Entering the European market for preserved chillies

The European market is a very attractive market for exporters of preserved chillies from developing countries. Europe’s emphasis on product quality, sustainability and traceability creates unique challenges. However, it also opens doors for exporters who can meet European standards and preferences. With Europe’s growing demand for healthy, tasty and ethically-sourced food products, exporters can find major opportunities. The focus should be on catering to the varied tastes and environmental expectations of European price-conscious consumers. Some markets may prefer different types of chilli peppers.

Contents of this page

- What requirements and certifications must preserved chillies comply with to be allowed on the European market?

- Through which channels can you get preserved chillies on the European market?

- What competition do you face on the European preserved chillies market?

- What are the prices of preserved chillies on the European market?

1. What requirements and certifications must preserved chillies comply with to be allowed on the European market?

General information on buyer requirements for processed fruit and vegetables can be found in our study on buyer requirements on the European processed fruit and vegetable market. Here, the sector-level requirements are analysed further on the product level for preserved chillies.

What are mandatory requirements?

Preserved chill products sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. Only approved additives are allowed, and products must conform to maximum levels for harmful contaminants. The most common requirements regarding contaminants are related to microbiological organisms, preservatives and food additives.

Due to the high level of optimisation in processing lines and the sterilisation used in canning, microbiological contamination is rare in the European market. However, physical and chemical contamination can be present. There were 92 chilli-related notifications reported by the European Rapid Alert System for Food and Feed (RASFF) between 2019 and 2023.

Of the 92 RASFF chilli notifications, only two were related to preserved chilli products. To view the notifications, consult these two RASFF links to chilli pepper and chili pepper notifications. We have provided two links because some reports use the British spelling (chilli) and others use the US spelling (chili).

You need a phytosanitary certificate to import fresh fruits and vegetables into the EU. However, this does not apply to canned versions of these products, according to Regulation (EU) 2019/2072.

Contaminant control

The EU places strict controls on contaminants in food, per Regulation (EU) 2023/915 on maximum levels for certain contaminants in food. This regulation is updated frequently. Apart from the limits set for general foodstuffs, there are also several specific contaminant limits for specific products. For canned food products, there is an important limit on inorganic tin (maximum 200 mg/kg).

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products. It maintains a list of approved pesticides that are authorised for use. In 2023, the European Commission approved 36 new regulations that modified this list.

Food canning operations, in particular washing, blanching, peeling and cooking, can lead to a significant reduction of pesticide residue. Some studies estimate these activities can reduce residue levels by 10–82%. Keep in mind that boiling and canning sometimes led to an increase in residues under certain conditions.

Microbiological contaminants

Botulism is a serious concern when exporting preserved chili peppers, especially to markets like the EU, which has stringent food safety regulations. Botulism is caused by the Clostridium botulinum bacterium, which produces a strong neurotoxin. This bacterium thrives in low-oxygen environments, such as improperly preserved or canned foods. This is why exporters need to follow strict guidelines to prevent contamination.

Clostridium botulinum cannot grow in acidic environments (pH below 4.6). Therefore, you should ensure that the pH level of the preserved chili peppers is low enough. However, bear in mind that a low pH will not degrade any pre-formed toxin. One example of an incident is this June 2023 notification of a suspected case of botulism following consumption of tinned chillies.

The bacteria and its spores can be destroyed through proper heat treatment. When canning, it is crucial to use the correct processing times and temperatures. These are usually achieved through pressure canning rather than boiling-water canning, especially for low-acid foods. Maintain strict hygiene standards during production to prevent contamination.

Other contaminants

Many contaminants can cause border rejections and market withdrawals of preserved chillies from the European market. These include possible cases of packaging corrosion and excessive levels of preservatives and colouring. Another reason is the migration of materials (tin, cadmium and glass) from the packaging into the product.

The European safety authorities must approve additives if any are present. Additives should comply with Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008.

One example of an additive-related incident is a September 2022 notification from Spain. The notification concerned a shipment of pickled chillies from Peru. The shipment had higher than permitted levels of Sodium metabisulphite (E223). Sulphites are used for their antimicrobial and antioxidant properties. They stop fungi and bacteria from growing. The maximum permitted level of sulphites in final food except beverages is 2 mg/kg, according to Regulation (EC) No 1333/2008.

Product composition

European authorities can reject products if they have undeclared, unauthorised or excessive levels of extraneous materials. There is specific legislation for food additives (e.g. colours, thickeners) and flavourings that lists which E numbers and substances are allowed. Authorised additives are listed in Annex II of the Food Additives Regulation. Other annexes of the regulation list food enzymes, flavourings and colourants.

Some preserved vegetable products can be produced using sulphite treatment. Sulphites are used as an antioxidant to prolong shelf life. Sulphur dioxide and sulphites are considered allergens under Regulation (EU) No. 1169/2011. Their presence must be indicated on the label. For processed vegetables in vinegar, oil or brine, the maximum level for all sulphur dioxide and sulphites (E220-228) is 100 mg/kg. The maximum level for golden peppers in brine is 500 mg/kg. Maximum levels are expressed as SO2.

What additional requirements and certifications do buyers often have?

Preparing preserved chillies from clean and sound chilli peppers is a basic requirement. They should be free from unrelated biological or inert matter. They can be with or without seeds, spices, aromatic herbs or condiments.

Quality requirements

There are no specific quality standards for preserved chillies. However, the basic quality requirements for preserved chillies are contained in the wider Codex Alimentarius Standard for Pickled Fruits and Vegetables (PDF).

- Basic ingredients are water and, wherever necessary, salt, oil or an acidic media like vinegar. Optional ingredients can include aromatic plants, spices, vinegar, oil and sauce. Key quality criteria for preserved chillies include:

- Colour: normal colour characteristics typical of the variety, type of packaging and style.

- Texture, flavour and odour: characteristic of the product. These can vary depending on geo-climatic factors/conditions.

- If packed in oil: the percentage of oil in the product should not be less than 10% by weight.

- The percentage of salt in the covering liquid or the acidity of the media should be sufficient to ensure the quality and proper preservation of the product.

- Defects: the product should be practically free from defects. These include blemishes and harmless extraneous material. Blemishes mean any characteristic including bruises, scabs and dark discolouration. ‘Harmless extraneous material’ means any vegetable part (e.g. a whole or partial leaf, or a stem) that does not pose any hazard to human health but affects the overall appearance of the final product.

Food safety certification

Although European legislation does not explicitly require food safety certification for preserved chillies, most European food importers do. Well-established importers will not be interested in your products if you cannot provide the needed certification. Most European buyers will ask for certification recognised by the Global Food Safety Initiative (GFSI). GFSI recognises a few certifications that meet the GFSI benchmarking requirements. For preserved chillies, the certification programmes recognised by GFSI are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Check which certifications are currently recognised against the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements. However, certain retailers may prefer one certification over another. They may ask for other certifications based on their own internal policies. Major buyers will also usually visit or audit production facilities before starting a business relationship.

Türkiye’s ekoFood offers preserved chillies in many formats from its BRCGS-certified unit, ensuring compliance with food safety standards. The company also has a system that regulates its social responsibility. It uses the SMETA 4 Pillar (SEDEX Members Ethical Trade Audit) for social certification (see below).

Corporate social responsibility (CSR) certification

Companies have different requirements for CSR. Many importers will ask preserved chilli suppliers to follow a specific CSR code of conduct. Most European retailers have their own codes of conduct, such as Lidl and Kaufland, that are part of Schwarz Group (pdf), Rewe, Carrefour (PDF), Tesco and Ahold Delhaize.

Other companies may insist on following common standards such as the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone (without an audit) is not very complicated and not very expensive. Other CSR alternatives include Ethical Trading Initiative’s Base Code (ETI), the amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Packaging requirements

Preserved chilli packaging must:

- Protect the product’s taste, colour and other quality characteristics.

- Protect the product from contamination (including contamination from the packaging material itself).

- Not pass on any odour, taste, colour or other characteristics foreign to the product.

- Be corrosion-resistant (in case of tins).

Manufacturers must prevent the migration of unsafe levels of chemical substances from the packaging material to the food. Bisphenol A (BPA) is used to produce epoxy resins found in protective coatings and linings for food and beverage cans and vats. In April 2023, the EFSA published a re-evaluation of the safety of BPA, significantly reducing the BPA tolerable daily intake (TDI) in food contact materials that it had set in its previous assessment in 2015. The TDI is around 20,000 times lower than before. There is no general rule for the export size of the packaging.

There are three main packaging types:

- Glass jars: Mostly for retail packaging. Preferred for their non-reactivity and recyclability. Ensure jars are sealed properly and are resistant to breakage during transport.

- Plastic containers: Must be BPA-free and suitable for food storage. Ensure containers are durable.

- Tin cans: Used for products with longer shelf-lives. Ensure cans are coated internally with food-grade lacquer to prevent corrosion.

Figure 1: Preserved chillies in glass packaging

Source: "Pickled Peppers" by ccarlstead, licensed under CC BY 2.0.

Labelling requirements

The name of the food must show the precise product as well as any special properties. All ingredients in prepackaged foods must be listed on the packaging. The ingredients are listed by descending order of weight.

For retail packaging, product labelling must comply with the EU Regulation 1169/2011 on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and legibility (minimum font size for mandatory information) more clearly.

Food businesses have to label foods with the country of origin or place of provenance of primary ingredients. These requirements are set out in Regulation (EU) 2018/775 and apply alongside existing rules in the Food Information Regulation (EU) 1169/2011.

Tips:

- Keep an eye on the EFSA page on BPA for changes in regulations and possible reductions in the tolerable daily intake.

- Consult the useful EU-wide uniform food labelling page provided by the German Ministry of Food and Agriculture and the latest updates on food labelling from the European Commission. If you export to the UK, consult official UK labelling guidance.

- Refer to industry examples of product technical sheets. For an example, read these product specifications for preserved hot pepper in sunflower oil (PDF) produced in Italy by Viander. Alternatively, consult a product technical sheet for canned sliced Jalapeno peppers (PDF) sold under the Riverdene brand. Riverdene is a canned foods brand of UK-based importer and distributor Martin Mathew & Co.

What are the requirements for niche markets?

Companies should expect European importers and retailers to require more of their suppliers in sustainable production or in niche markets.

Sustainability certification

Two commonly-used food sustainability certification schemes are Fairtrade Standards and Rainforest Alliance. Fairtrade international certifies the production of Fairtrade vegetables. Fairtrade standards also cover peppers.

The Rainforest Alliance’s online traceability platform has included vegetables since 1 January 2023. Products that contain herbs and spices can carry the Rainforest Alliance certification seal if they contain at least the minimum percentage of content from Rainforest Alliance-certified farms. Any herbs and spices that are certified as part of the Rainforest Alliance’s Herbs & Spices Programme can also be used in other products that carry the RA seal. This includes all varieties of chilli pepper (PDF).

Farms that cultivate chili without any other Rainforest Alliance-certified crop (e.g. coffee, cocoa, tea and palm oil) may choose between certification against the UEBT/Rainforest Alliance requirements or against the Rainforest Alliance 2020 Standard.

Organic preserved chillies

Organic certification may be an interesting way to set your preserved chilli product apart and market it at a higher price. Consider offering product variants with higher quality oils, such as olive oil. For example, Italy’s Bio Orto offers its organic sliced chilli peppers in extra virgin olive oil as a premium product.

To market preserved chillies as organic in Europe, they must be grown using organic production methods that conform to European legislation. Growing and processing facilities must be audited by an accredited certifier before you can put the EU’s organic logo on your products, as well as the logo of the standard holder (e.g. Soil Association in the UK, Naturland in Germany and Agriculture biologique in France).

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex of the Commission Regulation that defines imports of organic products from third countries.

For equivalent countries, including Argentina, India and Tunisia, certificates are issued by control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Ethnic certification

If you want to focus on the Jewish or Islamic ethnic niche markets, implement Halal or Kosher certification schemes. Several organisations provide Kosher certification in Europe. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain the Kosher certification. Halal certification in Europe can be obtained through certifying bodies like Halal Certification Services (HCS).

Shan Foods is a Pakistani producer of packaged spice mixes and preserved foods. The company offers chilli pickle with several Halal certifications from different national authorities.

Tips:

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH and equivalents. For the Swiss market, you can also check the approved inspection bodies at BIOSUISSE ORGANIC. For the UK market, read the list of approved UK control bodies.

- Find guidelines and main changes in the new organic regulation on IFOAM Organics Europe.

2. Through which channels can you get preserved chillies on the European market?

Manufacturers and processors often work with local chilli farmers in their respective countries or from supplier countries. These chillies are sourced and then processed. Other suppliers import the end products and re-pack them for sale under private labels to retailers or the food service sector.

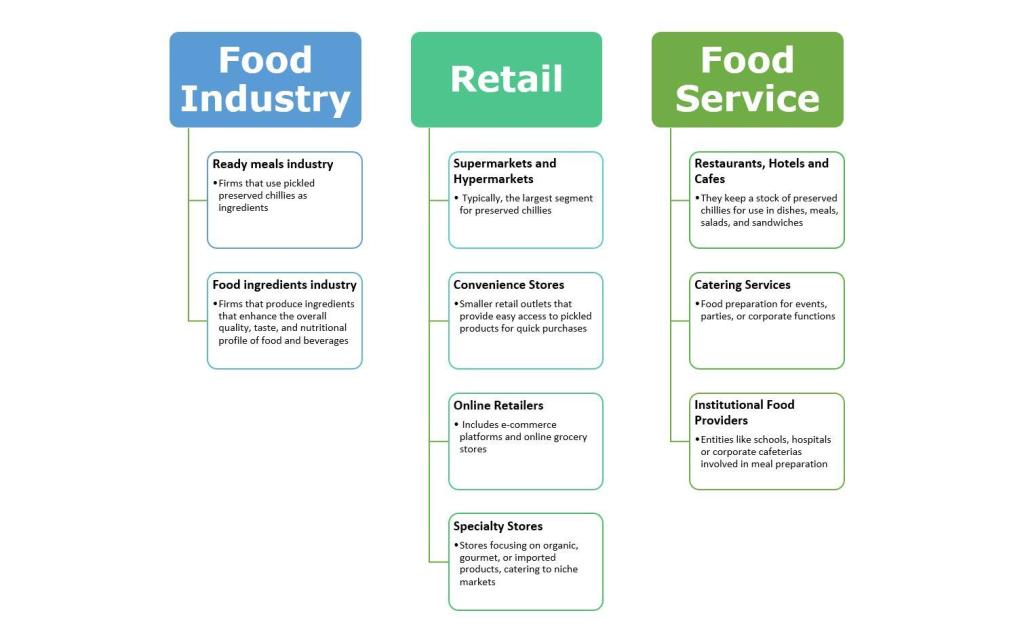

How is the end market segmented?

Precise statistical data on preserved chillies sold through the retail segment and to the food processing industry is not readily available. The retail, food service and food industry segments are the largest users of preserved chillies.

Figure 2: End-market segments for preserved chillies in Europe

Source: Autentika Global

Retail segment

Large retail chains tend to import preserved chillies from developing countries through intermediaries or source them from European suppliers. Usually, large-scale retail chains sell preserved chillies under their private labels. These are sourced from the private label supplier. The chain’s specifications and quality requirements must be met.

Leading food retail companies in Europe differ per country. These outlets are usually very important for sales of preserved chillies. The companies holding the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold Delhaize.

Keep in mind that several retail alliances coordinate buying operations in Europe:

- Coopernic – includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group.

- Carrefour World Trade or CWT – includes Carrefour, Système U, Match and Cora.

- AgeCore – Colruyt – cooperation on national brands and private label, Conad, Eroski and Coop Switzerland.

- European Marketing Distribution or EMD – Colruyt – cooperation only on private label, Pfäffikon, Countdown, Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia.

- Epic Partners – Edeka, Système U, Esselunga, Picnic, Migros, Jerónimo Martins and Ica.

Food service segment

The food service segment (hotels, restaurants and catering businesses) has different requirements for preserved chillies. These businesses usually source their supplies from large manufacturers or distributors. Food service often requires specific 1–5 kg packaging, which is different from bulk or retail packaging sizes.

Restaurants have long used chilli-based sauces with different spice mixes and condiments, such as mustard seed paste and vinegar-based products. Pickled chillies are also growing in popularity as a cocktail ingredient, for example in spicy martinis. There is growing consumer demand for interesting and offbeat flavours, especially from the younger generation. This means that innovative uses of preserved chillies are likely to appear.

Wholesale companies that cater to the food service segment include Sligro (the Netherlands), Carl Kühne and Alfred Paulsen (Germany) and Hugo Reitzel (Switzerland/France). Bart Ingredients and Riverdene (a brand of UK-based importer and distributor Martin Mathew & Co) are notable players in the UK market. Hugo Reitzel is a company that has extensive experience supplying the food service sector. It offers a wide range of convenient solutions for food service professionals.

Food industry (food processing segment)

Preserved chillies are mostly used by two segments of the food processing industry.

- The ready meals industry is a significant user of preserved chillies (mainly for pizzas, pastas and soups).

- The food ingredients industry is a user of preserved chillies for their unique spiciness.

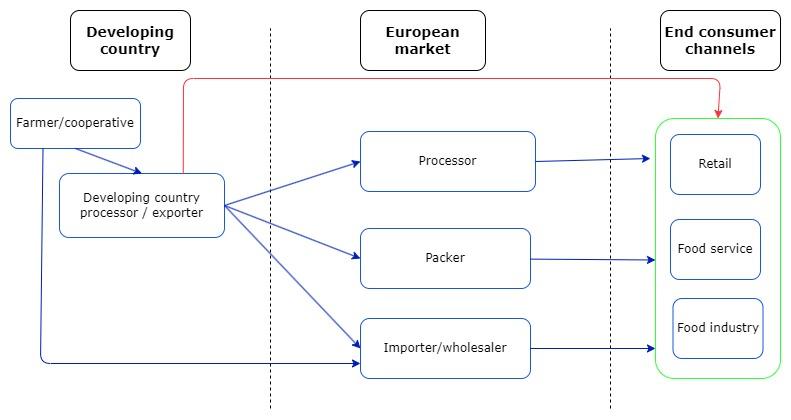

Through which channels does a product end up on the end market?

Large quantities of preserved chillies are sold in the retail segment under importer’s brands or private label brands. Preserved chillies sold as part of ethnic cuisine product ranges are also popular. The most important channel is importers. In Europe, importers choose their preferred channel based on their core strength.

Figure 3: European market channels for preserved chillies

Source: Autentika Global

Importer/Wholesaler

Importers and wholesalers are excellent contacts for exporters from developing countries. These companies have established networks of customers. They are also familiar with local markets, regulations and consumer preferences. They can provide access to important customers, such as retail outlets, supermarket chains and specialised stores. Achieving this alone is challenging and expensive for new exporters.

Partnering with established importers and wholesalers can also significantly reduce risks for exporters. Some marketing and distribution activities can be costly and risky for exporters to undertake on their own. In terms of preserved chillies, two interesting importers are Suntat, a wholesaler of Turkish food products, and Germany’s Crevel Europe, which imports and distributes Mexican products.

Other European importers of preserved chillies include: EMN Europe (active in 18 European countries), OttoFranck (Germany), Frank Hoffmann Konserven (Germany), Clama (Germany), Kreyenhop & Kluge (Germany), Henry Lamotte (Germany), Natco Foods (UK), Gama (UK), Goodies Foods (UK), Indo European Foods (UK), S.O.P International (UK), J.L. Machado (Portugal), Opa Distribution (France) and Agidra (France).

Direct supply to food retail or food service

Retailers that focus on specialty, gourmet or organic preserved food can be more open to direct relationships with exporters. These retailers often want unique products that differentiate their offerings from mainstream supermarkets. Retailers that specialise in ethnic or international foods are also more likely to engage directly. Large retailers are expanding into this segment, offering products that cater to consumers who like international cuisines.

The food service segment has a significant share in the European market for preserved chillies. This segment requires bigger packaging (up to 5 litres) and non-branded products of a standard quality. Reaching the food service segment directly is difficult, so you should search for specialised food service suppliers.

Tips:

- Watch this 2023 Deutsche Welle documentary for more insight into the competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

- Read this recent article on why European buying groups are becoming more important in European retail. Keep in mind that retailers exert more bargaining power when negotiating through alliances.

What is the most interesting channel for you?

Working with importers and wholesalers is seen as the easiest and least risky channel for exporters from developing countries. However, this channel might offer lower margins compared to direct sales.

Specialised preserved vegetable importers are excellent contacts for exporting to Europe, especially for new suppliers of preserved chillies. Supplying the retail segment directly is very demanding and requires a lot of quality and logistical investments. Importers usually have a good knowledge of the European market. Therefore, they are your preferred contact. Especially because they can inform you about market news and provide practical advice.

Direct supply to food retail or service and to food manufacturers might appeal more to exporters targeting niche markets or those with the capacity to meet specific quality or volume requirements. The growing European demand for certain exotic vegetables and spicy foods presents good opportunities.

Tips:

- Read our tips about doing business with European buyers of processed fruit and vegetables and finding buyers on the European market for processed fruit and vegetables.

- Keep an eye on events and channels in the dried chilli market as there might be potential for overlap. Read our report on exporting dried chillies to Europe.

3. What competition do you face on the European preserved chillies market?

The preserved chillies market is dominated by developing countries. The leading suppliers are Türkiye, Peru and Mexico. Greece is a major supplier to European buyers as well. Other important suppliers are Egypt and South Africa. Due to the similarity of the trade codes for preserved chillies in the EU and UK, it is possible to compile precise import statistics for these two markets combined. Statistics for the EFTA countries do not allow a similar level of precision.

Source: Autentika Global, ITC Trademap, *Greece, 2024

Which countries are you competing with?

Preserved chillies are a popular product across Europe, with regional preferences for varieties and flavour. Competition is strong with important suppliers from outside and inside Europe. There are many players with different roles. Some companies import preserved chillies for re-exports. The biggest suppliers are developing countries, including Türkiye, Peru and Mexico. Among European countries, Greece is the leading supplier of preserved chillies. Egypt and South Africa are also significant players.

Türkiye: Europe’s dominant and growing supplier

Türkiye is the largest single supplier of preserved chilli products to Europe. It exports more than twice as much as second-ranked Peru. Türkiye exported 45,400 tonnes of preserved chillies to the EU and the UK in 2023. Exports have risen consistently since 2019 when volume exports amounted to 31,800 tonnes. The average annual growth rate was 9.3% between 2019 and 2023.

Processing and preserving of vegetables and fruits is well developed in Türkiye. It accounts for a 15.7% share of the food processing industry, according to a USDA 2023 country report on Türkiye.

Türkiye mostly exports preserved chillies in vinegar or acetic acid to Europe. These exports amounted to 34,400 tonnes in 2023, representing a 9.2% growth rate. Exports of other types of preserved chillies grew faster, at a rate of 9.7%. They amounted to 11,000 tonnes in 2023. Almost 46% of the preserved chilli exports to Europe are destined for the German market. Today, an estimated three million people of Turkish heritage live in Germany.

Türkiye is also the largest supplier to the UK, exporting around 7,700 tonnes. Shipments to the Netherlands are growing at a rate of 12% and reached 2,800 tonnes in 2023.

Türkiye’s preserved exporters are supported by the Türkiye Exporters Assembly (TİM), which is the umbrella organisation of Turkish exports. The industry is also supported by the Federation of All Food and Drink Industry Associations of Türkiye (TGDF).

Peru: A supplier in slight decline

There are more than 60 companies dedicated to chilli exports in various forms in Peru, and they supply dozens of countries. The favourable climate in Peru and the many forms of chilli pepper processing make long storage periods possible. This also allows for good distribution of shipments and processing throughout the year. This allows preserved chillies to have a commercial window that practically covers the whole year.

Peruvian exports to Europe amounted to 17,800 tonnes in 2023. Spain was the largest export destination with 14,800 tonnes. Germany accounted for a further 1,000 tonnes of Peruvian preserved chilli imports. Over the past five years, Peruvian export volumes to the EU and the UK have fallen by 1.5% on average. Exports declined from 18,900 tonnes in 2019 to 17,800 tonnes in 2023.

Peru is known for producing a variety of chili peppers, including the famous Jalapeño, Ají Amarillo and Rocoto, which are prized for their flavour and quality. The North American region continues to be the main destination for Peruvian preserved chilli. This is thanks to how adaptable Peruvian preserved chillies are to American and Mexican cuisines.

Peruvian preserved chilli exporters enjoy the support of several important industry bodies. One such organisation is PromPerú, which works to boost the international visibility of Peruvian products. PromPerú provides export-oriented training, market intelligence and trade promotion services. Another key organisation is the Association of Exporters (ADEX), which advocates for exporters’ interests. ADEX provides resources and support to expand their global reach.

Exports of preserved chillies in vinegar can be found grouped with other vegetables (except table olives and cucumbers) under the Nandina trade code 2001.90.90.00. Exports of preserved chillies (grouped without other vegetables) preserved without vinegar can be tracked using the Nandina trade code 2005.99.31. This code includes sweet peppers and varieties of chilli peppers. Nandina is the common classification system (PDF) of the Andean Community and CAN members (Bolivia, Colombia, Ecuador and Peru).

Europe: Greece as Europe’s own exporting powerhouse

Greece is a significant supplier of chilli peppers to Europe. Its preserved chilli exports to Europe are comparable to Mexico. Greece exported 10,700 tonnes of preserved chillies to Europe (EU+UK) in 2023. Exports have declined by 2.5% on average in the period since 2019, when volume exports amounted to 11,900 tonnes. The average annual growth rate between 2019 and 2023 was 9.3%.

Greece exports slightly preserved chillies in vinegar and acetic acid to Europe. These exports amounted to 5,700 tonnes in 2023, and they are growing at a 5.2% rate per year. Exports of other types of preserved chillies contracted at a rate of 8.6%. They amounted to 5,000 tonnes in 2023. More than half of the preserved chilli exports to Europe end up on the German market.

Companies active in the sector are often members of the Greek International Business Association (SEVE). This association protects its members’ interests.

Mexico: A major competitor from North America

Mexico plays a significant role in the global market for preserved chili peppers. Mexico’s is the second-largest producer and the largest exporter of chilli peppers in the world. In Mexico, the main chilli pepper producing states are Chihuahua, Sonora and Zacatecas. Total production of fresh chilli peppers amounted to 3.1 million tonnes in 2023. This is just slightly ahead of Indonesia and Türkiye, according to the FAOStat database.

The country has a steady supply of high-quality chillies for processing. This is thanks to its vast production, favourable climatic conditions and extensive agricultural expertise. The industry produces a wide range of chillies that are used for preserving, including Jalapeños, Serranos and Poblanos, which are in high demand in Europe.

Mexico’s exports of preserved chillies to Europe (EU+UK) totalled 10,000 tonnes in 2023. Exports have grown at a rate of 0.3% over the past five years, starting in 2019. Mexico mostly supplies chillies preserved in vinegar or acetic acid. These forms account for more than 95% of exports to Europe. Roughly 40% of sales to Europe are destined for Germany, while 17% are destined for the UK market.

Tips:

- Identify the biggest importers of your product in selected European markets. Explore their product offerings and variants for clues about what is in demand.

- Study the performance and approaches of companies from developing countries that export to Europe. Consider what Türkiye, Peru, Mexico, Egypt and South Africa are doing successfully.

- Get information about the export strategies of fast-growing exporters. Consult the news and events pages of Peru’s ADEX (in Spanish) for ideas that could benefit your exports to Europe.

Which companies are you competing with?

The supply of preserved chillies is concentrated in the major supplying countries. Some European companies have production subsidiaries in supplying countries, and some trade relationships involve related parties.

Turkish companies

Türkiye’s EkoFood Tarim offers preserved chillies in many formats from its BRCGS and IFS food safety certified unit. Ciloglu Gida, a Turkish subsidiary of Germany’s Ciloglu Handels, is an important exporter to Europe. The Turkish arm, located in Istanbul, was established in 1999 to supply its parent company. Other large importers to Europe include Hemsi Tarim, Burakcan Gıda Ve Tarım (no website), H Bazaar Dış Ticaret and Rapunzel Organik Tarim, a subsidiary of Rapunzel Germany.

Other important players in the chilli pepper market include: Euro Gıda (supplies pickled Jalapeño peppers to Migros and Carrefour), Tat, Sezgin Sayar Gıda, Cenkci Turşuculuk, Hantat Gıda, Tamker, Tukas Gida, Penguen Gida, Sera and Tat Gida.

Peruvian companies

Danper Trujillo is a leading exporter of preserved vegetables and preserved chillies from Peru to Europe. The company is a supplier of the most demanding world food brands and supermarket chains. Ecosac Agrícola offers five varieties of canned pepper, including Jalapeño pepper, which are sold in different formats. Ecosac is a large supplier to Spain.

Another important supplier is Virú Group. The company has commercial offices in Europe that serve customers from its firms Virú Iberia, Virú France and Virú Italy. Virú also supplies to Europe through its Peruvian subsidiary Caynarachi. Another notable preserved chilli supplier to Europe is Green Peru.

European companies

Most of the European exports to European buyers are by Geek companies. Some important suppliers include Thessaloniki-based Nikos Export, Larissa-based Tasoulas Peppers, Almi Foods, Hercules Export and Konstantinos Tsagaropoulos Peppers (KT Peppers).

Tsarouchas Bros is a notable supplier of preserved chilli peppers. A more complete list of pepper exporting companies can be found in the exporters directory of preserved vegetable exporters on the site of the Greek exporters’ association Seve.

Mexican companies

La Costeña is one of the biggest Mexican canned food suppliers to global buyers. La Costeña produces 1,200 tonnes of Jalapeño peppers every day. Multinational Grupo Herdez produces pickled Jalapeño in many formats under its Herdez brand. The company was founded in 1914. It is active in 21 countries, and it has 13 production plants and 25 distribution centres.

La Morena specialises in canned chilies. The firm was founded in 1970 and has plants in Puebla and Tlaxcala that produce seven million boxes of chili peppers, sauces, fruits, beans and vegetables per year. Other suppliers include Conservas del Norte and San Marcos.

Which products are you competing with?

The principal competition comes from fresh and from dried chilli products. For example, the excellent availability of dried chilli peppers and dried chilli flakes in European supermarkets is a factor that affects preserved chilli sales.

Tips:

- Read CBI’s study on exporting fresh chilli peppers to Europe to understand competition from fresh variants.

- Read CBI’s study on exporting dried chillies to Europe to understand competition from dried chillies.

4. What are the prices of preserved chillies on the European market?

In Europe, bulk packages of good-quality private-label preserved chillies are sold in high volumes at lower profit margins. Prices for premium, branded and organic preserved chillies are higher. They may depend on the variety and uniqueness of the product. There is a wide price range, which may depend on the type of preservative used, such as brine or extra virgin olive oil.

A retail price breakdown for a jar of Rewe Beste Wahl private label preserved Jalapeño chillies is given below. It shows the margins each actor in the supply chain receives.

A rough indication of margins in the value chain is provided in Table 1. The table also shows a price breakdown for a pot of sliced chillies sold in a European supermarket in absolute terms.

Table 1: Sample structure of the retail price of preserved chillies

| Steps in the export process | Type of price | Margin % | Sliced preserved Jalapeño chillies in a 160 g jar | |

| Absolute margin in € | Price/kg in € (drained) | |||

| Production of vegetable | Raw material price (farmers’ price) | 5–15 | - | 0.24 |

| Handling, processing and selling of pickled product | FOB or FCA price | 30–40 | 0.48 | 0.72 |

| Shipment | CIF price | 5 | 0.08 | 0.80 |

| Import, handling, distribution | Wholesale price (value added tax included) | 10–15 | 0.16 | 0.96 |

| Retail sale | Shelf price | 40–50 | 0.64 | 1.60 |

Source: Autentika Global, 2024

Tips:

- Subscribe to S&P Global Commodity Insights, a leading market information service for processed commodities.

- Compare your offer with that of key competitors for your products in target markets. This is not a one-time operation: price levels should be monitored over time, in different channels and countries.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research