10 tips for finding buyers on the European tourism market

The European tourism market is crowded, sophisticated and fast-moving. It is also very competitive. European tour operators are always looking for new suppliers with innovative ideas. This helps them develop a strong USP and stand out in a crowded field. As a local operator providing tourism services, you must identify new buyers on an ongoing basis. Below are ten tips to help you find European buyers.

Contents of this page

- Know your market and whom you are targeting

- Find European buyers at travel fairs

- Consult websites of tourism sector associations

- Find buyers on online databases

- Create your own database of European tour operators

- Use OTAs to sell to consumers

- Optimise your website to reach buyers

- Use social media to connect with buyers

- Advertise in European trade publications

- Consult other organisations for help or information

1. Know your market and whom you are targeting

You need to understand the market that you are planning to sell into. The tourism sector has many different niches, and each has individual needs. Market research will enable you to understand the needs of the market you are targeting. CBI has published several studies covering specific European tourism market segments. These include Adventure tourism, Food tourism, Nature tourism and Wildlife tourism. They outline visitor types and their motivations for travel.

The European buyer market is large and dynamic. Since the pandemic, more and more European travellers are looking for authentic, unique travel experiences. Booking habits are also changing as more people book holidays, tours and activities online. As a result, routes to the European market now include both traditional and online channels.

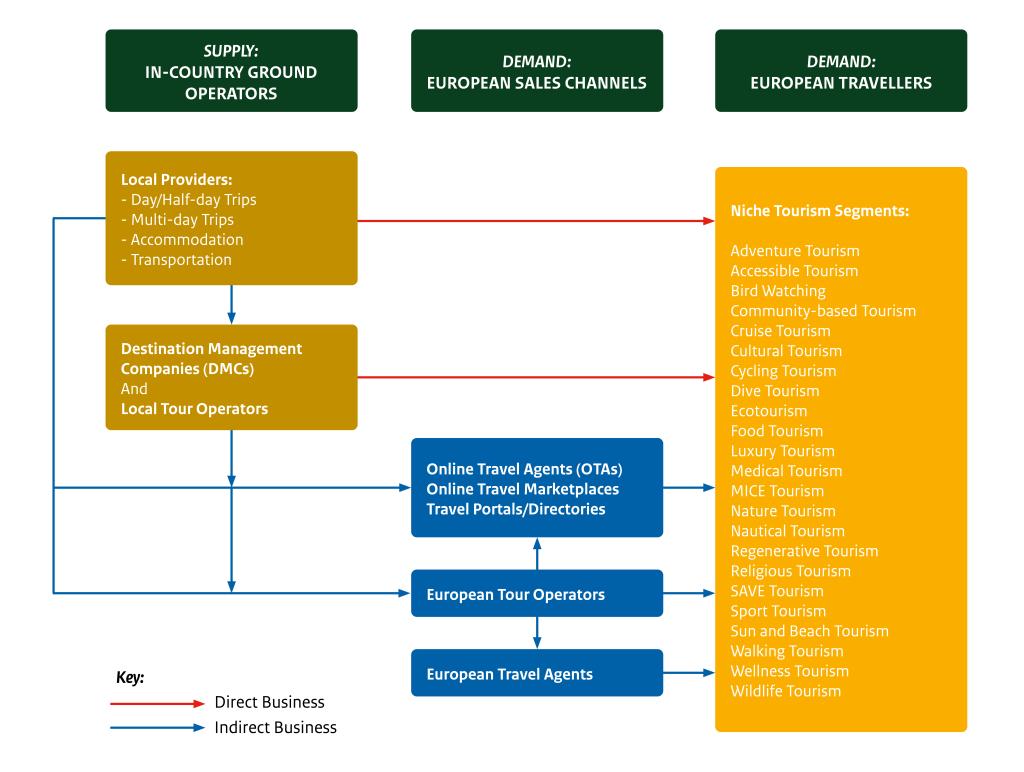

The diagram below shows how providers of local tourism services (supply) reach the two major travel markets: tour operators and independent travellers (demand).

Figure 1: How tourism services reach European tour operators and independent travellers

Source: Acorn Tourism Consulting

Holidays and trips are sold either directly to the consumer (the traveller) or indirectly through travel businesses. European tour operators tend to be either specialist or general travel businesses. The main buying channels on the European market are as follows.

- Specialist tour operators supply a particular type of travelling customer and tourism niche segment. One of the largest of these is adventure tourism. Examples of specialist tour operators are Anders Reizen (Belgium) for walking holidays; Better Places Travel (the Netherlands), specialising in tailor-made, family and impact travel; and Nomade Aventure (France), which offers trekking holidays and adventure trips.

- General tour operators usually cover several niche segments. They often sell packages to all-inclusive beach resorts and hotels. Examples are German-owned TUI, the largest travel company in Europe, and DERTOUR (Germany). Others include Sunweb (the Netherlands) and Jet2holidays, the UK’s largest tour operator. Specialist operators tend to be smaller, while general operators often cater for larger numbers of travellers.

- Travel agents usually package together different elements of a holiday (flights, accommodation, activities). They also sell package holidays on behalf of tour operators. There is some crossover between general tour operators, travel agents and online travel agents. High-street travel agents like Trailfinders (UK) and alltours (Germany) were the traditional method of buying holidays throughout Europe for many decades. Their number has fallen, though, as online bookings have grown. But traditional travel agents are still important in some markets, like Germany.

- Online travel agents (OTAs) market and sell travel products directly to consumers online. The OTA manages the booking and makes the sale. Some of the biggest OTAs focus on accommodation, flights and car rental; they include Booking.com and Expedia. Others specialise in selling tours, activities and experiences – for example, Viator, GetYourGuide and Travel Local.

- Online travel marketplaces and travel portals (or directories) are websites where tour operators can list their business and market their tours to consumers. Consumers browse many different products; when they are read to book, they are redirected to the seller’s own website. Examples include SafariBookings, TourHound and Travelstride.

- Fully independent travellers (FITs) are individual holidaymakers. They buy the elements of their holiday separately, from a variety of sources. These include airline tickets, accommodation, local and international tours, car rental and so on. They may purchase some elements before leaving their home country and others while travelling.

Tips:

- Decide which niche segment(s) best suit(s) the products and services offered by your organisation. If you are not sure, have a look at CBI’s interactive infographic. This useful tool outlines the main tourism segments and shows how their subsegments are related to each other.

- Decide your key target countries. Identify those with good access to your destination, such as direct flights, and/or with good onward connections. For more information on European tourism markets, read the CBI study What is the demand for outbound tourism on the European market?.

- Ask your national tourist board and/or trade association about target markets for your country. They may compile tourism data and other statistics that will help you identify key inbound markets.

- Consult the CBI study How to work effectively with OTAs? to find out which OTA works best for you.

2. Find European buyers at travel fairs

There are two types of travel fair: business-to-business (B2B) and business-to-consumer (B2C).

Sometimes these are combined, and certain areas or days are dedicated to each form. To distinguish between the B2B and B2C fairs, it can be helpful to look at the name of the event. B2B fairs are often called “travel trade fair” or “tourism trade fair”. A “travel show” or “consumer show” is usually a B2C event.

During the pandemic, many fairs were held online. This may still be the case. Be sure to explore the websites of the fairs that interest you, to see what elements you can join online.

European travel businesses exhibit or attend travel fairs for different reasons.

- They attend B2B shows to network with suppliers and identify new destinations.

- They exhibit at B2C fairs to attract potential travellers.

Local tour operators from developing country destinations, such as yourself, might exhibit at B2B fairs in order to attract buyers. National tourist boards exhibit at both B2C and B2B fairs, as they are both seeking to attract visitors to their country and make contact with business buyers. Lastly, consumers attend B2C fairs to research destinations and/or find an operator to travel with.

The table below summarises the key audiences for travel trade fairs and consumer shows, and the main reasons for their visits.

Table 1: Main audiences attending and exhibiting at travel trade fairs and consumer travel shows

| Audience | B2B travel trade fairs | B2C consumer travel shows |

| European tour operators | Attend | Exhibit |

| Developing country tour operators | Exhibit | Attend |

| National tourist boards | Exhibit | Exhibit |

| Travelling consumers | - | Attend |

Source: Acorn Tourism Consulting

Travel trade fairs are an excellent way to network with the organisations you want to sell to. But they are expensive to exhibit at and you need to be well-prepared.

Below is a list of some of the major travel trade fairs. Most are held annually and the dates of the most recent or upcoming event are included. If that date has passed, you can still tell when the next fair is likely to be held. But always check to verify when the event is taking place.

Global

- ITB Berlin (5-7 March 2024, Berlin, Germany) is the world’s leading travel trade show. ITB attracts more than 113,500 trade visitors and 10,000 exhibitors from more than 180 countries. (B2B)

- World Travel Market (WTM) (6-8 November 2023, London, UK) is an annual B2B show for the global travel trade. WTM attracts more than 50,000 international travel professionals from 190 countries and regions. (B2B)

To target buyers in specific European countries, consult the websites of these regional fairs.

Austria

- Ferien-Messe Wien (14-17 March 2024, Vienna) – Austria’s largest holiday and travel show. (B2C)

Belgium

- Belgium Travel Expo (13 November 2023, Nivelles; 14 November 2023, Antwerp) – trade show for tourism and MICE (meetings, incentives, conferences and exhibitions) professionals. (B2B)

- Brussels Holiday Fair (1-4 February 2024, Brussels) – holiday, travel, tourism and leisure fair. (B2C)

- Vakantiesalon Antwerpen (26-28 January 2024, Antwerp) – the largest holiday fair in the Flanders region. (B2C)

France

- IFTM Top Resa (International & French Travel Market) (20-22 September 2023, Paris) – annual trade show for travel and tourism, targeting the business, leisure, group, MICE and events segments. (B2B)

- ILTM (International Luxury Travel Market) (4-7 December 2023, Cannes) – trade show aimed at luxury travel suppliers and buyers. (B2B)

- Rendez-vous en France (21-22 March 2023, Paris) – international trade show for the French tourism offering. (B2B)

- Salon du Randonneur (24-26 March 2023, Lyon) – travel show specialising in the adventure travel segment. (B2C)

- Salon Mondial du Tourisme (26-28 January 2024, Lille; 8-10 March 2024, Lyon; 14-17 March 2024, Paris) – the French world tourism fair, hosted annually at three locations in France. (B2C)

- SIT Nantes and SIT Rennes (held every January in Nantes and Rennes) – regional tourism fairs. (B2C)

Germany

- Fair Handeln (13-16 April 2023, Stuttgart) – international exhibition for fair-trade and globally responsible trade and activities in business, finance, tourism and development co-operation. (B2B + B2C)

- F.re.e Die Reise- und Freizeitmesse (14-18 February 2024, Munich) – the largest exhibition for recreation and travel in southern Germany. (B2C)

- GBTA Conference (14-16 November 2023, Hamburg) – trade fair for business professionals. (B2B)

- GTM Germany Travel Mart (16-18 April 2023, Wiesbaden) – the largest workshop for inbound travel professionals for Destination Germany. (B2B)

- IMEX Frankfurt (23-25 May 2023, Frankfurt) – business trade fair for planners looking to book and organise MICE events. (B2B)

- Reisemarkt Rhine-Neckar-Palatinate (January 2024, Mannheim) – holiday fair in southwest Germany. (B2C)

- Reisen Hamburg (Hamburg) – Hamburg’s travel trade show. (B2B)

- TourNatur (Dusseldorf) – travel show for outdoor enthusiasts, covering the segments hiking, cycling and nature experiences. (B2C)

Italy

- BIT Milan (4-6 February 2024, Milan) – the largest travel trade show in Italy, with more than 2,000 exhibitors and 50,000 visitors. (B2B)

- BTO Florence (22-23 November 2023, Florence) – major travel trade show. (B2B)

- TTG Rimini – (11-13 October 2023, Rimini) – an important international travel trade show. It attracts 55,000 visitors, 2,200 exhibitors, and 1,000 buyers from 50 countries. (B2B)

The Netherlands

- Vakantiebeurs (11-14 January 2024, Utrecht) – major tourism and leisure fair. (B2C)

- Vakantiebeurs Vakdag (11 January 2023, Utrecht) – travel trade event. (B2B)

Scandinavia

- Danish Travel Show (23-25 February 2024, Herning, Denmark) – travel show at which 80% of visitors are seeking inspiration for their next holiday from international exhibitors. (B2C)

- Matka Nordic Travel Fair (19-21 January 2024, Helsinki, Finland) – the biggest travel fair in northern Europe. (B2C)

- Matka Pro (18 January 2024, Helsinki, Finland) – the largest travel industry event in northern Europe. It runs alongside the Matka Nordic Travel Fair. (B2B)

- Reiselivsmessen (13-14 January 2024, Oslo, Norway) – consumer travel show with an international audience. (B2C)

- Senior Göteborg (14-16 March 2023, Gothenburg, Sweden) – consumer show aimed at an active older audience. (B2C)

- Travel News Market (9 November 2023, Stockholm, Sweden) – the leading trade travel event in Sweden, bringing together international travel suppliers and the Nordic outbound market. (B2B)

Spain

- B-Travel International Tourism Show (24-26 March 2023, Barcelona) – international tourism show for experiential travel (B2C)

- Expovacaciones (5-7 May 2023, Bilbao) – travel fair that attracts 23,500 visitors and 184 exhibitors. Aimed at an international audience. (B2C)

- Feria Internacional de Turismo (FITUR) (24-28 January 2024, Madrid) – the leading international tourism fair in Spain. (B2B and B2C)

United Kingdom

- Destinations (11-14 January 2024, Manchester; 1-4 February 2024, London) – holiday and travel show with a focus on international destinations. (B2C)

- Experience Latin America (19-21 June 2023, London) and Experience Africa (26-28 June 2023, London) – travel events dedicated linking buyers from the UK and Europe with suppliers from each continent. (B2B)

- Adventure Travel Show (11-12 November 2023, London) – important consumer show aimed at the adventure travel segment. (B2C)

Regional

- AdventureELEVATE Near East (12-14 October 2023, Amman, Jordan) – event for an international audience of outbound tour operators, travel advisors and media. (B2B)

- Arival | Activate Bangkok (12-14 June 2023, Bangkok, Thailand) – aimed at the tours, activities and attractions sector in the Asia Pacific region. (B2B)

- GEM (Global European Marketplace) (2-3 November 2023, London, UK) – trade fair for global tour operators and travel buyers to contract business. (B2B)

- International Luxury Travel Market (ILTM) – regional trade fairs aimed at the luxury market, held in several regions: Asia Pacific, North America, Latin America, Africa and the Middle East. There is also a European show held in France, listed below. (B2B)

- PATA Travel Events (Pacific Asia Travel Association) – hosts a number of events in the Asia Pacific region: PATA Annual Summit & Adventure Mart (30 May-2 June 2023, Pokhara, Nepal); PATA Destination Experience Forum and Mart (21-23 June 2023, Sarawak, Malaysia); PATA Travel Mart (4-6 October 2023, New Delhi, India). (B2B)

- Regional ITB events: ITB Asia (25-27 October 2023, Singapore); ITB China (12-14 September, Shanghai, China); ITB India (26-28 April 2023, Mumbai, India). (B2B)

- Regional WTM events: WTM Africa (10-12 April 2024, Cape Town, South Africa); Arabian Travel Market (1-4 May 2023, Dubai, UAE); WTM Latin America (2-4 April 2024, Sao Paulo, Brazil). (B2B)

- TravelMart LatinAmerica (TMLA) (20-22 September 2023, location not yet known) – the region’s largest trade show, aimed at building business to Latin America from worldwide markets. (B2B)

Niche market fairs

- Adventure tourism. Adventure Travel World Summit (11-14 September 2023, Hokkaido, Japan) – an annual show attended by around 800 tour operators, adventure travel writers and influencers, tourism boards and industry partners. It is a key networking event for businesses in the adventure travel niche. The summit is held in different locations every year. Past hosts include Sweden, Chile and Argentina.

Other fairs under the same brand include AdventureELEVATE (9-11 May 2023, Maine, USA), which focuses on networking and education. It features workshops, panel discussions and keynote speakers covering adventure industry topics. (B2B). AdventureNEXT (25-27 June 2023, Bogota, Colombia) is a networking event for adventure tourism providers to share experiences around this business as an instrument of peace. (B2B) - Bird watching. Global BirdFair (14-16 July 2023, Rutland, UK) – annual show dedicated to bird watching. (B2C)

- Cycling tourism. Eurobike (21-25 June 2023, Frankfurt, Germany) – annual show that attracts large numbers of exhibitors (1,500 from 57 countries), 33,780 trade visitors and 27,370 cyclists. Some 52.1% of attendees are from outside Germany. (B2B + B2C)

- Diving. Go Diving Show (4-5 March 2024, Kenilworth, UK) – an annual show aimed at scuba divers, dive operators, resorts and destinations. (B2B + B2B)

- Diving. InterDive (21-24 September 2023, Friedrichshafen, Germany) – trade show specialising in the diving and snorkelling segment. (B2C)

- Experiential travel. PURE Life Experiences (10-13 September 2023, Marrakech, Morocco) – experiential travel show aimed at high-end buyers. (B2B)

- SAVE (scientific, academic, volunteering and educational) tourism. World Youth and Student Travel Conference (WYSTC) (12-15 September 2023, Lisbon, Portugal) – trade event for the youth, student and educational travel industry. (B2B)

Listings of travel and tourism trade fairs/shows

- World Tourism Exhibitions provides a comprehensive listing of travel and tourism fairs around the world, including Europe.

- 10times is a searchable database listing many thousands of travel and tourism trade shows around the world.

Tips:

- Make sure that you have a clear purpose for attending or exhibiting at a show. Are you looking for business suppliers (B2B) or to sell directly to consumers (B2C)? If both, does the fair attract both type of buyer? For more tips, see the Import Promotion Desk’s Foreign trade fair participation guide.

- Research the market well so that you know all about potential buyers. Consult the list of exhibitors on the fair’s website and draw up your own list of tour operators that could be potential buyers.

- Exhibit at a regional travel trade fair if the buyers you want to meet usually attend these events. This may be cheaper, too.

- Fix meetings with your target operators well in advance. Follow up with the tour operator soon after the fair. This keeps the outcome of the meeting fresh in both your minds.

- Schedule a Zoom or Teams meeting if you are unable to attend a show. Since the pandemic, many businesses are open to online meetings.

3. Consult websites of tourism sector associations

The tourism sector in Europe is well-supported by trade associations. Tour operators are often members of their national associations and may have a listing on its website. When you have identified the country and niche segment that offers you the most potential, consult the relevant association’s website to find out which members may be potential buyers.

Here are some of the most important tourism sector associations.

Global

- The Adventure Travel Trade Association (ATTA) is a community of more than 30,000 individual guides, tour operators, lodges, travel advisers, tourism boards, destination marketing and management organisations and more. Over 100 countries worldwide are represented. You can browse the ATTA’s active members across many categories.

- The African Travel & Tourism Association (ATTA) is a member-driven trade association that promotes tourism to Africa from all over the world. ATTA has more than 600 members, including European and UK tour operators.

- The Latin American Travel Association (LATA) is a membership association that aims to promote the region as a tourist destination. Members include destination management companies (DMCs) and European tour operators.

- The Pacific Asia Travel Association (PATA) is the leading association for travel and tourism in the Asia Pacific region. PATA chapters are local community organisations of travel industry professionals working to develop travel and tourism to, from and within the Asia Pacific. The European division has several chapters, including Denmark, Finland, Germany, France, Norway, Sweden and the United Kingdom. Check the links to each branch for activities in its region.

Europe

- The European Tour Operators Association (ETOA) is the trade association for tour operators and suppliers in European countries. It operates a number of events aimed at the B2B market.

- The European Travel Agents’ and Tour Operators’ Association (ECTAA) comprises a group of national travel agents and tour operators within the EU and elsewhere in Europe.

European countries also have national tourism associations you should consult.

Austria

- The Österreichischer ReiseVerband (ORV) provides a listing of its members online.

Belgium

- The Association of Belgian Travel Organisers (ABTO) provides details of members.

France

- Agir pour un Tourisme Responsible (ATR) is a network of tour operators committed to responsible tourism.

- Les Entreprises du Voyage is a membership organisation representing travel and tourism companies, and is a source of information about market trends. It features more than 3,500 members on its website.

- The Syndicat des Entreprises du Tour Operating (SETO) is a group of French tour operators. Its website also features tourism statistics.

Germany

- The Allianz Selbstandiger Reiseunternehmen Bundesverband (ASR) represents medium-sized tour operators and travel agents. It also welcomes membership applications from international operators that supports its goals.

- The Arbeitsgemeinschaft LateinAmerika (ARGE) has 90 members committed to promoting tourism in Latin America.

- Die Reisewirtschaft (DRV) represents tour operators, travel agents and tourism service providers. Enter the name of any German city/town (e.g. Hamburg) in its location search bar to pull up a list of local members.

Italy

- The Federazione Italiana Associazioni Imprese Viaggi e Turismo (FIAVET) represents 1,500 Italian travel agencies across 16 regions.

- The Italian Association for Responsible Tourism (AITR) has more than 100 members working in the tourism sector.

The Netherlands

- The Dutch Association of Travel Agents and Tour Operators (ANVR) is a representative body for the travel industry. Its website has a searchable database of members.

Scandinavia

- The Association of Danish Travel Agents and Tour Operators (DRF) has more than 100 members.

- The Association of Finnish Travel Agents (SMAL/AFTA) website lists all its members.

- The Association of Swedish Travel Agents and Tour Operators (SRF) has an online list of its tour-operator members, which can be downloaded as an Excel spreadsheet.

Spain

- The Asociación Corporativa de Agencias de Viajes Especializadas (ACAVe), representing specialist travel agencies, has more than 500 members.

- EXCELTUR, the Alliance for Excellency in Tourism, has 29 members from various tourism sectors, including travel agents and tour operators.

United Kingdom

- The Association of British Travel Agents (ABTA) is the UK’s largest travel association, representing 1,200 travel agents and tour operators. If you know the name of a UK operator, you can use ABTA’s member search function to check whether it is a member.

- The Association of Independent Tour Operators (AITO) is a travel association for specialist tour operators. You can find all its members listed here.

4. Find buyers on online databases

Online databases are useful tools to find travel companies. Here are some examples for you to explore.

- Tourism Review provides a directory of tour operators around the world. The listing can be filtered by western Europe and central/eastern Europe, and again by country and market sector. The website also features details of regional tourist boards and other tourism organisations.

- Travel and Tourism Directory is a large resource for consumers, buyers and suppliers. Businesses are listed by style of tourism – for example, backpacking, cultural tourism and pilgrimages.

- Directory Tourism is an international resource with almost 100 guides and directories to browse.

- Online travel marketplaces are also good places to find buyers. For example, TourRadar features a listing of all the operators active on its website. SafariBookings has more than 4,000 operators in its marketplace, which can be filtered by country.

5. Create your own database of European tour operators

Spend time researching the European tour operator market and create your own database of companies you think would be suitable partners. Most European tour operators have professional websites with lots of information about the company. Some provide information about their staff, with short biographies. You can often find this under the heading “About us”, “Who we are”, “Meet the team” or something similar. Take a look at this example, the KE Team at KE Adventure Travel.

Figure 2: The KE Team

Source: KE Adventure Travel

Sometimes, the contact person for local operators like you is listed with a direct e-mail address and/or telephone number. Otherwise, job titles can be a useful indicator. For example, the Operations Manager, Overseas Project Manager or Destination Manager is often the person responsible for working with local operators. This is useful information to gather when doing your research.

Make sure that you explore the websites fully. Identify what niche(s) the company serves – adventure, cycling, walking, wellness and so on. If you have a good understanding of what tour operators include in their packages and which destinations they travel to, you will be fully informed when you make an approach.

Your database of contacts will be a valuable asset to your business, so keep it up to date. Make sure that you refresh it with new contacts and archive old ones on a regular basis.

Tip:

- Ask your national tourist board for details of any European tour operators it works with. It is good to build a strong relationship with your tourist board. Ask if it can include a link from its website to yours. European tour operators like to know that the suppliers they work with have a good relationship with their national tourism authorities.

6. Use OTAs to sell to consumers

Online travel agents (OTAs) are the fastest growing sales channel for trips, tours and experiences. They are widely used by fully independent travellers (FITs). OTAs have an extensive reach and can provide direct access to large numbers of potential customers who are otherwise hard to reach.

The market for OTAs is very large and complex. They differentiate themselves in a crowded marketplace by specialising in a particular tourism niche and/or type of trip that appeals to their target audience. At its most basic level, the OTA marketplace is divided into two parts.

- Core global market – OTAs like Booking.com, Expedia and Airbnb.

- Specialist OTAs – some focus on day or half-day tours, like Viator and GetYourGuide. Others specialise in multi-day tours; for example, Ethical Travel Portal, Evaneos and kimkim. And others still serve niche segments like food tourism (Traveling Spoon), adventure (Much Better Adventures) and community-based tourism (Lokal Travel).

The CBI study How to work effectively with OTAs? will help you research and prepare, so that you can reach more customers using this channel.

7. Optimise your website to reach buyers

A business website is your shop window. European buyers often use the internet to look for new suppliers. If you are not on the web, buyers may not be able to find you. First impressions are very important in the European market, so a well-presented website is likely to generate interest. It may even be the main reason why a European tour operator or independent traveller decides to buy from you.

To find local travellers already at your destination, create a Google Business Profile (GBP). This is particularly useful for small and medium-sized businesses trying to generate sales in their local markets. If you manage your GBP well, you increase your visibility when travellers search for tours in your area. Find out more in the CBI study 10 Tips for doing business with European tourism buyers – see section 6, “Market your trips and experiences online, set up a Google Business Profile”.

If you do not have a website, consider building one. Online website builders are good value, easy to use and look professional. Examples include GoDaddy, Weebly and Wix.

If you already have a website, assess how well it is working. Ask yourself these questions.

- Who is your website aimed at? Trade buyers, consumers or a combination of the two?

- Are you making sales and reaching new buyers?

- Does it look professional and contemporary, with some great images and videos?

- Is it fast and enabled for mobile use? If you think it needs updating, discuss the options with your developer.

Take a look at the table below for tips to optimise your website for different audiences.

Table 2: Tips to optimise your website

| Optimising your website for consumers |

|

| Optimising your website for trade buyers |

|

| Optimising your website for both trade and consumer buyers |

|

Source: Acorn Tourism Consulting, Peter Fabricius

The CBI study How to be a successful tourism company online? will help you further.

8. Use social media to connect with buyers

Social media is an important tool that is widely used by tour operators to increase awareness and boost sales. So it really needs to be part of your marketing strategy, to help you connect with buyers. Driving traffic from social media platforms to your website will also improve its search engine optimisation (SEO). Good SEO ensures that search engines list your business higher in a user search.

The leading platforms used regularly by travel businesses and professionals are Facebook, LinkedIn, Instagram, Twitter and YouTube. Instagram is the platform most used by travel consumers. Good images and video stories (Reels) on Instagram are particularly important to reach independent travellers, especially those aged 16-40. Find out more about recording and posting Instagram Reels here.

Figure 3a: Journey Latin America’s social media channels – Facebook

Figure 3b: Journey Latin America’s social media channels – Instagram

Figure 3c: Journey America’s social media channels – Twitter

Sources: Facebook, Instagram, Twitter, Journey Latin America

Social media is also used widely by travellers themselves to share stories, images and videos, and to research future trips. Instagram is the most popular platform for that research. TikTok is also rising in popularity, particularly with the younger generation.

Working with travel influencers and bloggers can be a good way to attract buyers, because they know what their audiences want. Small businesses often invest in contacts with local influencers to promote their brand, as that helps them gain visibility and increase engagement. This approach can also be very cost-effective. Use Google to help you find a local influencer, or ask around for recommendations.

Tips:

- Research how to use social media to generate leads and build brand awareness. Most platforms post help articles to point you in the right direction. Take a look at LinkedIn pages best practices for tips to how make the most of a LinkedIn page, and also How to create a free Facebook Page.

- Explore ways to make your content shareable and more effective. Read this article: Becoming a travel content creator.

9. Advertise in European trade publications

Consider an advertising campaign to broaden your reach amongst European tour operators. Many of them read and/or subscribe to well-known trade publications, either online or in print, to keep up to date with industry news.

- Travel and Tour World is a global B2B travel magazine. It reaches 250,000 tour operators, travel agents, DMCs, MICE planners and luxury planners. The publication is also distributed at more than 150 international travel trade shows each year and can be read online. Download its 2023 Media Kit here.

- eTurboNews provides global travel industry news. It delivers news bulletins across several publications. Its various platforms attract more than 2 million unique users every month. The opt-in subscriber list totals more than 230,000 people worldwide, most of them travel trade professionals and specialist travel and tourism journalists. European travel businesses account for 30% of its geographical reach. The UK and Germany are the leading subscriber countries in Europe. To find out how to advertise, download the Media Kit.

- Business Travel News Europe provides information, news, features, data and research for European corporate travel managers. BTN Europe is published four times a year and has a circulation of 5,000 people. Its e-newsletter reaches 14,000 opt-in subscribers.

- INFOX is a German information logistics organisation that generates mailings for 15,000 travel agents and tour operators, plus 300 tourist providers. INFOX can prepare and print the mailing, and most business is handled electronically.

- The Travel Trade Gazette (TTG) is the UK’s weekly travel trade newspaper, covering many aspects of the business. It also has an advertising section that enables you to communicate with the UK’s travel buyers. You can advertise online, in print or at events. Check out how to advertise with TTG.

- MICE Central & Eastern Europe focuses on that region’s business and MICE industry. To see if this magazine would be right for you, consult 6 reasons why you should advertise with them.

10. Consult other organisations for help or information

Government departments or other trade organisations throughout Europe may be able to offer you support.

- If you are selling sustainable tourism products in Ecuador, Nepal, Tunisia or Uzbekistan, the German Import Promotion Desk (IPD) can help you access the European tour operator market.

- If you are selling sustainable tourism products in Colombia or Peru in Latin America or in Albania or North Macedonia in the Balkans, the Swiss Import Promotion Programme (SIPPO) can help you access the European tour operator market.

- CBI supports more than 800 entrepreneurs looking for success in the European market. Attracting tourists from Europe focuses on tourism and features a wide range of business studies to help you develop your product and reach new markets in Europe.

- The Netherlands Enterprise Agency has some good tips on finding business partners.

- Contact the local embassies and/or consulates of your target European countries to see if they can provide guidance on importing services into their markets.

To complement this study, CBI has published a number of related publications that you might be interested in.

- Once you have identified a new business partner, consult our 10 tips for doing business with European tourism buyers so that you know how to develop a good business relationship.

- For tips on launching your tourism service in the European marketplace, read our study 10 tips for organising your tourism services export to Europe.

This study was carried out on behalf of CBI by Acorn Tourism Consulting.

Please read our market information disclaimer.

Search

Enter search terms to find market research