison to the olive samples analysed by the laboratory Oleica. The olives must remain in one piece after pitting.

6. What trends offer opportunities? What trends pose a threat?

More demand for natural and organic foods

Demand for natural foods is one of the biggest trends in the European food market. Although Europe has not established a legal definition of the term ‘natural’, research has shown that consumers perceive natural as follows:

- The origin of the raw materials is natural. This means that they are not made from Genetically Modified Organisms (GMOs) and preferably produced with organic farming methods or at least a minimum amount of pesticides.

- The product preferably contains no additives such as colours, flavours and preservatives.

- Processing is as minimal as possible and should maintain the integrity of the raw material.

Demand for natural products offers interesting opportunities for Peruvian suppliers of natural black and green olives. In Peru, the natural processing method (Greek-style) is most common, while many European competitors supply Spanish-style olives. To produce Spanish-style olives, producers use an alkaline solution (lye) to remove the oleuropein. Consumers consider this method less natural.

Healthy Mediterranean diet

Healthy living is one of the most important trends in Europe. Consumers are increasingly aware that different lifestyles including diets have a different impact on their health. This has led to increasing interest in the Mediterranean diet, which is perceived as a healthy diet. Many consumers associate olives with the healthy Mediterranean diet.

Other health related trends include superfoods, raw foods, vegan products, healthy snacks, functional foods and products that are free of specific allergens such as gluten. The olive market benefits from several of these trends such as the healthy snacks and vegan trend. Olives are widely offered as snacks and appetizers and are perceived as much healthier than many other snacks such as cookies and potato chips. The high content of polyphenols in Alfonso olives may serve as a sales argument when positioning these olives as healthy foods. Minimally processed olives such as non-pasteurised olives can also fit within the raw foods category.

Unhealthy food ingredients such as salt, sugar and synthetic additives, are increasingly being removed or replaced by natural ingredients. Consumers want to know exactly what they eat. They expect clear labels on the products that they buy, indicating the exact ingredients and preferably with as little additives such as preservatives as possible.

Growing interest in authentic Peruvian foods

Currently, few European consumers know the Peruvian kitchen. However, this is changing, as consumers are becoming more interested in new ethnic foods and particularly authentic Peruvian foods. This culinary trend has been spurred by the popularisation of several Andean superfoods such as quinoa, chia and maca. These products have received extensive media attention (examples: FoodNavigator; BCC; Wall Street Journal) and put Peru in the spotlight as a major origin of healthy foods. Other Peruvian products have benefited from this focus on Peru.

Although olives may not be perceived as typically Peruvian products, the creation of Peruvian-style olives using other ingredients such as chilis or artichoke for stuffing and marinating allows you to benefit from the increased interest in the Peruvian kitchen.

Negative consumer perception of canned vegetables

Olive consumption in Europe is threatened by a decline in consumption of both canned and frozen vegetables, in particular, among younger individuals (< 30 years). This decline is largely caused by a negative perception of how healthy canned vegetables are. Especially studies that showed a high average amount of salt and sugars in canned vegetables have had a negative influence on consumer perception. The canning industry implemented new technology to reduce salt and sugar, but has not been able to significantly change this consumer perception.

The decline of the European canning industry illustrates the decline in consumption of canned vegetables. Between 2006 and 2016, production of canned vegetables including olives decreased by 6% annually to 2.1 million tonnes.

Table 4: Development in production of European canning industry, 2006-2016

| Country | Change in % |

| Belgium, Netherlands, UK, Germany | -4.9 |

| France | -6.3 |

| Spain, Portugal | -2.3 |

| Italy | -1.0 |

Source: PROFEL, 2018

The decline of the European canning industry offers only few opportunities for Peru. The European market is not looking for substitution of canning activities by companies in other countries. Instead, the market needs different packaging solutions which match consumer expectations of healthy products. Especially chilled (snack) olives can meet these changing consumer expectations. These olives are usually packed in plastic containers, which is difficult to recycle. This shows that consumers are mostly concerned about the negative effect of preservation on health aspects and less about the negative effects of packaging on the environment.

Reducing food waste to improve sustainability

Despite the negative consumer perception about the healthiness of canned foods as described above, canned foods including olives offer several benefits related to aspects other than health. More specifically, canned foods offer three solutions to improve sustainability of the food market:

- Canning of olives reduces losses at wholesale level by matching olive processing schedules with daily canning capacity. In comparison, the market for chilled olives can only take up processed olives based on actual demand. This often implies losses at wholesale level, as not all of the chilled olives can be sold.

- Use of misshapen and over- or undersized olives for slices, tapenades and other olive-based products.

- Longer shelf-life reduces losses at retail and consumer level.

With the interest from consumers in solutions for more sustainable food markets, the canning industry has an opportunity to promote above solutions and benefit from consumer demand for sustainable products.

Sustainable production

Consumers in Europe are increasingly concerned about the sustainability of production systems. Olive production raises particular concerns about the use of chemicals. The international olive sector addresses these concerns in the International Agreement on Olive Oil and Table Olives (2015). According to Article 24 on Environmental and ecological aspects: “Members shall give due consideration to the improvement of practices at all stages of olive and olive oil production in order to guarantee the development of sustainable olive growing and undertake to implement such action as may be deemed necessary by the Council of Members to improve or solve any problems encountered in this sphere.”

As shown in the section below on market requirements, excessive pesticide use is a common problem in olive production. The pesticide residues are not only a food safety issue, the pesticides also pollute the environment. In the Mediterranean area, many producers apply Integrated Pest Management or similar solutions to reduce chemicals use to a minimum. Production on a significant part of the olive growing area in Europe (0.5 million hectares) even complies with organic farming methods. The use of chemicals is highly restricted in organic farming.

Tips:

- Read detailed information by the European Union on how to register a product for a Geographic Indication.

- See our study about trends on the European market for processed fruits and vegetables for more information.

7. What requirements must your product comply with?

The European Rapid Alert System for Food and Feed (RASFF) database provides a list of cases in which olives and olive-based products did not comply with legal requirements of the European Union. The following table shows that excessive use of pesticides is the most common issue with olives.

Table 5 RASFF listings for olives

| Non-compliance issue | No. of times listed |

| Chlorpyrifos (pesticide) exceeding Maximum Residue Level (MRL) | 18 |

| Fenitrothion (pesticide) exceeding MRL | 6 |

| Botulinum toxin (from Clostridium Botulinum bacteria) detected | 5 |

| Diazinon (pesticide) exceeding MRL | 3 |

| Lead and tin (heavy metals) exceeding permitted level | 3 |

| Listeria monocytogenes (pathogenic bacteria) | 2 |

| Profenofos (pesticide) exceeding MRL | 1 |

| Phenthoate (pesticide) exceeding MRL | 1 |

| Methoxyfenozide (pesticide) exceeding MRL | 1 |

| Benzoic acid (food additive) exceeding permitted level | 1 |

| Erucic acid (food additive) exceeding permitted level | 1 |

| Sulphite (food additive) exceeding permitted level | 1 |

| Undeclared sulphite (food additive) | 1 |

| Unauthorised colour Sudan 1 | 1 |

| Too low acidity | 1 |

Another common compliance issue for olive imports into the European Union is the breaking of glass jars. Glass fragments in olives in glass jars have been reported 9 times in the past 10 years. Due to breaking of containers (e.g. glass) during transport, European customs registered 4 times that they found spoiled olives (moulded, infested).

To prevent border rejections or product recalls due to food safety issues, you must comply with the strict requirements for olives of the European Union. You will only be able to successfully market your product in Europe when you comply with food safety requirements and other requirements. See our study on buyer requirements for processed fruits and vegetables for a detailed analysis of these requirements. They deal with the following relevant topics:

- Food safety: Official border control for food imported to the European Union

- Food Safety Certification as a basis for entering the European market

- Corporate Social Responsibility

- Fulfilling requirements for organic products present opportunities for growing organic market segment

- Ethnic, niche markets certification

Food additives

In addition to the above requirements, the use of food additives deserves particular attention, as shown by the RASFF listings for olives in the table above. The European Union strictly regulates which substances are permitted in foods to ensure safety of those foods for consumers. Regulation 1333/2008 sets rules for the use of additives (e.g. preservatives such as sulphites). Refer to Annex II, part E, categories 0 (all foods) and 4.2.2 (Fruit and vegetables in vinegar, oil, or brine) and 4.2.3 (Canned or bottled fruit and vegetables) for conditions of use for these food additives. European custom authorities will not allow food products on the market if they contain:

- Undeclared substances (i.e. adulterants)

- Additives which are not permitted in the European Union

- Excessive amounts of additives above the permitted level. For example, the maximum permitted level for sorbic acid and potassium sorbate combined is 1,000 mg/kg.

Quality requirements

The IOC developed the internationally recognised trade standard applying to table olives. You must know this trade standard to determine if your product will be acceptable to the European market or if you will need to improve certain processes. The standard covers:

- Description (e.g. definitions)

- Essential composition and quality factors (e.g. maximum pH limit for each processing method)

- Food additives and processing aids (e.g. maximum levels of certain preservatives)

- Contaminants (as laid down by Codex Alimentarius)

- Hygiene (e.g. recommendations on hygiene practices)

- Containers

- Filling (e.g. net drained weight tolerances)

- Labelling and Point-Of-Sale displays (e.g. declarations on labels)

- Methods of analysis and sampling (as laid down by Codex Alimentarius)

Subject to defects and tolerances as mentioned in this standard, table olives are classified in one of the following three trade categories:

- “Extra” or “Fancy”

- “First”, “1st”, “Choice” or “Select”

- “Second”, 2nd” or “Standard”

Out of the 6 Peruvian samples tested by Oleica, 2 samples were classified as “Extra” and 1 sample was classified as “First”. The other 3 samples scored less points than required for the “Second” class. The major intolerance identified was abnormal texture (wrinkled). These test results show that the industry standard in Peru for sorting and grading is not very high. This may be caused by various factors, such as the lack of an industry standard, the lack of a Code of Practice or the lack of enforcement of an industry standard.

Contaminants

The IOC established some specific industry standards concerning microbiological activity. The olives and brine shall be devoid of any microbiological deterioration caused in particular by putrid, butyric or “zapatera” fermentation. Moreover, fermented olives held in bulk in a covering liquid may contain microorganisms used for fermentation, notably lactic bacteria and yeasts. The number of such microorganisms (lactic bacteria and/or yeasts) in a selective culture medium may, for each one, be up to 109 colony-forming units/ml of brine or per gramme of flesh depending on the level of fermentation.

Refer to our study on buyer requirements for processed fruits and vegetables for detailed information on limited use of pesticides, absence of mycotoxins, limited amount of heavy metals in food, reducing the risk of microbiological contaminants, absence of foreign matters, and product composition requests.

Packaging requirements

Specifically, the IOC industry standard prescribes that olives and packing medium should occupy not less than 90% of the water capacity of the container. Moreover, the IOC standard lays down tolerances concerning the net drained weight. These shall not exceed the following percentage scale

- 5% for containers with drained weight less than 200 grammes;

- 4% for containers with drained weight between 200 and 500 grammes;

- 3% for containers with drained weight between 500 and 1,500 grammes;

- 2% for containers with net drained weight in excess of 1,500 grammes.

Refer to our study on buyer requirements for processed fruits and vegetables for detailed information on general packaging requirements.

Labelling requirements

Specifically, the IOC industry standard prescribes that labels for olives include information on the type of olives (e.g. “Black”), trade preparation (e.g. “Natural”), style (e.g. “olives stuffed with anchovy”) and size. Refer to our study on buyer requirements for processed fruits and vegetables for detailed information on general labelling requirements.

Tips:

- Use the quality management guide for the table olive industry of the IOC to comply with quality requirements in the European Union.

- When you purchase olives from other farmers or from members of your organisation, require olive farmers to declare treatment with chemicals (e.g. pesticides) and analyse for residues. Reject lots of olives with residues exceeding MRLs.

- Apply the General Principles of Food Hygiene with the Code of Hygienic Practice for Low-Acid and Acidified Low-Acid Canned Foods to ensure compliance with hygiene requirements.

- For olives preserved by heat sterilisation, apply a processing treatment sufficient both in time and temperature to destroy spores of Clostridium botulinum.

- See the website of the European Commission for additional information on food labelling legislation. This requirement only applies to final products that are sold directly to consumers.

- Consult the Trade Helpdesk for a full list of requirements.

8. What tariffs apply when exporting to Europe?

In 2013, a new Free Trade Agreement between Peru and the European Union took effect. The agreement established a 0% import tariff for table olives and olive based snacks.

9. What competition do you face?

Competition for olives in general

Table 6: Competitors in main markets for Peruvian exporters of table olives (shares in imports in %)

| France | Italy | Germany | Belgium | Romania | United Kingdom |

| Morocco (52%) | Spain (59%) | Spain (53%) | Morocco (46%) | Greece (41%) | Spain (45%) |

| Spain (40%) | Greece (28%) | Greece (21%) | Greece (29%) | Turkey (25%) | Greece (23%) |

| Egypt (2%) | Morocco (7%) | Turkey (11%) | Turkey (11%) | Egypt (25%) | Morocco (17%) |

| Belgium (2%) | Egypt (3%) | Morocco (4%) | Spain (8%) | Spain (3%) | Turkey (5%) |

| Greece (2%) | Italy (4%) | Netherlands (2%) | Italy (2%) | Italy (5%) |

Spain is the leading supplier to European markets. Spain produces large volumes, benefits from economies of scale and is able to offer competitive prices. Implementation of a national strategy based on strong cooperation between exporters and their associations contributes to a favourable business environment in which Spanish companies operate. The Seville olives / Spanish-style pickled green olives from the Manzanilla variety are the mostly widely known olives in Europe.

Greek supplies of olives increased by 5.7% annually between 2013 and 2017. This rapid increase was caused by the economic recession. The domestic market shrank and olive producers were forced to expand their business to international markets.

Although the traditional suppliers of olives provide strong competition for Peruvian exporters, several European buyers indicate that they continue to look for new emerging suppliers such as Peru. The market always offers room for a unique product.

Direct competition for Peruvian black Alfonso olives

In the market for premium black olives and especially big olives, such as the Peruvian Alfonso olive, Greece is a particularly relevant competitor. Spain and Italy offer few big olives while Greece offers big Kalamata olives and other premium olives. Agrovim and Lelia are examples of leading Greek olive exporters. In Europe, particularly in France, ‘Greek-style olives’ are very popular. However, these olives are not necessarily from Greece. In 2017, Greece only accounted for 1.7% of total olive imports by France. High average import prices of Greek olives (€ 2.84 /kg), compared to average import prices of only € 1.43 /kg (all origins) caused olive companies on the French market to develop ‘Greek-style olives’ with olives from cheaper origins.

Direct competition for Peruvian green Sevillana and Ascolana olives

The green Sevillana olives are similar to Manzanilla olives. Manzanilla olives are some of the most widely available olives in Europe. Spain dominates this market. Companies such as Agro Sevilla, Angel Camacho and DCOOP are leaders in this market. Direct competition with these established companies will be extremely difficult for Peruvian suppliers. Spain produces large volumes of these olives, can benefit from economies of scale and is able to offer competitive prices.

The Ascolana olives are already supplied to Europe by Italy. The Ascolana variety is one out of many varieties supplied by Italy where production is more fragmented and smaller scale than in Spain. Based on data from the Italian research Institute CRN-ISPA, Ascolana olive production is limited to the regions of Marche and Abruzzo, which are minor olive growing regions in Italy. This implies that Ascolana olive production is much smaller than Manzanilla olive production. In that respect, suppliers of Ascolana olives may be less susceptible to price competition than suppliers of Manzanilla and Sevillana olives. In fact, the ‘Oliva Ascolana del Piceno’ is a Protected Denominaton of Origin (PDO) from Italy.

Country images

Few European buyers are familiar with Peruvian olives and they do not know what to expect from Peruvian suppliers.

Table 7: Comparison of country images

| Peru | Greece | Spain | Morocco | Turkey | |

| Prices | Unknown | High prices | Low prices | Low prices | Medium prices |

| Quality | Unknown | High quality | Good price-quality ratio | Low quality | Low quality |

| Preparation method | Unknown | Greek-style olives | Spanish-style olives | Lack of recognised authentic processing methods | Natural (black) olives |

| Geographical Indications | Unknown | Recognition of GIs such as Kalamata | Some specific olives from certain regions | No Geographical Indications | Only 1 Geographical Indication |

| Product range | Unknown | Not strong in olive based products | Strong in olive based products | Not strong in olive based products | Unknown |

| Culinary tradition | Less familiar diet, but origin of superfoods | Healthy Mediterranean diet | Healthy Mediterranean diet | Less familiar diet | Less familiar diet |

Some buyers indicate that they would expect Peru to offer low prices. They perceive Peru as a developing country with low labour costs and expect this to translate into lower total costs and lower prices.

The lack of a reputation and market share for olives can actually offer opportunities. It allows the Peruvian olive sector to shape the country image to their own benefit, building on the strong position the country has in fine foods. This requires a joint effort by the entire sector. A country strategy can help the sector to prioritise certain market segments and prevent development of a negative country image as a result of the actions of individual companies.

Geographic Indications

Greek olives such as Kalamata and Amphissa olives are generally more expensive than olives from other countries. This forces Greek suppliers to focus on the market for premium olives where price is a less important purchasing criterion. Certification of a Protected Denomination of Origin (PDO) is one of the value additions applied by Greek producers. Greece currently has the largest number (10) of Geographical Indications for olives of all countries.

The example above shows the potential value of Geographical Indications for the protection of a country or region brand. Spain, another major competitor in the premium segment registered 3 Geographical Indications in the past 5 years to protect their region brands. Spain’s main varieties for black olive production are Hojiblanca and Cacereña. Currently, below Geographical Indications are registered for table olives (those registered in the past 5 years are underlined).

Table 8: Registered Geographical Indication by country

| France | Greece | Italy | Portugal | Spain | Turkey |

|

|

|

|

|

|

Tips:

- To establish Peru as a supplier of high quality olives, Pro Olivo needs to standardize the product and create a reference to producers (e.g. preparation with basic extracts of bacteria). From this reference standard, companies can apply specific changes and develop their own product ranges.

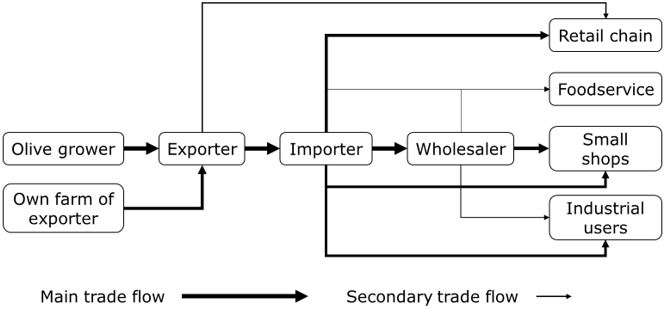

10. Through what channels can you get your product on the market?

The following figure presents the different market channels to the retail segments in the European market.

Figure 9: Market channels

Most olives pass through a relatively long chain of actors including importers and wholesalers. Only large retail chains source most of their olives directly from importers or even exporters.

In almost all channels importers play an essential role. The knowledge of importers about the needs of European retailers is of high value to many exporters and particularly for exporters which are located far away from the market such as Peruvian exporters. Importers know if their buyers want green or black olives, pitted olives or olives with a stone, stuffed olives or not, marinades with garlic, chili, thyme or other herbs or spices. They can develop concepts based on the needs of buyers and the qualities of the olives available to them.

Channel for olives to retail chains

Many retail chains offer a wide range of olives. They manage their olive category based on sales and marketing analyses (consumption and buying behaviour of consumers including frequency of purchasing and spending). This results in different categories for each retail chain. For example, Waitrose in the UK has a much wider and more diverse range of olives than Tesco. Tesco focuses on everyday products at low prices for the average consumers while Waitrose focuses on consumers which have more money to spend and are more interested in unique products.

Table 9: Major supermarkets in most promising markets

| France | Belgium | Romania | Germany | |

| Higher end | Carrefour, Intermarche, Auchan, E Leclerc | Colruyt, Delhaize, Carrefour | Profi, Mega Image, Auchan, Carrefour | Edeka, REWE |

| Lower end | Lidl, Casino, Leader Price, Super U | Aldi, Lidl | Lidl, Penny | Aldi, Lidl |

Supermarkets focusing on the lower end segment for price conscious consumers only offer a narrow range of products comprising the most popular olives. These could include green pitted olives of the Manzanilla variety or similar varieties such as the Peruvian Sevillana variety. Supermarkets focusing on the higher end segment for affluent consumers usually have a wider range of products including more unique olives such as the black Alfonso olives. In 2017, Waitrose offered Peruvian Alfonso olives as “a connoisseur olive, plump, soft and juicy, with a distinctively rich, fruity flavour”. Waitrose provided a description of the olives with tips on how to combine them with other foods and drinks: “Grown in the Peruvian farmlands of Tacna. These distinctively flavoured olives are a great accompaniment to a new world red such as a Chilean Shiraz or Colston Bassett Stilton cheese - a rich and spicy blue with a tangy finish”.

Large retail chains need relatively large volumes and do not need the bulk-breaking function of wholesalers. For example, an average Dutch supermarket sells around 26 units per premium type (e.g. Kalamata) of ambient (i.e. preserved) olives annually. This means that the purchasing organisation of a retail chain of 875 supermarkets (Albert Heijn in the Netherlands) would need 22,750 units annually.

Instead of buying from wholesalers, large retail chains source their products from importers or even directly from exporters. In many cases, retail chains collaborate with importers to develop their olive category. Enrico is an example of a Dutch importer specialised in product development for retail chains and other types of customers.

Channel for olives to small shops

Especially in Western Europe, small shops have difficulty to compete with the larger supermarkets that can offer more choice to consumers and offer lower prices as a result of economies of scale. In 2013 in France, Belgium and Germany, small shops (<400 m2) only accounted for 4%, 5% and 2% of the food retail market respectively. In East European markets such as Romania, small shops still had larger shares of 30-40%.

To distinguish themselves from competitors including large retail chains, small shops in West European markets often sell unique olives such as premium olives. Due to the relatively long market channel to small shops, they are unable to compete on price and must focus on quality instead. Particularly in (North)west European countries, small shops usually position themselves as specialist shops or delicatessen stores. Small shops need relatively small volumes compared to retail chains. This allows them to sell unique olives which are only available in limited quantities.

A study in France in 2010 showed that olives with a Geographic Indication were primarily marketed directly from producers to consumers and through delicatessen stores instead of through large retails chains. Consumers who lack knowledge on the specific taste of these olives and their origin favour the cheaper olives available in large retail chains. For this same reason, Greek olive exporters focus on other market channels than retail chains. Greek olives are relatively expensive and exporters see better opportunities in distribution through traders, industry, delicatessen stores and restaurants.

Small shops usually prefer to source their products from one-stop-shop wholesalers. These wholesalers offer a wide range of products including olives. The one-stop-shop concept allows the small shops to purchase all or most of their products at one wholesaler and focus on their sales activities instead of sourcing activities.

Wholesalers can have a variety of functions. One-stop-shop wholesalers often focus on sales activities and composition of a wide portfolio of products. Many of them rely on importers to source products from the countries of origin. In other cases, wholesalers combine wholesale with import in one company.

Channel for olives to the foodservice segment

The foodservice segment consists of restaurants, bars, catering service providers and other buyers serving the out-of-home consumption market. A relatively large group of buyers in this segment needs premium olives to prepare special high quality meals.

Many buyers in this segment source their olives at specialized wholesalers. These wholesalers often deliver directly to foodservice providers using trucks. ISPC is an example of a such a wholesaler in Belgium and Kattus is an example of an importing wholesaler supplying the foodservice segment in Germany.

Channel for olives to industrial users

Most industrial users such as manufacturers of pizzas, sauces or tapenades need large volumes of low priced olives such as olive slices or olive puree. Peruvian suppliers of green Sevillana/Ascolana olives and black Alfonso olives may use their waste materials to target these manufacturers. The manufacturers prefer to source directly from importers as these can usually offer lower prices than wholesalers. Only smaller artisanal manufacturers will source from wholesalers as these are able to supply smaller volumes.

Tips:

- Use different routes to the market to increase opportunities and spread your risks. Make sure to adapt your offer to each segment and channel.

- Partner with a knowledgeable importer to develop unique products for each target segment.

- As importers supply different segments with different needs, they prefer to be presented a range of products to choose from.

- Find potential buyers through the website of the International Olive Council.

- Search the exhibitor databases of European trade fairs such as SIAL, ANUGA and Biofach to identify importers and wholesalers of olives.

11. What is the best way to market the Peruvian olive (Green Sevillana, Green Ascolano, and Peruvian Alfonso Olives) to the different channels?

Identifying needs of buyers

Entry to the European market requires you to convince the buyer of your Unique Selling Proposition. In case you supply black Alfonso olives, you need to convince the buyer that your olive is a high quality unique product. When you are targeting a retail chain, you will need to convince the category or purchasing manager of the retail chain. Or you need to convince the importer which advises the category manager or even manages the olive category on behalf of the retail chain. When you are targeting small shops or foodservice providers, you will need to convince the importer that supplies to those channels.

The olives in the existing product range of the buyer have been carefully selected to match with the needs of their customers. You must gain an understanding of this existing product range to identify unique characteristics of your product which answer to a need of the customer.

Personal meetings at trade fairs

Face-to-face communication and a strong sales story are usually most effective when you need to convince a buyer. You can meet them in person at trade fairs in Europe. Some of the most relevant trade fairs for unique gourmet products such as Alfonso olives are trade fairs focusing on fine foods:

- Speciality & Fine Food Fair: trade fair for fine food and drink in the UK (700 exhibitors, 9,424 visitors). Next edition: 1 – 3 September 2019.

- Gourmet Selection: trade fair for fine food and drink in France (350 exhibitors, 4,000 visitors). Next edition: 22– 23 September 2019.

- Salone del Gusto: trade fair for fine food and drink in Italy (900 exhibitors, 1 million visitors incl. consumers). Next edition: Unknown.

- Salon De Gourmets: trade fair for fine food and drink in Spain (1,603 exhibitors, 90,158 visitors in 2018). Next edition: 8 – 11 April, 2019.

Besides the above international trade fairs, many different regional events for the food service sector offer good opportunities to showcase Peruvian olives.

Large trade fairs which are suitable to promote green olives for a wider market:

- SIAL: one of the largest trade fairs in Europe for food and drink (7,200 exhibitors, 160,000 visitors in 2018). PromPeru organizes the Peruvian pavilion at this trade fair in Paris, France. Next edition: 18 - 22 October 2020.

- ANUGA: one of the largest trade fairs in Europe for food and drink (7,405 exhibitors and around 165,000 visitors in 2017). PromPeru organizes the Peruvian pavilion at this trade fair in Cologne, Germany. Next edition: 5 - 9 October 2019.

- PLMA: trade fair for private label products. Private labels are brands owned by retailers. This trade fair takes place in Amsterdam, the Netherlands. Next edition: 21 – 22 May 2019.

- International Food & Drink Event: trade fair for food and drink in London. Next edition: 17-20 March, 2019.

- Biofach: largest trade fair in Europe for organic products. This trade fair takes place in Nuremberg, Germany. Next edition: 13 – 16 February 2019.

- Alimentaria Barcelona: one of the largest trade fairs in Europe for food and drink (4,500 exhibitors and around 150,000 visitors in 2018). At the 2018 edition, 10 Peruvian companies exhibited at the country pavilion. Next edition: 20 - 23 April 2020.

Trade fairs allow the preparation of a degustation (i.e. tasting) to bring out the unique qualities of your products. You can pair the olives with other foods or drinks to offer a sensational experience while mentioning the USP as identified beforehand.

Other platforms for personal meetings

You can also offer such a tasting at the offices of the buyer or their supplier. For example, some importers offer a meeting space to their buyers including a tasting. This can even include the preparation of a lunch or meal by a chef. The chef can explain to the buyer what recipe was used and point out the unique qualities of the olives.

Award shows can provide an alternative platform to meet potential buyers. Examples of such award shows:

- Sofi awards: Award by the Specialty Food Association. Applications for the 2019 sofi Awards open in February 2019

- London International Table olives Competitions: The next award show will take place from 12 to 14 April, 2019

- Superior taste award by the International Taste & Quality Institute: The Superior Taste Award label is a powerful marketing tool that is used to communicate about the products and the company's success. Registration for the next edition is open until April 25, 2019

- Great Taste awards: Great Taste is the stamp of approval for great-tasting food. The award show is linked to the Speciality & Fine Food Fair in the UK.

Trade promotion organisations such as Promperu or commercial offices of the Peruvian government in Europe can organize special seminars to introduce olives to potential buyers. Such events allow for country promotion to the benefit of all suppliers from Peru including suppliers of olives. The event can consist of presentations, tastings and even a full dinner to showcase the culinary richness of Peru and how to cook with Alfonso olives. The event can also serve as an invitation to a buyer mission to Peru, possibly organized by the same organization that organized the event.

Internet promotion

When buyers are looking for a specific product, they first use the internet to learn about new suppliers before planning for face-to-face contact with these suppliers. High-quality websites of suppliers are associated with being a modern, professional organisation. Such websites contain:

- Information about your product range (e.g. green/black, pitted or not, types of stuffings)

- Details about each of your products (e.g. size, colour, firmness, uses including recipes, packaging)

- The story behind your company and your products (e.g. company history)

- A description of your operations (e.g. quality control)

- Your track record (e.g. list of client references).

The websites of leading Spanish suppliers Agro Sevilla, Angel Camacho and DCOOP provide good examples of high-quality websites.

Some buyers are active on social media such as LinkedIn. When you connect with them, they may see your posts on their news feed. This is a relatively inexpensive promotion tool. However, it is far less effective than face-to-face contact.

Consumer promotion

You can trigger demand for your olives by promoting them directly to consumers. Promotion in close collaboration with your partner (importer, wholesaler or retail chain) is most effective. A strong partner knows where and how to organize in store promotions.

In store promotions can entail simple tasting and sampling events . Sometimes, it is possible to hire a chef to cook with your olives. Such in store promotions enable consumers to taste the olives and learn how to use the products. An added benefit of in store promotions is that you obtain consumer feedback on your product to identify USPs and areas for improvement. The costs of in store promotions can be high. For example, an in-store promotion by an importer in the Netherlands at a large retail chain could cost over € 25 thousand, depending of the scope and duration.

Food blogs offer a particularly good platform to promote unique products. Food bloggers use websites or social media to share ideas and insights. Sometimes these include independent or paid product tests. You can find influential food bloggers at the International Food Blogger Conference.

Tips:

- Make appointments with buyers at trade fairs beforehand. Buyers usually have full agendas at trade fairs and might not be able to meet with you without an appointment.

- Use the websites of European importers and retailers as examples for the development of your own website. For example, the importer The Real Olive Company explains the lack of firmness of Volos olives as follows: “Volos olives are allowed to mature fully, resulting in their purple colour, soft plump texture and strong flavour”.

- Ensure that consumers will be able to find your product in a shop after reading a blogger’s report about your olives.

12. What are the end-market prices?

European supermarket prices for canned olives usually range between € 6 and 15 per kg with only few olives exceeding the € 15 price mark. The cheapest can of olives in a supermarket typically contains around 150 gr of (pitted) olives and costs around € 1 with some of the lowest prices in Northwest Europe. Cans of 200 gr of premium olives such as Kalamata olives or high quality stuffed green olives can reach price levels up to € 3.

Table 10: Typical price breakdown estimates for premium canned olives sold at supermarkets

| Actor | Margin | Sales price example (€ /kg) |

| Olive grower | n.a. | 2.5 |

| Exporter | 100% | 5 |

| Transport companies | <5% | 5.5 |

| Importer and/or processor/distributor | 15-30% | 7 |

| Retail | 10- 40% | 10 |

| Tax Revenue Authority (Value Added Tax) | 20% | 12 |

Olive price levels at small shops will usually be higher than in supermarkets. The market channels to small shops often include an additional wholesaler and the retailer often requires a higher margin to compensate for the lower number of units sold per week.

Table 11: Typical price breakdown for premium canned olives sold at small shops

| Actor | Margin | Sales price example (€ /kg) |

| Olive grower | n.a. | 2.5 |

| Exporter | 100% | 5 |

| Transport companies | <5% | 5 |