How to successfully attract domestic and regional markets

As tourism recovers from the pandemic, you have good opportunities to diversify your product offering and attract more regional and domestic tourists. Domestic tourism is the largest segment of global tourism, accounting for about 71% of spending. Domestic and regional tourism shares many niches with long-haul tourism, such as adventure, nature, culture, wellness and business. But visitors have different needs – and you need to understand what they are. Partnerships and joint initiatives are good ways to enter this market.

Contents of this page

- What is domestic and regional tourism?

- Why focus on domestic and regional markets?

- Discover characteristics of groups of domestic and regional travellers

- Assess niche segments for domestic and regional travel

- How to attract domestic and regional markets?>

- Join national initiatives to promote domestic and regional tourism

- How to identify emerging trends and developments

1. What is domestic and regional tourism?

Domestic tourism refers to residents of a country travelling for any purpose – including leisure, business or visiting friends and relatives (VFR) – within that country.

Regional tourism means travel to neighbouring countries within the same region, such as east Africa, west Africa, south-east Asia or Central America, and so on.

Most domestic and regional tourists are citizens of a country who travel within it and/or in the region. But this group also includes non-citizens living in that country or region; they are often referred to as expats (expatriates).

Note that Europe, North America, Australia and New Zealand are referred to collectively as “long-haul markets” in this report.

2. Why focus on domestic and regional markets?

Covid-19 had a serious impact on the tourism industry. For many people, domestic tourism was the only possible form of travel for much of 2020. Some regions, like Europe, also allowed limited cross-border travel for regional tourism. But most long-haul travel was not possible for many months. The pandemic showed that long-haul travel markets are very sensitive to factors like health and safety, politics, security and war.

As the world slowly reopened to tourism, it was clear that domestic and regional tourism was driving recovery of the sector. People still wanted to travel, but safely, and found plenty to enjoy in their own countries and regions. Funds to help tourism recover were often targeted at domestic and regional tourism initiatives. For instance, Thailand’s US$722 million subsidy to boost domestic tourism and the Belizean Traveller Campaign to encourage locals to be tourists in their own country.

New trends show that tourists’ perceptions of travel are changing. They want to travel more meaningfully and more sustainably. They want to know that their travel habits will have a positive impact on the planet and local communities. “Staying local” has become more popular. Climate change and commitment to net-zero emissions are driving sustainability across all sectors.

All these factors demonstrate that domestic and regional markets present good opportunities for local operators to reach new markets and to diversify from reliance on long-haul markets.

Table 1: Characteristics and benefits of domestic and regional tourism

| Factor | Characteristics of domestic and regional tourism |

| Size of market |

Domestic tourism is the largest segment of global tourism. In all, 9 billion domestic tourism trips were taken globally in 2018. That compares with 1.4 billion international tourism trips. This means that domestic tourism is more than six times larger than international tourism. More than 50% of domestic tourism trips were taken in the Asia Pacific region. |

| Value of market |

Spending on domestic tourism is higher than inbound spending in most large destinations. It accounted for about 71% of global tourism spending, US$3,971 billion, in 2018. This shows that domestic tourism is an important contributor to a country’s economy, even though domestic tourists typically spend less than international ones. |

| Top destinations | Top destinations for domestic tourism in the developing world include India and China (the two largest), Brazil, Thailand, Malaysia, Indonesia, Mexico and Turkey. |

| Sustainable travel |

Domestic and regional tourists can travel more sustainably. They often stay with friends or relatives, or in locally run accommodation. They are more frequent users of local public transport. These options are often cheaper and more convenient for them, as well as being better for the planet. |

| Preserving local culture and heritage | Domestic and regional tourism plays an important role in fostering pride in local heritage and traditions. This helps to conserve and showcase local and regional culture and heritage, environments and wildlife for future generations. |

| Dual pricing | In most destinations, local people have less purchasing power than visitors from abroad. For this reason, prices for domestic and regional tourism products are lower than for international ones. |

| Factor | Benefits of domestic and regional tourism |

| Seasonality |

Domestic and regional tourism helps to address seasonality (fluctuations in demand at different times of year). Domestic and regional tourists are more likely to be able to travel during low or shoulder seasons. And to take shorter but more frequent trips. Long-haul travellers typically stay longer and so are more tied to national holiday periods in their own countries. |

| Overtourism | Domestic and regional tourism can help to disperse tourists to less-visited places. This helps to ease overtourism. |

| Reaching the market |

Marketing to domestic and regional tourists is generally cheaper and easier than targeting the long-haul market. Domestic and regional tourists are good targets for unique attractions/experiences such as religious festivals and pilgrimages, sporting events or other major activities special to the destination. For example, the Buddha Trail in India or the Timkat Festival in Ethiopia. |

| Spreading the risk | Having another market to focus on means you can spread the risk in the event that international tourism falls or stops, for whatever reason. |

Source: Acorn Tourism Consulting

3. Discover characteristics of groups of domestic and regional travellers

Much like other traveller types, domestic and regional tourists have particular characteristics. Knowing what these are will help you target them more effectively. The main domestic and regional traveller groups can be defined by nationality and by type of travel.

- Domestic and regional nationals. Many people in this group travel to visit friends and relatives (VFR), either domestically or in neighbouring countries. This type of travel is useful to spread expenditure across the country and to stimulate extra spending on food, at restaurants, on activities and on some types of accommodation. People paid a local wage may not have large amounts of disposable income for travel experiences.

- Foreign nationals/expats. This group bears some resemblance to the long-haul market. They often live with their families in places away from home for extended periods of time. They want to experience what the country has to offer while they are there, and will pay for experiences. They will take advantage of cheaper prices for “residents”, though, visit off-the-beaten track places and travel out of season. This helps destinations address overtourism and seasonality issues.

Each group travels for different reasons. They can be categorised as follows.

- Leisure travellers. Often middle-income locals with medium to high purchasing power. They are well-educated and like to learn more about what they can enjoy on their doorstep. They may have larger budgets, but they will still be looking for good value.

- Business travellers. Often spend money on overnight accommodation, plus food and drink. In their spare time, business travellers may also like to enjoy a leisure experience or activity.

- School and university travellers. Usually travel to take part in sightseeing or hands-on activities as part of their schoolwork or degree.

Broadly speaking, you need to realise that domestic and regional tourists have different needs than the long-haul market. One of the key differences is budget. Domestic and regional tourists typically spend less on tourism in their own countries and regions. But they also want good value for money, much like the long-haul market.

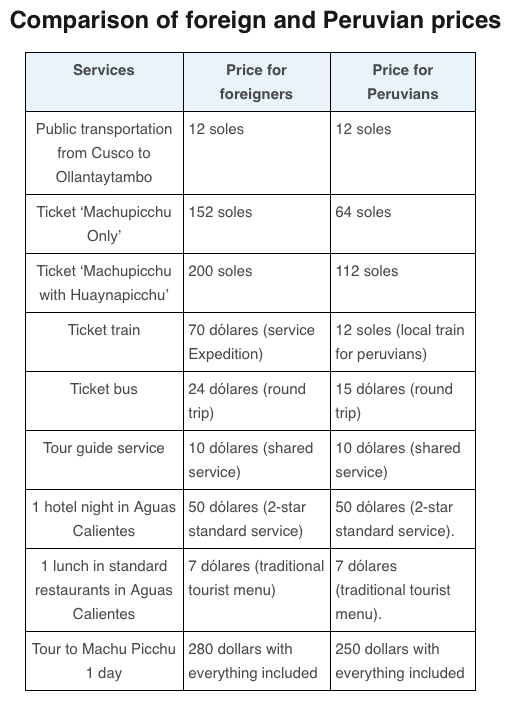

Many destinations charge local and regional citizens less to visit attractions than long-haul visitors. For instance, SAN Parks in South Africa and the wildlife parks operated by the Uganda Wildlife Authority. Heritage attractions like the Grand Palace in Bangkok and Machu Picchu in Peru also charge lower entry fees for locals. This type of pricing often extends to public transport as well. It is a vital strategy in many developing countries, so that local people have good and fair access to national attractions.

Figure 1: Machu Picchu, Peru: comparison of “foreigner” and “local” prices

Source: Ticket Machu Picchu

Do not assume, however, that reducing the price of a standard tour for the domestic and regional market is always the right thing to do. You might undermine other markets. It could also harm your reputation. To appeal to the domestic and local markets, you should create unique experiences tailored to their needs.

These groups do not necessarily need a high level of comfort (such as an air-conditioned vehicle or luxury accommodation), hotel pickups or a multilingual guide. They may prefer to bring their own food to keep their costs down. Knowing what domestic and regional tourists want helps you to manage your costs and keep your tours profitable.

Another possible risk is a local perception that tourism is only for wealthy foreigners. This can lead to domestic and regional tourists receiving less hospitable treatment from service providers. So tell your providers exactly what you expect of them. All tourists, whether domestic, regional or long-haul, should be treated with respect.

4. Assess niche segments for domestic and regional travel

There are many reasons for domestic and regional travel. The largest segments are leisure, business and VFR. Within all of these, tourists will also take part in other activities they are interested in. These could be cultural or sporting, festivals or wellness. The table below lists some of the niches that domestic and regional tourists fall into.

Table 2: Domestic and regional tourism niches

| Travel niche | Description | Requirements |

| Business |

|

|

| Culture and heritage |

|

|

| Daytrippers |

|

|

| Diaspora |

|

|

| Expats |

|

|

| Pilgrimage |

|

|

| Special interest groups |

|

|

|

Visiting friends and relatives

|

|

|

| Wellness |

|

|

Source: Acorn Tourism Consulting

Tip:

- Start with market research. Make sure that you understand why domestic and regional tourists want to visit your destination. Does it have a large diaspora population, or are you located on the route of an important pilgrimage? Is there an iconic monument or wildlife attraction? Once you know the answers to these questions, you can adapt your offering to the relevant niche markets.

5. How to attract domestic and regional markets?>

To appeal to the domestic and regional tourism markets, start with a plan and do some research. Once you understand the markets you want to target, you can develop the right products to attract them. Finally, market and sell those products. In short, follow these three practical steps.

- Plan and research

- Develop or adapt products

- Market and sell your products

Step 1. Plan and research

This is the first and most important step.

- Understand what your destination is best known for. Is it nature, adventure or culture? Or something else? Use the table of niche markets above to help you. You do not have to choose just one niche. If your destination is known for more than one thing, that may give you the opportunity to combine experiences in a unique way.

- Assess your current trips and experiences. Decide which could be adapted for the domestic and regional markets – perhaps by removing some elements (such as air-conditioned transport or meals) or changing others (self-guided rather than guided).

- Make sure that you know your USP (unique selling point). This is what sets you apart from your competitors. For instance, you are the best adventure provider, offer the most interesting cultural tours or deliver the tastiest food experiences. To help you, read the CBI study How to determine your Unique Value Proposition?.

- Look into who your customers are, where they come from and their characteristics and demographics. This will help you develop products that meet their needs. Your local tourist board or association may have market research that it can share with you. Read this example from Visit Scotland, Domestic overnight tourism performance in 2021, to see the type of information you should expect to gather.

- Find out what the competition is selling. Are there any gaps in the market that you could fill?

Step 2. Develop or adapt products

Once you have done your research, you are ready to put together some exciting experiences. Here are some ideas.

- When creating a new product, focus on what makes your destination unique. Is it nature, adventure, culture or something else? Are you near a famous route, or a UNESCO World Heritage site? Browse the UNESCO World Heritage List to see what cultural and natural sites are nearby.

- Promote unique local experiences that your visitors cannot find anywhere else. You can market these as “Only found in…”’ or something similar. This makes a strong USP. As an example, see these 23 Unique Travel Experiences in India That You Need to Have in 2023.

- Work with local hotels and other accommodation providers to create a range of “staycation packages” – a combination of tours and accommodation. Partnerships like these are very common in domestic and regional tourism initiatives. After all, both parties stand to benefit from the increased business.

- Create tours for special interest groups, like photographers, sports fans, writers, cooks or artists.

- Create tours that showcase activities by local creatives, like artists, musicians, artisan food producers, handicraft producers and other local businesses.

- If you can, cater for pets. People travelling close to home often like to take their pets with them, especially dogs. Read the blog 48-Hour with Four-Legged Friends at Phetchaburi-Ratchaburi for examples of products directly targeting this market.

- Create tours that offer combinations of activities unique to your destination. Something like “speciality food and football”, say.

- Make sure that your tours are suitable for the type(s) of traveller you want to reach. Experiences for families with small children, for instance, need to be different from those for couples or groups of friends.

- Tap into any local trails or routes if you are located on or close to – like the Inca Trail in Peru or the Jordan Trail. Walking and cycling are often popular activities for the domestic and regional visitors.

- Promote your day trips to appeal to the local market. For example, “day trips near me” or “Weekend getaways”.

Figure 2: Sightseeing in Cartagena, Colombia

Source: Pixabay

Step 3. Market and sell your products.

Your local tourist board, local DMC (destination management company) and OTAs (online travel agents) are the best way to reach the domestic and regional markets.

- Decide the best way to reach your target market and plan a campaign. Radio and TV are popular channels for domestic audiences. Facebook is popular, too, as tourists can use it to find local businesses that do not have their own websites.

- Ask to list your products on the local tourist board website. It will be looking for exciting experiences to attract visitors.

- Contact local DMCs to find out how you can sell your products to them. They can also help you create suitable products.

- Find the best OTA(s) to list your products. OTAs are the fastest growing sales channel for tours and experiences, but you need to do your research to find out which is best for you. Good OTAs for day trips and experiences include Viator (global), Cleartrip and MakeMyTrip (only accessible in India/Asia), Klook (Hong Kong), Thrillophilia (India) and Trip.com (China).

- Find out if there are any OTAs in your country. Jordan, for instance, has two local OTAs: Sawwah Travel and ViaVii. Both specialise in local trips within the country.

- To find out more, read the CBI study How to work effectively with OTAs?.

- See if you can find a local influencer to help promote your experiences. Local influencers live in the same neighbourhood, city or country and can have as many as 10,000 followers. Small businesses often invest in working with them to promote their brand, because they can help raise its visibility and increase engagement. Use Google to help you find one, or ask around for recommendations.

6. Join national initiatives to promote domestic and regional tourism

Government campaigns to reach domestic and regional markets and develop new products are common in the tourism sector. A lot were launched during the pandemic. These included promotions, financial incentives, product development initiatives and partnerships, all common techniques to grow tourism business. This approach proved successful, and many of the campaigns have continued post-Covid. If possible, try to join one as it can a good way to boost business.

Table 3: Domestic tourism promotion campaigns and pandemic case studies

| Campaign type | Pandemic case studies |

|

Financial incentives. The most common technique to stimulate domestic and regional tourism. Examples include discount vouchers to spend at accommodation or restaurants, or on other tourism service.

|

Serbia allocated US$33 million to issue tourist vouchers worth US$50 each, for Serbian citizens to spend at hospitality facilities in Serbia. Malaysia allocated US$113 million for travel discount vouchers to encourage domestic tourism. Thailand subsidised 5 million nights of hotel accommodation for domestic tourists: up to five nights per person at 40% of normal room rates. Another scheme, We Travel Together, provided discounts on eating out and domestic air fares for Thai nationals. This campaign has been extended into 2023. |

|

Marketing and promotion. Campaigns to provide information, restore confidence and encourage visits to lesser-known areas. Often promoted through digital platforms and social media.

|

Many countries launched national domestic tourism marketing and promotional campaigns, including Costa Rica, Fiji, Georgia, Jordan, Malaysia, Mexico, Morocco and Uruguay. Examples included: Argentina: Promociona tu Destino (Promote your Destination); Fiji: Love our Locals; New Zealand: Do Something New, New Zealand (video). |

|

Product development. During and post-Covid, many new products focused on being outdoors in nature. They included like wellness, wildlife, adventure and ecotourism, cultural, food and rural tourism experience, and road trips or walking trails connecting regions and destinations.

|

Mexico continued to promote its 121 Pueblos Mágicos(“magical towns”) on a digital platform, as a driving force for domestic tourism. Another focus was local and regional tourist routes. Jordan encouraged sustainable domestic ecotourism through its Travel Inside Your Country campaign, offering special prices and discounts at most nature reserves and Royal Society for the Conservation of Nature (RSCN) facilities. |

|

Partnerships. Public-public and/or public-private partnerships. Tourism ministries, national tourist boards, local tourism associations and private businesses join forces to offer incentives, develop new products, upgrade infrastructure and do promotional activities.

|

Peru’s Ministry of Foreign Trade and Tourism (MINCETUR), Ministry of Culture and National Service for Protected Natural Areas (SERNAP) launched a series of initiatives to give some Peruvian citizens free access to Machu Picchu and other sites. In Canada, the Northern British Columbia Tourisms Association invested C$2.3 million in regional tourism development, in partnership with community DMOs and local and regional governments. |

|

Market intelligence. Market surveys of domestic and regional tourists to find out how experiences for them can be developed and promoted better. |

Countries including Malaysia and the Philippines implemented initiatives to assess the domestic tourism market. In Argentina, a new department was formed: the Observatory for Domestic Tourism. Zambia invested in domestic market research as part of a domestic tourism strategy. |

|

Capacity-building and training. A wide range of initiatives and tools to support providers of domestic tourism. Often online.

|

In Costa Rica, the national tourism institute (ICT) launched a digital platform, ICT Capacita, to help develop the personal and professional skills of staff in the tourism industry. In Chile, national tourism service SERNATUR organised a series of training activities under the theme “Chile, tu major apuesta” (Chile, your best bet) to help travel agencies improve their domestic tourism know-how. Paraguay developed a series of webinars, Tourist Destinations of Paraguay, to showcase products and experiences in the country. |

Source: Acorn Tourism Consulting, UNWTO

Tips:

- Download the UNWTO study Understanding Domestic Tourism and Seizing its Opportunities to find out more about the campaigns and case studies in the table above.

- Contact your national tourist board to find out if it any domestic and/or regional promotions are under way or planned.

- Find out what the tourism associations in your destination are doing to promote domestic tourism.

- Ask local DMOs if they work with local tour operators to promote domestic and regional tourism. If so, join that effort.

Figure 3: River trip in Murchison National Park, Uganda

Source: Pixabay

7. How to identify emerging trends and developments

Monitor developments and trends in the market. Keeping up to date with them is a vital and permanent task for tourism professionals.

Consult the following sources regularly.

- Specialist travel news websites and publications. The travel press is a good source of trend information. Consult both regional and global publications, as they often have different perspectives.

- Local travel and news websites. Find out if any new infrastructure or tourist projects are planned or in development. They might affect your business.

- Travel trade websites. Websites like Booking.com often publish research and interesting articles. Tourism trends are a common topic. See Booking.com’s New research reveals the trends driving sustainable travel in 2023. Another article, New research reveals Asia Pacific’s most confident travellers, is more specific to domestic and regional tourism. Businesses that sell travel industry software also publish good research. Examples include TrekkSoft, Rezdy and Arival.

- Tourist attraction websites. Tripadvisor has a “Trending in travel” section on its home page, and an Articles section on the website. The WithLocals blog publishes “Top 5” and “Top 10” lists, which can give you an idea of what people are doing and what they are looking for.

- Local and regional events and festivals. Check local and regional calendars of events, and adapt your offering to them. As well as regular events like annual festivals, which you probably already know about, look out for new or one-off events that might appeal to visitors.

- Google Trends. Google Trends and Looker Studio (previously Data Studio) offer a range of free online tools to help you explore market trends. Google Trends shows what online search terms are popular. Looker Studio creates graphs, charts and tables to visualise that data. CBI has also created a number of Data Studio Dashboards to help you understand demand in the biggest outbound markets, including its recovery since the pandemic. For more information, read the study How to forecast tourism demand with Google Trends & Data Studio?. You can also download a video, How to use the dashboard.

- Your own product reviews. What your guests tell you can help you understand their behaviour, interests and motivations.

- Social media and influencers. Monitor your own social media (Facebook, Instagram, etc.), your destination’s official accounts and travel influencers’ websites. All can provide useful information about current trends.

In particular, stay up to date with the global sustainability trend. This is a hot topic around the world. And it is especially important for the tourism industry, because more and more travellers to domestic, regional and long-haul destinations are trying to minimise their impact on places and local people.

Tips:

- Bookmark the websites you find most useful. Add a diary entry so that you remember to check them again at least every two to three months.

- Research trends in greater depth once or twice a year. Again, make a note in your diary to remind you.

- Sign up to CBI’s tourism market information newsletter to receive updates about new reports and tourism news.

This study was carried out on behalf of CBI by Acorn Tourism Consulting.

Please read our market information disclaimer.

Search

Enter search terms to find market research