The European market potential for dive tourism

To help you prepare CBI provides market information with trends which offer opportunities in the European market for dive tourism. From information about what makes Europe an interesting market for dive tourism, to European countries which offer the most opportunities for dive tourism and trends opportunities in the European dive tourism market.

The UK, France and Germany are amongst the key European markets for dive tourism. Leisure divers are the largest segment of recreational divers, and the numbers of older divers aged 54+ are increasing. Many leisure divers obtain diving certification while on a holiday abroad from dive associations like PADI and SSI. Sustainability is a major trend in the dive industry, and divers are very sustainably minded. There are several sustainable schemes on the market to help dive businesses promote sustainable diving and snorkelling.

Contents of this page

1. Product description dive tourism

Dive tourism refers to tourism trips for the primary purpose of scuba (self-contained underwater breathing apparatus) diving. Dive tourism includes activities such as wreck diving, cave diving and free diving. Scuba is specialist diving equipment that includes an oxygen cylinder and breathing regulator. Destinations known for their underwater attractions are marine environments with coral reefs, shipwrecks, underwater caves, artificial reefs and marine life habitats. Dive tourism also includes snorkelling, which involves a mask, snorkel and fins.

Dive tourism destinations frequently offer a variety of diving experiences ranging from shallow reef dives suitable for beginners to deep-sea dives for more experienced divers. These destinations often provide training and certification courses for individuals who wish to learn how to scuba dive safely.

Dive tourism contributes to local economies by generating revenue through dive operators, dive shops, accommodations, food outlets, and other businesses catering to divers. It also helps raise awareness about marine conservation issues and fosters appreciation for the underwater world.

There are various types of diving, each offering unique experiences and challenges.

Table 1: Diving segments and specialist niches

| Diving segment | Specialist niches |

| Recreational diving | Recreational diving is the most common form of scuba diving and includes snorkelling. It is usually done in open bodies of water like oceans, lakes and quarries. Coral reefs, artificial reefs and diving walls are commonly explored in recreational diving. Usual depths for recreational diving are between 18 and 30 metres. Forms of recreational diving include:

|

| Technical diving | Technical diving involves scuba diving beyond the limits of recreational diving and often requires specialist equipment and training. Some types also require the use of advanced gas mixtures like trimix or heliox to extend dive times or depths. Amongst the many types of technical dives are:

|

| Scientific diving |

|

Source: Acorn Tourism Consulting, 2024

Many of the best places to dive are found in developing destinations, particularly in Asia, Latin America and the South Pacific. Between them, they offer a diverse range of diving experiences in coral reefs and walls and in blue holes, exploring ship and plane wrecks, artificial reefs and marine life itself.

Table 2: Developing countries with the best diving opportunities

| Africa | Asia | Latin America | Oceania |

Egypt Mauritius Seychelles South Africa | Indonesia Jordan Malaysia Maldives Philippines Thailand | Belize Costa Rica Ecuador (Galápagos) Grenada Mexico | Fiji French Polynesia Micronesia Palau Papua New Guinea |

Source: Acorn Tourism Consulting, 2024

Diving certification

Obtaining diving certification is not mandatory but most recreational divers will seek to become certified. They may choose to become certified in their home country before travelling, or alternatively take a certification course while on the trip and enjoy some dives as part of the course.

Local dive operators offer diving certification courses in dive destinations all over the world. They affiliate with a certification programme offered by one of the organisations listed below, such as PADI (Professional Association of Diving Instructors). Many dive operators will only take customers diving if they hold a diving qualification. However, many dive trips and holidays include training for certification as part of the trip.

The organisations that offer diving certification comply with established training standards and guidelines to ensure that divers receive quality instruction and certification. These organisations include:

- Professional Association of Diving Instructors (PADI): US-based PADI is the world’s largest dive organisation for recreational scuba diving training and certification. It offers several certificates, including Open Water Diver, Advanced Open Water Diver, and Divemaster. PADI certification is the most commonly issued.

- Scuba Schools International (SSI): an international organisation and one of the largest, with a presence in over 110 countries. There are many courses for beginner, advanced and professional divers.

- Confederation Mondiale des Activities Subaquatiques (CMAS): an international federation that offers an international system of recreational snorkel and scuba diving training. It offers a range of certification levels as well as Snorkel Diver.

- British Sub-Aqua Club (BSAC): UK-based BSAC offers a range of courses, including Discovery Diver, Ocean Diver and Advanced Ocean Diver to Sports Diver.

- National Association of Underwater Instructors (NAUI): US-based NAUI is a globally recognised non-profit organisation dedicated to promoting safe and responsible scuba diving. Its certification levels include Scuba Diver, Rescue Scuba Diver and Master Scuba Diver.

PADI issues around 1 million certifications every year. They have certified more than 29 million divers since 1967.

Examples of diving experiences

Diving holidays and experiences are quite varied. Some holidays are devoted entirely to diving and often take place on liveaboard boats. Others include a learn-to-dive course which takes a few days and includes open-water diving. Other diving holidays may include diving as one part of a wider trip. Day or part-day excursions that include diving and/or snorkelling experiences are also commonly offered.

The table below provides an indication of the wide variety on the market.

Table 3: Examples of diving holidays and experiences on the market

| Dive holiday or experience | Details |

| Raja Ampat Liveaboard, Indonesia | Raja Ampat is one of the best diving spots in the world. This diving holiday includes 8 nights on board a boat, exploring some of the archipelago’s 1,500 small islands and cays. The itinerary can be tailored to different durations to suit preferences. |

| PADI Open Water Diver Course, Koh Tao, Thailand | The 3½ day course includes theory, shallow water dives, and four open water dives. Courses like this are very common in most destinations and can be packaged with accommodations as part of a longer holiday. |

| Coast, Cayes and Culture: Highlights of Belize | This 15-day trip includes some diving days, time spent hiking in national parks, cultural and heritage sightseeing, and stays at luxury accommodations. |

| Coral Restoration in French Polynesia | This holiday includes an element of coral conservation. Divers learn about the practice and plant their own baby coral, regularly monitoring its progress during their trip. |

| South Africa and Mozambique Solo Divers | Aimed specifically at solo travellers, there is no room-sharing on this trip. Diving is focused on viewing as many species of shark found in the region. |

| La Paz, Mexico with Alex Tattersall – Photography Workshop | Led by a well-known underwater photography expert, this trip is a land-based, luxury experience. The main focus of the trip is photographing the large animals in the area, like the sealion colony and other large marine life, including sharks. |

| Snorkelling at Hol Chan Marine Reserve, Belize | A 4-hour snorkelling excursion at the Hol Chan Marine Reserve, known for its resident nurse sharks, southern sting rays and manatees. There is also a shipwreck to explore. |

| Truk Lagoon Diving Holiday, Marshall Islands, Micronesia | A liveaboard diving holiday to explore the Japanese World War II wrecks in Truk Lagoon, an area known for its concentration of underwater wrecks in a coral reef lagoon. There are over 60 wrecks, including supply vessels, planes and a submarine. |

Source: Acorn Tourism Consulting, 2024

End-market segmentation and consumer behaviour

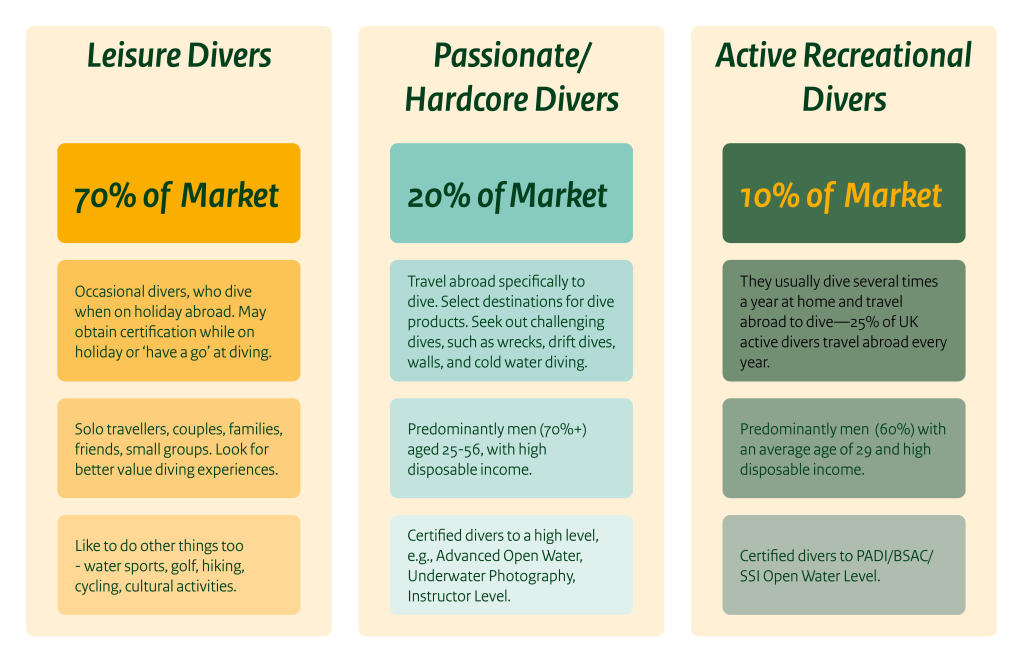

European divers are segmented into three major groups: leisure divers, passionate or hardcore divers, and active recreational divers.

Leisure divers: are occasional divers who often learn to dive or try diving when on holiday. They account for the largest segment, around 70% of the diving community. This group is made up of many traveller types, including couples, solo travellers, families, and groups of friends. There is also a wide demographic across the major consumer groups of Gen Z, Gen Y, Gen X and baby boomers.

While on holiday, diving is generally one of many activities they do. They are likely to combine diving with other activities like golf, hiking, cycling, surfing, and cultural undertakings. They seek a reasonable level of comfort or even luxury, depending upon their budget. In addition to a good dive destination, they also look for opportunities to experience something new and different.

Passionate/hardcore divers: are experienced divers, often with more than one diving qualification, who actively choose destinations to travel to, specifically to dive. Diving courses they take may be experience-based, like Dive Master, or in areas of special interest, like underwater photography or wreck diving. Passionate divers are more likely to travel alone or with other passionate divers.

They are less interested in convenience or luxury – their accommodation needs are basic and functional. This group is less likely to do other things while on a trip. They are more likely to travel further away for a unique experience and choose a destination based on their preference – to see specific species or explore a specific wreck. This group accounts for around 20% of the diving market. They are predominantly men, typically aged between 25 and 56, and have high disposable incomes.

- Active recreational divers: dive regularly but most often in their home countries. This group accounts for 10% of the diving market. They are also predominantly male with an average age of 29, and have high disposable incomes. One-quarter of this group will also travel abroad for a diving experience, whether just to dive or as part of a broader trip.

Figure 1: Segmentation of dive tourism consumers

Source: CBI, DEMA, Acorn Tourism Consulting, 2024

Many divers, particularly in the leisure diver group, have non-diving family members who travel with them. This market provides additional opportunities for local tour operators to offer them a range of activities they can take part in while their relative is diving, or even child care.

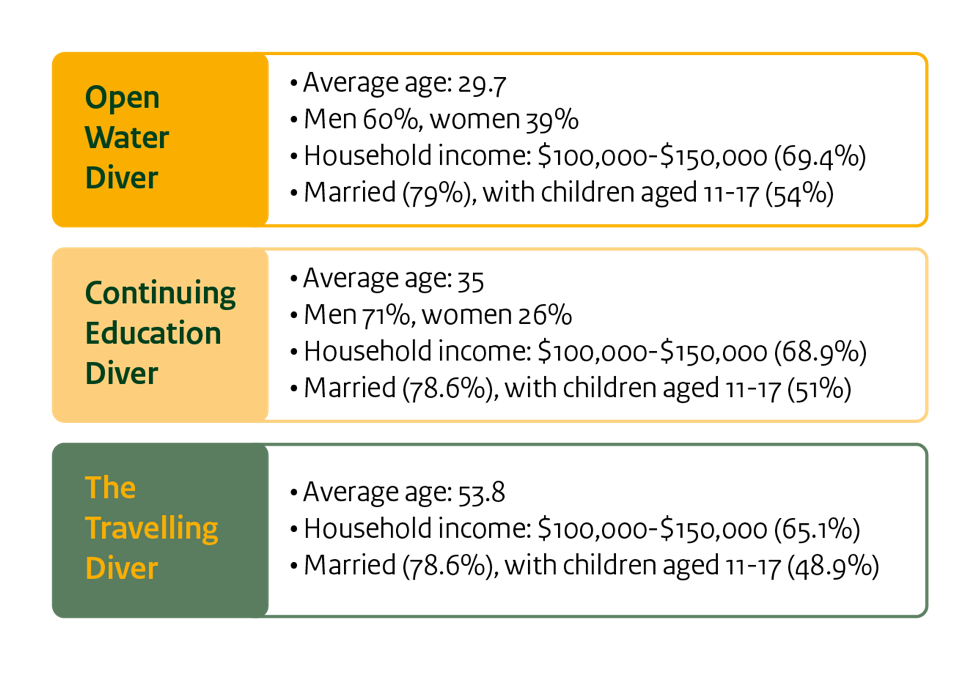

The worldwide market is dominated by male divers, with a global estimate of 65%. The Diving Equipment and Marketing Association (DEMA) categorises the US market (the world’s largest market of divers) by certification type. It shows how the market becomes more male-dominated as they choose to take additional certification courses. It also shows that the all-diving markets are dominated by high-earning individuals, which reflects how diving is an expensive sport to pursue.

Figure 2: Diver demographics by certification and activity level

Source: DEMA Diving Fast Facts, 2024

There is evidence that more women are taking part in the sport. Since PADI’s first Women’s Dive Day in 2014, there has been a 2.2% increase in women taking recreational diving certification courses. While there are more women dive instructors these days, the trend is that fewer women tend to continue learning and seek higher diving qualifications. Simple ways to attract women divers include having female instructors and being inclusive in your marketing materials to make women feel welcome.

European divers spend an average of €750 on a 5-to-7-day holiday before any diving expenditure. The diving component costs an extra €300-€400, which includes the diving package, course, and additional equipment and fees. Longer trips or trips to more remote destinations cost more. Liveaboard holidays typically cost more than a resort-based holiday.

People like to dive for all sorts of reasons. The key motivation is exploring the underwater environment. Diving is also a challenging and exhilarating sport, yet the peacefulness of the underwater environment is a feeling like no other. Diving is also known for its health benefits, as it can help improve both physical and mental well-being.

Divers are some of the most sustainably-minded tourists. They know that their diving experience is enhanced if the place they dive is well-maintained and pristine. They feel very passionate about the need to preserve coral reefs and marine environments to ensure their long-term health.

A survey conducted by The Reef-World Foundation in 2022 found that 59.1% of divers look for sustainable diving options, and 63.6% state that sustainability is a main consideration in the travel booking process; 75.8% are prepared to pay more for a sustainable option. Almost half of all divers (49%) believe that they have the responsibility to protect marine life when they are diving.

Tips:

- Take some time to analyse your own market of diving consumers so you can attract new ones. Find out where they come from, identify how much they spend and what other activities they like to do. You can ask them to complete a short survey so you can build up a picture of them.

- Find out what the common diving standards and regulations are in the CBI study Entering the European dive tourism market.

Accessible tourism on the European market

Accessible tourism is the ongoing endeavour to ensure tourist destinations, products and services are accessible to all people, regardless of physical limitations, disabilities or age. It encompasses publicly and privately owned tourist locations. The improvements not only benefit those with permanent physical disabilities, but also parents with small children, elderly travellers, people with temporary injuries such as a broken leg, as well as their travel companions. Disabled tourists may travel individually, in groups, with their family or with carers.

Accessibility and dive tourism

All dive organisations promote and/or provide services for accessible diving, such as PADI’s Adaptive Support Diver programme. In the UK, BSAC’s Diving for All programme caters diving to people with disabilities and ensures rigorous standards to ensure safety. There are special training courses for diving instructors and marketing materials for clubs to cater to divers with disabilities.

Figure 3: Marketing materials aimed at divers with disabilities

Source: BSAC, 2024

To attract this market, you must be able to offer diving experiences and courses that are safe, with properly trained instructors. The best thing to do is to find out what PADI and BSAC do for their disabled markets. You will need to be affiliated with their programmes.

The most important thing is to be honest. Do not offer services for this market you cannot provide or that will not be safe by the highest standards.

Tip:

- Read the CBI studies The European market potential for accessible tourism and Entering the European market for accessible tourism products for practical and useful advice on making your tours accessible.

2. What makes Europe an interesting market for dive tourism?

Europe is an interesting market to target for dive tourism, as it is one of the two largest markets in the world (together with the USA). There are an estimated 3.5 million European divers out of a global total of 6 to 9 million. Please note that statistics on scuba diving participation and the dive tourism market in Europe are very limited. By contrast, the American market is well-researched.

Facebook reach statistics help validate the popularity of scuba diving amongst Europeans. In April 2024, the number of Europeans who expressed an interest in, or liked pages, relating to scuba diving on Facebook or Instagram was between 7.4 million and 8.7 million. By comparison, the American market numbered between 8 million and 9.5 million. It is therefore clear that both markets show high awareness of scuba diving and that they are, broadly speaking, equally strong.

The global dive tourism market was estimated to be worth US$3.3 billion in 2024. It is estimated to grow by a CAGR (compound annual growth rate) of 5.5% to US$5.6 billion over the 10 years to 2034. More people are reportedly interested in diving, and an increased offering in certification classes and instructors is driving growth. In Europe, the diving industry generates more than €170 million every year, and it is estimated that around 800,000 Europeans travel at least once a year to dive.

Research was conducted amongst training agencies, dive centres and diving instructors into certification courses in 2023. The fastest growth in Western Europe in 2022 was in Try Scuba experiences. Try Dive is where people have a go at diving but do not obtain certification. Amongst dive operators, 47% reported an increase in number of Try Dive participants in 2022, 47% expected an increase in participation for 2023, 39% reported an increase in number of entry-level open water certifications in 2022, and 62% anticipated an increase in participation for 2023.

As activities targeting the Try Dive and people taking open water certifications offer the best opportunities for local tour operators, it can be concluded that the European scuba diving market is currently a growth market.

3. Which European countries offer the most opportunities for dive tourism?

The European countries offering the most opportunities for dive tourism in developing destinations are Germany, the UK, France, the Netherlands, Spain and Italy. Other European markets are also interesting, like Poland, the Scandinavian countries (Denmark, Finland, Norway and Sweden) and Hungary.

Characteristic of the dive market is that many certified divers do not dive regularly and there is a lack of information about active diver travel behaviour. It is known that divers like to do other sport-related activities while on holiday, like cycling, hiking and water sports. Statistical analysis ranking international tourist arrivals in 2019, consumer behaviour and a desire to enjoy outdoor activities on holiday identifies the top-6 markets in Europe.

Table 4: Analysis of top-6 markets by outbound arrivals, consumer behaviour and outdoor activities

| Rank | Country | Outbound arrivals to developing destinations (2019) | Preference for international travel post-pandemic (2020) | Preference for adventure travel post-pandemic (2020) | Sport-related activities (e.g. scuba, cycling) – Main reasons for going on holiday (2015) | Prefer active holidays over relaxing holidays (2017) | Score (0-5) |

| 1 | Germany | 13,500,000 | 35% | 4% | 15% | 32% | 3.92 |

| 2 | UK | 11,000,000 | 33% | 5% | 10% | 40% | 3.60 |

| 3 | France | 9,000,000 | 29% | 2% | 14% | 44% | 3.48 |

| 4 | Netherlands | 3,500,000 | 35% | 4% | 16% | 36% | 3.33 |

| 5 | Spain | 3,700,000 | 19% | 15% | 5% | 43% | 3.08 |

| 6 | Italy | 4,300,000 | 24% | 6% | 3% | 45% | 2.59 |

Source: Acorn Tourism Consulting, 2022

Dive tourism is well represented in the European tour operator market, which is a good indicator of demand. Amongst European tour operators that have a presence in the dive tourism sector, 19.8% offer diving trips, a ratio of about 1 in 5. Germany and the UK each have almost double the number of specialist dive tour operators than other European markets, making them the two largest markets for dive tourism.

Source: Acorn Tourism Consulting, 2022

Analysing Facebook statistics that estimate reach also gives some indication of the interest in scuba diving in European source markets. These figures represent a point in time and should not be viewed as diving participation figures.

Source: Facebook, 2024

CBI research conducted in leading European source markets in 2022 found that diving was the fifth most popular activity while on a trip, with 4% of respondents reporting that diving was a top activity in any destination. This figure rose to 9% for diving in developing destinations, showing the importance of diving in these countries. The research also found that divers stay longer than regular tourists, 12.6 nights compared to 10.5 nights. They also spend 33% more than regular tourists.

Germany

In 2023 there were 4.63 million scuba divers in Germany who dived in their spare time, 460,000 of them regularly. The total number of scuba divers rose by 1.1% between 2019 and 2023, but the numbers of those who dived regularly fell by 2.1% in the same period.

To reach the German market, consider attending trade fairs and contacting dive associations. Germany hosts Boot Düsseldorf, the largest annual yacht and water sports show in the world, with 214,000 visitors from 120 countries and 1,500 exhibitors. It will be held 18-26 January 2025. Germany also hosts ITB Berlin, the world’s largest tourism trade fair, to be held 4-6 March 2025. ITB attracts exhibitors and attendees across many niche markets, including diving.

Germany’s diving association is VDST (German Underwater Federation), offering a wide range of services and training courses.

The Association of Dive Tour Operators (ADTO) is a group of 19 dive tour operators from the German-speaking world (Germany, Austria, Netherlands and Switzerland) that joined together with a focus on cooperation. There is a full list of participating dive operators on the website.

The United Kingdom (UK)

In 2018, 365,000 British people participated in scuba diving. In addition, 52,200 people take part in scuba diving or snorkelling twice a month. UK residents make around 2 million dives per year.

BSAC (British Sub Aqua Club) is the UK’s scuba diving association. BSAC had 27,000 members in 2019, representing a small increase compared to 2018 but a significant decrease from an all-time high of 52,364 members in 1995.

A good place to find buyers is the Go Diving Show in Coventry. It is a large diving event for both trade and consumers, to be held 1-2 March 2025. The Go Diving Show is also held in Australia in September of each year.

France

FFESSM (French Federation of Underwater Studies and Sports) is France’s main diving association. It issued 272,039 diving licences in 2019, down from 327,363 in 2018. It also runs the Salon de la Plongée, the annual diving industry event, in Paris. To be held 9-12 January 2025.

The Netherlands

The NOB (Netherlands Underwater Association) is the national governing body for recreational diving and underwater sports in the Netherlands. In 2008 there were 260 affiliated scuba clubs and 20,000 members. The DUF (Dutch Underwater Federation) is one of the largest national diving associations in the Netherlands, with 14,000 members.

Spain

FEDAS (Spanish Federation of Underwater Activities) is the Spanish diving and fishing association. Spaniards may choose to travel to Spanish-speaking destinations, including the Canary Islands, Utila and Roatan in Honduras, the Riviera Maya in Mexico, and the Sea of Cortez and Baja California in Mexico.

Italy

Italy’s diving body is FIAS (Italian Underwater Activities Association). It publishes an online magazine, Blue Continent. EUDI (European Dive Show) is an annual region-wide diving industry event hosted in Bologna. It is due to be held 13-15 October 2025.

Insight: Europe is a growth dive market

Dominik Wyszogrodzki - Dive Tourism Consultant

Diving is gaining more enthusiasts every year, and with the post-Covid ease of travel restrictions, well established, classic markets like Germany, the UK, France, the Netherlands and Scandinavia are picking up in numbers of diving travellers. Eastern Europe, especially Poland, is also catching up. Divers are also starting to show an interest in other destinations beyond well-established ones like Egypt, Thailand and Maldives, to places like the Galápagos, Mexico and the Caribbean.

European divers are keen adventure tourists and like to spend money on travel. They look to obtain technical diving qualifications, which offers good opportunities for well-managed diving schools and centres to attract them.

Tips:

- To find out more about European divers, explore the wide range of scuba diving magazines on the market. They often have travel sections. Some of the best magazines are DIVER, Dive Magazine, SCUBA, Scuba Diving, Scubaverse and Tanked Up Magazine.

- Find out more about the European markets and keep up-to-date with broad changes in the source countries. Consult the CBI demand study What is the demand for outbound tourism on the European market?.

4. Which trends offer opportunities or pose threats in the European dive tourism market?

Sustainability is the number-one trend in the dive tourism market today. Divers like to engage with dive businesses that can prove their sustainable actions. They want to minimise their impact on marine habitats. Demand for new and exciting diving experiences is another trend, along with diving as a wellness activity. The senior diver market is an important trend, as the European population is ageing.

Divers seek sustainable dive operators

Embedding sustainability in diving and diving operators continues to evolve as a major trend in the niche. Divers are amongst the most sustainably minded of all tourists. Not only are they motivated to dive in pristine and well-managed dive sites, they also want to play their part in preserving the precious underwater environment. Divers are known for making sustainable and responsible decisions.

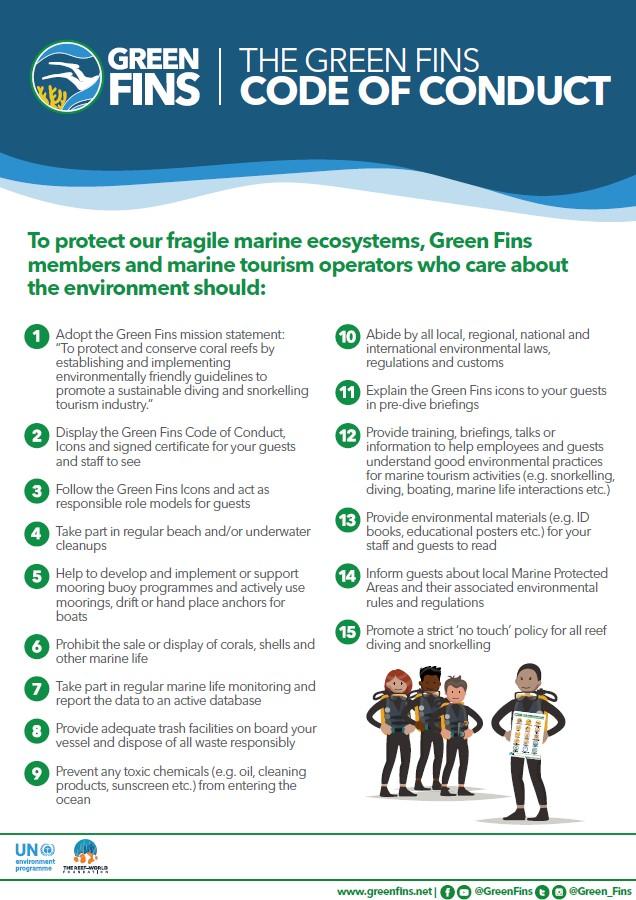

They see firsthand the damage that has been done to reefs and marine habitats, brought about by climate change and other actions. Therefore, divers are very keen to play their part in reversing damage and minimising any future impact. There are a few specialist diving sustainability schemes on the market, like Green Fins: this not-for-profit organisation has global recognition and has established a robust set of environmental guidelines for businesses to promote a sustainable diving and snorkelling industry.

Figure 6: The Green Fins Code of Conduct

Source: Green Fins, 2024

Since 2004, more than 700 marine tourism operators have become members of Green Fins.

A survey conducted by The Reef-World Foundation in 2022 sought views about sustainability amongst both divers and dive operators. The findings show a high awareness of the need for sustainability in the sector amongst both groups. Most importantly, divers say they are prepared to pay more for sustainable experiences. The survey shows that putting in place sustainable business models and good branding is likely to attract new customers.

Table 5: Key findings from Sustainability in a Recovering Travel World Survey

| Divers | Diving Operators |

|

|

Source: The Reef-World Foundation, 2022

As a result of the survey findings, PADI launched the PADI Eco Center on World Earth Day 2023. To be an Eco Center, dive businesses must meet the following criteria:

- Participate in the PADI Aware Adopt the Blue programme

- Be an active Green Fins member

- Be able to demonstrate a high level of environmental performance through the above schemes – for instance, evidence of conservation activities and a measured reduction in carbon footprint

By early 2024, there were 100 accredited PADI Eco Centers in 132 countries and more than 300 PADI businesses working towards accreditation. Collectively, the Centers have removed 2.3 million pieces of plastic from the sea, helped 34,773 marine animals be detangled from harmful debris, and identified 5,800 dive sites to be monitored as part of Marine Protected Areas.

PADI has set a goal of 660 Eco Centers by 2030, representing 10% of all dive operator members. Actions taken by the Eco Centers vary. For instance, in the Caribbean, coral replanting programmes are underway to help regenerate coastlines; in Mexico, citizen science causes are collecting data for whale conservation.

By the end of 2023, Southeast Asia and the Caribbean region had the most Centers. Ceningan Divers is a well-regarded PADI 5 Star Dive Resort and Eco Center in Bali. It received a zero-impact score on its 5th annual assessment in 2024, one of only two businesses to achieve this.

In May 2023, Deep Blue Dive Center became the first PADI Eco Center in Jordan. The business has undertaken many debris and waste cleanups to help preserve the 27 km of coastline on the Red Sea. They also do many survey dives to assess impacts. Becoming a member of Green Fins has helped the business educate staff and guests and find more ways to behave sustainably.

As these initiatives become increasingly popular amongst dive businesses and divers are more interested in sustainability, the diving industry looks set to be a market leader in sustainable tourism action.

Tips:

- Assess how sustainable your dive business is. Identify ways to add more sustainable actions to the way you operate your business. These CBI studies can be helpful tools: How to be a sustainable tourism business and 10 tips to go green in the tourism sector.

- Find out what you need to do to become a PADI Eco Center. Contact PADI and Green Fins for more information and study their websites. They are likely to be very helpful, as they are keen to make dive tourism as eco-friendly as possible.

Demand rises for new and exciting diving experiences

The European market of divers is looking for new and exciting diving experiences beyond the traditional destinations of the Red Sea, Thailand and Maldives. They also seek diving destinations further afield, to places like the Galápagos, Mexico and the Caribbean, for that diving experience of a lifetime.

Divers are also looking for different experiences, like shark diving in the Galápagos or South Africa, wreck diving in the South Pacific, and ice diving in the Arctic. Check out how this dive business, Galapagos Shark Diving, offers a lot of detail about its shark diving operation, and how it does it sustainably. The website is offered in English, Spanish and German, which is very appealing to the European market.

Underwater photography is another trend that’s becoming more popular. Digital underwater photography has made the experience much easier for amateur photographers. There is a range of underwater photography products, including underwater photoshoots for weddings or one-off events. PADI offers an Underwater Photographer course.

Tip:

- Assess your own dive offer and identify what makes your destination unique. Think about what extras you could add, like dives to wrecks or reefs that are further away. Team up with other dive operators to give your customers as much choice as you can.

Diving identified as a new wellness trend

There is a range of mental and physical benefits associated with scuba diving, and it is fast becoming associated with wellness. Many divers also take part in yoga, meditation and other fitness activities to enhance their diving performance and improve their overall wellbeing. Several studies identify the wellness attributes of diving:

- Being in and around ocean environments positively affects mood. Being close to large bodies of water, especially vast expanses like seas and oceans, improves overall health and wellbeing by reducing stress, promoting relaxation and connecting with nature. Research shows that diving could lower stress after just one hour.

- There are significant benefits to improving wellness amongst people with disabilities. Studies report improvement in quality of life after trying diving compared with other activities. Diving was found to help with both physical difficulties and mental issues like PTSD (post-traumatic stress disorder).

- The Harvard Study of Adult Development found that friendships and close relationships help keep people happy. Diving is a social sport with plenty of opportunities to meet like-minded people and share experiences.

With so many different experiences possible, from challenging deep-water dives to exciting animal encounters to exploring life on coral reefs, divers can enjoy an excellent wellness experience that enhances their personal physical and mental health.

Tip:

- Include statements in your marketing materials and your website about the health and wellness benefits of diving. Write a blog or find a local dive expert to write it for you. Using dive experts is a good way to reassure potential customers that your services are good and safe.

Diving attracts an ageing demographic

There has been an increase in the number of senior divers (aged 60+) over the past few years. Europe is an ageing demographic, and this is continuing to drive growth. It is estimated that as many as 22% of the diving population are over the age of 54. This age is expected to rise with an ageing European population.

Many older divers have been diving for many years and are still fully practicing their sport. As the 60+ generation lives longer, continues to have active lives and remains healthy, they are increasingly keen on trying new things – also diving. But it is important to remember that diving is considered to be an extreme sport and this should be taken into account as physical health and mental ability often change as people age.

Dive businesses must be aware of changing demographics of their diving customers and adapt their services accordingly. Experienced older divers are more likely to be well-informed about what they can and cannot do, physically and mentally. But those who are new to diving will appreciate detailed safety briefings and patient instructors who are habituated to older divers.

Tip:

- Offer diving tours aimed at older divers. These could include dives at limited depths with relatively slow descents and ascents.

Acorn Tourism Consulting Limited carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research