Entering the European market for luxury tourism

High levels of customer service, personalisation and flexibility are essential to meet the needs of luxury travellers. Sustainability is also in high demand in this segment. Luxury travellers expect tourism providers to take environmental, social and economic action to protect their localities and to support local communities. To sell luxury tourism products to the European market, local tour operators need to build strong relationships with destination management companies (DMCs).

Contents of this page

1. What requirements must luxury tourism comply with to be allowed on the European market?

By law, tour operators active in the European market must comply with various regulations to ensure that their customers are safe when they travel and that they are protected financially. Individual businesses also have their own requirements when working with operators, which they set out in a code of conduct and/or terms of business. You need to understand these requirements, and to update your business processes where necessary in order to meet expectations. These will include sustainability requirements.

What mandatory and additional requirements do buyers have?

The mandatory and additional requirements affecting the tourism sector include…

- The European Package Travel Directive.

- The General Data Protection Regulation (GDPR).

- Liability insurance and insolvency protection

You can find out more about these in the CBI document What are the requirements for tourism services in the European market?. That will help you understand the legal requirements European tour operators must comply with, as well as non-legal but standard requirements. If you understand these and can adapt your operations to meet their needs, European tour operators are more likely to do business with you. Buyers in Europe want to know that they can trust their suppliers to meet their – and their customers’ – needs.

What are the requirements for niche markets?

Luxury travel marketers use the so-called “5Cs” (see below) to create relevant tourism products. Sustainable practices and a high level of customer service are very important in this niche. To attract luxury tourists, you should also include high-quality images and information in all your communications. And you need sufficient funds to service this niche properly.

Create and deliver high-quality luxury experiences

Luxury travellers value information. So provide lots of details on your website about your experiences and activities. These visitors want well-written guides and itineraries, with attractive images. If you do not have a website yet, we strongly recommend that you build one to appeal to the luxury traveller.

Your website should be well-designed, with lots of inspirational images and videos to publicise your experiences. It should also be well-written. In all your marketing materials, take care to emphasise all the high-quality services that you offer. Use phrases like “personally tailored to your needs”, “exclusive experiences”, “luxurious facilities” and so on.

Figure 1: Peaceful luxury in Morocco

Source: Unsplash

Provide high levels of customer service

Luxury travellers demand a very high level of service and flexibility. They expect you to meet their needs wherever you can. They value a “can-do” attitude from their European travel specialists, who will require the same from you when providing your services directly to their customers. Your staff are crucial to establishing a good relationship with luxury guests. So make sure that they are good communicators and can act on their own initiative to “get things done”.

Here are some basic principles to apply when doing business with this market.

- Provide simple booking processes to save time. Luxury travellers are often “time poor”. Keeping the booking process simple will help them make quick decisions. Research shows that 62% of travellers are prepared to pay more for simple, efficient processes that save them time.

- Communicate honestly, proactively and fast. The luxury tourism market is discerning and demanding. Try to develop a warm but professional relationship with your customer. Always respond to queries and/or issues quickly and professionally. If you promise a customer that you will get back to them by a certain time, make sure that you do – even if just to give them an update. Listen actively to your customers, to avoid misunderstandings and make sure that their expectations are met.

- Personalise your service. Luxury travellers each have unique needs and preferences. For instance, so-called “high-touch” travellers want extensive human interaction and require more guidance and support when booking services or choosing experiences. On the other hand, “low-touch” travellers may want little or no interaction; they prefer to make their own decisions. And some like a mix of approaches at different stages of a trip. Learning what your customers want in advance will help you meet their needs more effectively.

- Train your staff. Luxury tourism requires staff who are skilled in hospitality and able to deliver high-quality customer service. This tourism segment has some very demanding customers, and there will be more high-pressure situations than in other niches. Your staff should be prepared for this. Explore what hospitality training courses are available in your region. Consider both online and in-person courses.

As an example, take a look at the Travel Institute’s online course to become a Certified Luxury Travel Specialist. It has been updated for 2023. Find out if anything similar is available in your country or region. - Ask for feedback, and act on it. This is an essential part of delivering excellent customer service. Use as many different means to gather feedback as you can. As well as talking directly with your customers, also talk with your staff: they might pick up feedback during their day-to-day work. Take a look at the tips from the Good Tourism Institute on How to get 5-star customer reviews.

Have sufficient funds to service the luxury market

Providing luxury tourism is expensive and requires investment. Furnishing accommodation and supplying top-class services and experiences costs more in this segment than in others. Your services need to be excellent, so your staff must be trained to a high standard. Becoming a certified sustainable business is expensive, too. Positive cashflow and good financial planning and management are essential.

Consider how you will fund your luxury tourism business.

- Write a business plan and discuss funding options with a bank or private investor. Take a look at this guide: How to create a tour operator business plan in 8 steps.

- Analyse your current cashflow so that you can track money coming in and going out. Cashflow management gives you a good picture of your costs and revenues. It helps make sure that you have enough funds to pay your bills and make a profit. To help you, take a look at The importance of cashflow for tourism businesses.

- It may be more cost-effective to join forces with other operators. Explore how you can work together to provide a “luxury package” of experiences.

- Consider working with an accommodation provider or a restaurant, for example, to provide a combination of services, with one dedicated point of contact to co-ordinate the whole package.

If you are unable to fund your business adequately to serve the luxury market, consider focusing on less demanding niches instead.

Best practices for luxury tourism service providers

Whether you offer tours or accommodation, make sure that you can offer the high-quality services that luxury tourists demand. The best practices listed below will help you assess what you are already able to do and what needs to be improved.

As a tour operator offering experiences and activities, you should…

- Make sure that your tours are personalised to your visitor. And be flexible. If your customer would rather visit one place before another, because that suits them better, try to accommodate their request even if it is less convenient for you.

- Make sure that your customers can contact you easily. WhatsApp phone numbers are a good solution, and are popular with younger luxury travellers.

- Be prepared to change plans at the last minute. For instance, if a customer wants to change their trip to the next day. Or if they suddenly ask to stay somewhere longer or leave earlier than planned. If it is possible, make the effort to do it.

- Make sure that any food and drink you provide are of very high quality. Use locally sourced, organic and seasonal produce whenever you can. Luxury travellers are often “foodies”, which means that they care very much about what they eat and where it comes from.

- Make sure that any adventure activities you offer luxury travellers comply the ISO Adventure Tourism Standard (21101:2014) or its British equivalent, BS 8848:2014. Luxury travellers want to be sure that the experiences you offer are safe and well-supervised.

- Take a look at the Adventure Travel Trade Association’s (ATTA) Sustainability Codes of Best Practice. These contain some good tips and ideas on how to improve sustainability across a range of adventure activities.

As an accommodation provider (hotel, resort, lodge, etc.) you should…

- Provide good-sized rooms with high-quality furniture and fittings.

- Provide bed linen that is 100% cotton (organic if possible). Organic cotton is more sustainable than fabrics that contain man-made fibres. It is fine – preferable even – if furniture is made from local materials, as long as the quality is excellent.

- Provide luxurious touches, like locally produced bathroom products (in refillable containers, for sustainability), fruit baskets, complimentary drinks, bathrobes and slippers.

- Find out as much as you can about your guests before they arrive. Are they are celebrating a particular occasion? When and what is it? Do they have any specific requests, like vegetarian/vegan food?

- Make sure that your guests know what excursions or trips you can help them take. These could be based around the local food scene, or cultural activities. Allocate a dedicated staff member to manage the planning and booking of additional activities, and provide plenty of options.

- Offer good options for guests with children, including activities tailored to their needs. Ideas could include a junior bird-watching experience or a hands-on local art activity. Try to cater for children of all ages.

- Offer exclusive experiences for “VIP” guests like honeymooners: a couple’s massage, for example, or a bottle of champagne and flowers in their room.

For case studies of luxury tourism providers in developing countries, consult the CBI study What are the opportunities for luxury tourism from Europe.

Tips:

- Make sure that your website appeals to luxury travellers and shows what you have to offer them. If necessary, update it or create a new site. Several good online website builders are now available, and they are affordable and easy to use.

- Read the CBI study How to be a successful tourism company online? and watch the video Tutorial on how to be a successful tourism company online.

Adopt the 5Cs of luxury travel

The “5Cs” are a set of principles that help luxury tourism providers serve their markets effectively. They cover the following topics: culture, cuisine, community, content and customisation.

- Culture. Culture and heritage are important drivers of global tourism. Cultural immersion, learning about new cultures and luxury products that showcase unique traditions are key factors for luxury tourists.

- Cuisine. Luxury travellers value quality food and culinary experiences as part of their trip. Food experiences that appeal to them are wide-ranging and include eating locally sourced produce, gourmet dining in exceptional settings (under moonlight on the beach, in the desert, on a luxury sailing yacht, etc.), cooking and tasting experiences, wine tours and visits to artisan producers.

- Community. Although luxury travellers do not tend to take group tours, they do enjoy a community element through cultural experiences.

- Content. Good marketing materials are important for luxury travellers, particularly high-quality images and videos, websites and travel planning tools. They like to be given a taste or feel of the experience they can expect to enjoy.

- Customisation. Possibly the most important principle for luxury tourists, customisation allows them to have the exact travel experience they want. The more choices they are able to make, the happier they are likely to feel. This is a good incentive for repeat purchases.

Embed sustainability into your business

Sustainable tourism is about reducing the harmful impact of tourism. It means taking action to minimise that impact and to benefit people and the planet, now and long into the future. Climate change and global warming, overuse of precious resources, plastic in our oceans, poverty and overtourism are all problems that sustainability and regenerative initiatives seek to address.

The luxury tourism segment has been stepping up its sustainability efforts. Top-end hotels, luxury resorts and even private jet companies with carbon-offsetting programmes are trying to be more and more sustainable. That helps them build a good business reputation, which is extremely important to luxury travellers when they are choosing services.

Activities in this area include adopting renewable sources of energy, installing efficient water conservation and waste management systems and reducing carbon footprints. High-profile initiatives to ban or reduce the use of single-use plastics like straws and water bottles have been popular in recent years.

Recognising the importance of local communities and fostering pride in local cultures are also important aspects of sustainability. Initiatives that benefit local communities are appealing for the luxury tourism market. Examples include employing local people, funding skills development, nurturing economic self-sufficiency and setting up conservation projects to regenerate biodiversity. Luxury consumers are becoming more and more interested in sustainable and regenerative tourism, and are prepared to pay more for it.

The Six Senses luxury resorts at various locations around the world are well-known for their sustainability efforts. Figure 2 summarises what they are doing.

Figure 2: Six Senses’ approach to sustainability

Source: Six Senses Resorts

To succeed in the luxury tourism market, you need be as sustainable as you can. It helps if you can qualify for certification through a scheme like Travelife for Tour Operators or TourCert. These are well-known in the European marketplace.

Even if you cannot achieve certification right now, it is still important to be as sustainable as possible. And to publicise your efforts – and how you measure their impact – on your website. European tour operators are only likely to do business with you if you can show that you understand the importance of sustainability in tourism.

Tip:

- Study the CBI guide How to be sustainable tourism business? to learn about the importance of sustainability in tourism. It tells you what actions you can take and introduces some of the leading certification schemes.

2. Through what channels can you get luxury tourism on the European market?

Most luxury tourism products are sold to European travellers by specialist providers in Europe itself. This is because they are experts in their home markets and know exactly what their customers need and want. These European firms usually use destination management companies (DMCs) to supply local products like experiences and excursions. So a good relationship with your local DMC will help you sell luxury products to the European traveller.

How is the market segmented?

At its most basic level, the luxury travel market is divided into two segments: leisure and business. And sometimes the two are combined, a market known as “bluxury”. Luxury travellers themselves are very varied, but in general they fall into six main types.

- Always luxury. Wealthy millionaires and billionaires. Money is no object. Luxury is part of their everyday lives.

- Special occasion. Reasonably wealthy, but luxury is a treat. They are willing to compromise on comfort to have an amazing travel experience.

- Bluxury. Travel primarily for business, but include leisure activities in the same trip, with or without their family.

- Cash rich, time poor. Travel when they are able to. Their plans may change at the last minute, so they value flexibility.

- Strictly opulent. Seek the best and most glamorous travel experiences. Often use influencers to find ideas.

- Independent and affluent. Use luxury travel as a way to pamper themselves. They can be spontaneous, travel alone or with friends and like to make their own decisions.

To find out more about these traveller types and their different characteristics, take a look at the detailed descriptions in our study The European market potential for luxury tourism.

Beyond the luxury segment, note that FITs (fully independent travellers) may be attracted by one or more luxury experiences while on a non-luxury trip. That could be a wellness experiences, a privately guided cultural tour, a luxury wine and food tasting session, a few nights camping in a luxury tent and so on. How you present your product to them will determine whether they consider it a luxury experience.

Tip:

- To find out more about the FIT market, read CBI’s market potential study for fully independent travellers.

Through what channels do luxury products reach the market?

In the European market, luxury travel is sold mostly through specialist firms, European tour operators and online travel agents (OTAs).

The diagram below shows that your route to this market is mostly indirect. The only direct route is to FITs, who may buy luxury tourism products from local operators as part of a broader trip. Each channel is described in more detail below.

Figure 3: Sales channels and routes to market for luxury tourism products

Source: Acorn Tourism Consulting

- Inbound DMCs. A destination management company is a local travel business that connects local tour operators with inbound European tour operators. It works on a business-to-business (B2B) basis. The advantage for the European companies is they deal only with the DMC, which may sell them tourism services from several local firms for one itinerary. Local tour operators that have good connections with DMCs in their area can use this channel to reach the European luxury market.

- Luxury travel specialists (tour operators and business travel planners). These tend to be small to medium-sized companies. They have a competitive advantage over the larger European tour operators and online travel agents (OTAs) because they know how to create tailor-made products from a wide range of suppliers. They are often staffed by former tour-operator employees who have set themselves up as expert travel planners. These people understand the market, and their customers, very well.

Trips for luxury buyers are mostly tailor-made, or “bespoke”. The travel specialists plan, book and care for their customers “from end to end”. They are on call for them throughout the trip, from the minute they leave their home or place of work until they arrive back home.

- European tour operators. “Mainstream” tour operators that sell luxury travel alongside products for other tourism niches, such as adventure, nature, culture and wellness. This is a very large group of businesses.

- OTAs. Online travel agents that specialise in creating tailor-made holidays, trips and experiences serving the luxury market.

- FIT Travellers (direct sales). FITs buy their luxury experiences direct from a range of European tour operators and OTAs. But they may also buy directly from local tour operators after they arrive at their destination.

Some examples of European businesses in each of these categories are listed in the table below.

Table 1: Luxury travel specialists, tour operators and OTAs in the European marketplace

| Sales channel | Examples |

| Luxury travel specialists | |

Tour operators

| Germany: DESIGNREISEN; One Luxury; Luxusreisen. France: Voyage de Luxe; My Luxury Travel; LUXeTHIKA. UK: Black Tomato; Virtuoso; EFR Travel. Switzerland: Amadi Journeys. Italy: Luxury Business Travel; Travel Design; Charmeadventure. The Netherlands/Belgium: Silk Travel; Pegase; Silverjet. Spain: Luxotour; Viajes TGM. |

| Business travel planners | Germany: One Luxury; Emporium Travel. France: CTA Business Travel. UK: EFR Travel; The Luxury Travel Agency. Switzerland: Globetrotter Business Travel. Italy: Luxury Business Travel. The Netherlands: Van Helden Travel. Spain: Travelface. |

| European tour operators | |

European tour operators (that offer luxury and/or tailor-made holidays) | Germany: Unforgettable Journeys; World Insight. France: Intermèdes; Secrets de Voyages. UK: Discover the World; South America Odyssey. Switzerland: Abendsonne Afrika; Davertour. Italy: Original Tour; Viaggi Responsabili. The Netherlands /Belgium: Sawadee; Experience Travel. Spain: INUK Travel. |

| OTAs | |

OTAs (that specialise in tailor-made trips) | Kimkim; Evaneos; We Design Trips; Better Places. |

OTAs (that specialise individual travel) | Tripaneer; With Locals. |

| Channels for FITs seeking luxury experiences | |

| European tour operators | Similar to European tour operators above. |

| OTAs | Similar to OTAs above, and also includes others like Viator and GetYourGuide. |

| Direct sales | Your own website, directly by phone. |

Source: Acorn Tourism Consulting

Luxury travellers are more likely to use specialist tour operators to make all their travel arrangements. They prefer companies that can curate itineraries exactly according to their needs and wishes.

What is the most interesting channel for you?

It is not easy to enter the luxury tourism market. Inbound DMCs are probably the most interesting channel for you. Because of their high service-level requirements, luxury travel specialists almost always use these firms to source products for their customers. Inbound DMCs know the demands of their European tour operator clients very well. So you need to build a relationship with them if you want to supply luxury products to the European market.

If you are targeting FITs who are looking for luxury tourism products, European tour operators and OTAs are interesting channels. For more information about attracting the FIT market, read the CBI study What are the opportunities in the European FIT tourism market?. And also How to work effectively with OTAs?

Tips:

- Use the internet to find DMCs in your region. You can also find them at travel trade shows. Many travel trade organisations publish member listings on their websites.

- Check out the list of exhibiting DMCs at the International Luxury Travel Market (ILTM). Be sure to select your region in the filter (e.g. Africa). The ILTM is held at several locations around the world every year. The largest event is in Cannes, France, each December.

- Explore the exhibitors and buyers at the PURE Life Experiences, a trade show for specialist luxury travel industry professionals held every year in Marrakech, Morocco. Use the filter to help find firms in your region.

- Continue to build your knowledge of local DMCs. Take a look at the list of DMC members published on the Conscious Travel Foundation website.

3. What competition will you face on the luxury tourism market?

The luxury tourism segment is very competitive. Luxury travellers like to visit places all over the world, and developing destinations interest and appeal to them. This demand creates good opportunities for local tour operators in developing countries to serve the European market.

Which countries are you competing with?

Many developing countries already have a strong luxury tourism product. Those with well-established luxury sectors include Mexico, India, South Africa, Morocco and Indonesia.

Mexico

Mexico is one of the world’s top tourism destinations, with 45 million international arrivals in 2019. In that its luxury tourism segment was worth US$14 billion. Tourism recovery is anticipated to be driven by international luxury travellers, and is forecast to rise to US$15 billion in 2024. The international market is estimated to account for one third (33%) of revenue.

Tulum is one of Mexico’s leading luxury destinations. It features beautiful beaches, boutique hotels and luxury resorts, as well as the Mayan ruins of Chichén Itzá, which attract 2 million visitors every year. Post-pandemic, tourism to Tulum has boomed, with 4 million more visitors to Quintana Roo state in 2022 than in the same period in 2019. But there are ongoing reports of conflict between local communities and developers as plans to build more luxury properties and a new international airport in Tulum press ahead. This is an example of the serious problems that can arise when unsustainable development threatens traditional livelihoods.

However, a different type of luxury tourist and residential development is also under way. This is underpinned by social integration, environmental conservation and lifestyle appeal. At Xala, near Puerto Vallarta on the Pacific coast, guests and residents will be able to join in with social, environmental and agricultural projects that actively benefit local communities.

India

India has a well-established luxury tourism market, for both domestic and international customers. Its total value was estimated at US$12 billion in 2019. The segment has recovered well following the pandemic; in fact, some observers say that luxury tourism has “saved” the Indian tourism sector. Its value was expected to exceed 2019 levels by 2022, and is forecast to rise to US$18 billion in 2024. The international segment is estimated to account for 40% of revenue.

The Indian luxury homestay sector has been enjoying particularly good growth, driven by Airbnb and Indian OTA brand Oyo, as customers seek high-end accommodation and unique experiences.

The country has numerous destinations for luxury tourism. Goa is one of the best places to visit, for UNESCO World Heritage sites, exceptional beaches, water sports and wellness. It is also very accessible for both international and domestic travellers. Other leading luxury destinations include Jaipur, Udaipur, Mumbai, Delhi, Puducherry, Kumarakom, Chennai, Kolkata and Chandigarh. Luxury is one of the major themes promoted by the Indian Tourist Board, Incredible India.

South Africa

South Africa’s luxury tourism segment was worth US$2.2 billion in 2019. It is expected to recover to similar levels in 2024, driven mostly by visitors from abroad. The international market is by far the largest part of this segment, accounting for almost three quarters of luxury tourists (72%).

South Africa has many excellent options for this group. It is a top destination for exclusive game safaris in its many national parks and private game reserves. For foodies, there are several world class wineries in the wine region. The spectacular coast along the Garden Route is a popular self-drive destination, and famous for whale-watching. Luxury train operators provide journeys in luxurious cabins and serve five-star cuisine, evoking the days of elegant rail travel and the romance of African exploration.

Morocco

Morocco’s luxury tourism segment was worth US$1.3 billion in 2019. It is dominated by the international market, which accounts for 92% of revenue. The segment is expected to recover to pre-pandemic levels by 2024. Europe is key to this market, though, so its recovery is dependent upon Europeans’ willingness to travel.

Morocco has a strong product offering for luxury travellers. The country is home to nine UNESCO World Heritage sites, including the old medina of Marrakesh: a busy cultural hotspot of historic sights, souks (markets), hammams (bath houses), food vendors, dancers and hidden gardens. Glamping in the Sahara Desert is in well-appointed nomad tents with bathrooms powered by solar energy. Steam baths and wellness treatments can be found in luxury hammams, and top-end accommodation includes historic palaces and mansions.

Morocco also hosts the annual luxury trade fair PURE Life Experiences, which brings together professionals working in the high-end tourism segment.

Costa Rica

As well as sustainable tourism, Costa Rica is well-known for very high-quality luxury ecotourism. Its rainforest and cloud lodges are exceptional, both environmentally and for sustainable luxury. Affluent travellers can also expect excellent cuisine and extraordinary and unique experiences, along with access to good communication technologies.

Some of the most popular destinations for luxury tourism are: the Gulf of Papagayo, known as Central America’s premier luxury destination, which has its own airport; Manuel Antonio, a wildlife-rich region; and Arenal, home to an active volcano and five-star properties located on or around hot springs.

Costa Rica is strong in ecotourism and beach tourism for luxury travellers. During 2021 and into 2022, nature experiences were one of the product types in most demand amongst this group. Wellness tourism, surfing and visits to national parks are popular, too. The country has more than 60 five-star hotels, and luxury tourists are estimated to spend more than US$35,000 each per trip.

Costa Rica is recovering well following the pandemic, and was one of the first countries to reopen to tourists. As a result, international arrivals in 2022 were just 10% below those reported in 2019. And it was a popular destination for European tourists. Visits from Spain increased by more than 34% during 2022. In 2023 the country expects international arrivals to exceed 2019 levels (3.1 million).

Indonesia – Bali and Lombok

Indonesia is one of Asia’s top luxury destinations. Made up of 17,000 islands, it has an exceptional natural environment. Bali is the country’s best-known destination for international tourism. Lombok is a good choice for luxury travellers seeking a less busy place to visit, as its high-end accommodation tends to be smaller and more intimate.

In 2019 the government launched a new approach to promote luxury tourism. The plan was to create “10 new Balis” in other regions, such as Lake Toba in northern Sumatra and Borobudur Temple in central Java.

In the Wakatobi National Park marine area, a diving and homestay destination, new rules have stopped destructive fishing practices and protected precious reefs from harmful diving. But critics say that some high-end community-based tourism (CBT) and volunteering initiatives are not, as intended, helping local people or providing immersive experiences. This shortcoming highlights the importance of ensuring that sustainability works for the long-term benefit of communities.

Key points

- Check with your national tourist board about its view of luxury tourism. How important is this segment? What markets does it want to appeal to? Align your product with the story on the tourist board’s website.

- Assess your destination or region’s luxury USP (unique selling point). Pinpoint the main places providing luxury activities, such as glamping or boutique hotels, cultural routes or food experiences. Research what European tour operators offer their luxury travellers. See if you can identify a gap in the market where you could deliver something a little different.

- If you offer cultural experiences like CBT, make sure that the benefits for local communities are clear, transparent and measured. For more information, see the CBI study on opportunities for CBT experiences on the European market.

Which companies are you competing with?

Local companies active in the luxury tourism market are a mix of tour operators and accommodation providers. High-end lodges, resorts and retreats are very appealing to luxury travellers. They often provide a range of excursions for their visitors. Community-owned establishments are also becoming more common in the marketplace.

Mexico

Mexico Sol Tours provides specially curated tailor-made tours and services in the Riviera Maya. It offers massages, water-based activities, boat trips and cultural tours of local heritage sites. Because these are bespoke private activities, it can customise them for each customer and so deliver a unique experience.

The company targets luxury visitors who are staying either in private accommodation or at a local hotel and are looking for a one-day experience close by. Its guides speak several European languages, including Spanish, English, Italian and French.

Devoured is a small women-owned culinary tour company. It offers authentic experiences that aim to make a positive impact on Mexico City’s economy. The tours are guided by food experts, walking through areas of the city undiscovered by tourists.

Several itineraries are available, including a wine and street-food experience and a morning breakfast tour. Tailor-made and special tours can also be provided, allowing the firm to target the luxury market. These custom products are built around the guest’s interests and can be any length.

India

Shakti Himalaya is a unique tour operator that offers walking and driving tours in the Kumaon, Sikkim and Ladakh regions The tours have been designed for the sophisticated traveller, who is looking for a private and authentic experience combined with comfort, style and delicious cuisine. All provide guests with an immersive experience, far away from the usual tourist trails.

Shakti is truly unique with its luxury offering. It has built each itinerary with the purpose of benefiting local communities, and all accommodation is in rented houses within villages, which provide simple luxury. Each group is accompanied by a private chef, driver, porter and expert guide. This dedicated team is there to ensure that the customer’s trip is up to the highest possible standard.

Make it Happen is an experiential tour operator that specialises in curating experiences that showcase local cultures and empower local communities. It offers full or part-day experiences and multi-day bespoke tours in three locations. Its unique offering and way of thinking help guests connect with communities in a true and meaningful way.

Its website is clear and well-presented, providing an easy-to-use booking platform. This helps the business cater to younger luxury travellers, who do in-depth research before booking and enjoy unique cultural experiences.

South Africa

Kiff Kombi Tours is a small tour operator offering day tours in and around Cape Town. Its private tours are split into four themes: cultural, food, scenery and drink. Tours can be booked individually, to meet the guest’s specific needs and requirements.

The style of the experience is designed to help the customer explore the area whilst feeling like a local. This is achieved by visiting places away from busy tourist destinations, including small, locally owned businesses. Guests discover coffee shops, restaurants and beaches that only true locals know about.

My Photo Safari is a specialist tour operator for bespoke photographic wildlife tours in some of South Africa’s leading national parks. It welcomes all levels of photographer. The operation is run by an enthusiast in photography who works with his guests and provides guidance on how to capture the perfect shot.

All aspects of the holiday are organised by the company, allowing guests to focus solely on their photography. It uses high-end lodges in unique locations, providing customers with both comfort and privacy.

Luhambo Tours is a Cape Town-based tour operator that specialises in wine experiences. It prides itself on offering unique and personalised tours with a private guide. Products range from full-day to multi-day experiences, visiting some of the top wineries in the region.

As guests may have specific wine interests, the tours can be tailored to match them. All the guides have an in-depth knowledge of South African wine and the regions they visit. They take guests away from the busy tourist areas to explore local hidden gems.

Morocco

Sahara Luxury Tours provides memorable experiences that allow guests to experience Berber culture, see the country’s diverse landscapes, relax on the beach or view Morocco from a hot-air balloon. Its core customer base is aged 18-40, from all over the world.

Its wide-ranging offering allows the company to tap into various niche markets and create tailor-made itineraries that appeal to different needs. Each trip includes an English-speaking private driver/guide. If it offers more languages, it might penetrate new markets.

Experience Morocco is a locally owned tour operator that offers curated experiences throughout the country. Its tours include tailor-made travel and MICE (meetings, incentives, conferences and exhibitions tourism) products for business travellers looking to stay on and explore their destination.

With its tailor-made offering, the company can work closely with the customer to understand their preferences regarding accommodation, activities and food choices. It can then create an itinerary to cater for these. Experience Morocco has featured in a number of media, including Wendy Perrin Insight Guides. It is also a member and preferred supplier of Virtuoso, the global network of luxury advisers. This helps its brand visibility.

Costa Rica

Swiss Traveller is a local tour operator offering a range of different experiences, from one-day to multi-day tours. These products target a range of niche markets: adventure, nature and ecotourism, celebration trips and more. The firm is a member of LATA and Virtuoso. And it holds the highest sustainability certification under Costa Rica’s national tourism certification programme, CST.

Swiss Traveller’s guides are all certified by the Costa Rican Institute, which guarantees high quality of service. They speak a range of languages, including Spanish, English, French, Italian and German. This is a unique selling point (USP), allowing the business to cater for various European markets. Whilst its website provides key information about its offering, improvements could be made by updating images, videos and descriptions to present its products better.

Jade Tours is a tour operator with four professional and licensed guides. Its products are all curated to provide exclusive experiences around nature and conservation. The business has a large offering at seven different locations; it works with its guests to mix and match multiple experiences to build a full-day or multi-day itinerary.

As a responsible operator, all its guides are naturalists certified by the Costa Rican Tourism Board. This reassures customers about their knowledge and service. The firm also provides high-level optical equipment on its tours, to ensure that guests have the best possible experience. Adding extras like this is an effective way to attract luxury tourists, and it can help an operator stand out from the competition.

El Silencio Lodge is a luxury lodge and spa located in a private reserve. It offers several different experiences, including cookery, yoga and painting classes. Further afield, there are tours to local communities and waterfalls or to see how gourmet coffee is produced.

This wide offering allows the lodge to cater for a range of markets, from people who want to relax and stay in one place to those seeking adventure. The property has its own dedicated “eco-concierge”, who recommends and books the experiences. All bookings are private and allow flexibility with timing.

Indonesia

Far Horizon Travel is a unique tour operator providing tailor-made itineraries for all travel styles. On its website it highlights cultural experiences that give guests unique, off-the-beaten-track options where they can immerse themselves in the lives of various Indonesian tribes. Its marketing is designed to appeal to the young affluent market. That is apparent from its use of images and wording.

Even though it is not certified, Far Horizon Travel provides good evidence of its sustainability commitments. These include reducing single-use plastic items and involving local communities. It is really important that you also do this, even if you are unable to achieve certification at the moment. If Far Horizon Travel does commit to certification, that should help build its client base and develop long-term relationships with travellers and tour operators seeking true meaningful experiences.

Authentic Indonesia creates both tailor-made and pre-packaged tours all over the country. It offers several one-day experiences that take guests to unique wonders and introduce them to local cultures. Some of its experiences are truly unique, because they have been developed together with local communities and their guides’ families.

The company has a strong commitment to sustainability and promotes both in-house and industry policies and codes of conducts on its website. Authentic Indonesia has been a Travelife Partner since 2018. Certification means that it can promote itself as a sustainable tour operator.

Pulau Private Charters is a boat tour operator in Bali. Its owns a fleet of five boats and offers tailor-made rentals and cruise options. Overnight stays, full-day rentals, sunset cruises, diving and other experiences are available. Its overnight options take guests to several nearby islands, including Nusa Penida and Komodo.

Every rental comes with a captain to skipper the boat, allowing guests to relax and enjoy the experience. A door-to-door pick-up and drop-off service from and to the guest’s accommodation in an air-conditioned vehicle is also included – another high-end extra.

Key points

- Offer unique experiences that no other local operators provide. Include tailor-made options so that tours can be built around customers’ needs. If you only offer tailor-made trips, promote examples of possible experiences on your website to give an idea of what you can deliver.

- Guides must be well-trained, have specialist knowledge and provide exceptional customer service. Having guides who speak several European languages is a strong selling point.

- Use locally owned suppliers and visit local communities – luxury travellers like to immerse themselves in the local culture.

- Offer a door-to-door service. Collect guests from their accommodation so that they do not have to find their own way, and drop them off again at the end of the tour.

- Add upgrades or surprises to the tour to make the guest feel special.

- Create a sleek, easy-to-use website that reflects your luxury product. Make sure that you emphasise privacy and exclusivity.

- If possible, obtain certification as a sustainable tourism business. Travellers and tour operators now actively seek suppliers that can prove their commitment to sustainability. If you are unable to achieve certification at the moment, make sure that you tell your customers what you are doing to be sustainable – and that you can prove it.

Which products are you competing with?

What products you are competing with in the luxury tourism market depends on the level of service and standards you are offering, as well as the appeal of your experiences. As we have seen, luxury products cross over with other tourism niches (adventure, nature, culture and so on), so your products will be competing on the level of quality and service you offer within the niche.

When developing products for the luxury market, use the “5Cs” to help shape experiences and create a unique selling point (USP). A strong USP sets you apart in a very competitive marketplace.

Tips:

- Use the internet to research luxury tourism in your destination. Check what other operators are already offering, and also which European tour operators serve your market. Build up a longlist so that you can start to develop your own ideas.

- Find out how to create a strong USP. Read the CBI study How to determine your Unique Value Proposition?

4. What are the prices for luxury tourism products?

There are no standard prices for luxury tourism products, in part because they are often tailor-made. The table below lists the approximate prices of various luxury experiences and overnight stays in a number of countries. You can see that they vary by destination and by the type of experience. The best thing you can do is compare prices in your own destination so that you set yours at the right level.

Table 2: Examples of prices in the luxury tourism market

| Luxury experience | Country | Duration | Guide price per person (€) |

| Private Wildlife Tour at Night with Naturalist Guide | Costa Rica | 2 hours | 49 |

| Fez Cooking Class Experience | Morocco | 1 day | 64 |

| Private Sunset Charter | Indonesia | 3 hours | 96 |

| Rio Celeste Waterfall Private Hiking Tour | Costa Rica | 7 hours | 160 |

| EAT, PRAY, LOVE – food tour in Bali | Indonesia | 1 day | 160 |

| Stay at Fenyan Ecolodge | Jordan | 1 night | 193 |

| Stay at Limalimo Lodge | Ethiopia | 1 night | 184 |

| The Colourful Akumal Bay Turtle Private Tour | Mexico | 6 hours | 199 |

| Private Sailboat Tour with Lagoon Swimming | Mexico | 3 hours | 229 |

| Private Wine Tour from Cape Town | South Africa | 1 day | 245 |

| Hot-Air Balloon Ride in Rajasthan | India | 1 hour | 250 |

| Private Desert Trip to Merzouga | Morocco | 3 days | 330 |

| Private Enchanting Varanasi Tour | India | 3 days | 356 |

| Bush Suite at The Fort, Etosha Reserve | Namibia | 1 night | 387 |

| Limalimo Local – long weekend | Ethiopia | 2 nights | 588 |

| Unique Stay at Naranjo | Costa Rica | 3 days | 652 |

| Stay at Clouds Mountain Gorilla Lodge | Uganda | 1 night | 735 |

| Limalimo Package – two nights at lodge, two nights camping | Ethiopia | 4 nights | 913 |

| Bali from the Sky – helicopter trip | Indonesia | 1.5 hours | 1,000 |

| Luxury Kruger Fly-In Safari | South Africa | 3 days | 1,229 |

| Sumba Private Adventure and Cultural Tour | Indonesia | 10 days | 1,330 |

| Stay at Nayara Tented Camp | Costa Rica | 1 night | 1,946 |

| Explore the Cultural Richness of Chiapas | Mexico | 10 days | 4,000 |

| Package at Pikaia Lodge | Galapagos | 3 nights | 4,248 |

| Package at Pikaia Lodge | Galapagos | 6 nights | 8,497 |

| Classic Delta Package | Botswana | 9 nights | 9,273 |

Source: Acorn Tourism Consulting

Prices are made up of many different elements, which are influenced by many factors. They include:

- Season of travel: high, medium (shoulder seasons) or low.

- Booking lead times: early bookings are often a little cheaper, to attract “early birds”.

- Flights: whether first class, premium or economy, international or internal.

- Accommodation type: five/four-star hotel, boutique property, luxury lodge/resort and so on.

- Type of room: suite, double, single.

- What meals are included: all inclusive, dinner bed and breakfast, bed and breakfast, room only

- Transport: for the luxury market this will be in high-quality vehicles with air conditioning, perhaps even helicopters or private aircraft.

- Type and number of experiences included with a holiday: each experience also comprises a mix of elements.

Setting prices correctly involves a mix of marketing strategy and financial know-how. The most important thing is to know what each element of your experience costs. Remember that luxury tourists are prepared to pay for exceptional personalised service, exclusive and sustainable accommodation, customised experiences, flexibility and the highest quality. If you do not meet their requirements, however, they will let you know that they are not happy.

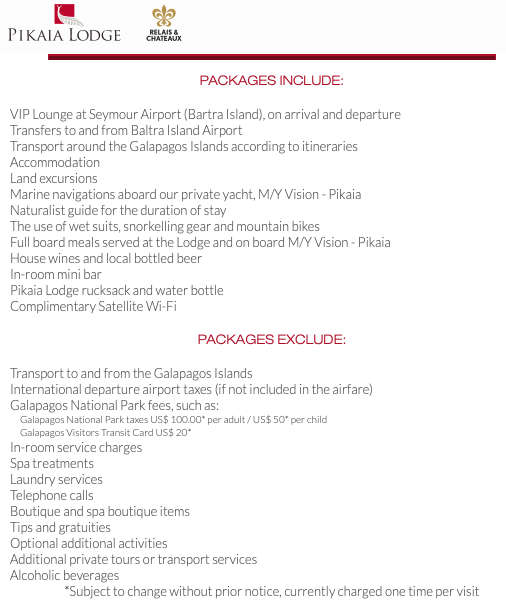

In your pricing strategy, be very clear about what is included and what is not. Take a look at this example from Pikaia Lodge in the Galapagos Islands. It states very clearly what its rates cover.

Figure 4: Inclusions in and exclusions from luxury package prices

Source: Pikaia Lodge

Tips:

- Research prices charged by your competitors to find out whether your products are within the normal range for your local luxury tourism market. Be sure to compare “like with like” (or as identical as possible), so that you can assess whether your product will be attractive to the luxury consumer.

- Ensure that you budget for highly trained staff and guides to satisfy all the requests made by your luxury guests.

- Consult the CBI study 10 tips for doing business with European tourism buyers – in particular tip 7: Set a fair price for your services. For more advice about setting prices, download the guide published by Destination New South Wales: Pricing your tourism product (PDF).

Acorn Tourism Consulting carried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research