Entering the European market for tropical frozen fruit

Food safety certification and frequent laboratory tests of their produce open many doors for frozen tropical fruit exporters to Europe. Sustainable production and implementation of social responsibility standards will provide additional advantages for emerging suppliers. The fastest growing suppliers from developing countries are Vietnam, Peru and Brazil. Keep an eye on the structure of their tropical frozen fruit exports as they may prove to be strong competition provided that you grow the same fruit.

Contents of this page

- What requirements and certifications must tropical frozen fruit comply with to be allowed on the European market?

- Through what channels can you get tropical frozen fruit on the European market?

- What competition do you face on the European tropical frozen fruit market?

- What are the prices for tropical frozen fruit?

1. What requirements and certifications must tropical frozen fruit comply with to be allowed on the European market?

General information on buyer requirements for processed fruit and vegetables is given in our study about buyer requirements on the European processed fruit and vegetable market. The requirements on the sector level will be analysed further on the product level for tropical frozen fruit. The section below deals with specific requirements applying to tropical frozen fruit in Europe.

What are the mandatory requirements?

All food products, including tropical frozen fruit, sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. This also applies to imported products. Only approved additives are allowed. Food products must conform to maximum levels for harmful contaminants, such as bacteria, viruses, pesticide residues and heavy metals. It should also be obvious from the labelling whether a food contains allergens.

Certain plants and plant products entering the EU must have a phytosanitary certificate. However, no phytosanitary certificate is required for the import of 5 fruits: pineapple, banana, coconut, durian and dates. This applies to coconuts, fresh or dried, whether or not shelled or peeled, according to Annex XII, Part C of Regulation (EU) 2019/2072.

If present, additives must be approved by the European safety authorities. Additives should meet the specifications outlined in Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008. Labels should make it obvious to consumers if tropical frozen fruit contains any allergens.

Contaminant control

Food contaminants are unwanted and harmful substances in food that can cause illness. The EU places strict controls on contaminants in food, especially on aflatoxins, as per Regulation (EU) 2023/915 on maximum levels for certain contaminants in food. This regulation entered into force on 25 May 2023. Annex I contains the maximum permitted levels for regulated contaminants. The most common requirements regarding contaminants in tropical frozen fruit are related to the presence of pesticide residues and microbiological organisms.

If a product contains more contaminants than allowed, it will be withdrawn from the market. These cases are reported by the European Rapid Alert System for Food and Feed (RASFF). An example of an incident related to tropical frozen fruit is a border rejection notification from Finland of a shipment of frozen papaya dices from India. The shipment was rejected in January 2022 because of Salmonella contamination. Frozen grated coconut from India was flagged by the United Kingdom in October 2020 because of Salmonella and Escherichia coli.

Keep an eye on rejections of tropical fresh fruit. These rejections can give insight into potential problems that are emerging in your country that could spill over into tropical frozen fruit. For example, Germany rejected a fresh papaya shipment from Thailand in April 2020 because of high pesticide content. Authorities found residue of 4 active ingredients with neurotoxic properties. Similarly, Switzerland recalled Thai mangosteens in June 2022 because of contamination with chlorpyrifos, while Brazilian mangos were recalled in 2021 because of formetanate.

Border control

Official food controls include regular inspections that can be carried out at import or further trade stages. In the event of repeated non-compliance of specific products originating from particular countries, products can only be imported under stricter conditions, such as having to be accompanied by a health certificate and analytical test report. Products from countries that have shown repeated non-compliance are put on a list included in the Regulation (EU) 2019/1793. These products are either subject to a temporary increase in official controls (Annex I) or to special entry conditions (Annex II).

At the moment (August 2023), fresh or chilled pitahaya (dragon fruit) from Vietnam is on this list. As a result, 20% of all pitahaya imported from Vietnam is controlled for the presence of pesticide residue. Ther list also includes jackfruit from Malaysia (50% frequency of checks) and passion fruit from Colombia (10% frequency of checks) because of pesticide residues. Guava shipments from India are also subject to checks (20% frequency) because of pesticide residues.

Pesticide residues

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. The European Union regularly publishes a list of approved pesticides that are authorised for use in the European Union. This list is frequently updated. In 2022, the European Commission approved 27 new implementing regulations that modified this list through new approvals, extensions, renewals, amendments or restrictions. Products containing more pesticide residues than allowed or pesticides that are not approved will be withdrawn from the market.

Most European importers will request a detailed test on the presence of a very large number of pesticides (sometimes in the hundreds). Importers of processed fruit may opt to limit the risk of non-compliance and adopt an even stricter safety margin compared to the official limit.

Microbiological contaminants

The most common types of microbiological contaminants present in tropical fruit are norovirus and salmonella. The main reason for the occurrence of those infectious microorganisms in tropical fruit is primarily related to sanitation issues. Contamination mainly occurs in the production environment and postharvest handling. As such, it is important for developing-country suppliers to educate their employees to implement good hygienic practices and to use clean vehicles for transport. Make sure the water you use for washing is safe. Read more in CBI’s article on washing fruit.

Heavy metals

The European Union’s regulation on food contaminants sets restrictions for lead, cadmium, mercury and tin. In the processed fruit and vegetables sector, high lead or cadmium levels can be found in frozen fruit. A recent example of an incident related to tropical frozen fruit recorded by the European RASFF is the presence of cadmium in frozen pineapple chunks from Costa Rica imported into France via Germany in May 2023.

Chlorate and perchlorate

Legislation on chlorate levels entered into force in the European Union in June 2020. The permitted level of chlorate is set at 0.3 mg/kg for kiwi, passion fruit and prickly pears/cactus fruits. The same limit is set for bananas, mangoes, papayas, guavas, pineapples, durians and soursops. Chlorate is no longer approved as a pesticide, but it can come into contact with food by the use of chlorinated water during processing. Another source may be the use of chlorinated detergents used to clean facilities and processing equipment.

Repacking requirements

The repacking of tropical frozen fruit under controlled conditions is permitted. Repacking must be done quickly at temperatures between 0 and 5°C. After repacking, products are returned into freezing chambers with a regular storage temperature of -18°C.

Tips:

- Monitor the latest updates on MRLs in order to find relevant changes in the permitted residue levels for tropical fruit. To be prepared for potential new changes in the MRLs, read the ongoing reviews of MRLs in the European Union.

- Follow guidelines published by the European Association of Fruit and Vegetable Processors (PROFEL) to prevent transmission of microorganisms by frozen fruit. Invest in hygiene rules training for your suppliers and workers and use clean water for irrigation and spraying.

- Refer to Codex Alimentarius for the Code of Practice for the Processing and Handling of Quick Frozen Foods (PDF). By following recommended good manufacturing practice schemes, you can fulfil requirements on European food safety legislation.

- Read our organising export tips to learn more about custom procedures, payment, logistics and documents used in the export of processed fruit and vegetables.

- Follow the latest information on phytosanitary requirements for selected tropical fruits published by TFNet

What additional requirements do buyers often have?

Quality requirements

Specific quality standards for tropical frozen fruit have not been officially defined by European authorities.

Some basic quality requirements for tropical frozen fruit are:

- Good, reasonably uniform colour, characteristic of the type of fruit and variety;

- Clean, sound and free from foreign matter;

- Free from foreign flavour and odour;

- When presented as individually quick frozen (IQF), the tropical fruits will not be attached to eachother;

- Reasonably free from uncoloured tropical fruit;

- Normally developed with the shape typical for the variety used and of similar varietal characteristics in each package;

- For berry types of fruit (acai berries, acerola) reasonably free from berries that are not whole in shape;

- The fruit should retain its natural flavour, colour, and texture as close to the fresh fruit as possible. Any alterations due to freezing should be minimal;

- European buyers often prefer fruits that are consistent in size for certain applications. Fruits must be appropriately sized and sorted;

- The percentage of defects such as bruising, blemishes and diseases should be minimal.

Although there are no official European standards, it makes sense for exporters to consult some standards for tropical fresh fruit for guidance purposes. Codex Alimentarius published standards for fresh tropical fruits, such as mango (PDF), prickly pear (PDF), avocado (PDF), litchi (PDF), guava (PDF), papaya (PDF) and pineapple (PDF).

Table 1: Common criteria used to define product quality of desiccated frozen mango chunks (example)

|

Presentation |

Mango chunks 20 x 20 mm, frozen IQF |

|

Variety name |

Kent |

|

Brix content |

12° to 13° |

|

pH level |

3 to 4.2 |

|

Size 20 x 20 x 20mm (3/4 inch) Diced |

Breakdown of chunk size:

Other frozen mango forms include different cuts such as cubes, slices, strips and halves. |

|

Flavour |

Typical as fresh mango |

|

Odour |

Characteristic for fresh mango, sweet, free from off-flavours and odours |

|

Partial or Mushy more than ¼ of surface damaged |

<2% in per Lb |

|

Peel no more than ¼ of the surface damaged |

<2% per Lb |

|

Clumping of 3 pieces not easily separated (valid for IQF fruits only) |

2% |

|

Stems and leaves |

Absent |

|

Foreign material |

Absent |

|

Remaining agricultural chemical |

No presence |

Source: Autentika Global

For direct consumption, only varieties with a firm flesh that retain as much of the original texture as possible should be frozen. Fruits for freezing must be clean and sound. The degree of ripeness at harvest has a marked influence on the quality of the frozen product. Prematurely harvested fruits lack flavour and colour. Fruits picked too late are soft and prone to crushing and fungal attack. Fruits should be cooled between harvest and freezing, unless the time can be kept very short.

The industry has set several additional criteria to determine quality for tropical frozen fruit. An important quality indicator for tropical frozen fruit intended for further processing is the brix level (sugar content of water solution). However, the brix level is more important for the juice and jams industry than for retail packing supply.

Some tropical frozen fruits (such as avocado) are commonly produced with the addition of acidity regulators (citric acid) to avoid the oxidation of the fruit. However, as this treatment alters the original taste, some buyers can request frozen fruit without addition of acids.

Keep in mind the specific traits of the product that you are freezing. Some products have more difficult consistencies, such as diced mango, which is sticky, wet and high brix. These products may need to be frozen using more innovative IQF tunnels in order to produce a better-quality frozen product.

Food safety certification

Although food safety certification is not obligatory for tropical frozen fruit under European legislation, it has become a must for almost all European food importers. Most established European importers will not work with partners who cannot provide products with the desired type of food safety certification.

The majority of European buyers will ask for a Global Food Safety Initiative (GFSI) recognised certification. GFSI does not provide food safety certification, rather it recognises a number of certification programmes that meet the GFSI benchmarking requirements. For tropical frozen fruit, the most popular certification programmes, all recognised by GFSI, are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Please note that this list is not exhaustive and food certification systems are constantly developing.

Make sure to check which certifications are currently recognised against the latest version of the GFSI benchmarking requirements. Food certification systems are constantly developing. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements, so there are no major discrepancies in their requirements. However, certain retailers may prefer one certification over another, or demand additional certifications based on their own internal policies.

For example, British buyers often require BRCGS, while IFS is more common for German retailers. These preferences are sometimes historical. For example, IFS was initially developed as a joint venture of the French retail association FCD and the German retail association HDE. Note also that food safety certification is only a basis for exports. Major buyers will usually visit/audit production facilities before starting a business relationship.

Corporate Social Responsibility

Companies have different requirements for corporate social responsibility. Some companies will require adherence to their code of conduct or common standards such as the Supplier Ethical Data Exchange (Sedex), Ethical Trading Initiative (ETI) and the amfori BSCI code of conduct.

If tropical frozen fruit products are destined for retail, suppliers will be asked to follow the specific Code of Conduct developed by the retailers. Many importers will ask you to follow their own specific code of conduct. Most European retailers have their own codes of conduct, such as Lidl (PDF), REWE, Carrefour (PDF), Tesco and Ahold Delhaize.

Packaging requirements

The most common types of frozen tropical fruit packaging are polyethylene (PET) bags placed in carton boxes. The carton boxes are packed on EURO pallets (80 x 120 cm), protected by polyethylene foil. Cardboard must be durable enough to not be deformed under the weight on the pallet due to prolonged storage. Cardboard boxes are sealed with tape. The size of the packaging may vary according to the buyers’ requests.

Retail packaging solutions include pouches, vacuum packaging, plastic bags, carton packaging, plastic containers and foil bags. With the increasing demand for eco-friendly solutions, many firms are looking into sustainable packaging options for frozen fruits. This can include biodegradable plastics, recycled materials and other innovative solutions.

The choice of the right packaging solution is based on the specific needs of the product, target audience and distribution channels. Proper packaging ensures that the frozen tropical fruits retain their freshness, taste and nutritional value until they reach the consumer.

Labelling requirements

The name of the food as declared on the label should include the name of the fruit and the words “quick-frozen” or “frozen”. The label should also include the style, as appropriate: “IQF whole”, “chunks”, “crushed”, and so on (for example, “quick-frozen mango chunks”). If a packing medium is used, this should be included on the label too. For example: “quick-frozen papayas in sugar syrup”.

In case of quick-frozen tropical fruit in bulk packaging, the information required above must either be placed on the container or be given in accompanying documents. The product name and the name and address of the manufacturer or packer must appear on the container. In addition to the type of fruit, it is common that the product specification also declares the crop year, variety and the brix level.

In the case of retail packaging, product labelling must meet the European Union Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling (tropical frozen fruits are not included in the allergen list of the regulation) and legibility (minimum font size for mandatory information) more clearly.

European Union rules require companies to label the origin of the food product. If a product is made from several ingredients, the indication of origin must be placed for the ingredients that represent more than 50% of the product. For example, if frozen mango chunks are packed in the Netherlands they are labelled with “Made in the Netherlands”, but the origin of the fruit must also be indicated. This can be done by indicating a country (for example, Peru), or by indicating “non-EU” or by declaring “mangoes do not originate from the Netherlands”.

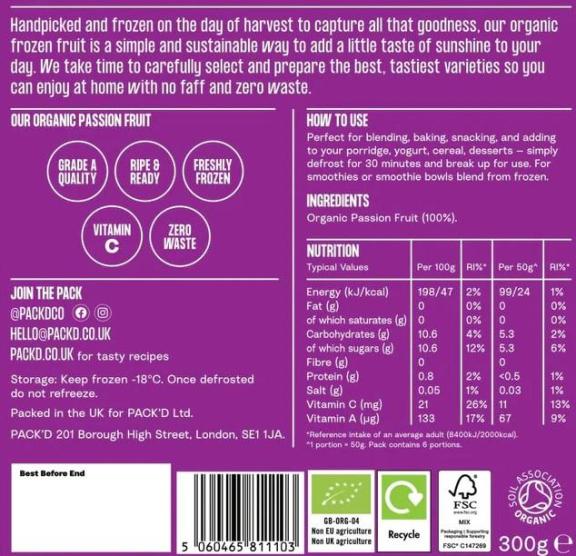

Figure 1: Example of retail package labelling

Source: Autentika Global

Tips:

- Refer to the Codex Alimentarius for the Code of Practice for the Processing and Handling of Quick Frozen Foods (PDF). The code was developed in 1978 and revised in 2008.

- Get a food safety certification. Carefully select a certifying company and consult with your preferred buyers about their certification preferences.

- Consult some technical sheets with specifications for tropical frozen fruits from Peru’s Agromar Industrial.

- Consult the foodstuffs labelling and packaging advice from the European Union’s Access2Markets portal.

- Check out some frequently used terms in the fruit industry in this industry ‘lingo’ overview.

What are the requirements for niche markets?

Organic tropical frozen fruit

To market tropical frozen food as organic in Europe, it must be grown using organic production methods according to European legislation. Growing and processing facilities must be audited by an accredited certifier before you may put the European Union’s organic logo on your products, as well as the logo of the standard holder (for example, Soil Association in the United Kingdom or Naturland in Germany).

Organic farming in the EU is expanding quickly, thanks to rising consumer interest in organic goods. To address this, the EU implemented new organic legislation as of January 2022. It strengthens the control system, boosting consumer trust in EU organic products and setting the same standard for local and imported organic products. Moreover, a wider range of products can now be marketed as organic under these guidelines.

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex of the Commission Regulation defining imports of organic products from third countries.

For equivalent countries (including Argentina, India and Tunisia) certificates are issued by control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Sustainability and Corporate Social Responsibility (CSR) certification

For the overview of developments in the sustainability initiatives in the European market, read our study on trends on the European processed fruit and vegetables market.

Firms have different requirements for social responsibility. Some companies will insist on their code of conduct or the following of common standards such as the Sedex Members Ethical Trade Audit (SMETA) standard. It provides a globally recognised way to assess responsible supply chain activities, including labour rights, health & safety, the environment and business ethics. Other alternatives include Ethical Trading Initiative’s Base Code (ETI), amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and B Corp certification.

Fairtrade International and Rainforest Alliance, although widely recognised certification schemes, are not very frequently used for certification of tropical frozen fruit. Fairtrade international has developed a specific standard for prepared and preserved fruit and vegetables for small-scale producer organisations but frozen products are rarely certified as freezing equipment is rather costly and not frequently bought by cooperatives in developing countries.

As certification of sustainably produced frozen tropical fruit is still in its early stages, companies can prepare for formal certification by taking steps to address sustainability risk in their operations. FAO is leading a project for building responsible global value chains for the sustainable production and trade of tropical fruits.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) propose specific restrictions on diets. If you want to focus on the Jewish or Islamic ethnic niche markets, consider implementing Halal or Kosher certification schemes. There are several organisations that provide Kosher certification in Europe, such as the Kosher London Beth Din (KLBD) that provides guidelines on how to obtain the certification. Halal certification in Europe can be obtained via certifying bodies, such as Halal Certification Services (HCS) that provides certification services.

Vietnam’s Hanoi Green Food exports Halal-certified tropical frozen fruit mixtures to markets around the world. Bangkok-based Cogistics also exports Halal-certified frozen papaya, while Bangkok-based Nuboon exports Halal-certified frozen passion fruit, mango, lychee, mangosteen and tamarind puree. The European Muslim community is predicted to grow from the current 4.9% of population to more than 7% by 2050, according to a report published in August 2023.

Tips:

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

- Check the guidance for importing organic food to the UK to familiarise yourself with the requirements of the UK organic market.

- Check out the sustainability best practices (PDF) for the mango industry developed by the National Mango Board in the US.

- Consult the latest FAO technical briefs on sustainable production of individual tropical fruits.

2. Through what channels can you get tropical frozen fruit on the European market?

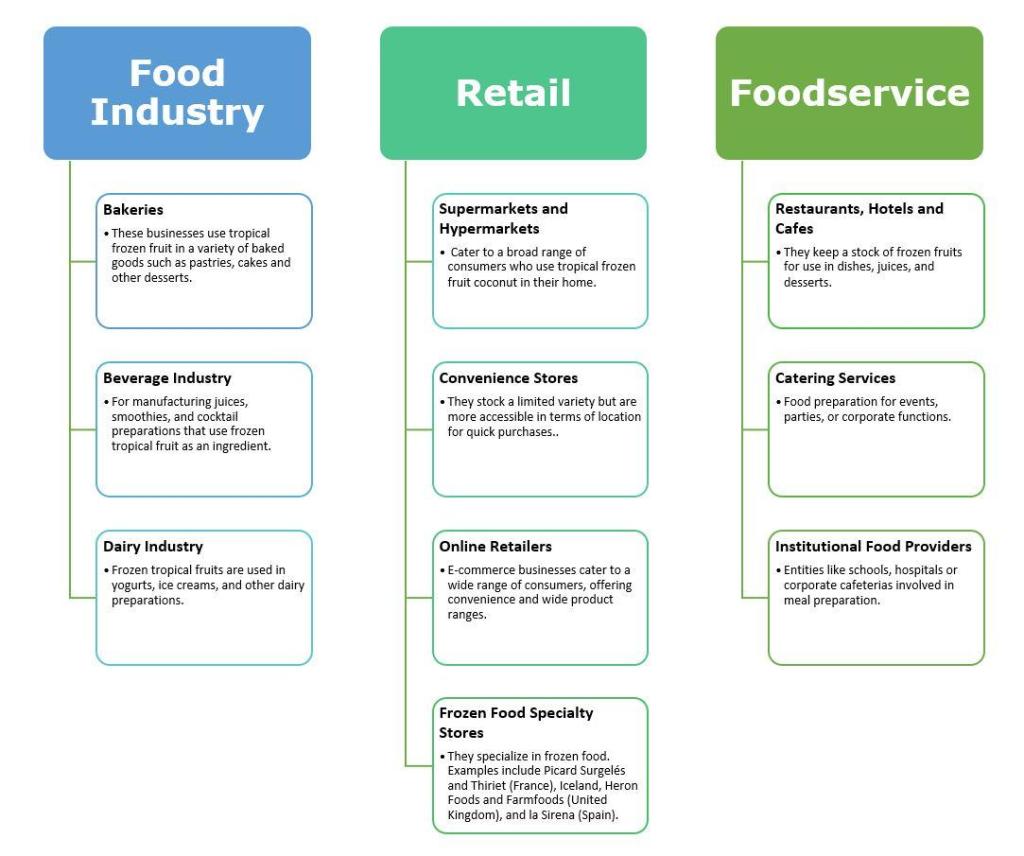

The largest quantity of tropical frozen fruit in Europe is used by the food processing industry but the share of retail and foodservice sales is increasing due to increasing consumption of smoothies and healthy snacks.

How is the end-market segmented?

A high share of imported tropical frozen fruit goes to the food processing industry, such as bakeries and the dairy industry. There are no exact data, but the food processing segment is roughly estimated at a 70% share of the European tropical frozen fruit market. This is followed by the retail and foodservice segment. Healthy, convenient and faster-to-prepare foods, such as smoothies, are gaining in popularity. As such, retail and foodservice sales are increasing.

Figure 2: End-market segments for tropical frozen fruit in Europe

Source: Autentika Global

Food Industry Segment

The most common food industry users of tropical frozen fruit in Europe include the following:

- Dairy and ice-cream industry – In the dairy industry, tropical fruit is used to manufacture yoghurts and other milk-based drinks. Suppliers of fruit preparations make such preparations from tropical frozen fruit. Frozen fruit crumbles are also often used as ingredients in ice cream and frozen yoghurt products.

- Bakery and confectionery industry – In the bakery industry, tropical frozen fruit is mainly used in the frozen baked sub-segment. This type of fruit is used to produce cakes, tartlets and other desserts. The bakery industry also uses significant quantities of fruit fillings for pies, pastries and other products. These fillings are commonly supplied by specialised food ingredient companies.

- Beverage industry – Tropical frozen fruit is used for the production of juices and smoothies, mainly in homes and smaller venues. Industrial smoothie producers more commonly use frozen purees. Depending on the blend, tropical frozen fruit purees (such as mango and pineapple) are often mixed with banana puree (to get a thick consistency) and other fruit and vegetable juices to get specific flavours.

Retail

Retail chains sometimes buy directly from developing country exporters, but they are mostly supplied by importing companies. Consolidation, market saturation, strong competition and low prices are key characteristics of the European retail food market. Currently, online retail sales of tropical frozen fruit account for a small share of the market but they are forecasted to increase in the near future.

Leading food retail companies in Europe differ per country. The companies holding the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, ALDI, EDEKA, Leclerc, Metro Group, REWE Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands). In addition, several retail chains in Europe specialise in the supply of frozen food such as Iceland, Farmfoods and Heron Foods (United Kingdom), Picard Surgelés and Thiriet (France), and La Sirena (Spain).

Keep in mind that several retail alliances coordinate buying operations in Europe:

- Coopernic (includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group);

- Carrefour World Trade or CWT (includes Carrefour, Système U, Match and Cora);

- AgeCore (Colruyt – cooperation on national brands and private label, Conad, Eroski and Coop Switzerland);

- European Marketing Distribution or EMD (Colruyt – cooperation only on private label, Pfäffikon, Countdown, Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia);

- Epic Partners (EDEKA, Système U, Esselunga, Picnic, Migros, Jerónimo Martins and Ica).

Foodservice

The foodservice channel (hotels, restaurants and catering) is usually supplied by importers. The foodservice segment often requires specific packaging sizes (1-5kg), which differ from bulk or retail packaging packs. Some catering companies have specialised in the supply of frozen fruit mixtures for smoothie bars and restaurants, such as Projuice (the United Kingdom), ACAI (Germany) and Juice Factory (Austria). Smoothies and frozen fruit mixtures have also benefited from the strong growth in the home deliveries market.

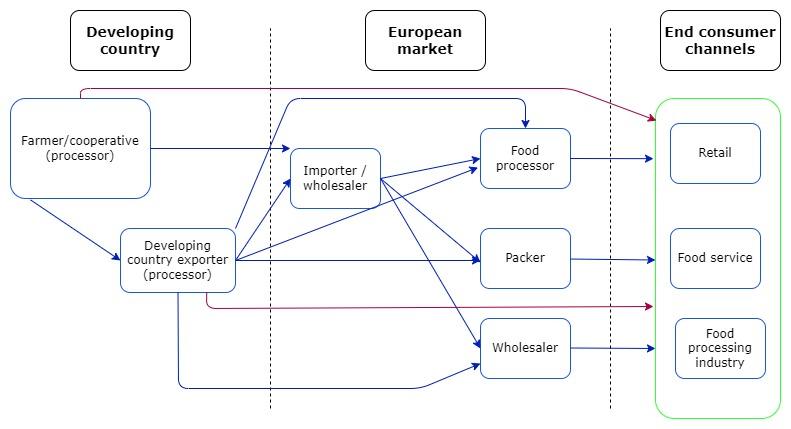

Through what channels does tropical frozen fruit end up on the end-market?

The most important channels for tropical frozen fruit in Europe are specialised (frozen fruit) importers/wholesalers and food processors. Although the largest user of tropical frozen fruit is the fruit processing industry, in the majority of cases they do not import directly but rather via importers. Sometimes packed tropical frozen fruits are sold directly to European retail chains. However, trading companies usually act as intermediaries and participate in the tender procedures of retail chains.

Figure 3: European market channels for tropical frozen fruit

Source: Autentika Global

Importers / wholesalers

Importers/wholesalers re-sell tropical frozen fruit to either food processors or packers. Some importers also own packing equipment to repack the produce for direct supply to end-market segments.

For new suppliers, the challenge is to establish long-term relationships with well-known importers, as they usually already work with selected suppliers. Well-known importers perform regular audits and visits to producing countries. As a new contact, you would often need to offer the same quality but at better prices than your competitors, at the start of the relationship.

The positions of importers and food manufacturers are being put under pressure by retail. The higher requirements from the retail industry determine the supply chain dynamics from the top down the chain. Pressure is translated into lower prices but also added-value aspects, such as transparency and therefore sustainable, natural, organic, or fair-trade products. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred developing-country suppliers.

There are many importers that are specialised in frozen products, with many of them importing a wide range of such items. Examples of large importers in the European frozen fruit market include Crops (Belgium) Greenyard Frozen (Belgium), Dirafrost (member of the Austrian AGRANA group), Lamex Food Group (UK), Binder International (Germany), Descours (France), Ardo (Belgium) and Grunewald (Austria).

Food processors

Food processors are a specific segment within the tropical frozen fruit market. Some companies are specialised as intermediaries between suppliers of tropical frozen fruit and industrial users. They are often specialised in the production of fruit fillings and preparations used in the bakery, confectionery, dairy or ice cream industry. These fruit preparations can be made from frozen fruit as a main ingredient. Ingredients are typically customised for each client and may include sugar, gelling agents, thickeners and concentrated juice.

Fruit preparation producers usually produce a wide range of products and act as food ingredient suppliers for many food industries. Examples of food ingredient suppliers that offer fruit preparations include Kerry (Ireland), ADM WILD (multiple countries inside and outside Europe), Döhler (Germany), FDL (the United Kingdom) and AGRANA (Austria). Several famous producers of jams and fruit spreads also offer fruit preparations. Some examples of such companies are Zentis (Germany), Zuegg (Italy) and Andros (France).

Packers

Frozen fruit packing companies are usually importers but also re-pack imported tropical fruit under their own brand or private label. Some importers that supply their own brand to the retail segment are Crops and Ardo. In some cases, suppliers from developing countries directly pack for retailers in Europe.

What is the most interesting channel for you?

Specialised frozen fruit importers are the best contact for exporting tropical frozen fruit to the European market. Importers usually have good knowledge of the European market and they monitor the situation in the tropical frozen fruit producing countries closely. Therefore, they are your preferred contact, as they can inform you about market developments and provide practical advice for your exports. Normally, importers also import other types of frozen fruit and vegetables, so offering several (tropical) fruits can increase your competitiveness.

In addition to specialised importers, food ingredient suppliers are also an interesting channel for market entry in this sector. In some cases, developing-country exporters can also supply other segments directly. However, be aware that direct supply to the retail segment is demanding as it requires a lot of investment in quality and logistics.

Moreover, compared to the general sector of frozen fruit and vegetables, the food industry is a relatively large segment for frozen tropical fruit, leaving less size and opportunities for areas such as food retail and food service.

Tips:

- Customise products strategically when choosing a preferred channel. For packers, the shape, colour and taste of IQF products are more relevant. For the food industry channel, the chemical composition of the frozen product may be more important.

- Search the 2023 list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for your tropical frozen fruit within the food ingredient segment.

- Understand the pressure by retailers for sustainable products and make yourself more competitive by investing in different certification schemes such as corporate social responsibility (CSR), organic and food safety.

- Watch a 2023 Deutsche Welle documentary for more insight on the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

- Read our tips about doing business with European buyers of processed fruit and vegetables and finding buyers on the European market for processed fruit and vegetables.

3. What competition do you face on the European tropical frozen fruit market?

Which countries are you competing with?

The leading suppliers of frozen tropical fruit products to Europe are Peru, Vietnam and India. These 3 countries are the only suppliers amongst developing countries that have exported around 10,000 tonnes of tropical frozen fruit to Europe annually. Brazil, Mexico and Ecuador export less than 5,000 tonnes of tropical frozen fruit to Europe.

Source: Autentika Global, GTA, 2023

Peru: Leading supplier with steady growth

In 2022, Peru exported around 27,000 tonnes of tropical frozen fruit to Europe. With a share of 44% of the total supply to Europe, Peru is by far the largest exporter of tropical frozen fruit to Europe. Moreover, Peru realised a strong growth in the past 5 years. The average annual growth rate was 10%, which is a very high rate for the largest supplier. The high share, combined with the strong upward growth trend, makes Peru a formidable competitor for exporters of tropical frozen fruit.

Within Europe, most of the tropical frozen fruit is exported to the re-exporting countries the Netherlands (35%) and Belgium (25%). They are followed by Germany (16%) and Poland (13%). Peru’s exports to all four countries have increased significantly between 2018 and 2022.

The most important tropical frozen fruits exported by Peru are mango, avocado, passion fruit and papaya. The country exported $131.2 million of frozen mango in 2021, followed by $78.1 million worth of frozen avocado and $5.0 million worth of frozen passion fruit. Exports of frozen papaya totalled 1.3 million in 2021, according to a frozen fruit report (PDF) published by the Peruvian Association of Exporters (ADEX) in October 2022.

However, many European clients are increasingly buying frozen mango from Asian origins because product prices are lower. Furthermore, shipping rates from Asia to Europe are often more competitive than those from Peru to Europe. Peru sends roughly half of its frozen mango shipments to the US and Canada. Mango production is mainly concentrated in the areas Piura, Lambayeque and Ancash.

Vietnam: The fastest growing exporter

Vietnam’s exports to Europe have almost tripled, from 5,607 tonnes in 2018 to 15,472 tonnes in 2022. In volume terms, the country has shown strong growth in the past 5 years (29% per year on average), which resulted in a share of 25% of European imports in 2022.

The 3 most important destinations within Europe are the Netherlands (32%), Germany (17%) and Belgium (14%). Exports to these countries increased substantially in the past 5 years. The highest growth was seen in exports to Poland, where exports increased more than twenty-fold from 90 tonnes in 2018 to 2,147 tonnes in 2022.

Vietnam’s success is not limited to just frozen fruits. Fresh fruit exports are also expanding rapidly and this indicates that Vietnam’s success is likely to be long-lasting. According to the Ministry of Agriculture and Rural Development, overall fruit exports have increased 39% year-on-year to $1.97 billion in the first 5 months of 2023. Most of this growth is due to China's increased purchases of tropical fruits such as dragon fruit, durian, mangoes and jackfruit following the end of the Covid-19 restrictions.

Vietnam initially focused mostly on dragon fruit shipments to China according to experts from the country’s largest fruit exporter, The Fruit Republic (TFR). However, the tide is changing, and more effort has been channelled into exports of bananas, mangoes and durian over the past 5 years. As Vietnam was heavily dependent on fruit exports to China, efforts are being made to diversify exports to other destinations. In recent years, this has fuelled the growth of exports to Europe.

The Mekong Delta contributes 60% to 65% of Vietnam’s total fruit export revenue. However, there are some risks for growers in the region in terms of sustainability of production. Production in the Mekong Delta has become increasingly susceptible to drought and salinity intrusion (PDF). According to Vietnam’s Ministry of Agriculture and Rural Development, drought and salinity intrusion affected 25,000 hectares of fruit crops in the Mekong Delta in 2020.

Vietnam’s domestic fruit industry views the EU-Vietnam free trade agreement (EVFTA), which took effect on 1 August 2020, as another opportunity for Vietnam to increase fruit exports in the coming years. The EU and Vietnam signed the Trade Agreement and an Investment Protection Agreement on 30 June 2019. The agreement contains provisions to make it easier to export or import fruit and vegetables.

As for frozen fruit, Vietnam produces a wide variety of tropical frozen fruit such as frozen mango, pineapple, passion fruit, avocado and pitahaya. Most frozen fruit manufacturers are located in the Southern and Western provinces such as Can Tho, Tien Giang, Hau Giang, Lam Dong and Daklak. Frozen fruit manufacturers vary in size. Large manufacturers can produce between 80 to 100 tonnes per day, while there also are companies with a small capacity (2 to 5 tonnes per day).

India: A major global producer of tropical fruit

With a volume of 9,598 tonnes in 2022, India is the third-largest supplier of tropical frozen fruit to Europe. India is home to about 1,000 mango varieties. However, only a few varieties are commercially cultivated throughout India. The major mango-growing states are Andhra Pradesh, Uttar Pradesh, Karnataka, Bihar, Gujarat and Telangana. Andhra Pradesh was the largest mango producing region with a share of 24% in 2021-2022.

India is the world’s largest mango market and most locally produced mango fruit is sold on the domestic market. The peak mango season in India is from April to July in the southwest. Moving to the north, mango harvesting shifts to the June-August period.

In 2018 and 2019, India was the second-largest exporter of tropical frozen fruit to Europe. However, after 2019, Vietnamese exports surged, while India’s exports remained stagnant. In the past 5 years, the export volume declined by 2.1% per year. In 2018, India’s share of the European market was 23%, while in 2022 its share had decreased to 16%.

Most of India’s tropical frozen fruit goes to the Netherlands (42%), followed by Belgium (15%), Spain (10%), Poland (9%) and Germany (8%). Although exports to the Netherlands increased slightly during this period, exports to Belgium, Spain and Poland increased slightly. Indian tropical frozen fruit exports to Germany more than halved, from 1,500 tonnes in 2018 to just 736 tonnes in 2022. A slightly less pronounced drop was seen in exports to the United Kingdom.

Mexico: Losing its competitiveness in Europe

Mexican exports of tropical frozen fruit to Europe fluctuated in the past 5 years, but overall, there is a clear downward trend. With a negative average growth rate of 22.3%, the supply to the European market decreased from 3,793 tonnes in 2018 to 1,383 tonnes in 2022. As a result, Mexico’s share in the European market decreased from 8.5% in 2018 to 2.2% in 2022.

The main destinations of tropical frozen fruit from Mexico to Europe are the Netherlands (39%) and Belgium (26%). Together they account for almost two-thirds of the total volume sold on the European market. Other important destinations within Europe are Latvia (12%), United Kingdom (9%) and Finland (8%). Most of these countries are markets in decline for Mexican exports, with the exception of the United Kingdom.

Mexico is a leading exporter of tropical fruit, such as mango, avocado and papaya, and these fruit types are also exported in frozen form. According to Empacadoras de Mango de Exportacion (EMEX), Mexico is the global leader in exporting fresh mangoes to the world. Mexico is also the fifth-largest global producer of mango fruit. The states that have optimal conditions for mango cultivation are Guerrero, Sinaloa, Nayarit, Chiapas, Oaxaca, Michoacan, Veracruz, Colima, Jalisco and Campeche.

The season for production and export runs from February to September. This is a period of relative scarcity in the market for mangoes, especially the Kent variety for the European market. The main varieties that are produced in Mexico are Manila, Ataulfo, Kent, Keitt, Tommy Atkins and Hadden. Some 98% of the mango produced in Mexico is exported as fresh, the remaining 2% is exported as frozen, pulp or juice.

Brazil and Ecuador: Europe’s supplementary suppliers

Brazil and the Ecuador have a relatively small share of the European market, which is similar to Mexico’s share (around 2%). Brazil’s export volume increased in the past 5 years at an average rate of 10%. The total volume increased from 1,054 tonnes in 2018 to 1,514 tonnes in 2022. In the same period, Ecuador grew even faster, at an average growth rate of 16.5%, reaching a total volume of 1,258 tonnes in 2022.

Four-fifths of the tropical frozen fruit shipped from Brazil to Europe is exported to the Netherlands. The share of the next 3 largest destinations (Portugal, France and Italy) is much smaller. The top two destinations of Ecuador are Poland (49% share) and United Kingdom (23% share).

Brazil exports frozen acai (often frozen puree that is not captured in the export numbers above) and also frozen passion fruit and mango to Europe.

Tips:

- Try to copy successful strategies from developing country exporters that already have a share on the European market, such as Peru, India, Vietnam and Mexico.

- Follow free news updates on exotic fruit markets published by Fruitnet.

- Monitor developments in Vietnam’s successful and growing fruit industry through regular news updates published by the country’s agriculture ministry.

Which companies are you competing with?

There are many companies producing, processing and exporting tropical frozen fruit that supply the European market. Each company has its own strategies for exports to the European market. The examples listed below are illustrations of some of the leading exporters in the industry, as there are many other prospective companies that cannot all be mentioned.

One of the common characteristics of the leading tropical frozen fruit suppliers to Europe is vertical integration. This is done either by tightening cooperation with farmers or by increasing their own production areas. These activities are mainly aimed at increasing the traceability of the collected and processed tropical fruit. Another characteristic is increased food safety controls, through frequent laboratory tests, and food safety certification.

Peru

Some of the largest tropical fruit exporting companies in Peru are Viru, Camposol, Agromar Industrial, Ecosac and Mebol (a frozen fruit subsidiary of Industrias Alimentarias del Peru).

Camposol is a vertically integrated global produce company that has been expanding into new markets in recent years. It is one of the largest employers in Peru. In the fruit segment, their assortment includes mangoes, avocados and blueberries. The company offers its products in different formats: fresh as well as frozen IQF.

In its Peruvian market, the company has the following international certifications: Global Gap, BRC Food, IFS Food and Organico (for food safety), SMETA, GRASP and Rainforest Alliance (for social responsibility, ethics and sustainability), and BASC and AEO (for safe trade).

Other examples of important tropical frozen fruit suppliers in Peru are Naturandina, INDUFRUT, El Frutero, Dominus, Delfrutto, Maqfruex del Perú and Sobifruits.

India

Sahyadri Farms is a a large Indian exporter of frozen fruits and vegetables, including frozen mango and frozen guava pulp. Sahyadri is one of the biggest players in India with respect to fruit and vegetable processing capacities. The company has numerous food quality certifications received from authorities in India and all over the world. These include certifications such as BRCGS, GLOBALG.A.P. and Fairtrade, as well as company certificates such as Tesco Nurture 10 (TN10).

Other examples of tropical fruit suppliers in India are Capricorn, ABC Fruits, B.Y. Agro & Infra, Validal and Allana.

Companies from other supplying destinations

Examples of other tropical frozen fruit suppliers to Europe are:

- Vietnam: An Giang Food and Vegetables (ANTESCO), Dong Giao Foodstuff Export (frozen pineapple, mango and lychee), Kim Minh International (many fruits), Global Food (frozen lychee, pineapple and passion fruit), HungHau Foods (frozen banana and mango), TS Food (frozen pineapple, banana, mango and durian) and Nafoods.

- Mexico: Frozen Pulps de Mexico, Freshcourt Mexico (frozen avocado), Grupo Comavo (frozen mango, avocado, papaya, passion fruit and pineapple), Fruvex and Mexifrutas (frozen mango, avocado, papaya, guava and jackfruit).

- Brazil: Frutamil (frozen pineapple, papaya, mango, passion fruit) and Demarchi.

- Ecuador: Quicornac, El Frutal, Productos Man Zhi and Frozentropic.

Tips:

- Regularly visit leading European trade fairs such as Fruit Logistica, Anuga, SIAL and Food Ingredients to meet your competitors.

- Read the latest mango, guava and papaya crop reports published by India’s fruit pulp and puree exporter ABC Fruits.

- Follow developments in the Peruvian and global frozen and fresh fruit markets by following commercial updates and market reports from ADEX (in Spanish).

- Keep an eye on the performance of the strengthening Vietnamese tropical fruit sector with the help of news reports from Vietnam’s HungHau Foods.

Which products are you competing with?

Major substitute products for frozen tropical fruit are fresh tropical fruit. Some consumers may wrongly think that freezing can have an impact on fruit nutritional values and decrease the quantity of some nutrients such as vitamins. However, a well-known and often-cited study from the University of California has shown that the vitamin content of frozen fruit and vegetable commodities is comparable to and occasionally higher than that of their fresh counterparts.

Fresh fruit consumption is officially supported by European authorities such as the European Fresh Produce Association (Freshfel). However, the fresh fruit industry is not a true competitor. Freshfel actively and tirelessly promotes reaching the minimum daily goal of 400g per capita of fruit and vegetables recommended by the WHO. The Freshfel Europe Consumption Monitor released in 2023 confirms that only a few countries in the EU reach the recommended goal of at least 400g of fruits and vegetables/day/capita.

Russia’s war against Ukraine has caused instability in energy prices across Europe, which has forced buyers to carefully select the products to be stocked up. Many buyers give priority to products that are most in demand (vegetables) over those in lower demand. This effect has been more pronounced in Europe than in the US and Canada, where energy markets were less affected by the conflict. This is the reason why European countries may be slightly less willing to purchase and stock frozen fruit if energy prices remain volatile.

Tip:

- Read our study on fresh exotic tropical fruit to understand the competition from fresh products.

4. What are the prices for tropical frozen fruit?

Tropical frozen fruits are widely traded commodities. The range of tropical frozen fruit is wide, and for that reason indications of margins are rather rough. Additionally, comparisons between competing countries are not easy because countries produce different types, packaging sizes, fruit varieties and qualities.

For some types of rarer tropical fruits, buyers are not well aware of the different varieties, but for the major tropical fruits, differences between varieties can strongly influence the price. For example, the Alfonso and Kesar mango varieties are usually more expensive than other varieties such as Kent, Raspuri and Totapuri (which is more used for purees).

In addition, the price of organic products is generally much higher. For example, the price of frozen conventional Kent mango chunks from Peru mostly ranged between €1.35/kg and €1.55/kg (CNF Rotterdam) between 2018 and 2021. In the same period, the price of Kent frozen organic mango chunks ranged mostly between €1.63/kg and €1.87/kg.

High demand for frozen mango chunks in 2021 was sustained well throughout 2022 because of the small crop. In the past few seasons, the mango market has experienced sharp fluctuations.

Very roughly, it can be estimated that the Cost, Insurance and Freight (CIF) price represents around 40-50% of the retail price. The best option to monitor prices is to compare your offer with the offer from the largest competitors. A very rough breakdown of the prices is shown in the table below:

Table 2: Sample tropical frozen fruit price breakdown

|

Steps in export process |

Type of price |

Margin % |

Example: frozen mango chunks |

Example: frozen pineapple chunks |

||

|

|

|

|

Absolute margin in € |

Price / kg in € |

Absolute margin in € |

Price / kg in € |

|

Fruit production |

Raw material price (farmers’ price) |

n.a. |

- |

2.80 |

- |

2.30 |

|

Handling, processing and selling bulk product |

FOB or FCA price |

20-30% |

0.85 |

3.65 |

0.70 |

3.00 |

|

Shipment |

CIF price |

10-20% |

0.55 |

4.20 |

0.45 |

3.45 |

|

Import, handling and processing |

Wholesale price (value added tax included) |

10-20% |

0.60 |

4.80 |

0.55 |

4.00 |

|

Retail packing, handling and selling |

Retail price (for average packaging of 250g) |

40-50% |

1.96 |

6.76 |

1.56 |

5.56 |

Source: Autentika Global, Market research compilation based on industry sources

Please note that the share of the retail price paid to farmers varies a lot between producing countries, harvesting season and type of the product.

Tip:

- Subscribe to S&P Global Commodity Insights to be regularly updated on frozen fruit export prices. This portal is a respected market information service for food ingredients, including tropical frozen fruit.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research