The European market potential for solo tourism

Solo travellers are people who go on trips alone – a niche that has seen strong growth in recent years. This group consists of diverse travellers of all ages and genders, and their activity preferences vary widely. Some choose to travel independently, while others choose group tours to meet like-minded people. Notably, women make up the majority of solo travellers. The highest potential source markets for solo travellers are those with a higher proportion of single-person households, such as the United Kingdom, Sweden, Denmark, Germany, the Netherlands and France.

Contents of this page

1. Product description

Solo travellers go on trips by themselves, without friends or companions. This includes short trips close to home and longer holidays to destinations that are further away. Solo travellers may participate in all kinds of activities. They can be of any age or gender and may choose to travel independently or go on a group trip. The only defining feature of this target group is that they travel alone.

Travellers in this market tend to be more independent than others, and they enjoy flexibility. Often, this is why they travel alone rather than with other people. The number of solo travellers has grown so fast in recent years that there are now tourism businesses that specifically target solo travellers. Some of these exclusively serve solo travellers, while others offer specific tours targeted at solo travellers.

Interestingly, most solo travellers who go on group tours are female. Women are well represented across the rest of the solo travel market as well:

- In 2018, British Airways found that over 50% of women have travelled alone, and 75% of women were planning a solo trip in the next few years.

- In Italy, 63% of women aged 18-65 had travelled to another country alone; 60% of German women had.

- 60% of women in the UK were planning a trip in the next few years; 16% had travel booked in the next two or three months.

- 30.5 million women have taken long-haul solo trips that lasted over six months.

- Overseas Adventure Travel found that 85% of its solo travellers are women.

- EF Go Ahead Tours found that its solo tours have 27% more women than non-solo tours.

- A recent study found that tour organisers serve four female solo travellers for every male solo traveller.

- Approximately 75% of Intrepid’s solo travellers from North America are women.

People are motivated to travel solo for different reasons, some of which are listed in Table 1 below. Motivations also change slightly for solo travellers above the age of 55.

Table 1: Why people travel solo

| Reason | <55 years | 55+ years | All |

| I want to see the world, and I don’t want to wait for others | 84% | 64% | 74% |

| I want to do what I want when I want | 68% | 57% | 63% |

| I like the feeling of freedom and independence | 57% | 47% | 52% |

| I want to meet new people | 41% | 43% | 42% |

| Personal growth | 42% | 30% | 36% |

| I have different interests than my friends | 43% | 37% | 40% |

| My partner does not want to travel as much as I do | 9% | 13% | 11% |

Source: Solo Traveler World

Men and women have different motivations for travelling solo, as well as different barriers. Male solo travellers are often driven by their desire for adventure, exploration and independence. They are likely to participate in adventure sports and physical activities, and to visit off-the-beaten-path destinations that offer unique experiences. Research shows that the biggest worry for men is the cost of a solo trip compared to travelling with others.

Women often embrace solo travel to seek empowerment, self-discovery and personal challenges. Wellness and self-care experiences might be more important for women than men. Safety and security tend to be the biggest concerns for women travelling alone. Women may choose to stay in women-only accommodation or take women-only tours for more comfort and to connect with like-minded travellers.

Women often choose destinations known for their safety. They take precautionary measures like researching local customs and using travel apps for security.

Source: Solo Female Travelers Club

Solo travellers tend to have specific booking behaviours and preferences. Most solo travellers like flexibility, so they will research the destination in advance but will not book day tours or activities until they arrive. Most solo travellers (89%) book their trips independently rather than using an agent or adviser. The majority use online methods to research and book their trips, as they like the convenience of online platforms.

Many solo travellers (62%) use their smartphones to research and plan their trips, and 46% have booked a hotel on their mobile phone in the past. 59% of solo travellers believe it is crucial to be able to add extras or adapt their bookings on the go using websites and phone applications. Solo travellers also want to receive targeted inspiration for their next trip based on their preferences. It is important to tailor marketing content to target groups.

Budget is one of the more challenging aspects for many solo travellers, as there is nobody to share expenses with. 44% are budget travellers, and only 19% travel in luxury. As the solo market grows, more tour operators and accommodation providers are now removing requirements for solo travellers to pay more on their trips.

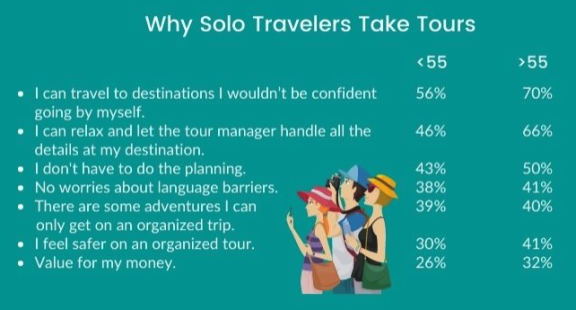

Solo travellers can choose to either travel independently or to join a group tour. 64% of travellers prefer to travel as part of a group ‘sometimes’, while 24% exclusively book group tours, meaning that almost nine out of 10 solo travellers sometimes go on group tours. This may be surprising, since solo travellers tend to be more independent and keen on flexibility than other markets. However, there are a number of reasons why they might prefer to go on a group tour rather than travel independently (Figure 2). For instance, group tours guarantee that they will meet other travellers, so they will not be completely alone.

Figure 2: Why solo travellers take tours

Source: Solo Traveler World

The table below provides examples of tour operators that successfully cater for solo travellers.

Table 2: Examples of holiday providers that cater for solo travellers and how they position themselves in the market

| Solo provider and unique selling point (USP) | How does the provider appeal to the market? |

(United Kingdom) ‘Bringing people together to share the joy of travel is our passion’ | Just You is a tour operator that focuses specifically on solo travellers. It offers a wide range of guided tours to every continent, and both long and short itineraries. Just You guarantees single occupancy rooms, with no single supplement fees. They also work with the non-profit organisation Planeterra to support community projects around the world, some of which are included in their itineraries. |

(India) ‘India is not often considered as the preferred destination for solo travel, but we believe otherwise and are working towards changing this perception’ | Solo Travel India started as a tour operator that focused on solo travel packages for single travellers. This means that everything is pre-booked, including accommodation and transportation. While solo packages are still a major part of the company’s operations, it now offers group tours for solo travellers as well. Solo Travel India is trying to change the way solo travellers see India, while making the country more accessible to this group. |

(Bali, Indonesia) ‘There’s no social talking or e-devices, except at the office & co-work space or hot springs’ | Bali Silent Retreat has a slightly different take on solo travel: it forbids speaking outside designated areas. Because of this, it may appeal more to solo travellers, since there is no interaction with others anyway. The retreat offers three different accommodation options for solo travellers, with rooms ranging from basic to deluxe. It is rare for accommodations or retreats to cater for solo travellers in this way. In fact, solo rooms are cheaper than double rooms. |

(Spain) ‘It’s about sharing your journey with other people in the same situation, nothing more’ | Taranna is an operator with tours across all seven continents. It offers both group trips and tailor-made self-guided trips, and it has a special category for single travellers, with a range of tours around the world catering for this group. The trips are exclusively for those travelling solo, and travellers are expected to share rooms with others. If they want their own room, they have to pay a single supplement. Groups are small (4-12 people), and the itineraries are designed specifically for solo travellers who want to make friends as they travel. |

(United Kingdom) ‘Just you – and the great outdoors’ | Black Tomato offers luxury travel experiences around the world. Its self-guided experiences are all tailored – the company offers suggestions and ideas for trips but builds each tour to suit the needs of the client. Black Tomato creates specialised experiences for solo travellers and offers a range of options for ‘wilderness escapes’. Its website has a solo page that answers frequently asked questions and gives examples of successful past solo trips. The page also offers examples of five-star reviews from satisfied clients. |

Source: Acorn Tourism Consulting

End-market segmentation and consumer behaviour

The segmentation of solo travellers by men and women was discussed above. Segmenting solo travellers by gender is popular since the motivations and desires of these two groups tend to differ. Tour operators and accommodations also cater for these two separate segments, with some operators offering women-only tours, and many hostels providing women-only dormitory options.

Solo travellers can also be segmented by their age, activity and budget preferences, and purpose of travel (see Table 3). Specific trends within these segments will be discussed in greater detail in the trends section of this report.

Table 3: Segmenting solo travellers

| Segment factor | Sub-groups |

| Age |

|

| Gender |

|

| Preferred activities | Solo travellers may fall under many other niche market segments, depending on their preferred activities. These may include:

|

| Budget preferences |

|

| Travel purpose |

|

Source: Acorn Tourism Consulting

Tips:

- Analyse your own solo customers to better understand which segments you naturally attract – look at factors like age, gender, activities and budget.

- Create specialised packages or services for different solo traveller segments. You could design adventure-focused packages for young adults or wellness retreats for travellers who prioritise personal wellbeing.

- Offer female-focused services that prioritise safety and self-discovery, as women make up such a large proportion of solo travellers.

- Foster a sense of community by creating spaces and opportunities for solo travellers to connect with like-minded people, regardless of their segment.

Accessible tourism in the European market

Accessible tourism is the ongoing endeavour to ensure that tourist destinations, products and services are accessible to everyone, regardless of their physical limitations, disabilities or age. It encompasses publicly and privately owned tourist locations. The improvements not only benefit those with permanent physical disabilities, but also parents with small children, elderly travellers, people with temporary injuries (such as broken bones), as well as their travel companions. Disabled tourists may travel individually, in groups, with their family or with caretakers.

Accessibility and solo tourists

Accessible tourism is crucial for solo travellers, especially those with disabilities, as it ensures equal opportunities and inclusivity. For solo travellers with disabilities, accessible accommodations, transportation and attractions make it possible to explore the world independently. This independence is critical for self-discovery, building confidence and fostering a sense of empowerment.

Accessible tourism enhances the overall solo travel experience, allowing individuals to fully immerse themselves in a destination’s culture, history and natural beauty, just like any other traveller.

Practical advice:

- Create a user-friendly website with accessibility features to make it easy for solo travellers with disabilities to book independently.

- On your website and in your marketing materials, clearly explain what you do to ensure accessibility.

- If you provide accommodation, designate specific rooms as accessible and ensure that these meet international accessibility standards.

- Create inclusive packages for transportation, accommodation and tours that cater for solo travellers with disabilities.

- Read the CBI study What are the opportunities in the European market for accessible tourism? for more tips on how to offer accessible tourism activities.

2. What makes Europe an interesting market for solo tourism?

Europe is an interesting market for solo tourism due to its large proportion of single-person households, and because many Europeans feel independent enough to take trips alone. The solo travel market in general is interesting for developing countries as it is growing very quickly, and looks like it will continue to grow. Moreover, solo travellers may be more valuable to the destinations they visit.

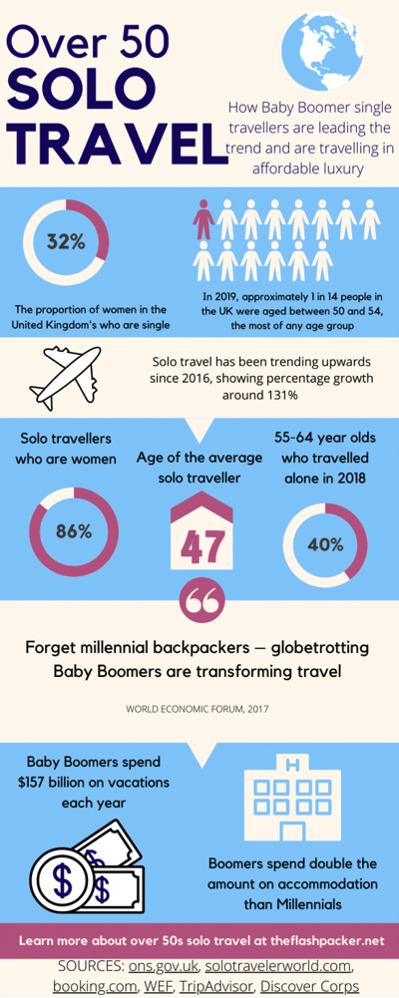

Solo travel has been trending for years, becoming a very important tourism market. Figure 3 shows some key statistics about the size of this market.

Figure 3: Key solo traveller statistics

Source: The Flash Packer

Within Europe, the number of single-person households has grown dramatically in recent years. In some European cities, they now represent up to 60% of all households. Since most solo travellers are single, this shows the market potential for solo travellers from Europe. Over a third of British people (37%) prefer to travel solo, and 31% booked a solo holiday in 2023.

Digitalisation in tourism may have boosted the increase in solo travel. European solo travellers can now use smartphones and apps to book their trips, and they can use review websites to make sure companies or accommodation providers are safe and reliable before they travel. Solo travel has also become more socially acceptable, as social media trends have made it more popular. For example, Emily Luxton from the UK posts and blogs about her solo travels and has been named travel blogger of the year four times. It is important for destinations to use digital methods to reach this market.

The growth in solo travel was accelerated by the pandemic: bookings by solo travellers have increased by 42% over the last two years. Online searches for ‘solo travel’ spiked by 267% from December 2020 to April 2022, showing strong interest in this type of trip. Airbnb reported that over 50% of stays booked in the first quarter of 2022 were for solo travellers.

Leading tour operators like EF Go Ahead Tours and Intrepid also saw rises in solo traveller bookings. Intrepid had 9,000 more solo traveller bookings globally in 2023 compared to 2022. Meanwhile, searches for single-traveller flights increased by 36% in 2023 compared to 2022. Pre-pandemic, 14% of people were considering traveling alone, which increased to 23% after the pandemic. Since many solo travellers are more adventurous than other travellers, developing destinations can greatly benefit from the growth in this market.

Solo travellers tend to stay longer and spend more when they travel. The average solo trip lasts 19 days, and longer stays usually mean higher spending. 36% of solo travellers spend US$1,000-2,000 per week during their trips. Those over 55 tend to spend more – only 13% of them spend less than US$1,000 per week. Their spending behaviour makes these travellers valuable for developing destinations.

Tips:

- Regularly check your company’s online reviews and address any recurring issues or complaints. Pay attention to any negative reviews that might be relevant to solo travellers – such as reviews that mention things like safety and sense of community – and see where you can improve.

- Provide specific information for solo travellers on your website, such as any discounts you might offer and safety information. As this market is set to keep growing, business models will need to change accordingly.

3. Which European markets offer opportunities for solo tourism?

The European markets with the most opportunities for solo tourism are the UK, Sweden, Denmark, Germany, the Netherlands and France. These are the European countries with a higher proportion of single-person households, cultures that encourage independence and a history of solo travel. These characteristics make these countries the most important for developing destinations to target when trying to attract solo travellers.

The number of single-person households in European countries has been increasing over the last three decades. Europeans are marrying later in life or, increasingly, not marrying at all. At the same time, divorce rates have risen. In 2022, the UK had the largest percentage of single-person households, followed by Sweden and Denmark (see Figure 4). While not all solo travellers are single, single people are more likely to travel solo. This single-person household trend is global and is expected to continue at least until 2030, and likely longer.

Sources: Trading Economics; ONS

United Kingdom

The UK is a great source market for solo travellers due to the high percentage of people that live alone, the high use of technology, and its diverse population. The UK’s geographical location and excellent international connectivity also make this a great source of solo travellers.

In 2022, almost 30% of UK households were single person (see Figure 4). This is more than any other country in Europe. Additionally, 28% of British people have travelled alone before, and almost half (46%) want to travel solo in the future. The pandemic encouraged around 30% of the population to consider solo travel. They wanted to travel again to make up for lost time, and they felt more adventurous.

UK travellers are interested in sustainability. 51% of British travellers want to travel more sustainably, and 50% would be willing to pay more for this. However, a majority of this source market (59%) do not know what they can do to travel more sustainably. That is why it is important for tourism businesses to advertise sustainable options and explain to their clients how they can make their trip more sustainable.

Solo travellers from the UK will likely prefer to travel to countries where people speak English. This is part of the reason why destinations like Tanzania and Bali are popular with this source market. Many British travellers also like adventure and outdoor activities, so they may prefer destinations with hiking opportunities, water sports or other outdoor adventure activities.

Sweden

Swedish culture promotes independence and personal freedom, which contributes to its large solo travel market. Additionally, the country has a lot of single-person households (23.5%), and people who live alone have more freedom to travel solo. Sweden also has the highest tourism spend per trip compared to the other European source markets. On average, Swedish travellers spend just over €1,000 per trip when they travel internationally.

Swedish people often speak fluent English as well as multiple other languages. This takes away many language barriers and makes it possible for them to travel to a lot of destinations. Many Swedes also travel abroad through study programmes, exchanges and work assignments from a young age, so they are experienced travellers who are not afraid to travel alone.

Swedish travellers are far more likely than most other Europeans to be interested in sustainability and their travel impact. 70% of Swedish travellers would pay more to protect the natural environment, whereas the average for Europe is only 35%. A total of 92% of Swedish travellers say they are prepared to change their travel habits to reduce their impact.

Solo travellers from Sweden have a wide range of interests when they travel. Some are interested in cultural exploration and the kind of historical sites offered by countries like Sri Lanka or Jordan. Others may prefer destinations that offer natural beauty, such as Costa Rica or Bali. Swedish travellers also appreciate social interaction, so they may prefer to join group tours or use networking apps to connect with other travellers.

Denmark

Denmark produces many solo travellers, likely due to its high number of single-person households (23.2%), as well as its culture. Similar to other Scandinavian countries, Denmark has a culture of independence and freedom. This encourages solo travel and inspires traveller confidence. A 2017 survey found that 15% of the Danish population had travelled solo in the previous three years.

Danish travellers appear slightly less interested in sustainability than some of the other European markets. 75% of Danish travellers say they would change their travel behaviour to travel more sustainably. At the same time, the Danish are more likely to choose transport options with lower ecological impact (38%) compared to the average European traveller. They also prefer local products and like to go on holiday outside the peak season to reduce their impact.

Like Swedes, Danish people often speak fluent English, as well as a number of other languages. This makes it easy for them to communicate when they travel and takes away many language barriers. Danes often like travelling to places with beautiful natural areas, and they tend to enjoy outdoor activities, such as camping and hiking. They also like to relax when they travel, so they may want to go on wellness retreats. Destinations like Costa Rica and Sri Lanka might appeal to Danish travellers.

Germany

Germany is a good source of solo travellers for several reasons. First, it has a high percentage of single-person households (20.1%), which means that there are a lot of people who may have the freedom and desire to travel alone. Moreover, the number of single-person households in Germany is expected to keep increasing until at least 2040, and German culture promotes independence. A 2018 survey found that 20% of Germans had travelled alone over 10 times. Domestic solo travel is also popular: in 2021, 2.41 million people travelled alone to a destination in Germany. This means that Germans are likely more familiar with solo travelling, and more confident about travelling alone.

German solo travellers enjoy participating in cultural and adventure activities. They like destinations with a rich history where they can learn about local customs and traditions. Because of this, destinations like Jordan and Cambodia will likely appeal to this market. German travellers also like to go hiking and being outdoors in beautiful places.

German travellers are increasingly concerned about the environment. A 2020 report found that 61% of German travellers agree that their holidays should be environmentally friendly. Because of this, they will likely search for responsible and eco-friendly travel options.

Netherlands

Dutch culture promotes independence and a healthy work-life balance, encouraging solo travel. The Netherlands also has a high proportion of single-person households (18.4%), making this a good source market for solo travellers. The number of single households in the Netherlands is expected to increase until at least 2030, and may continue to grow after that. Dutch people care about sustainability and will seek destinations and businesses that are eco-friendly and promote responsible travel experiences.

When it comes to sustainability, the Dutch are willing to travel outside the peak tourist season (45%), to try to reduce their waste (44%) and to consume locally sourced products while travelling (44%). Fewer are concerned about protecting the natural environment (38%), but this is still higher than the European average.

Dutch travellers tend to be social when they travel, and they like the opportunity to meet other like-minded travellers. They also enjoy outdoor activities – particularly cycling, as this is part of Dutch culture. The Dutch may appreciate destinations with many solo travellers, and with outdoor and adventure tours, like Cambodia and Bali.

France

France’s culture makes the country a good source of solo travellers. The French value a healthy work-life balance, and French workers get enough time off to go on holiday, driving international travel. Individuality and gender equality are also important in France, encouraging women to travel independently and giving them the confidence to do so.

France has a relatively high proportion of single-person households (17.7%). This means that many French people are free to travel alone, with no family commitments. Like the UK, France is well connected internationally, so travelling abroad is relatively easy. Similar to the Dutch, French travellers prefer to travel sustainably by consuming local products, reducing waste and going on holiday outside the main tourist season. They are also willing to pay more for their trip if it benefits the local community (EU Barometer Country Factsheets).

Many French solo travellers are interested in immersing themselves in a destination’s local culture. This may include visiting museums and historical sites, taking cultural tours and cooking classes, or even staying in homestays. These travellers may enjoy destinations that offer cultural immersion activities, like Cambodia and Tanzania. Other French travellers enjoy nature and photography, and will look for opportunities to get off the beaten path to find beautiful locations.

Tips:

- Market to solo travellers by showing how your adventures will give them freedom and the opportunity to ‘find themselves’. Many solo travellers from these source markets appreciate independence and travel to discover their inner purpose.

- Offer opportunities for socialisation and connection for travellers who enjoy meeting other travellers, such as those from the UK, Sweden and the Netherlands.

- Promote opportunities for cultural immersion to source markets that prioritise this, such as France and Germany.

- Use existing source market research to better understand key European markets – many destinations have publicly available market profiles, such as the UK and the US (under Statistics and Research Programs – Market and Sector Profiles).

- Read the CBI factsheets on nature tourism, adventure tourism and other niche markets. Solo travellers have diverse preferences when it comes to activities.

4. Which trends offer opportunities or pose threats in the European solo tourism market?

Solo travel has been influenced by trends across the global tourism market. Trends in this market include the increasing number of solo travellers over the age of 50, the impact of digital nomads and the growing demand for trips centred around wellness.

Working and networking

The digital nomad trend has had a significant impact on tourism over the last few years. There are currently over 35 million digital nomads worldwide, and one in six people plan to work when they travel next year. The top reasons for doing this are ‘it means I get more time in the destination’ (55%) and ‘it works out cheaper by flying at quieter times’ (51%). Many digital nomads (43.4%) travel alone, meaning they fall into the solo traveller market.

The digital nomad lifestyle is characterised by working remotely while travelling. It has led to a few key changes in the market:

- The line between work and leisure has blurred for many solo travellers. The ability to work virtually from almost anywhere has inspired people to take solo trips while keeping up with work commitments.

- Extended stays and slow travel have become more common with this trend. Digital nomads can spend longer periods in one place, and solo travellers have adopted a similar mindset.

- The rise of co-living and co-working spaces has come about because of digital nomads. These spaces cater to remote workers with an in-built community, reliable work infrastructure and networking opportunities. Many co-living and co-working spaces offer hostel-like accommodation, which is budget-friendly and sociable for solo travellers.

- Digital nomads have driven the demand for reliable connectivity in travel destinations. This benefits all travellers, including those travelling solo, meaning they can stay connected, share their experiences and work remotely when needed.

The digital nomad trend has also led to the growth of online communities and forums where people can exchange advice, provide each other with support, connect and network.

Many developing destinations are already putting in place policies to attract digital nomads. For example, many countries in the Caribbean now offer extended digital nomad visas, usually for one or two years. Other countries are focusing on improving the infrastructure this market relies on, such as high-speed internet and co-working locations. Finally, some countries are using tax incentives to attract digital nomads – Barbados has a policy that travellers on a digital nomad visa are not subject to Barbados income tax on their foreign-earned income during their stay.

Networking in the solo travel market is not just limited to digital nomads. Social media platforms, travel apps and online communities have become great tools for solo travellers looking to connect with like-minded people and share experiences. These digital platforms help solo travellers to build networks, find travel companions and exchange tips before and during their journeys. Solo travel meetups and events have gained popularity, creating opportunities for solo travellers to connect with others who share their interests.

Figure 5: Digital nomad in Bali, Indonesia

Source: Daria Mamont at Unsplash

See this best practice example:

Selina is a global brand that caters for solo travellers who want to work and meet new people while they explore the world. It has a network of co-working and co-living spaces in destinations around the world and provides a great environment for digital nomads and solo travellers. There are Selina co-working and co-living spaces across Central and South America, Europe and Northern Africa, and the company is also expanding into Asia. Selina’s facilities offer comfortable accommodation, dedicated workspaces with high-speed internet, and vibrant communal areas that encourage networking and socialising. Selina emphasises community building and cultural immersion, making it attractive to solo nomads and other travellers who want to connect with like-minded people.

Surfescape in Zanzibar is a co-working space located right on one the island’s beaches. The company offers high-speed internet, workstations, meeting rooms and other amenities to provide a first-class experience for digital nomads. Surfescape tries to build community amongst nomads and encourages networking. It offers daily and monthly co-working passes to cater for all travellers. Sufescape also has a number of beachfront apartments available for rent by nomads, making it easy to book everything in one go.

Tips:

- Consider creating co-working spaces that offer reliable high-speed internet and communal areas that encourage networking and social interaction.

- Highlight the reliable internet connectivity on your website and in promotional materials in order to attract digital nomads.

- Provide flexible booking options that cater for extended stays and solo travellers’ preference for slow travel. Offer discounts for longer stays to encourage guests to explore your destination at a relaxed pace.

- Highlight unique local experiences, cultural immersion opportunities and activities that appeal to digital nomads seeking personal and professional growth.

- Read more about current trends that may create opportunities or pose threats in the European outbound market in the CBI trends study.

50+ solo travellers

In recent years, solo travel has become increasingly popular amongst the 50+ age group. Figure 6 shows some statistics about this trend.

Figure 6: Over-50 solo travel is trending

Source: The Flash Packer

This trend may be driven by a range of factors:

- Empty nesters (couples whose children have left home) are realising they now have the time and a new desire to explore solo travel opportunities.

- Many in this age group have also experienced life changes such as retirement, health and wellness consciousness and divorce. Some have even lost their partners. These events drive them to take solo journeys as a means of self-discovery, rejuvenation and personal growth.

- Increased confidence, improved safety and security measures, and the existence of online solo travel communities have further increased the desire of older travellers to venture out on their own.

Solo travellers over 50 will usually have different preferences compared to younger travellers. They are more likely to want experiences that focus on health and wellness, such as spa retreats, yoga getaways and wellness workshops. These travellers also tend to prioritise cultural immersion and personal growth, and choose destinations with opportunities to learn about local cultures and history.

While they may have a preference for comfort and convenience, older solo travellers are generally more patient and adaptable. Their travels are often driven by a desire to create positive memories, cultivate new friendships and expand their horizons.

Developing destinations that are already benefiting from this age group include those with ‘bucket list’ attractions, like Machu Picchu in Peru, Angkor Wat in Cambodia and safaris in Tanzania or Kenya. Destinations known for their wellness offerings, like Thailand and Costa Rica, are popular amongst older travellers as well. This group also enjoys culture and history, drawing them to countries like Vietnam, Bhutan and Sri Lanka.

See this best practice example:

Saga Holidays specialises in travel experiences for people over 50. They offer a variety of tours designed exclusively for solo travellers in this age group, including cultural trips, cruises and relaxing getaways. These solo tours provide an opportunity to enjoy an easy pre-organised experience while travelling alone.

Tips:

- Create packages that cater for the health and relaxation needs of older travellers.

- Highlight cultural immersion activities, or chances to learn about local history. Offer cooking classes and opportunities for travellers to engage with local communities.

- Provide comfortable and convenient accommodation options, and comfort upgrades.

- Organise group activities and community events where older solo travellers can connect and socialise.

- Tailor your marketing efforts to address the specific interests and preferences of this demographic. Use images and content that resonate with older solo travellers.

Wellness travel

In recent years, there has been a significant trend towards wellness tourism within the solo travel market. Many solo travellers are actively seeking out experiences that improve their physical and mental wellbeing. These wellness-focused journeys often include yoga retreats, meditation workshops and spa getaways, all with a holistic approach to relaxation, self-care and overall wellbeing.

The wellness travel trend is not only seen in the solo market. Currently, just over a fifth (21%) of global travellers are choosing destinations and experiences for health and wellness-driven reasons. This percentage is expected to grow in 2023. 29% of global travellers are interested in travelling for wellness reasons in the future.

In Europe, more and more employees are experiencing burnout. A 2021 study found that Poland had the highest percentage of workers struggling with burnout symptoms (66%). The UK and France had the lowest burnout rates, but were still at 46% and 45% respectively. Employees recovering from burnout will be looking for regenerative and relaxing experiences when they take time off work.

Solo wellness retreats are specialised experiences designed for solo travellers who want to spend time improving their physical, mental and emotional wellbeing while travelling alone. They usually offer a range of activities and amenities to promote relaxation, self-care and health. These retreats provide a perfect opportunity for solo travellers looking to recharge.

One of the key aspects of this trend is the increasing desire for a ‘digital detox’. Solo travellers are looking for opportunities to disconnect from their devices and immerse themselves in natural surroundings. This detox allows travellers to recentre themselves. Whether it is meditating in serene forests, practicing yoga by the ocean or unplugging in a remote cabin, solo travellers can get a much-needed break from notifications and screens.

Interestingly, technology itself can play a role in improving the wellness travel experience. Solo travellers have access to a range of wellness, fitness and mental health apps. These apps can guide users through meditation sessions, provide fitness routines for on-the-go workouts, and offer mindfulness exercises. Technology can also let travellers connect with like-minded people, join wellness communities and share their experiences.

See this best practice example:

Kamalaya Koh Samui offers a range of wellness retreats with health treatments, wellness classes and meditation sessions. Many of the retreats are offered at different prices for single travellers and couples, making it easy for solo travellers to book alone. Other retreats – such as the personal yoga synergy retreat – are designed for one-on-one support for solo travellers, including private therapies and yoga classes. Solo travellers stay at the resort while participating in the retreats, giving them complete tranquillity during their stay.

Tips:

- Offer solo-friendly packages and programmes, with single accommodation and single-visitor prices. Consider offering special pricing or discounts for solo travellers.

- Promote a sense of community and connection amongst solo travellers. Organise group activities, workshops and communal dining experiences so solo guests can socialise and form meaningful connections.

- Create packages that encourage digital detoxes, providing guests the opportunity to immerse themselves in nature and mindfulness instead.

- Make booking processes transparent and easy for solo travellers. Clearly outline what is included in any packages, any additional costs, and solo traveller options for accommodations.

Sustainability

Sustainable travel is about being aware of both the positive and negative impacts that tourism can have on the environment, local communities and destinations tourists visit. Mitigating these negative effects and maximising the positive ones requires action. This approach to travel has been increasingly accepted by global tourists, who are becoming more concerned about the impact of their journeys. In fact, 70% of travellers have already shown their commitment to sustainability by avoiding destinations or travel companies that did not meet their expectations in this area.

Travellers are now seeking out sustainable accommodation options, marking a significant change in the industry. The number of travellers who have chosen sustainable accommodations increased by 11 percentage points from 2016 to 2022, from 35% to 46%. This shows a clear trend towards supporting businesses that prioritise sustainability.

Solo travellers also care about sustainability, but are less likely to pay more to reduce their impact. Solo travel is often more expensive than travel with partners or in groups, since there is nobody to share costs with. As a result, solo travellers are reluctant to pay extra for sustainable options.

Many solo travel brands are offering their customers simple ways to travel more responsibly, while not adding to their costs. For example:

- Solo Traveler released a ‘quick guide to reducing your impact’ to help make decisions about accommodation and transportation options. It also explains how to support local communities, and how to choose destinations that are more off-the-beaten-path or travel outside the peak season to reduce impact.

- Ms Travel Solo has a list of 10 eco-friendly travel tips for solo travellers (bring reusable products on your trip, dine at local restaurants, use public transport, etc.).

- World Packers lists a number of things solo travellers can do to travel more responsibly (choose a less visited destination, choose responsible tour operators, ‘leave no trace’, etc.).

- Ecotourism World published a blog to answer a frequently asked question: ‘Can travelling alone be sustainable?’ It discusses the sustainability and cost concerns solo travellers might have, and offers several tips for reducing impact (travel light, use reusable bags rather than single-use plastics, spend money locally, etc.).

These tips can be useful to guide solo travellers in making travel decisions that reduce their negative impact. This kind of sustainability guidance – which is offered by more and more businesses – can remind solo travellers that it is possible to travel sustainably by yourself.

Tips:

- Promote your sustainability commitments to help solo travellers make informed decisions.

- Advertise budget-friendly sustainable options, and highlight other businesses in your area that prioritise sustainability but still offer cost-effective options.

- Create resources, such as guides, blogs and infographics, to offer simple and budget-conscious ways for solo travellers to reduce their environmental impact. Emphasise ‘quick wins’ like packing light and spending locally.

Acorn Tourism Consulting Limited carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research