6 tips for organising your processed fruit and vegetables export to Europe

Finding a buyer who is satisfied with your offer is only half the battle when entering the European market. You still need to agree on the delivery and contract terms, arrange the required product and shipment documentation, organise transport to Europe, and get paid in full. Although this may seem like technical and easy work, it comes with many of its own challenges. The tips listed below give you some short but practical information on how to deal with the challenges and on how to become an efficient, trustworthy and successful exporter of processed fruit and vegetables.

Contents of this page

- Choose the method of payment according to the level of trust

- Reduce your export risk by investing in export insurance

- Consider tariff duties, documents and customs procedures when making an offer

- Select the best transport and logistics options

- Ensure safe and cost-effective packaging

- Use the assistance of support organisations when organising your export to Europe

1. Choose the method of payment according to the level of trust

The method of payment should be included in your sales contract. This means that you must agree on the method of payment that is the most beneficial for you and your buyer. This agreement is not always easy to make, especially when you are dealing with a buyer for the first time. Commonly, many buyers insist on deferred payment after receiving the goods. If you are not well acquainted with your buyer, you should always insist on either advance payment (to be paid before sending the goods) or securing the payment with export insurance or a letter of credit.

Basically, all methods of payment can be classified as either clean or documentary (also called 'cash against documents'). Clean payments do not involve any extra security measures. With documentary payments, a different level of security is achieved by using banking systems and specific accompanying documents. Tables 1 and 2 summarise the most important payment methods currently used in international trade.

Table 1: Clean payment methods

| Payment method | Description summary | Trust level | Points to consider |

| Full advance payment | You are fully paid before shipping the goods. | High | Not common for first-time orders as the risk is high for the importer. Common practice only between long-term trading partners. |

| Partial advance payment | You are partially paid before shipping the goods and the remainder is paid after the buyer receives the goods. | Medium | The risk is more evenly spread but still exists. Rarely used for first-time shipments. |

| Deferred payment | You ship the goods to the importer before you receive payment. | High | Acceptable when there is a high level of trust between you and your buyer (not for new business partners). It is possible to accept this payment for new partners if you secure payment by a letter of credit or export credit insurance. |

Source: Autentika Global

Table 2: Documentary payment methods

| Payment method | Description summary | Trust level | Points to consider |

| Clean collections | You send financial documents (bills of exchange or promissory notes) through the banking system in order to collect payments from the importer. | Medium | To be used only when there is a certain level of trust. The risk is that you lose physical control over the goods before receiving payment. |

| Documentary collection | Documents that represent the goods (e.g. invoices, shipping documents, insurance) are transferred through the banking system. | Low-to-medium | The advantage of this method is that your buyer can receive goods only after presenting documents to the bank in line with your instructions. However, it does not guarantee that payment will actually take place. |

| Letter of credit | After the importer presents certain documents to the bank, the bank organises the payment and the importer can redeem the goods. | Low | Other than payment in advance, this is the most secure method of payment for you. However, it is the most expensive method for the importer. |

Source: Autentika Global

Long-term relationships are usually based on trust. When making the first export shipments, you will commonly be required advance payment and gradually move from the letter of credit (LOC) through documentary collections towards clean bank transfers. The same trust issue applies to the buyer, so you will often need to find a middle ground.

Since an LOC is the most secure method of payment for you, it is described in more detail below. This is also a good way to check the buyer’s financial standing. If the importer is a debtor, the bank will usually not open an LOC for them.

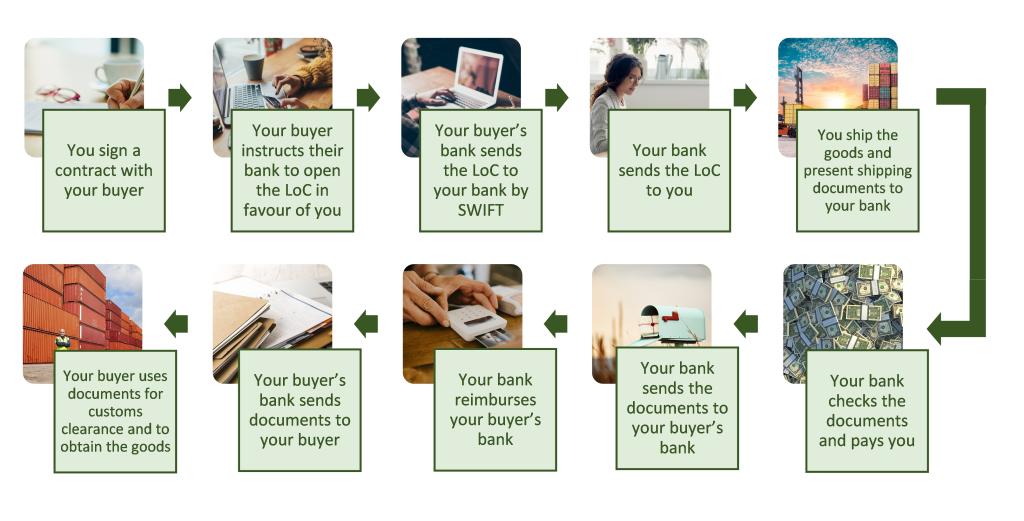

- You and your buyer sign a contract specifying that the method of payment is a letter of credit (also called documentary credit).

- Your buyer requests their bank to open an LOC in your favour.

- The bank of your importer (after evaluating the risks) requests your bank to confirm the LOC.

- Your bank checks the validity of the LOC and sends it to you.

- If you agree to the terms of the LOC, you ship the goods according to the agreed Incoterm.

- You present the required documents to your bank.

- Your bank checks the documents and, if satisfied, pays you according to the terms of the LOC.

- Your bank sends the documents to your buyer's bank.

- Your buyer's bank checks the documents and reimburses the amount to the confirming bank.

- Your importer's bank collects the money and releases the documents needed to take control of the goods.

- Your buyer collects the goods with the required documents.

The main disadvantage of an LOC is that it can be costly. To overcome this problem, you can offer the buyer to split the fees. For example, you can pay your bank fees while the importer can pay their (issuing) bank fees. Another problem faced by some developing countries is that their banking sector may fail to offer the possibility of an LOC. You need correspondent banks for this process, and some developing countries still lack them.

Figure 1: Simplified steps of the letter of credit (LOC) cycle

Source: Autentika Global

Tips:

- Check with your bank about the actual costs and procedures of an LOC. Although the process may seem complicated, in reality the majority of activities are performed by banks. You just need to follow the instructions given by the banks and make sure that the documents are correct.

- Select a bank that is recognised in Europe with daily LOC experience. Ideally, your bank and the buyer's bank should be part of the subsidiary network of the same bank.

- Use the support of the Trade Facilitation Programs by international development banks, such as the EBRD Trade Finance Programme, the IFC Global Trade Finance Program or the Asian Development Bank's Trade Finance Program. Those programmes offer guarantees to cover the costs of transactions. You can access this network through selected local banks in your country. These banks have to be members of those particular programmes.

- Consider purchasing international methods of payment guides from the International Chamber of Commerce (ICC) to better understand your payment options.

- Take part in the ICC online training or the Export Academy's online training on trade finance to better understand payment and bank procedures.

2. Reduce your export risk by investing in export insurance

The export of processed fruit, vegetables and edible nuts involves a lot of different risks. Those risks can relate to shipment conditions (e.g. delay, damage or temperature control) or external factors that are out of the shipping company's control (e.g. theft, currency fluctuations or political risks). It is therefore recommended to insure your product and payment. The most common types of insurance include cargo and marine insurance, export credit insurance and political risk insurance.

Cargo insurance

Cargo insurance is used to protect your products throughout the entire journey to a customer. It will protect you from any damage to your products caused by improper handling of pallets, crane breks, lack of temperature or humidity control inside containers, etc. One of the advantages of cargo insurance is that there is no need to obtain proof of damage or loss. In case of damage, it is only necessary to show that damage or loss has actually occurred.

It is important to understand that complete cargo insurance is not covered by shipping companies in sea transport. Usually, when you sign a contract with a sea shipping company the contract includes marine insurance. This insurance is purchased by the shipping company and only covers risks in the marine environment. This means that it will not cover damage due to improper loading of goods from the truck to the ship or any damage that occurs outside of a marine environment.

You and the importer will have to agree on who is responsible for the insurance, and this is specified in the Incoterms (technically required only under CIP/CIF terms).

Export Credit Insurance

The main aim of export credit insurance is to protect you from non-payment. The additional advantage of this type of insurance is that it enables you to offer your buyer-deferred payment. As many European buyers ask for deferred payment, export credit insurance can increase your competitiveness.

Export credit agencies (ECAs) are responsible for the insurance. There are many of them, with an international network of offices. They are often privately owned, but can also be government-owned. Some ECAs are established by governments in order to increase the general competitiveness of their country's exports. You should search for one in your country.

The added value of the export credit insurance procedure is that you also learn a lot about your buyers and gain insight into their solvency and creditworthiness. ECAs normally analyse the creditworthiness of your buyer before offering you the insurance policy. The ECA will give details of the risks covered by the policy, which normally relate to the event of non-payment by the buyer.

Political Risk Insurance

Political risk insurance protects your company from political risk. Some examples of political risks are the acquisition of your goods by state authorities, currency inconvertibility, or the cancellation of an import license. It can be useful when trading with countries that are politically unstable but it is usually not needed for exports to the European Union. Also, political risk insurance is often part of the export credit insurance policy.

Tips:

- Find reliable export credit agencies on the list of members of the Berne Union.

- Ask export credit agencies to give you an offer for the solvency report of your targeted buyers. This will not give you payment guarantees, but you will have a clearer picture of the company you want to make a deal with.

- Read more about insurance covering risks related to export credit agencies to understand the limitations of the insurance policies. Remember that insurance often fails to cover all your potential losses and can be expensive when dealing with high-risk businesses.

3. Consider tariff duties, documents and customs procedures when making an offer

Importers, agents or customs brokers are responsible for taking your products through European customs. Although you as the exporter are not usually involved in this process directly, it is extremely important to be in touch with the transporter and importer and to provide all the necessary documentation and information. Full customs clearance is only the exporter's responsibility when you use 'delivery duty paid' (DDP).

Generally, customs procedures follow these three steps:

- Customs pre-alert: processed fruit and vegetables entering the European Union must be 'pre-alerted'. This pre-alert is submitted electronically, normally by the carrier or freight forwarder carrying the goods. This is usually done between 2 and 24 hours before the arrival of the goods.

- Inspection and control: this step involves a documentation check and the physical examination of goods, often in collaboration with the national (customs and food safety) authorities.

- Customs decides about further action: accept the goods for free trade within the European Union, allow movement into the free zone, allow re-export outside of the European Union, or destroy or reject the goods.

The most important aspects related to customs rules and procedures are tariff duties, inspection of products and control of documents.

Tariffs

Tariffs are among the main trade barriers that can influence your competitiveness when exporting to Europe. Tariff duties are normally paid by the importer, so they will seek offers from countries where import is duty-free. For most processed fruit, vegetables and nuts imported from developing countries, the tariff rate is zero. This is because developing countries have guaranteed access to the European Union’s Generalised System of Preferences (GSP). In addition to GSP, the European Union has other free-trade agreements with specific countries to reduce or remove tariffs.

In some cases, tariffs still apply. The common ways to calculate tariff duties are:

- Ad valorem – Tariffs are calculated as a certain percentage of import value. For example, prunes imported from Argentina are subject to an ad valorem tariff of 9.6%.

- Specific – Certain value calculated for imported weight. For example, a tariff of €1.38/100 kg is applied to the import of fig paste from Turkey.

- Combined – A combination of ad valorem and specific tariffs. For example, strawberry jam from China is subject to an ad valorem rate of 24% and an additional rate of €23/100 kg.

- Tariff quotas – These apply when the limit on the amount of goods that can be imported at a reduced or zero rate of customs duty is exceeded. An example is the import of olive oil from Tunisia: zero tariffs apply, but export volumes exceeding 56,700 tonnes are subject to a tariff of €124.50/100 kg.

Inspection of products

When processed fruit and vegetables arrive in the European Union, they are inspected and checked by customs authorities. in addition to examining the export documents, the inspection can involve taking samples for analysis in the customs laboratory. In case of non-compliance with European Union food safety rules, the product will be rejected, and in some cases customs authorities may destroy the goods.

Rejection of goods may cause a major financial loss for the developing country exporter. Therefore, it is extremely important to properly check your processed fruit and vegetables before exporting them. This includes having them tested in a laboratory. To find out more about specific tests or requirements that are relevant for processed fruit and vegetables, read our study about buyer requirements.

Control of documents

The most important types of documents required for customs clearance are the certificate of origin, the commercial invoice and transport documents.

- Certificate of origin – Reduced tariffs for exports to Europe can only be applied with a valid certificate of origin. For countries that are part of the GSP schemes, Form A is used as proof of origin. For countries with a preferential trade agreement with the European Union, a EUR.1 certificate is used.

- Commercial invoice – A commercial invoice is a document that customs authorities require as evidence of your export. It basically states the amount of money to be paid for your products.

- Packing list – A packing list specifies the goods/number of goods in individual packages. It usually gives gross and net weights, the dimensions of each package and the number of pallets and packages. It is not required by customs authorities, but it can help customs inspectors if they want to open a certain package for inspection. Even though it is not mandatory, transport companies often require this document.

- Transport documents – Depending on the means of transport used, different documents are carried by the transport company and presented to the European customs authorities. These include a Bill of Lading (commonly used in sea transport as a receipt of goods by the transport company), Road Waybill (used in road transport), Rail Waybill (used in rail transport), Airway bill (used in air transport) and FIATA Bill of Lading (used when products are carried by more than one mode of transport).

- Health certificate – A health certificate, together with an analytical test report, is only necessary for a certain percentage of shipments from specified countries.

- Documents your importer must obtain to import your goods – Although you are not responsible for the documents that your buyer must provide to customs in Europe, you may need to give your buyer correct information to fill them out properly. Those include a Single Administrative Document (SAD), a customs value declaration and a warehouse guarantee.

Please note that a customs value declaration is often mentioned in online export guides as a document issued by the exporter. This is not true. The main purpose of a customs value declaration is to assess the value of the goods in order to apply tariff duties. Tariff duties are commonly paid by your buyer, unless you have agreed on Delivery Duty Paid (DDP) Incoterms. However, developing country exporters rarely use DDP, as they would need to have a registered company in Europe to organise all the import formalities.

Tips:

- Use the Market Access Map to analyse potential competitive advantages based on applied tariffs for your country and other countries. You can learn how to use 'compare' and other functions from instructional MacMap videos.

- Use Access2Markets to quickly check which rules of origin apply for your product.

- Hire freight forwarders to handle export documents and get advice on customs procedures. You can search for an agent on the International Forwarding Association website. Also, you can search for national associations through the website of the European Association for Forwarding, Transport, Logistics and Customs Services. Alternatively, you can search for the relevant association in your country through the International Federation of Freight Forwarders Associations website.

- Check possible additional costs if your country is on the list of stricter import conditions for specific products. Those usually include obligatory payments for specific laboratory tests for a certain percentage of shipments.

4. Select the best transport and logistics options

Over 90% of processed fruit and vegetables are imported into the European Union from developing countries via marine transport. However, in some cases (for example, imports of frozen berries from eastern European countries) road transport is also used. In the rare case of smaller volumes but high prices, air transport is used too. Air transport is likewise used for medical mushrooms (such as cordyceps or reishi) and powdered products such as maca (Peru), cordyceps (China) and ashwagandha (India).

For processed fruit and vegetables, transport is of extreme importance as it keeps the products in the right condition (e.g. frozen products), but it can damage your reputation (you could lose a client because of late delivery) and influences the price (20-40% of the sales price can be logistics costs).

There are many aspects of transport and logistics to consider when organising your export. Some important points for consideration:

- Always try to work with several freight agents and check different rates – Use a good freight forwarding company that takes care of most of the process. Take your time when selecting a logistics company. Send your request for a proposal to multiple operators and be as specific with your questions as possible. After you prepare a shortlist, make your selection and sign a detailed contract. Your contract needs to involve points such as responsibilities, how damaged goods are dealt with, price changes and compensation.

- Check the container before loading – Before you start loading the container, check if it is clean, waterproof (without holes) and well painted (without rust on the inside). When loading the container, consider using moisture-absorbing products like special (food-proof) gel bags. This decreases the risk of moisture damage and aflatoxins. For chilled and frozen products, it is a good idea to check the temperature inside the container with a control thermometer.

- Use the space inside the container smartly – For overseas transport, the basic movement of the container consists of loading onto a train or truck, transport to the port, unloading from the train or truck, inspection, and loading onto the ship (stowing). If the quantity of goods is Less than Container Load (LCL), you can use a groupage service, which is offered by many companies. They arrange goods in such a way that the container can be shared by several companies.

- Select the right Incoterms – The method of transport is also part of the Incoterms and therefore influences your decision about the price and contract you offer. For example, if you are trading large quantities of goods, you can get better offers from transport and insurance companies. In that case, the CIF price (Cost, Insurance and Freight) will usually be more competitive for you. If you have little export experience, it is safer to offer a price based on ExWorks or FOB only.

- Check the transport documents – Transport documents (such as a Bill of Loading) are issued by the nominated carrier or their agent. Check all the details of the transport document and do not accept 'dirty' documents. A transport document is considered 'dirty' when transport companies add a notation that they noticed defective packaging that can cause damage to the goods. Such transport documents do not give any guarantees that you will receive payment for the transaction.

- Check the shipment tracking service – The 'Track and Trace' service enables you to communicate any delays to your customers proactively. One recent development is blockchain technology. Blockchain systems allow each stakeholder in the supply chain to view the progress of goods through the supply chain, monitor the container movement in real-time, and see the status of the customs documents. In addition to tracking the goods, blockchain technology can encrypt important documentation.

Tips:

- Go to the websites of the Transport Information Service and Container Handbook for information on safe storage and transport of processed fruit and vegetables. You can also find specific advice on how to secure cargo for road transport (PDF) in the European best practice guidelines.

- Check the website of the European Logistics Association (ELA) to network with various operators within Europe. ELA also offers training on topics such as logistics, transportation and warehousing. You can also participate in ELA events.

- Find the list of quality certified ship agents and brokers on the FONASBA website.

- Monitor the developments of blockchain application in international transport and logistics through companies such as Hapag-Lloyd, Maersk and CMA CMG.

5. Ensure safe and cost-effective packaging

Optimal export packaging is one of the fundamental aspects in the trade of processed fruit and vegetables. This packaging must:

- Protect the quality characteristics of the product as well as its look, feel and smell.

- Protect the product from bacteriological and other contamination (including contamination from the packaging material itself).

- Protect the product from moisture loss, dehydration and, where appropriate, leakage.

- Not pass any odour, taste, colour or other foreign characteristics on to the product.

There are many different materials and forms used for export packaging of processed fruit and vegetables. You can learn more about specific product packaging in our product-specific studies, in our buyer requirements study and in our Tips to Go Green.

In November 2022, the European Commission proposed a revision of EU legislation on Packaging and Packaging Waste. The current directive will be changed to a regulation and set new targets for packaging collection, recycling and waste reduction. The main aim of the new regulation is that all packaging in the EU 'is to be reusable or recyclable in an economically viable way by 2030'. This has practical implications for suppliers from non-European countries because it includes all packaging that enters the EU.

Upon completion of packing and labelling, you must prepare a packing list that will be used by carriers, cargo handlers, warehouses and customers. A packing list states the following particulars for each package: marks, numbers, gross weight in kg, net weight in kg, dimensions in cm, volume and content description. This list also gives the total number of packages and the total gross weight and volume.

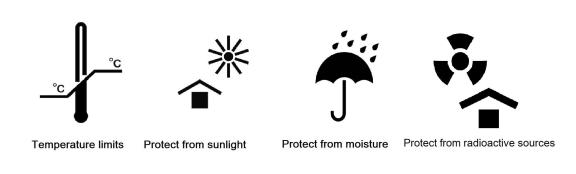

Depending on the product, certain internationally accepted marks are placed on the outside of the packaging. Share these with your customer before shipment and make sure they have all the information required for clearing.

Figure 2: Examples of marks used on the packaging for processed fruit and vegetables

Source: Autentika Global

Bear in mind that packed goods must be within the limits of the size and weight established by the carrier. The majority of European traders prefer to use pallet dimensions of 1,200x800mm (Euro Pallets). In order to avoid pallets overturning, you must ensure the cargo is well-stabilised. The maximum recommended height of a cargo unit is about 1.7m. However, you should ask your customer for the size limitations of their warehouse. Also, pay attention to the types of forklifts you use. Electric forklifts are obligatory when dealing with food, so as to avoid potential contamination from fuel-powered forklifts.

In addition to protective properties, the cost of transport is also influenced by size and weight. Packing and handling costs are reflected in the final cost of the product. Fully utilising the container can yield significant savings in packaging costs. It is important to emphasise that the time required for loading and unloading the container from a vessel can be reduced by 20-25% if the port has appropriate facilities. Please note that in some European countries labour health and safety legislation allows workers to lift a maximum of up to 20 kg.

Figures 3 and 4: Examples of packed goods on pallets ready for shipment

Olive Oil

Nuts in food contact and external packaging

Source: Autentika Global

Tips:

- If you are organising your first shipment to Europe, work with an intermediary company that has experience in packaging processed fruit and vegetables for export. Big export companies have staff specialised in packaging techniques. A good packaging specialist can save your company a lot of money if there is a sufficiently large volume of exports.

- Check computer programs that allow you to calculate and design packaging as well as plan the best arrangement of the goods inside containers and tracks, such as ShipHawk, Logen Solutions, Easy Cargo, packVol and TOPS Pro.

- Check instructions for shipping and storage of different types of processed fruit and vegetables on the website of Transport Information Services.

6. Use the assistance of support organisations when organising your export to Europe

There are many organisations where you can seek support in your own country as well as abroad. Below is a list of the most relevant organisations for exporters of processed fruit and vegetables:

- International Nuts and Dried Fruit Council (INC) – In addition to the international promotion of consumption of nuts and dried fruit, INC provides a lot of information about technical issues related to trade. For example, they publish technical guides for different products, including packaging, transport and storage guidelines. Also, INC organises an e-learning academy covering many topics, including logistics or arbitration rules.

- European Fruit Juice Association (AIJN) represents the European juice industry and provides useful information for its members, including codes of practice and guidelines.

- International Trade Centre (ITC) is a development agency for sustainable trade. It offers publications such as How to Access Trade Finance, Model Contracts for Small Firms and the SME Trade Academy with online courses (some are free of charge), including international transport and logistics.

- Access2Markets is a guide to duties, taxes, product rules and requirements on the EU market.

- International Chamber of Commerce (ICC) has worldwide offices and offers arbitration, export learning tools and information about Incoterms.

- Your own Chamber of Commerce can also provide advice and information. They usually have staff specialised in dealing with certain issues such as transport, trade agreements and legal issues.

Read CBI's Tips for Finding Buyers, Tips for Doing Business and Export to Europe Guide (PDF), as they can help you further understand how to access the European market and provide insights on how European buyers think.

This study was carried out on behalf of CBI by Autentika Global.

Please review our market information disclaimer.

Search

Enter search terms to find market research