The European market potential for cultural tourism

Cultural tourism is a huge opportunity and a growing trend. At least 40% of all tourists worldwide can be considered cultural tourists, and culture is one of the most important motivations for European tourists as well. Cultural tourists are more likely to travel by plane and they provide more economic benefits because they tend to stay longer than regular tourists. Cultural tourism can help to conserve tangible (material) and intangible (immaterial) heritage in your community. It offers you the opportunity to develop all kinds of creative activities and to provide tourists with authentic and genuine experiences.

Contents of this page

1. Product description

Cultural tourism refers to travel with the intent of experiencing and learning about the culture of a country or region. The cultural tourism market can be divided into two major groups. Tourists whose primary travel motivation is culture related only make up about 5-10% of all cultural tourists. These tourists are eager to learn, discover or experience local culture.

For the majority of cultural tourists, however, their primary motivation not related to culture at all. They simply like to visit cultural attractions or enjoy culture as one of the activities they undertake to complement their trip. These would be, for example, sun and beach tourists who stay at a resort in Mombasa in Kenya and visit a manyatta of the Maasai in Kenya.

Cultural tourists travel to enjoy a destination’s history and heritage, culture, lifestyle, traditions, art, music, literature, architecture and religion. The traditional cultural tourist is attracted by major cultural sites and attractions. The market for this kind of cultural tourism has grown dramatically over the past few decades, and has caused overcrowding of many of such destinations, resulting in a loss of their authentic character.

An increasing number of cultural tourists no longer feels attracted to crowded cultural attractions, instead preferring more personal, small-scale and authentic aspects of culture. Examples of this include artisanal, craft and hand-made products (tangible/material culture), and unforgettable and truly inspiring experiences that touch visitors in an emotional way and connect them with that specific place, people and culture (intangible/immaterial culture).

In short, attractions, products and experiences that are unique and that you cannot find anywhere else.

Based on the various types of interests the market can be subdivided into a number of niches, listed in table 1.

Table 1: Niche markets and specialist niche markets in cultural tourism

| Niche market | Products and services | Example |

| Tangible (material) heritage | Museums, art galleries, historic properties, places of worship, architectural tourism, other visitor attractions | The north of Colombia has a violent history. After the demobilisation of paramilitary forces, communities in the Antioquia state’s Urabá region started to reconcile and established the El Carlos Ecotourism and Archaeological Centre in which tourism, handicrafts, fisheries and cacao farming are integrated. Another example is Songup Folk Village on Jeju island in Korea. It offers a cultural heritage with traditional lifestyles and historic landscape dating back 500 years. |

| Intangible (immaterial) culture | Music festivals and events, film, DNA/genealogy, battlefield, dark tourism, other festivals/events | Mahika Mahikeng Cultural Festival, South Africa. Watch this short video of the 2017 edition. Audley Travel in the United Kingdom offers battlefield tours in Kwazulu Natal, South Africa. |

| City breaks | Acacia Africa offers city breaks, for example as part of an extended tour. In Colombia, 5Bogota is an example of a local tour operator that connects local hosts with travellers. | |

| Food & Wine | Food festivals, food trails, food museums, food tastings, cooking classes, wine tastings, wine trails, vegan tourism, producer visits, local farmers' markets | There are many tour operators that provide food and wine holidays and tours to Latin America or Africa. For example Upscapetravel, or Giltedge Africa. |

Community-based tourism (CBT) refers to tourism experiences hosted and managed by local communities, and which are sustainable and responsible | Homestays, visits to villages/communities, local festivals, learning local crafts, participation in community life | Il Ngwesi offers cultural and wildlife experiences, while profits flow back to the Maasai owners in the community. Other examples are: Portsmouth Indian River Tour Guides Association in Dominica. The small, award-winning, off-grid eco lodge 3Rivers Dominica in the Rosalie rainforest valley in Dominica. St. Helena Women’s Group, Jamaica. The women are subsistence farmers who make finely woven and unique handicraft souvenirs, such as purses, place mats, bowls, vases, picnic and laundry baskets, bread trays, wall decorations and bags. Tourists do not visit St. Helena Women’s Group in Jamaica but purchase their products in gift shops in hotels. Andaman Discoveries in Thailand provides home-stay programmes. The Khama Rhino Sanctuary is a community-based wildlife project that offers accommodation, activities, game drives, camping, and educational activities. |

| Religious/Spiritual tourism | Pilgrimage, visiting a sacred site, church/mosque/temple tourism, travel for the purpose of mission/worship | In Africa, the Vodun festival in Benin and the Osun-Osogbo festival of the Yoruba people of Western Nigeria are religious events that attract tourists from all over the world. The Ethiopian celebration of Timkat (also known as Epiphany) is another famous attraction. |

Tips:

- Inform yourself on the niches available in cultural tourism to be able to make a clear choice on the niche market you want to focus on. CBI offers an infographic that gives a clear overview, which includes other segments and niche markets in tourism as well.

- Read the CBI studies on the niche markets within cultural tourism such as religious tourism, community-based tourism and food tourism for information about opportunities within these related markets.

- Collaborate with other parties both within and outside your community and create networks, for example with a focus on the niches as listed in table 1. Ensure that you contribute to the needs of the local community and create benefits for everyone.

- Read ‘Kyoto Declaration on Tourism and Culture: Investing in Future Generations’. It gives direction to innovative usage of the positive potential of cultural tourism for the support of tangible and intangible heritage, the increase of community empowerment, the generation of inclusive wealth and the strengthening of capacities.

- For financial support, you may want to join the community tourism programme initiated by AirBnB. This programme offers financial support to innovative projects in local communities that encourage tourism in new ways to strengthen communities, empower citizens and preserve and promote local culture. One category of projects to which you can apply is festivals and events: projects “preserving or celebrating local festivals and events while introducing them to a broader, appreciative audience”.

2. What makes Europe an interesting market for cultural tourism?

The European market for cultural tourism is significant. The European Union estimates that cultural tourism accounts for 40% of all European tourism. The UNWTO expects that the interest for cultural tourism among Europeans will grow and that it will remain one of the key markets in Europe. Interestingly, cultural tourists spend 38% more per day and stay 22% longer than other tourists.

However, two years after the publication of the UNWTO report, the COVID-19 pandemic caused a serious decline in international tourism and it is still uncertain if, when and how international tourism in general, and cultural tourism in particular, will recover. In the World Tourism Barometer And Statistical Annex 2021, recently published by the UNWTO in January of this year, most panel experts expect a rebound of international tourism in Europe in the third quarter of 2021, or by 2022.

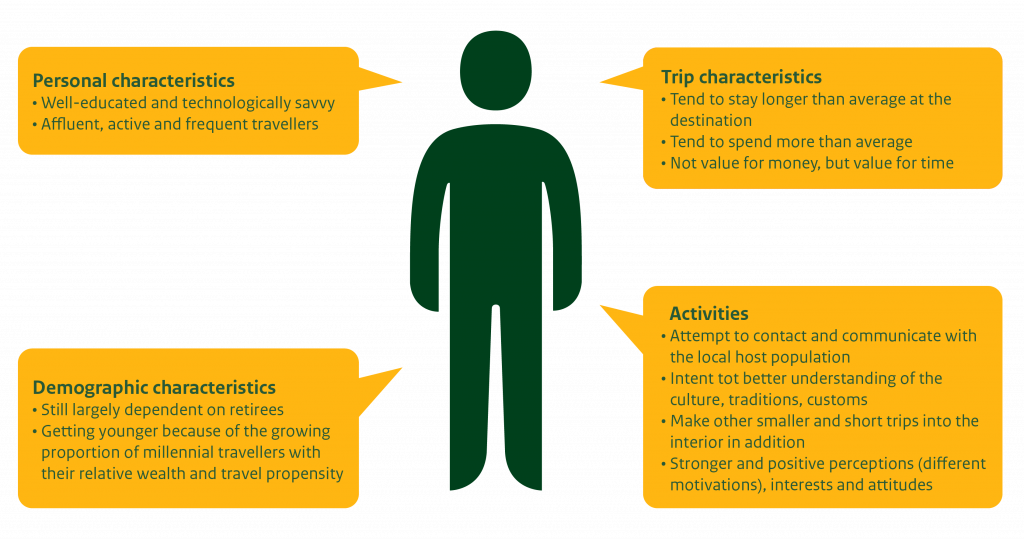

Cultural tourist profile

Cultural tourism dates back to the 1980s. Originally, cultural tourism was primarily driven by the interest of the baby boom generation to visit major cultural sites and attractions, such as museums and monuments, often travelling in groups. This generation has contributed to the strong growth of cultural tourism. The generations after them, generation Y (millennials) and generation Z (centennials), drive the demand for more authentic, unique, small-scale and personal experiences, and the demand for more popular and everyday culture. For them it is more important to be somewhere, rather than to go somewhere. They state “we want to do it our way, not their way”. These generations prefer to travel on their own.

Figure 1: Cultural traveller’s profile

Advantages of cultural tourism

Cultural tourism does not only benefit larger corporations, but offers interesting opportunities to smaller businesses – including businesses that would otherwise be excluded from tourism. This means that cultural tourism offers the possibility to collaborate and create useful relationships with other businesses and organisations, both within and outside the tourism industry. Such relationships and partnerships can strengthen the collective pride of your own culture.

This approach to cultural tourism starts with what the community finds important and what the community wants to show. Linking it to what tourists are looking for results in a kind of compromise with a concrete encounter between two cultures.

Tips:

- Review the cultural tourism offer in your community. Table 1 could help you with this.

- Try to understand the motivations of the cultural tourist and ask them how unique and authentic the cultural tourism offer is. This can help you to develop authentic experiences.

- Collaborate with other business and organisations in your community to create synergy and to better attract European tourists. Such collaboration could result in a cultural route along different places and attractions that is marketed as an arrangement to the tourists that visit your community.

- Cultural tourism is not the only trend in tourism, so think about creating cross-overs between cultural tourism and, for example, volunteer tourism, ecotourism, wellness, or adventure tourism.

- To offer your cultural offer to the market, remember that the contemporary tourists require online presence and convenience. To communicate with the market you can make use of Facebook (see for example PIRTGA) or AirBnB (such as illustrated by a bushwalk with Maasai warriors, or a city trip to Nairobi.

- Read UNWTOs Inclusive COVID-19 recovery guide for cultural tourism, with many suggestions and tips. If you are offering community-based tourism, also read recommendations for indigenous tourism.

- If too many tourists come to your community, there is a danger that cultural tourism can cause a negative impact on culture and heritage and damage the long-term sustainability of both tourism and the cultural sectors. Therefore, it is important to define the limits of change that you consider acceptable and to manage cultural tourism properly. If you have little experience with Europeans, it is helpful to get in touch with somebody in your community who does have this experience, for example because they lived there for a while. Such a person may help you develop a product that is attractive for European tourists and bring it to their attention in a meaningful way.

3. Which European countries offer most opportunities for cultural tourism?

Germany is the largest European source market in terms of market size, followed by the United Kingdom, Italy, France, the Netherlands and Spain. Table 2 shows the percentage of residents per country who gave culture or a city trip as a reason for going on holiday, and the number of tourists leaving the country for a holiday abroad. The third column gives an indication of the market size of each country for a cultural holiday abroad. The figure clearly illustrates that the top market (Germany) is over five times larger than the smallest market (Spain).

Table 2: Key statistics of the 6 most important European markets

| % of residents per country with culture or a city trip as a reason for going on holiday in 2015 | Outbound tourism, no of overnight stay tourists in 2018 (in millions) | Estimated number of overnight stays of tourists travelling for a cultural reason or city trip in 2018 (in millions) | |

| (1) | (2) | (3) | |

| Germany | 50% | 109 | 54 |

| United Kingdom | 48% | 70 | 34 |

| Italy | 66% | 33 | 22 |

| France | 62% | 27 | 17 |

| Netherlands | 65% | 24 | 15 |

| Spain | 50% | 19 | 10 |

Germany

Germany is by far the most significant European market for cultural tourism. In 2018, 109 million German tourists went abroad for a holiday. Half of them went on holiday for cultural reasons, resulting in an estimated amount of 54 million holiday makers.

Of the six countries listed, German tourist spent the most on outbound travel. The personal expenditure of outbound German tourists was also much bigger.

Table 3: Key statistics Germany

| Population size, in millions | 83 | |

| Nominal GDP in trillion Euros (2019) | 3.4 | |

| Nominal GDP per capita in thousand Euros (2019) | 42 | |

| No. of outbound overnight stay tourists in millions (2018) | 108,542 | |

| % of holiday makers’ motivation being … (2015) | Culture (religious, gastronomy, arts) | 26 |

| City trip | 24 | |

| Event (sporting events, festivals, clubbing) | 5 | |

| No. of holiday makers’ motivation being … (own calculations) | Culture (religious, gastronomy, arts) | 28,221 |

| City trip | 26,050 | |

| Event (sporting events, festivals, clubbing) | 5427 | |

| Outbound tourists’ expenditure (2018) | Travel (exclusive passenger transport) in billion euros | 79 |

| Personal (exclusive business/professional trips) in million euros | 72,871 |

United Kingdom

The United Kingdom is clearly the second-largest market for cultural tourism in Europe. This position is mainly caused by the large number of outbound tourists: 70 million in 2018. A share of 48% opt for a culturally motivated holiday abroad – 26% for culture in general and 22% for a city trip. This amounts to an estimated number of outbound cultural tourists of 34 million in 2018. Events were also quite popular among British holiday makers going abroad (13%).

The United Kingdom has the second-largest population (67 million), after Germany. In 2019 the country had the second-largest nominal GDP of the top 6 market countries in the European Union (€2.5 trillion), again after Germany, and the third-largest nominal GDP per capita (€28.000), after Germany and the Netherlands. In 2018 the travel expenditure of British outbound tourists amounted to €65,517 million, which was 2.4% of the GDP.

Table 4: Key statistics United Kingdom

| Population size, in millions | 67 | |

| Nominal GDP in trillion Euros (2019) | 2.5 | |

| Nominal GDP per capita in thousand Euros (2019) | 38 | |

| No. of outbound overnight stay tourists in millions (2018) | 70,386 | |

| % of holiday makers with motivation being … (2015) | Culture (religious, gastronomy, arts) | 26 |

| City trip | 22 | |

| Event (sporting events, festivals, clubbing) | 13 | |

| No. of holiday makers with motivation being … (own calculations) | Culture (religious, gastronomy, arts) | 18,300 |

| City trip | 15,485 | |

| Event (sporting events, festivals, clubbing) | 9150 | |

| Outbound tourists’ expenditure (2018) | Travel (exclusive passenger transport) in million euros | 65,517 |

| Personal (exclusive business/professional trips) in million euros | - |

Italy

If we look at the proportion of all outbound travellers motivated by culture, Italy is the European country that stands out with 66% of the 33 million outbound holiday makers. As opposed to the other five countries in the top 6, city trips are more popular (36%) than culture in general (30%). The number of outbound cultural tourists from Italy can be estimated at 22 million. The average length of an outbound holiday was 8.3 nights in 2018. The Italian cultural tourism market is less predictable than the other countries’ markets, because it is more fashion-driven.

In the top 6 countries, the Italian economy takes a mid-position with a nominal GDP of €1.8 trillion and a nominal GDP per capita of €30,000 in 2019. Total travel spending in 2018 had a value of €24,918 million, while personal expenditure was €17,334 million. Overall outbound tourists had a value of 1.8% of the GDP, which is the lowest of the six market countries.

Table 5: Key statistics Italy

| Population size, in millions | 60 | |

| Nominal GDP in trillion Euros (2019) | 1.8 | |

| Nominal GDP per capita in thousand Euros (2019) | 30 | |

| No. of outbound overnight stay tourists in millions (2018) | 33,347 | |

| % of holiday makers with motivation being … (2015) | Culture (religious, gastronomy, arts) | 30 |

| City trip | 36 | |

| Event (sporting events, festivals, clubbing) | 9 | |

| No. of holiday makers with motivation being … (own calculations) | Culture (religious, gastronomy, arts) | 10,004 |

| City trip | 12,005 | |

| Event (sporting events, festivals, clubbing) | 3001 | |

| Outbound tourists’ expenditure (2018) | Travel (exclusive passenger transport) in million euros | 24,918 |

| Personal (exclusive business/professional trips) in million euros | 17,334 |

France

The French market for cultural tourism is the fourth-largest. In 2018, 27 million French travellers went abroad for their holiday and 62% of them did so for cultural reasons. Among them, the interest in culture in general or in a city trip was equally divided at 31%. All in all, in 2018 about 17 million French people went on holiday abroad for cultural reasons. The average length of these holidays was 8.4 nights.

The nominal GDP (€2.4 trillion) and the nominal GDP per capita (€36,000) are also comparable to the United Kingdom. Total travel expenditure was much higher than in Italy and amounted to €39,696 million. Personal expenses in 2018 were €26,551 million. Outbound tourism had a total value of 2.1% of GDP.

Table 6: Key statistics France

| Population size, in millions | 7 | |

| Nominal GDP in trillion Euros (2019) | 2.4 | |

| Nominal GDP per capita in thousand Euros (2019) | 36 | |

| No. of outbound overnight stay tourists in millions (2018) | 26914 | |

| % of holiday makers with motivation being … (2015) | Culture (e.g. religious, gastronomy, arts) | 31 |

| City trip | 31 | |

| Event (e.g. sporting events, festivals, clubbing) | 9 | |

| No. of holiday makers with motivation being … (own calculations) | Culture (e.g. religious, gastronomy, arts) | 8343 |

| City trip | 8343 | |

| Event (e.g. sporting events, festivals, clubbing) | 2422 | |

| Outbound tourists’ expenditure (2018) | Travel (excl. passenger transport) in million € | 39,696 |

| Personal (excl. business/professional trips) in million € | 26,551 |

Netherlands

Despite its small size, the Netherlands has a relatively large number of outbound tourists. The Dutch holiday makers show the largest interest in culture (65%), second only to the Italians (66%), but as the population is relatively small it does only result in about 15 million culturally motivated holidays abroad. Compared to the other countries in the top 6, the interest in culture in general is much bigger (39%) than the interest in city trips (26%).

Compared to the other market countries discussed in this section, the Netherlands has a small population of 17 million. In line with this, the nominal GDP is relatively small as well with €0.8 trillion, making it the smallest economy in the list. Nevertheless, the nominal GDP per capita is the highest of the six countries at €47.000. On the other hand, total travel expenditure for foreign holidays (€18,868 million) and personal expenses abroad are the lowest (€ 16,296 million). 2.8% of the GDP was spent on outbound tourism.

Table 7: Key statistics Netherlands

| Population size, in millions | 17 | |

| Nominal GDP in trillion Euros (2019) | 0.8 | |

| Nominal GDP per capita in thousand Euros (2019) | 47 | |

| No. of outbound overnight stay tourists in millions (2018) | 23679 | |

| % of holiday makers with motivation being … (2015) | Culture (religious, gastronomy, arts) | 39 |

| City trip | 26 | |

| Event (sporting events, festivals, clubbing) | 9 | |

| No. of holiday makers with motivation being … (own calculations) | Culture (religious, gastronomy, arts) | 9235 |

| City trip | 6157 | |

| Event (sporting events, festivals, clubbing) | 2131 | |

| Outbound tourists’ expenditure (2018) | Travel (exclusive passenger transport) in million € | 18,868 |

| Personal (exclusive business/professional trips) in million € | 16,296 |

Spain

The market for cultural tourism in Spain is much smaller than it is in Germany, the United Kingdom, Italy, France and the Netherlands. If we take the relatively big population into account, the number of outbound holiday makers is relatively quite small with just 19 million. So despite the fact that half of these tourists goes on holiday for cultural reasons, this only results in an estimated 10 million travellers in 2018.

It’s also interesting to note that the average length of the stay is relatively short (7.8 nights), while the average spending per day seems rather high (€103). According to industry experts, it is mainly the region of Catalunya (Barcelona and environment) in which people are interested in outbound cultural tourism.

The population of Spain is 47 million. The economy of Spain ranks between Italy and the Netherlands, with a nominal GDP of €1.2 trillion. The nominal GDP per capita is the lowest of the six market countries at €26.000. The amount that all outbound tourists spend on their travel is slightly lower than it is Italy and a little higher than it is the Netherlands at €26,670. The percentage of the GDP that is spent on outbound travel is relatively low: only 1.9%.

Table 8: Key statistics Spain

| Population size, in millions | 47 | |

| Nominal GDP in trillion Euros (2019) | 1.2 | |

| Nominal GDP per capita in thousand Euros (2019) | 26 | |

| No. of outbound overnight stay tourists in millions (2018) | 19116 | |

| % of holiday makers with motivation being … (2015) | Culture (religious, gastronomy, arts) | 29 |

| City trip | 21 | |

| Event (sporting events, festivals, clubbing) | 7 | |

| No. of holiday makers with motivation being … (own calculations) | Culture (religious, gastronomy, arts) | 5544 |

| City trip | 4014 | |

| Event (sporting events, festivals, clubbing) | 1338 | |

| Outbound tourists’ expenditure (2018) | Travel (exclusive passenger transport) in million € | 26670 |

| Personal (exclusive business/professional trips) in million € | - |

Tips:

- Focus on Germany or the United Kingdom if you want to enter the European cultural tourism market. The market for cultural tourism in these countries is much bigger than it is in the other European countries, so you are more likely to succeed there.

- Create your tourism product in collaboration with your clients. Cultural tourists can be considered as co-creators of the best and least impactful tourism experiences. Also read our report on how to develop your tourism product to co-create cultural products together with your guests.

- If you want to protect your culture and remain unique and authentic, do not focus on short-term benefits and prevent too much commercialisation.

- If you want to focus on cultural events, it is recommended to make use of existing festivals or try to revive past festivals, because this reduces negative impacts and makes cultural tourism more sustainable.

4. Which trends offer opportunities on the European market for cultural tourism?

From cultural tourism to creative tourism

Cultural tourism is slowly changing into creative tourism. With creative tourism, tourists actively participate in cultural learning experiences. These could range from dyeing umbrellas in Thailand, dyeing textiles in Guatemala or making curry in Thailand, to making music in Brazil to the rhythm of samba, milonga, chamamé and chacarera. During such a holiday trip, tourists encounter things that are quite different from a trip in Europe.

Creative travel programmes allow tourists to get in touch with local people, local culture and local creativity. They allow visitors to take a souvenir back home that they made themselves and that can promote the culture to the tourists’ peers. They also lead to more opportunities for local people to acquire knowledge and skills and to earn an income.

Creative travel programmes are usually carried out by locals, for example in the role of inbound tour operator or “ground operator”. However, there are also tour operators in Europe that offer cultural tourism holidays, such as Charlies Travels in the Netherlands which offers holidays to Kenya.

A local example is the wide variety of round trips offered focusing on the "Maya Textile Route" in Guatemala, during which cultural visits of cities and museums are combined with weaving and dyeing workshops. During these workshops visitors learn how to create their own fabrics in the traditional brightly coloured threads of the “land of eternal spring”.

- Examples are the tours offered by Haute Culture Fashion or ArtGuat.

- The Blue Yonder, a tour operator in India, provides various options, including musical trails, gastronomic trails, local encounters, cultural heritage, and city breaks.

- Feynan Ecolodge in Jordan is an example of an accommodation promoting the rich Bedouin culture of the region, and exploring local archeological sites.

- In Thailand DASTA (Designated Areas for Sustainable Tourism Administration) developed a cultural tourism programme that is different from many other Asian countries. It is based on the idea that the Thai culture is unique and that unique forms of creativity are linked to it. 20 different villages offer a unique taste of Thai culture for visitors, each being linked to a particular craft or skill that demonstrates Thai creativity and is rooted in the local involvement. As part of the project a toolkit was provided which offers a step-by-step guide to developing creative tourism.

Networks are of great importance to the development of creative tourism. There are quite a few examples of creative tourism networks, such as Recria Brasil in Brazil. Local people and businesses also use platforms such as AirBnB to sell experiences. In that case you do not need a tour operator, and you establish a direct connection with the tourist in exchange for a small fee.

Creative Tourism Network is an international network that serves as a great example of collaboration across country borders. The website gives examples of creative tourism in various countries and you can become a member yourself. The network developed a “creating creative tourism toolkit” that is accessible online. The toolkit also provides an introduction into the ins and outs of creative tourism.

Although in Europe itself, CreaTour may offer an inspiring example of a creative tourism network. It is intended as an incubator/demonstration initiative to catalyse creative tourism in small cities and rural areas throughout Portugal. CreaTour’s website gives an overview of inspiring best practices in Portugal. A prize-winning documentary about creative tourism development in small cities and rural areas is also available.

Major trends in creative tourism:

- Taking home skills as well as souvenirs: exchange of skills between hosts and visitors, and the production of art, photos or craft objects as souvenirs

- Creative gastronomy: courses and workshops to refine the guests’ culinary skills, such as making curry in Thailand

- Creative personal space: retreats or other peaceful surroundings linked to a search for mindfulness, spirituality, including yoga experiences and meditation

- Creative work: co-working spaces and living labs as destinations for travellers who want to combine their work with their passion, which fits with the drive of remote working, the growing number of digital nomads and the increase in bleisure, which refers to travellers who combine business with leisure activities, or leisure travel with business.

- Digital creativity (needed for work but also for being able to develop one’s own content and share one’s life story; offered in major creative cities or attractive settings in nature.

- Social connectivity: creative tourism with a more explicit social and relational dimension, such as volunteer programmes directed towards particular forms of creativity useful for community development.

- Live like a (creative) local to have transformational authentic experiences; Airbnb allows hosts to provide local experiences, which may include workshops and crafts classes. A transformational experience allows a tourist to understand themselves, others and the world in a new way.

- Holidays for the creative class, not only in urban areas but also in creative clusters in rural areas; it requires the presence of trendsetters and coolhunters who can identify and promote new creative experiences

- Destinations as hubs of creative networks, the places to be for specific creative activities and/or knowledge

Tips:

- Invest in slow travel, meaning travellers take more time to experience destinations more deeply and in a more laid-back way, and offer transformative experiences.

- Offer opportunities to immerse in the local culture and to ‘feel like a local’, such as opportunities to stay with a local family, indulge in the local nightlife or services that connect travellers to local tastes,

- Platforms such as EatWith or BiteMojo offer opportunities to connect travel to local tastes.

- Because young millennials yearn for unique experiences, it is recommended to approach and treat them in a personal way.

- Ensure a clear online presence. Potential visitors should be able to find you online and be able to easily access your online information.

- Invite social media influencers like influential bloggers or vloggers for a free stay so that they will write about your product or service in a style that appeals to their followers. You can find bloggers and vloggers via Typsy or YouTube.

- Link people and place through storytelling. An example of this is offered by industry expert Greg Richards in his report ‘from Cultural to creative tourism – the role of craft’: “When a tourist comes to my workshop, I can make up a story about how I work, and this adds value. People want to know why I have done something, how it was done”.

Health and safety measures

In response to the COVID-19 pandemic the UNWTO identified health and safety measures as the second largest trend for 2021, and it is likely that this trend will become more important in the years to come.

The COVID-19 pandemic will likely have a major impact on travellers’ attitudes towards hygiene. Safety and hygiene standards have become very important and may even become non-negotiable, because travellers simply require that this is at an appropriate standard.

Travellers will be more reluctant to travel to tourism hot spots and may need more persuasion to perceive a destination, or your business, as safe. Precautions and the way in which the initial COVID-19 outbreak was handled in your country will help convince travellers that they will be safe at a specific destination, location or service business.

It is expected that hygiene will impact the way people travel to a destination and how they move around within their destination. This applies to for example hygiene standards, whether face masks are compulsory or not, seat spacing, and many other factors. Price may become less important than hygiene and travelling in groups with strangers will probably be less attractive.

Moreover, it is likely that the COVID-19 pandemic has made more travellers aware and uncertain about travel safety, hygiene and contradicting information, and they will increasingly turn to travel experts when they want to plan a holiday trip.

Tips:

- Be transparent and inform cultural tourists properly about the health and safety measures you have taken. Only then you will be able to gain their trust. Possible measures are: intensified cleaning, socially distanced seating, providing hand gel, providing accessories such as face masks, glasses and gloves (possibly branded with a logo of the destination or your business), offering contactless payment, or driverless transport.

- With reference to COVID-19 is it recommended to focus on outdoor cultural tourism activities.

- Seize the opportunity, if your business is located within a destination that is perceived as clean, safe, unspoilt or uncrowded. That may allow you to attract new or more visitors. According to Booking.com, 54% of global travellers want to play a part in reducing overtourism, and 51% is interested in swapping destinations for a lesser known, yet similar alternative.

This study was carried out on behalf of CBI by Molgo and ETFI.

Please review our market information disclaimer.

Search

Enter search terms to find market research