The European market potential for free independent traveller tourism

Free independent travellers (FITs) are travellers who plan their own trips and prefer to travel alone or in small groups. They are the opposite of mass tourists, who travel in large groups and buy predefined travel packages. Eastern European markets are more engaged in mass tourism, while FIT tourism is becoming the norm in Western European and Scandinavian countries. For FITs, unique experiences are most important. If you can offer these, the FIT market is your primary target.

Contents of this page

1. Product description

The acronym FIT may refer to free independent traveller, fully independent traveller, foreign independent traveller or frequent independent traveller. In all of these definitions, independence is the keyword. In our study, when we use ‘FIT’, we refer to travellers who plan their own trips and prefer to travel alone or in small groups.

FIT tourism is better defined as a way of travelling. Instead of comprehensive travel packages for groups, FIT tourism travelling is more personal and individual. Travellers design their own trips, choose their own destinations and visits, based on the information already they have. FIT tourism is the opposite of mass tourism; FITs prefer to create their own trips instead of following crowds.

FITs travel alone, as a couple or accompanied by a small number of people. The goal of FITs is to follow their own path, explore the things they want to see and with that create their own unique travelling experience. By planning their own trip, they can travel at their own pace, not bound to a group.

When talking with a European tour operator, it is very important to understand what they mean when talking about FIT tourism. The concept of FIT tourism is loose; it can range from travellers booking without a tour operator, to personalised trips conducted by a tour operator based on the wishes of the traveller, to trips based on components which are predefined by a tour operator, or dynamic packaging. Some European tour operators even see fully predefined trips for individuals or small groups as FIT tourism, although for the purpose of this study, we do not.

Free independent travellers are mostly well experienced and very individualistic travellers, which is why they try to keep some degree of freedom by not booking everything on a trip in advance. They already have enough experience to allow them to decide on sight what to visit and how to travel. They seek less group experience than other tourists, but most still want to see the big highlights. The difference is that they do not want to visit these in an ordinary way with a big group, but rather in special and unique ways.

The internet gives travellers better access to research on travelling information. They also get travel inspiration from photos, videos, stories and online reviews. Because there is so much to find online, it is much easier for tourists to make decisions about what to visit then it was before the internet. The internet has become the most important place for fully independent travellers to get their travel information, which means you must be well represented online for FITs to find you.

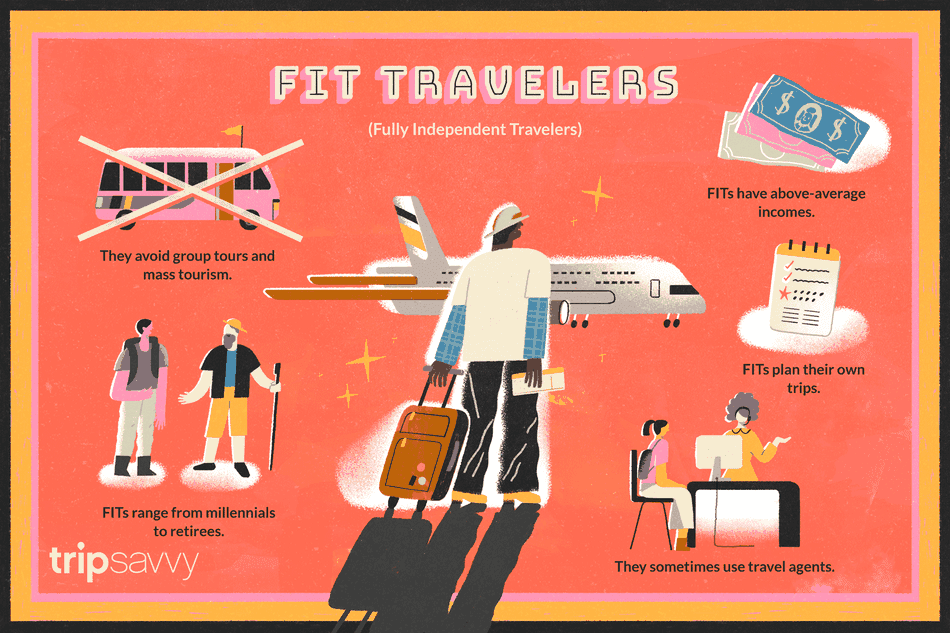

Figure 1: FIT traveller characteristics

Source: tripsavvy

Tips:

- Make sure you have pictures as well as travel stories and links to blogs on your website.

- Ask customers to review your business online. FITs see online ratings and reviews as good indicators of quality.

- Try to be present on multiple social media channels to interact with current and future customers.

- Read our other tips on how to become a successful tourism company online.

Some free independent travellers choose to travel with the help of a travel agency. These agencies offer building blocks for tourists to complement once they are already on travel, but they also offer completely customised trips.

Backpacking is a classic form of FIT tourism. Backpackers normally book some sort of transport to arrive at an initial point of departure and from there they travel farther without a specific plan or time schedule, but only carrying a backpack as luggage. They decide where to go next, how to go and how long to stay on the fly during their trip. Flexibility is very important to backpackers and that is why they will not book much of their trips far into the future.

A small minority of independent travellers has very specific interests. The interests can vary widely, from caves, to special birds, specific communities, tribal governance systems, organisation of labour in small villages, and traditional values in communities. Although few in number, these travellers tend to spend a lot of money in your country. They are served best if you think along with them about the opportunities your country offers within their specific field of interest.

Tips:

- Focus on backpackers if there is still little tourism in your area. Backpackers are the explorers and pioneers among tourists.

- When you guide fully independent travellers, avoid the other tourists and take more unknown routes.

- Show the big highlights quickly to FITs, then focus on smaller and unique aspects of the destination.

2. What makes Europe an interesting market for FIT tourism?

Europeans tend to travel extensively as FITs, although to what extent varies by destination. Attracting European FIT travellers offers an interesting opportunity, because attracting FIT tourists usually offers better margins compared to selling via European tour operators. However, many European FIT tourists are very price conscious. Before corona, the FIT market was growing by between 5% and 10% per year in Western Europe, and with 0–5% per year in Eastern and Southern European countries.

European FIT tourists are very active compared to tourists from Asia and the United States. Many travellers like to enjoy your country cycling and hiking. Compared to American tourists, Europeans also travel slower. They will stay in a certain area for a longer period of time, while Americans make more use of domestic flights to see all the highlights in your country.

Compared to tourists from the United States, European travellers are very demanding. They need a lot of detailed information and are more price conscious. However, they are less interested in luxury, expensive food and accommodation, and more interested in remote locations and nature. Offering a holiday to a remote location in a tent can be very appealing to European independent travellers.

Destinations which are safe and where infrastructure is better, tend to be popular among FITs. Nonetheless, in absolute numbers, Asia is the most popular among FITs from Europe, followed by South America and Africa. According to a study profiling 263 backpackers in Bangkok’s Khao San Road area, most of them (63%) were from Europe.

But for African countries, too, Europe offers a valuable source market for FIT tourism, as Europe is relatively close to Africa and therefore flight tickets are cheaper. Another consequence is that it is easier to sell shorter trips to European travellers.

Many FITs looking for online deals travel on low-cost airlines, whose budget prices make it more accessible for travellers to fly. The declining costs of long-haul flights facilitated by budget airlines has helped to boost a 29% increase in long-haul trips booked by Europeans in 2017 compared to 2016. In the same period, the biggest increases in the number of tickets booked were to the Dominican Republic (147%), New Delhi (106%) and Praia, Cabo Verde (76%). In 2018 compared to 2017, the number of cheap flights booked to some destinations were even higher: Marsa Alam, Egypt (156%), Sal, Cabo Verde (148%) and Rosario, Argentina (130%).

It is very uncertain how the FIT market will develop after corona. Some experts expect the European FIT market will increase, while others expect it to decrease. An important reason for an expected increase is that the financial crisis in many European countries forces tourists to search for the best deals and one way of doing this is by cutting the costs of European tour operators by planning their own trip. One of the tour operators we spoke to expected that within ten years the market for FIT tour operators in Western Europe will have completely vanished, because all customers will book directly via local entrepreneurs.

The main reason for the return of package deals is because it offers European tourists security. Under some circumstances, European tour operators are obliged to bring their customers home. In case of increased travel restrictions due to COVID-19 it also offers European tourists the right to cancel their trip and get the costs of their trip refunded, whereas there is no such protection for travellers who book their travel arrangements independently. Note that this may also affect you if you work with European tour operators.

Tips:

- Identify and invite a European tour operator to visit your area or attraction free of charge. Make sure you are dealing with a serious operator who will not just take advantage of simply taking a free holiday at your expense.

- Provide tour operators with sufficient information, like clear brochures including detailed photos, to facilitate them sell your activities. European travellers demand lots of information. For example, if you organise a bike ride, just saying that it happens in the morning is not enough; you should also provide the distance travelled, the change in altitude, the duration, the number of breaks, etc.

- Make sure the information on your website and in other materials is appealing to the European target group, like the information on Go Adventure and Adventure & Fun Albania.

- Read our tips on how to deal with the European Package directive if you are offering services to European tour operators.

- Do not publish accurate prices on your website if you sell to tourists directly and via European tour operators. European tour operators are not eager to buy from you if their customers see that your prices are lower than their prices.

3. Which European countries offer most opportunities for FIT tourism?

Germany, the United Kingdom, France, the Netherlands, Sweden and Denmark offer most opportunities on the independent travel market.

Independent travel is most common among Western European and Scandinavian travellers, especially long-haul trips. On account of their large populations and willingness to travel independently, Germany, the United Kingdom and France are the main FIT markets in Europe. Although Sweden and Denmark are relatively small source markets, they offer high opportunities due to their willingness to travel independently and their high travel budget. Italy and Spain offer large tourism markets, but their willingness to travel independently is far less.

Germany is the largest European FIT market

According to tourism experts, Germany is the largest independent traveller market. It offers the most trips to developing countries and there is a high willingness to travel independently. Before corona, the market share for FIT tourism remained stable for many years. In 2018, 36% of German tourists booked their accommodations directly, compared to 34% in 2010. In 2019, this rate dropped to 35%.

Germany is by far the largest economy in the EU and the fourth-largest in the world with a gross domestic product (GDP) of €3.5 trillion, or €43 thousand per capita. According to Reiseanalyse, the percentage of German travellers booking package tours in 2019 was 45%, rising 3% since 2010. In the same period, online bookings increased significantly from 26% to 44%. The percentage of travellers booking their transportation independently was 15%. 56% of German travellers use an online travel agency to book a trip, which is more than the British (47%) and the French (44%).

Germans have an ever-growing concern about the sustainability of holidays, as 73% feel at least a little guilty about climate consequences when they travel by air. Furthermore, 61% of German tourists feel positive towards sustainable trips, but only 6% are acting on it. This means there is still a large gap between the attitude and actual behaviour of these tourists.

Although the COVID-19 pandemic has caused a huge drop in outgoing travel in 2020, it also made German travellers even more eager to travel the world, as 62% of the travellers have a heightened desire to see more of the world. 60% won’t take travel for granted in the future, which is comparable to the global average of 61%. The German vaccination rate is comparable to most other Western European countries, with 42% of the adult population being fully vaccinated by July 2021.

Hygiene safety measures are important for German travellers, but less important compared to other European countries. Only 51% of the German travellers, compared to 70% globally, will book an accommodation if it is clear about health and hygiene policies. 47% of travellers accept health checks on arrival, which is much lower than the global average of 67%.

Table 1: German travellers’ long-haul destinations in 2019 compared to 2017

| Destination | Percentage of bookings in 2019 compared to 2017 |

| South East Asia | 18% (-5%) |

| North America | 23% (+3%) |

| Caribbean | 11% (-4%) |

| Africa | 14% (0%) |

| Latin America | 11% (+3%) |

| India | 8% (+2%) |

| Middle East | 5% (-1%) |

| China | 4% (0%) |

| Australia and New Zealand | 6% (+2%) |

Source: Reiseanalyse

When targeting German travellers, you need to offer sufficient information to attract German FITs. They tend to seek a lot of information before deciding to go visit a place. Like most Europeans, Germans are quite straightforward in their communication style, but they are also well known for their organisation and punctuality. In general, they don’t like changes and you need very good arguments if you intend to deviate your offering from the arrangement. As Germans tend to travel a lot, most German travellers are very experienced.

The United Kingdom offers the second-largest European market for free independent travellers

Looking at holidays spent abroad, 50% of British travellers booked their travel and accommodation themselves, using different travel companies. As many as 15% of British travellers choose to travel solo as FITs. Turkey (1.6 million trips), Thailand and India (each with 1 million trips) are the most visited developing country destinations by British tourists, according to UNWTO data.

When booking a trip, British travellers have a lower preference for all-inclusive holidays compared to German and French tourists. However, the demand for all-inclusive and package holidays saw a comeback in 2019, mainly caused by travel to Egypt and Turkey.

Compared to other European source countries, British travellers are more demanding and assertive if their requirements are not met. In general, they will ask for a lot of information on possible activities.

The COVID-19 pandemic has made British travellers even more eager to travel the world, as 47% of travellers have a heightened desire to see more of the world.

Hygiene safety measures are important for British travellers, compared to German and Dutch travellers. 68% of the British travellers, compared to 70% globally, will book an accommodation if it is clear about health and hygiene policies. 63% of travellers accept health checks on arrival, which is comparable to the global average of 67%. The United Kingdom currently has the highest vaccination rate in Europe, with 50% of the adult population being fully vaccinated by July 2021.

With a population of 66 million and a gross domestic product of €2.3 trillion, the United Kingdom is the fifth-largest economy in the world and the second in Europe. The UK’s GDP per capita is €38 thousand per year, meaning the British have least disposable income among the top FIT markets in Europe.

France

From our top-6 countries, according to experts, the French have the lowest preference for independent travel. However, France is a very important source market, especially for French-speaking destinations such as Morocco. Also, French travellers enjoy more, and longer holiday trips in comparison to German and British tourists. They also have a higher preference for holidays with their families and relaxation.

When booking online, online travel agents (OTAs) (44%), search engines (38%) and travel reviews sites are the most important sources when booking a trip. Their preference for OTAs is slightly lower than the preference of German and British travellers, however.

Although the COVID-19 pandemic has caused a huge drop in outgoing travel in 2020, it also made French travellers even more eager to travel the world. 45% of travellers have a heightened desire to see more of the world. 65% of travellers won’t take travel for granted in the future, which is about equal to the global average of 61%. 38% of the adult population was fully vaccinated by July 2021, which is less than most other Western European countries. Many French are sceptical about the COVID-19 vaccine.

Hygiene safety measures are relatively important for French travellers, compared to German and Dutch travellers. 64% of the French travellers, compared to 70% globally, will book an accommodation if it is clear about health and hygiene policies. 66% of travellers accept health spot checks on arrival, which is comparable to the global average of 67%.

After the UK, France has the third-biggest GDP of Europe and the seventh-largest of the world, with about €2.3 trillion in 2019. Their population count is just over 65 million. Just like other European source countries, France saw a serious decline in their GDP in 2020. The average holiday budget has decreased from €2,201 in 2019 to €1,522 in 2020. This is comparable to the holiday budget of the Germans.

The Netherlands

The Netherlands has a huge potential for independent travel, as according to research by GFK, only 3% always book via a tour operator. They are also very disloyal, as only 10% always book their trip via the same supplier. Therefore, Dutch travellers are relatively easy to convince to become your customer, but hard to maintain as a client. An important driver for this behaviour is that Dutch independent travellers are very price conscious. They compare many offerings before they choose the best deal.

The fear of violence, price, political stability and the chance of (COVID-19) infections are the most important drivers when choosing a destination. Over 75% of tourists mainly book their trips online. Dutch travellers don’t value luxurious accommodations but want to make the most out of their trips by being physically active.

The COVID-19 pandemic has made Dutch travellers even more eager to travel the world, as 26% of travellers have a heightened desire to see more of the world. 45% won’t take travel for granted in the future, which is below the global average of 61%. 44% of the adult population was fully vaccinated by July 2021, which is a bit higher than most Western European countries, but lower than the United Kingdom.

Hygiene safety measures are important for Dutch travellers, but less important compared to other European countries. Only 52% of the Dutch travellers, compared to 70% globally, will book an accommodation if it is clear about health and hygiene policies. 50% of travellers accept health checks on arrival, which is much lower than the global average of 67%.

Sweden

Sweden offers a wealthy but small market, with a population of 10.3 million and a GDP per capita of €41 thousand. Swedish travellers consider travelling sustainably to be very important. They prefer to book their travel before their flight and especially prefer adventure travel. 98% of the Swedish prefer to book their trips online. When on holiday, 61% prefers a digital detox, especially those between 35 and 55.

Although most Swedish travellers book online, word of mouth is the main source influencing destination choices. 72% of Swedish travellers argue that talking to others influences their destination choice, compared to a European average of 40%.

Denmark has a high percentage of free independent travellers

Denmark offers a small market: less than 6 million people. However, Denmark’s GDP per capita is approximately €54 thousand, which means the Danish have budget for travel expenditures. The Danes spend on average €2,000 on a summer holiday, which they normally book in January or February. Many Danes prefer adventurous travel; according to UNWTO’s 2017 statistics, more Danes visit developing country destinations proportionally than the European average: 15.8% versus 12.4%.

For the Danes, the most important reasons to return to the same destination for a holiday are the natural features and the cultural and historical attractions. Many Danes, especially the fully independent travellers, speak more than one foreign language, such as English and German.

Tips:

- Focus on Denmark or Sweden if you aim to maximise a limited marketing budget. These countries have relatively small populations, but incomes are high and their travellers are highly focused on FIT tourism.

- Offer great quality and sustainable holidays when attracting Swedish travellers, as it is very likely that good experiences by Swedish travellers will lead to more tourists.

- Study your target markets. Update your knowledge by analysing statistics, for example, about the German holiday market and the British holiday market.

4. What trends offer opportunities in the European FIT tourism market?

Local and unique experiences are growing in demand

The free independent traveller is looking for a unique experience, more so than a regular tourist. This includes, for example, contact with local communities and experiencing daily life. FITs want to experience ordinary life in the places they visit, including doing and seeing things that locals do and see. Fully independent travellers want to meet and talk with locals to get a real feeling of how life is in their country.

Figure 2: Enjoying a cooking class and learning to prepare local food can be a unique experience

Source: Shutterstock

Note that most FITs also want to see the main touristic highlights and visit the same destinations as package tourists. Even for young travellers, famous sights and attractions are still the number-one priority when travelling, followed by adventure experiences, special local food and spontaneous experiences with locals. FITs aim to experience ordinary life and unique experiences on top of the main attractions. This is especially the case where life in the places they visit differs from their lives at home.

Tips:

- Develop activities with local agents, since it does not take much to create interesting activities. This can be as simple as a bike tour through surrounding villages, visiting local businesses or agriculture, and getting travellers into contact with locals. An example is Chambok Community, a village in Cambodia where visitors join in activities with locals, such as helping to collect food or going on a tractor ride. Read our study on community-based tourism to learn more on how to offer local experiences.

- Offer workshops, which are easy to set up and accessible for tourists, for example, a cooking workshop where you learn to make local food specialities. Other examples include dyeing umbrellas in Thailand, dyeing textiles in Guatemala, or making music in Brazil on the rhythm of samba, milonga, chamame, and chacarera. More examples of these forms of creative tourism can be found in our study on the opportunities for cultural tourism.

- Use local forms of transport, like riding an oxcart or a tuk-tuk.

- Start something close to a tourist attraction or on a route between attractions. European FITs want to travel efficiently.

Keep in mind that most European tourists prefer comfort, demand clean beds and choose to stay in places that are in line with an idealised image of a country, not necessarily what the experience of locals actually is. Check the Asian Homestay Standard, which offer standards on hosting, accommodation, activities, management, location, hygiene and cleanliness, safety and security, marketing, and sustainability principles. However, keep in mind that this standard is not a regulation. Read it as a source of inspiration and talk to your clients to learn what they really want.

Tips:

- Adjust your homestay to European standards but keep the rest intact. Existing facilities can be uncomfortable for Europeans. For any visits longer than an hour, you need at least seats and a toilet. For overnight stays, you will need a clean bed and a shower. If you can’t assure a clean bed, avoid overnight stays.

- Ask your European clients for precise instructions about the comfort needs of your guests.

- Offer enough diversity and options in the food you serve. Although most FITs want to experience the local cuisine, Europeans likely won’t understand three rice meals a day, for example. Ideally, if you can, offer local cuisine with a lot of variety. For inspiration, read about the food offered by a Dutch tour operator on the Inca trail in Peru or read our study on food and wine tourism.

- Understand your clients and listen to them. Many visitors will appreciate locals wearing traditional clothing or performing a ritual dance, for example. Others may be disappointed, finding it contrived and no reflective of actual daily life.

Increasing price consciousness

Many independent travellers are very price conscious, and some experts expect this number to grow. Due to increased use of the internet, and better search engine algorithms, the market is becoming increasingly transparent. This gives independent travellers the opportunity to compare your offerings with many competitors and choose the deal with the best value for money. Many travellers are willing to book with a local tour operator or destination management company directly, to cut the margins of a European tour operator.

Increasing demand for sustainability

Although the demand for sustainable travel is a general trend, FITs have an even higher demand for sustainable travel, because in general they are younger and more educated.

According to Booking.com, the top-5 most important eco-friendly practices when considering an accommodation to stay in are solar energy (67%), sustainable water system (43%), low-flow showers and toilets (36%), organic restaurants and food options (31%) and recycling baskets in the room (29%). Eco lodges are very popular among travellers because it is an expression of having an eco-friendly and sustainable business. An example in Myanmar is A Little Eco Lodge.

Most tourists associate sustainability with environmental sustainability. However, interest in how the community is affected by their travel is increasing as well.

Tips:

- Start small and find something eco-friendly that your area is good at to show to tourists, like reducing plastic waste. Start for example by examining your receipts to find out which items contribute the most to plastic waste and then choose a top 3 to eliminate or reduce. Another way of doing this is to identify which plastic items are being used out of habit rather than necessity, and remove these completely.

- Keep comparing your prices to other similar businesses. Many free independent travellers will choose sustainable trips, but they will refrain from booking when the differences in price are too big.

- Target older FITs if your accommodation offers high comfort. Older FITs are more experienced travellers who demand more comfort, have more budget and are less tied to seasons.

- Explain to independent travellers how their trip benefits the local community. Examples of doing so are explaining about jobs that are provided and products that are being sold, offering the community the ability to sustain their families.

- Make sure your website accepts a valid European online pay method; it helps build trust and rapport with customers, when all they know about your business is your website. Read also the CBI study on how to implement online payments.

Experiences shared online

FITs often get inspiration online from blogs, vlogs and other sources. Complete travel reports and reviews in those sources give tourists a good view of how other people have experienced their journeys and destinations. They make it easier for the tourist to decide what to visit based on other people’s reviews.

Many tourists share their own experiences online, for example, on Airbnb, Backstreet Academy, Local Alike and Resirest.

Tips:

- Invite bloggers to write about your area. If possible, let them come and stay free of charge.

- Read the CBI study on how to start a travel blog to learn about using it to attract tourists.

- Improve the impression that tourists get from your website: display online reviews, memberships in organisations like a regional tourism board, and certifications such as the Global Sustainable Tourism Council certification.

- Respond quickly to emails. Flexibility is important for tourists and they want quick responses on questions and bookings, preferably by the next day at the latest.

- Offer alternatives if you can’t meet the requests of FITs, who are often very flexible.

Health and safety measures become more important

The COVID-19 pandemic can be expected to have a major impact on travellers’ attitudes towards hygiene. Safety and hygiene standards have become paramount and may even become non-negotiable, because travellers simply require these to be at an appropriate standard.

Travellers will be more reluctant to travel to tourism hot spots and may need more persuasion to perceive a destination or your business as safe. Precautions and explaining how the initial COVID-19 outbreak was handled will help to convince travellers that they will be safe at a specific destination, location or service business.

It is expected that hygiene will impact the way people travel to and within a destination. This applies to, for example, hygiene standards, whether face masks are compulsory, and seat spacing. Price may become less important than hygiene and travelling in groups with strangers is probably becoming less attractive.

Women are more cautious regarding health and safety standards than men. Countries in southern Europe and the United Kingdom find it more acceptable to have health spot checks on arrival compared to Germany, the Netherlands and Scandinavian countries.

A consequence of the higher emphasis on health and hygiene is a higher demand for small-scale accommodations. The expectations are that prices of small-scale accommodation will rise when visitors return.

This study was carried out on behalf of CBI by Molgo and ETFI.

Please review our market information disclaimer.

Search

Enter search terms to find market research