The European market potential for sun and beach tourism

Sun and beach tourism is the most popular type of leisure trip amongst European tourists seeking to visit developing destinations that offer some of the world’s best and most sought-after beaches. Visitors to sun and beach destinations can choose from a huge range of activities. This creates many opportunities for local tour operators. Britain, France and Germany are the largest European markets, and people from these countries showed a strong intention to travel outside Europe in 2024.

Contents of this page

1. Product description

Sun and beach tourism refers to holidays spent in or near beaches. It is a significant niche market in the larger segments of nature, nautical and wellness tourism. Tourists take sun and beach holidays to relax and engage in a range of activities outlined in the table below.

Table 1: Typical activities enjoyed on sun and beach holidays

| Water-based activities on a sun and beach holiday | Beach-based activities on a sun and beach holiday |

Swimming and snorkelling Kayaking and canoeing Non-motorised water sports, including stand-up paddleboarding (SUP), body boarding, kitesurfing, windsurfing, surfing Motorised water sports, including jet skiing, flyboarding, RIB adventures Fishing Towed water sports, including water skiing, wakeboarding, parasailing, tubing Recreational boating | Relaxing on a sun lounger Paddling and walking on the beach Building sandcastles Flying kites Looking for shells and rock pooling BBQs and picnics Beach sports like volleyball, frisbee, cricket, yoga Watching the sunrise/sunset Cycling and hiking Eating/drinking in local beach bars and restaurants Community-based tourism (CBT) Wellness and spa Horse riding |

Source: Acorn Tourism Consulting, 2024

Sun and beach tourism is extremely common and is one of the most popular holiday types. Beach destinations include locations on coasts. Sun and beach holidays can be enjoyed as stand-alone holidays or be combined with other activities. Developing countries have some of the most beautiful beach destinations and are very popular amongst Europeans seeking sun and beaches.

Table 2: Examples of sun and beach holidays in developing countries

| Sun and Beach Destination | Activities |

| The Makokola Retreat, Malawi | Accommodation is provided in villas and rooms on the shores of Lake Malawi. Activities offered include spa visits, golf, waterskiing, sailing, snorkelling and kayaking. A speedboat ride to an island nearby to watch sunsets is also available. |

| Turtle Bay Beach Club, Kenya | It offers a range of activities, including water sports, diving, and bird watching. It is located on a 200-metre beach in Watamu National Marine Park. The resort calls itself ‘Kenya’s Responsible Resort’ owing to its sustainable actions. |

| Anantara Bazaruto Island Resort, Mozambique | This luxury island resort offers various activities, including diving, sailing, snorkelling, deep-sea fishing and sunset dune boarding. Visitors can also go whale watching. |

| Baba Ecolodge, Thailand | It is located on the island of Ko Pra Thong off the west coast of Thailand, part of the. Activities offered include snorkelling, kayaking, yoga, bird watching, fishing, SUP and cooking classes. Responsibility is a key characteristic of the ecolodge. |

| San Blas Islands, Panama | The remote San Blas islands offer a range of accommodation options for adventurous sun and beach seekers, from budget to luxury. Packages of two days/one night or three days/two nights are common. Beach activities such as SUP, kayaking, beach volleyball, and snorkelling on local reefs are popular. |

Tantra Bohemian Luxury Beach Club, Mexico | It features a restaurant and beach club on beautiful white sandy beaches in the Tulum area. The club’s buildings are inspired by Balinese architecture, which has many ‘beachy’ features like shells, rope and bamboo. |

| SeaShell Hotel Resorts Spa, Andaman Mu Ko Ra - Ko Phra Thong National Park and Nicobar Islands | The beaches of the Andaman and Nicobar Islands in the Indian Ocean are some of the most beautiful and remote. Five SeaShell resorts are located around different beachfront locations across the islands. Adventure, culture and traditional sun and beach activities are available. |

| Filha da Lua Eco Lodge, Brazil | The lodge is in an ecological sanctuary on one of Brazil’s loveliest beaches, Praia das Minas, north of Recife. It offers the perfect setting to reconnect with yourself, nature and the locals. Activities include wellness and water sports. |

Acajou Beach Resort, Seychelles | This resort, located on a white sandy beach in Praslin, offers peace and tranquillity. It offers beautiful gardens and wellness activities. Solar panels generate 50% of the resort’s energy, and there are programmes to recycle and reduce waste. The resort also supports local organisations that help the local environment and communities. |

| Safari and Beach Combination Holiday | Combining a beach holiday with a safari is popular in Africa. Typical combinations include Tanzania and Zanzibar, South Africa and Mauritius and the Kenyan coast. |

| Adventure, Culture and Beach Combination Holiday | Combinations that include adventure and culture are also popular among group tours. Examples include the Sri Lanka tour and beach tour, Ho Chi Minh City and Beach (Vietnam), Incas and Coconuts (Peru) and Elephant Hills Experience and Thai Beach Tour (Thailand). |

Source: Acorn Tourism Consulting, 2024

End market segmentation and consumer behaviour

The sun and beach tourism market can be segmented into roughly three core groups: traditional holidaymakers, FITs (fully independent travellers) and small-group travellers. The table below outlines the differences. FITs and small-group travellers share similar characteristics.

Table 3: Market Segmentation of Sun and Beach Tourism

| Segment | Characteristics | How long do they stay? | Who travels? |

| Traditional Holidaymakers | The beach is the main focus of their trips; they book package holidays to single destinations and stay in purpose-built resorts. All-inclusive holidays are common. | 1–2 weeks most common | Mostly families |

| FIT (Fully Independent Traveller) | The beach may be part of a larger trip; participants take part in multiple activities outside the resort. They usually book trips or parts of trips themselves, create their itineraries and often act spontaneously. | The time spent at the resort varies according to the duration and activities of the trip | Couples, families, singles, LGBTQ+ |

| Small Group Travellers | This group uses a tour operator to arrange trips for them. The beach is usually part of a larger trip. | The time spent at the resort varies according to the duration and activities of the trip | Couples, families, singles, LGBTQ+ |

Source: Acorn Tourism Consulting, 2024

Sun and beach tourism attracts a large European market across all consumer segments: Baby Boomers, Gen X, Gen Y and Gen Z. Each market is distinctive, and they look for different things. The main characteristics of the consumer groups are outlined below.

- Baby Boomers: Born between 1946 and 1964, aged between 60 and 78 as of 2024. Baby Boomers are active, discerning and influential. They are also the wealthiest group and like luxury travel experiences. Baby Boomers like to participate in unique, authentic experiences and are prepared to pay more for them. Luxury eco-beach resorts are likely to be appealing and affordable. Culture is also important to them during Sun and Beach holidays. Some Baby Boomers like to travel independently; others use a tour operators to help them plan trips.

- Gen X: Born between 1965 and 1980, aged between 44 and 59 as of 2024. This group mostly works full-time so has less time to travel. Family life is also likely to be a priority, so budgets are tighter. They value family learning experiences and will do extensive online research. Gen X prioritises authenticity and skill development while travelling. Sun and beach aspects are important to this market as families especially favour this type of holiday.

- Gen Y: Born between 1981 and 1995, aged between 29 and 43 as of 2024. Gen Y is a key target group for travel experiences, which they prefer to buying possessions. They are heavy technology users who like researching and booking their trips and experiences online. Social networking is second nature to them, and they rely heavily on word-of-mouth in their decision-making processes. Sun and beach holidays are a natural fit for Gen Y, whether as a complete trip or part of a trip, providing the experience is authentic.

- Gen Z: Born between 1996 and 2012, aged between 12 and 28 in 2024. Gen Z is the first generation to be wholly shaped by technology. They are often called ‘digital natives’. Naturally adventurous, Gen Z want exciting and immersive experiences, and sun and beach destinations in developing countries are particularly attractive. Gen Z can often travel more cheaply in developing destinations, which appeal to their sense of adventure.

The characteristics of each group are outlined in the chart below according to budget and time for travel.

Table 4: Travel Characteristics of Consumer Groups by budget and time to travel

| Demographic | Budget | Mid-Budget | Luxury | Time Rich | Time Poor |

| Baby Boomers | ✓ | ✓ | ✓ | ||

| Gen X | ✓ | ✓ | ✓ | ✓ | |

| Gen Y | ✓ | ✓ | ✓ | ✓ | |

| Gen Z | ✓ | ✓ |

Source: Acorn Tourism Consulting, 2024

Tips:

- Decide which market is most appropriate for your business. Design activities for it. For instance, if you can offer a range of water sports, you may appeal to the family market as well as Gen Y and Gen Z. Alternatively, if you offer cultural activities, you may attract the older Baby Boomer and FIT markets.

- Find out more about the different markets using the CBI studies to help you. Have a look at the target groups studies on Baby Boomers, Gen X, Gen Y and Gen Z.

Accessible tourism on the European market

Accessible tourism is the ongoing endeavour to ensure tourist destinations, products and services are accessible to all people, regardless of physical limitations, disabilities or age. It encompasses publicly and privately owned tourist locations. The improvements benefit those with permanent physical disabilities as well as parents with small children, elderly travellers, people with temporary injuries and their travel companions. Disabled tourists may travel individually, in groups, and with their families and carers.

Accessibility and sun and beach tourism

As one of the top choices of holiday, people with disabilities are just as likely to want to enjoy a sun and beach holiday as people without disabilities. You should make sure you can cater for this group. Remember that people with accessibility needs are not just people in wheelchairs. For instance, elderly Baby Boomers are enthusiastic sun and beach tourists, but they may have mobility issues. If you can cater for them, you will be able to attract them.

- Provide ramps, walkways and roll-out mats so sand is easier to move around

- Provide specialist equipment to help wheelchair users enjoy the water

- Provide beach-friendly wheelchairs with thicker wheels suitable for the sand

- Create accessible playgrounds for children

- Find suppliers that can provide adaptive water sports

See the Amilla Resort in the Maldives. It is a good example of a place that has embraced accessibility for its clients. It has several easy-access villas with wide doorways and accessible showers, and it provides beach wheelchairs and floating wheelchairs for swimming. It has partnered with a dive business to provide PADI open-water scuba certification for people with movement disabilities. Adaptive yoga and snorkelling adventures are also offered.

All this shows the resort has carefully considered the needs of a wide range of clients.

Tips:

- Find out as much as you can about accessibility at your destination’s beach locations so you can inform your guests. Your guests will want to know what can be arranged and what cannot, so ensure you are completely up to date with information.

- Read the CBI studies The European market potential for accessible tourism and Entering the European market for accessible tourism products for practical advice to make your tours accessible.

2. What makes Europe an interesting market for sun and beach tourism?

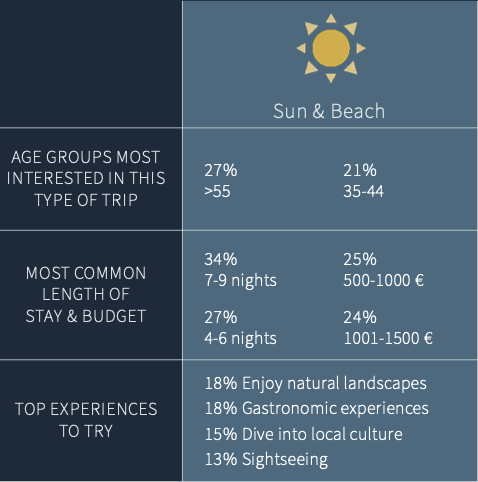

Europe is an interesting market because it is the most popular holiday type for Europeans. In a 2024 study by the European Travel Commission (ETC), 19.4% of Europeans stated that sun and beach were their preferred type of leisure trip, ahead of nature and outdoor trips (13.6%) and city breaks (13.4%).

Figure 1: Preferred type of leisure trip in the next six months (June 2024)

Source: ETC, 2024

Sun and beach tourism has been the most popular holiday type amongst Europeans for many years. In 2022, CBI research found that beach tourism was the top holiday choice amongst the key European markets (UK, Germany, France, Italy, Netherlands, Spain) for 40% of respondents, regardless of destination. This rose to 53% for developing country destinations.

The study also found that European tourists stay longer on sun and beach holidays than on other holiday types (11.2 nights versus 10.5 nights) and spent more per trip on sun and beach holidays than other niches (€1,629 versus €1,547).

Globally, sun and beach tourism is a substantial market. Global sales of sun and sea packages were estimated to have grown by 75% between 2021 and 2022, indicating a strong recovery following the COVID-19 pandemic. By 2023, the market was estimated to be worth $152.3 billion (USD). It is forecast to be worth $265.1 billion by 2033. This represents a compound annual growth rate (CAGR) of 5.7%.

Sun and beach tourism has long been associated with package holidays at beach resorts, including all-inclusive, which means all costs (flights, transfers, accommodation, food and drink, even some activities) are paid upfront. Today, the all-inclusive segment of sun and beach holidays is largest. All-inclusive and part-inclusive are popular options as they offer good value and provide a worry-free holiday. However, since all activities and food and drink are included in the price, guests have little incentive to leave the resorts. As a result, there are fewer opportunities for local tour operators to cater to them.

However, the growing popularity of authentic and immersive experiences and of less busy destinations means that there is growing demand for travelling off the beaten track and discovering new places. This creates opportunities for local operators to attract the European market.

The chart below shows travellers’ intent to take sun and beach holidays in the summer of 2024. Intent amongst British tourists was particularly high, at almost one in three. Among French and German tourists, it is around one in five. These markets provide good opportunities for local tour operators.

Source: ETC, 2024

Other markets with a significant intent to travel for sun and beach holidays include Spain (15%), Switzerland (15%) and Italy (14%).

Figure 3: Statistics about sun and beach tourism for European markets (Austria, Belgium, France, Germany, Italy, the Netherlands, Poland, Spain, Switzerland, UK)

Source: ETC, 2024

Be aware that sun and beach tourism is often combined with other activities.

- Belgians were the most likely to travel outside Europe (15%), followed by France and the Netherlands (14%) and the United Kingdom (UK) (13%).

- Beach and leisure activities were the most important activities for most of the source markets, especially the UK (66%), Germany (64%) and the Netherlands (55%).

- Cultural and gastronomic activities were very important to most of the source markets, especially Belgium (62%), France (51%) and the UK (43%).

- European markets consider local culture and history important when planning trips abroad, especially the Netherlands (31%), France (30%) and Belgium (28%).

- Cost and affordability were key factors for planning trips for all the source markets, especially the UK (51%), Germany (45%) and the Netherlands (40%).

- Most European source markets spent 7–12 nights abroad. The French market was the most likely to spend 7–12 nights on holiday (42%), followed by the German and Belgian markets (40%). Trips of 4–6 nights were also popular, especially for France (36%), Austria (35%), Belgium and the UK (31% each).

- Average expenditure on trips was between €501 and €2,500 per person. However, around 1 in 5 people in the Netherlands (19%), Austria (18%) and Belgium (17%) spent more than €2,500 per person.

- Across all markets, travelling with a partner or family was the most popular group type. The markets with the biggest solo travel markets were Austria (15%), the Netherlands (14%), the UK and Germany (13% each). The June to September period is the main travelling period for European source markets. This coincides with school summer holidays and the main sun and beach travel season.

Tips:

- Assess the sun and beach products available in your destination. You should not target the larger, all-inclusive beach resorts.

- Focus on FITs and families to offer products that combine beach with other activities. Collaborate with other suppliers and Destination Management Companies (DMCs) to increase your options and create diversity.

3. Which European countries offer the most opportunities for sun and beach tourism?

The European countries that offer the most sun and beach tourism opportunities for developing destinations are the United Kingdom, France, Germany, Austria, Belgium and the Netherlands. These markets had the highest intent to travel and are high-demand outbound tourism markets.

The United Kingdom

The UK has traditionally been one of the top European markets for sun and beach tourism for many decades. In 2024, ETC research found that almost 80% of British respondents intended to travel within six months, an increase of 4% on the previous year. Of those, 29% intended to travel for sun and beach holidays. While Europe is still the top destination for outbound British nationals, 13% of Britons planned to travel outside Europe.

British travellers are becoming more sustainably minded and are willing to pay more for sustainable options. However, they still want to travel long-haul and are reluctant to limit air travel. Nevertheless, there is a trend for British tourists to travel for longer and take fewer trips.

Table 5: Characteristics of British outbound tourists

| Characteristics | Indicators |

| Popular travel period | June–July – 36% August-September – 37% October-November – 16% |

| Travel partners | With a partner – 36% With family – 36% Solo – 13% |

| Number of nights abroad | More than 12 nights – 11% 7–12 nights – 38% 4–6 nights – 31% Up to 3 nights – 20% |

| Total budget per person | €2,501+ – 10% €1,501–2,500 – 22% €1,001–1,500 – 22% €501–1,000 – 29% <€500 – 17% |

| Top trip types | Sun and beach – 29% City break – 19% Nature and outdoors – 11% |

| Top activities whilst on a trip | Beach and leisure activities – 66% Cultural and gastronomic activities – 43% Shopping – 40% |

| Essential travel needs | Quality and comfort – 64% Security – 50% Competitive prices – 40% |

| The most important factors when planning a trip | Cost and affordability – 51% Free time to relax – 33% Culture and history – 26% |

| Intent to travel to developing destinations | Middle East – 6% Southeast Asia – 6% Central and South America – 5% North Africa – 3% East Asia – 3% Central Asia and Rest of Africa – 2% each |

| Importance of sustainability to British tourists | Want to minimise impact on the environment while travelling – 75% Have stayed in or are interested in staying in eco-friendly accommodation – 73% Interested in taking part in a nature-based activity – 68% |

| Leading developing country destinations | Turkey India Mexico Morocco |

Source: ETC, TGM, UN Tourism, 2024

France

France is a strong sun and beach market, with 21% expressing a preference for a sun and beach holiday after culture and heritage (24%) but ahead of nature and outdoors (15%). Like many markets, French tourists like to combine the sun and beach with other activities.

Morocco, Turkey and Tunisia were French outbound tourists' most popular developing destinations in 2022. Destinations with a French-speaking heritage are also popular with French tourists to Madagascar and Senegal.

Table 6: Characteristics of French outbound tourists

| Characteristics | Indicators |

| Popular travel period | June–July – 30% August–September – 42% October–November – 17% |

| Travel partners | With a partner – 38% With family – 37% Solo – 12% |

| Number of nights abroad | More than 12 nights – 10% 7–12 nights – 42% 4–6 nights – 36% Up to 3 nights – 11% |

| Total budget per person | €2,501+ – 15% €1,501–2,500 – 27% €1,001–1,500 – 17% €501–1,000 – 25% <€500 – 16% |

| Top trip types | Culture and heritage – 24% Sun and beach – 21% Nature and outdoors – 15% |

| Top activities whilst on a trip | Cultural and gastronomic activities – 51% Beach and leisure activities – 49% Shopping – 31% |

| The most important factors when planning a trip | Cost and affordability – 35% Local culture and history – 30% Free time to relax – 31% |

| Essential travel needs | Quality and comfort – 53% Competitive prices – 53% Security – 36% |

| Intent to travel to developing destinations | Rest of Africa – 7% Central and South America – 4% North Africa and the Middle East – 3% each Southeast Asia – 3% East Asia – 2% |

| Main sustainability intentions when on holiday | Consume locally sourced products on holiday – 52% Reduce waste while on holiday – 45% Take holidays outside of the high tourist season – 39% Pay more to the benefit of the local community – 39% |

| Leading developing country destinations | Turkey Morocco Tunisia Mexico |

Source: ETC, TGM, UN Tourism, 2024

Figure 4: Beach and leisure activities are popular on sun and beach holidays

Source: Elizeu Dias at Unsplash, 2018

Germany

Germans have taken sun and beach holidays for years. Since 2019, the number of Germans who have preferred beach holidays has remained similar, accounting for around 45.3 million tourists annually. In 2023, more Germans travel abroad (78%) than took domestic holidays (22%). Turkey was the most popular developing destination for German holidaymakers. Germans indicated a 20% likelihood of taking a sun and beach holiday within six months in 2024. It was the most preferred trip type ahead of Coast, Sea, Nature and Outdoor trips.

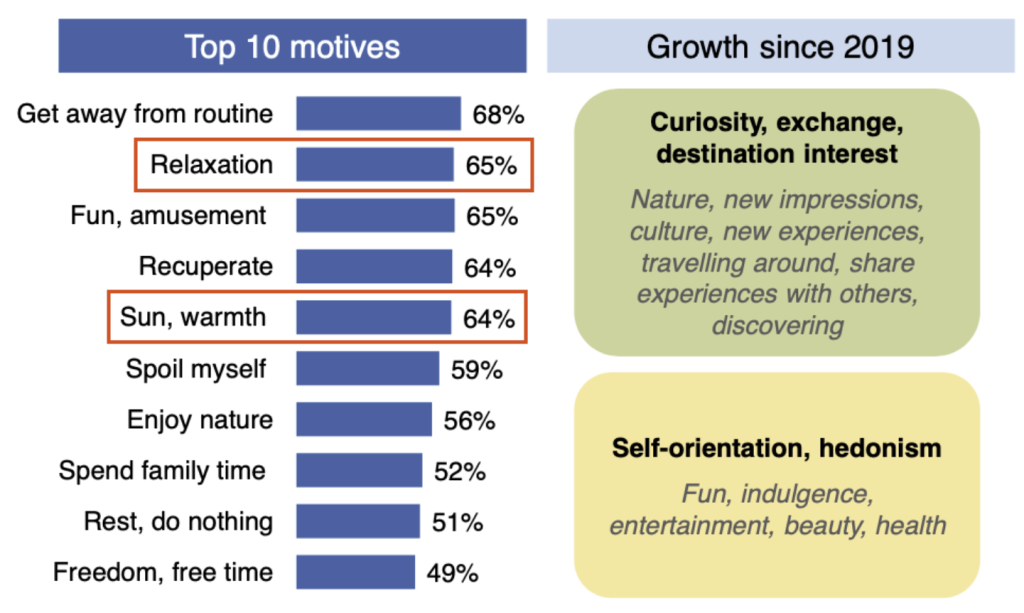

German motivations for travel include relaxation and sun/warmth, both of which align well with sun and beach. Being out in nature, having new experiences and culture are all growing in importance amongst German travellers. Around 8% of Germans choose long-haul destinations for their holiday trips.

Figure 5: General holiday motives of German tourists

Source: Reise Analyse, 2024

Table 7: Characteristics of German outbound tourists

| Characteristics | Indicators |

| Popular travel period | June–July – 46% August–September – 33% October-November – 16% |

| Travel partners | With a partner – 29% With family – 36% Solo – 13% |

| Number of nights abroad | More than 12 nights – 17% 7–12 nights – 40% 4–6 nights – 28% Up to 3 nights – 14% |

| Total budget per person | €2,501+ – 14% €1,501–2,500 – 28% €1,001–1,500 – 19% €501–1,000 – 25% <€500 – 15% |

| Top trip types | Sun and beach – 20% Coast and Sea – 17% Nature and outdoors – 16% |

| Top activities whilst on a trip | Beach and leisure activities – 64% Cultural and gastronomic activities – 41% Shopping – 31% |

| The most important factors when planning a trip | Cost and affordability – 45% Free time to relax – 34% Local culture and history – 19% |

| Essential travel needs | Quality and comfort – 60% Security – 46% Competitive prices – 38% |

| Intent to travel to developing destinations | Central and South America – 7% North Africa – 4% Southeast Asia, East Asia, Rest of Africa and Middle East – 2% Central Asia – 1% |

| Main sustainability intentions when on holiday | Consume locally sourced products on holiday - 54% Pay more to protect the natural environment – 47% Reduce waste while on holiday – 45% |

| Leading developing country destinations | Turkey Egypt Thailand Morocco South Africa |

Source: ETC, TGM, UN Tourism, 2024

Austria

Many Austrians intended to enjoy sun and beach holidays within six months in 2024 (18%), more than Culture and Heritage and Nature and Outdoor holidays. Austrian nationals made 16.1 million outbound visits in 2023. As German speakers, Austrians have their own media, but they also use German and Swiss media and the German travel trade. The environment and sustainability are important to Austrians, which may determine the accommodation or tour operators they choose.

Before the COVID-19 pandemic, Thailand was the top developing destination choice for Austrians. In 2022, Mexico, the Dominican Republic and South Africa were the top choices.

Table 8: Characteristics of Austrian outbound tourists

| Characteristics | Indicators |

| Popular travel period | June–July – 39% August–September – 32% October-November – 11% |

| Travel partners | With a partner – 30% With family – 32% Solo – 15% |

| Number of nights abroad | More than 12 nights – 10% 7–12 nights – 31% 4–6 nights – 35% Up to 3 nights – 23% |

| Total budget per person | €2,501+ – 18% €1,501–2,500 – 28% €1,001–1,500 – 17% €501–1,000 – 22% <€500 – 15% |

| Top trip types | Sun and beach – 18% Nature and outdoors – 15% Coast and Sea – 14% |

| Main sustainability intentions when on holiday | Consume locally sourced products on holiday – 47% Pay more to protect the natural environment – 39% Reduce waste while on holiday – 38% Take holidays outside of the high tourist season – 38% |

| Leading developing country destinations | Mexico Dominican Republic South Africa Brazil |

Source: ETC, UN Tourism

Belgium

Belgians indicated an 18% likelihood of taking a sun and beach holiday within six months in 2024. They are enthusiastic travellers. In 2023, they made more trips than ever before: 23.3 million trips, a 2.2% increase on 2019. As Belgium only has a population of 11.7 million, this is a very large market for outbound tourists.

Like most European source countries, Belgians like to travel within Europe. Turkey is the top developing destination, followed by Morocco and Tunisia. Belgians also speak Dutch and French, so destinations with French or German heritage, such as Madagascar and Namibia, are interesting to them.

Table 9: Characteristics of Belgian outbound tourists

| Characteristics | Indicators |

| Popular travel period | June-July – 38% August-September – 36% October-November – 15% |

| Travel partners | With a partner – 31% With family – 28% Solo – 12% |

| Number of nights abroad | More than 12 nights – 13% 7–12 nights – 40% 4–6 nights – 31% Up to 3 nights – 16% |

| Total budget per person | €2,501+ – 17% €1,501-2,500 – 22% €1,001-1,500 – 19% €501-1,000 – 23% <€500 – 19% |

| Top trip types | Sun and beach – 18% Culture and heritage – 16% Nature and outdoors – 15% |

| Top activities whilst on a trip | Cultural and gastronomic activities – 62% Beach and leisure activities – 52% Shopping – 20% |

| The most important factors when planning a trip | Cost and affordability – 34% Local culture and history – 28% Free time to relax – 27% |

| Essential travel needs | Quality and comfort – 58% Security – 32% Competitive prices – 45% |

| Intent to travel to developing destinations | Rest of Africa – 8% Middle East – 5% Southeast Asia and Central and South America – 4% North Africa and Central Asia – 3% East Asia – 1% |

| Main sustainability intentions when on holiday | Reduce waste while on holiday – 41% Consume locally sourced products on holiday – 28% Take holidays outside of the high tourist season – 28% Reduce water usage on holiday – 28% |

| Leading developing country destinations | Turkey Morocco Tunisia |

Source: ETC, TGM, UN Tourism, 2024

Netherlands

Dutch tourists showed the lowest intent of the major source markets to take sun and beach holidays in the next six months in 2024 at 16%. This is behind Nature and Outdoors and City Breaks. They took 37.5 million outbound trips in 2023, particularly with small-scale hotels or more traditional accommodation providers.

Dutch tourists are some of the most sustainable European nations. More than half of Dutch people (53%) plan to think more about their sustainability and environmental impact when planning a trip. This number is higher amongst younger consumers (70% under 25) than older consumers (48% aged 55+).

Table 10: Characteristics of Dutch tourists

| Characteristics | Indicators |

| Popular travel period | June–July– 41% August–September – 38% October–November – 12% |

| Travel partners | With a partner – 36% With family – 25% Solo – 14% |

| Number of nights abroad | More than 12 nights – 18% 7–12 nights – 37% 4–6 nights – 29% Up to 3 nights – 17% |

| Total budget per person | €2,501+ – 19% €1,501–2,500 – 22% €1,001–1,500 – 17% €501–1,000 – 30% <€500 – 13% |

| Top trip types | Nature and outdoors – 19% City break – 18% Sun and beach – 16% |

| Top activities whilst on a trip | Beach and leisure activities – 55% Cultural and gastronomic activities – 39% Shopping – 30% |

| The most important factors when planning a trip | Free time to relax – 43% Cost and affordability – 40% Local culture and history – 31% |

| Essential travel needs | Quality and comfort – 66% Competitive prices – 39% Security – 35% |

| Intent to travel to developing destinations | Central and South America – 8% North Africa and Southeast Asia – 4% Rest of Africa, Central Asia, and Middle East – 3% East Asia – 1% |

| Main sustainability intentions when on holiday | Take holidays outside of the high tourist season – 45% Consume locally sourced products on holiday – 44% Reduce waste while on holiday – 44% |

| Leading developing country destinations | Turkey Egypt Thailand Morocco South Africa |

Source: ETC, TGM, UN Tourism, 2024

Tips:

- Pay attention to the activities that Europeans participate in on sun and beach trips. Food and local culture are also extremely important to them. Assess what your trips provide so you can meet their expectations.

- Consider quality and value for money when preparing your trips. Europeans on sun and beach holidays want experiences and trips of a good standard that are competitively priced. They also take security seriously. You must be able to guarantee your guests’ safety.

- For more information about doing business with European markets, download the CBI study, Tips for doing business with European tourism buyers.

4. Which trends offer opportunities or pose threats in the European sun and beach tourism market?

There has been a shift from package beach holidays to more remote and less crowded beach destinations. Embedding sustainability into all tourism businesses is a key trend to be aware of. It is now essential that all tourism businesses play a key role in protecting people, places and the planet long into the future. However, because of climate change, you should be aware of guests’ needs in very hot weather.

Off-the-beaten-track beaches gain popularity versus traditional beach destinations

In line with the general trend of authentic and unique experiences in off-the-beaten-track destinations, there is growing demand for beach holidays in places where the beaches are less crowded, creating more immersive experiences. Many travellers no longer want to spend two weeks lying on a beach. They also want to get to know a place, the local people, culture and customs.

This trend provides many opportunities to local tour operators in sun and beach destinations to appeal to this group of tourists. Activities, like visiting local communities, getting involved in local agritourism experiences and participating in environmental activities, are popular with this group. Adventure activities, such as hiking, fishing and kitesurfing, are also popular. Providing sustainably managed and authentic experiences to this new type of tourist is key to success.

Sustainability is crucial to deliver successful sun and beach tourism packages

Sun and beach tourism relies heavily on well-managed natural environments with pristine beaches, clean, sparkling waters and sustainability being embedded in the businesses. It cannot succeed in the long term without these elements. Sun and beach tourists choose their destinations for these reasons, so local tour operators should manage their businesses in line with sustainable principles. Associated businesses, like accommodation, water sports providers, restaurants and beach clubs, should also provide high-quality and sustainable services.

Ever more beach resorts describe themselves as eco-friendly or eco-resorts. Luxury resorts have embraced sustainability, like the Bucuti & Tara Beach Resort in Aruba, one of the Caribbean’s only certified carbon-neutral resorts. It has gained a wide range of sustainability certificates in several areas including Green Globe, Travelife Gold and LEED Gold. Its owner was also one of the first signatories of the Glasgow Declaration for Climate Action in Tourism in 2023.

Not all tourism businesses can be certified to this level. However, this does not mean they should not embed sustainability in their business activities. It is essential that tourism businesses of all sizes are sustainable. A good example is Playa Viva, a tranquil Mexican hideaway with solar-powered eco-cabins, vehicles powered by biofuels and organic food grown on-site. The resort pays great attention to community activities, farming and reforestation. It also manages a turtle hatchery.

Tips:

- Educate your guests about being sustainable. You could encourage them to participate in sustainability actions like beach clean-ups, planting initiatives or wildlife recording for conservation purposes.

- See if you can move towards banning single-use plastics from your business, like plastic straws, bags and water bottles. Some places give or lend their guests free reusable bottles during their stay. You will need to have a safe water supply so they can refill their bottles.

- Invest in an electric vehicle or e-bike for your business. It will save you money in the long run and impress your buyers.

- Use the CBI studies that focus on sustainability to help you on your journey to be a sustainable tourism business. These are: How to be a sustainable tourism business, Tips to go green in the tourism sector and Tips on how to become more socially responsible in the tourism sector.

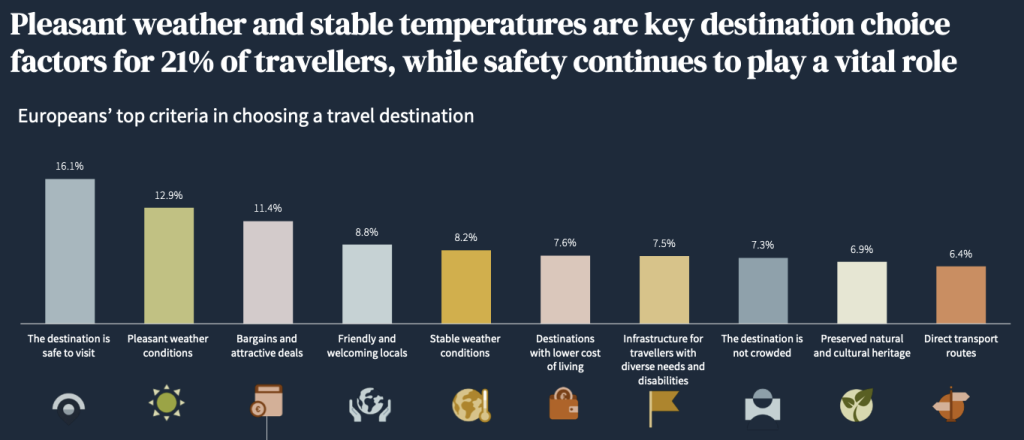

Climate change changes European tourists’ travel habits

A third of travellers choose where to go based on extreme weather events. Where they know that temperature could rise to extreme levels, they increasingly choose destinations with more stable weather. However, this is more marked amongst older Europeans aged 55+ (32%) compared to the younger population, where only 11% are changing their habits.

Figure 6: Europeans’ top criteria for choosing a destination to visit

Source: ETC, 2024

Factors other than climate change also cause concern:

- 20.8% of travellers are concerned about increased trip costs owing to inflation

- The economic situation and personal finances are a concern to 16.1%

- 11.4% are worried about the conflict between Ukraine and Russia.

- 10.2% consider the possible impacts on travel safety because of rising tensions in the Middle East

- 9.3% are concerned about the high numbers of visitors at the destinations they want to visit

If your destination is located in an area known for extreme weather, you should make provisions to help visitors. This could include creating more shaded areas, investing in fans to help make tourists more comfortable and ensuring safe drinking water is available at all times. You could also put up signs to provide advice.

Acorn Tourism Consulting Limited carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research