Entering the Scandinavian tourism market

Scandinavians are well-known for their love of adventure travel and seek inspirational, unique experiences. However, as inhabitants of one of the ‘greenest’ regions on the planet, sustainability and minimising carbon footprint throughout their daily lives is important to them. As Scandinavians are keen travellers to hot and sunny climates, the market includes fully independent travellers (FITs) who make their own arrangements, using local operators and OTAs to build their trips. There are many opportunities for local operators in Jordan to attract tourists from Nordic countries and compete effectively with the challenging competition in Asia.

Contents of this page

- What requirements and certifications must Jordanian tour operators comply with to be allowed on these markets?

- Through what channels can you get Jordanian tourism products on Scandinavian markets?

- How can you find buyers and do business with the Scandinavian market?

- What competition do you face on Scandinavian markets?

- What are the prices for competing tourism products on the Scandinavian market?

1. What requirements and certifications must Jordanian tour operators comply with to be allowed on these markets?

What are the mandatory requirements?

As the countries of Denmark, Finland and Sweden are all members of the EU, travel products in Jordan should align with the following:

- The European Package Travel Directive

- The General Data Protection Regulation (GDPR)

- Liability insurance and insolvency protection

As a first step, read the CBI report What are the requirements for tourism service in the European market? and familiarise yourself with the comprehensive details of legal, non-legal and common requirements. Although not part of the EU, Norway has very close relationships with other European countries, so these requirements are also applicable to the Norwegian market.

What certifications and standards are required?

There are no mandatory certifications or standards. However, Scandinavian market parties are increasingly demanding that sustainability is embedded into tourism products they buy for their customers before they will do business with you. It is also a good idea to implement internationally recognised standards into your business processes, as it is a clear indicator of good business practice.

Sustainability certification for tour operators is an important process for consideration. The Travelife for Tour Operators scheme is the most widely recognised in Europe. The CBI study, How to be a sustainable tourism business, provides very detailed information to support local tour operators towards becoming certified. Why sustainability is so significant is covered in more detail in the section below, Sustainability – why it is so important.

For details about the most suitable standards to consider implementing for your business, read the CBI report indicated above, which includes a table with the International Organisation for Standardization (ISO) standards most commonly adopted by the tourism industry worldwide, along with standards for adventure tourism.

Tips:

- Make sure you have revised your terms & conditions and updated your cancellations and refund policies, so they do not deter travellers from making bookings.

- Ensure your business complies with the WTTC Safe Travels protocols, which Jordan has committed to as a destination. You should contact Visit Jordan to find out how your business can comply with the Safe Travels stamp and display it on your website or Facebook page.

What are the requirements for niche markets?

Sustainability – why it is so important

Global travellers are increasingly keen that their trips do not have a negative impact on the destination and that they can have a positive impact on the places and people they visit wherever possible. Across Europe, embedding sustainability into all aspects of a tourism business is becoming more common and sustainable operating practices are increasingly becoming a statutory requirement in the EU and the UK.

The European Green Deal compels European tourism companies to implement sustainability into their business operations in order to meet the commitment to reduce carbon emissions to net zero by 2050. Some airlines, including British Airways and easyJet, are now informing their customers of the carbon emissions that will be emitted during their chosen flight.

As inhabitants of one of the greenest regions in the world, Scandinavians are particularly knowledgeable about sustainability and carbon neutrality. Each nation has implemented a wide range of initiatives and people throughout the region are well aware of what sustainability means in practice in their daily lives. Northern European cities were among the first in the world to pioneer car-free cities, including Copenhagen in Denmark and Oslo in Norway. More are developing car-free areas and/or days of the week.

Sweden was the origin of flygskam, meaning ‘flight shame’, a movement committed to encouraging people to give up flying for the good of the planet. Leaders of the movement included the mother of the teenage climate activist, Greta Thunberg, who has helped raise the profile of climate change to a global audience. The flygskam movement led to a 4% reduction of international flights to Swedish airports in one year.

The Sustainable Travel Index was developed by Euromonitor to help destinations and travel companies to shift to more sustainable tourism models. Using a range of ‘pillars’, countries’ sustainability actions are measured according to environmental, social and economic sustainability factors, country risk, sustainable tourism demand, transport and lodging. The top 20 countries are all in Europe; Sweden and Finland take the two top spots, and Norway is in fifth place. Jordan is in 43rd place.

Figure 1: Sustainable travel pillars

Source: Euromonitor

For more information about sustainability in tourism and to understand why Scandinavians are leading the way, download Euromonitor’s 2020 report, Top Countries for Sustainable Tourism.

Market research conducted by the EU in 2021 revealed that the Swedes stand out as the people most keen on adopting sustainable actions while travelling. Consuming local produce, reducing waste, travelling out of season, and choosing more sustainable transport options are all important factors.

Table 1: Are you prepared to change your travel and tourism habits to be more sustainable? (2021)

| Sustainable action | Denmark | Finland | Sweden |

| Consume locally sourced products on holiday | 33% | 64% | 82% |

| Reduce waste while on holiday | 25% | 51% | 75% |

| Holiday out of tourist high season | 30% | 55% | 66% |

| Travel to less visited destinations | 24% | 36% | 64% |

| Choose transport based on ecological impact | 38% | 36% | 66% |

| Pay more to respect the natural environment | 26% | 31% | 70% |

| Reduce water usage on holiday | 19% | 34% | 63% |

| Contribute to carbon-offsetting activities | 15% | 30% | 69% |

| Pay more to benefit the local community | 21% | 37% | 67% |

| I am not prepared to change my habits | 25% | 11% | 8% |

Source: Flash Eurobarometer 499: Attitudes of Europeans towards tourism

To find out why Nordic countries consistently rank high on lists for environmental sustainability and carbon neutrality, read these articles: 5 Things we can learn from Swedish sustainability efforts and 7 Ways Norway is leading in sustainability.

Digitalisation in tourism

To be competitive and efficient, the tourism industry is rapidly implementing a range of digital processes across many aspects of its businesses. It is looking for suppliers that can show they have a good understanding of digitalisation and have digital processes in place.

Digitalisation processes in tourism are wide-ranging and include digitalisation of daily operations such as calendars and emails; optimisation of websites; social media management; mobile connectivity; online sales (or other forms of online communication with customers); and many other new technologies.

The greater the level of digitalisation that you can adopt for your business, the more confidence your buyers will have in your business. Study the CBI guide, Tips to go digital in the tourism sector, as a first step towards digitalising your business.

Create adventure products for the Scandinavian market

You should consider carefully whether your product will attract the adventure tourist. As a well-known destination with an exciting outdoor adventure travel product, you can benefit from the increasing numbers of inbound travellers seeking a unique adventure. When putting together your adventure travel products, think about the following:

- Offer a combination of activities, such as a cycling/hiking, combined with a cultural activity such as sightseeing, or visiting a market.

- Make sure your itineraries are inspiring.

- Be sure to emphasise the beauty and uniqueness of the Jordanian desert landscape, the extraordinary vistas of Wadi Rum, and so on. Scandinavian adventure tourists are very interested in the natural environment and like to be off the beaten track, away from other tourists.

- Include community-based tourism (CBT) experiences which are increasingly sought after by adventure tourists, as they offer genuine insights into the lives of local people and provide economic benefits. However, it is important that the experience is authentic and not staged in any way.

- For multi-day trips, include a day relaxing at a beach or by the pool.

- Be sure to promote your products locally to attract the FITs, who prefer to book trips/tours whilst at the destination.

- If you have a website or use a social media platform, make sure you can accept last-minute bookings, as many adventure tourists like the flexibility and spontaneity of booking on-the-go via their mobiles.

- Consider your audience carefully. For older consumers, activities should be lower risk, while younger adventure tourists are more likely to take part in something that requires more energy and/or risk.

- Make sure you provide detailed information about the product, such as level of difficulty, safety measures in place, and other requirements.

- Promote trips as sustainable and responsible. This is very important for the Scandinavian market. Read the responsibility statement of this local tour operator in Egypt, Memphis Tours, which has established a wide range of policies in the areas of economic, environmental, and social responsibility.

Tips:

- Download the CBI study, Entering the European market for adventure tourism, for other useful tips on creating adventure travel products.

- For tips on starting a new tourism product, download the CBI guide, How to get started developing your tourism product.

2. Through what channels can you get Jordanian tourism products on Scandinavian markets?

How is the end market segmented?

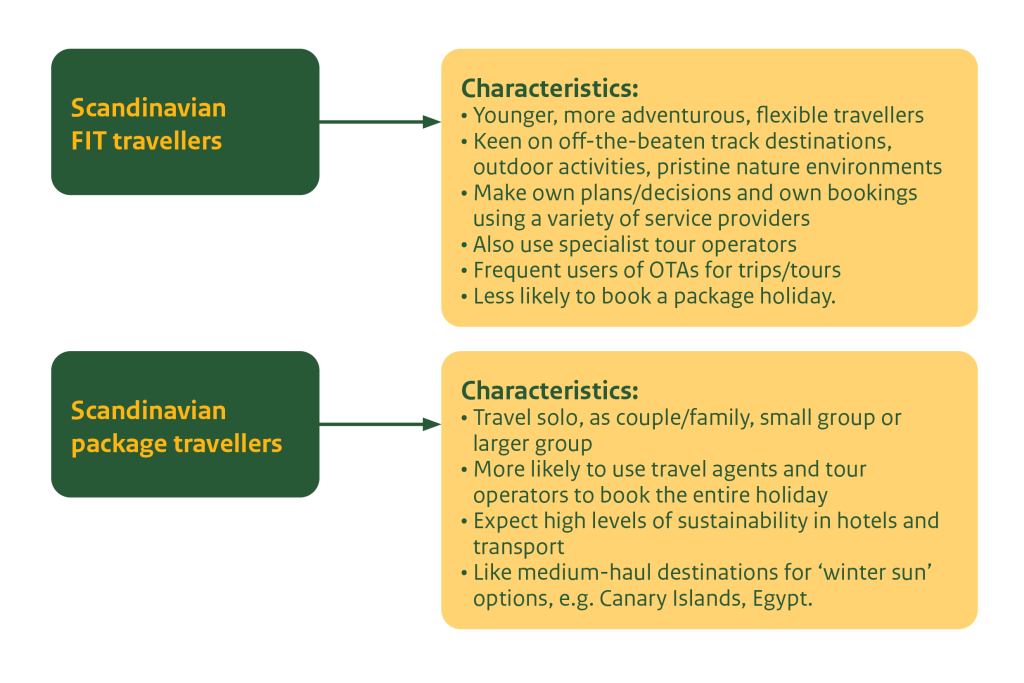

Outbound travellers from Scandinavia are segmented into two main types – package travellers and FITs.

- Package travellers – buy their products directly from travel agencies and tour operators that sell holidays to the destination they wish to travel to. This is an important market in Scandinavia, as they are keen on travelling to warm and sunny climates to escape the harsher winters in their region. However, they are discerning customers, demanding high levels of sustainability and good activities at their destination.

- FITs – do their own planning and research and make bookings directly with airlines, accommodation providers, and trip and tour activity providers. They also use OTAs for either accommodation or trips, or for both. They are also more spontaneous and may book their adventure tours/trips at the last minute, while on their trip, via their mobiles.

Figure 2: Characteristics of Scandinavian travellers

Source: Acorn Tourism Consulting

Tips:

- Put together affordable trips/packages of different activities and durations to ensure that you are appealing to the younger FIT markets from the Scandinavian countries. See how this local operator, Excursion Marmaris, has developed a wide range of different products to appeal to active FIT tourists.

- Ensure you build sustainability into your travel products. Scandinavian outbound tour operators increasingly require their suppliers to provide evidence that they operate sustainably.

Through what channels does a product end up on the end market?

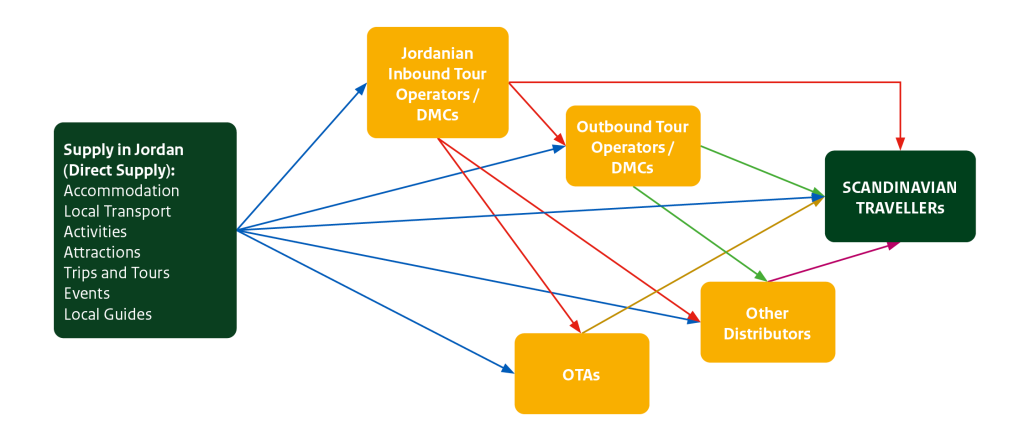

Scandinavian travellers buy travel products in much the same way as other European travellers and use a mix of direct sales to purchase components such as flights, accommodation and trips, and packages through specialist tour operators and travel agents. They are extremely tech-savvy and spend a lot of time using devices including mobiles to research, plan and purchase travel products.

Sales channels have become more complex and varied as digitalisation has transformed the marketplace. The chart below shows how buyers and suppliers are interlinked and sell to one another.

Figure 3: Sales channels to the Scandinavian market

Source: Acorn Tourism Consulting

Tip:

- Make an inventory of Jordan’s supply chain, so you have a clear idea of the internal structure and how the buying process works.

What is the most interesting channel for you?

All sales channels are suitable to explore for opportunities.

There are many travel agents and tour operators on the Scandinavian market and they are commonly used by outbound travellers to book all or some elements of a trip.

When visiting websites, you should be aware that they are in the local language. Google offers a ‘translate this page’ option, but the feature doesn’t always work well throughout the site.

DER Touristik is one of the largest travel agents in northern Europe and owns several well-known travel brands, including the Apollo Travel Group, which has divisions in all four Scandinavian countries – Denmark, Finland, Norway and Sweden.

TUI Sverige is a subsidiary of German-owned TUI and serves all four markets. TUI and Apollo offer a wide range of package holidays to winter sun destinations including the Canary Islands, and summer sun to Turkey and Greece, which are popular destinations for sun-loving Scandinavians.

The Unlimited Travel Group owns a number of travel brands in the Nordic region, including Go Active, an adventure travel brand. Resia Travel Group is another operator in the region with a number of brands, including its online travel agency, Resia. Sustainability is a key feature highlighted by both companies.

Scandinavian travel portals are another option that might be suitable to list your product:

- Reseguiden – Sweden’s largest online travel guide

- Reiseguiden – is the Norwegian version

- Utsidan – portal for adventure tours (Sweden)

OTAs are the fastest growing sales channel for short trips and experiences. It is a fast-growing market and, as more and more travellers are opting to take tours, is set to continue to evolve and grow as the pandemic eases. To work with an OTA, you will need to sign up as a supplier – look for the link on their website.

Examples of well-known OTAs:

- Viator is the world’s largest OTA for trips and experiences. It is a Tripadvisor company, so having a listing on Viator also means you will also have a listing on Tripadvisor. It is widely used around the world, reaching 455+ million travellers.

- GetYourGuide is based in Berlin, Germany and is a popular platform among European travellers. It has a global reach of more than 25 million worldwide.

- Musement is based in Milan, Italy and is another popular platform used by Europeans.

- Klook serves the FIT market and is rapidly increasing its presence on the Asian market.

- Some OTAs, such as Much Better Adventures and Responsible Travel, offer multi-day tours and holidays. They both have good reputations for promoting sustainability in their trips and throughout their businesses.

As well as using OTAs, FITs also like to book travel products such as accommodation, local transport, and local guides directly with suppliers. This presents opportunities for small operators to enter the market by using their website or social media platform.

Tips:

- Research which OTA would be the best to work with. There are several guides to help you to work effectively with OTAs, like Working with OTAs.

- Make sure your website is kept up to date, has relevant information and presents your trips and tours attractively.

- If you don’t have a website, consider building one. Download the CBI study, How to be a successful tourism company online, to help you.

3. How can you find buyers and do business with the Scandinavian market?

Learn about the Scandinavian market

You should do your research before taking steps to enter the Scandinavian market, as it is a sophisticated, professional market. This is best done by taking a universal approach, so that all elements of the Jordanian tourism industry are invested in the development of the market. Market representation travel companies specifically help tourism boards, destination marketing organisations (DMOs), and local operators to enter new markets.

They charge a fee for services that include sales, marketing, trade public relations, and networking, but as they are experts in developing outbound tourism markets, it could be a good investment.

Have a look at these travel market representation companies based in Scandinavia to see which might be a good fit for your organisation. All companies cover the four markets.

- Our Man in Scandinavia – based in Stockholm, Sweden

- Bridge Representation – based in Copenhagen, Denmark

- SIR (Scandinavian International Representatives) – based in Stockholm, Sweden

- Atlantic Link – based in Copenhagen, Denmark

- Related – with offices in Denmark and Sweden

- AviaReps – is an international representation, marketing and communications company for the aviation, tourism and hospitality sectors, and has offices in all four countries. Pre-COVID 19, it organised a number of travel roadshows and other B2B events to connect the travel trade. You should keep an eye out for any similar plans they may have in the future.

Tips:

- Make a list of the market representation companies that you feel would be most suitable for you to contact for advice. Thoroughly research what services they provide, so you are sure they will offer what you need.

- Contact those you feel would be most suitable to find out what services they offer and whether they could be good business partners.

Doing business with the Scandinavian market

Before doing business with new countries, it is essential to research the business culture to find out how they like to conduct business. There are many resources online that you can consult to help you. This one, Doing business in the Nordics, offers useful tips.

For additional information, the Passport to Trade has published individual guides on the business culture in Denmark, Finland and Sweden.

The Department for International Trade in the UK provides detailed guidance for businesses seeking to export goods and services to each of the four Scandinavian countries. Although primarily aimed at British businesses, it provides useful information that is also relevant for overseas businesses, such as trade and services regulations. Download each of the market guides to find out more.

The European Union also publishes a guide to the import of services from outside the EU to help you understand if your business is ready for importing and understand the four-step process.

The CBI study, 10 tips for doing business with European tourism buyers, will also give you useful information about doing business with European buyers.

Finding buyers on the Scandinavian market

B2B travel trade fairs provide networking opportunities with professionals in the markets you want to target. Having a stand is a more expensive option, but it gives a good presence and provides multiple opportunities to meet the right people. However, you should book meetings with the relevant contacts well in advance and make sure you follow them up afterwards.

Alternatively, attending fairs as a visitor and ensuring you spend time making appointments with relevant buyers in advance can also be an effective way of networking. Attending trade fairs virtually is a cheaper and more environmentally sustainable option. Virtual trade fairs are also more common these days.

ITB Berlin is the world’s largest and leading trade fair for travel professionals. It is held every year and will be hosted virtually between 8 and 10 March 2022.

WTM World Travel Market hosts six events annually in London, Dubai, Sao Paulo and Cape Town. The global event in London is due to be held between 7 and 9 November 2022.

Regional tourism fairs in the target markets are worth researching:

- Travel News Market is the leading B2B travel event in Sweden bringing together international travel suppliers with the Nordic outbound market.

- The Matka Nordic Travel Fair is the biggest travel fair in northern Europe. Held every January in Helsinki, Finland.

- Since the Swedish trade fair TUR was discontinued in 2018, there have been no major trade fairs in Sweden. Senior Göteborg in Gothenburg, Sweden, is aimed at an active older audience. 5-7 April 2022.

- Danish Travel Show in Herning, Denmark. 25-28 February 2022.

- Reiselivsmessen in Oslo, Norway. A consumer travel show held in January every year; cancelled in 2022 but will return in due course.

- You can keep up to day with travel trade events that Visit Sweden participates in.

Trade associations are good sources to find Scandinavian tour operators:

The Adventure Travel Trade Association (ATTA) lists all its members online, segmented by business type (including tour operators). The annual Adventure Travel World Summit may offer opportunities to network with the Scandinavian market. In 2019, the summit was hosted in Sweden.

The Pacific Asia Travel Association (PATA) is another source of information for Scandinavian travel businesses seeking to network in the region that includes Jordan. You should check what events and initiatives may be suitable.

Check out the tour operator and travel agent listings on the websites of national tour operator and travel agent associations:

- Association of Danish Travel Agents and Tour Operators (DRF)

- Association of Finnish Travel Agents (AFTA)

- Enterprise Federation of Norway (Virke)

- Association of Swedish Travel Agents and Tour Operators (SRF), which has an Excel spreadsheet of tour operators that you can download. The website is in Swedish only, so you will have to use a translation programme.

Consult the travel trade associations in each country to see if there is any relevant information relating to outbound tour operators relating to your business:

There are also several travel magazines and trade travel publications that feature listings of outbound tour operators that are worth researching. Be aware that they may be published in the language of the nation, so you will need to use Google Translate to help you, or look for the option on the website to view it in English:

- RejsRejsRejs – Danish travel magazine

- Reiseliv – Norwegian travel magazine, in Norwegian

Europages is a B2B sourcing platform featuring European business listings in many sectors and by country. ‘Tour operators’ and ‘travel agencies’ are two of the filters.

Download the CBI study, 10 tips for finding buyers on the European tourism market, for additional useful information.

4. What competition do you face on Scandinavian markets?

Which countries are you competing with?

For Scandinavian adventure tourists, Asia is the top outbound region, so the competition for Jordan is challenging. Thailand, Indonesia and to a lesser extent China and Vietnam are major competitors in Asia.

Turkey is the top destination for travellers from Sweden, Norway and Finland, and Egypt is popular with travellers from Sweden and Denmark. These two countries are comparable with Jordan in terms of their product offer.

Winter sun is important for Scandinavians, and there is potential for Jordan to develop more low-season travel products to attract this market. Common winter sun destinations for European travellers include the Canary Islands, medium-haul destinations like Dubai in the Middle East, and Morocco, an important adventure destination.

Turkey

Turkey has a reputation for a wide range of tourism experiences that include sun and beach, ancient history, diverse culture, and good weather. It is a popular destination for many European countries. There were 51.2 million international tourists to Turkey in 2019, of which more than 33.5 million were European.

It has invested heavily in its national airline, Turkish Airlines, which offers direct routes to many global destinations and has won numerous awards, including Best Airline in Europe.

Access to the Scandinavian market is very good. There are at least two or three daily direct flights to Istanbul and/or Antalya from all the major Scandinavian hubs.

Turkey is well known for its rich cultural treasures that include the Byzantine Mosque of Hagia Sophia in Istanbul, the evocative city that links Europe and Asia and is situated on the Bosporus Strait. There are many ancient Greek-Roman ruins, including those at Ephesus, Aspendos and Pergamum, and the lunar-like landscape of Cappadocia where hot air balloon rides are popular. Turkey’s beaches on the Mediterranean are famed for sparkling seas and a multitude of water sports and activities that appeal to large numbers of tourists every year.

China

China is one of the top five developing destinations for all four Scandinavian nations. Scandinavians are attracted by the sense of adventure, culture and nature, along with the challenge of visiting somewhere that is very different from their own home. There are a wealth of sites to visit, such as the Great Wall of China, the Forbidden City and Imperial Palace in Beijing, and the Terracotta Army in Xian.

Adventure activities are multiple – hiking and trekking, river cruising on the Yangtze River and Three Gorges, and many national forests, such as the Zhangjiajie National Forest Park with its unique pillar-like rock formations and Grand Canyon Glass Bridge.

There is good access from the Nordic countries to China – Air China flies direct to Beijing from Stockholm and Copenhagen once a week and SAS provides a daily direct connection from Copenhagen to Beijing.

Egypt

Egypt is a world-famous destination known for its ancient civilisations and spectacular built heritage, which dates back more than 4,000 years and includes the pyramids of Giza, the Valley of the Tombs and the temples of Luxor, all UNESCO World Heritage Sites. Situated on the Red Sea, Egypt also has a very strong sun and beach product that is appealing to both package tourists and FITs. It is also one of the best places in the world to scuba dive.

Although Egypt has made good steps towards implementing more widespread responsible tourism practices that have a greater benefit for local communities, it is an area that requires improvement. Issues to be addressed include overtourism at key sites, polluting Nile cruises and dealing with irresponsible wildlife encounters.

Indonesia

With multiple opportunities for adventure and culture, Indonesia received more than 16.1 million international arrivals in 2019. It has extreme geographical diversity with beaches, jungles and volcanoes, and more than 17,500 islands. Bali is the most popular island for tourism and it has a well-known beach culture. More adventurous tourists head for other islands such as Java, Sumatra, Lombok, and Sulawesi. For rugged adventure travel, they head for east Nusa Tenggara, which includes the island of Komodo.

Indonesia is also a top destination for scuba diving, with some of the best diving spots in the world.

Although more of a challenge to reach, the fact that Indonesia is popular with Scandinavians is a clear indication of the strong desire they have for an adventure.

Thailand

Thailand is one of the world’s top tourist destinations, rich in culture, adventure, nature, sun and beach – which are all important to Scandinavian travellers. As a ‘bucket list’ destination with a huge variety of travel experiences, it is a good choice for Scandinavian adventure travellers, as it is well established on the backpacking market, easy to travel around and offers good value.

Thailand is well served with direct flights from the target markets. Thai Airways operates direct routes to Bangkok from Denmark and Sweden, and Finnair operates direct flights from Helsinki and Stockholm.

Vietnam

With around 18 million international visitors in 2019, Vietnam has been rapidly rising in popularity over the past two decades and is very popular with adventure tourists. The country has an incredible nature adventure travel product, including the world-renowned Ha Long Bay and Mekong Delta, attractions relating to the Vietnam War such as the Cu Chi war tunnels, historic trading centres, and community-based tourism with the hill tribes in the northern jungle regions.

The Vietnam National Administration of Tourism (VNAT) is proactive in its work to increase international arrivals and has developed a number of strategic partnerships, including one with the OTA Klook to promote tourism to Da Nang. New Vietnamese airline Bamboo Airways is rapidly expanding and increasing routes into Europe.

Tips:

- Do your own research into tourism products on the market from the competing nations to see what ideas you can adapt for your business. Carefully assess packages and trips to identify what is included and what is not, so you can see what travellers to these countries like to do.

- Research sustainable tourism products in Scandinavia to assess which ones are popular and could be learned and/or adapted for Jordan.

- Use the research and information you gather to make sure that you are preparing your travel product in a way that will appeal to similar traveller types to Jordan.

- Price your product carefully. The section below, What are the prices for competing tourism products, covers information about pricing.

Which companies are you competing with?

Turkey

Yummy Istanbul specialises in food tours in Istanbul. It is a small family business run by locals and professional tour guides. Example products include Taste of Two Continents, and Flavours of the Old City. Its website is detailed with attractive photography, and there are extensive FAQs with clear information about food allergies and dietary requirements, and up to date guidelines about COVID-19. The operator also sells its tours through Viator.

Tourmania is a specialist travel agency for tours, attractions, and activities, offering trips and experiences in 25 Turkish destinations, including Cappadocia, Bodrum, Fethiye and Northern Cyprus. The most popular tours are featured on the homepage, which is a good idea to stimulate interest and bookings. The operator uses lots of good, inspirational images and its website is available in several languages, including English, German and Russian.

China

Trippest was founded in 2015 and since then has expanded to provide a wide range of trips and experiences around the country. Also included are walking tours, biking tours, and food tours, and it offers day and multi-day tours. The operator is certified with international travel associations and has been featured in international publications in Europe and the US. It publishes a range of travel guides for the major cities and regions in China and has been awarded Tripadvisor awards and an award by the China Association of Travel Services.

Wendys Xian Tours specialises in private tours to the famous Terracotta Warriors and other attractions in and around the city of Xian. Having a specific focus offers a level of expertise that is attractive to inbound visitors. Wendy is a professional English-speaking guide and tour operator and the website features many images of her accompanying visitors on tours. Tripadvisor reviews are very positive – with such good feedback, the operator could make more of this on the website.

Egypt

Emo Tours Egypt offers day trips and holiday packages to Egypt’s major destinations – Cairo, Luxor and Aswan, Red Sea destinations and Nile cruises. Emo is an experienced destination management company (DMC) that has worked with tour operators, airlines and accommodation providers, and is a top-ranked Tripadvisor company based on 6,000 online reviews. Its website is available in several languages, and it features a wide range of useful information for incoming travellers.

Nile Holiday provides a range of tourist packages, including Nile cruises, day tours, city breaks and desert safaris. All tours/trips can be customised. The operator is a member of several tourism associations, including the Egyptian Travel Agents Association and the Egyptian Hotel Association. Its website is clear and inspirational and there are many informational pages for the visitor. Social media channels are easy to see and interact with, and there is a clear ‘call to action’ chatbot at the bottom of the screen.

Indonesia

Sumatra Adventure Holidays is a locally-owned and operated sustainable tour operator that specialises in ecotourism. Supporting local communities is a vital part of the business and the operator’s profits are reinvested in the local communities it works with. Groups are small, ranging from 1 to 7-day treks, 3 to 14-day tours, or tailor-made. The operator also offers volunteering experiences in education and/or conservation.

Bambus Tours serves the island of Lombok and provides tours to a number of destinations in the area (including trips to outer islands and beaches), services such as surf lessons and scooter rentals, and waterfall and beach tours. Based in Kuta, the operator’s website is simple yet inspirational and visitors are encouraged to contact it directly to help design a private tour. Methods of contact are broad and include email, phone, WhatsApp and a map to help visitors who want to book directly at the destination.

Thailand

Chiang Mai Local Tours is a locally-owned and operated travel agent and tour operator. Itineraries offered are both private and scheduled and cover half-day tours, day trips, trekking, adventure, scooter tours and much more. Presented in English (with a Chinese option), the website is very informative, with several links to other organisations such as a Thai cookery school and accommodation booking platform. Additional information is provided, including a blog and links to social media platforms.

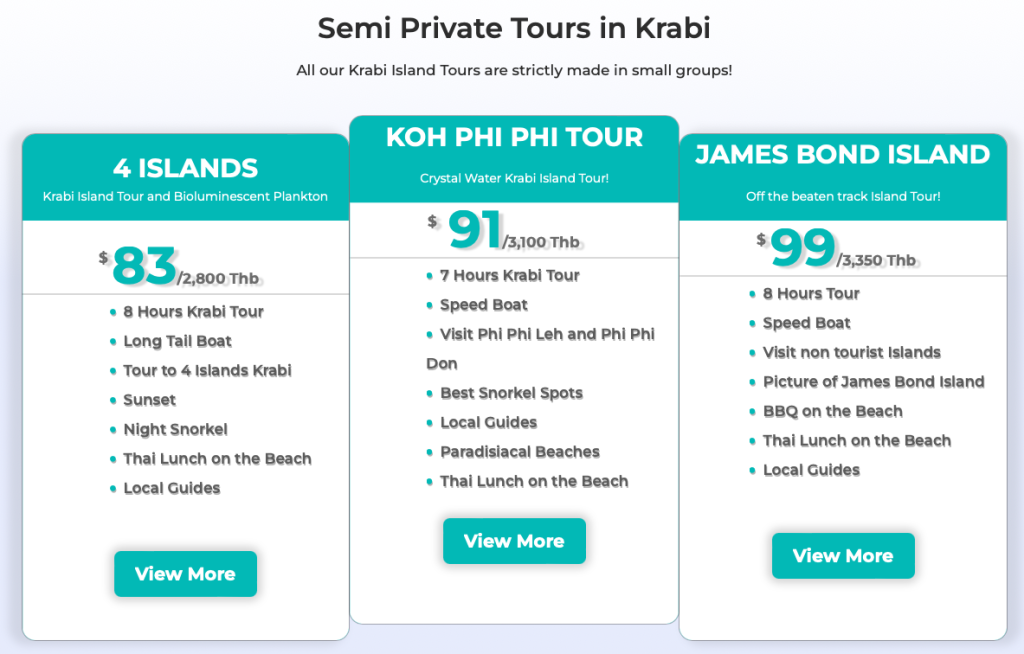

Thalassa Boat Tours is based in Krabi, southern Thailand, and specialises in boat trips around the many iconic islands in the region. The website is simple and inspirational and makes good use of images and design to promote its great-sounding trips. You can see how effective this presentation of tours is to the visitor, as they can clearly see what the tour involves, how long it is, what’s included and how much it is.

Figure 4: Example of tour listing

Source: Thalassa Boat Tours

The operator makes good use of its association with Tripadvisor, clearly featuring its certificates of excellence on the homepage, along with customer testimonials. There is plenty of information for the visitor, including about safety, flexibility and sustainability.

Vietnam

Lily’s Travel Agency offers a range of tours throughout Vietnam, ranging from short tours to multi-day trips, aimed at an international market. The website is simple, informative, and useful. There are many positive Tripadvisor reviews and it is presented in English.

Fabulous Mekong Eco Tours is a small tour operator managed by two women in Can Tho in the Mekong Delta region. They focus on providing authentic experiences while preserving traditional indigenous values. Experiences are wide-ranging and include cooking and food, visiting floating markets, cycling through local villages, walking tours and motorbike tours. The operator also offers homestays and tailor-made tours. The website is simply created, using bright yellow which helps it to stand out, and features customer testimonials.

Tips:

- Have a look at these websites to assess what they do well and what could be done better and see how they compare with tour operator websites in Jordan.

- Do your own research of the competing markets and see what ideas could be adapted for the market in Jordan.

Which products are you competing with?

Adventure travel products that offer a wide range of exciting opportunities in outstanding natural environments that also offer immersive cultural experiences are the key competing products for Scandinavian tourists. They are very common on the Asian continent which, combined with the favourable climate, makes it a challenging competitor.

Sun and beach products are another competing product, also very popular on the Scandinavian market. Currently, packaged products in traditional winter and summer sun destinations (Canary Islands, Turkey, Greece, other Mediterranean countries) are the biggest competitors.

Tips:

- As well as the global OTAs, research OTAs that are present in competing countries, such as Geoota, an Egyptian OTA.

- Undertake a thorough audit of Jordan’s travel product to identify where suitable gaps exist to create new experiences for the Scandinavian market.

5. What are the prices for competing tourism products on the Scandinavian market?

Traditionally, Scandinavian travellers spend more on travel than other European tourists, spending more on food, accommodation, and attractions. Since the pandemic, however, there has been an increase in concerns over the cost of travel in every country, with Finnish travellers expressing the greatest concern (22%), followed by Swedish (20%), Norwegian (18%) and Danish travellers (13%).

Scandinavian adventure travellers are budget-conscious because they like to travel further afield and for longer periods of time, 9-14 days on average. Once the cost of an international airfare to Thailand or Vietnam has been met, daily living expenses are considerably cheaper than European destinations, which is a very attractive factor in the choice of destination.

The table below provides an example of daily expenses on a trip to Jordan versus other destinations favoured by the Scandinavian market. Jordan is more than twice as expensive as Turkey, the cheapest by a significant margin. Both Thailand and Vietnam also offer very good value for money for a long-haul holiday destination that has an excellent tourism product and favourable weather conditions.

Table 2: Price comparison of a mid-budget, 7-night trip to Jordan vs. competing destinations, price per person

| Expenditure | Jordan | Thailand | Vietnam | Turkey |

| (USD) | ||||

| Accommodation | 308 | 210 | 161 | 105 |

| Local transport | 126 | 84 | 77 | 42 |

| Activities/attractions | 245 | 112 | 84 | 112 |

| Food | 225 | 98 | 84 | 84 |

| Total trip cost (7 days) | 904 | 504 | 406 | 343 |

| Average daily spend (excl. international flights) | 129 | 72 | 58 | 49 |

Source: Budget Your Trip

Therefore, it is important to present Jordan as a good-value destination to attract Scandinavian tourists. To justify the higher prices compared with competing destinations, make sure you highlight the quality of Jordan’s tourism product, such as unique features, value to local communities, the quality of the destination, and sustainability.

Tips:

- Focus on products that offer challenging and exciting experiences in spectacular, natural, and wild environments and that will attract the discerning adventure tourist.

- Make sure there is a good mix of activities in an adventure travel product. Include strong cultural and natural elements.

- Work with accommodation providers to offer competitive deals and include added extras in packages, such as complimentary food/drink, free entry to attractions, welcome beverages, and so on.

- Add value to your product by offering add-ons such as sightseeing trips, activities like visits to local attractions, and cultural experiences. For example, Ala Turka has created trips that can be taken in different ways, like a 1-day tour or 2-day tour with different activities on each trip to appeal to the needs of different travellers.

- Be sure to emphasise any sustainable business practices you have adopted and benefits you bring to the local communities.

This study was carried out on behalf of CBI by Acorn Tourism Consulting Limited.

Please review our market information disclaimer.

Search

Enter search terms to find market research